Asia Pacific Smart Fleet Management Market size was valued at USD 539.44 Bn in 2022 and the total Asia Pacific Smart Fleet Management revenue is expected to grow by 7.92% from 2023 to 2029, reaching nearly USD 919.72 Bn.Asia Pacific Smart Fleet Management Market Overview

The Asia Pacific Smart Fleet Management Market prefers to use advanced technologies to manage and optimize fleet vehicles effectively in the region. The addition of various technologies like telematics, data analytics, GPS tracking, and connectivity to improve fleet operations, efficiency, reduction in cost, and driver safety. The market growth of this region is largely credited to the rising demand for fleet management solutions, the growing population, and supportive government initiatives. India plans for infrastructure development with investments of $1 trillion over the coming years. This is united with recent initiatives by the central and local governments to install 400,000 new buses in the upcoming years and is expected to increase the adoption of smart fleet management solutions.Asia Pacific Smart Fleet Management Market Snapshot

To know about the Research Methodology :- Request Free Sample Report Increasing demand for fleet optimization & focus on driver safety drives the market The growing demand for smart fleet optimization due to improved logistics and reductions in cost is driving the adoption of smart fleet management solutions in the Asia Pacific region. It offers real-time data and insights that help to achieve the objectives. Advancements in technologies like cloud computing, IoT, big data analytics, and Artificial Intelligence (AI) have eased the development that makes it more accessible and affordable for fleet operators. Driver safety and reducing accidents are the main focus of fleet operators. Hence, smart fleet management solutions provide the features like real-time alerts, behavior monitoring of drivers, and collision avoidance systems which minimize the risk of accidents and improve driver safety. As a result, these are the important factors that drive the Asia Pacific Smart Fleet Management Market. Data security concerns, Lack of awareness, and education restraint the Asia Pacific Smart Fleet Management Market Smart fleet management systems depend on the gathering and analysis of sensitive data, including driver information, and vehicle information. Data privacy and data protection are important aspects to protect data from cyber threats. Barriers to adopting smart fleet operators are concerns about data breaches, illegal access, and misuse of data. Awareness and understanding of the benefits and abilities of smart fleet management solutions are limited among some smart fleet operators. Advantages of the market like return on investment, and long-term benefits of the technologies need to educate and make them know about the benefits of smart fleet management solutions that can lead to the adoption of smart fleet management solutions. These factors can hamper the Asia Pacific Smart Fleet Management Market. Growing demand for logistics and transportation creates an opportunity for the market. The Market is experiencing economic growth and rapid urbanization, leading to increased demand for logistics and transportation services. It offers the potential to optimize routes, reduce delivery times, and enhance overall operational efficiency, meeting the timely transportation services. The adoption of IoT and connected technologies are rising because it used to enable real-time tracking, reduce downtime, improve fleet efficiency, and predictive maintenance. Governments in the Asia Pacific region are taking initiatives and implementing regulations to promote maintainable transportation and improved road safety. It helps fleet operators to fulfill these regulations by providing real-time data on fuel consumption, driver behavior, and emissions. Government support for transportation safety creates an opportunity to increase the demand for smart fleet management.

Asia Pacific Smart Fleet Management Market Segment Analysis

Based on the Transportation, Roadways transportation is the dominant sector in the Market and is expected to dominate during the forecast period. Transportation of goods and passengers is majorly done by roadways. GPS tracking, behavior monitoring of drivers, and route optimization are the smart fleet management solutions for roadways. The railway sector is growing significantly with the advancements in smart fleet management in the Asia Pacific region. Airways and Marine do not adopt smart fleet management as compared to roadways and railways which limits the widespread adoption.Asia Pacific Smart Fleet Management Market Revenue Share, By Transportation(%) in 2022

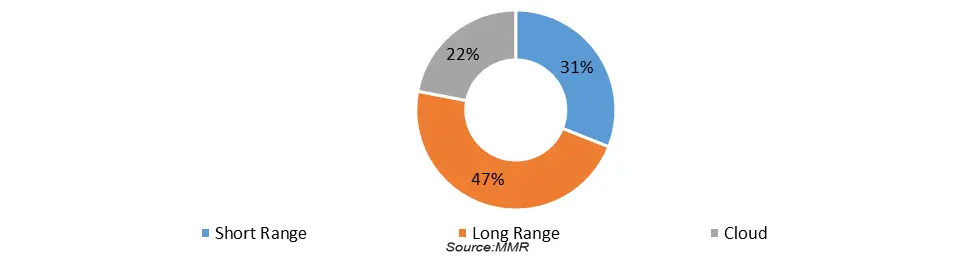

Based on the Connectivity, Long-range connectivity has conquered the Market in the year 2022 and is expected to dominate during the forecast period. Cellular networks are widely used for long-range connectivity like 4G LTE and provide continuous connectivity. It offers a wide range of coverage which makes it suitable for monitoring and tracking vehicles in a large geographical area. Short-range connectivity is used by Wi-Fi and Bluetooth connectivity for short-range communication within precise areas like warehouses, depots, etc. Whereas Cloud connectivity refers to connecting fleet management systems and cloud-based platforms. It allows to synchronize the real-data, and remote monitoring.

