The Atomic Clock Market size was valued at USD 545.7 million in 2024 and the total Global Atomic Clock revenue is expected to grow at a CAGR of 7% from 2025 to 2032, reaching nearly USD 937.61 million.Atomic Clock Market Overview

It is a universally known fact that Atom is made up of a nucleus consisting of protons and neutrons surrounded by electrons. When utilized in timekeeping mechanisms, the oscillation of these atoms acts like the functionality of traditional pendulums in old clocks. Atomic clocks use atoms in contrast to other clocks which are mechanical. It operates by utilizing atomic oscillations. The frequency in an atomic clock comes from the crossing radiation of electrons. This unique feature makes atomic clocks exceptionally accurate in keeping time.To know about the Research Methodology :- Request Free Sample Report Atomic clocks which are also known as primary clocks, are among the most accurate timekeeping devices in history with an error of only 1 second in up to 100 million years. According to the data collected from International Bureau of Weights and Measures located in France, there are over 260 atomic clocks at over 60 different places globally. Atomic clocks are used in setting International time standard. The accuracy of atomic clocks allow them to play an important part in GPS infrastructure. When it comes to scientific research, mainly physics in which atomic clocks are integral part of various research and experiment to accurately measure time. Various sectors like Telecom industry, Finance industry, Space exploration rely on atomic clocks for better performance, enhancing efficiency. There are 3 frequently used atomic clocks which includes the Cesium atomic beam, the hydrogen maser, and the rubidium gas cell. Among these types, Cesium atomic beam is the most accurate atomic clock available in the market. The integral of frequency be measured by cesium clocks is 9,192,631,770 hertz (Hz = cycles/second) provides the fundamental unit of time. The market demand for cesium atomic clocks is experiencing a significant and accelerated growth trajectory. North America dominates position in the global revenue landscape of the cesium beam atomic clock market with key players like Microchip Technology, Excelitas Technologies, and Stanford Research Centre. Europe fuelled by the presence of nuclear power facilities plays an important role as they rely on atomic clocks for precise monitoring purposes. The European atomic clock market segments including Russia, Germany, France, and Italy contributing the major portion. In 2023, the Russian dominated by securing the largest share within the Europe atomic clock market. Switzerland and China are investing heavily in the research and development of atomic clocks.

Atomic Clock Market Dynamics:

Rising Demand of Atomic Clock in Navigation Satellite System

Atomic clocks are closely tied to the expansion of GNSS, such as GPS, Galileo, and BeiDou. Global Navigation Satellite Systems (GNSS) are involved in our day to day activities from communication system to mobile navigation application like Google Maps. Atomic Clocks help these applications to continuously provide accurate time for ranging measurement. Advancement in these GNSS technologies drive the growth of atomic clock. North America accounts for 55% of all GNSS devices globally and Europe making significant contribution through GLONASS which is second largest GNSS system used globally. The substantial investments made in navigation technology are positioned to directly stimulate the expansion of the atomic clocks sector.Growth of Atomic clocks are fuelled by rising demand for satellite projects. The focus on space missions and the expansion of satellite-based communication systems has increased as there is a growing need for precise timing, which is efficiently fulfilled by atomic clocks. Significant investments have been made by armed forces around the globe for making new aircrafts and UAVs. Atomic clock comes into play as most of these aircraft use TACAN (Tactical Air Navigation System), GNSS navigation system for accurate position and navigation system. Countries like US, Germany, China, India, and UAE are investing heavily in these new technologies which directly affects the demand for Atomic clocks. In 2022, the United States government allocated nearly USD 62 billion to its space programs, establishing itself as the world's leading investor in space initiatives. This substantial investment significantly amplifies the demand for atomic clocks, integral components in precision timekeeping for satellite communication systems. Players such as Hughes, Comtech Telecommunications Corp., ST Engineering iDirect, Comtech EF Data, Satcom Direct, DataPath, Inc., and Astranis Space Technologies, further contribute to the growing market for atomic clocks. As these prominent companies continue to advance and grow their satellite communication capabilities, the need for atomic clocks becomes increasingly important.

