The Automotive Market size in Europe was valued at USD 16.26 Billion in 2023 and the total Automotive Market in Europe revenue is expected to grow at a CAGR of 8.9 % from 2024 to 2030, reaching nearly USD 29.55 Billion. The European automotive market is a dynamic and diverse sector, characterized by a rich history of automobile manufacturing and a commitment to innovation. It encompasses a wide range of vehicles, from compact city cars to high-performance luxury models and heavy-duty commercial trucks. European automakers such as Volkswagen, BMW, and Mercedes-Benz have established themselves as industry leaders, known for their engineering excellence and cutting-edge technology. The region has also seen a significant shift towards electric and hybrid vehicles, with companies like Tesla and Nissan making strong inroads. In recent years, the industry has been challenged by regulatory pressures to reduce emissions, leading to a surge in electric vehicle adoption, with countries like Norway leading the way. The rise of mobility-as-a-service (MaaS) platforms has transformed the way Europeans think about transportation, encouraging shared mobility and reducing the emphasis on car ownership. The European automotive market is also marked by a growing focus on sustainability, with companies like Volvo committing to becoming carbon-neutral by 2040. This market is driven by traditional automotive manufacturers and by an ever-expanding ecosystem of startups and tech companies working on autonomous driving, connectivity, and innovative mobility solutions. As the industry adapts to these changes, it remains a vital driver of the European economy, offering a multitude of opportunities for companies and individuals involved in manufacturing, research and development, and service provision, all while contributing to the ongoing evolution of transportation on the continent.Automotive Market in Europe Scope and Research Methodology:

The research methodology involves a multi-faceted approach to gathering and analyzing data and insights related to the European automotive market. Examination of market data and statistics from reliable sources such as government reports, industry associations, and market research firms to understand current market trends, including sales, production, and growth forecasts. Conducting interviews and surveys with industry experts, executives, and stakeholders to gather qualitative insights and opinions on market dynamics, challenges, and opportunities. European automotive market analysis of relevant data sets to identify correlations, trends, and market dynamics. Assessment of geopolitical events and their implications on the European automotive industry, including case studies like Brexit. Exploration of changing consumer preferences through surveys and behavioral analyses related to shared mobility and autonomous vehicles. Study of labor shortages in skilled automotive manufacturing positions, including specific instances like Audi's labor challenges. Evaluation of vehicle ownership rates in European countries, such as Germany and France, to understand the market's saturation levels. It is based on the findings, providing forecasts for the European automotive market's future trends and offering recommendations for stakeholders and policymakers.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

