Artificial Intelligence and Robotics in Aerospace and Defense market size reached USD 18.97 Bn in 2022 and is expected to reach USD 34.60 Bn by 2029, growing at a CAGR of 7.8 % during the forecast period. The aerospace and defense industry has played a crucial role in protecting national security and bolstering a country’s global power and influence. Nations across the world are increasing their aerospace and defense budgets each year, giving rise to ample opportunities in Artificial Intelligence and Robotics in the Aerospace & Defense Market. AI has been used at various stages in aerospace applications, including aircraft maintenance, aircraft health and performance monitoring, airport operations, pilot training, and others. Artificial intelligence is becoming integral to the Air space as companies and government agencies are using technologies from robotics and autonomous systems for national security. Some of the major airlines and airport authorities have invested in the implementation of artificial intelligence in various passenger processes at airports to enhance their safety and efficiency during the COVID-19 pandemic. The ever-increasing application of AI-based technologies in the Aerospace and Defense sector and increasing investments in AI and machine learning (ML) are expected to drive the Artificial Intelligence and Robotics in Aerospace and Defense market during the forecast period. However, the technical and operational challenges that are often observed during the initial stages of development and adoption of AI technology are hindering market growth. The leading key players profiled in the artificial intelligence and robotics in aerospace and defense market report include IBM Corporation, Airbus SE, Boeing Company, Thales Group, GE Aviation, Lockheed Martin Corporation, Raytheon Technologies Corporation, Intel Corporation, General Dynamics Corporation, and Microsoft Corporation. The aerospace and defense industry is dominated by Boeing, Airbus, and Lockheed Martin and they are responsible for the majority of the business or contracts for aerospace and defense which leads to fierce competition. Many companies are partnering with aerospace and defense OEMs to develop advanced AI-based solutions that will enhance the safety and efficiency of operations to expand their presence in the market. For Instance, IBM and Raytheon Technologies signed a collaboration deal to develop advanced AI, cryptographic, and quantum solutions for the aerospace, military, and intelligence sectors. The systems that incorporate AI and quantum technologies are expected to have more secure communication networks and superior decision-making processes for aerospace and government customers. Artificial Intelligence and Robotics in Aerospace and Defense Market offer a comprehensive overview of the current market situation and provide a forecast until 2029. This report provides qualitative and quantitative information that highlights important market developments, trends, challenges, competition, and new opportunities within Artificial Intelligence and Robotics in Aerospace and Defense Market. This report aims to provide a comprehensive presentation of the global market for Artificial Intelligence and Robotics in Aerospace and Defense, with both quantitative and qualitative analysis to help readers develop business/growth strategies, assess the market competitive situation, and analyze their position in the current marketplace. The report also discusses technological trends and new product developments. The report includes Porter’s Five Forces analysis which explains the five forces: namely buyers' bargaining power, supplier's bargaining power, the threat of new entrants, and the degree of competition in the Artificial Intelligence and Robotics in Aerospace and Defense Market. The report also focuses on the competitive landscape of the Market. The analysis will help the Artificial Intelligence and Robotics in Aerospace and Defense market players to understand the present situation of the market.To know about the Research Methodology :- Request Free Sample Report

Artificial Intelligence and Robotics in Aerospace and Defense Market Dynamics:

Increasing Applications of AI and Robotics in the Aerospace and Defense Sector to drive market growth Intelligent aerospace is a quickly growing trend among aerospace and defense sectors that are adopting and relying on new, smarter technologies to collect and use data more effectively. AI has been used at different levels in a number of airspace applications, including aircraft repair, aircraft health and performance tracking, and airport operations. AI can be used to monitor, plan, and handle maintenance in aerospace and defense. AI systems in airspace track historical data on part use, breakdowns, wear and tear, accurately predicting when a part needs to be replaced. Global trends such as emissions reduction vehicle electrification are forcing Aerospace and Defense to think beyond fuel efficiency and embrace a green transition in the sector. This need promotes the search for a drastic increase in speed and efficiency of product design development. In the modern military, aircraft autonomy based on artificial intelligence is used at various levels. ISR systems utilize AI-based technologies, targeting technology, and automated drones. The incorporation of artificial intelligence into the design of traditional battle networks is expected to improve the performance of existing platforms. As a result, the adoption of AU technologies is expected to increase Artificial Intelligence andRobotics in Aerospace and Defense Market growth.

