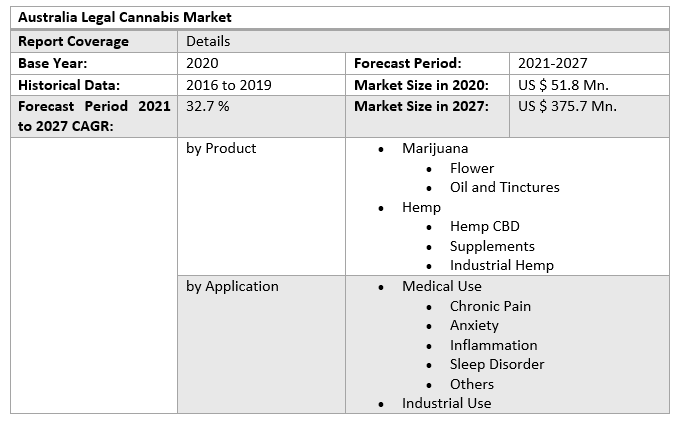

Australia Legal Cannabis Market size was valued at US$ 51.8 Mn in 2020 and the total revenue is expected to grow at 32.7% through 2021 to 2027, reaching nearly US$ 375.7 Mn.Australia Legal Cannabis Market Overview:

The industry is being driven by expanding consumer awareness of the health advantages of cannabis intake, as well as the growing legalization of marijuana, mostly for medical purposes. In July 2020, 41.0% of Australians supported cannabis legalization, according to the Australian Institute of Health and Welfare. It was nearly double the amount of support expressed in the 2007 poll. Furthermore, due to the increased illness load and chronic pain across the country, there is an increase in demand for pain management therapy.To know about the Research Methodology :- Request Free Sample Report Australia Legal Cannabis Market size was valued at US$ 51.8 Mn in 2020 and the total revenue is expected to grow at 32.7% through 2021 to 2027, reaching nearly US$ 375.7 Mn.

Australia Legal Cannabis Market Overview:

The industry is being driven by expanding consumer awareness of the health advantages of cannabis intake, as well as the growing legalization of marijuana, mostly for medical purposes. In July 2020, 41.0% of Australians supported cannabis legalization, according to the Australian Institute of Health and Welfare. It was nearly double the amount of support expressed in the 2007 poll. Furthermore, due to the increased illness load and chronic pain across the country, there is an increase in demand for pain management therapy. The report has covered the market trends from 2015 to forecast the market through 2027. 2020 is considered a base year however 2020's numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done good in lockdown also and specific strategic analysis of those companies is done in the report.Australia Legal Cannabis Market Dynamics:

When compared to other Asia Pacific countries, Australia has been a strong supporter of cannabis legalization. The legalization of cannabis in Canberra, for example, permitted residents over the age of 18 to possess up to 50 grams of dried marijuana and to grow up to two marijuana plants. Many other countries have discussed legalizing marijuana for recreational use, following in the footsteps of the United States. It is expected to contribute positively to the growth of the legal cannabis industry in Australia over the predicted period. Furthermore, the increasing number of businesses participating in the legal medical marijuana sector is assisting overall growth. Increased occurrences of opioid drug toxicity are predicted to raise demand for medicinal cannabis, which will require more cultivation to fulfill expanding consumer demand. According to data released by the Therapeutic Goods Administration in June 2020, approximately 14 emergency department admissions and 150 hospitalizations occur every day in the United States, with three people dying as a result of opioid intoxication. The legal framework surrounding medicinal cannabis in Australia is continually changing and remains tightly regulated. Medical marijuana was legalized in Australia at the federal level in 2016, while Australia's capital Canberra became the first city to decriminalize personal growing and possession of marijuana for recreational purposes in September 2019. However, recreational marijuana possession is still illegal in the United States on a federal level. The Australian government established new cannabis rules that allowed the Australian Capital Territory (ACT) to possess and cultivate marijuana for adult use.Australia Legal Cannabis Market Segment Analysis:

The Hemp segment is considered to supplement the growth of the Australian Legal Cannabis Market. In 2020, the hemp category led the Australian legal cannabis market, accounting for 84.9% of total sales. The increase is attributable to rising rates of ailments such as epilepsy and other sleep disorders, as well as increased use of hemp-based products, such as hemp CBD and supplements, for their many health advantages. According to Epilepsy Action Australia, over 250,000 people in Australia have been diagnosed with epilepsy. Furthermore, the increased use of these goods for various industrial uses, as well as the growing desire for green buildings as a result of environmental degradation, is expected to drive demand for hemp-based construction materials in the future. During the projected period, the marijuana segment is expected to grow at the fastest rate in Australia's legal cannabis industry. People are moving to legally acquire marijuana products for medical use as a result of medical marijuana legalization and decriminalization in the country, which is expected to result in a large drop in the illicit market. Cannabis legalization's potential to boost government revenue through taxation is projected to boost market growth even more.