Advanced High-Strength Steel Reshaping Environmental Impact in the Automotive Industry: There is increasing demand for reducing the weight of vehicles in Europe. This drive towards weight reduction is not merely for the sake of efficiency but is closely tied to enhancing vehicle performance and safety. As a response to this demand, Advanced High Strength Steel (AHSS) has emerged as a pivotal material. It is now one of the fastest-growing materials in the European automotive industry. To put this into perspective, steel constitutes approximately 70% of the average weight of a European automobile. However, when compared to standard steel, AHSS has the remarkable ability to reduce vehicle weight by 23-35%, which equates to shedding about 165 to 250 kilograms of weight for a regular passenger car. This weight reduction translates into substantial environmental benefits, saving 3 to 4.5 tons of greenhouse gases over the total life cycle of the vehicle. This environmental impact is even more significant than the CO2 emissions produced during the entire production process of the steel required for the car. The role of AHSS in weight reduction is multifaceted. Within a vehicle's structure, AHSS constitutes 34% of the body structure, panels, doors, and trunk closures. This composition provides energy absorption and high strength in case of a collision, contributing to enhanced safety. Another 23% of AHSS is allocated to the engine and machinable carbon steel for wear-resistant gears, further optimizing performance. An additional 12% is utilized in the suspension, utilizing rolled high-strength steel. The remaining percentage is distributed across crucial components such as wheels, tires, fuel tanks, steering, and braking systems.Advancements in European Automotive Steel Technologies Drive the European Automotive Industry: The key companies within the European automotive industry are actively taking necessary initiatives to improve their presence in the market. For example, Thyssenkrupp completed the sale of Acciai Speciali Terni (AST) to the Italian company Arvedi in February 2022. This strategic move aligns with the industry's commitment to advancing lightweight materials and reducing emissions. Automotive steel technologies are not stagnant. Advancements are ongoing, with a focus on developing different alloys that allow for processing combinations, high tensile strength, ductility, and optimized chemical compositions to achieve multiphase microstructures of Advanced High Strength Steel (AHSS). These advancements are designed to meet the ever-evolving demands of the European automotive market. As market players continue to innovate and develop new products centered around AHSS, it is expected that the competition in the European automotive lightweight materials market will intensify in the coming years. Another noteworthy advancement is the expanded capabilities of automotive steels with high strength. This enables the design of thinner parts that optimize stiffness while maintaining the necessary geometries. The utilization of materials like Nano Steel allows for the manufacture of thinner gauges of steel and components at room temperature, further contributing to weight reduction and enhanced performance. The continuous evolution in Automotive AHSS technology is a driving force in the European automotive market. It not only aligns with the goals of weight reduction and improved safety but also addresses crucial environmental concerns by reducing greenhouse gas emissions. As industry players actively engage in the development and application of these materials, the European automotive market is poised for dynamic changes and increased competitiveness. This trend is set to offer lucrative opportunities for players operating in the market during the forecast period, ensuring the automotive industry in Europe remains at the forefront of innovation and sustainability. Growing Raw Material Price Impacting the European Car Market: Supply chain disruptions, exemplified by the semiconductor shortage, have affected vehicle production. For instance, in 2021, the shortage of semiconductors forced many European automakers to reduce their production capacity, impacting the market's growth prospects. Stringent environmental regulations drive up the costs of manufacturing environmentally friendly vehicles. European emissions standards, like Euro 6d and Euro 7, necessitate costly technology upgrades, potentially hampering market growth. While the transition to EVs is essential, the shift poses challenges. The growth of EV infrastructure and charging networks, exemplified by Tesla's efforts to expand its Supercharger network in Europe, is necessary for market success. Escalating raw material costs, especially steel and aluminum, affect production expenses. Volkswagen experienced this firsthand when steel price increases impacted production costs, challenging market growth. The rise of Asian automakers in Europe, such as Hyundai and Kia, intensifies competition. Their competitive pricing and high-quality vehicles challenge traditional European car manufacturers. Changing consumer preferences, notably the shift towards shared mobility and autonomous vehicles, disrupt traditional market dynamics. Car-sharing platforms like BlaBlaCar offer alternatives to car ownership, impacting market growth. Trade tensions and geopolitical uncertainties, such as Brexit, can disrupt the flow of automotive components and finished vehicles. The post-Brexit trade disruptions between the UK and the EU serve as an example. Labor shortages in skilled automotive manufacturing positions can lead to production delays. As an illustration, Audi has faced labor shortages, impacting production schedules. Some European markets are nearing saturation, with high vehicle ownership rates. In countries like Germany and France, where car ownership per capita is already high, market growth is inherently limited.

Automotive Market in Europe Segment Analysis:

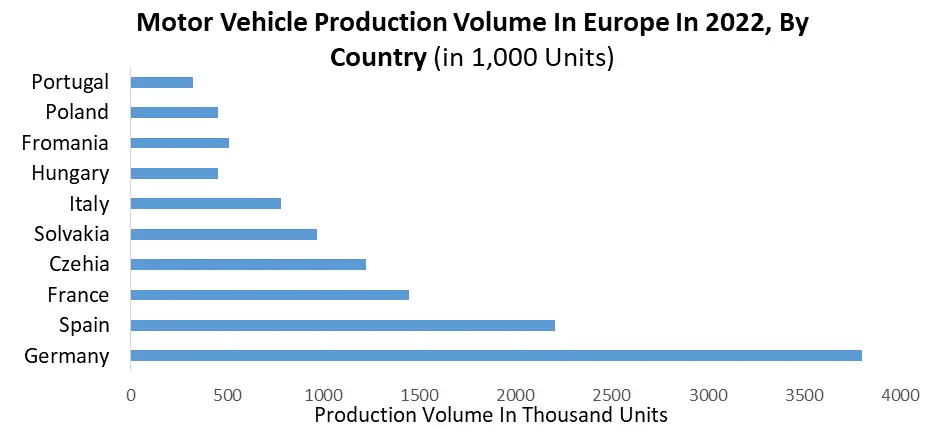

Based on Vehicle Type, Passenger cars continue to dominate the European automotive market due to their widespread use for personal transportation. However, the adoption of electric cars is on the rise, challenging the dominance of traditional internal combustion engine passenger cars and making the European automotive market more environmentally sustainable. Traditional passenger cars continue to be widely adopted for personal and family use. European consumers favor compact and fuel-efficient models, but there's a growing interest in hybrid and electric passenger cars as environmental awareness increases. Electric vehicles (EVs) are gaining momentum, primarily due to environmental concerns and government incentives. The adoption of electric cars is notably high in countries like Norway, where EVs dominate the market, supported by incentives and charging infrastructure. Motor Vehicle Production Volume is shown in the European automotive industry statistics. Commercial vehicles, including trucks and vans, are crucial for logistics and transportation services in Europe. Their adoption is driven by the need for efficient goods transportation, with e-commerce expansion fueling growth. Three-wheelers find applications in urban mobility and last-mile delivery services. In congested European cities, they offer nimble solutions for transport and courier companies. Motorcycles and scooters are popular for urban commuting, with a focus on fuel efficiency and reduced emissions. In densely populated European cities, two-wheelers are embraced for their agility and convenience. Utility vehicles, including SUVs and crossovers, are gaining popularity among European consumers, reflecting a shift towards larger, more versatile vehicles, driven by lifestyle preferences and the desire for increased interior space in the car industry in Europe.Automotive Market in Europe Regional Insights:

The European automotive market is a dynamic and influential industry, characterized by a clear distinction between large producing and large consuming regions. Central and Eastern Europe has emerged as significant automotive production hubs. Countries like Germany and France are home to major manufacturing facilities for renowned automakers. Germany stands out as a production powerhouse, with a strong emphasis on luxury and high-performance vehicles. Poland and Hungary are also witnessing a surge in automotive production, attracting investments from Europe manufacturers. These countries benefit from a skilled workforce and strategic geographical locations for easy access to key markets. Germany, France, and the United Kingdom dominate the consumption of automobiles. These nations have a well-established automotive culture, and consumers in Europe are known for their affinity for high-quality, performance-oriented vehicles. Germany, as the largest consumer and producer, exemplifies this trend, with a strong market for domestic brands and imports. European nations are increasingly adopting electric vehicles and hybrid technology to address environmental concerns and government incentives, driving changes in consumer preferences and industry dynamics with more automotive market share in Europe.

Competitive Landscape

Key Players of the Automotive Market in Europe profiled in the report are Darling Ingredients Inc., Ewald-Automotive Market in Volkswagen, Toyota, Nissan, Honda, Mazda, Mitsubishi, Mercedes-Benz, BMW, Porsche, Skoda, Land Rover, Audi Motors, Autoliv, Bosch, and Continental. This provides huge opportunities to serve many End-users and customers and expand the Automotive Market in Europe. In February 2022, Thyssenkrupp finalized the sale of Acciai Speciali Terni (AST), along with its associated sales operations in Germany, Italy, and Turkey, to the Italian company Arvedi. This sale, which was contractually agreed upon in September 2021, marks a significant shift in ownership within the steel industry. While the financial specifics of the transaction remain undisclosed, an intriguing facet of this deal is Thyssenkrupp's decision to retain a 15% minority shareholding in AST. This strategic move signifies a commitment to maintaining an operational partnership with Arvedi, emphasizing the importance of collaboration and synergies within the steel sector.Europe Automotive Market Scope: Inquiry Before Buying

Europe Automotive Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 16.26 Bn. Forecast Period 2024 to 2030 CAGR: 8.9% Market Size in 2030: US $ 29.55 Bn. Segments Covered: by Vehicle Type Commercial Vehicles Electric Cars Passenger Cars Three Wheelers Two-Wheelers Utility Vehicles by Fuel Type Petrol Diesel Electric CNG/LPG Automotive Market in Europe Key Players:

1. Honda 2. Volkswagen 3. Toyota 4. Nissan 5. Mazda 6. Mitsubishi 7. Mercedes-Benz 8. BMW 9. Porsche 10. Skoda 11. Land Rover 12. Audi Motors 13. Autoliv 14. Bosch 15. Continental 16. DAF Trucks 17. Daimler 18. Delphi 19. Denso 20. Deutsche Telekom 21. Ericsson 22. Eurofiber FAQs: 1. What are the growth drivers for the Automotive Market in Europe? Ans. Advanced High-Strength Steel Reshaping Environmental Impact in the Automotive Industry and is expected to be the major driver for the Automotive Market in Europe. 2. What is the major restrain for the Automotive Market in Europe's growth? Ans. Growing Raw Material prices impacting the European Car Market are expected to be a restraint in the Automotive Market in Europe. 3. Which country is expected to lead the Automotive Market in Europe during the forecast period? Ans. The United Kingdom is expected to lead the Automotive Market in Europe during the forecast period. 4. What is the projected market size and growth rate of the Automotive Market in Europe? Ans. The Automotive Market in Europe size was valued at USD 16.26 Billion in 2023 and the total Automotive Market in Europe revenue is expected to grow at a CAGR of 8.9 % from 2024 to 2030, reaching nearly USD 29.55 Billion. 5. What segments are covered in the Automotive Market in Europe report? Ans. The segments covered in the Automotive Market in Europe report are by Vehicle Type, Fuel Type, and Country.

