Automatic Emergency Braking (AEB) Market was valued at US $ 12.79 Bn. in 2022. Global Automatic Emergency Braking (AEB) Market size is estimated to grow at a CAGR of 14.5%. The market is expected to reach a value of US $ 33.01 Bn in 2029.Automatic Emergency Braking (AEB) Market Overview:

An automobile's primary duty is to move people and goods from one location to another. However, in today's world, in addition to conforming to fundamental functionality, automobiles are responsible for safeguarding the safety of occupants in the event of an emergency in which human response is inadequate to avoid a collision. The emergence of modern technology, such as ADAS, has resulted in a dramatic change in the vehicle safety system market (advanced driver assist systems). When a collision is unavoidable, the automatic emergency braking system uses electronic stability control (ESC) and advanced driver assistance systems (ADAS) to slow the car and perhaps decrease the severity of the impact. As a result, in high-speed circumstances, the automated emergency braking system is a useful feature.To know about the Research Methodology :- Request Free Sample Report

Automatic Emergency Braking (AEB) Market Dynamics:

A forward collision warning system is frequently used in conjunction with an automatic emergency braking system. The former uses camera or radar sensors to determine the distance between the vehicle and the one ahead. In the event of a collision, warning signals are supplied so that the driver can take corrective action; if no action is taken by the driver, brakes are deployed automatically to slow the car down. The automated emergency braking system does not claim to totally avoid a collision, but it does minimize the severity of the impact. The automatic emergency braking system market is now in the introduction and growth stages of the product life cycle; consequently, significant growth is expected in the market over the forecast period. The pre-crash braking system, intelligent braking system, and forward collision mitigation system are all terms used in the commercial world to describe the automatic driving system. Various national and international regulatory bodies favor the automatic emergency braking system because they believe it has the ability to reduce catastrophic rear-end collisions and thereby save lives. The market for automotive automated emergency braking systems is expected to remain lucrative over the next ten years, as regulatory authorities and automotive OEMs throughout the world strive to equip vehicles with revolutionary technology to improve the safety of occupants and others on the road. According to industry experts, autonomous emergency braking will soon be a standard feature in many future vehicles. To avoid rear-end collisions, driverless automobiles, which are expected to be sold in the near future, will need to include such a capability. From a macroeconomic standpoint, the automatic emergency braking system market is expected to grow significantly due to rising vehicle production and sales, as well as shifting consumer preferences for improved safety features. The extent of safety afforded by autonomous emergency braking systems, on the other hand, has been a topic of contention in the market. Is it possible to avoid collisions by braking suddenly without human intervention or, conversely, will it destabilize the situation? Furthermore, the absence of motivation for road management organizations and automakers to adopt autonomous emergency braking systems stymies their deployment. Rising passenger car sales will help to expand the market significantly. In the midrange and luxury car sectors, major automakers are including crash prevention technology. Furthermore, electric and hybrid car manufacturers, such as Tesla, are standardizing collision avoidance technology in the majority of vehicles, influencing market revenue. The automatic emergency braking market is expected to develop in response to rising demand for autonomous vehicles and growing concerns about driver and passenger safety. Advanced technologies such as adaptive cruise control, lane departure warning, frontal collision warning with automated emergency braking and a blind spot recognition system are becoming more popular among car owners. The market may be limited by a lack of supporting infrastructure and increased expenses involved with the implementation and maintenance of these systems. The lack of an acceptable frequency range for operating such electronic systems, on the other hand, may compromise the system's performance. Governments are enacting new laws to make low frequency brands available for use in automobiles.Automatic Emergency Braking (AEB) Market Segment Analysis:

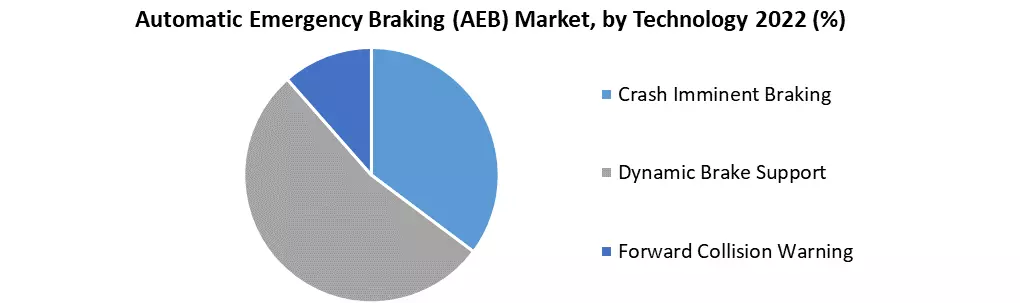

Based on Brake, the market is sub-segmented into Disc and Drum. Due to increased AEB installation in commercial and passenger cars, the disc brake category accounted for over 65 % of the volume share in 2022. Furthermore, regulatory agencies like as the NHTSA are lowering minimum braking distance limits, which has a beneficial impact on product demand. Longer durability, decreased noise and warping, and greater thermal conductivity are just a few of the system's benefits that will rocket the industry statistics even higher. The drum brakes segment is expected to increase at a rate of roughly 17% until 2029. The segment's growth is being fueled by lower component costs and less maintenance requirements, the automatic emergency braking market is expected to grow as the applicability of these brakes extends across a wider range of cheap hatchbacks. Based on Technology, the market is sub-segmented into Crash Imminent Braking, Dynamic Brake Support and Forward Collision Warning. Until 2029, the crash-imminent braking category will grow at a rate of over 16.5 %. The market share of automatic emergency braking will grow as more people use crash-imminent braking systems to avert rear-end collisions. Forward-looking sensors, in combination with forward collision warning system warnings, will propel the industry forward. In 2022, the dynamic emergency braking market accounted for almost 20% of total sales. The growing use of these technologies in the event of a collision is expected to move the market forward. Furthermore, the sector is growing because to the reduced wear and tear on tyres and brake pads as a result of uniform braking application.

Global Automatic Emergency Braking (AEB) Market Regional Insights:

Automatic emergency braking systems are likely a major industry in North America, with the United States leading the way. Certain automakers in the United States have stated that automobile emergency braking systems will be standard in their forthcoming passenger vehicles. As a result, the market in these regions has a lot of room to improve. Europe is expected to be a significant market, with a number of major manufacturers and technology providers situated there. Except for the EU, certain European countries have a modest adoption rate. Asia Pacific is predicted to become a substantial market for the automatic emergency braking system throughout the forecast period due to increased vehicle sales. Automatic emergency braking systems are expected to be widely used in Japan, particularly in commercial vehicles. The objective of the report is to present a comprehensive analysis of the Automatic Emergency Braking (AEB) Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help understand the Automatic Emergency Braking (AEB) Market dynamic and structure by analyzing the market segments and projecting the Automatic Emergency Braking (AEB) Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Automatic Emergency Braking (AEB) Market make the report investor’s guide.Automatic Emergency Braking (AEB) Market Scope: Inquiry Before Buying

Automatic Emergency Braking (AEB) Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 12.79 Bn. Forecast Period 2023 to 2029 CAGR: 14.5% Market Size in 2029: US$ 33.01 Bn. Segments Covered: by Vehicle type • Commercial Vehicles • Passenger Vehicles by Brake • Disc • Drum by Technology • Crash Imminent Braking • Dynamic Brake Support • Forward Collision Warning Automatic Emergency Braking (AEB) Market, by Region:

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Automatic Emergency Braking (AEB) Market Key Players are:

• Volvo Car Corporation • Tesla Inc. • Ford Motor Company • Daimler AG • Audi AG • BMW Group • Volkswagen Group • Toyota Motor Corporation • Honda Motor Company Ltd • Jaguar Land Rover Automotive Plc. • Autoliv Inc. • Continental AG • Delphi Technologies • Robert Bosch GmbH • Mercedes Benz • AB Volvo • Siemens • Mitsubishi Corporation • General Motors. • Mazda Motor Corporation • Groupe PSA • Hyundai Motor Corporation • Magna International Inc. • ZF TRW Automotive Inc Frequently Asked Questions: 1] What segments are covered in the Automatic Emergency Braking (AEB) Market report? Ans. The segments covered in the Automatic Emergency Braking (AEB) Market report are based on vehicle type, Brake type and Technology. 2] Which region is expected to hold the highest share in the Automatic Emergency Braking (AEB) Market? Ans. The North America region is expected to hold the highest share in the Automatic Emergency Braking (AEB) Market. 3] What is the market size of the Automatic Emergency Braking (AEB) Market by 2029? Ans. The market size of the Automatic Emergency Braking (AEB) Market is expected to reach US $ 33.01 Bn. by 2029. 4] What is the forecast period for the Automatic Emergency Braking (AEB) Market? Ans. The Forecast period for the Automatic Emergency Braking (AEB) Market is 2023-2029. 5] What was the market size of the Automatic Emergency Braking (AEB) Market in 2022? Ans. The market size of the Automatic Emergency Braking (AEB) Market in 2022 was worth US $ 12.79 Bn.

