Automotive 48V System Market size was valued at USD 5.21 Billion in 2023 and the total Automotive 48V System Revenue is expected to grow at a CAGR of 24.2 % from 2024 to 2030, reaching nearly USD 23.75 Billion in 2030.Automotive 48V System Market Overview:

The Automotive 48V System is a state-of-the-art technology that is making waves in the automotive industry. It is an electrical architecture that is designed to support a range of advanced features in modern vehicles, such as increased power output, improved fuel efficiency, and enhanced performance stringent emission norms for automobiles issued by the governments of various regions to regulate the CO2 level in the environment that again trigger the adoption of automotive 48V technology in the future. European Commission announced its plan to cut the emission rate by 37.5 percent by the end of 2030. To meet the standards Original Equipment Manufacturers (OEMs) are efficiently implementing 48V technology in their next-generation models. Audi was the first who use the 48V technology in its production car SQ7. Though the car wasn’t hybrid rather it had a 48V driven turbine to force additional air into the combustion chamber to provide surplus power when needed. The car also has an active suspension system running on 48V. Audi has shown a 48V electrical system in their concept cars. RS 5 TDI and A6 TDI, which work alongside the conventional 12V system. Delphi Automotive is a global technology company that specializes in automotive systems and components. The company has a strong presence in the automotive 48V systems market and has been at the forefront of developing advanced technologies to enhance vehicle performance and efficiency. Delphi Automotive has a successful history of delivering innovative solutions and has witnessed significant Automotive 48V System Market growth.To know about the Research Methodology :- Request Free Sample Report

Automotive 48V System Market Dynamics:

Exploring Growth Trends in the Automotive 48V System Market The growth of the Automotive 48V System market is primarily driven by the rise in international trade activities, globalization of supply chains, and the increasing complexity of logistics operations. The 48V is frequently used for pumping water, lighting systems, and other purposes when driving electric and hybrid cars. Automotive 48V systems are widely used in hybrid vehicles to produce additional power through acceleration and improve fuel efficiency. Mild hybrids are inexpensive have been made possible by 48V systems and are gaining much worldwide popularity. Significant suppliers are concentrating on creating 48V systems for mild hybrid vehicles, including Bosch, Delphi Automotive, Continental, Valeo, and Gustanski. Mercedes-Benz has unveiled the GLE580, a new hybrid SUV, while Audi's rival has already debuted the Q8, a hybrid SUV. Both of the vehicles are outfitted with 48-volt battery systems and hybrid engines. Demand for low-powered BEVs is growing in emerging economies where vehicles are often driven at low speeds in crowded urban areas. The development of a 48V all-electric drive solution is fuelling the growth of the Automotive 48V System Market. The Advancement of 48V Systems in the Automotive Market Companies in the automotive 48V system market are increasingly adopting 48-volt electrical architecture to enhance overall vehicle efficiency. Tesla, in March 2023, incorporated a 48-volt electrical architecture in its CyberTracker, significantly impacting the vehicle's weight, power delivery efficiency, and ability to handle higher electrical loads with smaller cabling. The adoption of higher voltage in auxiliary devices results in lower current losses and allows for the use of thinner wires, reducing weight and cost. The 48 V technology is advanced to the other high voltage technologies as well as being within the safety limits of 60V for prevention of human shock. The system has introduced various new technologies such as the Starter-Generator which works as the starter as well as torque provider through the motion of a vehicle, advanced regenerative braking, electrically driven rear axle, electric compressor, electric pumps, electric power steering pump, etc.Challenges Hindering Growth in the Automotive 48V System Market High cost of the system in vehicles and the rise in the sale of battery electric vehicles restrain the growth of the market. The availability of infrastructure to support the widespread adoption of 48V systems, such as charging stations and battery recycling facilities, is limited. The lack of robustness hinders the market growth. Integrating the 48V system into existing vehicle architectures is complex and requires significant engineering expertise. The complexity poses challenges for automakers through the forecast period. The performance and durability of 48V system batteries impact the overall reliability and lifespan of the system. Battery technology limitations, such as energy density and charging times, need to be addressed to drive Automotive 48V System market growth.