1. Automotive Market in Europe: Research Methodology 2. Automotive Market in Europe Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Automotive Market in Europe: Dynamics 3.1 Automotive Market in Europe Trends 3.2 Automotive Market in Europe Drivers 3.3 Automotive Market in Europe Restraints 3.4 Automotive Market in Europe Opportunities 3.5 Automotive Market in Europe Challenges 3.6 PORTER’s Five Forces Analysis 3.6.1 Bargaining Power of Suppliers 3.6.2 Bargaining Power of Buyers 3.6.3 Threat Of New Entrants 3.6.4 Threat Of Substitutes 3.6.5 Intensity Of Rivalry 3.7 PESTLE Analysis 3.8 Value Chain Analysis 3.9 Regulatory Landscape in Europe 3.10 Analysis of Government Schemes and Initiatives for the Automotive Market in Europe. 3.11 Price Trend Analysis 3.12 Technological Road Map 4. Automotive Market in Europe Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 4.1 Automotive Market in Europe Size and Forecast, By Vehicle Type (2023-2030) 4.1.1 Commercial Vehicles 4.1.2 Electric Cars 4.1.3 Passenger Cars 4.1.4 Three Wheelers 4.1.5 Two-Wheelers 4.1.6 Utility Vehicles 4.2 Automotive Market in Europe Size and Forecast, By Fuel Type (2023-2030) 4.2.1 Petrol 4.2.2 Diesel 4.2.3 Electric 4.2.4 CNG/LPG 4.3 Automotive Market in Europe Size and Forecast, by Country (2023-2030) 4.3.1 United Kingdom 4.3.1.1 United Kingdom Automotive Market Size and Forecast, By Vehicle Type (2023-2030) 4.3.1.1.1 Commercial Vehicles 4.3.1.1.2 Electric Cars 4.3.1.1.3 Passenger Cars 4.3.1.1.4 Three Wheelers 4.3.1.1.5 Two-Wheelers 4.3.1.1.6 Utility Vehicles 4.3.1.2 United Kingdom Automotive Market Size and Forecast, By Fuel Type (2023-2030) 4.3.1.2.1 Petrol 4.3.1.2.2 Diesel 4.3.1.2.3 Electric 4.3.1.2.4 CNG/LPG 4.3.2 France 4.3.2.1 France Automotive Market Size and Forecast, By Vehicle Type (2023-2030) 4.3.2.1.1 Commercial Vehicles 4.3.2.1.2 Electric Cars 4.3.2.1.3 Passenger Cars 4.3.2.1.4 Three Wheelers 4.3.2.1.5 Two-Wheelers 4.3.2.1.6 Utility Vehicles 4.3.2.2 France Automotive Market Size and Forecast, By Fuel Type (2023-2030) 4.3.2.2.1 Petrol 4.3.2.2.2 Diesel 4.3.2.2.3 Electric 4.3.2.2.4 CNG/LPG 4.3.3 Germany 4.3.3.1 Germany Automotive Market Size and Forecast, By Vehicle Type (2023-2030) 4.3.3.1.1 Commercial Vehicles 4.3.3.1.2 Electric Cars 4.3.3.1.3 Passenger Cars 4.3.3.1.4 Three Wheelers 4.3.3.1.5 Two-Wheelers 4.3.3.1.6 Utility Vehicles 4.3.3.2 Germany Automotive Market Size and Forecast, By Fuel Type (2023-2030) 4.3.3.2.1 Petrol 4.3.3.2.2 Diesel 4.3.3.2.3 Electric 4.3.3.2.4 CNG/LPG 4.3.4 Italy 4.3.4.1 Italy Automotive Market Size and Forecast, By Vehicle Type (2023-2030) 4.3.4.1.1 Commercial Vehicles 4.3.4.1.2 Electric Cars 4.3.4.1.3 Passenger Cars 4.3.4.1.4 Three Wheelers 4.3.4.1.5 Two-Wheelers 4.3.4.1.6 Utility Vehicles 4.3.4.2 Italy Automotive Market Size and Forecast, By Fuel Type (2023-2030) 4.3.4.2.1 Petrol 4.3.4.2.2 Diesel 4.3.4.2.3 Electric 4.3.4.2.4 CNG/LPG 4.3.5 Spain 4.3.5.1 Spain Automotive