The Angina Market size was valued at USD 9.56 Bn in 2022 and is expected to reach USD 13.66 Bn by 2029, at a CAGR of 5.23% Angina, primarily triggered by diminished blood flow to the heart muscles, leads to chest pain or discomfort. This condition typically arises when the heart muscles do not receive an adequate supply of oxygen, a result of narrowed arteries that transport oxygen-rich blood to the heart. Factors such as coronary artery spasm, unstable plaques, diminished heart pumping function, and blood clots can contribute to the development of angina pectoris. Common symptoms include chest pain or discomfort, shortness of breath, weakness, nausea, and dizziness. Managing mild angina pectoris often involves lifestyle adjustments, including smoking cessation, weight management, and adopting a healthy diet. Medications such as beta-blockers, non-steroidal anti-inflammatory drugs, ACE inhibitors, calcium channel blockers, and others are employed to alleviate symptoms in the treatment of mild to severe angina pectoris.To know about the Research Methodology :- Request Free Sample Report

Angina Market Dynamics

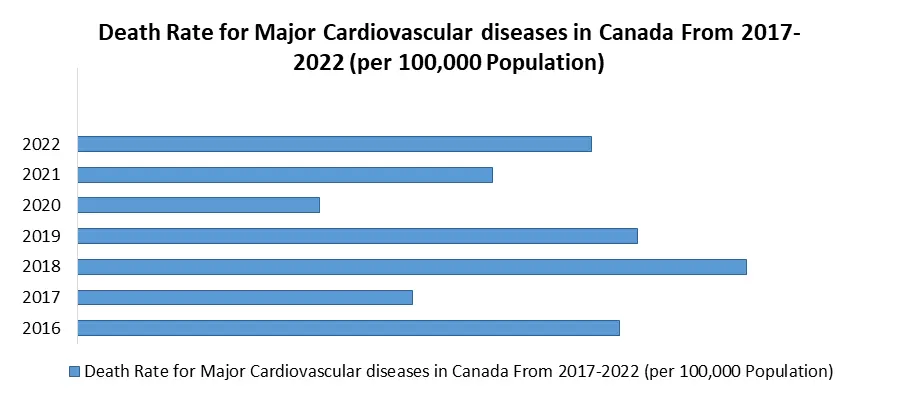

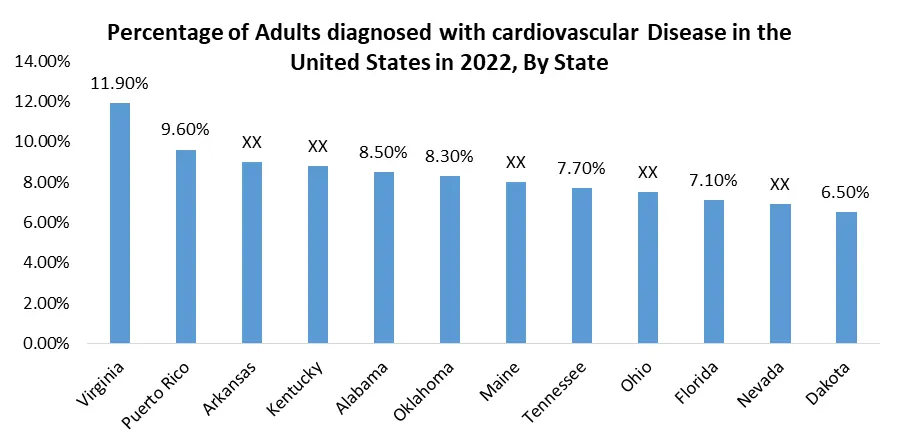

The elevated prevalence of angina, identification of therapeutic prospects, and growing investments in research and development are set to drive the Angina market's demand. Moreover, the ready accessibility of therapeutic drugs for angina, the introduction of new products, and increased awareness of various cardiovascular disorders will substantially enhance market growth during the forecast period. Nevertheless, a challenge to Angina market growth lies in the observed non-adherence to cardiovascular medications among patients with cardiovascular diseases, as they tend to opt for generic medicines instead of specific branded drugs, impacting Angina market growth during the forecast period. A key driver fueling market growth is the rise in the patient population grappling with cardiac disorders, notably coronary heart disease. According to data released by the World Health Organization in December 2020, ischemic heart disease emerged as the foremost global cause of death, contributing to 16 % of all fatalities. This disease showed the most significant surge in deaths since 2000, escalating by over 2 million to reach 8.9 million deaths in 2019. Stroke and chronic obstructive pulmonary disease (COPD) ranked as the second and third leading causes of death, constituting approximately 11% and 6% of all deaths, respectively. Furthermore, an article titled Angina: contemporary diagnosis and management, published in PubMed Central in February 2020, highlighted that Ischemic heart disease (IHD) remains the predominant cause of death and lost life years in adults, particularly among women below the age of 55. Angina pectoris, characterized by chest discomfort resulting from a heart attack, serves as a common clinical manifestation of IHD. Consequently, the increasing prevalence of IHD patients is expected to propel the Angina market growth towards the north. Nevertheless, the growing adoption of minimally invasive surgeries and potential side effects associated with specific drug classes pose as factors that may impede the Angina market's growth during the forecast years. The rising demand for personalized medicine and precision healthcare The rising demand for personalized medicine and precision healthcare is transforming the Angina market by enabling the development of more effective treatments, earlier diagnosis, and improved patient outcomes. Personalized medicine tailors’ treatment plans to an individual's unique genetic makeup, lifestyle, and medical history, leading to more targeted and efficacious therapies. This approach is particularly beneficial for angina pectoris, as it can identify patients at risk before symptoms emerge, facilitating early intervention and preventing complications. Precision healthcare complements personalized medicine by employing advanced technologies, such as genetic testing and biomarker analysis, to gain deeper insights into disease mechanisms and patient susceptibility. This comprehensive approach enables healthcare providers to make informed decisions about treatment strategies, optimizing patient care and improving overall health outcomes. Growing urbanization and changing lifestyles Growing urbanization and changing lifestyles are significantly impacting the Angina market, contributing to an increased prevalence of risk factors for the condition. As populations shift towards urban centers, they often adopt sedentary lifestyles characterized by reduced physical activity and increased consumption of processed foods. This