Automotive 48V System Market Segment Analysis:

Based on Architecture, the belt-driven segment is the leading segment of the market, accounting for the largest share of 45 % in 2023, owing to the low cost and ease of installation of belt-driven systems. In the belt-driven (P0) architecture, the electric machine and the Internal Combustion Engine (ICE) cannot be separated as they are mechanically linked with the accessory belt. Consequently, one of the major disadvantages of the configuration accounts for the parasitic loss of the engine friction torque for the electric machine when it provides boost torque and when it’s improving electrical energy. The 48-volt starter generator's initial topology position is at the engine belt; it resembles a car alternator but is slightly larger. The minimal impact of the 48V system on the current vehicle architecture makes this mild hybrid topology the most economically viable. Compared to 12-volt systems, P0 drives based on a 48-volt system enable a significant amount of braking energy to be recovered and a dynamic and comfortable start for the internal combustion engine. The demonstrator vehicle comprises a 48V belt-driven starter generator. The vehicle has an electric rear axle running on the 20kW motor while the front axle being driven by the engine.Based on vehicle class, the middle segment is the highest contributor with a market share of 42 %. A mid-level vehicle, also referred to as an intermediate vehicle, belongs to the size class of vehicles between compact and full-size vehicles but is more significant than either. Sedans, coupes, and station wagons are just a few different body types that mid-level automobile manufacturers produce. Mid-range vehicles typically have a three-box layout with distinct spaces for the engine, passengers, and cargo. Automobile manufacturers in various countries globally are launching vehicles with a mild hybrid system with less than 48 V capacity, which is further increasing demand for the less than 48 V capacity segment. The 48V electric system in mild-hybrid vehicles has resulted in downsized engines with higher fuel efficiency and minimum loss of engine performance along with lower exhaust emissions. Schaeffler presented a 48V mild hybrid concept vehicle, based on Audi TT.

Automotive 48V System Market Regional Insight:

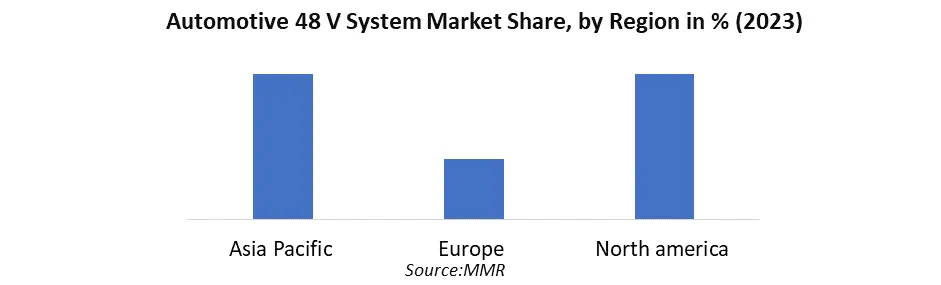

Asia Pacific holds the largest share in Automotive 48V System Market with 60, owing to the presence of major automotive manufacturers and the growing demand for fuel-efficient vehicles. The demand for Belt Driven (P0) and Crankshaft Mounted (P1) types of topologies for 48V systems and the rise in automotive manufacturing facilities significantly contribute to the development of the Asian Automotive 48V System Market. The automotive 48V systems market is significantly impacted by the availability of raw materials, government regulations, rising urbanization, rising fuel prices, a surge in the adoption of non-fossil fuel-based vehicles, low labor costs, and rising disposable income. With the increasing number of automobiles along with the increment of exhaust emissions, the emission standards for various countries are becoming strict. The US, China, and Europe have already set their targets for vehicle economy and emission control. Car makers in the US have to double their average fuel economy up to 54.5mpg by 2025, while China being strict on carbon emission has set the limit to down CO2 to 117gm per km, and for the same year, Europe has set fleet averages of 95g/km only. India sold a whopping 11,65,057 units of electric vehicles in March 2023 while hitting the milestone. Additionally, government subsidies to promote the adoption of electric vehicles are observed to boost the growth of the automotive 48V system Automotive 48V System Market. In Maharashtra, India, buyers get up to Rs.5000 per kWh subsidy on the purchase of an electric vehicle. The maximum subsidy getting from the government is INR 1.5 lakh for the first 10,000 buyers Europe is expected to grow through the forecast period with a market share of 25 %. The UK, Germany, France, Italy, Spain, and the rest of Europe are all included in the analysis of Europe's automotive 48V system market. Through the forecast period, growth in the market is to be aided by rising demand for electric vehicles in the region and increased investment in R&D related to them. Europe produces its cars, vans, trucks, and buses with lower levels of CO2 and GHG, making them among the world's safest, cleanest, and quietest vehicles. To meet the goal of 95 grams of CO2 per kilometer, the producers and suppliers need to produce 48V systems that are fuel-efficient. UK’s leading automotive companies and academia Ford, Ricardo, CPT, EALABC, Faurecia, and the University of Nottingham are working together on a project known as ADEPT, which is a 48V mild hybrid system comprising various advanced mild hybrid technologies. ADEPT has been implemented on the demonstrator car Ford Focus, using an advanced Lead-Carbon battery.

