The Animal Model Market size was valued at USD 19.59 Billion in 2023 and the total Animal Model revenue is expected to grow at a CAGR of 6.5% from 2024 to 2030, reaching nearly USD 30.45 Billion.Animal Model Market Overview

An animal model is a non-human species used in biomedical research because it can mimic aspects of a biological process or disease found in humans. The importance of disease modeling and pathogenesis studies drives the demand for animal models that accurately replicate specific human diseases. This leads to an increased demand for genetically modified models tailored to mimic the pathological features of targeted illnesses. Pharmaceutical and biotechnology companies heavily depend on disease models to develop and test therapeutic interventions. The demand for animal models to simulate disease conditions contributes to an expanded scope of research in drug discovery and development. Animal models aid in the better understanding of disease mechanisms, which in turn aids in the development of targeted therapeutics. The need for animal models that faithfully capture the nuances of certain diseases will increase in tandem with the growing importance of precision medicine.To know about the Research Methodology :- Request Free Sample Report The adoption of organoids and 3D models has a significant impact on the animal model market by improving the relevance and predictability of preclinical studies. Organoids and 3D models better mimic the complexity of human organs compared to traditional two-dimensional cultures. Its increased physiological relevance allows researchers to study diseases in a more realistic context, enhancing the reliability of preclinical data. Pharmaceutical companies are increasingly identifying the value of organoids and 3D models in early drug discovery. The demand for animal models that include these advanced technologies is expected to grow as drug development pipelines prioritize more predictive and relevant preclinical studies. Technological developments play an essential role in shaping the landscape of animal model development. In Vivo Imaging Systems, techniques like bioluminescence and fluorescence imaging, allow real-time visualization of biological processes within living animals. Charles River Laboratories is a leading player that incorporates advanced imaging technologies into its animal models, providing researchers with dynamic insights for preclinical studies.

Dynamics of the Animal Model Market

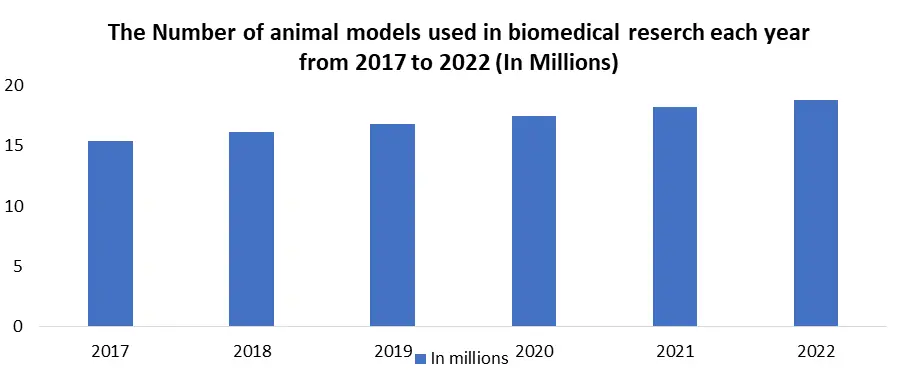

Biomedical Research Advancements The continuous advancements in biomedical research indeed play an essential role in driving the demand for animal models. Animal models allow researchers to replicate specific aspects of human diseases, mimicking the pathological conditions observed in patients. This replication is crucial for studying the progression and characteristics of diseases under controlled experimental conditions. The demand for modeling specific diseases leads to an increase in the variety of animal models available. Researchers search for models that closely mimic human physiology and pathogenesis, leading to the development of new species-specific models or genetically modified variants. The increased demand for preclinical testing services, driven by pharmaceutical and biotechnology companies leveraging disease-specific animal models, has several implications for the future of the animal model market. The growing need for preclinical testing services is likely to lead to the growth of Contract Research Organizations (CROs) specializing in preclinical studies. The future of preclinical testing is expected to observe an integration of advanced technologies. This may include the incorporation of advanced imaging techniques, omics technologies, and other high-throughput methodologies to gather more comprehensive data from preclinical studies. Key Trends in Animal Models Used for HIV/AIDS Research Animal models are essential for testing antiretroviral drugs to treat HIV infection in humans and for acquiring the basic scientific knowledge that will ultimately be needed to develop a safe and effective vaccine against HIV-1. Genetic differences between macaque species, and in some cases between geographically distinct populations of the same species, can dramatically affect the outcome of SIV and SHIV infections and are important considerations in the use of these models. Infection of Asian macaques with certain SIV or simian–human immunodeficiency virus (SHIV) recombinants results in gradual CD4+ T cell depletion and progression to AIDS, similar to HIV infection in humans. Thus, SIV and SHIV infection of macaques are currently the best, most widely accepted models for AIDS research. Developments in Genomic Editing Technologies Ongoing advancements in genomic editing technologies, such as CRISPR/Cas9, provide opportunities