Automotive Coolant Market size was valued at USD 8.94 Bn. in 2023 and the total revenue is expected to grow at 5.1% of CAGR through 2024 to 2030, reaching USD 12.67 Bn.Automotive Coolant Market Overview:

A coolant, also known as antifreeze, is a unique fluid that travels through engine to maintain the proper operating temperature range. It is typically coloured green, blue, or even pink and is manufactured from either ethylene glycol or propylene. Coolants’ main functions are to transport heat and guard against freezing or boiling-related engine damage. It's essential to prevent coolant from freezing or evaporating because heat can only be transported efficiently when there is a liquid in the system. The automotive coolant market was valued at USD 8.7 billion in 2021 and it is projected to grow at CAGR of 5.1% during the forecast period The main factors influencing the demand for coolant in the OMEs of the market include rising vehicle production, particularly in the SUV and light truck segments, and a recent trend toward growth in the trucks and buses category in nations like India. The number of operating vehicles and the number of kilometres driven annually is expected to raise demand for antifreeze in the aftermarket segment.To know about the Research Methodology:- Request Free Sample Report

Research Methodology

A good sample size for the primary research in all countries has helped to make the report findings more authentic and deep insides are given. The primary respondents include manufacturers, distributors, OMEs and investors that have helped to get an understanding of the ecosystem. Secondary sources referrers for the research are press releases, company annual reports, and government websites; unorganised players are referred and paid sources such as Bloomberg, Hoovers, etc. The bottom-up approach has been used to estimate and validate the size of the global market. The market size, by volume, is derived by identifying the total production volumes and analysing the demand trends, and opportunities. The key players as well as local players are studied and analysed in the report. That study of import and export of countries and working of the countries are analysed by production and consumption by segments and sub-segments.Automotive Coolant Market Dynamics:

Environment-friendly coolants

Ethylene glycol is a frequently utilized base fluid in coolants. Given its affordable production and refining expenses, it is a by-product of crude oil and is frequently used. Animals are drawn to the sweet taste and toxicity of ethylene glycol in nature. Numerous instances of animal poisoning are the outcome of this. These and other factors have forced the OMEs to look at bio-based coolants that can replace ethylene glycol while also helping to safeguard the environment and driving market growth.The demand for electric vehicles hampers the automotive coolant market

The automotive sector now needs to explore alternative technologies due to growing environmental concerns. The creation of battery electric automobiles is one such phase (BEVs). These cars run on batteries and a variety of management systems that not only boost performance but also completely eliminate pollution. Coolants are also not used in battery-powered electric vehicles because there is no need for an internal combustion engine these factors’ hampering the market growthCoolants can be recycled

Recycling old antifreeze solutions is seen as a good substitute for dumping. Due to the toxicity of the ethylene glycol used as the basic fluid, used antifreeze poses a risk to both the environment and human health. Heavy metals like cadmium, lead, chromium and others are present in high concentrations in waste antifreeze, which is bad for the environment. Therefore, suppliers and OEMs face a challenge when it comes to recycling coolant and antifreeze.Automotive Coolant Market Segment Analysis:

By Vehicle Type, the passenger car segment is expected to hold a significant share of the market by the end of the forecast period, owing to an increase in demand for utility vehicles in densely populated countries such as China, India, and Brazil. The share of the automotive coolant market is growing as automakers introduce innovative brands and products to provide clients with tailored coolant and lubricant solutions. Numerous international OEMs are making investments in the nation either through joint ventures with well-established companies or directly after FDI norms have been implemented in setting up their production unit or improving their sales and dealership networks around the nation. The passenger vehicle market is being driven by strong demand for e-class, crossovers, SUVs, and hatchbacks, which will likely have a positive impact on the automotive coolant market. The market for passenger vehicles is being driven by consumers' rising preference for private transportation and their increasing purchasing power.By Product, The automotive coolant market share based on product is segmented into Ethylene Glycol, Propylene Glycol, and Glycerine. Glycerine is expected to account significant share in the automotive market. Glycerin and 1, 3-propanediol (PDO) have recently attracted a lot of attention in the automotive coolant aftermarket as fluids for the coolant's base. Glycerin, a by-product of biodiesel is also being studied for use in coolants, if it worked, it may be a competitor to ethylene glycol in future. Since it has a high viscosity index, its application is uncertain because it might need to be diluted first. Propylene glycol has an isomer called PDO. Given that it comes from natural sources, propylene glycol is probably going to face some price competition from it. PDO is more environmentally friendly, has stronger anti-corrosive capabilities, and has enhanced thermal stability, making it a great choice for trucks and off-road vehicles. Additionally, studies on nano-fluids based on ethylene glycol and including titanium dioxide, copper oxide, and aluminum oxide are being conducted. Nano-fluids, which are purported to improve the thermo physical characteristics of the coolant, have enormous promise in a variety of applications, including the cooling of computers, vehicles, electronics, and transformers. The frontal area of the radiators would be reduced by 10% with the use of nano-fluids, allowing for better sized and positioned radiators. This would result in significant emissions reductions and fuel savings of up to 5%.

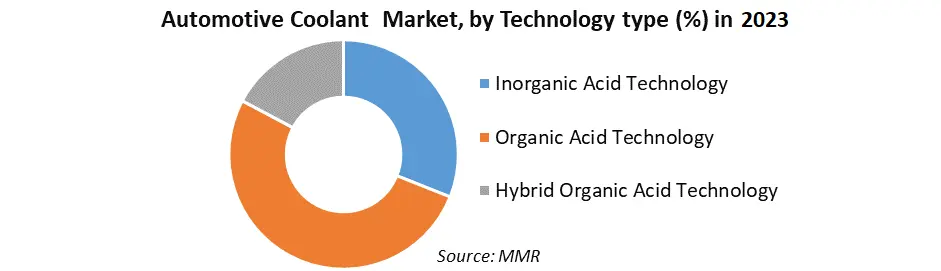

By Technology Type, the market share of automotive coolants is anticipated to increase significantly throughout the forecast period thanks to technological developments in the industry. Over the forecast period, the market share is growing due to the growing use of Organic Acid Technology (OAT), which is based on neutralized organic azoles and acids. Additionally, these substances considerably lower the likelihood of corrosion and material degradation. The OAT also extends the life of engines and protects the aluminum from high temperatures, growing the market for the product.

Automotive Coolant Market Regional Insights:

Asia Pacific is expected to account significant share of the automotive coolant market. Thanks to the higher volume of vehicles produced in important nations like India, China, and Japan as well as cheaper manufacturing and labour costs in the region. India is anticipated to develop significantly during the forecast period as a result of the increased demand for automobiles. The market in Asia-Pacific is also expected to grow during the projected period due to the region's accessibility to cheap labour and raw materials, as well as the rising number of local producers. India is currently the second-largest commercial vehicle developer and the sixth-largest passenger car producer in the world. Infrastructure upgrades have replaced rapid industrialization, which is anticipated to be advantageous for the development of the local market. Demand for light passenger cars and a heavy-duty truck has increased due to the growth of small and medium-sized businesses. Indian PSU oil companies like IOCL, HPCL, BPCL, and others, as well as private companies like RIL, are consistently growing their ability to produce crude oil. Since ethylene glycol is a by-product of crude oil production, rising crude oil output and refining capability may enhance the availability of ethylene glycol in India, hence boosting domestic coolant manufacturing there. The country's rising need for coolants may be greatly aided by the increased domestic production of coolants by coolant manufacturers. Over the following several years, this is anticipated to fuel the region's automotive coolant industry. The objective of the report is to present a comprehensive analysis of the Automotive Coolant Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants.Automotive Coolant Market Scope: Inquire before buying

Automotive Coolant Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.94 Bn. Forecast Period 2024 to 2030 CAGR: 5.1% Market Size in 2030: US $ 12.67 Bn. Segments Covered: by Vehicle Type • Passenger Cars • Heavy Commercial Vehicles • Light Commercial Vehicles • Others by Product • Ethylene Glycol • Propylene Glycol • Glycerin by Technology • Inorganic Acid Technology • Organic Acid Technology • Hybrid Organic Acid Technology by End User • Original Equipment Manufacturer (OEM) • Automotive Aftermarket by Application • Engine Coolant • HVAC Coolant • Engine Lubricant • Brake Lubricant • Transmission Lubricant Automotive Coolant Market, by Region

• North America • Europe • Asia Pacific • Middle East and Africa • South AmericaAutomotive Coolant Market Key Players

• Castrol Limited • Exxon Mobil Corp • Royal Dutch Shell plc • Sinopec Lubricant Company • Ashland • Sinclair Oil Corporation • Havoline • Chevron Corporation • British Petroleum • Valvoline • Chevron Philips Corporation • Sinopec • Total S.A. • Kost USA • Motul • Ashland Corporation • Lukoil • Petronas • Sinclair Oil Corporation • Rudson • Amsoil • Bluestar Lubrication Technology Frequently Asked Questions: 1. What is the forecast period considered for the Automotive Coolant Market report? Ans. The forecast period for the Automotive Coolant Market is 2024-2030 2. Which key factors are hindering the growth of the Automotive Coolant Market? Ans. The demand for electric vehicles hampers the automotive coolant market 3. What is the compound annual growth rate (CAGR) of the Automotive Coolant Market for the forecast period? Ans. 5.1% of CAGR is the annual growth rate of the automotive coolant market. 4. What are the key factors driving the growth of the Automotive Coolant Market? Ans. Environment-friendly coolants driving the automotive coolant market. 5. Which are the worldwide major key players covered for the Automotive Coolant Market report? Ans. Castrol Limited, Exxon Mobil Corp, Royal Dutch Shell plc, Sinopec Lubricant Company, Ashland are the major key players covered for the automotive coolant market.

1. Global Automotive Coolant Market: Research Methodology 2. Global Automotive Coolant Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Automotive Coolant Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Automotive Coolant Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Automotive Coolant Market Segmentation 4.1 Global Automotive Coolant Market, by Vehicle Type (2023-2030) • Passenger Cars • Heavy Commercial Vehicles • Light Commercial Vehicles • Others 4.2 Global Automotive Coolant Market, by Product (2023-2030) • Ethylene Glycol • Propylene Glycol • Glycerin 4.3 Global Automotive Coolant Market, by Technology (2023-2030) • Inorganic Acid Technology • Organic Acid Technology • Hybrid Organic Acid Technology 4.4 Global Automotive Coolant Market, by End User (2023-2030) • Original Equipment Manufacturer (OEM) • Automotive Aftermarket 4.5 Global Automotive Coolant Market, by Application (2023-2030) • Engine Coolant • HVAC Coolant • Engine Lubricant • Brake Lubricant • Transmission Lubricant 5. North America Automotive Coolant Market(2023-2030) 5.1 North America Automotive Coolant Market, by Vehicle Type (2023-2030) • Passenger Cars • Heavy Commercial Vehicles • Light Commercial Vehicles • Others 5.2 North America Automotive Coolant Market, by Product (2023-2030) • Ethylene Glycol • Propylene Glycol • Glycerin 5.3 North America Automotive Coolant Market, by Technology (2023-2030) • Inorganic Acid Technology • Organic Acid Technology • Hybrid Organic Acid Technology 5.4 North America Automotive Coolant Market, by End User (2023-2030) • Original Equipment Manufacturer (OEM) • Automotive Aftermarket 5.5 North America Automotive Coolant Market, by Application (2023-2030) • Engine Coolant • HVAC Coolant • Engine Lubricant • Brake Lubricant • Transmission Lubricant 5.6 North America Automotive Coolant Market, by Country (2023-2030) • United States • Canada • Mexico 6. Europe Automotive Coolant Market (2023-2030) 6.1. European Automotive Coolant Market, by Vehicle Type (2023-2030) 6.2. European Automotive Coolant Market, by Product (2023-2030) 6.3. European Automotive Coolant Market, by Technology (2023-2030) 6.4. European Automotive Coolant Market, by End User (2023-2030) 6.5. European Automotive Coolant Market, by Application (2023-2030) 6.6. European Automotive Coolant Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Automotive Coolant Market (2023-2030) 7.1. Asia Pacific Automotive Coolant Market, by Vehicle Type (2023-2030) 7.2. Asia Pacific Automotive Coolant Market, by Product (2023-2030) 7.3. Asia Pacific Automotive Coolant Market, by Technology (2023-2030) 7.4. Asia Pacific Automotive Coolant Market, by End User (2023-2030) 7.5. Asia Pacific Automotive Coolant Market, by Application (2023-2030) 7.6. Asia Pacific Automotive Coolant Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Automotive Coolant Market (2023-2030) 8.1 Middle East and Africa Automotive Coolant Market, by Vehicle Type (2023-2030) 8.2. Middle East and Africa Automotive Coolant Market, by Product (2023-2030) 8.3. Middle East and Africa Automotive Coolant Market, by Technology (2023-2030) 8.4. Middle East and Africa Automotive Coolant Market, by End User (2023-2030) 8.5. Middle East and Africa Automotive Coolant Market, by Application (2023-2030) 8.6. Middle East and Africa Automotive Coolant Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Automotive Coolant Market (2023-2030) 9.1. South America Automotive Coolant Market, by Vehicle Type (2023-2030) 9.2. South America Automotive Coolant Market, by Product (2023-2030) 9.3. South America Automotive Coolant Market, by Technology (2023-2030) 9.4. South America Automotive Coolant Market, by End User (2023-2030) 9.5. South America Automotive Coolant Market, by Application (2023-2030) 9.6. South America Automotive Coolant Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Exxon Mobil Corp (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Cummins Inc. (US) 10.3 BECHEM Lubrication Technology, LLC (US) 10.4 Ashland Global Specialty Chemicals Inc. (US) 10.5 Sinclair Oil Corporation (US) 10.6 Chevron Corporation (US) 10.7 AMSOIL Inc. (US) 10.8 Kost USA, Inc. (US) 10.9 Lubex Corporation (US) 10.10 OLD WORLD INDUSTRIES (US) 10.11 Prestone Products Corporation (US) 10.12 Valvoline Inc. (US) 10.13 Recochem Inc. (Canada) 10.14 Shell plc (UK) 10.15 Castrol Limited (UK) 10.16 BP p.l.c. (UK) 10.17 BASF SE (Germany) 10.18 TotalEnergies SE (France) 10.19 Motul (France) 10.20 Arteco (Belgium) 10.21 Sinopec Lubricant Company (China) 10.22 Petroliam Nasional Berhad (Malaysia) 10.23 Fleetguard Filters Private Limited (India) 10.24 PrixMax (Australia)