The Automotive Fintech Market size was valued at USD 47.2 Billion in 2022 and the total Automotive Fintech Market revenue is expected to grow at a CAGR of 9.1 % from 2023 to 2029, reaching nearly USD 94.74 Billion. Fintech has become an integral part of every industry, offering faster, cheaper, and easier services for organizations and their customers. According to recent statistics, in 2022 alone, nearly xx% of consumers used two or more Fintech services or platforms. Experts predict that the Fintech Industry will experience a compound annual growth rate of 25-30% between 2019 and 2025, making it a rapidly booming sector. The automotive industry has also benefited from the growth of Automotive Fintech Market. As more devices become digital and interconnected, exchanging data becomes easier. Vehicles now send and receive data across the internet, providing consumers with a more convenient and seamless experience. Payments have been a clear way that Fintech has impacted the auto industry. In-car payment technology has risen, with OEMs partnering with payment solutions to offer services such as paying for gas and parking. Established players such as SAP, Volkswagen, Ford, GM, Daimler, Visa, Jaguar, and BMW have all taken significant steps in this area. Payment solution providers like Cardtek are also exploring new models for in-car payment, including an IoT platform that interfaces with merchant devices, an integrated mobile wallet, and a personal POS terminal for transactions. The new transportation-sharing economy, which includes on-demand transportation, car-sharing, and ride-sharing services, has opened up opportunities for growth in digital leasing and lending in Automotive Fintech Market. This shift in consumer behaviour has been driven by the popularity of sharing services, which have challenged traditional car ownership. This has led to a surge in on-demand transportation, with companies like Uber, Lyft, Didi, and Grab changing the transportation landscape across the globe in Automotive Fintech Market. As a result, there is an increasing demand for specialized financial services for on-demand platforms, such as vehicle leasing for on-demand platforms (Drover, HyreCar), and commercial insurance for drivers in the on-demand economy (Inshur, Zego). With digital transactions becoming more efficient, next-generation car rental players are providing consumers with flexible options, including the ability to rent out their own cars. This sector is evolving, with new players using subscription-based pricing or shared ownership models to gain Automotive Fintech Market share. Report covered the detailed analyses of Automotive Fintech Market trends, market competition, key benchmarking with investment plans and development.

To know about the Research Methodology :- Request Free Sample Report

Automotive Fintech Market Dynamics:

Online Car Buying Surges, Unlocking Lucrative Opportunities in Fintech Market The digitalization of the automotive industry presents numerous revenue opportunities in the near future in Automotive Fintech Market. However, as a result of COVID-19, the automotive industry is experiencing a significant shift towards digital market adoption, with online transactions being the furthest along. In response to the pandemic, consumers are increasingly turning to online shopping for vehicles, as demonstrated by a recent survey by CarGurus, where 61% of consumers expressed interest in purchasing a vehicle online, up from 32% before the pandemic. Automakers are taking note of this trend and adapting their business strategies accordingly. For instance, Daimler AG has set an objective to have 25% of passenger car sales made via digital channels by 2025. Despite the growth of online sales, there are still limitations in the U.S. due to franchise laws, which restrict innovation. However, Europe and Asia are not affected by such regulatory restrictions. According to GForces data, the number of cars sold online using their technology increased 1228% from 2019 to 2020, worth over £500 million in total. The data also shows that online car sales have gained traction, particularly for used vehicles, which have proven to be more nimble and less resistant to digital adoption than legacy OEMs. Despite this, there is still a lack of consumer awareness in the auto e-retail sector, and less than 1% of used car sales were transacted online in 2020. This is in contrast to the 39% of clothing sales that were made online. However, unlike apparel, buying a car requires multiple agencies to verify car ownership titles, vehicle registrations, credit histories, insurance, and other factors. The digitalization of the automotive industry has also created opportunities in digital financing in Automotive Fintech Market, with automakers and fintech lenders partnering to offer the best rates and incentives. Nevertheless, many OEMs are reluctant to relinquish a lucrative part of their business to third-party fintech companies. Despite the challenges, the automotive industry is ripe for development, and the recent acceleration in online car shopping is evidence of this. Connected Cars are fuelling the Growth of Automotive Fintech Industry As cars continue to advance technologically, they are increasingly becoming a new source of payment and data. MMR Research has expected that the global transaction volume of in-vehicle payments will rise to over 4.7 billion by 2026, an impressive growth from the 87 million recorded in 2021. This growth will be fueled by the increasing collaborations and initiatives from stakeholders in the industry. Connected cars have the potential to revolutionize how people transact, create new business models, and provide new opportunities for stakeholders in the industry, which increases the Automotive Fintech Market demand during the forecast period. In terms of payment, connected cars offer opportunities in both the business-to-consumer (B2C) and the business-to-business (B2B) fields. In B2C, a mobile wallet integrated into a connected car enables drivers to make seamless transactions, including paying for coffee, parking spaces, or their car loan monthly payments. Manufacturers and dealerships can also use a car wallet to enable electrical charging deposits and trade-in credits for use in an ecosystem, improving customer retention and providing better ownership and mobility experiences, which drive the Automotive Fintech Market growth. In B2B, a car wallet can be used by businesses to pay for their employees' travel and expenses, reducing the need to report expenses separately and mitigating fraud. Connected cars have the potential to become a new channel for marketplaces and e-commerce activities, connecting drivers to retailers, gas stations, and service providers through their dashboards. Connected cars also offer data monetization opportunities for auto manufacturers, allowing them to gain deeper insights into their customers and offer personalized services. Growing demand for Automotive Fintech Market in Insurance companies could also use this data to offer pay-as-you-go insurance coverage, personalized pricing options, and improve the overall claims process.Digital Finance Drives Growth and Transformation in the Automotive Fintech Industry Digital finance has been a major driver of growth in the Automotive Fintech Industry. The use of digital technologies to facilitate financial transactions in the automotive industry has transformed the way people buy and finance cars. One of the key ways that digital finance is driving growth in the Automotive Fintech Industry is by making it easier and more convenient for consumers to finance their car purchases. Digital platforms and apps are allowing consumers to complete the entire car buying process online, from browsing inventory to securing financing. The automobile financing industry is rapidly evolving, with a expected annual growth rate of 6%, reaching a value of $300 billion by 2026. This transformation is being driven by new business models, including Fintech, which promise to make the industry more efficient and dynamic. Wall Street has taken notice of this trend, as evidenced by Goldman Sachs' recent involvement in Caribou's (formerly MotoRefi) oversubscribed Series C funding round, which raised $115 million. As auto financing becomes increasingly digitized, with advanced technologies such as artificial intelligence, Fintech are poised to become a crucial component of the auto lending ecosystem. By accelerating loan processing times and reducing costs for both auto lenders and consumers, companies that partner with Fintech will likely dominate the market. While some traditional lenders have been slow to embrace Fintech, those that fail to adapt may struggle to remain competitive. Additionally, digital finance has enabled the development of new financing models, such as peer-to-peer lending and crowd-sourced financing. These models allow individuals to invest in and finance automotive purchases, bypassing traditional banks and financial institutions, which drive the Automotive Fintech Market. Furthermore, the use of digital finance is also facilitating the development of new financial products and services, such as usage-based insurance and car-sharing programs. These products and services are appealing to a new generation of consumers who are looking for more flexibility and customization in their automotive purchases. Potential Auto Captive Offerings in the Future of Mobility in 2022

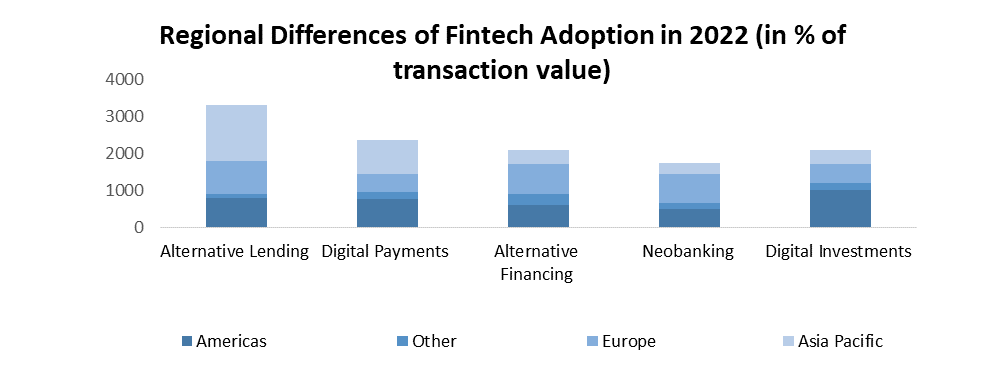

By End-Use Type: the Automotive Fintech Market is segmented into In-vehicle payments, Online Leasing, Digital Loans and Purchas, Online Insurance. Digital Loans and Purchase segment is expected to dominate the Automotive Fintech Market during the forecast period. Digital loan and purchase in the automotive Fintech market refer to the use of technology and digital platforms to offer financing solutions for the purchase of vehicles. In recent years, there has been a surge in the number of Fintech companies offering digital lending solutions for automotive purchases. Digital lending in the automotive Fintech market typically involves an online application process that is quick and convenient. The applicant provides their personal information, financial information, and information about the vehicle they wish to purchase. The Fintech Company then uses artificial intelligence and machine learning algorithms to assess the applicant's creditworthiness and risk profile. Based on the assessment, the Fintech Company may offer a loan approval and provide the funds necessary to purchase the vehicle. One of the major benefits of digital lending in the automotive Fintech market is the speed and convenience it offers. Applicants can apply for a loan and receive a loan decision within minutes, which makes it easier for them to purchase the vehicle they want without having to go through a lengthy and tedious application process. Additionally, digital lending often results in lower interest rates and fees compared to traditional lending methods, as Fintech companies are able to offer more competitive rates due to their lower overhead costs. Report covered the detailed analyses of each market segment with micro details. Automotive Fintech Market Regional Insights: Asia pacific is expected to dominate the Automotive Fintech Market during the forecast period. The rapid growth and evolution of the Asian market has made it a leader in adopting and revolutionizing new technologies, and Automotive Fintech market. In fact, Asian countries are investing just as much, if not more, in Fintech than the US, with investments in the Asia-Pacific region increasing by 9.1% to $1.4 billion in Q2 2020, according to the MMR analysis. China, in particular, has become the world's leading Fintech investor since 2018, giving birth to numerous Fintech unicorns such as Grab, GoTo, Sea, Ovo, and Bitkub. The growth of Automotive Fintech products in the Asia Pacific region can be attributed to various factors, including positive government initiatives, multiple investors interested in Fintech, a large unbanked population, and a general openness to new financial technologies. In 2019, 87% of individuals in China and India reported adopting Fintech apps, while the adoption rate for SMEs in the region is the highest worldwide at 61%. The governments in the region differ in their support of Automotive Fintech industry adoption, resulting in variations in the number of Fintech start-ups and investment attracted in different regions. Report covered the detailed analyses of global as well as regional country wise Automotive Fintech Market growth.