Government investment and regulation over Atomic Clock

Government is responsible for upholding time standards and synchronization. It is important for government to ensure the accuracy and reliability of atomic clocks across diverse applications. Government in North America have enabled the companies to increase focus on research and development related to Atomic Clocks by spending huge amount of capital. Through proper governance and adherence to strict standards, the government plays a pivotal role in maintaining the integrity of timekeeping, thereby encouraging the dependability of atomic clocks in various application. NIST (National Institute of Standards and technology) is an important U.S. federal agency, which is investing heavily atomic clock technology. Their work is important in the research and development of highly precise atomic clocks. These Atomic clocks contribute significantly to the financial sector.Trends in Atomic Clock Market

In Telecommunications, aerospace, atomic clocks play a crucial role in providing time precision. As communication networks evolve with 5G technology, there is an increasing need for precise timekeeping and synchronization. Atomic clocks ensures that data transfer and communication occur flawlessly. The atomic clock market is positioned for dynamic expansion, with growing opportunities in emerging economies within the Asia Pacific (APAC) region. The APAC region is estimated to undergo substantial as heightened investments in infrastructure development. Countries such as China, India, Japan, and others within the Asia Pacific region are poised to become focal points for the atomic clock market, offering substantial growth prospects. Inter-University Centre for Astronomy and Astrophysics (IUCAA)of India, Chengdu Spaceon Electronics and Xi'an Synchronization Electronics Technology Limited Company of China, National Institute of Information and Communications Technology (NICT) of Japan are one of the key manufacturers of atomic clocks in APAC. In the cybersecurity world, atomic clocks play a crucial role. Atomic Clocks help, keeping networks secure from cyber threats. Atomic clocks are important in boosting the security of digital systems, adding an extra layer of protection. The increasing adoption of IoT (Internet of Things) devices within GPRS (General Packet Radio Service) networks highlights a growing trend. Atomic Clocks enable IoT devices to communicate and share data easily, contributing to the efficient operation of GPRS networks. This reliance on accurate timekeeping becomes especially crucial as the use of IoT devices continues to grow in business and industry applications.Atomic Clock Market segment analysis

By type, there are 3 frequently used atomic clocks which are cesium atomic beam, the hydrogen maser, and the rubidium gas cell. In recent times Rubidium has gained importance as it represents a high-precision frequency and time standard. Distinguished by its simplicity and compact design compared to other atomic clocks, this timekeeping device employs a glass cell containing rubidium gas. Synergy ensures accurate and reliable timekeeping, making rubidium atomic clocks a preferred choice for various applications. The cesium atomic clock market has witnessed consistent growth in recent years, propelled by a surging demand across diverse sectors. The growth is attributed to the escalating integration of atomic clocks in a multitude of applications. North America dominated the global cesium atomic clock market in 2024. Oscilloquartz is one the leading manufacturing company in North America when it comes to Cesium Atomic Clock. Microsemi is the only commercial provider of cesium beam-tube clocks, indispensable timekeeping instruments adopted by esteemed national laboratories globally, which fosters the growth of Atomic clock market in North America.By application, most significant application of Atomic clocks application is in navigation system. The rise of autonomous vehicles depend significantly on the deployment of precise navigation systems. Atomic clocks play a pivotal role in enhancing navigation precision, thereby facilitating the secure and streamlined operation of autonomous cars, drones, and other vehicles. The integration of atomic clocks contributes to the overall efficiency and safety of autonomous transportation systems. Enterprises engaged in the conception, production, and implementation of atomic clocks are actively directing significant investments towards the advancement of this domain. Prominent entities within the industry, including Hewlett Packard Enterprise (HPE), Symmetricom, and Oscilloquartz, are strategically allocating resources to propel the evolution of atomic clock technology.

Atomic clocks play an important role in growth in the field of radio astronomy especially in the realm of Very Long Baseline Interferometry (VLBI) applications. This technological synergy not only advances the precision of astronomical observations but also contributes to the expansion and innovation of radio astronomy applications.