for the creation of more precise and sophisticated animal models. The ability to use CRISPR/Cas9 and other advanced genomic editing technologies has led to a surge in the demand for genetically modified animal models. Researchers now can introduce specific genetic modifications with high precision, allowing for the creation of models that closely mimic human conditions. Disease-specific models created through targeted genetic modifications provide a more accurate representation of human diseases. By introducing mutations associated with specific conditions, researchers can closely mimic the pathological features and molecular characteristics of the human disease, enhancing the significance of preclinical studies. Disease-specific models play a vital role in the validation of drug candidates. As a result, researchers can evaluate the efficacy and safety of potential therapies in a context that closely mimics human disease, providing better data for decision-making during drug development. The use of animals in research remains a significant challenge. Ethical concerns surrounding the use of animals in research indeed present a significant challenge in the animal model market. Addressing these concerns is crucial not only from a moral perspective but also to maintain public trust and observe to regulatory standards. Negative public perceptions may result in decreased support for institutions and industries involved in animal research. Funding agencies, both public and private, may be influenced by public sentiment, impacting the financial resources available for animal model research. Institutions and companies engaged in animal research may encounter difficulties in forming collaborations. Researchers and organizations from other sectors, particularly those with strong ethical stances, may be uncertain about working together with entities supposed negative due to their involvement in animal studies. Allocate resources and investment towards the development and application of alternative technologies that reduce dependence on animal models. Embrace innovations such as in vitro assays, microfluidic systems, and advanced computational models to provide viable alternatives. Maintain a transparent communication about the ethical considerations and justifications for using animal models in research. Clearly articulate the efforts taken to minimize animal use, ensure humane treatment, and adhere to the principles of Replacement, Reduction, and Refinement (3Rs). Implement educational programs to raise awareness about the ethical considerations involved in animal research. Engage with the public, researchers, and stakeholders to foster an understanding of the importance of animal models in advancing scientific knowledge and improving human and animal health.

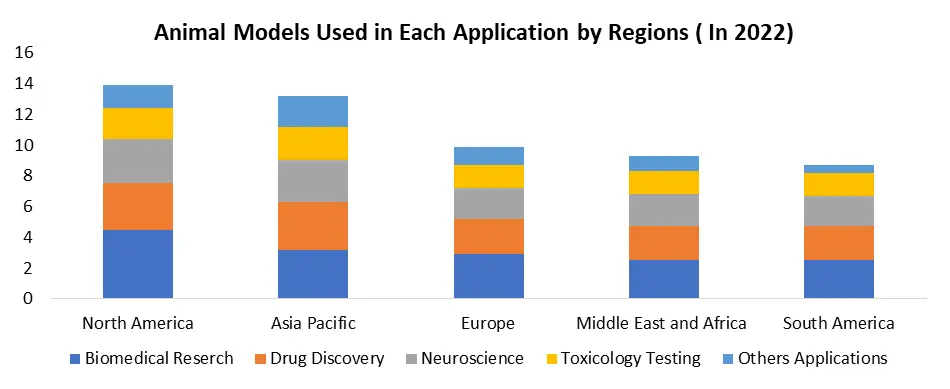

Animal Model Market Regional Insights

North America is a dominant region with the highest animal model market share in 2023. The region has increased its infrastructure, including state-of-the-art laboratories and specialized facilities for conducting experiments with animal models. This infrastructure attracts investigators and contributors to the growth of the animal model market. Numerous scientific fields are included in biomedical research, which aims to increase medical knowledge, comprehend disease mechanisms, and create novel remedies. Preclinical research, medication development, and disease research all heavily rely on animal models, including mice, rats, and other species. As members of North America, the United States and Canada dedicate a large amount of funding to biomedical research. This investment fuels advancements in various scientific fields, driving the demand for animal models and related services. The impact of U.S. and Canadian investments in biomedical research is truly global and far-reaching. The discoveries and advancements made in North America have a deep effect on global research trends and practices. The United States and Canada, with some of the top research institutes and universities globally, are at the forefront of biomedical research advancements. These organizations are renowned for establishing the bar for quality in research, which other universities are compelled to meet. Thanks to investments in biomedical research in North America, cutting-edge technologies have been developed and adopted, which have become globally recognized and widely used in laboratories around the world. Asia Pacific is expected to dominate the Animal model market. Countries in the Asia Pacific such as China, Japan, South Korea, and have been increasing their investments in biomedical research. Cities including Beijing, Shanghai, and Tokyo are becoming major biomedical research hubs, attracting scientists and researchers globally. The presence of these hubs contributes to the demand for the animal model market. The growth of the pharmaceutical industries in China and India has led to increased drug development activities. As companies in these countries work on developing new drugs and therapies, there is a heightened demand for preclinical testing using animal models to assess the safety and efficiency of these potential treatments. The Pharmaceutical industries in these countries are actively engaged in researching and developing treatments for a diverse range of diseases. This includes diseases that are prevalent in the respective populations as well as global health concerns. Animal models play a crucial role in understanding disease mechanisms and testing potential interventions. A significant driver for the growth of the pharmaceutical industries in both China and India is a focus on developing affordable medicines. Animal models are essential in the early stages of drug development to evaluate the potential effectiveness of new treatments, contributing to the goal of providing cost-effective healthcare solutions.

Animal Model Market Segment Analysis

By Species, Mice and rat segments dominate the animal model market and are expected to grow during the forecast period. Mice and rats show a considerable genetic similarity with humans, allowing researchers to study diseases and test treatments in models that closely mimic human biology. This improves the application of research outcomes, attracting pharmaceutical and biotech companies looking for reliable preclinical models. The demand for animal models that closely reflect human responses drives market growth. Mice and rats are cost-effective to breed and maintain compared to larger animals. This cost efficiency is important for researchers working within budget constraints. Zebrafish is expected to dominate the market in the future allowing researchers to observe internal structures and developmental processes easily. This transparency provides a clear view of organ formation and facilitates real-time imaging. The ability to visually track development is a valuable asset for researchers in developmental biology, toxicology, and drug screening. The demand for animal models with such observational advantages attracts users, contributing to Animal model market growth. Zebrafish have a rapid developmental process, with embryos developing into larvae within a short timeframe. The quick development cycle enhances the efficiency of studies, making zebrafish an attractive model for time-sensitive research projects. This efficiency is a driving factor in the increasing adoption of zebrafish, contributing to Animal Model market growth. Rabbits are commonly used in cardiovascular research, especially in studies related to atherosclerosis. Their larger blood vessels allow for the examination of vascular conditions, making them suitable for investigating heart diseases. The use of rabbits in cardiovascular research is crucial for understanding and developing interventions for cardiovascular diseases. Researchers looking for models that closely mimic human cardiovascular physiology make animal models popular in this field.Competitive Landscape of the Animal Model Market Companies are increasingly investing in advanced genetic engineering techniques, such as CRISPR/Cas9, to create more precise and sophisticated animal models. Many companies are growing their service portfolios beyond the supply of animals to offer a comprehensive range of preclinical services, including study design, in vivo imaging, and other specialized services. Companies are incorporating in vitro models, which involve studying biological processes outside of living organisms. This can include cell cultures, tissue cultures, and organoids. Offering in vitro solutions allows companies to address ethical concerns associated with animal use while providing researchers with alternative platforms for experimentation. In Jan 2023- Charles River Laboratories International, Inc. declared that it had acquired SAMDI Tech, Inc., a leading provider of high-quality, label-free high-throughput screening (HTS) solutions for drug discovery research. The acquisition marks the conclusion of a partnership between the companies that began in 2018. In January 2020, Horizon Discovery Group plc. confirmed a partnership and license deal with Mammoth Biosciences to gain access to Mammoth's unique CRISPR technology, and, as a result, make it easier to provide a new generation of genetically altered CHO cells for the manufacture of biotherapeutics such as therapeutic antibodies. April 28, 2021, IGM Biosciences received its first Licence it is a clinical-stage biotechnology company dedicated to the creation and development of engineered IgM antibodies, signed a multi-license commercial agreement for the continued use of Horizon's cGMP-compliant CHO SOURCE platform for the advancement of IGM's innovative therapeutic IgM antibodies.

Animal Model Market Scope: Inquire Before Buying

Global Animal Model Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 19.59 Bn. Forecast Period 2024 to 2030 CAGR: 6.5% Market Size in 2030: USD 30.45 Bn. Segments Covered: by Species Mice and Rats Zebrafish Rabbits Monkeys Dog Pigs Cat Other Species by Application Basic Research Drug Development Neuroscience by End User Academic & Research Institution Pharmaceuticals Companies Biotechnology Companies Contract Research Organization Animal Model Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Animal Model Market

1. Charles River Laboratories International, Inc. 2. Horizon Discovery Group plc. 3. The Jackson Laboratory 4. Taconic Biosciences, Inc. 5. Genoway SA 6. Eurofins Scientific SE 7. Crown Bioscience, Inc. 8. Envigo CRS SA 9. Transposagen Biopharmaceuticals, Inc. 10. Ozgene Pty Ltd. 11. Inotiv, Inc. 12. Janvier Labs 13. LLC, Crown Bioscience Inc. 14. Genoway S.A. 15. Hera Biolabs 16. Trans Genic Inc. FAQs: 1. What are the growth drivers for the Animal Model Market? Ans. The growing importance of genetic research and engineering contributes to the demand for genetically modified animal models. These models allow researchers to study specific genes and their functions, facilitating advancements in genetics and molecular biology. 2. What is the major Opportunity for the Animal Model Market growth? Ans. One major opportunity for the growth of the animal model market lies in the advancements and opportunities associated with genomic editing technologies. 3. Which country is expected to lead the global Animal Model Market during the forecast period? Ans. North America is expected to lead the Animal Model Market during the forecast period. 4. What is the projected market size and growth rate of the Animal Model Market? Ans. The Animal Model Market size was valued at USD 19.59 Billion in 2023 and the total Animal Model revenue is expected to grow at a CAGR of 6.5% from 2024 to 2030, reaching nearly USD 30.45 Billion. 5. What segments are covered in the Animal Model Market report? Ans. The segments covered in the Animal Model Market report are by species, Application, end user, and Region.

1. Animal Model Market: Research Methodology 2. Animal Model Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Animal Model Market: Dynamics 3.1 Animal Model Market Trends by Region 3.1.1 North America Animal Model Market Trends 3.1.2 Europe Animal Model Market Trends 3.1.3 Asia Pacific Animal Model Market Trends 3.1.4 Middle East and Africa Animal Model Market Trends 3.1.5 South America Animal Model Market Trends 3.2 Animal Model Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Animal Model Market Drivers 3.2.1.2 North America Animal Model Market Restraints 3.2.1.3 North America Animal Model Market Opportunities 3.2.1.4 North America Animal Model Market Challenges 3.2.2 Europe 3.2.2.1 Europe Animal Model Market Drivers 3.2.2.2 Europe Animal Model Market Restraints 3.2.2.3 Europe Animal Model Market Opportunities 3.2.2.4 Europe Animal Model Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Animal Model Market Market Drivers 3.2.3.2 Asia Pacific Animal Model Market Restraints 3.2.3.3 Asia Pacific Animal Model Market Opportunities 3.2.3.4 Asia Pacific Animal Model Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Animal Model Market Drivers 3.2.4.2 Middle East and Africa Animal Model Market Restraints 3.2.4.3 Middle East and Africa Animal Model Market Opportunities 3.2.4.4 Middle East and Africa Animal Model Market Challenges 3.2.5 South America 3.2.5.1 South America Animal Model Market Drivers 3.2.5.2 South America Animal Model Market Restraints 3.2.5.3 South America Animal Model Market Opportunities 3.2.5.4 South America Animal Model Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives for the Animal Model Industry 3.8 The Global Pandemic and Redefining of The Animal Model Industry Landscape 3.9 Global Animal Model Trade Analysis (2017-2022) 3.9.1 Global Import of Animal Model 3.9.2 Global Export of Animal Model 3.10 Global Animal Model Production Capacity Analysis 3.10.1 Chapter Overview 3.10.2 Key Assumptions and Methodology 3.10.3 Animal Model Manufacturers: Global Installed Capacity 3.10.4 Analysis by Size of Manufacturer 4. Global Animal Model Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 4.1 Global Animal Model Market Size and Forecast, by Species (2023-2030) 1.1.1 Mice and Rats 1.1.2 Zebrafish 1.1.3 Rabbits 1.1.4 Monkeys 1.1.5 Dog 1.1.6 Pigs 1.1.7 Cat 1.1.8 Other Species 1.2 Global Animal Model Market Size and Forecast, by Application (2023-2030) 1.2.1 Basic Research 1.2.2 Drug Development 1.2.3 Neuroscience 1.3 Global Animal Model Market Size and Forecast, by End-Use (2023-2030) 1.3.1 Academic & Research Institution 1.3.2 Pharmaceuticals Companies 1.3.3 Biotechnology Companies 1.3.4 Contract Research Organization 1.4 Global Animal Model Market Size and Forecast, by Region (2023-2030) 1.4.1 North America 1.4.2 Europe 1.4.3 Asia Pacific 1.4.4 Middle East and Africa 1.4.5 South America 2. North America Animal Model Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 2.1 North America Animal Model Market Size and Forecast, by Species (2023-2030) 2.1.1 Mice and Rats 2.1.2 Zebrafish 2.1.3 Rabbits 2.1.4 Monkeys 2.1.5 Dog 2.1.6 Pigs 2.1.7 Cat 2.1.8 Other Species 2.2 North America Animal Model Market Size and Forecast, by Application (2023-2030) 2.2.1 Basic Research 2.2.2 Drug Development 2.2.3 Neuroscience 2.3 North America Animal Model Market Size and Forecast, by End-Use (2023-2030) 2.3.1 Academic & Research Institution 2.3.2 Pharmaceuticals Companies 2.3.3 Biotechnology Companies 2.3.4 Contract Research Organization 2.4 North America Animal Model Market Size and Forecast, by Country (2023-2030) 2.4.1 United States 2.4.1.1 United States Animal Model Market Size and Forecast, by Species (2023-2030) 2.4.1.2 Mice and Rats 2.4.1.3 Zebrafish 2.4.1.4 Rabbits 2.4.1.5 Monkeys 2.4.1.6 Dog 2.4.1.7 Pigs 2.4.1.8 Cat 2.4.1.9 Other Species 2.4.2 United States Animal Model Market Size and Forecast, by Application (2023-2030) 2.4.2.1 Basic Research 2.4.2.2 Drug Development 2.4.2.3 Neuroscience 2.4.3 United States Animal Model Market Size and Forecast, by End-Use (2023-2030) 2.4.3.1 Academic & Research Institution 2.4.3.2 Pharmaceuticals Companies 2.4.3.3 Biotechnology Companies 2.4.3.4 Contract Research Organization 2.4.4 Canada 2.4.4.1 Canada Animal Model Market Size and Forecast, by Species (2023-2030) 2.4.4.1.1 Mice and Rats 2.4.4.1.2 Zebrafish 2.4.4.1.3 Rabbits 2.4.4.1.4 Monkeys 2.4.4.1.5 Dog 2.4.4.1.6 Pigs 2.4.4.1.7 Cat 2.4.4.1.8 Other Species 2.4.4.2 Canada Animal Model Market Size and Forecast, by Application (2023-2030) 2.4.4.2.1 Basic Research 2.4.4.2.2 Drug Development 2.4.4.2.3 Neuroscience 2.4.4.3 Canada Animal Model Market Size and Forecast, by End-Use (2023-2030) 2.4.4.3.1 Academic & Research Institution 2.4.4.3.2 Pharmaceuticals Companies 2.4.4.3.3 Biotechnology Companies 2.4.4.3.4 Contract Research Organization 2.4.5 Mexico 2.4.5.1 Mexico Animal Model Market Size and Forecast, by Species (2023-2030) 2.4.5.1.1 Mice and Rats 2.4.5.1.2 Zebrafish 2.4.5.1.3 Rabbits 2.4.5.1.4 Monkeys 2.4.5.1.5 Dog 2.4.5.1.6 Pigs 2.4.5.1.7 Cat 2.4.5.1.8 Other Species 2.4.5.2 Mexico Animal Model Market Size and Forecast, by Application (2023-2030) 2.4.5.2.1 Basic Research 2.4.5.2.2 Drug Development 2.4.5.2.3 Neuroscience 2.4.5.3 Mexico Animal Model Market Size and Forecast, by End-Use (2023-2030) 2.4.5.3.1 Academic & Research Institution 2.4.5.3.2 Pharmaceuticals Companies 2.4.5.3.3 Biotechnology Companies 2.4.5.3.4 Contract Research Organization 3. Europe Animal Model Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 3.1 Europe Animal Model Market Size and Forecast, by Species (2023-2030) 3.2 Europe Animal Model Market Size and Forecast, by Application (2023-2030) 3.3 Europe Animal Model Market Size and Forecast, by End-Use (2023-2030) 3.4 Europe Animal Model Market Size and Forecast, by Country (2023-2030) 3.4.1 United Kingdom 3.4.1.1 United Kingdom Animal Model Market Size and Forecast, by Species (2023-2030) 3.4.1.2 United Kingdom Animal Model Market Size and Forecast, by Purity (2023-2030) 3.4.1.3 United Kingdom Animal Model Market Size and Forecast, by End-Use (2023-2030) 3.4.2 France 3.4.2.1 France Animal Model Market Size and Forecast, by Species (2023-2030) 3.4.2.2 France Animal Model Market Size and Forecast, by Application (2023-2030) 3.4.2.3 France Animal Model Market Size and Forecast, by End-Use (2023-2030) 3.4.3 Germany 3.4.3.1 Germany Animal Model Market Size and Forecast, by Species (2023-2030) 3.4.3.2 Germany Animal Model Market Size and Forecast, by Application (2023-2030) 3.4.3.3 Germany Animal Model Market Size and Forecast, by End-Use (2023-2030) 3.4.4 Italy 3.4.4.1 Italy Animal Model Market Size and Forecast, by Species (2023-2030) 3.4.4.2 Italy Animal Model Market Size and Forecast, by Application (2023-2030) 3.4.4.3 Italy Animal Model Market Size and Forecast, by End-Use (2023-2030) 3.4.5 Spain 3.4.5.1 Spain Animal Model Market Size and Forecast, by Species (2023-2030) 3.4.5.2 Spain Animal Model Market Size and Forecast, by Application (2023-2030) 3.4.5.3 Spain Animal Model Market Size and Forecast, by End-Use (2023-2030) 3.4.6 Sweden 3.4.6.1 Sweden Animal Model Market Size and Forecast, by Species (2023-2030) 3.4.6.2 Sweden Animal Model Market Size and Forecast, by Application (2023-2030) 3.4.6.3 Sweden Animal Model Market Size and Forecast, by End-Use (2023-2030) 3.4.7 Austria 3.4.7.1 Austria Animal Model Market Size and Forecast, by Species (2023-2030) 3.4.7.2 Austria Animal Model Market Size and Forecast, by Application (2023-2030) 3.4.7.3 Austria Animal Model Market Size and Forecast, by End-Use (2023-2030) 3.4.8 Rest of Europe 3.4.8.1 Rest of Europe Animal Model Market Size and Forecast, by Species (2023-2030) 3.4.8.2 Rest of Europe Animal Model Market Size and Forecast, by Application (2023-2030). 3.4.8.3 Rest of Europe Animal Model Market Size and Forecast, by End-Use (2023-2030) 4. Asia Pacific Animal Model Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 4.1 Asia Pacific Animal Model Market Size and Forecast, by Species (2023-2030) 4.2 Asia Pacific Animal Model Market Size and Forecast, by Application (2023-2030) 4.3 Asia Pacific Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4 Asia Pacific Animal Model Market Size and Forecast, by Country (2023-2030) 4.4.1 China 4.4.1.1 China Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.1.2 China Animal Model Market Size and Forecast, by Application (2023-2030) 4.4.1.3 China Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4.2 South Korea 4.4.2.1 S Korea Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.2.2 S Korea Animal Model Market Size and Forecast, by Application (2023-2030) 4.4.2.3 S Korea Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4.3 japan 4.4.3.1 Japan Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.3.2 Japan Animal Model Market Size and Forecast, by Application (2023-2030) 4.4.3.3 Japan Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4.4 India 4.4.4.1 India Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.4.2 India Animal Model Market Size and Forecast, by Application (2023-2030) 4.4.4.3 India Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4.5 Australia 4.4.5.1 Australia Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.5.2 Australia Animal Model Market Size and Forecast, by Application (2023-2030) 4.4.5.3 Australia Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4.6 Indonesia 4.4.6.1 Indonesia Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.6.2 Indonesia Animal Model Market Size and Forecast, by Application (2023-2030) 4.4.6.3 Indonesia Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4.7 Malaysia 4.4.7.1 Malaysia Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.7.2 Malaysia Animal Model Market Size and Forecast, by Application (2023-2030) 4.4.7.3 Malaysia Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4.8 Vietnam 4.4.8.1 Vietnam Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.8.2 Vietnam Animal Model Market Size and Forecast, by Application (2023-2030) 4.4.8.3 Vietnam Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4.9 Taiwan 4.4.9.1 Taiwan Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.9.2 Taiwan Animal Model Market Size and Forecast, by Application (2023-2030) 4.4.9.3 Taiwan Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4.10 Bangladesh 4.4.10.1 Bangladesh Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.10.2 Bangladesh Animal Model Market Size and Forecast, by Application (2023-2030) 4.4.10.3 Bangladesh Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4.11 Pakistan 4.4.11.1 Pakistan Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.11.2 Pakistan Animal Model Market Size and Forecast, by Application (2023-2030) 4.4.11.3 Pakistan Animal Model Market Size and Forecast, by End-Use (2023-2030) 4.4.12 Rest of Asia Pacific 4.4.12.1 Rest of Asia Pacific Animal Model Market Size and Forecast, by Species (2023-2030) 4.4.12.2 Rest of Asia PacificAnimal Model Market Size and Forecast, by Application (2023-2030) 4.4.12.3 Rest of Asia Pacific Animal Model Market Size and Forecast, by End-Use (2023-2030) 5. Middle East and Africa Animal Model Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 5.1 Middle East and Africa Animal Model Market Size and Forecast, by Species (2023-2030) 5.2 Middle East and Africa Animal Model Market Size and Forecast, by Application (2023-2030) 5.3 Middle East and Africa Animal Model Market Size and Forecast, by End-Use (2023-2030) 5.4 Middle East and Africa Animal Model Market Size and Forecast, by Country (2023-2030) 5.4.1 South Africa 5.4.1.1 South Africa Animal Model Market Size and Forecast, by Species (2023-2030) 5.4.1.2 South Africa Animal Model Market Size and Forecast, by Application (2023-2030) 5.4.1.3 South Africa Animal Model Market Size and Forecast, by End-Use (2023-2030) 5.4.2 GCC 5.4.2.1 GCC Animal Model Market Size and Forecast, by Species (2023-2030) 5.4.2.2 GCC Animal Model Market Size and Forecast, by Application (2023-2030) 5.4.2.3 GCC Animal Model Market Size and Forecast, by End-Use (2023-2030) 5.4.3 Egypt 5.4.3.1 Egypt Animal Model Market Size and Forecast, by Species (2023-2030) 5.4.3.2 Egypt Animal Model Market Size and Forecast, by Application (2023-2030) 5.4.3.3 Egypt Animal Model Market Size and Forecast, by End-Use (2023-2030) 5.4.4 Nigeria 5.4.4.1 Nigeria Animal Model Market Size and Forecast, by Species (2023-2030) 5.4.4.2 Nigeria Animal Model Market Size and Forecast, by Application (2023-2030) 5.4.4.3 Nigeria Animal Model Market Size and Forecast, by End-Use (2023-2030) 5.4.5 Rest of ME&A 5.4.5.1 Rest of ME&A Animal Model Market Size and Forecast, by Species (2023-2030) 5.4.5.2 Rest of ME&A Animal Model Market Size and Forecast, by Application (2023-2030) 5.4.5.3 Rest of ME&A Animal Model Market Size and Forecast, by End-Use (2023-2030) 6. South America Animal Model Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 6.1 South America Animal Model Market Size and Forecast, by Species (2023-2030) 6.2 South America Animal Model Market Size and Forecast, by Application (2023-2030) 6.3 South America Animal Model Market Size and Forecast, by End-Use (2023-2030) 6.4 South America Animal Model Market Size and Forecast, by Country (2023-2030) 6.4.1 brazilBrazil 6.4.1.1 Brazil Animal Model Market Size and Forecast, by Species (2023-2030) 6.4.1.2 Brazil Animal Model Market Size and Forecast, by Application (2023-2030) 6.4.1.3 Brazil Animal Model Market Size and Forecast, by End-Use (2023-2030) 6.4.2 Argentina 6.4.2.1 Argentina Animal Model Market Size and Forecast, by Species (2023-2030) 6.4.2.2 Argentina Animal Model Market Size and Forecast, by Application (2023-2030) 6.4.2.3 Argentina Animal Model Market Size and Forecast, by End-Use (2023-2030) 6.4.3 Rest Of South America 6.4.3.1 Rest Of South America Animal Model Market Size and Forecast, by Species (2023-2030) 6.4.3.2 Rest Of South America Animal Model Market Size and Forecast, by Application (2023-2030) 6.4.3.3 Rest Of South America Animal Model Market Size and Forecast, by End-Use (2023-2030) 7. Global Animal Model Market: Competitive Landscape 7.1 MMR Competition Matrix 7.2 Competitive Landscape 7.3 Key Players Benchmarking 7.3.1 Company Name 7.3.2 Product Segment 7.3.3 End-user Segment 7.3.4 Revenue (2022) 7.3.5 Manufacturing Locations 7.3.6 SKU Details 7.3.7 Production Capacity 7.3.8 Production for 2022 7.3.9 No. of Stores 7.4 Market Analysis by Organized Players vs. Unorganized Players 7.4.1 Organized Players 7.4.2 Unorganized Players 7.5 Leading Animal Model Global Companies, by market capitalization 7.6 Market Structure 7.6.1 Market Leaders 7.6.2 Market Followers 7.6.3 Emerging Players 7.7 Mergers and Acquisitions Details 8. Company Profile: Key Players 9. Charles River Laboratories International, Inc. 9.1.1 Company Overview 9.1.2 Business Portfolio 9.1.3 Financial Overview 9.1.4 SWOT Analysis 9.1.5 Strategic Analysis 9.1.6 Scale of Operation (small, medium, and large) 9.1.7 Details on Partnership 9.1.8 Regulatory Accreditations and Certifications Received by Them 9.1.9 Awards Received by the Firm 9.1.10 Recent Developments 9.2 Horizon Discovery Group plc. 9.3 The Jackson Laboratory 9.4 Taconic Biosciences, Inc. 9.5 Genoway SA 9.6 Eurofins Scientific SE 9.7 Crown Bioscience, Inc. 9.8 Envigo CRS SA 9.9 Transposagen Biopharmaceuticals, Inc. 9.10 Ozgene Pty Ltd. 9.11 Inotiv, Inc. 9.12 Janvier Labs 9.13 LLC, Crown Bioscience Inc. 9.14 Genoway S.A. 9.15 Hera Biolabs 9.16 Trans Genic Inc. 10. Key Findings 11. Industry Recommendations 12. Terms and Glossary