The Australia Oncology Drug Market size was valued at USD 250 million in 2023. The total Australia Oncology Drug Market revenue is expected to grow at a CAGR of 8.9% from 2023 to 2030, reaching nearly USD 454 Million.Australia Oncology Drug Market Overview

Oncology drugs are pharmaceutical substances specifically developed for the prevention, diagnosis, and treatment of cancer. The MMR report covers various factors that influence the Australian oncology medication industry and requires looking at the key players, therapeutic alternatives, and regulatory environment. Its comprehensive investigation facilitates comprehension of market prospects, difficulties, and prospective growth regions. Pharmaceutical companies, healthcare providers, and research universities all make significant profits from the market for cancer therapies. Sales are driven by the rising need for innovative and efficient treatments. It also demonstrates how essential these businesses are to meeting the growing demand for advanced cancer treatments. Personalized medicine, targeted medicines, immunotherapy, cell-based therapeutics, and digital health solutions are among the healthcare industry's dominating fields. High unmet medical requirements, encouraging government policies, growing knowledge of early detection, and rising disposable incomes are some of the elements that add to their demand. These interactions create an atmosphere that is favorable to innovations in medicine.To know about the Research Methodology :- Request Free Sample Report Immunotherapy Advancements Australia's oncology drug market is experiencing a surge in immunotherapy adoption, driven by significant advancements and promising clinical outcomes. Immunotherapy trials in Australia are demonstrating positive results across various cancer types. For instance, researchers at Peter MacCallum Cancer Centre achieved complete remission in advanced head and neck cancer patients using CAR-T cell therapy. The Australian government recognizes the potential of immunotherapy and allocates funding for research and development. The Medical Research Future Fund and the National Health and Medical Research Council (NHMRC) invest in clinical trials and commercialization efforts. To create next-generation immunotherapies, multinational pharmaceutical companies are partnering with Australian institutions and setting up research hubs. Examples include Bristol Myers Squibb's $123 million research investment with the Garvan Institute, and Merck & Co.'s partnership with the University of Melbourne to develop personalized cancer vaccines.

Rising Drug Costs The rising expense of cancer medications, especially specific treatments and new medicines, is an enormous issue for both patients and Australia's healthcare system. Oncology drug prices are rising considerably faster than inflation and overall healthcare expenditure. According to an MMR survey, between 2008 and 2018, the price of cancer drugs climbed by 7.2% yearly, whereas the price of other pharmaceuticals increased by 2.9%. The increasing cost of cancer drugs puts strain on public healthcare budgets, impacting the allocation of resources for other healthcare needs.

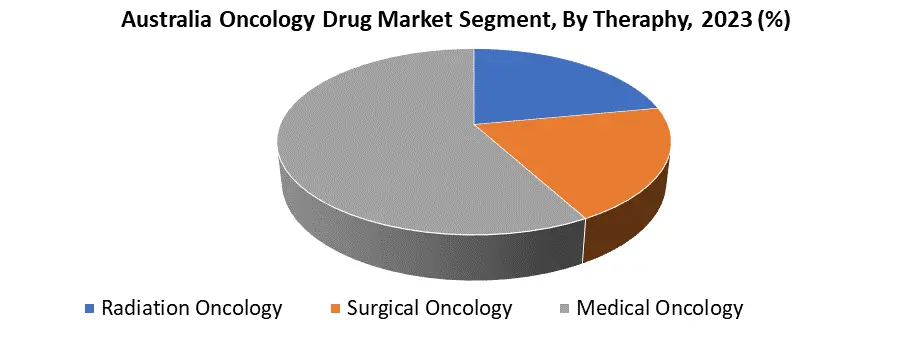

Australia Oncology Drug Market Segment Analysis

By Therapy Type, Medical oncology holds the dominant share of the Australian oncology drug market, estimated at around 73%. The high market share of medical oncology as an entire sector helps the pharmaceutical industry tremendously, bringing in enormous amounts of money for businesses and healthcare providers. It has an impact on the hospital infrastructure since it necessitates modern equipment, specialized training, and dedicated facilities. In addition, policy discussions are shaped by the high costs of medical oncology medications, which give rise to arguments about treatment accessibility and affordability.