Atomic Clock Market Regional Insights:

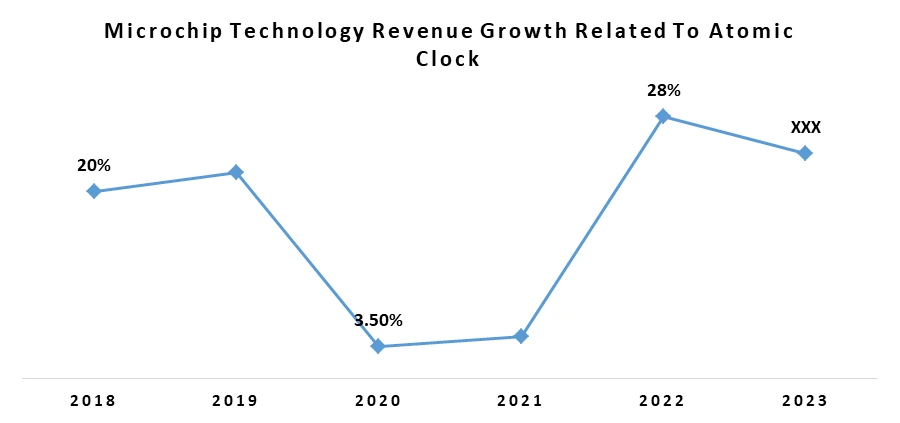

The atomic clock market is growing across five main regions which are North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America. North America has its leadership in the market, securing a significant share of the revenue of atomic clocks. Europe and the Asia Pacific (APAC) region have also significant investments in atomic clock market and estimating a CAGR of 7.5% in APAC region. The United States stands as the foremost producer of cesium atomic clocks, positioning the region as a key player expected to hold a prominent market share. The increasing momentum in space exploration supported by companies like NASA and SpaceX makes United States play significant role in shaping and leading the cesium atomic clock market. Europe plays a vital role in the growing atomic clock market, primarily attributed to substantial investments in research and development activities within the space and defence industries. Countries like the UK, France, Italy, and Russia are contributors to the region's significant market size. The combined effect of research investments in Europe and the increasing demand for cutting-edge technology in the Asia Pacific positions these regions as key drivers in the global atomic clock market. Atomic Clock market competitive landscape Companies like Microchip Technology have made significant progress in atomic clock market. The introduction of the 5071B cesium atomic clock made a significant milestone in precision timekeeping technology in 2022. The 5071B cesium atomic clock aligns with the evolving needs of scientific communities, offering a reliable and transportable temporal reference which boosts the demand for atomic clocks with increasing revenue contribution. Safran, second largest aircraft equipment manufacturer in India, has recently declared the inauguration of three new manufacturing facilities in India. The company has revealed ambitious plans to establish a substantial plant by the year 2025. The company is dedicated to align with the government's strategy and actively participating in the "Make in India" program. This strategic expansion reflects the growing demand of Atomic clocks use in these aircrafts.

Atomic Clock Market Report Scope: Inquire Before Buying

Global Atomic Clock Market Report Coverage Details Base Year: 2024 Forecast Period: 2024-2030 Historical Data: 2019 to 2024 Market Size in 2024: US $ 545.7 Mn. Forecast Period 2025 to 2032 CAGR: 7% Market Size in 2032 : US $ 937.61 Mn. Segments Covered: by Type Cesium Rubidium Hydrogen by Application Space & Military/Aerospace Scientific & Metrology Research Telecom & Broadcasting Others Atomic Clock Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Atomic Clock Market, Key Players are

1. Microchip Technology Inc 2. AccuBeat Ltd 3. Excelitas Technologies Corp 4. Oscilloquartz SA 5. Leonardo SpA 6. IQD Frequency Products Ltd 7. Orolia (Safran SA 8. Stanford Research Systems Inc 9. Tekron International Ltd 10.VREMYA-CH JSC FAQs: 1. What is the current market of atomic clocks globally? Ans: The Global Atomic Clock Market is 545.7 Mn as per 2024. 2. What are the major types of atomic clocks? Ans: There are 3 major types atomic clocks, namely; cesium, rubidium and hydrogen. 3. What are key manufacturers of atomic clocks? Ans: AccuBeat Ltd, Excelitas Technologies Corp, IQD Frequency Products Ltd, Leonardo, Microchip Technology Inc., Orolia, Oscilloquartz, Stanford Research Systems, Tekron, VREMYA-CH JSC the key players. 4. Which region holds the largest market share in atomic clocks? Ans: North America holds the largest market share in atomic clocks. 5. What are the application of atomic clocks? Ans: Space & Military/Aerospace, Scientific & Metrology Research, Telecom are key application.

