The Automotive Electronics Control Unit Market size was valued at USD 105.35 Billion in 2023 and the total Automotive Electronics Control Unit Market revenue is expected to grow at a CAGR of 5.84 % from 2024 to 2030, reaching nearly USD 156.74 Billion. An Automotive Electronics Control Unit (ECU), also known as an Electronic Control Module (ECM), is a vital component of modern vehicles' electronic systems. It serves as an embedded system that manages and controls various functions within the vehicle, such as engine management, transmission control, airbag systems, braking systems, and more. The ECU processes input data from various sensors strategically placed throughout the vehicle and generates output signals to control actuators, ensuring optimal vehicle performance, efficiency, safety, and emissions control. The Automotive Electronics Control Unit (ECU) market is witnessing robust growth globally, driven by advancements in automotive technology, increasing demand for connected vehicles, rising safety and emission regulations, and the shift towards electric and autonomous vehicles. The market encompasses various types of ECUs, including engine control units, transmission control units, body control modules, airbag control units, and others, catering to different vehicle functions and systems. The Automotive ECU market is characterized by rapid technological advancements, increasing vehicle electrification, and the integration of advanced features such as connectivity, ADAS (Advanced Driver Assistance Systems), and infotainment systems. Key drivers fueling the Automotive Electronics Control Unit Market growth include the growing adoption of electric vehicles (EVs), the proliferation of connected cars, stringent emission regulations, and the emphasis on vehicle safety and security. The increasing adoption of electric vehicles worldwide is driving the demand for powertrain control units and battery management systems, supporting the growth of the Automotive Electronics Control Unit Market. With the rise of connected vehicles, there is a growing need for ECUs to manage communication between vehicle components and external networks, enabling features like telematics, remote diagnostics, and over-the-air updates. Stringent safety and security regulations are fueling the adoption of advanced ECUs equipped with features such as ADAS, collision avoidance systems, and cybersecurity measures. The development of autonomous vehicles requires sophisticated ECUs to process vast amounts of sensor data and make real-time decisions, presenting opportunities for ECU manufacturers. Consumer demand for advanced infotainment systems, connectivity, and in-car entertainment is driving the integration of multimedia ECUs, offering opportunities for Automotive Electronics Control Unit Market growth. Recent developments include the introduction of advanced ECU platforms with enhanced processing capabilities, integration of AI and machine learning algorithms for predictive maintenance and autonomous driving, and partnerships with technology companies to develop connected vehicle solutions. For example, Aptiv PLC has been collaborating with industry leaders to develop next-generation ECUs capable of supporting the increasing complexity of vehicle systems while ensuring safety and reliability. Such advancements underscore the dynamic nature of the Automotive ECU market and its commitment to driving innovation in the automotive industry.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

Rapid Advancements in Connected, Electric, and Autonomous Vehicles: The continuous evolution of connected, electric, and autonomous vehicles has led to an increased demand for electronic control units (ECUs) to integrate various vehicle systems and deliver advanced functionalities. For instance, as electric vehicles (EVs) become more prevalent, the complexity of ECUs required to manage battery systems, electric drivetrains, and onboard electronics increases substantially. This drives the need for more sophisticated ECUs with enhanced capabilities to ensure robust vehicle performance and functionality in the face of evolving automotive technologies. Innovations like the integration of infotainment and driver assistance functions onto a single chip, as demonstrated by Bosch at CES 2024, streamline automotive electronics and pave the way for software-defined mobility. By consolidating functions onto powerful system-on-chips (SoCs), manufacturers can simplify vehicle electronics while enhancing security and performance. This convergence of functionalities reduces hardware complexity, lowers costs, and accelerates the development of next-generation vehicles, contributing to Automotive Electronics Control Unit Market growth. Collaborative efforts between companies like HARMAN and proteanTecs aim to advance predictive and preventive maintenance for automotive electronics. By leveraging over-the-air (OTA) technology and deep data analytics, these solutions enable remote diagnostics and