Automotive Market in China is expected to grow at a CAGR of 6.49% during the forecast period and is expected to reach US$ 3.24 Tn by 2029.To Know About The Research Methodology :- Request Free Sample Report

Automotive Market in China Overview:

China endures being the world’s major vehicle market with the Chinese government expecting that automobile output will reach 32 Mn units by 2021 & 35 Mn by 2025. According to the MMR study, over 27 Mn vehicles were sold in the year 2018. This included 23.79 Mn passenger vehicles, down 4.08 percent from 2017, & 4.38 Mn commercial vehicles, an increase of 5.05 percent. The decline in passenger vehicle sales is the 1st annual decline in at least 20 years.Autos, counting new energy vehicles, are one of ten segments of the Made in China 2025 program, the Chinese government initiative to upgrading the country’s industry from low-cost mass production to higher value-added progressive manufacturing. For new energy vehicles, the government’s aim is to produce 1 Mn electric & plug-in hybrid cars in China by 2021, with local production accounting for at least 70 percent of the country’s market share. Moreover, China goals to sell 3 Mn locally branded NEV’s in the year 2025 with a minimum of 80 percent of the country’s new energy vehicles market share. China’s Automobile Mid & Long-Term Development Proposal, released in April 2017, supports this initiative; aiming to make China a robust auto power within 10 years. This strategy highlights the growth of new energy vehicles & connected & autonomous vehicles as an opportunity for China to lead this developing market. Numerous ambitious targets have been set relating to the creation of national winners in auto parts/brands, connected car technology, driver assistance, & autonomous systems. Added guidelines focus on new energy vehicles engines, plug-in hybrid engines, fuel cell systems & main components, charging stations, battery manufacturing facilities, & testing equipment.

China contribute 35% of global growth from 2022:

Leading sub-segments:

Automotive Aftermarket:

The Chinese parts & repair aftermarket is estimated to reach $3.24 Trillion by 2029. The Chinese automotive parts market is led by foreign & JV companies with a 70 percent revenue share in 2022.Specialty Auto Parts:

China’s specialty auto parts market reached about $2.08 Tn in the year 2022, registering a CAGR of about 30 percent. The car modification business stays popular in many established cities despite the fact that China’s Road Safety Law basically prohibits modifications. However, foreign specialty equipment establishments have understood the market potential. The International Trade Administration endures to engage with Chinese industry & government representatives on aftermarket problems & has delivered information on how the US controls its aftermarket, with specialty equipment. The Specialty Equipment Market Association has a MDCP award with ITA to support United States specialty parts establishments grow their exports to China.Autonomous and Connected Vehicles:

The promising industry of autonomous driving vehicles, as a main sector for growth in China, offers new areas of opportunity for high quality automotive component & IT companies. “The Connected Vehicle Industry Development Plan 2022” sets exact goals for autonomous driving vehicles with the reduction of vehicle traffic accidents by 30 percent, increase traffic efficiency by 10 percent, & decrease fuel consumption by 5 percent. The strategy also calls for at least 50 percent of the vehicles being equipped with driver assistance, partial assistance (PA) or conditional assistance (CA). The growth of autonomous driving vehicles in China faces challenges relating to standards growth, on-road testing, cyber security, geographic data collection, & intellectual property protection amongst others. The report covers Commercial Vehicles, Passenger Vehicles, with detailed analysis Automotive Market in China industry with the classifications of the market on the Type, Application & region. Analysis of past market dynamics from 2017 to 2021 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled twelve key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw materials, labor cost, availability of advanced Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in four regions. The major states policies about manufacturing & Covid 19 impact on demand side are covered in the report.Scope of the Automotive Market in China: Inquiry before Buying

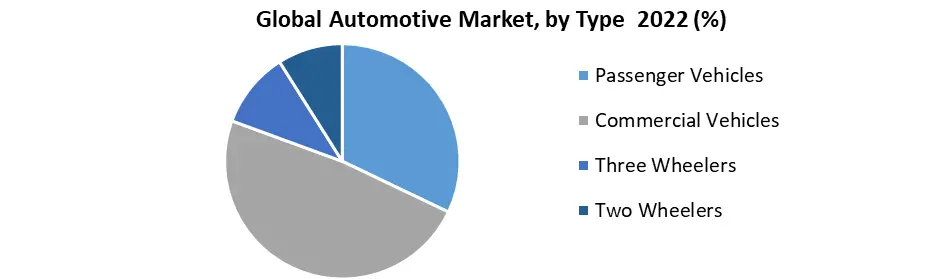

Automotive Market in China Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 2.08 Tn. Forecast Period 2023 to 2029 CAGR: 6.49% Market Size in 2029: US $ 3.24 Tn. Segments Covered: by Type Passenger Vehicles Commercial Vehicles Three Wheelers Two Wheelers Automotive Market in China Key Players are

1. Honda 2. Geely Auto 3. Dongfeng Motors 4. Changan Automobile 5. Faw Group 6. Great Wall Motors 7. SAIC-Wuling-GM 8. Byd Auto Co. Ltd 9. Brilliance Auto 10. Chery 11. Lifan Group 12. Green Field Motors 13. Volkswagen 14. HONGQI 15. FAW Group 16. Chana 17. GWM 18. Qoros 19. XPeng 20. WulingFrequently Asked questions

1. What is the market size of the Automotive Market in China in 2022? Ans. The market size Automotive Market in China in 2022 was US$ 2.08 Trillion. 2. What are the different segments of the Automotive Market in China? Ans. The Automotive Market in China is divided into Type. 3. What is the study period of this market? Ans. The Automotive Market in China will be studied from 2022 to 2029. 4. Which region is expected to hold the highest Automotive Market in China share? Ans. The Asia Pacific dominates the market share in the market. 5. What is the Forecast Period of Automotive Market in China? Ans. The Forecast Period of the market is 2032-2029 in the market.

Automotive Market in China 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: China Automotive Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. China Automotive Market Analysis and Forecast 7. China Automotive Market Analysis and Forecast, by Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. China Market Value Share Analysis, by Type 7.4. China Market Size (US$ Mn) Forecast, by Type 7.5. China Market Analysis, by Type 8. China Automotive Market Analysis 8.1. China Market Forecast, by Type 8.1.1. Passenger Vehicles 8.1.2. Commercial Vehicles 8.1.3. Three Wheelers 8.1.4. Two Wheelers 8.2. PEST Analysis 8.3. Key Trends 8.4. Key Developments 9. Company Profiles 9.1. Market Share Analysis, by Company 9.2. Competition Matrix 9.2.1. Competitive Benchmarking of key players by price, presence, market share, Raw material and R&D investment 9.2.2. New Raw material Launches and Raw material Enhancements 9.2.2.1. Market Consolidation 9.2.2.2. M&A by Regions, Investment and Raw material 9.2.2.3. M&A Key Players, Forward Integration and Backward Integration 9.3. Company Profiles: Key Players 9.3.1. Honda 9.3.2. Geely Auto 9.3.3. Geely Auto 9.3.4. Dongfeng Motors 9.3.5. Changan Automobile 9.3.6. Faw Group 9.3.7. Great Wall Motors 9.3.8. SAIC-Wuling-GM 9.3.9. Byd Auto Co. Ltd 9.3.10. Brilliance Auto 9.3.11. Chery 9.3.12. Lifan Group 9.3.13. Green Field Motors 9.3.14. Volkswagen. 9.3.15. HONGQI 9.3.16. FAW Group 9.3.17. Chana 9.3.18. GWM 9.3.19. Qoros 9.3.20. XPeng 9.3.21. Wuling