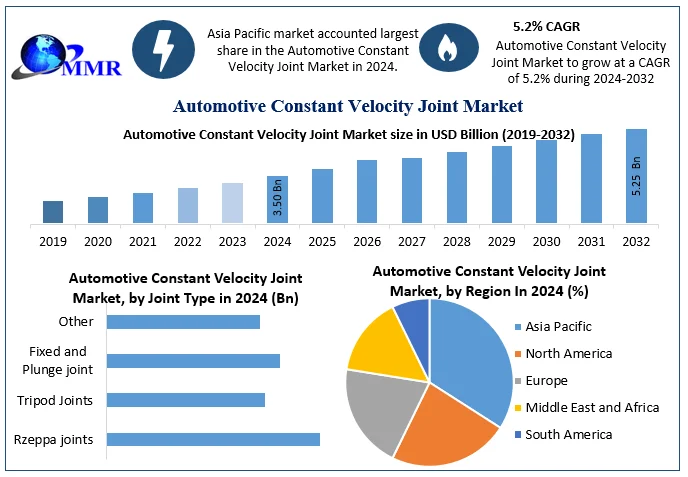

Automotive Constant Velocity Joint Market Size by Joint Type, Vehicle Type, End-Use and Region – Segment-Level Market Assessment, Growth Opportunity Analysis, Competitive Mapping & Forecast to 2032

Overview

Automotive Constant Velocity Joint Market size was valued at USD 3.50 Bn. in 2024 and the total Graphene Battery revenue is expected to grow by 5.2 % from 2025 to 2032, reaching nearly USD 5.25 Bn.

Automotive Constant Velocity Joint Market Overview:

The automotive constant velocity joint helps in transmitting torque to the fronts without higher frictions at a persistent speed. The constant velocity joints are usually surrounded by rubber that is filled with grease that reduces wear and tear. Hence, it is an important material for vehicles for which the demand has been growing due to the increase in demand for passenger cars. Vehicles are used in many industries like logistics, construction, commercial passenger cars, and personal commutation.

The current demand for increased fuel efficiency and less vehicle weight, it is important to minimize the joint size and improve the efficiency of an automotive constant velocity joint to drive the market demand. Solving tribology details for extended life under high contact pressure is a key issue for building an automotive constant velocity joint market in order to save weight. Because the outer race, inner race, cage, and balls function complicatedly and exchange loads at numerous locations, it is difficult to grasp the properties of a contact surface, such as relative slip velocity or spin behavior hamper the automotive constant velocity joint market growth. During joint endurance testing, ball-spalling marks near the ball's pole are occasionally noticed. Simulating ball rotational behavior and determining the mechanism of such events could help to increase joint durability and efficiency, which creates an opportunity for new market players.

The report is not only a representation of global players but also covers the market holding of local players in each country. Market structure by country with market holding by market leaders, market followers, and local players make this report a comprehensive and insightful industry outlook. The report has covered the mergers and acquisitions, strategic alliances, joint ventures, and partnerships happening in the market by region, by investment, and their strategic intent. To know about the Research Methodology :- Request Free Sample Report

To know about the Research Methodology :- Request Free Sample Report

Automotive Constant Velocity Joint Market Dynamics:

Growing demand for lightweight constant velocity joints in automobile

The automobile industry has been constantly working to improve vehicle features in order to fulfill increasing mileage and emission requirements. This is being approached by using innovative materials and production technologies in the automotive constant velocity joint market. The primary techniques for attaining these goals are lowering aerodynamic drag, driveline and transmission losses, tire rolling resistance, and electrical parasitic and vehicle weight. Among them, it appears that lowering vehicle weight is the most cost-effective. OEMs of automotive constant velocity are increasingly focusing on lightening a vehicle to improve performance and efficiency while lowering emissions and retaining safety and comfort. Global attempts to reduce CO2 emissions and optimize fuel use have provided the impetus to the present Lightweight Vehicle concept.

constant velocity joints, and more particularly, a lightweight low angle fixed constant velocity joint with better packing and assembly efficiency are driving the constant velocity joints market. Constant velocity joints (CVJ joints) are common automobile components. Constant velocity joints are typically employed where a constant velocity rotating motion must be transmitted. GKN Driveline, a global leader in automotive driveline technology, has developed a new family of lightweight constant velocity joint (CV joint) solutions that allow rear-wheel drive platforms to save up to 4kg in weight. Higher-performance drivelines with less rotating mass are an important component of CO2 reduction measures in the automotive industry. GKN's innovative VL3 CV joint boosts torque capacity by up to 27% while requiring no additional packaging space, which drives the automotive constant velocity market. The VL3-33ISM version, which is available in four sizes, now has a torque capacity of 3300Nm in a package that previously could only deliver 2600Nm. The VL3 CV joint system can also maintain performance while shrinking the package by about 7%. Overall, the sideshaft system reduces weight by up to 4.2kg for each vehicle set.

Constant velocity joint in an electric vehicle is more challenging than other engines

Constant Velocity (CV) joints in an electric vehicle have quite different lubrication requirements than CV joints in an internal combustion engine. In an electric car, the CV joints must work with increased initial torque provided by the electric motor. This causes the CV joint to wear more during the starting phase because lubricant may not be accessible at the mating surfaces during the start of the vehicle, which is more challenging than another automobile engine.

The previous generation lubricants utilized in the CV joint design are unable to meet the greater torque operating requirements. This has resulted in greater temperatures, oil leakage from the grease, and increased grease evaporation in the CV joint, all of which have hampered the automobile's constant velocity joint market.

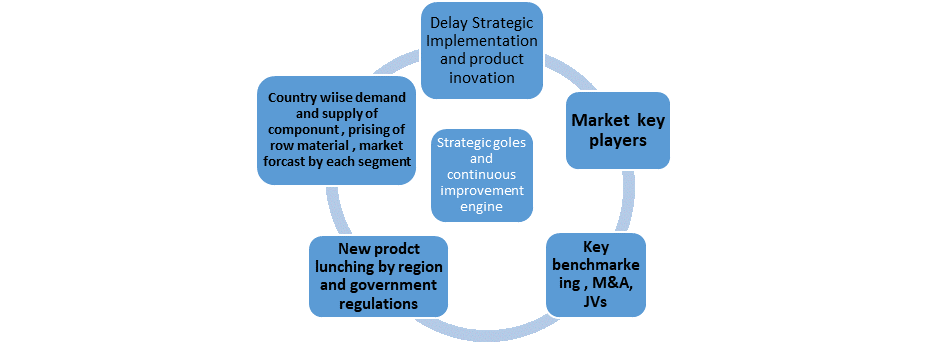

Strategic improvement in the automotive constant velocity joint market

Every investor group, including industry associations, the government, and original equipment manufacturers (OEMs), is essential to helping auto component manufacturers reach their full potential. The industry group might, among other things, assist in scaling up the development of skilling academies and guidelines and co-creating import substitution strategies. Among other policy efforts, the government might think about creating Centers for Excellence for Quality, evaluating the implementation of upskilling projects, and investigating the creation of performance cells. As consumers are looking for various automobile models for a variety of reasons, which affects the size and utility of the product offered by automakers in Europe and the United States. The main requirements are to design automobiles that will really be purchased by people as well as those that meet government specifications.

The constant improvement of CV Joints by GKN Automotive makes them lighter, smaller, and more potent. GKN Automotive is a major market player in the automotive constant velocity market. AB SKF - The business sells CV joint kits that come with clamps, boots, and CV joints. Under the industrial division, the firm creates and produces rotating shaft services and solutions, as well as bearings, seals, and lubrication systems, as well as goods and services for a machine health evaluation, reliability engineering, and maintenance.

Automotive Constant Velocity Joint Market Segment Analysis:

Based on Type, The Automotive Constant Velocity Market is segmented into Rzeppa joints, Tripod Joints, Fixed and Plunge joints, and Others. Rzeppa joints are expected to dominate the market during the forecast period. The Rzeppa joint is the most well-known CV joint. This joint is used on both ends or one end of most streetcar driveshafts. These joints are made up of four parts: the outer race, (typically) six balls surrounded by a cage, and the inner race. The outer race is often integrated into the output shaft or flange, whereas the inner race has an internal spline and can be mounted to an axle or a shaft. The grooves on both the inner and outer races are the same diameter as the balls, allowing the balls to move axially in reference to the shaft. The demand for Rzeppa is high due to the large articulation angle, unserviceable, which drives the automotive constant velocity joint market.

The fundamental advantage of the Rzeppa joint in the automotive constant velocity joint market is the greater articulation angle it provides. As a result, most automobiles use this type of joint on the wheel side of the driveshaft. This is especially true in front-wheel-drive vehicles, where the CV joints handle both steering and suspension movement. Rzeppa joints are commonly used in street automobiles and provide a sufficient range of angles on the inboard side. Whether or not a tripod joint can be employed is determined by the needed angle. This is also determined by the suspension geometry and travels in the automotive constant velocity joint market. Rzeppa joints are smaller and lighter, making them ideal for race cars. When space is limited, installing a tripod joint allows for a stronger driveshaft without taking up additional room and increases the demand for the market globally.

Based on the Application, based on segments passenger cars held the largest market share in 2024. Constant velocity (CV) joints connect the vehicle's transmission to the wheels. CV joints are part of the driveshaft and are most commonly seen in front-wheel drive automobiles, though they are also found in the rear- and four-wheel drive vehicles. Each driving wheel has two CV joints one connecting the transmission to the axle and one connecting the axle to the wheel. The CV joint gets its name from its capacity to move with the passenger car's suspension in any direction while maintaining the constant velocity of the driving wheels. The introduction of the constant velocity universal joint has the dual benefit of correcting universal joint-caused vibration in modern passenger automobiles and giving greater freedom in driveline design, which creates an opportunity in the Automotive constant velocity market.

Automotive Constant Velocity Joint Market Regional Insights:

Asia Pacific Automotive’s constant velocity joint market is expected to dominate the market during the forecast period. Due to numerous environmental requirements, the major drive system in automotive production in Indonesia is changing from axle-suspended (rigid axle) rear-wheel-driven vehicles (FR vehicles) to front-wheel-driven vehicles (FF vehicles). As a result, demand for CVJ, a vital component of FF cars, is likely to skyrocket. NTN has been producing CVJ locally in Thailand and India throughout ASEAN and South Asia, but not in Indonesia, till today.

In these circumstances, the IGP of Astra Group, which manufactures automotive components in Indonesia, suggested a joint venture for the local production of CVJ. NTN and IGP agreed to form a joint venture because NTN needs to produce CVJ domestically, and their goals are aligned in terms of boosting sales and decreasing costs.

China is expected to dominate the market for automobile constant velocity joints during the forecast period. The market is growing quickly due to the robust growth of the automotive industry across all categories and growing consumer preference for improvements in fuel-efficient automobiles. The desire for lightweight constant velocity joints and the demand for commercial vehicles are the two main reasons propelling the growth of the automotive constant velocity joint market. The market's growth is also a result of the market economy. The economies of countries like China, India, Brazil, and South Africa are developing. As a result, these countries manufacturing sectors experienced significant growth, which is expected to create profitable opportunities for the growth of the automotive industry, which will in turn help to drive the market.

Automotive Constant Velocity Joint Market Scope: Inquiry Before Buying

| Automotive Constant Velocity Joint Market | |||

|---|---|---|---|

| Report Coverage | Details | ||

| Base Year: | 2024 | Forecast Period: | 2025-2032 |

| Historical Data: | 2019 to 2024 | Market Size in 2024: | USD 3.50 Bn. |

| Forecast Period 2025 to 2032 CAGR: | 5.2% | Market Size in 2032: | US$ 5.25 Bn. |

| Segments Covered: | by Joint Type | Rzeppa joints Tripod Joints Fixed and Plunge joint Other |

|

| by Vehicle Type | Passenger car Light Commercial Vehicle Heavy Commercial Vehicle |

||

| by End-Use | ICE Electric and Hybrid Other |

||

Automotive Constant Velocity Joint Market, by Region

North America (United States, Canada, and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific)

Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A)

South America (Brazil, Argentina, Rest of South America)

Automotive Constant Velocity Joint Key Players

1. SDS

2. Neapco

3. Guansheng

4. Seohan Group

5. Heri Automotive

6. American Axle & Manufacturing, Inc. (AAM)

7. Dana Incorporated

8.GKN plc

9. GSP Automotive Group Wenzhou Co., Ltd. (GSP Group)

10. Hyundai WIA Corporation

11. IFA ROTORION - Holding GmbH

12. JTEKT Corporation

13. Nexteer Automotive Group Limited

14. NTN Corporation

15. Shandong Kaifurui Auto Parts Co., Ltd. (Shandong Huifeng Group)

16. SKF AB

17. Wanxiang Group Corporation

18. Wonh Industries Co, Ltd.

19. Xiangyang Automobile Bearing Co., Ltd.

20. Zhejiang Feizhou Vehicle Industry Co., Ltd.

Frequently Asked Questions:

1] What segments are covered in the Global Automotive Constant Velocity Joint Market report?

Ans. The segments covered in the Automotive Constant Velocity Joint Market report are based on Joint Type, Vehicle Type , End-user, and Region.

2] Which region is expected to hold the highest share in the Global Automotive Constant Velocity Joint Market?

Ans. The Asia Pacific region is expected to hold the highest share in the Automotive Constant Velocity Joint Market.

3] What is the market size of the Global Automotive Constant Velocity Joint Market by 2032?

Ans. The market size of the Automotive Constant Velocity Joint Market by 2032 is expected to reach US$ 5.25 Bn.

4] What is the forecast period for the Global Automotive Constant Velocity Joint Market?

Ans. The forecast period for the Automotive Constant Velocity Joint Market is 2052-2032.

5] What was the market size of the Global Automotive Constant Velocity Joint Market in 2024?

Ans. The market size of the Automotive Constant Velocity Joint Market in 2024 was valued at USD 3.50 Bn.