Automotive 48V System Market Competitive Landscape:

1. In February 2023, the Stellantis-developed new 48V hybrid system became available on the PEUGEOT 3008 and 5008 before being made accessible on other models. It added to Peugeot’s existing wide range of electrified engines, which already included plug-in hybrid, entirely electric, and fuel cell models. The PEUGEOT 48V HYBRID system combined an electric motor and a new 6-speed dual-clutch electrified gearbox with a new generation 136 horsepower PureTech petrol engine. The technology, which used a battery that recharged while the vehicle was in motion, increased torque at low engine speeds and reduced fuel consumption by up to 15%. 2. In October 2023, Infineon Technologies AG, a Germany-based semiconductor manufacturer, acquired GaN Systems Inc. for USD 830 million. Through the acquisition, Infineon’s GaN roadmap is expedited dramatically, solidifying its position as a leading GaN powerhouse. With the acquisition, Infineon gains access to a wide range of GaN-based power conversion technologies and cutting-edge application expertise, strengthening its position as the industry leader in power semiconductors and significantly accelerating time to market. GaN Systems Inc. is a Canada-based company that manufactures automotive 48V systems. 3. In October 2023, Big 3 automakers announced that they are descending the prices of their electric vehicle, in the big three, General Motors GM 2023, the Chevy Bolt is declared as one of the most affordable electric vehicles in the Automotive 48V System Market. The price for the retail starts at USD 25,500. The second in the big 3 automakers is Ford F down the price of all their electric cars like the F-150 Lightning electric pickup by about USD 10,000 in July and the Mustang Mach-E by up to USD 4,000 in May. The third company in the Big 3 automakers is Stellantis, the company announced that in July 2024 they launched the new entry-level Fiat Branded electric vehicle that is priced at about USD 27,900 which is less than €25,000. 4. In October 2023, Mercedez-Benz announced its plans to launch GLE in India by November 2024. The official image of the upcoming mid-size luxury SUV was shared by the German marque on their social media handles. The upcoming GLE is offering different types of engines like a 2.0-liter, four-cylinder diesel engine in 300d trim and a 3.0-liter, six-cylinder petrol engine in the 450 variants.Automotive 48V System Market Scope: Inquiry Before Buying

Automotive 48V System Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.21 Bn. Forecast Period 2024 to 2030 CAGR: 24.2% Market Size in 2030: US $ 23.75 Bn. Segments Covered: by Architecture Belt Driven Crankshaft Mounted input shaft of the transmission Rear Axle by Vehicle Class Entry Mid Premium Luxury Automotive 48V System Market, by region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Automotive 48V System Market Key Players:

1. Continental AG(Germany) 2. Robert Bosch GmbH - Germany 3. Schaeffler AG - Germany 4. MAHLE GmbH - Germany 5. ZF Friedrichshafen AG - Germany 6. Infineon Technologies AG - Germany 7. Eberspaecher Group GmbH & Co. KG - Germany 8. BorgWarner Inc. - United States 9. Lear Corporation - United States 10. Cummins Inc. - United States 11. Nexteer Automotive Group Limited - United States 12. Texas Instruments Incorporated - United States 13. Denso Corporation - Japan 14. Hitachi Automotive Systems, Ltd. - Japan 15. Mitsubishi Electric Corporation - Japan 16. Panasonic Corporation - Japan 17. Renesas Electronics Corporation - Japan 18. Toshiba Corporation - Japan 19. GKN plc - United Kingdom 20. Delphi Technologies - United Kingdom 21. Valeo SA - France 22. Magneti Marelli S.p.A. - Italy 23. Johnson Electric Holdings Limited - Hong Kong 24. Samsung SDI Co. Ltd. - South Korea 25. Aptiv PLC – IrelandFrequently Asked Questions:

1] What segments are covered in the Automotive 48V System Market report? Ans. The segments covered in the Automotive 48V System Market report are based on, Architecture, and Vehicle Class. 2] Which region is expected to hold the highest share in the Automotive 48V System Market? Ans. The Asia Pacific region is expected to hold the highest share of the Automotive 48V System Market. 3] What is the market size of the Automotive 48V System Market by 2030? Ans. The market size of the Automotive 48V System Market by 2030 be USD 23.75 Billion. 4] What is the forecast period for the Automotive 48V System Market? Ans. The Forecast period for the Automotive 48V System Market is 2024- 2030.

1. Automotive 48V System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive 48V System Market: Dynamics 2.1. Automotive 48V System Market Trends by Region 2.1.1. North America Automotive 48V System Market Trends 2.1.2. Europe Automotive 48V System Market Trends 2.1.3. Asia Pacific Automotive 48V System Market Trends 2.1.4. Middle East and Africa Automotive 48V System Market Trends 2.1.5. South America Automotive 48V System Market Trends 2.2. Automotive 48V System Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive 48V System Market Drivers 2.2.1.2. North America Automotive 48V System Market Restraints 2.2.1.3. North America Automotive 48V System Market Opportunities 2.2.1.4. North America Automotive 48V System Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive 48V System Market Drivers 2.2.2.2. Europe Automotive 48V System Market Restraints 2.2.2.3. Europe Automotive 48V System Market Opportunities 2.2.2.4. Europe Automotive 48V System Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive 48V System Market Drivers 2.2.3.2. Asia Pacific Automotive 48V System Market Restraints 2.2.3.3. Asia Pacific Automotive 48V System Market Opportunities 2.2.3.4. Asia Pacific Automotive 48V System Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive 48V System Market Drivers 2.2.4.2. Middle East and Africa Automotive 48V System Market Restraints 2.2.4.3. Middle East and Africa Automotive 48V System Market Opportunities 2.2.4.4. Middle East and Africa Automotive 48V System Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive 48V System Market Drivers 2.2.5.2. South America Automotive 48V System Market Restraints 2.2.5.3. South America Automotive 48V System Market Opportunities 2.2.5.4. South America Automotive 48V System Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis for Allogeneic Cell Therapy Industry 2.7. Analysis of Government Schemes and Initiatives for Automotive 48V System Industry 2.7.1. Global Import of Automotive 48V System 2.7.1.1. Ten Largest Importer 2.7.2. Global Export of Automotive 48V System 2.7.3. Ten Largest Exporter 3. Automotive 48V System Market: Global Market Size and Forecast by Segmentation (by Value) (2023-2030) 3.1. Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 3.1.1. Belt Driven 3.1.2. Crankshaft Mounted 3.1.3. Input shaft of transmission 3.1.4. Rear Axle 3.2. Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 3.2.1. Entry 3.2.2. Mid 3.2.3. Premium 3.2.4. Luxury 3.3. Automotive 48V System Market Size and Forecast, by region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Automotive 48V System Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 4.1. North America Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 4.1.1. Belt Driven 4.1.2. Crankshaft Mounted 4.1.3. Input shaft of transmission 4.1.4. Rear Axle 4.2. North America Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 4.2.1. Entry 4.2.2. Mid 4.2.3. Premium 4.2.4. Luxury 4.3. North America Automotive 48V System Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 4.3.1.1.1. Belt Driven 4.3.1.1.2. Crankshaft Mounted 4.3.1.1.3. Input shaft of transmission 4.3.1.1.4. Rear Axle 4.3.1.2. United States Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 4.3.1.2.1. Entry 4.3.1.2.2. Mid 4.3.1.2.3. Premium 4.3.1.2.4. Luxury 4.3.2. Canada 4.3.2.1. Canada Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 4.3.2.1.1. Belt Driven 4.3.2.1.2. Crankshaft Mounted 4.3.2.1.3. Input shaft of transmission 4.3.2.1.4. Rear Axle 4.3.2.2. Canada Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 4.3.2.2.1. Entry 4.3.2.2.2. Mid 4.3.2.2.3. Premium 4.3.2.2.4. Luxury 4.3.3. Mexico 4.3.3.1. Mexico Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 4.3.3.1.1. Belt Driven 4.3.3.1.2. Crankshaft Mounted 4.3.3.1.3. Input shaft of transmission 4.3.3.1.4. Rear Axle 4.3.3.2. Mexico Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 4.3.3.2.1. Entry 4.3.3.2.2. Mid 4.3.3.2.3. Premium 4.3.3.2.4. Luxury 5. Europe Automotive 48V System Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 