Asia Pacific Electric Vehicle Market was valued at USD 246.23 Bn in 2023 and is expected to reach USD 273.17 Bn by 2030, at a CAGR of 10.94 % during the forecast period.Asia Pacific Electric Vehicle Market Overview

An electric vehicle (EV) is powered, either partially or entirely, by electricity stored in rechargeable batteries or another energy storage device. Unlike conventional internal combustion engine vehicles that rely on gasoline or diesel, electric vehicles use electric motors for propulsion. Electric vehicles offer several advantages over traditional vehicles, including lower operating costs (due to cheaper electricity compared to gasoline), reduced greenhouse gas emissions (especially if the electricity comes from renewable sources), and quieter operation. They are also seen as a way to reduce dependence on fossil fuels and mitigate air pollution in urban areas.To know about the Research Methodology:- Request Free Sample Report China has been the world's largest EV market, both in terms of sales and manufacturing, which significantly boosts the Asia Pacific Electric Vehicle Market growth. The Chinese government has implemented various policies and subsidies to promote EV adoption, including subsidies for manufacturers and buyers, preferential treatment for EVs in license plate lotteries, and investment in charging infrastructure. Chinese Electric Vehicle manufacturers such as BYD, NIO, and Xpeng have gained prominence both domestically and internationally. India has been gradually increasing its focus on electric vehicles as a means to reduce air pollution and decrease dependence on imported oil. The government has announced various initiatives to promote EV adoption, including tax incentives, subsidies for EV purchases, and investments in charging infrastructure. Indian automakers like Tata Motors and Mahindra Electric are actively developing electric vehicles for the domestic Asia Pacific Electric Vehicle Market. The Asia Pacific region is poised for significant growth in the electric vehicle market, driven by government support, technological innovation, and increasing consumer awareness of environmental issues.

Asia Pacific Electric Vehicle Market Dynamics

Government Policies and Incentives to boost Asia Pacific Electric Vehicle Market growth Governments across the Asia Pacific region have been implementing supportive policies and incentives to promote the adoption of electric vehicles. These measures include subsidies and tax incentives for EV manufacturers and buyers, preferential treatment for EVs in terms of regulations and road tolls, and investment in charging infrastructure. For example, China has been a frontrunner in providing substantial subsidies for EV purchases and investing heavily in charging infrastructure to support its ambitious EV targets. With growing concerns about air pollution and climate change, there is increasing pressure on governments to reduce emissions from transportation, which is a significant contributor to pollution, which is expected to boost the Asia Pacific Electric Vehicle Market growth. Tightening emissions regulations and the need to meet international commitments such as the Paris Agreement have accelerated the transition to electric vehicles. Countries like Japan and South Korea have stringent emissions standards, further incentivizing the adoption of electric vehicles. The argument for promptly transitioning consumer transport to electric power is indisputable. With the transportation sector responsible for approximately 17 percent of worldwide greenhouse gas emissions, incentivizing both the production and purchase of electric vehicles (EVs) on a large scale is crucial for Asian nations to achieve their national emission targets and contribute to the global aim of limiting climate change to a 1.5-degree increase. Nickel, a vital component in battery pack manufacturing, is abundant in Indonesia, with the country possessing 21 million metric tonnes, making it a significant global contributor alongside Australia. Over the next 5 to 10 years, the Indonesian government, led by the coordinating minister for Maritime Affairs and Investment, has been actively implementing measures to accelerate the growth of the country's EV industry, which significantly boosts the Asia Pacific Electric Vehicle Market growth. The government introduced the Rechargeable Automotive (EV) framework in September 2020, highlighting its commitment to fostering a robust electric vehicle sector. Mature Asia Pacific Electric Vehicle Market has seen rapid development, buoyed by robust policy measures across four key areas: official EV targets, constraints on internal combustion engine (ICE) production and sales, consumer incentives, and the bolstering of EV charging infrastructure (EVCI). In the Asian context, governments exhibit varying levels of commitment to electrification. Notably, China, Japan, and South Korea have established comprehensive policy frameworks to facilitate adoption. In emerging Asian markets, Thailand has introduced its 3030 EV Production Policy, aiming for 30 percent of domestic vehicle production to be electric by 2030. Meanwhile, Indonesia has announced plans to prohibit the sale of fossil fuel motorcycles by 2040 and fossil fuel cars by 2050. Dominated by Affordable Two- and Three-Wheelers, a Strategic $1.3 Billion Federal Plan Sparks Accelerated Sales. With Over 90% of Electric Vehicles Comprising Motorbikes, Scooters, and Rickshaws, and More than Half of 2022's Three-Wheeler Registrations Being Electric, India Emerges as a Global EV Hub. The Confluence of Government Incentives, Escalating Fuel Prices Over the Past Decade, and Heightened Consumer Awareness Fuels a Robust Surge in Electric Vehicle Adoption. India gaining recognition as one of the fastest-growing electric vehicle markets globally, attracting international attention and fostering collaborations, partnerships, and investments in the Indian electric mobility sector. In 2022, China emerged as the global leader in electric vehicle production, manufacturing nearly 60% of the world's EVs, encompassing both battery electric vehicles and plug-in hybrid vehicles. The momentum is set to continue in 2023, with an anticipated production of 8 million units, constituting 25% of all cars sold in China, surpassing percentages in key markets such as the European Union (22%), the United States (6%), and Japan (3%). Chinese automotive companies have further propelled this growth by offering an extensive range of 90 different EV brands, catering to diverse consumer preferences and budgets, with prices spanning from US$5000 to $90,000. Notably, the average cost of an EV in China stood at €32,000 (US$53,800) in 2022, significantly lower than the European average of €56,000 (US$94,100). While China's EV exports accounted for a modest 3% of Europe's EV sales in 2022, projections indicate a substantial increase to 20% by 2030. This growth faces challenges as the European Union objects to China's generous subsidies for its EV firms, with EU Trade Commissioner Valdis Dombrovskis advocating for China to focus on serving its domestic market rather than exports. This has led to tensions, with China opposing the EU's protectionist policies. The dynamics surrounding the potential establishment of a Chinese EV factory in Europe remain uncertain, presenting contrasts in reactions between the EU and the United States.High Initial Costs to limit Asia Pacific Electric Vehicle Market growth Electric vehicle adoption is the higher upfront cost compared to traditional internal combustion engine vehicles. Electric vehicles typically have higher sticker prices due to the cost of batteries and other advanced technologies. This deter price-sensitive consumers, particularly in emerging markets where purchasing power is lower. Range anxiety, the fear of running out of battery charge before reaching a destination, remains a significant concern for consumers considering electric vehicles. While battery technology has improved, providing longer driving ranges, many consumers still perceive electric vehicles as less convenient for long-distance travel, particularly in regions with limited charging infrastructure, which is expected to limit the Asia Pacific Electric Vehicle Market growth. The availability and accessibility of charging infrastructure play a crucial role in the widespread adoption of electric vehicles. In many parts of the Asia Pacific region, the charging infrastructure is still underdeveloped, with insufficient charging stations, especially in rural and remote areas. The lack of standardization and interoperability among charging networks create inconvenience for EV drivers, which is expected to restrain the Asia Pacific Electric Vehicle Market growth. The production and disposal of lithium-ion batteries used in electric vehicles raise environmental concerns. The extraction of raw materials for batteries, such as lithium and cobalt, have negative environmental and social impacts. The recycling and disposal of batteries at the end of their life cycle pose challenges in terms of sustainability and environmental management. The widespread adoption of electric vehicles poses challenges to the existing electricity infrastructure and grid capacity. The increased demand for electricity from charging electric vehicles strain the grid, especially during peak charging periods. Upgrading and expanding the electricity infrastructure to support the growing number of electric vehicles will require substantial investment and planning.

Asia Pacific Electric Vehicle Market Segment Analysis

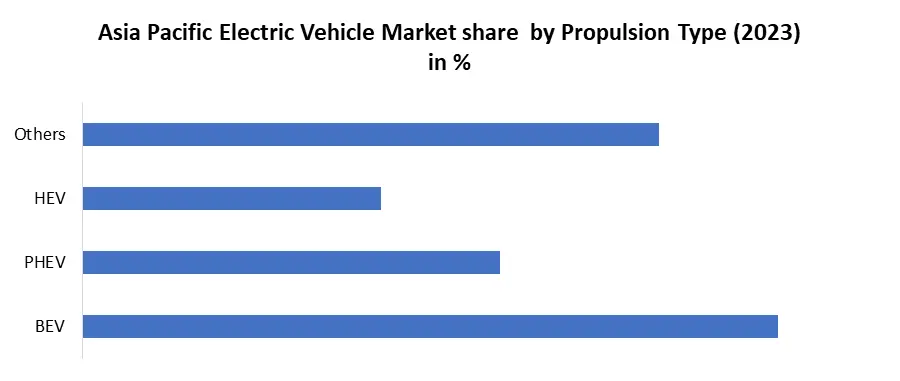

Based on Type, the market is segmented into Two-Wheeler, Passenger Vehicle, Commercial Vehicle, and Others. Commercial vehicle segment dominated the market in 2023 and is expected to hold the largest Asia Pacific Electric Vehicle Market share over the forecast period. The commercial vehicle segment in the Asia Pacific electric vehicle industry is the subset of electric vehicles that are designed and used for commercial purposes, such as transportation of goods and passengers, delivery services, logistics, and fleet operations. This segment includes a wide range of vehicles, including vans, trucks, buses, and specialized vehicles used for various commercial applications. Electric commercial vehicles offer lower operating costs compared to traditional diesel or gasoline vehicles. While the initial purchase price of electric vehicles is higher, lower fuel and maintenance costs over the vehicle's lifetime make them more cost-effective in the long run, especially for fleet operators with high mileage requirements.Based on Propulsion Type, the market is segmented into BEV, PHEV, HEV, and Others. BEV segment dominated the market in 2023 and is expected to hold the largest Asia Pacific Electric Vehicle Market share over the forecast period. The Battery Electric Vehicle (BEV) segment encompasses vehicles that rely solely on electric power stored in onboard batteries for propulsion. These vehicles do not have an internal combustion engine and produce zero tailpipe emissions. The BEV segment includes a variety of vehicle types, such as passenger cars, SUVs, vans, and commercial vehicles, designed for both personal and commercial use. Governments across the Asia Pacific region are implementing policies and incentives to promote the adoption of BEVs as part of efforts to reduce air pollution, greenhouse gas emissions, and dependence on fossil fuels. These policies include subsidies, tax incentives, zero-emission vehicle mandates, and exemptions from registration fees and road taxes for BEV buyers.

Asia Pacific Electric Vehicle Market Regional Insight

Many Asian nations find themselves at the forefront of climate-related challenges. The continent hosts 93 out of the 100 most polluted cities and six of the top ten countries most vulnerable to climate risks. Moreover, due to rapid growth and urbanization, many countries in Asia face substantial energy demands. China, for instance, consumes over three times the energy of Europe, which complicates its efforts towards achieving net-zero emissions. Given that the transportation sector is a major contributor to greenhouse gas emissions, its progress will play a pivotal role in addressing the climate crisis in Asia. According to MMR, between 2018 and 2050, the transport sector potentially contribute around 14 percent of emission reduction efforts, which is expected to boost the Asia Pacific Electric Vehicle Market growth. To tap into the potential for decarbonization, governments worldwide have set ambitious targets for electric vehicles. Examples include the EU's Fit for 55 plan, aiming for carbon neutrality by 2050, and the Biden administration's goal for half of new vehicles sold in the United States by 2030 to be electric. Aligned with these objectives, it's projected that by 2030, electric vehicle adoption reach 45 percent under existing regulatory frameworks. This estimate encompasses battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs). Across Asian nations, consumer uptake of EVs varies. While mature markets like China and Japan lead the way, emerging Asian economies, notably India and ASEAN countries, are slower to adopt. In 2021, electric vehicles accounted for less than 1 percent of new vehicle sales in the region. In June 2022, The second phase of China Lithium Battery Technology Co., Ltd.'s (CALB) Wuhan production site for power batteries and energy storage batteries has been completed. With a CNY 22 billion investment, it is Wuhan's first significant EV battery project. In April 2022, For an EV battery project, BYD Co., Ltd. (BYD) has established a new company in Nanning City, Guangxi Province. Guangxi FinDreams Battery Co., Ltd. is the name of the business, and it has a registered capital of CNY 50 million. In addition to producing and selling batteries, it will also recycle and reuse used batteries for new energy vehicles (as long as hazardous waste management is not involved), provide energy storage technology services, transmit and distribute intelligent power, and sell control equipment. India is another country in the region catching up in the electric vehicle sales. In India, 3,29,190 electric vehicles were sold in 2021, a 168 percent increase over the 1,22,607 units sold the previous year with passenger EV sales in India tripled in 2021 to 14,800 units and are still showing signs of Asia Pacific Electric Vehicle Market growth. In February 2023, BYD expanded its dealer network in Europe with the addition of two new companies. Motor Distributors Ltd (MDL) is present in Ireland and will sell BYD models in select cities such as Dublin and Cork. BYD already works with RSA in Norway, and it will offer Chinese-made EVs in Finland and Iceland. BYD will initially launch three electric vehicle models in select European countries at the end of 2022.Asia Pacific Electric Vehicle Market Scope:Inquire before buying

Asia Pacific Electric Vehicle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 246.23 Bn. Forecast Period 2024 to 2030 CAGR: 10.94% Market Size in 2030: USD 273.17 Bn. Segments Covered: by Type Two-Wheeler Passenger Vehicle Commercial Vehicle Others by Propulsion Type BEV PHEV HEV Others by Component EV Battery Electric Engine Others Leading Asia Pacific Electric Vehicle Manufacturers include:

1. TATA Motors (Mumbai, India) 2. BYD Company Limited - Shenzhen, China 3. Mahindra Electric - India 4. Suzuki - Hamamatsu, Shizuoka, Japan 5. NIO Inc. - Shanghai, China 6. XPeng Inc. - Guangzhou, China 7. Li Auto Inc. - Beijing, China 8. WM Motor - Shanghai, China 9. SAIC Motor Corporation Limited (Roewe, MG) - Shanghai, China 10. Geely Automobile Holdings Limited - Hangzhou, China 11. Great Wall Motors Company Limited (ORA) - Baoding, China 12. BAIC Motor Corporation Limited (BAIC BJEV) - Beijing, China 13. Chery Automobile Co., Ltd. - Wuhu, China 14. JAC Motors - Hefei, China 15. Others Frequently Asked Questions: 1. What is an electric vehicle (EV)? Ans: An electric vehicle is a vehicle powered, either partially or entirely, by electricity stored in rechargeable batteries or another energy storage device. Unlike conventional internal combustion engine vehicles that rely on gasoline or diesel, electric vehicles use electric motors for propulsion. 2. Which country is the world's largest electric vehicle market? Ans: China has been the world's largest electric vehicle market, both in terms of sales and manufacturing. 3. What initiatives has India taken to promote electric vehicle adoption? Ans: India has been gradually increasing its focus on electric vehicles to reduce air pollution and decrease dependence on imported oil. 4. What factors are driving the growth of electric vehicles in the Asia Pacific region? Ans: Several factors are driving the growth of electric vehicles in the Asia Pacific region, including supportive government policies and incentives, advancements in battery technology, increasing consumer awareness of environmental issues, and investments in charging infrastructure.

1. Asia Pacific Electric Vehicle Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Asia Pacific Electric Vehicle Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Asia Pacific Electric Vehicle Market: Dynamics 3.1. Asia Pacific Electric Vehicle Market Trends 3.2. Asia Pacific Electric Vehicle Market Dynamics 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape 3.7. Key Opinion Leader Analysis For Asia Pacific Electric Vehicle Industry 3.8. Analysis of Government Schemes and Initiatives For Asia Pacific Electric Vehicle Industry 4. Asia Pacific Electric Vehicle Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2023-2030) 4.1. Asia Pacific Electric Vehicle Market Size and Forecast, By Type (2023-2030) 4.1.1. Two-Wheeler 4.1.2. Passenger Vehicle 4.1.3. Commercial Vehicle 4.1.4. Others 4.2. Asia Pacific Electric Vehicle Market Size and Forecast, By Propulsion Type (2023-2030) 4.2.1. BEV 4.2.2. PHEV 4.2.3. HEV 4.2.4. Others 4.3. Asia Pacific Electric Vehicle Market Size and Forecast, By Component (2023-2030) 4.3.1. EV Battery 4.3.2. Electric Engine 4.3.3. Others 4.4. Asia Pacific Electric Vehicle Market Size and Forecast, by Region (2023-2030) 4.4.1. China 4.4.2. S Korea 4.4.3. Japan 4.4.4. India 4.4.5. Australia 4.4.6. Indonesia 4.4.7. Malaysia 4.4.8. Vietnam 4.4.9. Taiwan 4.4.10. Rest of Asia Pacific 5. Company Profile: Key Players 5.1. TATA Motors (Mumbai, India) 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Recent Developments 5.2. BYD Company Limited - Shenzhen, China 5.3. Suzuki - Hamamatsu, Shizuoka, Japan 5.4. NIO Inc. - Shanghai, China 5.5. XPeng Inc. - Guangzhou, China 5.6. Li Auto Inc. - Beijing, China 5.7. WM Motor - Shanghai, China 5.8. SAIC Motor Corporation Limited (Roewe, MG) - Shanghai, China 5.9. Geely Automobile Holdings Limited - Hangzhou, China 5.10. Great Wall Motors Company Limited (ORA) - Baoding, China 5.11. BAIC Motor Corporation Limited (BAIC BJEV) - Beijing, China 5.12. Chery Automobile Co., Ltd. - Wuhu, China 5.13. JAC Motors - Hefei, China 5.14. Others 6. Key Findings and Analyst Recommendations 7. Asia Pacific Electric Vehicle Market: Research Methodology