The Autoimmune Treatment Market size was valued at USD 6125 Million in 2023 and the total Autoimmune Treatment Market revenue is expected to grow at a CAGR of 6.9% from 2024 to 2030, reaching nearly USD 9771.2 Million by 2030Autoimmune Treatment Market Overview

Autoimmune diseases are conditions in which one's immune system mistakenly damages healthy cells in one's body. The symptoms of an autoimmune disease depend on the part of the individual's body that’s affected. Many types of autoimmune diseases cause redness, swelling, heat, and pain. There is a growing need for novel autoimmune treatment options due to the fast-expanding patient population. The key driving factors for the Autoimmune Treatment Market are, the rapid rise in patient population creates demand for innovative autoimmune treatment options, and increased awareness about autoimmune disease has increased the market for autoimmune treatments is boosted by impact on the patient.To know about the Research Methodology :- Request Free Sample Report There are more than 80 distinct kinds of autoimmune diseases, common varieties include rheumatoid arthritis, type 1 diabetes, lupus, IBS, Thyroid, multiple sclerosis, and psoriasis. Advancements in Diagnostic Methods, tactical initiatives by key players, and increasing financial support from institutions such as the National Institutes of Health (NIH) are helping with autoimmune disease management and treatment. One of the prime segments of the autoimmune treatment market, which holds dominance in 2022 is Systemic autoimmune disease. Maximize Market Research conducted an analysis of the Autoimmune Treatment Market over the past 5 years by using data that concluded that North America dominates the Autoimmune Treatment Market. The region accounts for 40% to 45% of Europe and is expected to dominate the Autoimmune Treatment Market in the forecast period, emerging players like Asia-Pacific, South America, and Middle East & and Africa are emerging regions in the Autoimmune Treatment Market. Major Key players in the sector are Abbott Laboratories, Amgen Inc., Genentech Inc., Bayer Schering Pharma AG, Biogen Idec Inc., and others mentioned below in the report.

Autoimmune Treatment Market Dynamics

Developments in Medical Technology and Research Technological and scientific developments in medicine have fuelled the market for autoimmune treatments. The development of more efficient procedure options and the identification of new biological purposes have been aided by developments in molecular biology, immunology, and genetics. The first biological medication authorized for the treatment of rheumatoid arthritis was infliximab (Remicade). The digital health innovations, which include telemedicine, portable devices, and health monitoring apps, increased access to healthcare and enhanced how well autoimmune disease patients' conditions functioned. The pharmaceutical industry is making significant investments in the study and creation of new autoimmune treatments. The creation of brand-new medications, the investigation of combination therapies, and the study of cutting-edge therapeutic approaches like gene therapy and cell-based therapies.Increasing healthcare overheads are fuelling the market growth The factors that collectively contribute to the robust growth of the Autoimmune Treatment Market are the growing incidence of autoimmune diseases is a major factor propelling the market enlargement, Research, and development in pharmaceuticals to provide the best medicine contributes in the growth of the Autoimmune Treatment Market, Advancements in technology for screening procedures and the broad accessibility of therapies, and many other factors are driving the Autoimmune Treatment Market growth. 1. According to the MMR report, The Union Budget 2022-23 of India allocated USD 88,700 to the Ministry of Health and Family Welfare, a nearly 18.5 percent increase in comparison to 2020-21. Increasing healthcare spending contributes to the rising cost of healthcare resources and services. The capacity to provide healthcare has increased with the use of digital health technologies, electronic medical records, telemedicine, and remote monitoring systems. Absence of standardized treatment procedures. The market faces difficulties as a result of variations in product quality, safety, and efficacy brought about by the absence of consistent standards and laws. Standardized treatment protocols are necessary to guarantee consistent and efficient management of autoimmune disorders due to their chronic nature and the lack of long-term cures. Developing standardized treatment protocols is difficult because every patient's condition and response to treatment are unique. It was challenging for medical professionals to treat the autoimmune treatment market in the absence of standard operating procedures. This hampered the expansion of the market and resulted in inconsistent treatment outcomes. The adoption of standardized treatment procedures is impacted by various factors, including variations in healthcare infrastructure, resource limitations, and patient population differences. Increasing Recognition of Autoimmune Disorders Offers Profitable Development Prospects The need for efficient therapies is being driven by the rise in autoimmune disease prevalence and the growing number of clinical needs. The demand for autoimmune treatments is driven by an increase in several patients which results in higher diagnosis rates of about 20% and due to the rising prevalence of autoimmune diseases the need for more testing is been seen. Moreover, improvements in medical science and technology have produced more effective therapies, like biologics, which have completely changed the way autoimmune diseases are managed and greatly enhanced patient outcomes. The patient and their families actively consider all of the available treatment options with medical professionals. The pharmaceutical industry's research and development, innovation in development, and launch of novel therapies are all fuelled by the need for efficient treatments. According to some estimates, autoimmune diseases affect 5–8% of people in developed nations and are expected to drive the market in the forecast period.