Asia Pacific Smart Fleet Management Market Share(%), By Connectivity in 2022

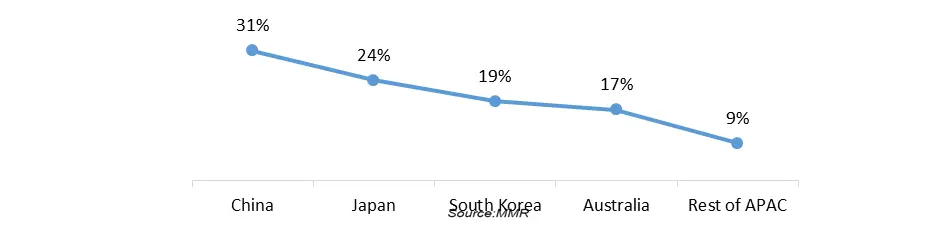

Asia Pacific Smart Fleet Management Market Country Insights:

China is the dominating country and is expected to dominate the Market during the forecast period. China is the biggest car manufacturer and has a significant car sales market. The country’s large fleet size and focus on technology adoption increase the demand for smart fleet management solutions. Japan has observed substantial adoption of smart fleet management solutions. The country has developed the automotive industry so well and has solid attention to the innovation of technologies. Whereas South Korea has highly advanced in technology and country is proactive in accepting smart fleet management solutions. Countries like Australia and India have potential growth as these countries have a vast geography and significant transportation industry.Asia Pacific Smart Fleet Management Market Share(%), By Country in 2022

Asia Pacific Smart Fleet Management Market Scope: Inquire Before Buying

Asia Pacific Smart Fleet Management Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 539.44 Bn. Forecast Period 2023 to 2029 CAGR: 7.92% Market Size in 2029: US $ 919.72 Bn. Segments Covered: by Transportation Airways Railways Roadways Marine by Connectivity Short Range Long Range Cloud by Hardware Tracking Optimization ADAS Remote diagnostics Automatic Vehicle Identification by Solution Vehicle Tracking Fleet Optimization Asia Pacific Smart Fleet Management Market by Country

China South Korea Japan India Australia Indonesia Malaysia Vietnam Taiwan Bangladesh Pakistan Rest of APACAsia Pacific Smart Fleet Management Market Key Players

1. International Business Machines Corporation (Singapore) 2. Siemens AG 3. Tech Mahindra Limited (APAC) 4. Sierra Wireless Inc. 5. Denso Corporation 6. I D Systems Inc. (Powerfleet Inc.) 7. Continental AG 8. Cisco Systems Inc. 9. Omnitracs LLC 10. Robert Bosch GmbH 11. Zonar Systems Inc. 12. CONCOX 13. WABCO Vehicle Control Systems 14. Convexicon India 15. Orbcomm Inc. 16. Hertz Corporation 17. LeasePlan Corporation 18. MasternautFrequently Asked Questions:

1] What segments are covered in the Market report? Ans. The segments covered in the Market report are based on Transportation, Connectivity, Hardware, Solution, and Country. 2] Which country is expected to hold the highest share in the Market? Ans. China is expected to hold the highest share of the Market. 3] What is the market size of the Market by 2029? Ans. The market size of the Market by 2029 is expected to reach US$ 919.72 Billion. 4] What is the forecast period for the Market? Ans. The forecast period for the Market is 2023-2029. 5] What was the market size of the Market in 2022? Ans. The market size of the Market in 2022 was valued at US$ 539.44 Bn.

1. Asia Pacific Smart Fleet Management Market: Research Methodology 2. Asia Pacific Smart Fleet Management Market: Executive Summary 3. Asia Pacific Smart Fleet Management Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Asia Pacific Smart Fleet Management Market: Dynamics 4.1. Market Trends by Region 4.1.1. Asia Pacific 4.2. Market Drivers by Region 4.2.1. Asia Pacific 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. Asia Pacific 5. Asia Pacific Smart Fleet Management Market Size and Forecast by Segments (by Value USD) 5.1. Asia Pacific Smart Fleet Management Market Size and Forecast, by Transportation (2022-2029) 5.1.1. Airways 5.1.2. Railways 5.1.3. Roadways 5.1.4. Marine 5.2. Asia Pacific Smart Fleet Management Market Size and Forecast, by Connectivity (2022-2029) 5.2.1. Short Range 5.2.2. Long Range 5.2.3. Cloud 5.3. Asia Pacific Smart Fleet Management Market Size and Forecast, by Hardware (2022-2029) 5.3.1. Tracking 5.3.2. Optimization 5.3.3. ADAS 5.3.4. Remote diagnostics 5.3.5. Automatic Vehicle Identification 5.4. Asia Pacific Smart Fleet Management Market Size and Forecast, by Solution (2022-2029) 5.4.1. Vehicle Tracking 5.4.2. Fleet Optimization 5.5. Asia Pacific Smart Fleet Management Market Size and Forecast, by Country (2022-2029) 5.5.1. China 5.5.2. South Korea 5.5.3. Japan 5.5.4. India 5.5.5. Australia 5.5.6. Indonesia 5.5.7. Malaysia 5.5.8. Vietnam 5.5.9. Taiwan 5.5.10. Bangladesh 5.5.11. Pakistan 5.5.12. Rest of APAC 6. Company Profile: Key players 6.1. International Business Machines Corporation 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Siemens AG 6.3. Tech Mahindra Limited 6.4. Sierra Wireless Inc. 6.5. Denso Corporation 6.6. I D Systems Inc. (Powerfleet Inc.) 6.7. Continental AG 6.8. Cisco Systems Inc. 6.9. Omnitracs LLC 6.10. Robert Bosch GmbH 6.11. Zonar Systems Inc. 6.12. CONCOX 6.13. WABCO Vehicle Control Systems 6.14. Convexicon India 6.15. Orbcomm Inc. 6.16. Hertz Corporation 6.17. LeasePlan Corporation 6.18. Masternaut 7. Key Findings 8. Industry Recommendation