Automotive Quantum Computing Market size was valued at USD 164.56 Million in 2023 and is expected to reach USD 1416.10 Million by 2030, exhibiting a CAGR of 36% during the forecast period (2024-2030)Automotive Quantum Computing Market Overview

Quantum Computing is the technology that processes large amounts of information at high speed and solves complex problems that would take conventional computers an inordinate amount of time. The Automotive Quantum Computing market is still in its early stages of development, but it has the potential to revolutionize the way vehicles are manufactured, designed and developed. Many of the automotive industry players are fully involved in exploring quantum computing applications and use cases. Some of the OEMs and Tier 1 suppliers, which are known to belong to these players are Toyota, Volkswagen, Daimler and Bosch. As per the study, the automotive companies are majorly investing in research and development, working in partnerships and collaborating with automotive companies, which is resulting in the developments in automotive quantum computing. The latest developments in quantum computing are expected to drive the global market.To know about the Research Methodology :- Request Free Sample Report

Automotive Quantum Computing Market Dynamics

Impacts on the Automotive Industry Development of Advanced Materials and Manufacturing Technologies: Tier 1 suppliers and OEMs can create new materials with custom properties such as better electricity connectivity and enhanced strength by using quantum computers to simulate the behavior of molecules and atoms. This is expected to result in streamlined production processes and lighter, more durable components for vehicles during the forecast period. Important Role in Optimizing Traffic Flow and Transportation Systems: By using quantum computers that perform real-time calculations, traffic engineers can predict traffic patterns and congestion with better accuracy, leading to more efficient and intelligent transportation systems. This is expected to reduce carbon emissions, decrease travel times and improve road safety, which is expected to drive the demand for quantum computing in the automotive industry immensely during the forecast period. Major Trend in the Automotive Quantum Computing Industry The Automotive Quantum Computing Market is majorly driven by the rising trend of OEMs partnering with quantum computing companies or setting up their own research. As per the research, the automotive and transportation industry is embracing this emerging technology. The Autonomous vehicle industry is one of the various beneficiaries of quantum computing. As the awareness of the potential of quantum computing for powerful computation is rising, more OEMs are investing or collaborating with quantum computing companies to address various optimization challenges in the automotive industry such as vehicle design and battery power. Some examples of this trend are: Mercedes-Benz: A team of experts at Mercedes-Benz Research and Development North America (MBRDNA) is exploring quantum computing to discover efficient battery technologies, fine-tune the manufacturing process and stimulate aerodynamic shapes to improve fuel efficiency and driving comfort. Hyundai: The company is working with IonQ, a trapped-ion quantum processor maker on an Electric Vehicle research project aimed at developing new quantum algorithms to explore lithium compounds and their chemical reactions and create an advanced battery chemistry model. Ford: is using quantum computing to develop new batteries in collaboration with quantum computing company Quantinuum. To research lithium-ion battery chemistry for model materials of next-generation electric vehicle batteries, the company has been using Quantinuum’s quantum chemistry platform, InQuanto. Future of Quantum Computing in the Automotive Industry Many automotive players are actively pursuing quantum computing research and sometimes partnering with companies in the upstream part of the quantum computing value chain. They all investigate quantum simulation for material sciences to improve the safety, efficiency and durability of fuel cells and batteries. As per the IBM industry general manager for automotive Aerospace and Defense, higher forms of computing power are needed to assist with the rapid development of electric vehicle technology. While quantum computing applications based on this research are expected to be seven years down the road, OEMs have demonstrated successful quantum computing pilots in some areas. Thus, the high research and development in the industry are creating various opportunities for market growth. Restraints for the Automotive Quantum Computing Market Growth High Cost of Quantum Computers: Quantum Computers are very expensive to manufacture and develop due to which many automotive companies are still reluctant to invest in the technology. Lack of Skilled Workers: Skilled workers who are expertise in quantum computing are lacking in the Automotive Quantum Computing Industry. For automotive companies, this makes it difficult for them to find the talent they require to develop Quantum computing applications. Building a solid cadre of talent is an early challenge for automotive players. Since the initial need is small around three to five experts and quantum translators working full-time on quantum computing research and application.Automotive Quantum Computing Market Regional Insights