Autoimmune Treatment Market Segment Analysis

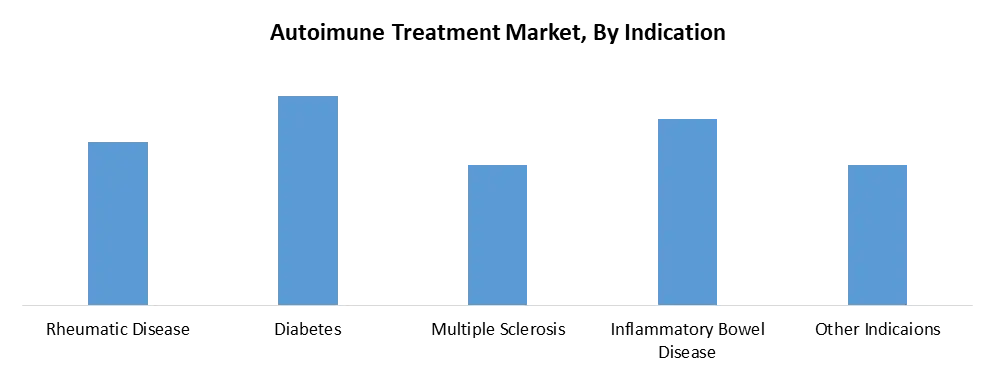

By Indication, the segment includes the diseases by which the autoimmune diseases are caused they are Rheumatic Disease, Diabetes, Multiple Sclerosis, Inflammatory Bowel Disease, and Other Indications. In 2023, the autoimmune treatment market was dominated by the diabetes segment. Diabetes increases the risk of autoimmune illnesses like multiple sclerosis, lupus, and rheumatoid arthritis in people. Approximately, globally 580 million people (adults 20-79 years) are living with diabetes. The market for autoimmune procedures is likely to grow as long as there is a growing demand for combined therapies that address both diabetes and autoimmune conditions. Global advancements in drug discovery and biotechnology, along with a growing focus on personalized medicine strategies, propel the growth of the segment. Rheumatic Disease is a chronic autoimmune disease that mainly affects the joints and causes pain, inflammation, and joint damage. The disease is treated by non-steroidal anti-inflammatory medicines. According to the analysis done in 2023, about 17.9 million people suffer from Rheumatic disease. Multiple Sclerosis is caused by to variety of neurological symptoms, which are characterized by inflammation and damage to the central nervous system. Treatment for Multiple Sclerosis disease is Disease-modifying therapies (DMTs), over 2.2 million people suffer from MS globally. Inflammatory bowel disease is a chronic autoimmune disease that involves conditions like inflammation of the gastrointestinal tract, such as Crohn's disease and ulcerative colitis. A possible treatment for IBD is aminosalicylates. Around 5.4 million people globally are affected and suffering from inflammatory bowel disease. Psoriasis is a long-term autoimmune skin condition that causes skin cells to grow quickly, resulting in thick, red, and scaly patches. Treatment of psoriasis is done by Topical treatments, systemic medications, and biologic therapies. According to an analysis done in 2023, about 123 million people globally suffer from psoriasis.

Autoimmune Treatment Market Regional Insight

North America is dominating the Autoimmune Treatment Market and is expected to continue its dominance in the next 5 years, because of the high occurrence of autoimmune diseases, advanced healthcare infrastructure, and robust research and development activities. One of the world's biggest markets for autoimmune treatments is in the United States. North America holds the largest market share of about 39.4% of which the US has the highest incidences of autoimmune diseases, with 15 to 30 million patients affected in the analysis done in 2022. Prominent pharmaceutical firms in North America make significant investments in the creation of novel treatments for autoimmune diseases, which propels market growth. Europe is the second largest region witnessing a notable growing adoption in the Autoimmune Treatment Market, due to the presence of key players like AbbVie, Johnson &Johnson, Eli Lilly and Company, AstraZeneca, Lupin, Amgen, Bristol-Myers Squibb, and Others, and countries like Germany, France, and UK. Europe holds a significant market share of about 28.3%, which makes it the second-largest market after North America. The European market for autoimmune treatments is advantageous due to its well-established healthcare system, and development, and increasing emphasis on biological therapies and personalized medicine. Autoimmune Treatment Market Competitive Landscape 1. Johnson & Johnson is an American company that offers a wide range of skincare products and an experimental drug that treats autoimmune disorders. Additionally, Momenta Pharmaceuticals, which created nipocalimab, an anti-FcRn antibody for the treatment of autoimmune diseases, was acquired by J&J. With these new therapies J&J has the potential to earn $5 billion each in peak annual sales. 2. Eli Lilly and Company, an American company pharmaceutical company, has operations in 18 nations and sells its goods in about 125 nations. The company had a market valuation of US$659.746 billion and reported revenue of US$27.50 billion in 2023. Eli Lilly and Company is listed on the New York Stock Exchange under the ticker symbol LLY.Autoimmune Treatment Market Scope: Inquire before buying

Global Autoimmune Treatment Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6125 Bn. Forecast Period 2024 to 2030 CAGR: 6.9% Market Size in 2030: US $ 9771.2 Bn. Segments Covered: by Indication Rheumatic Disease Diabetes Multiple Sclerosis Inflammatory Bowel Disease Other Indications by Drug Class Anti-Inflammatory Anti-Hyperglycemics NSAIDs Interferons Other Drugs by Product Diagnostic Equipment Drugs Therapeutic & Monitoring Equipment by Treatment Drugs Physical Therapy by Distribution Channel Hospitals & Clinics Diagnostic Centers Drug Stores Pharmacies Others Autoimmune Treatment Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Autoimmune Treatment Market Key Players

1. AbbVie 2. johnson&Johnson 3. Eli Lilly and Company 4. AstraZeneca 5. Lupin 6. Amgen 7. Bristol-Myers Squibb 8. Pfizer Inc. 9. GlaxoSmithKline 10. Sanofi 11. UCB S.A. 12. F. Hoffmann-La Roche 13. Novartis International AG 14. Merck & Co., Inc 15. Gilead Sciences 16. Celgene 17. Boehringer Ingelheim 18. Takeda Pharmaceuticals 19. Janssen Pharmaceuticals 20. UCB Pharmaceuticals Frequently Asked Questions: 1] What segments are covered in the Global Autoimmune Treatment Market report? Ans. The segments covered in the Autoimmune Treatment Market report are based on Indication, Drug Class, Product, Treatment, Distribution Channel and Regions. 2] Which region is expected to hold the highest share in the Global Autoimmune Treatment Market? Ans. The North American region is expected to hold the highest share of the Autoimmune Treatment Market. 3] What was the market size of the Global Autoimmune Treatment Market by 2023? Ans. The market size of the Autoimmune Treatment Market by 2023 is expected to reach US$ 6125 Mn. 4] What is the forecast period for the Global Autoimmune Treatment Market? Ans. The forecast period for the Autoimmune Treatment Market is 2024-2030. 5] What is the market size of the Global Autoimmune Treatment Market in 2029? Ans. The market size of the Autoimmune Treatment Market in 2030 is valued at US$ 9771.25 Mn.

