Automotive DC-DC Converter Market was valued at USD 1614.48 Million in 2023, and is expected to reach USD 11112.87 Mn by 2030, exhibiting a CAGR of 31.73 % during the forecast period (2024-2030)Overview:

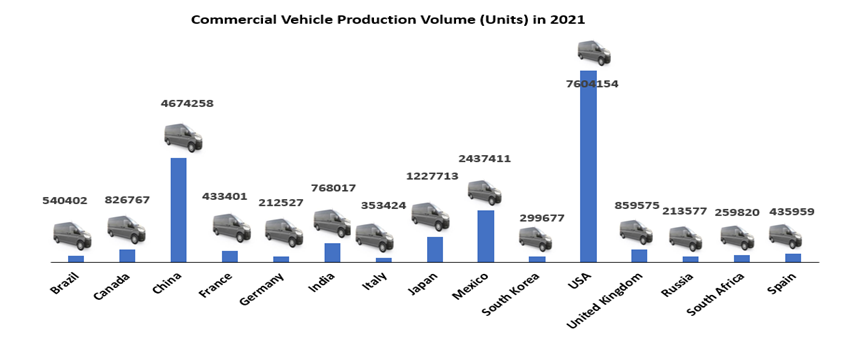

A DC-DC converter is an electronic control unit, which converts a source voltage from one level to another level in automotive Input Voltage. It requires power input and load output simulations to measure the stability and integrity of voltage outputs, power efficiency. Automotive Input Voltages characteristically use higher power DC-DC converters, with ranges beyond 200 W. DC-DC converters have a specified input voltage operating range. They are tested using a programmable DC power source to confirm the entire range of input voltages. As the numbers of control modules throughout the vehicles are increasing, DC-DC converters are requiring to manage the power at the point of load in each device. They mainly playing a vital role in isolation and voltage conversion in automotive industry.To know about the Research Methodology :- Request Free Sample Report DC-DC converters are used in start-stop systems of automobiles, which automatically shut off engine combustion during standstill and restarting the engine. The implementation rate of DC-DC has increased at sound rate because of efforts of industry players to create greener environments with low carbon emissions. Key players operating in the market are making strategies in the design of the dc-dc converter development. They are focusing on the deployment of the DC-DC coveters with small size and higher efficiency to provide advantages to their customers. Manufacturers are offering comprehensive device solutions to customers developing new products through the analysis of basic product designs. According to the research, more than 45 percent of new vehicle sales in the US, China and Japan to be battery electric vehicles by 2030. Global Automotive Industry Scenario: The automotive industry is a major industrial and economic force in several economies. The automotive industry makes a significant contribution to the global economy. The industry is capital-intensive, drives innovation and generates billions of dollars in investment. MNCs dominate the automobile industry across the world. Small and medium-sized enterprises (SMEs) are much more prevalent among the second and third tiers of the industry’s supply chains. Mergers and acquisitions have played a key role in shaping the structure and geographic footprint of the automotive industry. The automotive industry is a key industry, which plays an important role in the development of countries with its capital-intensive structure. Despite there are countries such as China, USA, Russia, South Korea, Japan, India, Germany, Italy, Spain, France as the major automotive industry countries on a global scale, the Eastern European countries (such as Bulgaria, Czech Republic, Poland), Turkey and several Middle East countries are standing out as the rising values of the automotive industry. Many key players from different sector are focusing on the shifting their production unit to the Asia Pacific because of availability of the cheap labor and drastically increasing economic growth rate and manufacturing industries

