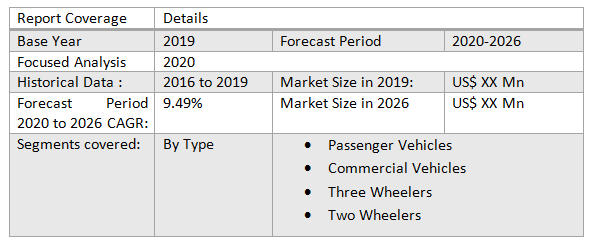

Automotive Market in Japan size was valued at US$ XX Mn in 2019 and the total revenue is expected to grow at 6.49% through 2020 to 2026, reaching US$ XX Mn.

To Know About The Research Methodology :- Request Free Sample Report

Automotive Market in Japan Overview:

The automotive segment in Japan is the 3rd largest automotive manufacturing industry in the world, with 78 factories in 22 regions & employing over 5.5 Mn people, it is a key pillar of the nation’s economy. Automotive manufacturing takes up 89 percent of the nation’s manufacturing segment & auto parts suppliers have also grown a large part of Japan’s economy, spreading into other industries like chemicals & rubber. It is an extremely innovative & technology-driven industry, with improved production of hybrid & EVs being brought onto the local & global market & an increase of supply & demand on a global scale. Local brands like Toyota, Nissan, Honda, and Suzuki & Mitsubishi lead the Japanese automotive market, with foreign-manufactured cars seen more as position symbols owing to the incredibly high maintenance cost of imported vehicles. The majority of car holders reside in rural areas of Japan, but its urban population deeply relies on public transport. Kei cars & motorcycles are also cheap alternatives to regular-sized cars & satisfy the nation’s demand for convenience in small spaces, though, the Japanese automotive industry is becoming more environmentally conscious thus customers are moving away from motorcycles to bicycles & e-bikes.Top-selling Brands in Japan’s Automotive Industry:

Toyota: Toyota is now the top-selling vehicle brand in country, selling more cars than its opponents Nissan & Honda combined. In the year 2019, it sold 1.5 Mn vehicles in Japan & 10.7 Mn vehicles globally, a rise from the last year. Yet its start was very humble, starting as a textile maker in the mill town of Koromo, it is currently one of the major automakers in the world. The establishment has pushed limits, curated high-quality designs for practical & recreational use combined, & are responsible for pushing hybrid & electric cars to the forefront of the automotive segment in Japan with their model Toyota Prius- the best-selling passenger car model in Japan. The company strategies to release a 2-seater EV later this year, mainly aimed at older drivers & rise its global sales of EVs to 5.5 Mn units by 2025. Not only does this accommodate the automotive segment in Japan, but it was recently declared that Toyota would collaborate with Hitachi & JR East on emerging railway vehicles equipped with hybrid systems, & before the company declared it would build a prototype ‘city of the future’, a fully-connected ecosystem motorized by hydrogen fuel cells. Nissan : Nissan is one of the giants in the Japanese automotive market, selling over half a Mn units in the year 2019 & has also expanded into the worldwide market. The company is one of the oldest in the Japanese auto segment, established in the year 1911 & manufactured trucks & airplanes for the Japanese army during the 2nd World War. It has partnered with several foreign brands like Austin & Prince Motor Company, however, it is more currently in a horizontal keiretsu between Renault & Mitsubishi an expansive network of businesses working strongly to maintain mutually beneficial planned relationships. Together, they have sold 10.6 Mn units in 2019. Honda: Honda is another big player within the Japanese automotive market, almost 50 percent of automobile sales occurred in Japan & other Asian nations this year. Honda started by selling motorcycles in Japan post-war for the nation to be mobile at a rapid & reasonable mass-producing rate. It became the major motorcycle in Japan in the year 1950s, upholding that title with 45.6 percent of the market share in the year 2019, despite the current drop of motorcycle sales in Japan. It is also now one of the major motorcycle brands in the world, along with Suzuki & Yamaha. Recently, the company revealed it would EV on October 30th in Japan, to rise the consumption of EVs. Honda strategies to have EVs, fuel cell vehicles, & hybrids account for two-thirds of its cars worldwide by 2030.Impact of Corona Virus pandemic on the Japanese Automotive Market:

Like many other industries, the Japanese automotive market has been affected by Corona Virus pandemic. All Japanese automakers had to shut down production plants all around the world for safety actions. Japan sales dropped sharply by 23 percent in June, with Toyota still being the top-forming brand, followed by Honda & Nissan. However, the Japanese automakers vowed to keep jobs against the global pandemic, setting up a special fund for those who have been laid off to find jobs & even produced face masks.The Future of the Japanese Automotive Market:

While the worldwide pandemic has had a massive impact on the automotive industry in Japan, it’s clear to understand where the segment is going in terms of emerging renewable, green technologies to be combined into vehicles. Demand for electric motorcycles is stronger now than ever before amid declining sales in Japan, so positively, these will be released on the Japanese automotive market soon sufficient & help spur development in the segment. Japan remains to be a leader in this space, and & United Kingdom-Japan Trade Deal will also profit the Japanese automotive market in the long run. The report covers Commercial Vehicles, Passenger Vehicles, with detailed analysis Automotive Market in Japan industry with the classifications of the market on the Type, Application & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled twelve key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different given on the regional impact on the cost of manufacturing, supply chain, availability of raw materials, labor cost, availability of advanced Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in four regions. The major states policies about manufacturing & Covid 19 impact on demand side are covered in the report.Scope of the Automotive Market in Japan: Inquire before buying

Automotive Market in Japan Key Players

• Honda • Volkswagen • Toyota • Nissan • Honda • Mazda • Mitsubishi • Others

Japan Automotive Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Japan Automotive Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Japan Automotive Market Analysis and Forecast 7. Japan Automotive Market Analysis and Forecast, by Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. Japan Market Value Share Analysis, by Type 7.4. Japan Market Size (US$ Mn) Forecast, by Type 7.5. Japan Market Analysis, by Type 8. Japan Automotive Market Analysis 8.1. Japan Market Forecast, by Type 8.1.1. Passenger Vehicles 8.1.2. Commercial Vehicles 8.1.3. Three Wheelers 8.1.4. Two Wheelers 8.2. PEST Analysis 8.3. Key Trends 8.4. Key Developments 9. Company Profiles 9.1. Market Share Analysis, by Company 9.2. Competition Matrix 9.2.1. Competitive Benchmarking of key players by price, presence, market share, Raw material and R&D investment 9.2.2. New Raw material Launches and Raw material Enhancements 9.2.2.1. Market Consolidation 9.2.2.2. M&A by Regions, Investment and Raw material 9.2.2.3. M&A Key Players, Forward Integration and Backward Integration 9.3. Company Profiles: Key Players 9.3.1. Honda 9.3.2. Volkswagen 9.3.3. Toyota 9.3.4. Nissan 9.3.5. Honda 9.3.6. Mazda 9.3.7. Mitsubishi 9.3.8. Others