1. Autoimmune Treatment Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Autoimmune Treatment Market: Dynamics 2.1. Autoimmune Treatment Market Trends by Region 2.1.1. North America Autoimmune Treatment Market Trends 2.1.2. Europe Autoimmune Treatment Market Trends 2.1.3. Asia Pacific Autoimmune Treatment Market Trends 2.1.4. Middle East and Africa Autoimmune Treatment Market Trends 2.1.5. South America Autoimmune Treatment Market Trends 2.2. Autoimmune Treatment Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Autoimmune Treatment Market Drivers 2.2.1.2. North America Autoimmune Treatment Market Restraints 2.2.1.3. North America Autoimmune Treatment Market Opportunities 2.2.1.4. North America Autoimmune Treatment Market Challenges 2.2.2. Europe 2.2.2.1. Europe Autoimmune Treatment Market Drivers 2.2.2.2. Europe Autoimmune Treatment Market Restraints 2.2.2.3. Europe Autoimmune Treatment Market Opportunities 2.2.2.4. Europe Autoimmune Treatment Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Autoimmune Treatment Market Drivers 2.2.3.2. Asia Pacific Autoimmune Treatment Market Restraints 2.2.3.3. Asia Pacific Autoimmune Treatment Market Opportunities 2.2.3.4. Asia Pacific Autoimmune Treatment Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Autoimmune Treatment Market Drivers 2.2.4.2. Middle East and Africa Autoimmune Treatment Market Restraints 2.2.4.3. Middle East and Africa Autoimmune Treatment Market Opportunities 2.2.4.4. Middle East and Africa Autoimmune Treatment Market Challenges 2.2.5. South America 2.2.5.1. South America Autoimmune Treatment Market Drivers 2.2.5.2. South America Autoimmune Treatment Market Restraints 2.2.5.3. South America Autoimmune Treatment Market Opportunities 2.2.5.4. South America Autoimmune Treatment Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Autoimmune Treatment Industry 2.8. Analysis of Government Schemes and Initiatives For Autoimmune Treatment Industry 2.9. Autoimmune Treatment Market Trade Analysis 2.10. The Global Pandemic Impact on Autoimmune Treatment Market 3. Autoimmune Treatment Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 3.1.1. Rheumatic Disease 3.1.2. Diabetes 3.1.3. Multiple Sclerosis 3.1.4. Inflammatory Bowel Disease 3.1.5. Other Indications 3.2. Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 3.2.1. Anti-Inflammatory 3.2.2. Anti-Hyperglycemics 3.2.3. NSAIDs 3.2.4. Interferons 3.2.5. Other Drugs 3.3. Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 3.3.1. Diagnostic Equipment 3.3.2. Drugs 3.3.3. Therapeutic & Monitoring Equipment 3.4. Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 3.4.1. Drugs 3.4.2. Physical Therapy 3.5. Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 3.5.1. Hospitals & Clinics 3.5.2. Diagnostic Centers 3.5.3. Drug Stores 3.5.4. Pharmacies 3.5.5. Others 3.6. Autoimmune Treatment Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Autoimmune Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 4.1.1. Rheumatic Disease 4.1.2. Diabetes 4.1.3. Multiple Sclerosis 4.1.4. Inflammatory Bowel Disease 4.1.5. Other Indications 4.2. North America Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 4.2.1. Anti-Inflammatory 4.2.2. Anti-Hyperglycemics 4.2.3. NSAIDs 4.2.4. Interferons 4.2.5. Other Drugs 4.3. North America Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 4.3.1. Diagnostic Equipment 4.3.2. Drugs 4.3.3. Therapeutic & Monitoring Equipment 4.4. North America Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 4.4.1. Drugs 4.4.2. Physical Therapy 4.5. North America Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 4.5.1. Hospitals & Clinics 4.5.2. Diagnostic Centers 4.5.3. Drug Stores 4.5.4. Pharmacies 4.5.5. Others 4.6. North America Autoimmune Treatment Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 4.6.1.1.1. Rheumatic Disease 4.6.1.1.2. Diabetes 4.6.1.1.3. Multiple Sclerosis 4.6.1.1.4. Inflammatory Bowel Disease 4.6.1.1.5. Other Indications 4.6.1.2. United States Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 4.6.1.2.1. Anti-Inflammatory 4.6.1.2.2. Anti-Hyperglycemics 4.6.1.2.3. NSAIDs 4.6.1.2.4. Interferons 4.6.1.2.5. Other Drugs 4.6.1.3. United States Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 4.6.1.3.1. Diagnostic Equipment 4.6.1.3.2. Drugs 4.6.1.3.3. Therapeutic & Monitoring Equipment 4.6.1.4. United States Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 4.6.1.4.1. Drugs 4.6.1.4.2. Physical Therapy 4.6.1.5. United States Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.1.5.1. Hospitals & Clinics 4.6.1.5.2. Diagnostic Centers 4.6.1.5.3. Drug Stores 4.6.1.5.4. Pharmacies 4.6.1.5.5. Others 4.6.2. Canada 4.6.2.1. Canada Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 4.6.2.1.1. Rheumatic Disease 4.6.2.1.2. Diabetes 4.6.2.1.3. Multiple Sclerosis 4.6.2.1.4. Inflammatory Bowel Disease 4.6.2.1.5. Other Indications 4.6.2.2. Canada Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 4.6.2.2.1. Anti-Inflammatory 4.6.2.2.2. Anti-Hyperglycemics 4.6.2.2.3. NSAIDs 4.6.2.2.4. Interferons 4.6.2.2.5. Other Drugs 4.6.2.3. Canada Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 4.6.2.3.1. Diagnostic Equipment 4.6.2.3.2. Drugs 4.6.2.3.3. Therapeutic & Monitoring Equipment 4.6.2.4. Canada Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 4.6.2.4.1. Drugs 4.6.2.4.2. Physical Therapy 4.6.2.5. Canada Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.2.5.1. Hospitals & Clinics 4.6.2.5.2. Diagnostic Centers 4.6.2.5.3. Drug Stores 