Increased investment in artificial intelligence and technological advancements to drive market Militaries all over the world including the U.S. Department of Defense are progressively treating AI as a technology that is central to their long-term strategies and planning. To stay relevant and remain ahead of their competitors, large Aerospace and Defense companies are also trying to tap into AI technologies being developed in the commercial space through investment and M&A approaches. The increased use of cloud-based solutions as well as the growing demand for artificial intelligence is expected to drive Artificial Intelligence and Robotics in Aerospace and Defense Market growth during the forecast period. For example, IBM Corporation announced the acquisition of Databand.ai, Ltd. in July 2022. The acquisition of Databand.ai broadens IBM Corporation's research and development capacities as well as strategic partnerships in automation and AI. Leading key players such as Northrop Grumman and Boeing increasingly offer technology hardware and services alongside their traditional delivery of aerospace products and conventional military systems. These factors are expected to boost Artificial intelligence and robotics in Aerospace and defense market growth during the forecast period. Research and Development Initiatives with trusted partners to Drive the Market The aerospace and defense sector is well known for its technological accomplishments and ability to introduce innovative breakthroughs in both product development and manufacturing processes. Industry 4.0-driven technologies have transformed the Aerospace and Defense industry. The Aerospace and Defense industry is currently using these technologies and tools to access, manage, analyze, and leverage data from their digital assets to inform decision-making in real-time. There are many leading Companies that are working to design the next generation of aircraft, which traditionally keeps the Aerospace and Defense industry strong through economic cycles. They are doing a large number of research and development initiatives at a global level. Thus, the increasing investments are expected to enable the market key players to spend more on R&D and introduce more efficient and advanced AI and robotic technologies, thereby increasing the demand for Artificial Intelligence and Robotics in Aerospace and Defense Market. Technical and Operational Challenges may hamper the growth of the market Highly skilled employees are required to operate robots because of their complex functioning. Some aerospace industries find it difficult to employ skilled operators who possess the necessary technical skills to operate robots. Furthermore, the maintenance of robotics in Aerospace and Defense is not easy and requires a specific skill to perform preventive maintenance. The shortage of skilled labor limits manufacturers from using robotics on a full scale for the manufacturing process. Furthermore, the incorporation of robotics in Aerospace and Defense involves high initial costs. Manufacturers planning to adopt robotics in their process but they need to carefully consider the return on investment before applying a new system. Thus, these factors may hamper the growth of Artificial Intelligence and Robotics in Aerospace and Defense market.

Artificial Intelligence and Robotics in Aerospace and Defense Market Segment Analysis:

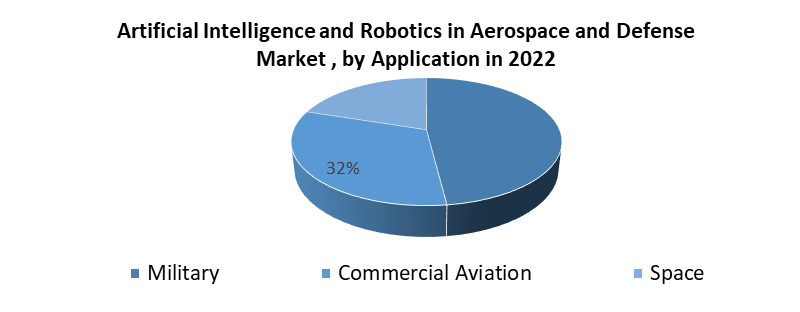

Based on the Offering, the software segment held the largest revenue share of 46.1% in 2022. The segment's growth can be attributed to the importance of AI software in developing IT infrastructure and combating security breaches. Artificial intelligence's rising technical growth generates unique AI software and related software development tools, which are expected to accelerate AI in the and Robotics in Aerospace and Defense sector in the coming years. AI software that connects with computer systems performs complicated operations by merging data from hardware systems and processing it in an AI system to generate an intelligent response. Based on the Application, the application of artificial intelligence (AI) in defense improves computational military reasoning for intelligence, surveillance, and reconnaissance (ISR) tasks. Computer vision allows for the safe administration of equipment and the control of autonomous weapon systems, resulting in reduced military casualties. Defense firms test new military product iterations and allow predictive maintenance for military assets through the use of digital twins and machine learning. In addition, companies are adopting swarm computing to create self-organizing intelligent systems that collaborate to achieve a strategic goal. The rise in investments in the development of AI and robotics and the enhanced defense budget allocation toward the R&D and acquisition of AI-based equipment is also expected to augment military segment growth.Artificial Intelligence and Robotics in Aerospace and Defense Market Regional Insights

North America is expected to emerge as the major contributor in terms of revenue in the Artificial Intelligence and Robotics in Aerospace and Defense market during the forecast period. The aerospace industry in the region is driven by the robust aviation base in the US. The presence of major aerospace and defense firms in the country also aids in the development and incorporation of modern robotics and AI systems into manufacturing, maintenance, and other commercial and defense-oriented applications. SkyGrid, a joint venture between Boeing and SparkCognition, revealed intentions to deploy an AI-powered cybersecurity solution on drones in January 2021. Moreover, the government authorities are focusing on investing in advanced technology robots in the coming years. Thus, Artificial Intelligence and Robotics in Aerospace and Defense market are expected to grow during the forecast period.Asia-Pacific is the second largest growing region across the globe in the Artificial Intelligence and Robotics in Aerospace and Defense market. Asia-Pacific. Countries such as Japan, South Korea, and China have emerged as the leading innovators in the field of AI development and integration for the Aerospace and Defense sector. Many companies in the region are involved in research activities pertaining to advanced applications of AI in the Aerospace and Defense industry. For instance, the use of adaptive machining and cutting-edge automated inspection technologies at Pratt & Whitney Singapore manufacturing has resulted in a steady rise in output volumes in recent years. Such advancements are expected to have a significant beneficial impact on the market under review throughout the forecast period.

Artificial Intelligence and Robotics in Aerospace and Defense Market Scope: Inquiry Before Buying

Artificial Intelligence and Robotics in Aerospace and Defense Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 18.97 Bn. Forecast Period 2023 to 2029 CAGR: 7.8% Market Size in 2029: USD 34.60 Bn. Segments Covered: by Offering 1. Hardware 2. Software 3.Service by Application 1.Military 2. Commercial Aviation 3. Space Artificial Intelligence and Robotics in Aerospace and Defense Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Artificial Intelligence and Robotics in Aerospace and Defense Market Key Players

1. Airbus SE 2. IBM Corporation 3. The Boeing Comapny 4. Nvidia Corporation 5. GE Aviation 6. Thales Group 7. Lockheed Martin Corporation 8. Intel Corporation 9. Iris Automation Inc. 10. SITA 11. Raytheon Technologies Corporation 12. General Dynamics Corporation 13. Northrop Grumman Corporation 14. Microsoft 15. Spark Cognition 16. Honeywell International Inc. 17. Indra Sistemas SA 18. T-Systems International GmbH FAQs: 1. Who are the key players in Market? Ans. Airbus SE, IBM Corporation, The Boeing Company, and Thales Group are the major companies operating in Artificial Intelligence and Robotics in Aerospace and Defense market. 2. Which Application segment dominates Market? Ans. The military segment accounted for the largest share of the global Artificial Intelligence and Robotics in Aerospace and Defense market in 2021. 3. How big is the market? Ans. The Global Market size reached USD 18.97 Bn in 2022 and is expected to reach USD 34.60 Bn by 2029, growing at a CAGR of 7.8 % during the forecast period. 4. What are the key regions in the global market? Ans. Based On the region, the Artificial Intelligence and Robotics in Aerospace and Defense Market has been classified into North America, Europe, Asia Pacific, the Middle, East and Africa, and Latin America. North America dominates the global Artificial Intelligence and Robotics in Aerospace and Defense market. 5. What is the study period of this market? Ans. The Global Market is studied from 2021 to 2029.