5.1. Europe Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 5.2. Europe Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 5.3. Europe Automotive 48V System Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 5.3.1.2. United Kingdom Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 5.3.2. France 5.3.2.1. France Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 5.3.2.2. France Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 5.3.3.2. Germany Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 5.3.4.2. Italy Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 5.3.5.2. Spain Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 5.3.6.2. Sweden Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 5.3.7.2. Austria Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 5.3.8.2. Rest of Europe Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 6. Asia Pacific Automotive 48V System Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 6.1. Asia Pacific Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 6.2. Asia Pacific Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 6.3. Asia Pacific Automotive 48V System Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 6.3.1.2. China Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 6.3.2.2. S Korea Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 6.3.2.3. S Korea Automotive 48V System Market Size and Forecast, by 6.3.3. Japan 6.3.3.1. Japan Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 6.3.3.2. Japan Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 6.3.4. India 6.3.4.1. India Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 6.3.4.2. India Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 6.3.5.2. Australia Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 6.3.6.2. Indonesia Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 6.3.7.2. Malaysia Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 6.3.8.2. Vietnam Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 6.3.9.2. Taiwan Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 6.3.10.2. Rest of Asia Pacific Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 7. Middle East and Africa Automotive 48V System Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 7.1. Middle East and Africa Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 7.2. Middle East and Africa Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 7.3. Middle East and Africa Automotive 48V System Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 7.3.1.2. South Africa Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 7.3.2.2. GCC Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 7.3.3.2. Nigeria Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 7.3.4.2. Rest of ME&A Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 8. South America Automotive 48V System Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 8.1. South America Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 8.2. South America Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 8.3. South America Automotive 48V System Market Size and Forecast, by Resolution (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 8.3.1.2. Brazil Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 8.3.2.2. Argentina Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Automotive 48V System Market Size and Forecast, by Architecture (2023-2030) 8.3.3.2. Rest Of South America Automotive 48V System Market Size and Forecast, by Vehicle Class (2023-2030) 9. Global Automotive 48V System Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Automotive 48V System Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Continental AG(Germany) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Delphi Technologies - United Kingdom 10.3. Valeo SA - France 10.4. Robert Bosch GmbH - Germany 10.5. Denso Corporation - Japan 10.6. BorgWarner Inc. - United States 10.7. Magneti Marelli S.p.A. - Italy 10.8. Schaeffler AG - Germany 10.9. Hitachi Automotive Systems, Ltd. - Japan 10.10. MAHLE GmbH - Germany 10.11. GKN plc - United Kingdom 10.12. ZF Friedrichshafen AG - Germany 10.13. Mitsubishi Electric Corporation - Japan 10.14. Infineon Technologies AG - Germany 10.15. Panasonic Corporation - Japan 10.16. Lear Corporation - United States 10.17. Eberspaecher Group GmbH & Co. KG - Germany 10.18. Johnson Electric Holdings Limited - Hong Kong 10.19. Samsung SDI Co. Ltd. - South Korea 10.20. Cummins Inc. - United States 10.21. Nexteer Automotive Group Limited - United States 10.22. Renesas Electronics Corporation - Japan 10.23. Texas Instruments Incorporated - United States 10.24. Toshiba Corporation - Japan 10.25. Aptiv PLC - Ireland 11. Key Findings 12. Industry Recommendations 13. Automotive 48V System Market: Research Methodology