4.6.2.5.4. Pharmacies 4.6.2.5.5. Others 4.6.3. Mexico 4.6.3.1. Mexico Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 4.6.3.1.1. Rheumatic Disease 4.6.3.1.2. Diabetes 4.6.3.1.3. Multiple Sclerosis 4.6.3.1.4. Inflammatory Bowel Disease 4.6.3.1.5. Other Indications 4.6.3.2. Mexico Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 4.6.3.2.1. Anti-Inflammatory 4.6.3.2.2. Anti-Hyperglycemics 4.6.3.2.3. NSAIDs 4.6.3.2.4. Interferons 4.6.3.2.5. Other Drugs 4.6.3.3. Mexico Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 4.6.3.3.1. Diagnostic Equipment 4.6.3.3.2. Drugs 4.6.3.3.3. Therapeutic & Monitoring Equipment 4.6.3.4. Mexico Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 4.6.3.4.1. Drugs 4.6.3.4.2. Physical Therapy 4.6.3.5. Mexico Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.3.5.1. Hospitals & Clinics 4.6.3.5.2. Diagnostic Centers 4.6.3.5.3. Drug Stores 4.6.3.5.4. Pharmacies 4.6.3.5.5. Others 5. Europe Autoimmune Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 5.2. Europe Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 5.3. Europe Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 5.4. Europe Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 5.5. Europe Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.6. Europe Autoimmune Treatment Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 5.6.1.2. United Kingdom Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 5.6.1.3. United Kingdom Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 5.6.1.4. United Kingdom Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 5.6.1.5. United Kingdom Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.2. France 5.6.2.1. France Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 5.6.2.2. France Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 5.6.2.3. France Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 5.6.2.4. France Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 5.6.2.5. France Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 5.6.3.2. Germany Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 5.6.3.3. Germany Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 5.6.3.4. Germany Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 5.6.3.5. Germany Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 5.6.4.2. Italy Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 5.6.4.3. Italy Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 5.6.4.4. Italy Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 5.6.4.5. Italy Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 5.6.5.2. Spain Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 5.6.5.3. Spain Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 5.6.5.4. Spain Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 5.6.5.5. Spain Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 5.6.6.2. Sweden Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 5.6.6.3. Sweden Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 5.6.6.4. Sweden Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 5.6.6.5. Sweden Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 5.6.7.2. Austria Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 5.6.7.3. Austria Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 5.6.7.4. Austria Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 5.6.7.5. Austria Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 5.6.8.2. Rest of Europe Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 5.6.8.3. Rest of Europe Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 5.6.8.4. Rest of Europe Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 5.6.8.5. Rest of Europe Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Autoimmune Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 6.2. Asia Pacific Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 6.3. Asia Pacific Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 6.4. Asia Pacific Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 6.5. Asia Pacific Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.6. Asia Pacific Autoimmune Treatment Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 6.6.1.2. China Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 6.6.1.3. China Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 6.6.1.4. China Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 6.6.1.5. China Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 6.6.2.2. S Korea Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 6.6.2.3. S Korea Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 6.6.2.4. S Korea Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 6.6.2.5. S Korea Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 6.6.3.2. Japan Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 6.6.3.3. Japan Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 6.6.3.4. Japan Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 6.6.3.5. Japan Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.4. India 6.6.4.1. India Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 6.6.4.2. India Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 6.6.4.3. India Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 6.6.4.4. India Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 6.6.4.5. India Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 6.6.5.2. Australia Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 6.6.5.3. Australia Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 