1. Artificial Intelligence and Robotics in Aerospace and Defense Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Artificial Intelligence and Robotics in Aerospace and Defense Market: Dynamics 2.1. Artificial Intelligence and Robotics in Aerospace and Defense Market Trends by Region 2.1.1. North America Artificial Intelligence and Robotics in Aerospace and Defense Market Trends 2.1.2. Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Trends 2.1.3. Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Trends 2.1.4. Middle East and Africa Artificial Intelligence and Robotics in Aerospace and Defense Market Trends 2.1.5. South America Artificial Intelligence and Robotics in Aerospace and Defense Market Trends 2.2. Artificial Intelligence and Robotics in Aerospace and Defense Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Artificial Intelligence and Robotics in Aerospace and Defense Market Drivers 2.2.1.2. North America Artificial Intelligence and Robotics in Aerospace and Defense Market Restraints 2.2.1.3. North America Artificial Intelligence and Robotics in Aerospace and Defense Market Opportunities 2.2.1.4. North America Artificial Intelligence and Robotics in Aerospace and Defense Market Challenges 2.2.2. Europe 2.2.2.1. Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Drivers 2.2.2.2. Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Restraints 2.2.2.3. Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Opportunities 2.2.2.4. Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Drivers 2.2.3.2. Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Restraints 2.2.3.3. Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Opportunities 2.2.3.4. Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Artificial Intelligence and Robotics in Aerospace and Defense Market Drivers 2.2.4.2. Middle East and Africa Artificial Intelligence and Robotics in Aerospace and Defense Market Restraints 2.2.4.3. Middle East and Africa Artificial Intelligence and Robotics in Aerospace and Defense Market Opportunities 2.2.4.4. Middle East and Africa Artificial Intelligence and Robotics in Aerospace and Defense Market Challenges 2.2.5. South America 2.2.5.1. South America Artificial Intelligence and Robotics in Aerospace and Defense Market Drivers 2.2.5.2. South America Artificial Intelligence and Robotics in Aerospace and Defense Market Restraints 2.2.5.3. South America Artificial Intelligence and Robotics in Aerospace and Defense Market Opportunities 2.2.5.4. South America Artificial Intelligence and Robotics in Aerospace and Defense Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Artificial Intelligence and Robotics in Aerospace and Defense Industry 2.8. Analysis of Government Schemes and Initiatives For Artificial Intelligence and Robotics in Aerospace and Defense Industry 2.9. Artificial Intelligence and Robotics in Aerospace and Defense Market Trade Analysis 2.10. The Global Pandemic Impact on Artificial Intelligence and Robotics in Aerospace and Defense Market 3. Artificial Intelligence and Robotics in Aerospace and Defense Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 3.1.1. Hardware 3.1.2. Software 3.1.3. Service 3.2. Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 3.2.1. Military 3.2.2. Commercial Aviation 3.2.3. Space 3.3. Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 4.1.1. Hardware 4.1.2. Software 4.1.3. Service 4.2. North America Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 4.2.1. Military 4.2.2. Commercial Aviation 4.2.3. Space 4.3. North America Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 4.3.1.1.1. Hardware 4.3.1.1.2. Software 4.3.1.1.3. Service 4.3.1.2. United States Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 4.3.1.2.1. Military 4.3.1.2.2. Commercial Aviation 4.3.1.2.3. Space 4.7.2. Canada 4.3.2.1. Canada Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 4.3.2.1.1. Hardware 4.3.2.1.2. Software 4.3.2.1.3. Service 4.3.2.2. Canada Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 4.3.2.2.1. Military 4.3.2.2.2. Commercial Aviation 4.3.2.2.3. Space 4.7.3. Mexico 4.3.3.1. Mexico Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 4.3.3.1.1. Hardware 4.3.3.1.2. Software 4.3.3.1.3. Service 4.3.3.2. Mexico Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 4.3.3.2.1. Military 4.3.3.2.2. Commercial Aviation 4.3.3.2.3. Space 5. Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 5.2. Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 5.3. Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 5.3.1.2. United Kingdom Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 5.3.2. France 5.3.2.1. France Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 5.3.2.2. France Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 5.3.3.2. Germany Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 5.3.4.2. Italy Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 5.3.5.2. Spain Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 5.3.6.2. Sweden Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 5.3.7.2. Austria Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 5.3.8.2. Rest of Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 6.2. Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 6.7. Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 6.3.1.2. China Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 6.3.2.2. S Korea Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 6.3.3.2. Japan Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 6.3.4. India 6.3.4.1. India Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 6.3.4.2. India Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 6.3.5.2. Australia Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 6.3.6.2. Indonesia Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 6.3.7.2. Malaysia Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 6.3.8.2. Vietnam Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 6.3.9.2. Taiwan Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 6.3.10.2. Rest of Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 7.2. Middle East and Africa Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 7.7. Middle East and Africa Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Country (2022-2029) 7.7.1. South Africa 7.3.1.1. South Africa Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 7.3.1.2. South Africa Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 7.7.2. GCC 7.3.2.1. GCC Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 7.3.2.2. GCC Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 7.7.3. Nigeria 7.3.3.1. Nigeria Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 7.3.3.2. Nigeria Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 7.3.4.2. Rest of ME&A Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 8. South America Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 8.2. South America Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 8.7. South America Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 8.3.1.2. Brazil Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 8.3.2.2. Argentina Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Offering (2022-2029) 8.3.3.2. Rest Of South America Artificial Intelligence and Robotics in Aerospace and Defense Market Size and Forecast, by Application (2022-2029) 9. Global Artificial Intelligence and Robotics in Aerospace and Defense Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Artificial Intelligence and Robotics in Aerospace and Defense Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Airbus SE 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. IBM Corporation 10.3. The Boeing Comapny 10.4. Nvidia Corporation 10.5. GE Aviation 10.6. Thales Group 10.7. Lockheed Martin Corporation 10.8. Intel Corporation 10.9. Iris Automation Inc. 10.10. SITA 10.11. Raytheon Technologies Corporation 10.12. General Dynamics Corporation 10.13. Northrop Grumman Corporation 10.14. Microsoft 10.15. Spark Cognition 10.16. Honeywell International Inc. 10.17. Indra Sistemas SA 10.18. T-Systems International GmbH 11. Key Findings 12. Industry Recommendations 13. Artificial Intelligence and Robotics in Aerospace and Defense Market: Research Methodology 14. Terms and Glossary