Australia Oncology Drug Market Scope: Inquiry Before Buying

Australia Oncology Drug Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 250 Mn. Forecast Period 2024 to 2030 CAGR: 8.9% Market Size in 2030: US $ 454 Mn. Segments Covered: by Therapy Type Radiation Oncology Surgical Oncology Medical Oncology by Cancer Type Kidney Cancer Liver Cancer Ovarian Cancer Prostate Cancer Skin Cancer Colorectal Pancreatic Cancer Breast Cancer Blood Cancer Key Players in the Australia Oncology Drug Market

1. CSL Behring 2. Mesoblast 3. Sirtex Medical 4. Pro Medicus 5. AdAlta 6. OncoDNA 7. Imugene 8. CellaustraliaFAQs:

1. What is the current state of the Oncology Drug Market in Australia? Ans The aging population in Australia is leading to a significant increase in cancer incidence, which is mostly caused by longer lifespans. People who live longer tend to have more cancer risk factors in their bodies, which increases the chance of getting cancer. The healthcare system is going to be significantly impacted by this demographic shift, leading to the need for a comprehensive strategy to meet the growing demand for oncology services and treatments. 2. Which segments constitute the Oncology drug in Australia? Ans. By therapy type and cancer type. These are the segments constituted in Australia teleradiology Market. 3. What is the projected market size & and growth rate of the Australian oncology Drug Market? Ans. The Australia Oncology Drug Market size was valued at USD 250 Million in 2023. The total Australian oncology Drug market revenue is expected to grow at a CAGR of 8.9% from 2023 to 2030, reaching nearly USD 454 Million By 2030.

1. Australia Oncology Drug Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Australia Oncology Drug Market: Dynamics 2.1. Australia Oncology Drug Market Trends 2.2. PORTER’s Five Forces Analysis 2.3. PESTLE Analysis 2.4. Value Chain Analysis 2.5. Regulatory Landscape of Australia Oncology Drug Market 2.6. Technological Advancements in the Australian Oncology Drug Market 2.7. Factors Driving the Growth of the Oncology Drug Market in Australia 2.8. Technological Advancements in Oncology 2.9. Government Policies Reform for the Healthcare Sector in Australia 2.10. Emerging Therapies 2.11. Cancer Incidence and Prevalence 2.12. Immunotherapies Advancement in Australia 2.13. Australian's Annual Expenditure on Pharmaceuticals 2.14. Key Opinion Leader Analysis for Australia Oncology Drug Industry 2.15. Australia Oncology Drug Market Price Trend Analysis (2022-23) 3. Australia Oncology Drug Market: Market Size and Forecast by Segmentation for (by Value in USD Million) (2023-2030) 3.1. Australia Oncology Drug Market Size and Forecast, by Therapy Type (2023-2030) 3.1.1. Radiation Oncology 3.1.2. Surgical Oncology 3.1.3. Medical Oncology 3.2. Australia Oncology Drug Market Size and Forecast, by Cancer Type (2023-2030) 3.2.1. Kidney Cancer 3.2.2. Liver Cancer 3.2.3. Ovarian Cancer 3.2.4. Prostate Cancer 3.2.5. Skin Cancer 3.2.6. Colorectal 3.2.7. Pancreatic Cancer 3.2.8. Breast Cancer 3.2.9. Blood Cancer 4. Australia Oncology Drug Market: Competitive Landscape 4.1. MMR Competition Matrix 4.2. Competitive Landscape 4.3. Key Players Benchmarking 4.3.1. Company Name 4.3.2. Product Segment 4.3.3. End-user Segment 4.3.4. Revenue (2023) 4.4. Market Analysis by Organized Players vs. Unorganized Players 4.4.1. Organized Players 4.4.2. Unorganized Players 4.5. Leading Australia Oncology Drug Market Companies, by market capitalization 4.6. Market Trends and Challenges in China 4.6.1. Technological Advancements 4.6.2. Affordability and Accessibility 4.6.3. Shortage of Skilled Professionals 4.7. Market Structure 4.7.1. Market Leaders 4.7.2. Market Followers 4.7.3. Emerging Players in the Market 4.7.4. Challenges 4.7.5. Mergers and Acquisitions Details 5. Company Profile: Key Players 5.1. CSL Behring 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Details on Partnership 5.1.7. Potential Impact of Emerging Technologies 5.1.8. Regulatory Accreditations and Certifications Received by Them 5.1.9. Strategies Adopted by Key Players 5.1.10. Recent Developments 5.2. Mesoblast 5.3. Sirtex Medical 5.4. Pro Medicus 5.5. AdAlta 5.6. OncoDNA 5.7. Imugene 5.8. Cellaustralia 6. Key Findings 7. Industry Recommendations 8. Australia Oncology Drug Market: Research Methodology