The Latin America Electric Vehicle Market size was valued at USD 1.10 Billion in 2023 and the total Latin America Electric Vehicle revenue is expected to grow at a CAGR of 14.32 % from 2024 to 2030, reaching nearly USD 2.81 Billion by 2030. Electric vehicles (EVs) are a model shift in transportation, driven by a collaboration of sophisticated components that redefine automotive technology. The Latin America Electric Vehicle market is experiencing a transformative shift, embracing sustainable transportation. The Latin America Electric Vehicle market showcases promising potential amidst the push towards eco-friendly transportation. rising environmental concerns, government incentives promoting EV adoption, and technological advancements enhancing battery efficiency and driving range are the major factor driving the growth of South America Electric Vehicle Market. In recent times, key players such as BYD, Tesla, and Nissan have made substantial strides in the region. For instance, BYD expanded its electric bus operations in Chile and Brazil, Tesla increased its presence by establishing charging infrastructure in key Latin American cities, and Nissan launched its latest electric vehicle models tailored for the regional market. These developments underscore a burgeoning landscape for EVs in Latin America, where the convergence of technological innovation, governmental support, and consumer demand sets the stage for a compelling transformation in the automotive industry.To know about the Research Methodology :- Request Free Sample Report

Latin America Electric Vehicle Market Dynamics:

Escalating Fuel Costs Motivate Consumers to opt for EVs Is Driving Latin America Electric Vehicle Market Growth In Latin America, governments are actively incentivizing electric vehicle (EV) adoption through various policies. Brazil, for instance, offers tax exemptions and subsidies to EV buyers, resulting in a remarkable surge in electric vehicle sales. Companies such as Renault have significantly benefited from these policies, experiencing substantial increases in sales of their EV models such as the Zoe. The region's push for charging infrastructure expansion has been pivotal.In Chile, the collaboration between Enel X and Engie to implement charging stations has not only facilitated EV growth but has also encouraged companies such as BYD to invest more in electric buses, expanding their operations across the country. Environmental consciousness is profoundly influencing consumer preferences in South America. Colombia, through its environmental initiatives, has boosted the popularity of EVs, exemplified by the remarkable growth in Chevrolet Bolt sales, meeting the escalating demand for eco-friendly transportation options. Technological innovations that improve battery life and efficiency are driving market growth. Volkswagen's entry into the South America electric vehicle market with the ID.4, equipped with extended range and cutting-edge battery technology, illustrates how such advancements attract consumers seeking reliable and advanced electric vehicles. Decreasing battery costs are contributing significantly to Latin America electric vehicle market Growth. Companies such as Chery are capitalizing on reduced battery prices to introduce affordable EVs such as the Arrizo, specifically targeting price-sensitive consumers in countries such as Argentina, thereby enhancing market accessibility. Economic factors, like escalating fuel costs in Uruguay, are also motivating consumers to shift towards EVs. The popularity surge of electric vehicles such as the Nissan Leaf in response to soaring fuel prices highlights how these economic considerations influence consumer decisions in favor of electric mobility. These multifaceted drivers, including favorable regulations, educational campaigns, strategic partnerships, and the urgency to address urban congestion and pollution, collectively fuel the burgeoning growth of the South America electric vehicle market. Limited Availability and Variety of EV Models in Latin American Markets Hinder the Market Growth Inadequate charging infrastructure is a primary obstacle across regions in Brazil and Argentina, where limited charging stations impact consumer confidence and impede Latin America electric vehicle market growth, despite increasing interest in EVs. Higher upfront costs of EVs, in countries such as Colombia and Peru, act as a barrier to widespread adoption, particularly for models like the Tesla Model 3, deterring consumers due to comparatively lower average incomes. Concerns regarding limited driving range persist in markets such as Chile and Uruguay, despite the popularity of models like the Nissan Leaf, dissuading potential buyers from embracing EVs for longer journeys, slowing down broader acceptance. Restricted availability and variety of EV models in markets such as Ecuador and Bolivia limit consumer options, impacting the potential for wider EV adoption. Challenges in battery technology and supply chain disruptions affect markets like Argentina and Chile, impacting the availability of EVs and critical components. Misconceptions and insufficient knowledge about EVs, particularly in Paraguay and Venezuela, impede consumer acceptance and confidence due to misinformation regarding EV technology and performance. Inconsistent or unclear government policies in Brazil and Peru regarding EV incentives and infrastructure development create market instability, causing uncertainty among investors and consumers. Uncertainties surrounding EV resale value in Uruguay and Colombia contribute to consumer hesitancy, impacting long-term adoption. Additionally, prolonged charging times and accessibility issues in countries like Bolivia and Ecuador affect the convenience of owning an EV, while inadequate rural infrastructure in remote areas of Peru and Bolivia limits the feasibility and accessibility of EVs beyond urban centers. These collective challenges present significant hurdles to the widespread adoption of electric vehicles in South America.

