Aspirating System Market was valued at US$ 66.71 Bn. in 2022. Global Aspirating System Market size is estimated to grow at a CAGR of 5% over the forecast period. Aspirating System Market Definition: An aspirating system checks the presence of smoke by acquiring a sample of air of the surrounding from monitoring areas. It consists of central detection unit which collects air through a network of pipes and detect smoke well before it is visible to the naked eye. The lockdown in all over the world because of COVID-19 had led to environmental closure and social reduction, which led to the closure of manufacturing in the first phase of the epidemic. As allowed to operate in a few industries, consumer electronics and automotive industries are experiencing declining demand for products. The above factors have affected the Aspirating System market as there are very few new detecting systems which are expected to be used by these industries during the ongoing crisis.Aspirating systems have been penetrating the market across the globe as a means of fire detection, owing to their high level of accuracy against false alarms, advancement in the IOT and low maintenance cost. The higher the value of properties and assets, the more vulnerable a fire can be; therefore, customers are expected to invest in fire safety, which in turn is predicted to rise the growth of the aspirating system market over the forecast period of 2022-2029.

To know about the Research Methodology :- Request Free Sample Report

Aspirating System Market Dynamics:

The increasing expansion of residential, commercial sectors, rising focus on enhancing safety, rapid urbanization, advancements in fire detection technology, and rising rate of fire accidents are some of the major factors driving the global aspirating system market. Aspirating systems have the capability to detect fires faster than obsolete fire detection systems. They can provide prior warning in case of emergency so that proper actions can be taken. These fire detection systems are usually suitable where a highly sensitive smoke detection capability is needed. Aspirating systems are basically designed to provide unparalleled security in residential buildings, businesses, industries, health facilities and education systems. Increasing security concerns in all of these end use methods is one of the major factors influencing the adoption of aspirating systems programs. Increasing government regulations and policies along with obligatory building codes is expected to continue to accelerate growth for aspirating system market. Several government organizations all over the world such as the National Fire Protection Association (NFPA) have made it compulsory to use fire alarm and smoke detection systems especially in healthcare and educational places. Rising awareness among people for the merits of using aspirating systems along with introduction of new fire detections systems integrated with both aspirating smoke detectors and alarm systems is expected to further accelerate the growth of the aspirating system market. The increase in the number of fire hazards worldwide has become a major problem as it not only results in the loss of lives and property but also contributes to the country's economy. According to the International Association of Fire and Rescue Services Center of Fire Statistics 2022, there were 4.6 million fires, 30.8 thousand deaths and 51.3 thousand fire injuries reported by fire services in 46 countries in 2022. Driven by this, sales of wishing systems are expected to rise sharply during the forecast period. Moreover, the increasing integration of internet of things (IoT) and big data in aspirating systems is expected to further support their adoption across end use verticals during the forecast period of 2022-2029.Aspirating System Market Segment Analysis:

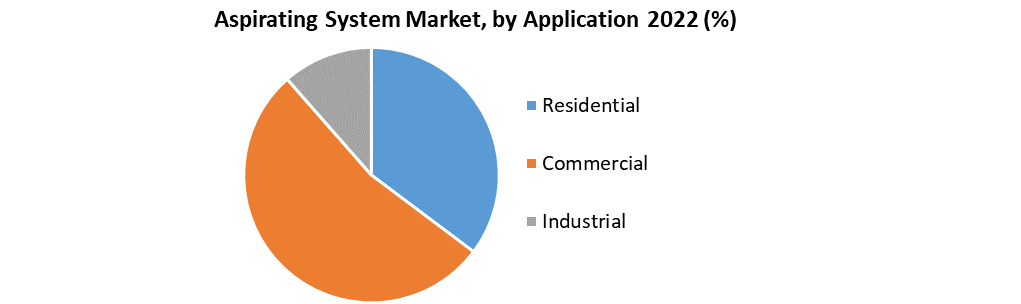

By Range, Aspirating Systems are of three ranges starting from within 300 m2, ranging between 300 m2 to 1000 m2 and above 1000 m2. During the forecast period of 2022-2029, it is expected that the growth of between 300 m2 to 1000 m2 range segment is the most. This is due to the range of warehouses and manufacturing areas which are expected to lie within this range only. Other segments are also showing an accelerating pace in the growth of the market during the forecast period. By Application, Aspirating System market is basically divided into three parts i.e., Residential, Commercial and Industrial. In this segment, Industrial zones are expected to dominate the Aspirating System market with a large margin during the forecast period. The rising development in the developing and developed countries at accelerating pace, is the major and significant region for the rise of the market in industrial region. As manufacturing units are always prone to short-circuits and other such related incidents, hence, to avoid any mis happening, these aspirating systems are critically important as they help the units to save the lives and properties at large scale. Industrial areas, it is predicted to account for 48% of market share, making it the largest contributor in this segment followed by commercial and residential. In the firms and IT organizations, where in buildings the accidents related to electricity are very often takes place, therefore, aspirating systems are responsible for the safeguard of the buildings and warehouses. In the residential areas, due to rising awareness and more knowledge about the fire safety rules and regulations, the installations of aspirating systems is expected to play a crucial role as to prevent any firebreaks and gas leakages in kitchen areas to prevent any accident. Hence the overall growth is expected in the Aspirating System market during the forecast period of 2022 to 2029.