The Automotive Quantum Computing Market in North America dominated the global market by holding the largest market share in 2023. This is attributed to the presence of key players and the early adoption of quantum computing in the region. The market players in the region are highly investing in research and development. The Automotive Quantum Computing Market in Europe is expected to grow rapidly due to the presence of major automotive companies, whose demand for quantum computing is increasing. The EU Commission has financed a 10-year initiative that promotes research into quantum technologies. Germany holds the major share of the global market. Recently both Volkswagen and BMW have joined the German national Quantum Technology and Application Consortium (QUTAC) alliance to promote German capabilities in quantum technology. The Asia Pacific Automotive Quantum Computing Market is also expected to grow at a high rate during the forecast period. In recent years, the region has emerged as a hub for automotive production. Therefore, most of the component manufacturers and OEMs are based out of Asian countries. India, China, Japan and South Korea are the main vehicle production hubs in the region. The regional players are highly investing in quantum computing technology and exploring its capabilities majorly in autonomous vehicles and electric vehicle batteries. In 2023, at IBM’s flagship event THINK Mumbai, IBM released a white paper on Building a Quantum Strategy for India, where they promised to address large computational problems that could not be addressed by classical computing.Automotive Quantum Computing Market Segment Analysis

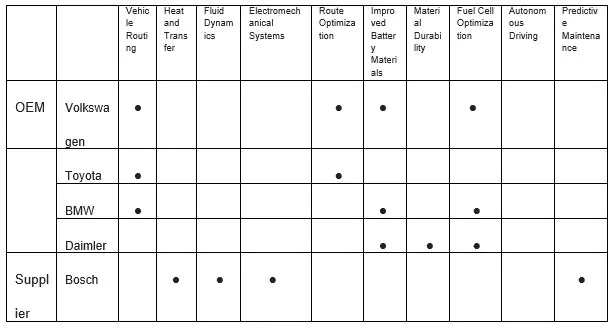

Based on Component: The segment is divided into Hardware, Software and Services. The software segment held the largest Automotive Quantum Computing Market share in 2023. This is because around half of the participants in the quantum computing value chain develop software. Major hardware players such as IBM and D-Wave also develop quantum computing software. Some programs are used for automotive use cases such as hardware-design and process-design optimization. Such solutions are expected to be used at a large scale within the next seven years. The Hardware segment held the second-largest share of the market in 2023 and is expected to grow rapidly during the forecast period. One-third of quantum companies focus on hardware development. The industry players include global technology giants mainly based in the US. It is exactly unclear exactly how the industry is expected to configure hardware for quantum computers over the next seven years because the market players are developing several competing approaches and these are expected to evolve over time. The Services segment is expected to grow at a high rate during the forecast period as the growing market is expected to increase the demand for services too. Based on Deployment: The segment is divided into Cloud and On-premises. During the forecast period, the Cloud segment is expected to grow rapidly. The world’s largest automakers are expected to develop their own algorithms and run them on the cloud-based quantum computing systems of their partners. During the forecast period, the demand for cloud-based access to quantum computing services is expected to increase due to the developing high powerful systems. Based on Application: The Automotive Quantum Computing Market segment is divided into Vehicle Routing, Heat and Mass Transfer, Fluid Dynamics, Electrochemical Systems, Route Optimization, Improved Battery Materials, Material Durability, Fuel Cell Optimization and Autonomous Driving. Quantum computing for business in the automotive sector is majorly used for traffic flow optimization and routing. As per the research, the Improved battery materials and fuel cell optimization held the major share of the market and are expected to grow at a high rate during the forecast period. This is mainly attributed to the increasing demand for electric vehicles to reduce CO2 emissions. Quantum Computing Applications in the Automotive Sector (Selected Companies)

Automotive Quantum Computing Market Competitive Analysis

This section of the report provides information on Automotive Quantum Computing key competitors in each region including their revenue, investment in research and development, mergers, acquisitions, collaborations and joint ventures. SWOT analysis was employed to provide strengths and weaknesses of the key competitors in the Automotive Quantum Computing Industry. Volkswagen partnered with quantum computing startups and research institutions such as D-Wave Systems, Cambridge Quantum Computing and Google Quantum AI. In 2022, the Toyota’s trading arm Toyota Tsusho Corporation partnered with the Israeli startup Quantum Machines to provide quantum technologies to Japanese customers and to build future quantum capabilities. To analyze optimization problems using quantum computing, BMW hosted “Quantum Computing for Automotive Challenges” in collaboration with Amazon Web Services (AWS). It is also working with PASQAL to enhance its primary manufacturing processes by using quantum computing.Automotive Quantum Computing Market Scope: Inquire before buying

Automotive Quantum Computing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 164.56 Mn Forecast Period 2024 to 2030 CAGR: 36% Market Size in 2030: USD 1416.10 Mn Segments Covered: by Component • Software • Hardware • Services by Deployment • Cloud • On-premises by Stakeholder • OEMs • Automotive Tier 1, Tier 2 and Tier 3 • Warehousing and Distribution by Application • Vehicle Routing • Heat and Mass transfer • Fluid Dynamics • Electromechanical Systems • Route Optimization • Improved Battery Materials • Material Durability • Fuel-cell Optimization • Autonomous Driving • Predictive Maintenance Automotive Quantum Computing Market Regional Insights:

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Automotive Quantum Computing Key Players

• Accenture plc (Ireland) • IBM Corporation (US) • Microsoft Corporation (US) • D-wave systems, inc. (Canada) • PASQAL (France) • Terra Quantum (Swizerland) • Rigetti & Co, LLC (US) • IONQ (US) • Atom Computing Inc (US) • Quantinuum Ltd. (US) • Zapata Computing (US) • Xanada Quantum Technologies Inc (Canada) • Anyon Systems (Canada) • Alpine Quantum Technologies (Austria) • Multiverse Computing (Spain) • Avanetix (German) Frequently Asked Questions 1] What is the expected CAGR of the Global Automotive Quantum Computing Market during the forecast period? Ans. During the forecast period, the Global Automotive Quantum Computing Market is expected to grow at a CAGR of 36 percent. 2] What was the Automotive Quantum Computing Market size in 2023? Ans. 164.56 Mn was the Automotive Quantum Computing Market size in 2023. 3] What is the expected Automotive Quantum Computing Market size by 2030? Ans. 1416.10 Mn is the expected Automotive Quantum Computing Market size by 2030. 4] What are the major Automotive Quantum Computing Market segments? Ans. The market is divided by Component, Deployment, Stakeholder and Application. 5] Which region’s Automotive Quantum Computing Market share is expected to increase at a high rate during the forecast period? Ans. The Automotive Quantum Computing Market share of Asia Pacific is expected to increase at a high rate during the forecast period. 6] Who are the key players in the Automotive Quantum Computing Industry? Ans. Accenture plc, IBM Corporation, Microsoft Corporation, D-wave systems, inc,, PASQAL, Terra Quantum, Rigetti & Co, LLC, IONQ, Atom Computing Inc, Quantinuum Ltd, Zapata Computing, Xanada Quantum Technologies Inc, Anyon Systems, Alpine Quantum Technologies, Multiverse Computing, Avanetix.