1. Global Automatic Emergency Braking (AEB) Market Size: Research Methodology 2. Global Automatic Emergency Braking (AEB) Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Automatic Emergency Braking (AEB) Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Automatic Emergency Braking (AEB) Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Automatic Emergency Braking (AEB) Market Size Segmentation 4.1. Global Automatic Emergency Braking (AEB) Market Size, by Vehicle type (2022-2029) • Commercial Vehicles • Passenger Vehicles 4.2. Global Automatic Emergency Braking (AEB) Market Size, by Brake (2022-2029) • Disc • Drum 4.3. Global Automatic Emergency Braking (AEB) Market Size, by Technology (2022-2029) • Crash Imminent Braking • Dynamic Brake Support • Forward Collision Warning 5. North America Automatic Emergency Braking (AEB) Market (2022-2029) 5.1. North America Automatic Emergency Braking (AEB) Market Size, by Vehicle type (2022-2029) • Commercial Vehicles • Passenger Vehicles 5.2. North America Automatic Emergency Braking (AEB) Market Size, by Brake (2022-2029) • Disc • Drum 5.3. North America Automatic Emergency Braking (AEB) Market Size, by Technology (2022-2029) • Crash Imminent Braking • Dynamic Brake Support • Forward Collision Warning 5.4. North America Automatic Emergency Braking (AEB) Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Automatic Emergency Braking (AEB) Market (2022-2029) 6.1. European Automatic Emergency Braking (AEB) Market, by Vehicle type (2022-2029) 6.2. European Automatic Emergency Braking (AEB) Market Size, by Brake (2022-2029) 6.3. European Automatic Emergency Braking (AEB) Market Size, by Technology (2022-2029) 6.4. European Automatic Emergency Braking (AEB) Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Automatic Emergency Braking (AEB) Market (2022-2029) 7.1. Asia Pacific Automatic Emergency Braking (AEB) Market, by Vehicle type (2022-2029) 7.2. Asia Pacific Automatic Emergency Braking (AEB) Market Size, by Brake (2022-2029) 7.3. Asia Pacific Automatic Emergency Braking (AEB) Market Size, by Technology (2022-2029) 7.4. Asia Pacific Automatic Emergency Braking (AEB) Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Automatic Emergency Braking (AEB) Market (2022-2029) 8.1. Middle East and Africa Automatic Emergency Braking (AEB) Market, by Vehicle type (2022-2029) 8.2. Middle East and Africa America Automatic Emergency Braking (AEB) Market Size, by Brake (2022-2029) 8.3. Middle East and Africa Automatic Emergency Braking (AEB) Market Size, by Technology (2022-2029) 8.4. Middle East and Africa Automatic Emergency Braking (AEB) Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Automatic Emergency Braking (AEB) Market (2022-2029) 9.1. Latin America Automatic Emergency Braking (AEB) Market, by Vehicle type (2022-2029) 9.2. Latin America Automatic Emergency Braking (AEB) Market Size, by Brake (2022-2029) 9.3. Latin America Automatic Emergency Braking (AEB) Market Size, by Technology (2022-2029) 9.4. Latin America Automatic Emergency Braking (AEB) Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 10. Company Profile: Key players 10.1. Volvo car corporation 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Tesla Inc. 10.3. Ford Motor Company 10.4. Daimler AG 10.5. Audi AG 10.6. BMW Group 10.7. Volkswagen Group 10.8. Toyota Motor Corporation 10.9. Honda Motor Company Ltd 10.10. Jaguar Land Rover Automotive Plc. 10.11. Autoliv Inc. 10.12. Continental AG 10.13. Delphi Technologies 10.14. Robert Bosch GmbH 10.15. Mercedes Benz 10.16. AB Volvo 10.17. Siemens 10.18. Mitsubishi Corporation 10.19. General Motors. 10.20. Mazda Motor Corporation 10.21. Groupe PSA 10.22. Hyundai Motor Corporation 10.23. Magna International Inc. 10.24. ZF TRW Automotive Inc