proactive fault prevention in software-defined vehicles. This proactive approach enhances vehicle reliability, minimizes downtime, and improves overall customer satisfaction, driving the adoption of advanced ECUs and maintenance solutions in the automotive industry. Collaborations between cybersecurity solution providers like VicOne and automotive electronics manufacturers such as Clientron underscore the growing importance of cybersecurity in modern vehicles. Integrated solutions that combine cybersecurity software with ECUs safeguard against cyber-attacks targeting vital vehicle systems and passengers' data. As cybersecurity regulations become more stringent, the demand for ECUs with built-in cybersecurity features is expected to rise, fostering Automotive Electronics Control Unit Market growth. Initiatives like Onsemi's establishment of a state-of-the-art systems application lab for electric vehicles in Europe demonstrate the industry's commitment to developing next-generation semiconductor solutions tailored to automotive applications. These investments focus on advancing silicon (Si) and silicon carbide (SiC) semiconductor technologies for use in ECUs and power conversion systems. By developing highly efficient and specialized semiconductor solutions, companies aim to address the increasing power demands of automotive electronics, fueling Automotive Electronics Control Unit Market growth and innovation in the automotive electronics control unit market.Integration of Advanced Security Features: The increasing complexity of automotive ECUs necessitates robust cybersecurity measures to protect vehicle systems from cyber threats. Integration of advanced security features, such as intrusion detection systems and encryption protocols, into ECUs enhances vehicle cybersecurity. For example, Elektrobit's EB tresos 9 update integrates industry-leading cyber security intrusion detection technology from Argus Cyber Security, ensuring compliance with cybersecurity standards like ISO/SAE 21434. Collaboration between companies like Continental and Synopsys accelerates software development for next-generation vehicles. Integration of virtual electronic control unit (vECU) solutions with cloud-based development environments enables faster advancement of software-defined vehicles (SDVs). By streamlining development processes, automotive manufacturers can reduce time-to-market for new vehicle models. The emergence of advanced automotive antennas, such as KYOCERA AVX's A-Series, facilitates enhanced wireless connectivity for automotive applications. These antennas support a wide range of wireless technologies, including Bluetooth, cellular, and 5G, enabling seamless integration of connectivity features into vehicles. Enhanced wireless connectivity enhances vehicle-to-vehicle communication, telematics systems, and over-the-air updates, driving Automotive Electronics Control Unit Market growth. Collaboration between companies like ETAS and BlackBerry QNX fosters the development of safe and secure solutions for next-generation vehicles. Integrated solutions leveraging middleware and operating systems provide a high-performance foundation for safety-critical functions in software-defined vehicles. By simplifying processes and ensuring compliance with industry standards, such partnerships drive innovation and Automotive Electronics Control Unit Market growth. The automotive industry's increasing focus on regulatory compliance, such as UN-R155, GB/T, and ISO/SAE 21434, presents opportunities for ECU manufacturers to develop solutions that meet stringent standards. Solutions like those offered by ETAS GmbH and BlackBerry QNX align with regulatory requirements, providing automakers with compliant and reliable solutions for next-generation vehicles. Compliance-driven demand for certified ECUs drives market growth and fosters innovation in automotive electronics.

Automotive Electronics Control Unit Market Segment Analysis:

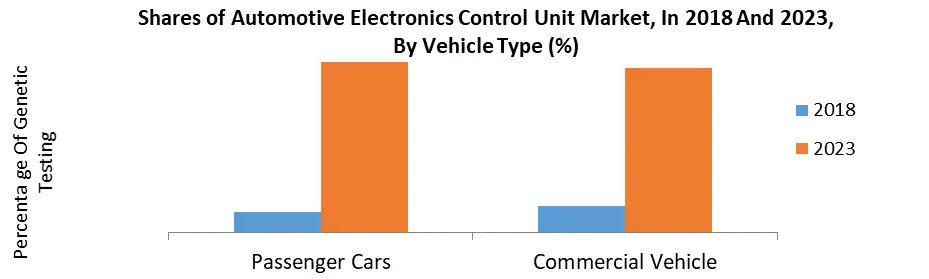

Based on Vehicle Type, In the Automotive Electronics Control Unit (ECU) market, both Passenger Cars and Commercial Vehicles segments play crucial roles. Currently, the Passenger Cars segment dominates the market due to the high volume of passenger car sales globally. Passenger cars typically have a higher number of ECUs compared to commercial vehicles, driving the demand for ECUs in this segment. However, the Commercial Vehicles segment is also significant, especially with the increasing adoption of advanced electronics for functionalities like telematics, fleet management, and driver assistance systems. With the rise of electric and autonomous commercial vehicles, the Commercial Vehicles segment is expected to witness substantial growth in ECU adoption. The dominance of the Passenger Cars segment is expected to continue in the near term, but the Commercial Vehicles segment is anticipated to gain momentum, driven by technological advancements and increasing demand for smart transportation solutions.