1. Global Atomic Clock Market: Research Methodology 2. Global Atomic Clock Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Global Atomic Clock Market: Dynamics 3.1 Global Atomic Clock Market Trends by Region 3.1.1 North America Global Atomic Clock Market Trends 3.1.2 Europe Global Atomic Clock Market Trends 3.1.3 Asia Pacific Global Atomic Clock Market Trends 3.1.4 Middle East and Africa Global Atomic Clock Market Trends 3.1.5 South America Global Atomic Clock Market Trends 3.2 Global Atomic Clock Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Global Atomic Clock Market Drivers 3.2.1.2 North America Global Atomic Clock Market Restraints 3.2.1.3 North America Global Atomic Clock Market Opportunities 3.2.1.4 North America Global Atomic Clock Market Challenges 3.2.2 Europe 3.2.2.1 Europe Global Atomic Clock Market Drivers 3.2.2.2 Europe Global Atomic Clock Market Restraints 3.2.2.3 Europe Global Atomic Clock Market Opportunities 3.2.2.4 Europe Global Atomic Clock Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Global Atomic Clock Market Drivers 3.2.3.2 Asia Pacific Global Atomic Clock Market Restraints 3.2.3.3 Asia Pacific Global Atomic Clock Market Opportunities 3.2.3.4 Asia Pacific Global Atomic Clock Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Global Atomic Clock Market Drivers 3.2.4.2 Middle East and Africa Global Atomic Clock Market Restraints 3.2.4.3 Middle East and Africa Global Atomic Clock Market Opportunities 3.2.4.4 Middle East and Africa Global Atomic Clock Market Challenges 3.2.5 South America 3.2.5.1 South America Global Atomic Clock Market Drivers 3.2.5.2 South America Global Atomic Clock Market Restraints 3.2.5.3 South America Global Atomic Clock Market Opportunities 3.2.5.4 South America Global Atomic Clock Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives For the Coffee Shop Industry 3.8 The Global Pandemic and Redefining of The Coffee Shop Industry Landscape 3.9 Technological Road Map 4. Global Atomic Clock Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 4.1 Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 4.1.1 Cesium 4.1.2 Rubidium 4.1.3 Hydrogen 4.2 Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 4.2.1 Space & Military/Aerospace 4.2.2 Scientific & Metrology Research 4.2.3 Telecom & Broadcasting 4.2.4 Others 4.3 Global Atomic Clock Market Size and Forecast, by Region (2024-2032) 4.3.1 North America 4.3.2 Europe 4.3.3 Asia Pacific 4.3.4 Middle East and Africa 4.3.5 South America 5. North America Global Atomic Clock Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 5.1 North America Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 5.1.1 Cesium 5.1.2 Rubidium 5.1.3 Hydrogen 5.2 North America Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 5.2.1 Space & Military/Aerospace 5.2.2 Scientific & Metrology Research 5.2.3 Telecom & Broadcasting 5.2.4 Others 5.3 North America Global Atomic Clock Market Size and Forecast, by Country (2024-2032) 5.3.1 United States 5.3.1.1 United States Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 5.3.1.1.1 Cesium 5.3.1.1.2 Rubidium 5.3.1.1.3 Hydrogen 5.3.1.2 United States Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 5.3.1.2.1 Space & Military/Aerospace 5.3.1.2.2 Scientific & Metrology Research 5.3.1.2.3 Telecom & Broadcasting 5.3.1.2.4 Others 5.3.2 Canada 5.3.2.1 Canada Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 5.3.2.1.1 Cesium 5.3.2.1.2 Rubidium 5.3.2.1.3 Hydrogen 5.3.2.2 Canada Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 5.3.2.2.1 Space & Military/Aerospace 5.3.2.2.2 Scientific & Metrology Research 5.3.2.2.3 Telecom & Broadcasting 5.3.2.2.4 Others 5.3.3 Mexico 5.3.3.1 Mexico Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 5.3.3.1.1 Cesium 5.3.3.1.2 Rubidium 5.3.3.1.3 Hydrogen 5.3.3.2 Mexico Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 5.3.3.2.1 Space & Military/Aerospace 5.3.3.2.2 Scientific & Metrology Research 5.3.3.2.3 Telecom & Broadcasting 5.3.3.2.4 Others 6. Europe Global Atomic Clock Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 6.1 Europe Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 6.2 Europe Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 6.3 Europe Global Atomic Clock Market Size and Forecast, by Country (2024-2032) 6.3.1 United Kingdom 6.3.1.1 United Kingdom Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 6.3.1.2 United Kingdom Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 6.3.2 France 6.3.2.1 France Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 6.3.2.2 France Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 6.3.3 Germany 6.3.3.1 Germany Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 6.3.3.2 Germany Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 6.3.4 Italy 6.3.4.1 Italy Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 6.3.4.2 Italy Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 6.3.5 Spain 6.3.5.1 Spain Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 6.3.5.2 Spain Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 6.3.6 Sweden 6.3.6.1 Sweden Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 6.3.6.2 Sweden Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 6.3.7 Austria 6.3.7.1 Austria Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 6.3.7.2 Austria Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 6.3.8 Rest of Europe 6.3.8.1 Rest of Europe Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 6.3.8.2 Rest of Europe Global Atomic Clock Market Size and Forecast, By Application (2024-2032). 