Latin America Electric Vehicle Market Segment Analysis:

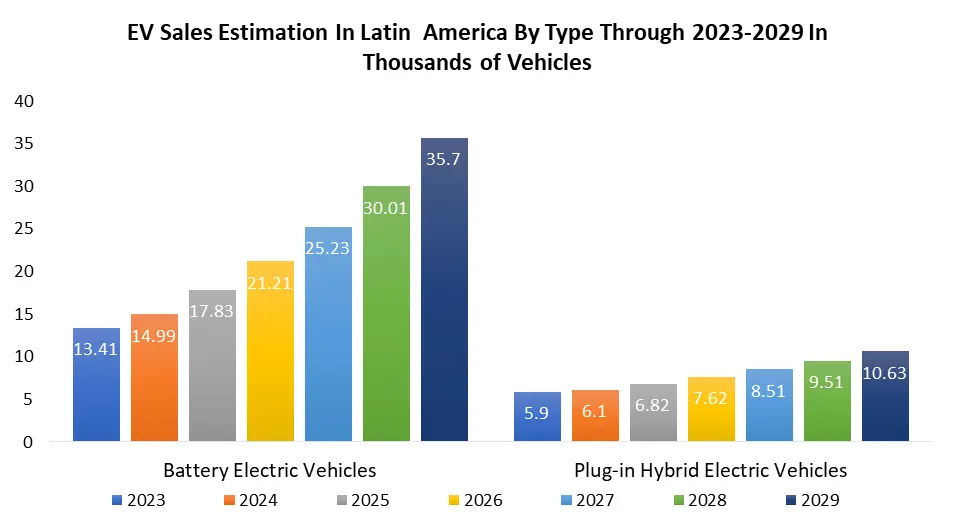

Based on Type, Battery Electric Vehicles (BEVs) dominated the Latin American Electric Vehicle market in 2023 as electric batteries, are gaining traction primarily in urban settings due to their zero-emission nature, appealing to environmentally conscious consumers and governmental initiatives promoting clean transportation. Plug-in Hybrid Electric Vehicles (PHEVs) is fast growing segment in Latin American Electric Vehicle market, offering both electric and internal combustion engine power, find favour among consumers seeking a balance between electric range and the convenience of a backup combustion engine, suitable for longer drives and regions with inadequate charging infrastructure. HEVs, operating on both electric and internal combustion engines but not requiring external charging, maintain popularity among consumers transitioning to electric mobility, especially in areas where charging infrastructure remains limited, serving as an intermediary step towards full electrification. BEVs dominate urban landscapes, PHEVs find application in mixed-use scenarios, and HEVs serve as a transitional option in regions with evolving charging infrastructure, reflecting diverse adoption patterns based on application suitability and regional infrastructure readiness.

Latin America Electric Vehicle Market Regional Insights:

Brazil Dominance in the Latin America Electric Vehicle Market Brazil emerges as a key producing region, boasting a burgeoning manufacturing sector for electric vehicles in Latin America Electric Vehicle Market. With its robust automotive industry and government incentives, Brazil leads in producing various EV components, including batteries and vehicles, contributing significantly to the regional supply chain. Argentina also plays a substantial role in production, focusing on battery manufacturing and assembly operations, further enhancing the local EV manufacturing landscape. In terms of consumption, Chile and Colombia stand out as large consuming regions. Both countries have witnessed a surge in EV adoption driven by environmental consciousness, governmental support, and expanding charging infrastructure. Chile, in particular, showcases a strong consumer for electric mobility, fostering a growing market for EVs across various segments. Regarding import-export dynamics, while Brazil and Argentina contribute significantly to regional production, they also engage in substantial trade, importing and exporting EV components and vehicles.Latin America Electric Vehicle Market Scope: Inquire before buying

Latin America Electric Vehicle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.10 Bn. Forecast Period 2024 to 2030 CAGR: 14.32% Market Size in 2030: US $ 2.81 Bn. Segments Covered: by Type BEV PHEV HEV by Vehicle Type Two-Wheeler Passenger Car Commercial Vehicle Latin America Electric Vehicle Market Key Players:

Major Contributors in the Latin America Electric Vehicle Industry:FAQs: 1] What segments are covered in the Market report? Ans. The segments covered in the Market report are based on Type, Vehicle Type and Region. 2] Which region is expected to hold the highest share in the Latin America Electric Vehicle Market? Ans. Brazil region is expected to hold the highest share in the Latin America Electric Vehicle market. 3] What is the market size of the Latin America Electric Vehicle Market by 2030? Ans. The market size of the Latin America Electric Vehicle Market by 2030 is expected to reach US$ 2.81 Bn. 4] What is the forecast period for the Latin America Electric Vehicle Market? Ans. The forecast period for the Latin America Electric Vehicle Market is 2024-2030. 5] What was the market size of the Latin America Electric Vehicle Market in 2023? Ans. The market size of the Latin America Electric Vehicle Market in 2023 was valued at US$ 1.10 Bn.

Electric Vehicle Manufacturer Headquarters Latin American Operations/Presence Renault France Brazil Nissan Japan Brazil Chevrolet United States Various South American countries BYD China Brazil Volkswagen Germany Brazil Tesla United States Presence in South American markets Chery China Brazil and other South American countries BMW Germany South American markets Jaguar Land Rover United Kingdom Latin American countries Hyundai South Korea Various South American countries

1. Latin America Electric Vehicle Market: Research Methodology 2. Latin America Electric Vehicle Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Latin America Electric Vehicle Market: Dynamics 3.1. Latin America Electric Vehicle Market Trends 3.2. Latin America Electric Vehicle Market Drivers 3.3. Latin America Electric Vehicle Market Restraints 3.4. Latin America Electric Vehicle Market Opportunities 3.5. Latin America Electric Vehicle Market Challenges 4. PORTER’s Five Forces Analysis 5. PESTLE Analysis 6. Technological Roadmap 7. Regulatory Landscape 8. Key Opinion Leader Analysis for Latin America Electric Vehicle End User 9. Analysis of Government Schemes and Initiatives for Latin America Electric Vehicle End User 10. The Covid 19 Pandemic Impact on Latin America Electric Vehicle Market 11. Latin America Electric Vehicle Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 11.1. Latin America Electric Vehicle Market Size and Forecast, by Type (2022-2029) 11.1.1. BEV 11.1.2. PHEV 11.1.3. HEV 11.2. Latin America Electric Vehicle Market Size and Forecast, by Vehicle Type (2022-2029) 11.2.1. Two-Wheeler 11.2.2. Passenger Car 11.2.3. Commercial Vehicle 11.3. Latin America Electric Vehicle Market Size and Forecast, by Country (2022-2029) 11.3.1. Brazil 11.3.1.1. Brazil Electric Vehicle Market Size and Forecast, by Type (2022-2029) 11.3.1.2. Brazil Electric Vehicle Market Size and Forecast, by Vehicle Type (2022-2029) 11.3.2. Argentina 11.3.2.1. Argentina Electric Vehicle Market Size and Forecast, by Type (2022-2029) 11.3.2.2. Argentina Electric Vehicle Market Size and Forecast, by Vehicle Type (2022-2029) 11.3.3. Rest Of Latin America 11.3.3.1. Rest Of Latin America Electric Vehicle Market Size and Forecast, by Type (2022-2029) 11.3.3.2. Rest Of Latin America Electric Vehicle Market Size and Forecast, by Vehicle Type (2022-2029) 12. Latin America Electric Vehicle Market: Competitive Landscape 12.1. MMR Competition Matrix 12.2. Competitive Landscape 12.3. Key Players Benchmarking 12.3.1. Company Name 12.3.2. Service Segment 12.3.3. End-user Segment 12.3.4. Revenue (2022) 12.3.5. Company Locations 12.4. Leading Latin America Electric Vehicle Market Companies, by Market Capitalization 12.5. Market Structure 12.5.1. Market Leaders 12.5.2. Market Followers 12.5.3. Emerging Players 12.6. Mergers and Acquisitions Details 13. Company Profile: Key Players 13.1. Renault 13.1.1. Company Overview 13.1.2. Business Portfolio 13.1.3. Financial Overview 13.1.4. SWOT Analysis 13.1.5. Strategic Analysis 13.1.6. Scale of Operation (Small, Medium, and Large) 13.1.7. Details on Partnership 13.1.8. Regulatory Accreditations and Certifications Received by Them 13.1.9. Awards Received by the Firm 13.1.10. Recent Developments 13.2. Nissan 13.3. Chevrolet 13.4. BYD 13.5. Volkswagen 13.6. Tesla 13.7. Chery 13.8. BMW 13.9. Jaguar Land Rover 13.10. Hyundai 14. Key Findings 15. End User Recommendations