Automotive Electronics Control Unit Market Regional Insights:

North America is the dominant region in the Automotive Electronics Control Unit Market, attributed to the presence of established automotive manufacturers and technological advancements in the region. Companies like Bosch, Continental AG, and Delphi Technologies have their headquarters in Europe but have a strong presence in North America. With a well-established automotive industry and increasing demand for advanced vehicle features, North America continues to lead in ECU adoption, driving Automotive Electronics Control Unit Market dominance. The Asia Pacific region is poised for significant growth in the automotive ECU market. Countries like Japan, China, and South Korea are witnessing rapid industrialization, leading to increased vehicle production and technological advancements. Companies like Denso Corporation and Panasonic Corporation, headquartered in Japan, are key players in driving innovation and Automotive Electronics Control Unit Market growth. With the increasing demand for electric vehicles (EVs) and advancements in autonomous driving technology, Asia Pacific is expected to emerge as a dominant force in the Automotive ECU market in the forecast period. Europe, known for its automotive engineering expertise, remains a significant player in the automotive ECU market. Companies like Bosch and Continental AG, headquartered in Germany, lead the market with innovative solutions and a strong focus on research and development. With stringent regulations regarding vehicle emissions and safety standards, Europe continues to drive demand for advanced ECUs, contributing to Automotive Electronics Control Unit Market growth.Automotive Electronics Control Unit Market Competitive Landscape

The developments in automotive electronics, such as the introduction of virtual ECUs, integrated infotainment and driver assistance functions, predictive maintenance solutions, and advanced electronic control units, are poised to drive Automotive Electronics Control Unit Market growth significantly. These innovations address key industry challenges, including software complexity, safety, and sustainability, while enhancing driver experience and vehicle performance. With a focus on efficiency, security, and functionality, these advancements cater to the evolving needs of modern vehicles and contribute to the proliferation of software-defined mobility. As automotive manufacturers adopt these technologies to meet regulatory requirements and consumer demands, the market is expected to experience robust expansion, driving increased investment and innovation in automotive electronics On August 17, 2023, Continental and Amazon Web Services launched the Virtual Electronic Control Unit (vECU), Creator, accelerating automotive software development. This solution shortens development time by up to twelve months, allowing developers to simulate applications and ECU system performance before finalizing hardware. Powered by Elektrobit’s software, it facilitates software development in Classic and Adaptive AUTOSAR environments. Integrated with the Continental Automotive Edge framework on AWS, it enables faster, more efficient development of software-defined vehicles (SDVs). Gilles Mabire, CTO at Continental Automotive, highlighted its role in enhancing driver safety and experience. On December 5, 2023, Bosch showcased at CES 2024 the integration of infotainment and driver assistance functions on a single chip, revolutionizing automotive electronics. This advancement aligns with the shift towards software-defined mobility and centralized vehicle architectures. By consolidating functions into a powerful System on Chip (SoC), Bosch aims to simplify car electronics while enhancing security. Dr. Markus Heyn, Bosch's board member, emphasizes their commitment to reducing complexity and advancing automated driving technologies for various car segments. On February 7, 2023, HARMAN and proteanTecs partnered to enhance predictive and preventive maintenance for automotive electronics. Their collaborative solution integrates over-the-air (OTA) technology and chip telemetry to enable remote diagnostics, ensuring the safety and reliability of software-defined vehicles. With modern cars becoming "computers on wheels" containing over 100 Billion lines of software code, and electronic control units featuring advanced systems-on-chips (SoCs), the complexity of vehicle electronics poses challenges. This joint effort addresses these challenges by leveraging deep data analytics and advanced device health monitoring to predict and prevent malfunctions across the entire fleet. On March 6, 2023, Dorna and Marelli unveiled the BAZ-340 Electronic Control Unit (ECU) for MotoGP, revolutionizing race control and sustainability. Marelli's cutting-edge ECU boasts 4x computational power and 10x data management increase, supporting MotoGP's shift towards sustainable fuels. With real-time data collection and analysis, it empowers race direction for enhanced safety measures, including immediate crash notifications. The ECU's dual voltage supply enhances energy efficiency, reducing overall system energy dissipation. Marelli, alongside Dorna, commits to fostering sustainability in MotoGP, aiming to minimize the carbon footprint of every event while advancing race control capabilities and safety standards. On July 11, 2023, VicOne and Clientron collaborated on an IVI solution with built-in cybersecurity for EV buses. The partnership integrates VicOne's cybersecurity software with Clientron's ECU to safeguard against cyber-attacks targeting vital systems and passengers' data. This aligns with automotive industry standards like ISO/SAE 21434. Edward Tsai of VicOne highlights the increasing need for cybersecurity in EV buses globally. Clientron, a leading automotive electronics provider, offers a comprehensive IVI system for enhanced driving experiences. VicOne's software detects and mitigates cyber threats while monitoring IVI app performance, ensuring smooth operation and safety for drivers and passengers.Automotive Electronics Control Unit Market Scope: Inquiry Before Buying

Automotive Electronics Control Unit Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 105.35 Bn. Forecast Period 2024 to 2030 CAGR: 5.84% Market Size in 2030: US $ 156.74 Bn. Segments Covered: by Capacity Type 16-Bit 32-Bit 64-Bit by Vehicle Type Passenger Cars Commercial Vehicle by Application ADAS & Safety System Body Electronics Powertrain Infotainment Others by Propulsion Type Battery Powered Hybrid Internal Combustion Engine Automotive Electronics Control Unit Market Key Players:

North America: 1. Magna International (Canada) 2. Visteon Corporation (United States) 3. Lear Corporation (United States) 4. Aptiv PLC (United States) 5. Harman International Industries, Inc. (United States) Europe: 6. Valeo (France) 7. Faurecia (France) 8. Delphi Technologies (United Kingdom) 9. HELLA GmbH & Co. KGaA (Germany) 10. Robert Bosch GmbH (Germany) 11. Continental AG (Germany) 12. ZF Friedrichshafen AG (Germany) 13. Infineon Technologies AG (Germany) 14. Autoliv Inc. (Sweden) Asia Pacific: 15. Denso Corporation (Japan) 16. Panasonic Corporation (Japan) 17. Mitsubishi Electric Corporation (Japan) 18. Hitachi Automotive Systems, Ltd. (Japan) 19. Aisin Seiki Co., Ltd. (Japan) 20. NXP Semiconductors N.V. (Netherlands) 21. Renesas Electronics Corporation (Japan) 22. Rohm Co., Ltd. (Japan) 23. Toshiba Corporation (Japan)FAQs:

1. What are the growth drivers for the Automotive Electronics Control Unit Market? Ans. Rapid Advancements in Connected, Electric, and Autonomous Vehicles and expected to be the major driver for the Automotive Electronics Control Unit Market. 2. What are the major Opportunity for the Automotive Electronics Control Unit Market growth? Ans. Integration of Advanced Security Features and is the major opportunity for the Automotive Electronics Control Unit market. 3. Which country is expected to lead the global Automotive Electronics Control Unit Market during the forecast period? Ans. North America is expected to lead the Automotive Electronics Control Unit Market during the forecast period. 4. What is the projected market size and growth rate of the Automotive Electronics Control Unit Market? Ans. The Automotive Electronics Control Unit Market size was valued at USD 105.35 Billion in 2023 and the total Automotive Electronics Control Unit Market revenue is expected to grow at a CAGR of 5.84 % from 2024 to 2030, reaching nearly USD 156.74 Billion. 5. What segments are covered in the Automotive Electronics Control Unit Market report? Ans. The segments covered in the Automotive Electronics Control Unit Market report are by Capacity Type, Vehicle Type, Application, Propulsion Type, and Region.

1. Automotive Electronics Control Unit Market: Research Methodology 2. Automotive Electronics Control Unit Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Global Automotive Electronics Control Unit Market: Competitive Landscape 3.1 MMR Competition Matrix 3.2 Competitive Landscape 3.3 Key Players Benchmarking 3.3.1 Company Name 3.3.2 Business Segment 3.3.3 Propulsion Type Segment 3.3.4 Revenue (2023) 3.3.5 Manufacturing Locations 3.4 Market Structure 3.4.1 Market Leaders 3.4.2 Market Followers 3.4.3 Emerging Players 3.5 Mergers and Acquisitions Details 4. Automotive Electronics Control Unit Market: Dynamics 4.1 Automotive Electronics Control Unit Market Trends 4.2 Automotive Electronics Control Unit Market Dynamics 4.2.1 Market Drivers 4.2.2 Market Restraints 4.2.3 Market Opportunities 4.2.4 Market Challenges 4.3 PORTER’s Five Forces Analysis 4.4 PESTLE Analysis 4.5 Value Chain Analysis 4.6 Regulatory Landscape by Region 4.6.1 North America 4.6.2 Europe 4.6.3 Asia Pacific 4.6.4 Middle East and Africa 4.6.5 South America 5. Global Automotive Electronics Control Unit Market: Global Market Size and Forecast by Segmentation (By Value) (2023-2030) 5.1 Global Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 5.1.1 16-Bit 5.1.2 32-Bit 5.1.3 64-Bit 5.2 Global Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 5.2.1 Passenger Cars 5.2.2 Commercial Vehicle 5.3 Global Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 5.3.1 ADAS & Safety System 5.3.2 Body Electronics 5.3.3 Powertrain 5.3.4 Infotainment 5.3.5 Others 5.4 Global Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 5.4.1 Battery Powered 5.4.2 Hybrid 5.4.3 Internal Combustion Engine 5.5 Global Automotive Electronics Control Unit Market Size and Forecast, by Region (2023-2030) 5.5.1 North America 5.5.2 Europe 5.5.3 Asia Pacific 5.5.4 Middle East and Africa 5.5.5 South America 6. North America Automotive Electronics Control Unit Market Size and Forecast by Segmentation (By Value) (2023-2030) 6.1 North America Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 6.1.1 16-Bit 6.1.2 32-Bit 6.1.3 64-Bit 6.2 North America Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 6.2.1 Passenger Cars 6.2.2 Commercial Vehicle 6.3 North America Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 6.3.1 ADAS & Safety System 6.3.2 Body Electronics 6.3.3 Powertrain 6.3.4 Infotainment 6.3.5 Others 6.4 North America Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 6.4.1 Battery Powered 6.4.2 Hybrid 6.4.3 Internal Combustion Engine 6.5 North America Automotive Electronics Control Unit Market Size and Forecast, by Country (2023-2030) 6.5.1 United States 6.5.1.1 United States Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 6.5.1.1.1 16-Bit 6.5.1.1.2 32-Bit 6.5.1.1.3 64-Bit 6.5.1.2 United States Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.1.2.1 Passenger Cars 6.5.1.2.2 Commercial Vehicle 6.5.1.3 United States Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 6.5.1.3.1 ADAS & Safety System 6.5.1.3.2 Body Electronics 6.5.1.3.3 Powertrain 6.5.1.3.4 Infotainment 6.5.1.3.5 Others 6.5.1.4 United States Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 6.5.1.4.1 Battery Powered 6.5.1.4.2 Hybrid 6.5.1.4.3 Internal Combustion Engine 6.5.2 Canada 6.5.2.1 Canada Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 6.5.2.1.1 16-Bit 6.5.2.1.2 32-Bit 6.5.2.1.3 64-Bit 6.5.2.2 Canada Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.2.2.1 Passenger Cars 6.5.2.2.2 Commercial Vehicle 6.5.2.3 Canada Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 6.5.2.3.1 ADAS & Safety System 6.5.2.3.2 Body Electronics 6.5.2.3.3 Powertrain 6.5.2.3.4 Infotainment 6.5.2.3.5 Others 6.5.2.4 Canada Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 6.5.2.4.1 Battery Powered 6.5.2.4.2 Hybrid 6.5.2.4.3 Internal Combustion Engine 6.5.3 Mexico 6.5.3.1 Mexico Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 6.5.3.1.1 16-Bit 6.5.3.1.2 32-Bit 6.5.3.1.3 64-Bit 6.5.3.2 Mexico Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.3.2.1 Passenger Cars 6.5.3.2.2 Commercial Vehicle 6.5.3.3 Mexico Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 6.5.3.3.1 ADAS & Safety System 6.5.3.3.2 Body Electronics 6.5.3.3.3 Powertrain 6.5.3.3.4 Infotainment 6.5.3.3.5 Others 6.5.3.4 Mexico Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 6.5.3.4.1 Battery Powered 6.5.3.4.2 Hybrid 6.5.3.4.3 Internal Combustion Engine 7. Europe Automotive Electronics Control Unit Market Size and Forecast by Segmentation (By Value) (2023-2030) 7.1 Europe Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 7.2 Europe Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 7.3 Europe Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 7.4 Europe Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 7.5 Europe Automotive Electronics Control Unit Market Size and Forecast, by Country (2023-2030) 7.5.1 United Kingdom 7.5.1.1 United Kingdom Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 7.5.1.2 United Kingdom Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.1.3 United Kingdom Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 7.5.1.4 United Kingdom Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 7.5.2 France 7.5.2.1 France Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 7.5.2.2 France Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.2.3 France Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 7.5.2.4 France Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 7.5.3 Germany 7.5.3.1 Germany Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 7.5.3.2 Germany Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.3.3 Germany Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 7.5.3.4 Germany Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 7.5.4 Italy 7.5.4.1 Italy Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 7.5.4.2 Italy Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.4.3 Italy Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 7.5.4.4 Italy Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 7.5.5 Spain 7.5.5.1 Spain Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 7.5.5.2 Spain Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.5.3 Spain Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 7.5.5.4 Spain Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 7.5.6 Sweden 7.5.6.1 Sweden Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 7.5.6.2 Sweden Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.6.3 Sweden Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 7.5.6.4 Sweden Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 7.5.7 Russia 7.5.7.1 Russia Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 7.5.7.2 Russia Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.7.3 Russia Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 7.5.7.4 Russia Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 7.5.8 Rest of Europe 7.5.8.1 Rest of Europe Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 7.5.8.2 Rest of Europe Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030). 7.5.8.3 Rest of Europe Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 7.5.8.4 Rest of Europe Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 8. Asia Pacific Automotive Electronics Control Unit Market Size and Forecast by Segmentation (By Value) (2023-2030) 8.1 Asia Pacific Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 8.2 Asia Pacific Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 8.3 Asia Pacific Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 8.4 Asia Pacific Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 8.5 Asia Pacific Automotive Electronics Control Unit Market Size and Forecast, by Country (2023-2030) 8.5.1 China 8.5.1.1 China Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 8.5.1.2 China Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.1.3 China Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 8.5.1.4 China Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 8.5.2 South Korea 8.5.2.1 S Korea Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 8.5.2.2 S Korea Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.2.3 S Korea Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 8.5.2.4 S Korea Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 8.5.3 Japan 8.5.3.1 Japan Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 8.5.3.2 Japan Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.3.3 Japan Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 8.5.3.4 Japan Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 8.5.4 India 8.5.4.1 India Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 8.5.4.2 India Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.4.3 India Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 8.5.4.4 India Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 8.5.5 Australia 8.5.5.1 Australia Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 8.5.5.2 Australia Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.5.3 Australia Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 8.5.5.4 Australia Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 8.5.6 ASEAN 8.5.6.1 ASEAN Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 8.5.6.2 ASEAN Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.6.3 ASEAN Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 8.5.6.4 ASEAN Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 8.5.7 Rest of Asia Pacific 8.5.7.1 Rest of Asia Pacific Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 8.5.7.2 Rest of Asia Pacific Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.7.3 Rest of Asia Pacific Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 8.5.7.4 Rest of Asia Pacific Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 9. Middle East and Africa Automotive Electronics Control Unit Market Size and Forecast by Segmentation (By Value) (2023-2030) 9.1 Middle East and Africa Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 9.2 Middle East and Africa Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 9.3 Middle East and Africa Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 9.4 Middle East and Africa Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 9.5 Middle East and Africa Automotive Electronics Control Unit Market Size and Forecast, by Country (2023-2030) 9.5.1 South Africa 9.5.1.1 South Africa Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 9.5.1.2 South Africa Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 9.5.1.3 South Africa Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 9.5.1.4 South Africa Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 9.5.2 GCC 9.5.2.1 GCC Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 9.5.2.2 GCC Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 9.5.2.3 GCC Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 9.5.2.4 GCC Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 9.5.3 Rest of ME&A 9.5.3.1 Rest of ME&A Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 9.5.3.2 Rest of ME&A Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 9.5.3.3 Rest of ME&A Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 9.5.3.4 Rest of ME&A Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 10. South America Automotive Electronics Control Unit Market Size and Forecast by Segmentation (By Value) (2023-2030) 10.1 South America Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 10.2 South America Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 10.3 South America Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 10.4 South America Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 10.5 South America Automotive Electronics Control Unit Market Size and Forecast, by Country (2023-2030) 10.5.1 Brazil 10.5.1.1 Brazil Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 10.5.1.2 Brazil Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 10.5.1.3 Brazil Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 10.5.1.4 Brazil Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 10.5.2 Argentina 10.5.2.1 Argentina Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 10.5.2.2 Argentina Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 10.5.2.3 Argentina Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 10.5.2.4 Argentina Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 10.5.3 Rest Of South America 10.5.3.1 Rest Of South America Automotive Electronics Control Unit Market Size and Forecast, by Capacity Type (2023-2030) 10.5.3.2 Rest Of South America Automotive Electronics Control Unit Market Size and Forecast, by Vehicle Type (2023-2030) 10.5.3.3 Rest Of South America Automotive Electronics Control Unit Market Size and Forecast, by Application (2023-2030) 10.5.3.4 Rest Of South America Automotive Electronics Control Unit Market Size and Forecast, by End Use (2023-2030) 11. Company Profile: Key Players 11.1 Magna International (Canada) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Magna International (Canada) 11.3 Visteon Corporation (United States) 11.4 Lear Corporation (United States) 11.5 Aptiv PLC (United States) 11.6 Harman International Industries, Inc. (United States) 11.7 Valeo (France) 11.8 Faurecia (France) 11.9 Delphi Technologies (United Kingdom) 11.10 HELLA GmbH & Co. KGaA (Germany) 11.11 Robert Bosch GmbH (Germany) 11.12 Continental AG (Germany) 11.13 ZF Friedrichshafen AG (Germany) 11.14 Infineon Technologies AG (Germany) 11.15 Autoliv Inc. (Sweden) 11.16 Denso Corporation (Japan) 11.17 Panasonic Corporation (Japan) 11.18 Mitsubishi Electric Corporation (Japan) 11.19 Hitachi Automotive Systems, Ltd. (Japan) 11.20 Aisin Seiki Co., Ltd. (Japan) 11.21 NXP Semiconductors N.V. (Netherlands) 11.22 Renesas Electronics Corporation (Japan) 11.23 Rohm Co., Ltd. (Japan) 11.24 Toshiba Corporation (Japan) 12. Key Findings and Analyst Recommendations 13. Terms and Glossary