7. Asia Pacific Global Atomic Clock Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 7.1 Asia Pacific Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.2 Asia Pacific Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3 Asia Pacific Global Atomic Clock Market Size and Forecast, by Country (2024-2032) 7.3.1 China 7.3.1.1 China Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.1.2 China Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3.2 South Korea 7.3.2.1 S Korea Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.2.2 S Korea Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3.3 Japan 7.3.3.1 Japan Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.3.2 Japan Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3.4 India 7.3.4.1 India Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.4.2 India Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3.5 Australia 7.3.5.1 Australia Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.5.2 Australia Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3.6 Indonesia 7.3.6.1 Indonesia Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.6.2 Indonesia Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3.7 Malaysia 7.3.7.1 Malaysia Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.7.2 Malaysia Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3.8 Vietnam 7.3.8.1 Vietnam Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.8.2 Vietnam Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3.9 Taiwan 7.3.9.1 Taiwan Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.9.2 Taiwan Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3.10 Bangladesh 7.3.10.1 Bangladesh Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.10.2 Bangladesh Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3.11 Pakistan 7.3.11.1 Pakistan Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.11.2 Pakistan Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 7.3.12 Rest of Asia Pacific 7.3.12.1 Rest of Asia Pacific Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 7.3.12.2 Rest of Asia Pacific Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 8. Middle East and Africa Global Atomic Clock Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 8.1 Middle East and Africa Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 8.2 Middle East and Africa Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 8.3 Middle East and Africa Global Atomic Clock Market Size and Forecast, by Country (2024-2032) 8.3.1 South Africa 8.3.1.1 South Africa Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 8.3.1.2 South Africa Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 8.3.2 GCC 8.3.2.1 GCC Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 8.3.2.2 GCC Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 8.3.3 Egypt 8.3.3.1 Egypt Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 8.3.3.2 Egypt Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 8.3.4 Nigeria 8.3.4.1 Nigeria Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 8.3.4.2 Nigeria Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 8.3.5 Rest of ME&A 8.3.5.1 Rest of ME&A Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 8.3.5.2 Rest of ME&A Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 9. South America Global Atomic Clock Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 9.1 South America Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 9.2 South America Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 9.3 South America Global Atomic Clock Market Size and Forecast, by Country (2024-2032) 9.3.1 Brazil 9.3.1.1 Brazil Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 9.3.1.2 Brazil Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 9.3.2 Argentina 9.3.2.1 Argentina Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 9.3.2.2 Argentina Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 9.3.3 Rest Of South America 9.3.3.1 Rest Of South America Global Atomic Clock Market Size and Forecast, By Type (2024-2032) 9.3.3.2 Rest Of South America Global Atomic Clock Market Size and Forecast, By Application(2024-2032) 10. Global Atomic Clock Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Coffee Shop Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Microchip Technology Inc 11.2 AccuBeat Ltd 11.3 Excelitas Technologies Corp 11.4 Oscilloquartz SA 11.5 Leonardo SpA 11.6 IQD Frequency Products Ltd 11.7 Orolia (Safran SA 11.8 Stanford Research Systems Inc 11.9 Tekron International Ltd 11.10 VREMYA-CH JSC 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary