Areca Nuts Market size was valued at USD 935.74 Mn in 2023 and the market revenue is expected to reach USD 1502.60 Mn by 2030, at a CAGR of 7% over the forecast period (2024-2030).Areca Nuts Market Overview

Areca nut is widely consumed globally after nicotine, ethanol, and caffeine. It is also known as ‘betel nut' and is a seed of the Areca catechu palm tree. Areca nuts are popularly consumed in various forms such as raw, ripe, dried, and roasted, especially in South and Southeast Asia. It is used in pan masala, gutkha, mawa, dohra, and kharra, betel and so on with or without tobacco. Its addictive properties, areca nuts are estimated to be consumed by hundreds of millions of people across various countries. The global areca nuts market has experienced steady growth in recent years, owing to its cultural significance and various medicinal properties. The active compounds in areca nut include alkaloids such as arecoline, which can have stimulating and euphoric effects on the brain and body. The areca nuts market is expanding into new regions, including Europe and North America. The growing awareness about the health benefits of areca nut, combined with the increasing popularity of natural and traditional remedies, is creating new opportunities for market growth.To know about the Research Methodology :- Request Free Sample Report

Areca Nuts Market Dynamics

Medicinal Properties of Areca Nuts to Boost the Market Growth The areca nut has been known for its medicinal properties for a long time, and its demand is increasing because of this. It has antioxidant and anti-inflammatory properties, which are believed to be beneficial for various health conditions. The growing awareness about the various medicinal properties of the areca nut, such as its antioxidant and anti-inflammatory properties, is a key driver of the global areca nuts market. Additionally, the increasing demand for natural and traditional remedies in various parts of the world is also contributing to the growth of the market and is expected to increase the areca nut revenue size. The rising demand for areca nut-based products such as chewing tobacco and betel quid is also driving the growth of the Areca Nuts industry. Areca nut is deeply rooted in many cultural and traditional practices in South and Southeast Asia. Its consumption is often linked with social and religious ceremonies, and it is considered to be an important part of the cultural identity of many communities. The consumption of areca nuts also helps in the treatment of stomach, worms such as roundworms and tapeworms. Such factors are expected to drive the areca nuts market growth. The Rising Health Concerns among Population of Areca Nuts Chewing to Restrain the Market Despite the potential health benefits, the consumption of areca nuts has been linked to various health risks such as addiction, oral cancer, cardiovascular disease, and digestive problems. For example, Chewing areca nuts caused various other diseases apart from malignant or potentially malignant disorders. Arecoline is the most abundant alkaloid in the areca nut. It affects the autonomic nervous system and stimulates both sympathetic and parasympathetic nervous systems. It causes an increase in pulse rate, dilation of the pupil, an increase in peristalsis and tone in the intestine, and a hyperthermic effect on skin temperature. In addition, arecoline is cholinergic and decreases diastolic blood pressure, damages the child and neonatal withdrawal syndrome if used by a pregnant woman, causes bronchoconstriction as well as affects asthma control and the severity of attacks. This has led to the regulation of areca nut production and sales in some countries such as India and Taiwan. The health risks associated with areca nut consumption have raised concerns among health officials and policymakers, and efforts are being made to promote healthier alternatives and cessation programs. Areca nut (AN) is a carcinogenic substance consumed by roughly 600 million individuals worldwide with increasing popularity in Guam. The development and promotion of cessation programs for areca nut users is a challenge for the industry. As the health risks associated with areca nut consumption become more widely known, there is a need to develop effective programs to help users quit the habit. However, the increasing popularity of natural and traditional remedies is creating opportunities for the areca nuts market. Consumers are increasingly turning towards natural remedies and alternative medicines, which is expected to increase the demand for areca nut-based products. Government Regulations: The areca nuts market is highly regulated in many countries, which is act as a restraining factor for the industry. Government regulations such as prevention of food and safety standard rules and smokeless tobacco control policies are expected to limit the production, sale, and consumption of areca nut products and restrict the growth of the Areca Nuts Market. Areca nut consumption is often stigmatized, particularly in regions where it is not a common practice. This stigma act as a restraining factor for the Areca Nuts Market, as it discourages some consumers from using areca nut products. Increasing Imports of Areca Nuts from India to Influence the Market Growth India is the major producer and consumer of areca nuts in the world. Areca nut production in India is the largest in the world, as per FAO statistics for 2022, accounting for 49.74 % of its world output, and is exported to many countries. It is estimated that nearly ten million people depend on the areca nut s industry for their livelihood in India. The fruits of areca nut are used in traditional herbal medicine. The demand for areca nuts is rising in India due to their usage in traditional customs and consumption in various forms. The usage of these nuts in betel leaves with different flavors is enhancing the market for areca nuts in the country. They are used in various forms, including fresh, dried, baked, boiled, roasted, and cured. Dehusked areca nuts are used in a raw or processed form, generally with tobacco. These are also majorly used in different industrially manufactured products, such as gutka and pan masala. These factors are further expected to increase the imports of India. With the growing consumption of paan across various regions, especially in India, the areca nuts market growth is expected to propel over the forecast period. In 2021, the price of tender areca nuts reached an all-time high due to a sharp decline in production caused by various diseases affecting areca nut palms. Areca nut palms are susceptible to various diseases, such as fruit rot disease, bud rot, and yellow leaf disease due to the heavy rain. The shortage in the arrival of the commodity, due to a decline in yield and the huge demand for the product in the market, especially in Karnataka, was the major reason for the sudden spurt in the price of the crop. Therefore, all these factors, coupled with reduced domestic production affected by diseases and the steadily growing demand, led to increased imports of the commodity.Areca Nuts Market Segment Analysis

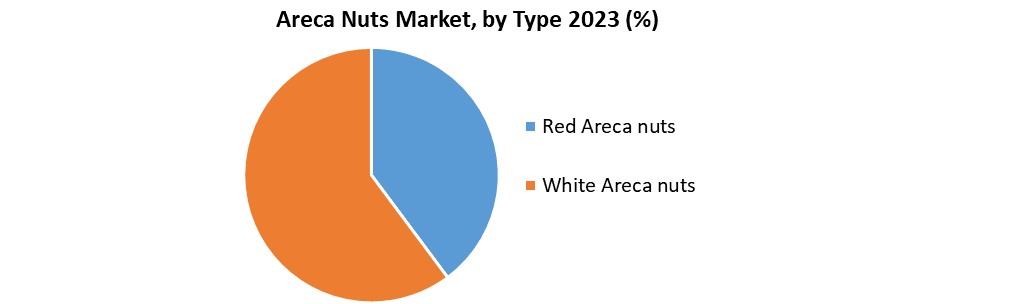

The global Areca Nuts Market is segmented into type, product, and region. By region, the areca nuts market is analyzed across North America, Europe, Asia-Pacific, South America and MEA. Based on Types, the Areca Nuts Market is segmented into, white and red areca nuts. In 2023, the Red Areca nut segment dominated the largest market share and is expected to maintain its dominance over the forecast period. Red areca nut is produced from green areca nuts. Red areca nuts are produced in the Malnad region in Karnataka. It is made after harvesting tender nuts, along with de- husking and boiling them in massive copper vessels. To enhance the color and quality, teak tree bark, lime, and betel leaf are added. Prior to marketing, they are graded and sun-dried. The increasing consumption of red areca nuts for chewing with paan is a responsible factor for the high demand for red areca nuts and is expected to add to the Areca Nuts Market growth across the world.

Areca Nuts Market Regional Insight

The Asia-Pacific held the largest Areca Nuts Market share with 90%. India is the largest producer and the biggest consumer of areca nuts in the world. The growth of the areca nuts market is mainly due to the increasing consumption of nuts in both developed and developing countries of Asia-Pacific. For Example, Approximately, 600 million people globally chew betel quid. Most of them are from the Asia- Pacific region including Sri Lanka, India, Bangladesh, Myanmar, and Taiwan. Most of the betel chewers in other countries are also emigrants from these countries. People use areca nut alone or in a betel quid comprising ingredients such as betel leaf, slaked lime, and tobacco. Ingredients of betel quid have differed according to country, ethnicity, and personal choice. Almost all the demand for areca nuts is met by India, Bangladesh, Indonesia, Thailand, Sri Lanka, and Myanmar. According to an MMR report, people older than 40 years were more likely to start chewing areca nuts. However, the per capita consumption of areca nuts is high in Myanmar and Taiwan, followed by Bangladesh, India, Indonesia, and China. The consumption is further expected to increase consumption of these areca nuts in different processed foods.Areca Nuts Market Competitive Landscape

The Areca Nuts Market major companies include GM Group, Vietdelta Industrial Co., Ltd, Shri Ganesh Prasad Traders, Pt. Ruby Privatindo, Swastika International, The Campco Ltd., and Sri Vinayaka Betelnut Traders. The quality and variety of areca nuts have competitive advantages in the market. They offering adverse varieties and offer high quality, properly processed and graded areca nuts and pricing and cost efficiency make market highly competitive. Collaboration with other companies, research institutions, or organizations can bring synergies and shared resources, enabling companies to enhance their capabilities and market reach. Strategic partnerships can involve joint ventures, supply chain collaborations, or technology-sharing agreements. Investing in research and development can lead to product innovation, improved processing techniques, and the development of new applications for areca nuts. Companies that invest in R&D have a higher likelihood of staying ahead of competitors and addressing emerging market trends.Areca Nuts Market Scope: Inquire before buying

Areca Nuts Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 935.74 Mn. Forecast Period 2024 to 2030 CAGR: 7% Market Size in 2030: US $ 1502.60 Mn. Segments Covered: by Type 1. Red Areca nuts 2. White Areca nuts by Product 1. Scented Supari 2. Tannin 3. Pan Masala by Form 1. Raw 2. Ripe 3. Roasted 4. Dried by Applications 1. Traditional 2. Medicinal/ Pharmaceuticals 3. Health Care Products 4. Foods 5. Others by Age-Group 1. 15-20 year 2. 21-25 year 3. 31-50 year Areca Nuts Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Areca Nuts Market, Key Players are

1. Swastika International 2. R. K. TRADING 3. GM Mallikarjunappa 4. Maganlal Shivram and Company 5. S. K. Associates 6. SrinidhiFarm 7. The Areca Nut Company 8. Gm Group 9. Vietdelta Industrial Co., Ltd 10. Shri Ganesh Prasad Traders 11. Pt. Ruby Privatindo 12. The Campco Ltd. 13. Sri Vinayaka Betelnut Traders 14. PT Ruby Privatindo 15. The CAMPCO Ltd. 16. Surya Exim 17. Biotan Pharma 18. Shri Ganesh Prasad Traders 19. Marlene Traders Co., Ltd. Frequently Asked Questions: 1] What is the growth rate of the Global Areca Nuts Market? Ans. The Global Areca Nuts Market is growing at a significant rate of 7% during the forecast period. 2] Which region is expected to dominate the Global Areca Nuts Market? Ans. Asia Pacific is expected to dominate the Areca Nuts Market during the forecast period. 3] What is the expected Global Market size by 2030? Ans. The Areca Nuts Market size is expected to reach USD 1502.60 Mn by 2030. 4] Which are the top players in the Global Market? Ans. The major top players in the Global Areca Nuts Market are Swastika International, R. K. Trading and others. 5] What are the factors driving the Global Market growth? Ans. The rise in consumption of area nuts among the huge population is expected to drive market growth during the forecast period.

1. Areca Nuts Market: Research Methodology 2. Areca Nuts Market: Executive Summary 3. Areca Nuts Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1.Market Leaders 3.4.2.Market Followers 3.4.3.Emerging Players 3.5. Consolidation of the Market 4. Areca Nuts Market: Dynamics 4.1. Market Trends by region 4.1.1.North America 4.1.2.Europe 4.1.3. Asia Pacific 4.1.4.Middle East and Africa 4.1.5.South America 4.2. Market Drivers by Region 4.2.1.North America 4.2.2.Europe 4.2.3. Asia Pacific 4.2.4.Middle East and Africa 4.2.5.South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1.North America 4.9.2.Europe 4.9.3. Asia Pacific 4.9.4.Middle East and Africa 4.9.5.South America 5. Areca Nuts Market: Segmentation (by Value USD and Volume Units) 5.1. Areca Nuts Market, by Type (2023-2030) 5.1.1.Red Areca nuts 5.1.2.White Areca nuts 5.2. Areca Nuts Market, by Product (2023-2030) 5.2.1.Scented Supari 5.2.2. Tannin 5.2.3. Pan Masala 5.3. Areca Nuts Market, by Form (2023-2030) 5.3.1.Raw 5.3.2. Ripe 5.3.3. Roasted 5.3.4.Dried 5.4. Areca Nuts Market, by Application (2023-2030) 5.4.1.Traditional 5.4.2.Medicinal/ Pharmaceuticals 5.4.3.Health Care Products 5.4.4.Foods 5.4.5.Others 5.5. Areca Nuts Market, by Age Group (2023-2030) 5.5.1. 15-20 year 5.5.2. 21-25 year 5.5.3. 31-50 year 5.6. Areca Nuts Market, by Region (2023-2030) 5.6.1.North America 5.6.2.Europe 5.6.3.Asia Pacific 5.6.4.Middle East and Africa 5.6.5.South America 6. North America Areca Nuts Market (by Value USD and Volume Units) 6.1. North America Areca Nuts Market, by Type (2023-2030) 6.1.1.Red Areca nuts 6.1.2.White Areca nuts 6.2. North America Areca Nuts Market, by Product (2023-2030) 6.2.1.Scented Supari 6.2.2. Tannin 6.2.3. Pan Masala 6.3. North America Areca Nuts Market, by Form (2023-2030) 6.3.1.Raw 6.3.2.Ripe 6.3.3.Roasted 6.3.4.Dried 6.4. North America Areca Nuts Market, by Application (2023-2030) 6.4.1.Traditional 6.4.2.Medicinal/ Pharmaceuticals 6.4.3.Health Care Products 6.4.4.Foods 6.4.5.Others 6.5. North America Areca Nuts Market, by Age-Group (2023-2030) 6.5.1. 15-20 year 6.5.2. 21-25 year 6.5.3. 31-50 year 6.6. North America Areca Nuts Market, by Country (2023-2030) 6.6.1.United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Areca Nuts Market (by Value USD and Volume Units) 7.1. Europe Areca Nuts Market, by Type (2023-2030) 7.2. Europe Areca Nuts Market, by Product (2023-2030) 7.3. Europe Areca Nuts Market, by Form (2023-2030) 7.4. Europe Areca Nuts Market, by Application (2023-2030) 7.5. Europe Areca Nuts Market, by Age Group (2023-2030) 7.6. Europe Areca Nuts Market, by Country (2023-2030) 7.6.1.UK 7.6.2.France 7.6.3.Germany 7.6.4.Italy 7.6.5.Spain 7.6.6.Sweden 7.6.7.Austria 7.6.8.Rest of Europe 8. Asia Pacific Areca Nuts Market (by Value USD and Volume Units) 8.1. Asia Pacific Areca Nuts Market, by Type (2023-2030) 8.2. Asia Pacific Areca Nuts Market, by Product (2023-2030) 8.3. Asia Pacific Areca Nuts Market, by Form (2023-2030) 8.4. Asia Pacific Areca Nuts Market, by Application (2023-2030) 8.5. Asia Pacific Areca Nuts Market, by Age Group (2023-2030) 8.6. Asia Pacific Areca Nuts Market, by Country (2023-2030) 8.6.1.China 8.6.2.S Korea 8.6.3.Japan 8.6.4.India 8.6.5.Australia 8.6.6.Indonesia 8.6.7.Malaysia 8.6.8.Vietnam 8.6.9.Taiwan 8.6.10. Bangladesh 8.6.11. Pakistan 8.6.12. Rest of Asia Pacific 9. Middle East and Africa Areca Nuts Market (by Value USD and Volume Units) 9.1. Middle East and Africa Areca Nuts Market, by Type (2023-2030) 9.2. Middle East and Africa Areca Nuts Market, by Product (2023-2030) 9.3. Middle East and Africa Areca Nuts Market, by Form (2023-2030) 9.4. Middle East and Africa Areca Nuts Market, by Application (2023-2030) 9.5. Middle East and Africa Areca Nuts Market, by Age group (2023-2030) 9.6. Middle East and Africa Areca Nuts Market, by Country (2023-2030) 9.6.1.South Africa 9.6.2. GCC 9.6.3. Egypt 9.6.4. Nigeria 9.6.5.Rest of ME&A 10. South America Areca Nuts Market (by Value USD and Volume Units) 10.1. South America Areca Nuts Market, by Type (2023-2030) 10.2. South America Areca Nuts Market, by Product (2023-2030) 10.3. South America Areca Nuts Market, by Form (2023-2030) 10.4. South America Areca Nuts Market, by Application (2023-2030) 10.5. South America Areca Nuts Market, by Age Group (2023-2030) 10.6. South America Areca Nuts Market, by Country (2023-2030) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Rest of South America 11. Company Profile: Key players 11.1. Swastika International 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. R. K. TRADING 11.3. GM Mallikarjunappa and Sonâ 11.4. Maganlal Shivram and Company 11.5. S. K. Associates 11.6. SrinidhiFarm 11.7. The Areca Nut Company 11.8. Gm Group 11.9. Vietdelta Industrial Co., Ltd 11.10. Shri Ganesh Prasad Traders 11.11. Pt. Ruby Privatindo 11.12. The Campco Ltd. 11.13. Sri Vinayaka Betelnut Traders 11.14. PT Ruby Privatindo 11.15. The CAMPCO Ltd. 11.16. Surya Exim 11.17. Biotan Pharma 11.18. Shri Ganesh Prasad Traders 11.19. Marlene Traders Co., Ltd. 12. Key Findings 13. Industry Recommendation