6.6.5.4. Australia Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 6.6.5.5. Australia Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 6.6.6.2. Indonesia Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 6.6.6.3. Indonesia Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 6.6.6.4. Indonesia Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 6.6.6.5. Indonesia Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 6.6.7.2. Malaysia Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 6.6.7.3. Malaysia Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 6.6.7.4. Malaysia Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 6.6.7.5. Malaysia Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 6.6.8.2. Vietnam Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 6.6.8.3. Vietnam Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 6.6.8.4. Vietnam Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 6.6.8.5. Vietnam Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 6.6.9.2. Taiwan Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 6.6.9.3. Taiwan Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 6.6.9.4. Taiwan Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 6.6.9.5. Taiwan Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 6.6.10.2. Rest of Asia Pacific Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 6.6.10.3. Rest of Asia Pacific Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 6.6.10.4. Rest of Asia Pacific Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 6.6.10.5. Rest of Asia Pacific Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Autoimmune Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 7.2. Middle East and Africa Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 7.3. Middle East and Africa Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 7.4. Middle East and Africa Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 7.5. Middle East and Africa Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7.6. Middle East and Africa Autoimmune Treatment Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 7.6.1.2. South Africa Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 7.6.1.3. South Africa Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 7.6.1.4. South Africa Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 7.6.1.5. South Africa Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 7.6.2.2. GCC Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 7.6.2.3. GCC Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 7.6.2.4. GCC Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 7.6.2.5. GCC Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 7.6.3.2. Nigeria Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 7.6.3.3. Nigeria Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 7.6.3.4. Nigeria Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 7.6.3.5. Nigeria Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 7.6.4.2. Rest of ME&A Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 7.6.4.3. Rest of ME&A Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 7.6.4.4. Rest of ME&A Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 7.6.4.5. Rest of ME&A Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Autoimmune Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 8.2. South America Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 8.3. South America Autoimmune Treatment Market Size and Forecast, by Product(2023-2030) 8.4. South America Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 8.5. South America Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 8.6. South America Autoimmune Treatment Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 8.6.1.2. Brazil Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 8.6.1.3. Brazil Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 8.6.1.4. Brazil Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 8.6.1.5. Brazil Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 8.6.2.2. Argentina Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 8.6.2.3. Argentina Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 8.6.2.4. Argentina Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 8.6.2.5. Argentina Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Autoimmune Treatment Market Size and Forecast, by Indication (2023-2030) 8.6.3.2. Rest Of South America Autoimmune Treatment Market Size and Forecast, by Drug Class (2023-2030) 8.6.3.3. Rest Of South America Autoimmune Treatment Market Size and Forecast, by Product (2023-2030) 8.6.3.4. Rest Of South America Autoimmune Treatment Market Size and Forecast, by Treatment (2023-2030) 8.6.3.5. Rest Of South America Autoimmune Treatment Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Autoimmune Treatment Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Autoimmune Treatment Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. AbbVie 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. johnson&Johnson 10.3. Eli Lilly and Company 10.4. AstraZeneca 10.5. Lupin 10.6. Amgen 10.7. Bristol-Myers Squibb 10.8. Pfizer Inc. 10.9. GlaxoSmithKline 10.10. Sanofi 10.11. UCB S.A. 10.12. F. Hoffmann-La Roche 10.13. Novartis International AG 10.14. Merck & Co., Inc 10.15. Gilead Sciences 10.16. Celgene 10.17. Boehringer Ingelheim 10.18. Takeda Pharmaceuticals 10.19. Janssen Pharmaceuticals 10.20. UCB Pharmaceuticals 11. Key Findings 12. Industry Recommendations 13. Autoimmune Treatment Market: Research Methodology 14. Terms and Glossary