1. Automotive Quantum Computing Market: Research Methodology 2. Automotive Quantum Computing Market: Executive Summary 3. Automotive Quantum Computing Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Automotive Quantum Computing Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Automotive Quantum Computing Market Size and Forecast by Segments (by Value USD) 5.1. Automotive Quantum Computing Market Size and Forecast, by Component (2023-2030) 5.1.1. Software 5.1.2. Hardware 5.1.3. Services 5.2. Automotive Quantum Computing Market Size and Forecast, by Deployment (2023-2030) 5.2.1. Cloud 5.2.2. On-premises 5.3. Automotive Quantum Computing Market Size and Forecast, by Stakeholder (2023-2030) 5.3.1. OEMs 5.3.2. Automotive Tier 1 and Tier 2 5.3.3. Warehousing and Distribution 5.4. Automotive Quantum Computing Market Size and Forecast, by Application (2023-2030) 5.4.1. Vehicle Routng 5.4.2. Heat and Mass transfer 5.4.3. Fluid Dynamics 5.4.4. Electromechanical Systems 5.4.5. Route Optimization 5.4.6. Improved Battery Materials 5.4.7. Material Durability 5.4.8. Fuel-cell Optimization 5.4.9. Autonomous Driving 5.4.10. Predictive Maintenance 5.5. Automotive Quantum Computing Market Size and Forecast, by Region (2023-2030) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Automotive Quantum Computing Market Size and Forecast (by Value USD) 6.1. North America Automotive Quantum Computing Market Size and Forecast, by Component (2023-2030) 6.1.1. Software 6.1.2. Hardware 6.1.3. Services 6.2. North America Automotive Quantum Computing Market Size and Forecast, by Deployment (2023-2030) 6.2.1. Cloud 6.2.2. On-premises 6.3. North America Automotive Quantum Computing Market Size and Forecast, by Stakeholder (2023-2030) 6.3.1. OEMs 6.3.2. Automotive Tier 1 and Tier 2 6.3.3. Warehousing and Distribution 6.4. North America Automotive Quantum Computing Market Size and Forecast, by Application (2023-2030) 6.4.1. Vehicle Routng 6.4.2. Heat and Mass transfer 6.4.3. Fluid Dynamics 6.4.4. Electromechanical Systems 6.4.5. Route Optimization 6.4.6. Improved Battery Materials 6.4.7. Material Durability 6.4.8. Fuel-cell Optimization 6.4.9. Autonomous Driving 6.4.10. Predictive Maintenance 6.5. North America Automotive Quantum Computing Market Size and Forecast, by Country (2023-2030) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Automotive Quantum Computing Market Size and Forecast (by Value USD) 7.1. Europe Automotive Quantum Computing Market Size and Forecast, by Component (2023-2030) 7.1.1. Software 7.1.2. Hardware 7.1.3. Services 7.2. Europe Automotive Quantum Computing Market Size and Forecast, by Deployment (2023-2030) 7.2.1. Cloud 7.2.2. On-premises 7.3. Europe Automotive Quantum Computing Market Size and Forecast, by Stakeholder (2023-2030) 7.3.1. OEMs 7.3.2. Automotive Tier 1 and Tier 2 7.3.3. Warehousing and Distribution 7.4. Europe Automotive Quantum Computing Market Size and Forecast, by Application (2023-2030) 7.4.1. Vehicle Routng 7.4.2. Heat and Mass transfer 7.4.3. Fluid Dynamics 7.4.4. Electromechanical Systems 7.4.5. Route Optimization 7.4.6. Improved Battery Materials 7.4.7. Material Durability 7.4.8. Fuel-cell Optimization 7.4.9. Autonomous Driving 7.4.10. Predictive Maintenance 7.5. Europe Automotive Quantum Computing Market Size and Forecast, by Country (2023-2030) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Automotive Quantum Computing Market Size and Forecast (by Value USD) 8.1. Asia Pacific Automotive Quantum Computing Market Size and Forecast, by Component (2023-2030) 8.1.1. Software 8.1.2. Hardware 8.1.3. Services 8.2. Asia Pacific Automotive Quantum Computing Market Size and Forecast, by Deployment (2023-2030) 8.2.1. Cloud 8.2.2. On-premises 8.3. Asia Pacific Automotive Quantum Computing Market Size and Forecast, by Stakeholder (2023-2030) 8.3.1. OEMs 8.3.2. Automotive Tier 1 and Tier 2 8.3.3. Warehousing and Distribution 8.4. Asia Pacific Automotive Quantum Computing Market Size and Forecast, by Application (2023-2030) 8.4.1. Vehicle Routng 8.4.2. Heat and Mass transfer 8.4.3. Fluid Dynamics 8.4.4. Electromechanical Systems 8.4.5. Route Optimization 8.4.6. Improved Battery Materials 8.4.7. Material Durability 8.4.8. Fuel-cell Optimization 8.4.9. Autonomous Driving 8.4.10. Predictive Maintenance 8.5. Asia Pacific Automotive Quantum Computing Market Size and Forecast, by Country (2023-2030) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Automotive Quantum Computing Market Size and Forecast (by Value USD) 9.1. Middle East and Africa Automotive Quantum Computing Market Size and Forecast, by Component (2023-2030) 9.1.1. Software 9.1.2. Hardware 9.1.3. Services 9.2. Middle East and Africa Automotive Quantum Computing Market Size and Forecast, by Deployment (2023-2030) 9.2.1. Cloud 9.2.2. On-premises 9.3. Middle East and Africa Automotive Quantum Computing Market Size and Forecast, by Stakeholder (2023-2030) 9.3.1. OEMs 9.3.2. Automotive Tier 1 and Tier 2 9.3.3. Warehousing and Distribution 9.4. Middle East and Africa Automotive Quantum Computing Market Size and Forecast, by Application (2023-2030) 9.4.1. Vehicle Routng 9.4.2. Heat and Mass transfer 9.4.3. Fluid Dynamics 9.4.4. Electromechanical Systems 9.4.5. Route Optimization 9.4.6. Improved Battery Materials 9.4.7. Material Durability 9.4.8. Fuel-cell Optimization 9.4.9. Autonomous Driving 9.4.10. Predictive Maintenance 9.5. Middle East and Africa Automotive Quantum Computing Market Size and Forecast, by Country (2023-2030) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Automotive Quantum Computing Market Size and Forecast (by Value USD) 10.1. South America Automotive Quantum Computing Market Size and Forecast, by Component (2023-2030) 10.1.1. Software 10.1.2. Hardware 10.1.3. Services 10.2. South America Automotive Quantum Computing Market Size and Forecast, by Deployment (2023-2030) 10.2.1. Cloud 10.2.2. On-premises 10.3. South America Automotive Quantum Computing Market Size and Forecast, by Stakeholder (2023-2030) 10.3.1. OEMs 10.3.2. Automotive Tier 1 and Tier 2 10.3.3. Warehousing and Distribution 10.4. South America Automotive Quantum Computing Market Size and Forecast, by Application (2023-2030) 10.4.1. Vehicle Routng 10.4.2. Heat and Mass transfer 10.4.3. Fluid Dynamics 10.4.4. Electromechanical Systems 10.4.5. Route Optimization 10.4.6. Improved Battery Materials 10.4.7. Material Durability 10.4.8. Fuel-cell Optimization 10.4.9. Autonomous Driving 10.4.10. Predictive Maintenance 10.5. South America Automotive Quantum Computing Market Size and Forecast, by Country (2023-2030) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Accenture plc 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. IBM Corporation 11.3. Microsoft Corporation 11.4. D-wave systems, Inc 11.5. PASQAL 11.6. Terra Quantum 11.7. Rigetti & Co, LLC 11.8. IONQ 11.9. Atom Computng Inc 11.10. Quantinuum Ltd 11.11. Zapata Computing 11.12. Xanada Quantum Technologies Inc 11.13. Anyon Systems 11.14. Alpine Quantum Technologies 11.15. Multiverse Computing 11.16. Avanetix 12. Key Findings 13. Industry Recommendation