Automotive Fintech Market Segment Analysis:

Automotive Fintech Market Scope: Inquire before buying

Automotive Fintech Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 47.2 Bn. Forecast Period 2023 to 2029 CAGR: 9.1 % Market Size in 2029: USD 94.72 Bn. Segments Covered: By End-Use 1. In vehicle payments 2. Online Leasing 3. Digital Loans and Purchase 4. Online Insurance by Channel 1. On Demand 2. Subscription by Vehicle Type 1. Passenger Car 2. Commercial Vehicle By Propulsion Type 1. ICE 2. Electric Automotive Fintech Market Regional Insights:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Automotive Fintech Market, Key Players are

1. Fidelity 2. London Stock Exchange Group 3. Global Payments 4. Fiserv 5. Ant Financial 6. Stripe 7. CoinBase 8. Robinhood 9. Klara 10. Gtrab 11. J.D Digit 12. GoJek 13. Paytm FAQs: 1. What are the growth drivers for the Automotive Fintech Market? Ans. The increasing prevalence of Connected Car, is expected to be the major driver for the Automotive Fintech Market. 2. What is the major restraint for the Automotive Fintech Market growth? Ans. Stringent government regulations are expected to be the major restraining factor for the Automotive Fintech Market growth. 3. Which region is expected to lead the global Automotive Fintech Market during the forecast period? Ans. Asia Pacific is expected to lead the global Automotive Fintech Market during the forecast period. 4. What is the projected market size & growth rate of the Automotive Fintech Market? Ans. The Automotive Fintech Market size was valued at USD 47.2 Billion in 2022 and the total Automotive Fintech Market revenue is expected to grow at a CAGR of 9.1% from 2023 to 2029, reaching nearly USD 94.74 Billion. 5. What segments are covered in the Automotive Fintech Market report? Ans. The segments covered in the Automotive Fintech Market report are Type, Applications, End-use, and Region.

1. Automotive Fintech Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Fintech Market: Dynamics 2.1. Automotive Fintech Market Trends by Region 2.1.1. North America Automotive Fintech Market Trends 2.1.2. Europe Automotive Fintech Market Trends 2.1.3. Asia Pacific Automotive Fintech Market Trends 2.1.4. Middle East and Africa Automotive Fintech Market Trends 2.1.5. South America Automotive Fintech Market Trends 2.2. Automotive Fintech Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive Fintech Market Drivers 2.2.1.2. North America Automotive Fintech Market Restraints 2.2.1.3. North America Automotive Fintech Market Opportunities 2.2.1.4. North America Automotive Fintech Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive Fintech Market Drivers 2.2.2.2. Europe Automotive Fintech Market Restraints 2.2.2.3. Europe Automotive Fintech Market Opportunities 2.2.2.4. Europe Automotive Fintech Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive Fintech Market Drivers 2.2.3.2. Asia Pacific Automotive Fintech Market Restraints 2.2.3.3. Asia Pacific Automotive Fintech Market Opportunities 2.2.3.4. Asia Pacific Automotive Fintech Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive Fintech Market Drivers 2.2.4.2. Middle East and Africa Automotive Fintech Market Restraints 2.2.4.3. Middle East and Africa Automotive Fintech Market Opportunities 2.2.4.4. Middle East and Africa Automotive Fintech Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive Fintech Market Drivers 2.2.5.2. South America Automotive Fintech Market Restraints 2.2.5.3. South America Automotive Fintech Market Opportunities 2.2.5.4. South America Automotive Fintech Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Automotive Fintech Industry 2.8. Analysis of Government Schemes and Initiatives For Automotive Fintech Industry 2.9. Automotive Fintech Market Trade Analysis 2.10. The Global Pandemic Impact on Automotive Fintech Market 3. Automotive Fintech Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 3.1.1. In vehicle payments 3.1.2. Online Leasing 3.1.3. Digital Loans and Purchase 3.1.4. Online Insurance 3.2. Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 3.2.1. On Demand 3.2.2. Subscription 3.3. Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 3.3.1. Passenger Car 3.3.2. Commercial Vehicle 3.4. Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 3.4.1. ICE 3.4.2. Electric 3.5. Automotive Fintech Market Size and Forecast, by Region (2022-2029) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Automotive Fintech Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 4.1.1. In vehicle payments 4.1.2. Online Leasing 4.1.3. Digital Loans and Purchase 4.1.4. Online Insurance 4.2. North America Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 4.2.1. On Demand 4.2.2. Subscription 4.3. North America Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 4.3.1. Passenger Car 4.3.2. Commercial Vehicle 4.4. North America Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 4.4.1. ICE 4.4.2. Electric 4.5. North America Automotive Fintech Market Size and Forecast, by Country (2022-2029) 4.5.1. United States 4.5.1.1. United States Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 4.5.1.1.1. In vehicle payments 4.5.1.1.2. Online Leasing 4.5.1.1.3. Digital Loans and Purchase 4.5.1.1.4. Online Insurance 4.5.1.2. United States Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 4.5.1.2.1. On Demand 4.5.1.2.2. Subscription 4.5.1.3. United States Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 4.5.1.3.1. Passenger Car 4.5.1.3.2. Commercial Vehicle 4.5.1.4. United States Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 4.5.1.4.1. ICE 4.5.1.4.2. Electric 4.5.2. Canada 4.5.2.1. Canada Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 4.5.2.1.1. In vehicle payments 4.5.2.1.2. Online Leasing 4.5.2.1.3. Digital Loans and Purchase 4.5.2.1.4. Online Insurance 4.5.2.2. Canada Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 4.5.2.2.1. On Demand 4.5.2.2.2. Subscription 4.5.2.3. Canada Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 4.5.2.3.1. Passenger Car 4.5.2.3.2. Commercial Vehicle 4.5.2.4. Canada Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 4.5.2.4.1. ICE 4.5.2.4.2. Electric 4.5.3. Mexico 4.5.3.1. Mexico Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 4.5.3.1.1. In vehicle payments 4.5.3.1.2. Online Leasing 4.5.3.1.3. Digital Loans and Purchase 4.5.3.1.4. Online Insurance 4.5.3.2. Mexico Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 4.5.3.2.1. On Demand 4.5.3.2.2. Subscription 4.5.3.3. Mexico Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 4.5.3.3.1. Passenger Car 4.5.3.3.2. Commercial Vehicle 4.5.3.4. Mexico Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 4.5.3.4.1. ICE 4.5.3.4.2. Electric 5. Europe Automotive Fintech Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 5.1. Europe Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 5.1. Europe Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 5.1. Europe Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 5.5. Europe Automotive Fintech Market Size and Forecast, by Country (2022-2029) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 5.5.1.2. United Kingdom Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 5.5.1.3. United Kingdom Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 5.5.1.4. United Kingdom Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 5.5.2. France 5.5.2.1. France Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 5.5.2.2. France Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 5.5.2.3. France Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 5.5.2.4. France Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 5.5.3. Germany 5.5.3.1. Germany Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 5.5.3.2. Germany Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 5.5.3.3. Germany Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 5.5.3.4. Germany Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 5.5.4. Italy 5.5.4.1. Italy Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 5.5.4.2. Italy Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 5.5.4.3. Italy Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 5.5.4.4. Italy Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 5.5.5. Spain 5.5.5.1. Spain Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 5.5.5.2. Spain Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 5.5.5.3. Spain Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 5.5.5.4. Spain Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 5.5.6. Sweden 5.5.6.1. Sweden Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 5.5.6.2. Sweden Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 5.5.6.3. Sweden Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 5.5.6.4. Sweden Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 5.5.7. Austria 5.5.7.1. Austria Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 5.5.7.2. Austria Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 5.5.7.3. Austria Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 5.5.7.4. Austria Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 5.5.8.2. Rest of Europe Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 5.5.8.3. Rest of Europe Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 5.5.8.4. Rest of Europe Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 6. Asia Pacific Automotive Fintech Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 6.2. Asia Pacific Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 6.3. Asia Pacific Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 6.4. Asia Pacific Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 6.5. Asia Pacific Automotive Fintech Market Size and Forecast, by Country (2022-2029) 6.5.1. China 6.5.1.1. China Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 6.5.1.2. China Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 6.5.1.3. China Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.1.4. China Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 6.5.2. S Korea 6.5.2.1. S Korea Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 6.5.2.2. S Korea Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 6.5.2.3. S Korea Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.2.4. S Korea Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 6.5.3. Japan 6.5.3.1. Japan Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 6.5.3.2. Japan Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 6.5.3.3. Japan Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.3.4. Japan Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 6.5.4. India 6.5.4.1. India Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 6.5.4.2. India Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 6.5.4.3. India Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.4.4. India Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 6.5.5. Australia 6.5.5.1. Australia Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 6.5.5.2. Australia Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 6.5.5.3. Australia Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.5.4. Australia Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 6.5.6. Indonesia 6.5.6.1. Indonesia Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 6.5.6.2. Indonesia Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 6.5.6.3. Indonesia Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.6.4. Indonesia Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 6.5.7. Malaysia 6.5.7.1. Malaysia Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 6.5.7.2. Malaysia Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 6.5.7.3. Malaysia Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.7.4. Malaysia Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 6.5.8. Vietnam 6.5.8.1. Vietnam Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 6.5.8.2. Vietnam Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 6.5.8.3. Vietnam Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.8.4. Vietnam Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 6.5.9. Taiwan 6.5.9.1. Taiwan Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 6.5.9.2. Taiwan Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 6.5.9.3. Taiwan Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.9.4. Taiwan Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 6.5.10.2. Rest of Asia Pacific Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 6.5.10.3. Rest of Asia Pacific Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 6.5.10.4. Rest of Asia Pacific Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 7. Middle East and Africa Automotive Fintech Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 7.2. Middle East and Africa Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 7.3. Middle East and Africa Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 7.4. Middle East and Africa Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 7.5. Middle East and Africa Automotive Fintech Market Size and Forecast, by Country (2022-2029) 7.5.1. South Africa 7.5.1.1. South Africa Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 7.5.1.2. South Africa Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 7.5.1.3. South Africa Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.1.4. South Africa Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 7.5.2. GCC 7.5.2.1. GCC Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 7.5.2.2. GCC Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 7.5.2.3. GCC Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.2.4. GCC Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 7.5.3. Nigeria 7.5.3.1. Nigeria Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 7.5.3.2. Nigeria Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 7.5.3.3. Nigeria Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.3.4. Nigeria Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 7.5.4.2. Rest of ME&A Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 7.5.4.3. Rest of ME&A Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 7.5.4.4. Rest of ME&A Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 8. South America Automotive Fintech Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 8.2. South America Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 8.3. South America Automotive Fintech Market Size and Forecast, by Vehicle Type(2022-2029) 8.4. South America Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 8.5. South America Automotive Fintech Market Size and Forecast, by Country (2022-2029) 8.5.1. Brazil 8.5.1.1. Brazil Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 8.5.1.2. Brazil Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 8.5.1.3. Brazil Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 8.5.1.4. Brazil Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 8.5.2. Argentina 8.5.2.1. Argentina Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 8.5.2.2. Argentina Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 8.5.2.3. Argentina Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 8.5.2.4. Argentina Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Automotive Fintech Market Size and Forecast, by End-Use (2022-2029) 8.5.3.2. Rest Of South America Automotive Fintech Market Size and Forecast, by Channel (2022-2029) 8.5.3.3. Rest Of South America Automotive Fintech Market Size and Forecast, by Vehicle Type (2022-2029) 8.5.3.4. Rest Of South America Automotive Fintech Market Size and Forecast, by Propulsion Type (2022-2029) 9. Global Automotive Fintech Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Automotive Fintech Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Fidelity 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. London Stock Exchange Group 10.3. Global Payments 10.4. Fiserv 10.5. Ant Financial 10.6. Stripe 10.7. CoinBase 10.8. Robinhood 10.9. Klara 10.10. Gtrab 10.11. J.D Digit 10.12. GoJek 10.13. Paytm 11. Key Findings 12. Industry Recommendations 13. Automotive Fintech Market: Research Methodology 14. Terms and Glossary