Market Size and Forecast, By Vehicle Type (2023-2030) 4.3.5.1.1 Commercial Vehicles 4.3.5.1.2 Electric Cars 4.3.5.1.3 Passenger Cars 4.3.5.1.4 Three Wheelers 4.3.5.1.5 Two-Wheelers 4.3.5.1.6 Utility Vehicles 4.3.5.2 Spain Automotive Market Size and Forecast, By Fuel Type (2023-2030) 4.3.5.2.1 Petrol 4.3.5.2.2 Diesel 4.3.5.2.3 Electric 4.3.5.2.4 CNG/LPG 4.3.6 Sweden 4.3.6.1 Sweden Automotive Market Size and Forecast, By Vehicle Type (2023-2030) 4.3.6.1.1 Commercial Vehicles 4.3.6.1.2 Electric Cars 4.3.6.1.3 Passenger Cars 4.3.6.1.4 Three Wheelers 4.3.6.1.5 Two-Wheelers 4.3.6.1.6 Utility Vehicles 4.3.6.2 Sweden Automotive Market Size and Forecast, By Fuel Type (2023-2030) 4.3.6.2.1 Petrol 4.3.6.2.2 Diesel 4.3.6.2.3 Electric 4.3.6.2.4 CNG/LPG 4.3.7 Austria 4.3.7.1 Austria Automotive Market Size and Forecast, By Vehicle Type (2023-2030) 4.3.7.1.1 Commercial Vehicles 4.3.7.1.2 Electric Cars 4.3.7.1.3 Passenger Cars 4.3.7.1.4 Three Wheelers 4.3.7.1.5 Two-Wheelers 4.3.7.1.6 Utility Vehicles 4.3.7.2 Austria Automotive Market Size and Forecast, By Fuel Type (2023-2030) 4.3.7.2.1 Petrol 4.3.7.2.2 Diesel 4.3.7.2.3 Electric 4.3.7.2.4 CNG/LPG 4.3.8 Rest of Europe 4.3.8.1 Rest of Europe Automotive Market Size and Forecast, By Vehicle Type (2023-2030) 4.3.8.1.1 Commercial Vehicles 4.3.8.1.2 Electric Cars 4.3.8.1.3 Passenger Cars 4.3.8.1.4 Three Wheelers 4.3.8.1.5 Two-Wheelers 4.3.8.1.6 Utility Vehicles 4.3.8.2 Rest of Europe Automotive Market Size and Forecast, By Fuel Type (2023-2030). 4.3.8.2.1 Petrol 4.3.8.2.2 Diesel 4.3.8.2.3 Electric 4.3.8.2.4 CNG/LPG 5. Automotive Market in Europe: Competitive Landscape 5.1 MMR Competition Matrix 5.2 Competitive Landscape 5.3 Key Players Benchmarking 5.3.1 Company Name 5.3.2 Product Segment 5.3.3 End-user Segment 5.3.4 Revenue (2023) 5.3.5 Manufacturing Locations 5.3.6 SKU Details 5.3.7 Production Capacity 5.3.8 Production for 2023 5.4 Market Analysis by Organized Players vs. Unorganized Players 5.4.1 Organized Players 5.4.2 Unorganized Players 5.5 Leading Automotive Market in Europe Companies, by market capitalization 5.6 Market Structure 5.6.1 Market Leaders 5.6.2 Market Followers 5.6.3 Emerging Players 5.7 Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1 Honda 6.1.1 Company Overview 6.1.2 Business Portfolio 6.1.3 Financial Overview 6.1.4 SWOT Analysis 6.1.5 Strategic Analysis 6.1.6 Scale of Operation (small, medium, and large) 6.1.7 Details on Partnership 6.1.8 Regulatory Accreditations and Certifications Received by Them 6.1.9 Awards Received by the Firm 6.1.10 Recent Developments 6.2 Volkswagen 6.3 Toyota 6.4 Nissan 6.5 Honda 6.6 Mazda 6.7 Mitsubishi 6.8 Mercedes-Benz 6.9 BMW 6.10 Porsche 6.11 Skoda 6.12 Land Rover 6.13 Audi Motors 6.14 Autoliv 6.15 Bosch 6.16 Continental 6.17 DAF Trucks 6.18 Daimler 6.19 Delphi 6.20 Denso 6.21 Deutsche Telekom 6.22 Ericsson 6.23 Eurofiber 7. Key Findings 8. Industry Recommendations 9. Terms and Glossary