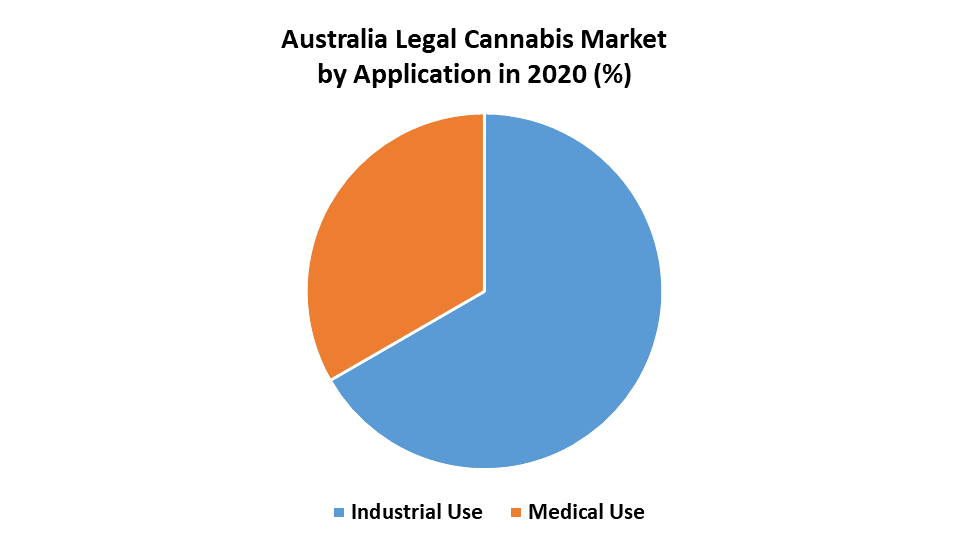

The Industrial use segment is dominating the Product segment of the Australia Legal Cannabis Market:

In 2020, the industrial application segment led the Australian legal cannabis market, accounting for 83.2 % of revenue. The construction, automotive, personal care, food and beverage, and textile industries are all seeing increased demand for hemp fibers and oil, which is helping the market grow. Product demand for varnishes, oil paints, printing inks, solvents, fuel, putty, chain-saw lubricants, and coatings is predicted to increase. Cannabis is rapidly being used in non-textile applications to reduce pollution, deforestation, and landfill waste. According to a November 2016 Rodale Institute article, replacing fossil fuel-based plastic with hemp can help reduce the quantity of plastic that ends up in the ocean and landfills, as well as exposure to hazardous compounds found in plastic. During the projection period, the medicinal application segment of the legal cannabis market in Australia is predicted to develop at the fastest rate. It's due to a growing understanding of the health advantages of cannabis products, as well as the Australian government's support for medical cannabis use. The Australian federal government, as well as state and territory governments, have approved rules allowing for simple access to medicinal cannabis products. Anxiety, chronic pain, sleep problem, and inflammation were among the sub-applications in the medical application. The objective of the report is to present a comprehensive analysis of the Australia Legal Cannabis Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Australia Legal Cannabis Market dynamics, structure by analyzing the market segments and project the Australia Legal Cannabis Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the Australia Legal Cannabis Market make the report investor’s guide.Australia Legal Cannabis Market Scope: Inquire before buying

Australia Legal Cannabis Market Key Player

• Cann Group Ltd. • Zelira Therapeutics • Aus Cann Group Holdings Pty Ltd. • Bod Australia • THC Global Group Limited • Althea Group Holdings Limited • Ecofibre Limited • MGC Pharmaceuticals Ltd. • Incannex Healthcare (IHL) • Creso Pharma (CPH) • Little Green Pharma (LGP) • Botanix Pharmaceuticals • IDT Australia (IDT) • Zelira Therapeutics (ZLD) • Emyria Limited (EMD) • Medlab Clinical (MDC) • Elixinol Wellness (EXL) • Neurotech International (NTI) • Rhinomed (RNO) • Avecho Biotech (AVE)FAQs:

1. What is the Australian Legal Cannabis market value in 2020? Ans: Australia Legal Cannabis market value in 2020 was estimated as 51.8 Million USD. 2. What is the Australian Legal Cannabis market growth? Ans: The Australia Legal Cannabis market is anticipated to grow with a CAGR of 32.7% in the forecast period and is likely to reach USD 375.7 Million by the end of 2027. 3. Which segment is expected to dominate the Australia Legal Cannabis market during the forecast period? Ans: Hemp dominated the Australia legal cannabis market with a share of 84.9% in 2020. This is attributable to the increased number of patients consuming hemp-based products such as hemp CBD and supplements for various health benefits. 4. Who are the key players in the Australia Legal Cannabis market? Ans: Some key players operating in the Australian legal cannabis market include AusCann Group Holdings Pty Ltd; Cann Group Ltd; Bod Australia; Zelira Therapeutics; Althea Group Holdings Limited; THC Global Group Limited; MGC Pharmaceuticals Ltd; and Ecofibre Limited. 5. What is the key driving factor for the growth of the Australia Legal Cannabis market? Ans: Key factors that are driving the market growth include the increasing legalization of marijuana for adult and medical use and the high consumption rate in the country.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Australia Legal Cannabis Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2020 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Australia Legal Cannabis Market 3.4. Geographical Snapshot of the Australia Legal Cannabis Market, By Manufacturer share 4. Australia Legal Cannabis Market Overview, 2020-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. The threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. The threat of Substitute Grades 4.1.6.5. The intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Australia Legal Cannabis Market 5. Supply Side and Demand Side Indicators 6. Australia Legal Cannabis Market Analysis and Forecast, 2020-2027 6.1. Australia Legal Cannabis Market Size & Y-o-Y Growth Analysis. 7. Australia Legal Cannabis Market Analysis and Forecasts, 2020-2027 7.1. Market Size (Value) Estimates & Forecast By Product, 2020-2027 7.1.1. Marijuana 7.1.1.1. Flower 7.1.1.2. Oil and Tinctures 7.1.2. Hemp 7.1.2.1. Hemp CBD 7.1.2.2. Supplements 7.1.2.3. Industrial Hemp 7.2. Market Size (Value) Estimates & Forecast By Application, 2020-2027 7.2.1. Medical Use 7.2.1.1. Chronic Pain 7.2.1.2. Anxiety 7.2.1.3. Inflammation 7.2.1.4. Sleep Disorder 7.2.1.5. Others 7.2.2. Industrial Use 8. Australia Legal Cannabis Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2020-2027 8.1.1. Australia 9. Australia Legal Cannabis Market Analysis and Forecasts, 2020-2027 9.1. Market Size (Value) Estimates & Forecast By Product, 2020-2027 9.1.1. Marijuana 9.1.1.1. Flower 9.1.1.2. Oil and Tinctures 9.1.2. Hemp 9.1.2.1. Hemp CBD 9.1.2.2. Supplements 9.1.2.3. Industrial Hemp 9.2. Market Size (Value) Estimates & Forecast By Application, 2020-2027 9.2.1. Medical Use 9.2.1.1. Chronic Pain 9.2.1.2. Anxiety 9.2.1.3. Inflammation 9.2.1.4. Sleep Disorder 9.2.1.5. Others 9.2.2. Industrial Use 10. Competitive Landscape 10.1. Geographic Footprint of Major Players in the Australia Legal Cannabis Market 10.2. Competition Matrix 10.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Fiber Grades, and R&D Investment 10.2.2. New Grade Launches and Grade Enhancements 10.2.3. Market Consolidation 10.2.3.1. M&A by Regions, Investment, and Verticals 10.2.3.2. M&A, Forward Integration and Backward Integration 10.2.3.3. Partnership, Joint Ventures, and Strategic Alliances/ Sales Agreements 10.3. Company Profile: Key Players 10.3.1. Cann Global 10.3.1.1. Company Overview 10.3.1.2. Financial Overview 10.3.1.3. Geographic Footprint 10.3.1.4. Grade Portfolio 10.3.1.5. Business Strategy 10.3.1.6. Recent Development 10.3.2. Cann Group Ltd. 10.3.3. Zelira Therapeutics 10.3.4. AusCann Group Holdings Pty Ltd. 10.3.5. Bod Australia 10.3.6. THC Global Group Limited 10.3.7. Althea Group Holdings Limited 10.3.8. Ecofibre Limited 10.3.9. MGC Pharmaceuticals Ltd. 10.3.10. Incannex Healthcare (IHL) 10.3.11. Creso Pharma (CPH) 10.3.12. Little Green Pharma (LGP) 10.3.13. Botanix Pharmaceuticals 10.3.14. IDT Australia (IDT) 10.3.15. Zelira Therapeutics (ZLD) 10.3.16. Emyria Limited (EMD) 10.3.17. Medlab Clinical (MDC) 10.3.18. Elixinol Wellness (EXL) 10.3.19. Neurotech International (NTI) 10.3.20. Rhinomed (RNO) 10.3.21. Avecho Biotech (AVE) 11. Primary Key Insights