Regional Insights:

The Asia Pacific region is expected to grow during the forecasting period among all these regions. This is because of the increasing requirements for Aspirating System in the regions due to industrial development and urban growth, the expansion of the construction industry especially in China, Japan, and India because of the increasing incidence of fire hazards. This region is expected to grow exponentially and gain a superior position in the international market in the upcoming years in countries such as China and India As people become more aware of the benefits of early fire detection, they show a deeper interest in adopting smarter fire detection technology as desired systems. These programs have been shown to be effective in reducing the risk of fire hazards. Similarly, an increase in investment in residential and commercial infrastructure across the Asia Pacific region is expected to improve opportunities for systemic production growth during forecasting. Moreover, the broad range of acceptance of Aspirating System in the enhancement of the IT and telecommunications industry is expected to raise the Aspirating System market in North America as well. It is expected that North America is expected to reach a market value of 477.0 Mn. USD by 2029. The objective of the report is to present a comprehensive analysis of the global Aspirating System Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Aspirating System Market dynamic, structure by analyzing the market segments and projecting the Aspirating System Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Aspirating System Market make the report investor’s guide.Aspirating System Market Scope: Inquiry Before Buying

Global Aspirating System Market Base Year 2022 Forecast Period 2023-2029 Historical Data CAGR Market Size in 2022 Market Size in 2029 2018 to 2022 5% US$ 66.71 Bn US$ 93.87 Bn Segments Covered by Range Below 300 sq m Between 300 sq m & 1000 sq m Above 1000 sq m by Application Below 300 sq m Between 300 sq m & 1000 sq m Above 1000 sq m Regions Covered North America United States Canada Mexico Europe UK France Germany Italy Spain Sweden Austria Rest of Europe Asia Pacific China S Korea Japan India Australia Indonesia Malaysia Vietnam Taiwan Bangladesh Pakistan Rest of APAC Middle East and Africa South Africa GCC Egypt Nigeria Rest of ME&A South America Brazil Argentina Rest of South America Key Players are:

1. Apollo Fire Detectors (Uk) 2. Aritech (US) 3. C-Tec (Uk) 4. Fireclass (UK) 5. Morley (US) 6. Nittan (Japan) 7. Notifier (US) 8. Patol (UK) 9. Protec (UAE) 10. System Sensor (US) 11. Siemens (Germany) 12. Honeywell International (US) 13. Minimax USA (US) 14. Zeta Alarms (UK) 15. Pertronic Industries (New Zealand) 16. Eurofyr (UAE) 17. Vimal Fire Controls (India) Frequently Asked Questions: 1] What segments are covered in the Global Aspirating System Market report? Ans. The segments covered in the Aspirating System Market report are based on Range, Application and Region. 2] Which region is expected to hold the highest share in the Global Aspirating System Market? Ans. The Asia Pacific region is expected to hold the highest share in the Aspirating System Market. 3] What is the market size of the Global Aspirating System Market by 2029? Ans. The market size of the Aspirating System Market by 2029 is expected to reach US$ 93.87 Bn. 4] What is the forecast period for the Global Aspirating System Market? Ans. The forecast period for the Aspirating System Market is 2023-2029. 5] What was the market size of the Global Aspirating System Market in 2022? Ans. The market size of the Aspirating System Market in 2022 was valued at US$ 66.71 Bn.

1. Global Aspirating System Market Size: Research Methodology 2. Global Aspirating System Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Aspirating System Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Aspirating System Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Aspirating System Market Size Segmentation 4.1. Global Aspirating System Market Size, by Range (2022-2029) • Below 300 sq m • Between 300 sq m and 1000 sq m • Above 1000 sq m 4.2. Global Aspirating System Market Size, by Application (2022-2029) • Residential • Commercial • Industrial 5. North America Aspirating System Market (2022-2029) 5.1. North America Aspirating System Market Size, by Range (2022-2029) 5.1.1. Below 300 sq m 5.1.2. Between 300 sq m and 1000 sq m 5.1.3. Above 1000 sq m 5.2. North America Aspirating System Market Size, by Application (2022-2029) 5.2.1. Residential 5.2.2. Commercial 5.2.3. Industrial 5.3. North America Aspirating System Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Aspirating System Market (2022-2029) 6.1. European Aspirating System Market Size, by Range (2022-2029) 6.2. European Aspirating System Market Size, by Application (2022-2029) 6.3. European Aspirating System Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Aspirating System Market (2022-2029) 7.1. Asia Pacific Aspirating System Market Size, by Range (2022-2029) 7.2. Asia Pacific Aspirating System Market Size, by Application (2022-2029) 7.3. Asia Pacific Aspirating System Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Aspirating System Market (2022-2029) 8.1. The Middle East and Africa Aspirating System Market Size, by Range (2022-2029) 8.2. The Middle East and Africa Aspirating System Market Size, by Application (2022-2029) 8.3. The Middle East and Africa Aspirating System Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Aspirating System Market (2022-2029) 9.1. South America Aspirating System Market Size, by Range (2022-2029) 9.2. South America Aspirating System Market, by Application (2022-2029) 9.3. South America Aspirating System Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Apollo Fire Detectors (UK) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Development 10.2. Aritech (US) 10.3. C-Tec (Uk) 10.4. Fireclass (UK) 10.5. Morley (US) 10.6. Nittan (Japan) 10.7. Notifier (US) 10.8. Patol (UK) 10.9. Protec (UAE) 10.10. System Sensor (US) 10.11. Siemens (Germany) 10.12. Honeywell International (US) 10.13. Minimax USA (US) 10.14. Zeta Alarms (UK) 10.15. Pertronic Industries (New Zealand) 10.16. Eurofyr (UAE) 10.17. Vimal Fire Controls (India)