Automotive DC-DC Converter Market Dynamics

An uptake of electric vehicles has been heavily incentivized through a slew of policy measures: Drive the need for DC-DC converters In recent years, the rise in environmental awareness in society has accelerated the widespread use of electric vehicles, including hybrid electric vehicles. The sales of electric vehicle in Europe are boosted by aggressive government policy push which positively affects both carmakers and consumers through various incentives and subsidies. The emergence and future ubiquity of electric vehicles have created one of the most demanding application spaces for DC-DC converters across a wide variety of automotive application. Manufacturers are pushing the boundaries of DC-DC converters capability while simultaneously expanding their portfolios with new voltage technologies. DC-DC converters are used in nearly every subsystem of an electric vehicle (EV). An EVs require numerous DC voltages with varying demands on power, temperature, ripple from high power charging and power distribution circuits to simple USB ports. Electric vehicles have created a new landscape of available DC-DC converters technologies to meet automotive quality and reliability standards. Electric vehicles are becoming an increasingly popular substitute to conventional automobiles. Global developments influencing the automotive industry The automotive industry is adapting to the new fast-changing competitive landscape. With rapidly expanding electronic content in the generation of modern cars, there is an increasing requirement for power conversion from the car’s battery rail. The 12-V battery rail is subject to a variety of transients, which is expected to present a unique challenge in terms of the power architecture for off-battery systems. Automobile manufacturing has undergone numerous rapid upheavals. The major breaks have been marked by shifts in production and demand and technological inventions and innovations in production methods. Strong momentum in electric vehicle markets Drive the Need For DC-DC Converter Vehicle manufacturers and policy makers are boosting their focus and actions associated to electric vehicles (EVs). EV technologies like full battery electric and plug-in hybrid electric models are attractive options to help reach environmental, societal and health objectives that also drive the need for DC-DC converter for voltage optimization from battery sources. EV fleets are expanding at a fast pace in several of the world’s largest vehicle markets. The costs of batteries and EVs are dropping. Charging infrastructure is expanding that is one of the key drivers behind the high requirement of DC-DC converters. In 2022, the global transition to EVs continued to accelerate. The global EV sales hit a record-high of 6.9 million in 2021. By the end of 2022, global sales of EVs has reached 18.6 million, a 58% increase from end of 2020. Miniaturization in the DC-DC Converter: One of the Key Opportunities for Key Players Now-a-days, products are becoming increasingly smaller and drive in more functionality. Miniaturization of one phase of a product, which is usually, reveals limitations and obstacles in the overall design and manufacturing process. An increase in the demand for compact electronic devices like DC-DC converter in the automotive sector is expected to boost the market growth. Key players operating in the DC-DC converter are focusing on the miniaturization of the electronics products. Miniaturization is the one of the key elements for modern consumer products. The miniaturization of products has led to the requirement for compact DC-DC converter.Automotive DC-DC Converter Market Segment Analysis

Battery electric vehicle is expected to contribute dominant share in the market during the forecast period. The batteries of a Battery Electric Vehicle (BEV) deliver output several hundred volts of Direct Current (DC). A DC-to-DC converter is a category of power converters, which converts a DC source from one voltage level to another. It is a critical component in the architecture of a BEV, where it is used to convert power from the high voltage (HV) bus to the 12V Low Voltage (LV) bus to charge the LV battery and power the onboard electric devices. Battery electric vehicles have multiple architectural variations. The requirements for DC-DC converters are heavily dependent on the development of the EV sector. The requirement to design and test DC-DC converters is at its peak as the market for EVs is now exponentially expanding. At present, more than 140 BEVs are under development globally, which is expected to be launched by 2023-2024. OEMs are working out long-term supplier contracts for the DC-DC converter. Based on the vehicle type, passenger vehicle segment is held the dominant position in 2023 and is projected to continue its dominance during the forecast period. Top automotive manufacturers like Ford, Tesla, Honda are heavily investing in the production of the electrical vehicles and research and development activities related to the passenger electrical vehicles. The non-isolated DC-DC converter is tending to be smaller in size over isolated DC-DC converter. It also tends to operate at higher switching frequencies and helps to reduce the size of capacitors. The Asia-Pacific electric passenger car market is expected to grow at a rapid rate during the forecast period, that also expected to impact positively on the demand for high voltage DC-DC Converter Market.Electric cars had a record year in 2023, Europe has overtaken China as the biggest market Global: Battery electric vehicles (BEVs) have accounted for two-thirds of new electric car registrations and two-thirds of the stock in 2023. The global market for cars was significantly affected by the economic repercussions of the Covid-19 pandemic. More than 3 million new electric cars were registered in 20201. Europe has led with 1.4 million new registrations. China has followed with 1.2 million registrations and the United States has registered 295 000 new electric cars. Several governments have provided or extended fiscal incentives that buffered electric car purchases from the downturn in car markets. Europe: In 2023, Europe has maintained its leading role in electric vehicle penetration. With annual sales of 2.3 million electric LDVs. Germany has registered 395 000 new electric cars and France registered 185 000. The United Kingdom has more than doubled registrations to reach 176000 in 2022. In European countries, BEV registrations have accounted for 54% of electric car registrations. The share of BEVs was particularly high in the Netherlands (82% of all electric car registrations), Norway (73%), United Kingdom (62%) and France (60%). China: In 2023, China has enhanced its leading role in EV deployment. More than 3.5 million EVs were sold in China in 2023. More than 3.4 million electric LDVs and 0.1 million electric HDVs were sold in China in 2023, which has accounted for 50% and 92% of the world’s total, respectively. By the end of 2023, sales of EVs in China has reached 9.4 million, which has represented 50% of the global stock. Changing Consumer Sentiment Towards Electrical Vehicle Adoption and Government Policies are expected to Drive the growth scope for DC-DC Converter Government intervention continues to play an important role in driving EV sales and encouraging consumers to purchase electrical vehicles. Many governments have offered compelling financial incentives to make the electric switch, such as providing cash subsidies to consumers buying low-emission vehicles, reducing taxes on EVs and increasing or maintaining taxes on ICE vehicles. EVs are increasingly becoming a realistic and viable option. Some prominent OEMs have announced strategic commitments to EV. Automotive DC-DC Converter Market: Competitive Landscape Key Players operating in the Automotive DC-DC Converter market are directing multiple research and development activities to expand the technology involved in the DC-DC converters. The growth of mergers and acquisitions activity was initially driven by economies of scale and growth, as well as to increase product ranges. Companies have started expanding their operations to emerging markets, especially the BRIC (Brazil, Russian Federation, India and China) countries, in order to establish a global presence and in some cases to reduce production costs. Key players are gradually stepped up their investment in innovations and marketing across the globe. For instance, RECOM Power GmbH has introduced new product range of fully custom, semi-custom, and modified-standard AC/DC and DC/DC converters in 2023. Key players are focusing on integration of the DC converter and inverter units as a single unit. The Automotive DC-DC converter market is highly R&D-intensive and concentrating on integration of DC-DC converters in larger vehicles. The trend has encouraged key players of DC-DC converters to launch innovative product offerings to enable integration into commercial vehicles. The prominent automotive key player General Motors (GM) has announced that it will be investing $35 billion in EV production through 2025. By the end of 2025, GM plans to offer 30 battery electric vehicle (BEV) models globally and aims to have more than one million units of EV capacity in North America in response to a goal of BEVs comprising 40 percent of U.S. models that is expected to boost the need for DC-DC converters in automotive application. The objective of the report is to present a comprehensive analysis of the global automotive DC-DC converter market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. The reports also help in understanding the global automotive DC-DC Converter Market dynamics like Drivers, Restraints, Challenges and Opportunities by region like North America, Asia Pacific, Europe, Middle East and Africa and South America. Clear representation of competitive analysis of key players by segment and regional presence in the global automotive DC-DC converter market make the report investor’s guide.

Automotive DC-DC Converter Market Regional Insights

Scope of the Report: Inquiry Before Buying

Automotive DC-DC Converter Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US 1614.48 Mn. Forecast Period 2024 to 2030 CAGR: 31.73 % Market Size in 2030: US 11112.87 Mn. Segments Covered: by Vehicle Type Commercial Vehicle Passenger Vehicle by Propulsion Type Battery Electric Vehicle Fuel Cell Electric Vehicle Plug-in Hybrid Vehicle by Input Voltage <40V 40-70V >70V by Product Type Isolated Non-isolated Automotive DC-DC Converter Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Automotive DC-DC Converter Market, Key Players are

1. Borgwarner Inc.(US) 2. Skyworks Solutions Inc. (US) 3. Semiconductor Components Industries. (US) 4. Synqor Inc (US) 5. Crane Aerospace and Electronics (US) 6. Vicor Corporation (US) 7. VPT Power Inc. (US) 8. Microsemi Corporation(US) 9. UTC Aerospace Systems (US) 10. Texas Instruments (US) 11. Robert Bosch Gmbh (Germany) 12. Continental Ag (Germany) 13. Infineon Technologies Ag (Germany) 14. Vitesco Technologies (Germany) 15. Deutronic Elektronik Gmbh (Germany) 16. Valeo (France) 17. Recom Power Gmbh (Austria) 18. Stmicroelectronics (Switzerland) 19. Mornsun Guangzhou Science & Technology Co.,Ltd (China) 20. Denso Corporation (Japan) 21. Murata Manufacturing Co., Ltd (Japan) 22. Tdk Corporation (Japan) 23. Toyota Industries Corporation (Japan) 24. Shindengen Electric Manufacturing Co., Ltd (Japan) 25. Delta Electronics (Taiwan) 26. Sinpro Electronics Co., Ltd (Taiwan) Frequently Asked Questions: 1] What segments are covered in the Global Automotive DC-DC Converter Market report? Ans. The segments covered in the Automotive DC-DC Converter Market report are based on Vehicle Type, Propulsion Type, Input Voltage, Product Type and Frequency. 2] Which region is expected to hold the highest share in the Global Automotive DC-DC Converter Market? Ans. The North America region is expected to hold the highest share in the Automotive DC-DC Converter Market. 3] What is the market size of the Global Automotive DC-DC Converter Market by 2030? Ans. The market size of the Automotive DC-DC Converter Market by 2030 is expected to reach USD 11112.87 Mn. 4] What is the forecast period for the Global Automotive DC-DC Converter Market? Ans. The forecast period for the Automotive DC-DC Converter Market is 2024-2030. 5] What was the market size of the Global Automotive DC-DC Converter Market in 2023? Ans. The market size of the Automotive DC-DC Converter Market in 2023 was valued at USD 1614.48 Mn.

1. Global Automotive DC-DC Converter Market Size: Research Methodology 2. Global Automotive DC-DC Converter Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Automotive DC-DC Converter Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Automotive DC-DC Converter Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Automotive DC-DC Converter Market Size Segmentation 4.1. Global Automotive DC-DC Converter Market Size, by Vehicle Type (2023-2030) • Commercial Vehicle • Passenger Vehicle 4.2. Global Automotive DC-DC Converter Market Size, by Propulsion Type (2023-2030) • Battery Electric Vehicle • Fuel Cell Electric Vehicle • Plug-in Hybrid Vehicle 4.3. Global Automotive DC-DC Converter Market Size, by Input Voltage (2023-2030) • <40V • 40-70V • >70V 4.4. Global Automotive DC-DC Converter Market Size, by Product Type (2023-2030) • Isolated • Non-isolated 5. North America Automotive DC-DC Converter Market (2023-2030) 5.1. North America Automotive DC-DC Converter Market Size, by Vehicle Type (2023-2030) • Commercial Vehicle • Passenger Vehicle 5.2. North America Automotive DC-DC Converter Market Size, by Propulsion Type (2023-2030) • Battery Electric Vehicle • Fuel Cell Electric Vehicle • Plug-in Hybrid Vehicle 5.3. North America Automotive DC-DC Converter Market Size, by Input Voltage (2023-2030) • <40V • 40-70V • >70V 5.4. North America Automotive DC-DC Converter Market Size, by Product Type (2023-2030) • Isolated • Non-isolated 5.5. North America Automotive DC-DC Converter Market, by Country (2023-2030) • United States • Canada 6. European Automotive DC-DC Converter Market (2023-2030) 6.1. European Automotive DC-DC Converter Market, by Vehicle Type (2023-2030) 6.2. European Automotive DC-DC Converter Market, by Propulsion Type (2023-2030) 6.3. European Automotive DC-DC Converter Market, by Input Voltage (2023-2030) 6.4. European Automotive DC-DC Converter Market, by Product Type (2023-2030) 6.5. European Automotive DC-DC Converter Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Automotive DC-DC Converter Market (2023-2030) 7.1. Asia Pacific Automotive DC-DC Converter Market, by Vehicle Type (2023-2030) 7.2. Asia Pacific Automotive DC-DC Converter Market, by Propulsion Type (2023-2030) 7.3. Asia Pacific Automotive DC-DC Converter Market, by Input Voltage (2023-2030) 7.4. Asia Pacific Automotive DC-DC Converter Market, by Product Type (2023-2030) 7.5. Asia Pacific Automotive DC-DC Converter Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Automotive DC-DC Converter Market (2023-2030) 8.1. Middle East and Africa Automotive DC-DC Converter Market, by Vehicle Type (2023-2030) 8.2. Middle East and Africa Automotive DC-DC Converter Market, by Propulsion Type (2023-2030) 8.3. Middle East and Africa Automotive DC-DC Converter Market, by Input Voltage (2023-2030) 8.4. Middle East and Africa Automotive DC-DC Converter Market, by Product Type (2023-2030) 8.5. Middle East and Africa Automotive DC-DC Converter Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Automotive DC-DC Converter Market (2023-2030) 9.1. South America Automotive DC-DC Converter Market, by Vehicle Type (2023-2030) 9.2. South America Automotive DC-DC Converter Market, by Propulsion Type (2023-2030) 9.3. South America Automotive DC-DC Converter Market, by Input Voltage (2023-2030) 9.4. South America Automotive DC-DC Converter Market, by Product Type (2023-2030) 9.5. South America Automotive DC-DC Converter Market, by Country (2023-2030) • Brazil • Mexico • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Borgwarner Inc. (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Skyworks Solutions Inc. (US) 10.3. Semiconductor Components Industries. (US) 10.4. Synqor Inc (US) 10.5. Crane Aerospace and Electronics (US) 10.6. Vicor Corporation (US) 10.7. VPT Power Inc. (US) 10.8. Microsemi Corporation (US) 10.9. UTC Aerospace Systems (US) 10.10. Texas Instruments (US) 10.11. Robert Bosch Gmbh (Germany) 10.12. Continental Ag (Germany) 10.13. Infineon Technologies Ag (Germany) 10.14. Vitesco Technologies (Germany) 10.15. Deutronic Elektronik Gmbh (Germany) 10.16. Valeo (France) 10.17. Recom Power Gmbh (Austria) 10.18. Stmicroelectronics (Switzerland) 10.19. Mornsun Guangzhou Science & Technology Co.,Ltd (China) 10.20. Denso Corporation (Japan) 10.21. Murata Manufacturing Co., Ltd (Japan) 10.22. Tdk Corporation (Japan) 10.23. Toyota Industries Corporation (Japan) 10.24. Shindengen Electric Manufacturing Co., Ltd (Japan) 10.25. Delta Electronics (Taiwan) 10.26. Sinpro Electronics Co., Ltd (Taiwan)