shift, coupled with the stress and environmental factors associated with urban living, contributes to a rise in obesity, diabetes, and hypertension, all of which are major risk factors for angina. The prevalence of obesity is particularly concerning, as it is a significant contributor to the development of atherosclerosis, the narrowing of arteries that can lead to angina. The World Health Organization estimates that over 650 million adults worldwide were obese in 2022, and this number is estimated to increase. This rise in obesity is paralleled by an increase in diabetes, another major risk factor for angina. The International Diabetes Federation estimates that 537 million adults worldwide were living with diabetes in 2021, and this number is expected to reach 783 million by 2045. Hypertension, or high blood pressure, is another critical risk factor for angina, and it is also on the rise in urban populations. The World Health Organization estimates that 1.9 billion adults worldwide were living with hypertension in 2016. This increase in hypertension is attributed to factors such as stress, unhealthy diets, and a lack of physical activity. The growing prevalence of these risk factors is driving the demand for angina diagnosis and treatment. As more people develop angina, the need for diagnostic tools, medications, and interventional procedures increases. This demand is expected to continue to grow as urbanization and lifestyle changes persist. To address this growing burden, the Angina market is responding with innovative solutions. Pharmaceutical companies are developing new medications and drug combinations to manage angina symptoms and reduce the risk of cardiovascular events. Medical device manufacturers are creating minimally invasive procedures and advanced diagnostic tools to improve patient outcomes. Additionally, healthcare providers are emphasizing lifestyle modifications, such as weight management, diet changes, and regular exercise, to prevent the development of angina and other cardiovascular diseases. Growing urbanization and changing lifestyles are playing a significant role in the Angina market. These factors are contributing to the increased prevalence of risk factors for angina, driving demand for diagnosis and treatment, and fostering innovation in the field of cardiovascular medicine.Angina Market Segment Analysis

Beta Blockers are poised to demonstrate a substantial Compound Annual Rate (CAR) during the forecast period. Operating by impeding the impact of adrenaline on the heart, beta-blockers confer advantages such as decelerating heart rate and diminishing the force of heart muscle contraction. For individuals with stable angina attributed to coronary artery disease (CAD), beta-blockers are regarded as the primary therapeutic approach. The growth of this segment primarily stems from an increase in the target population and a growing number of strategic initiatives among market participants to enhance the commercial availability of beta-blocker medications. For instance is the agreement between New American Therapeutics and Melinta Therapeutics in April 2022, granting the rights to TOPROL-XL (metoprolol succinate) in the United States. TOPROL-XL, an FDA-approved cardio-selective beta-blocker, is utilized for hypertension treatment, either independently or in combination with other antihypertensives. It is also employed for the long-term treatment of angina pectoris and stable, symptomatic heart failure due to specific causes. Such collaborations and advancements are expected to strengthen the growth of the beta-blockers segment of Angina Market during the forecast period. Furthermore, a research article titled "Pharmacologic Management of Coronary Artery Ectasia," published in Cures in September 2021, emphasized that Coronary Artery Ectasia (CA) is a rare form of aneurysmal coronary heart disease impacting a limited number of individuals. Angina pectoris and acute coronary syndrome are likely outcomes of this disorder, with beta-blockers and trimetazidine suggested as treatments for individuals displaying angina symptoms. These findings support the use of beta-blockers in addressing patients with coronary heart diseases, contributing to the growth of this segment. Consequently, the increasing prevalence of cardiac disorders, coupled with the increasing commercial availability and utilization of beta-blocker drugs for coronary heart disease treatment, is expected to propel the segment's growth of Angina Market during the forecast period.

Angina Regional Insights:

North America commands a leading position in the angina market, driven by its well-established healthcare infrastructure, widespread adoption of therapeutics, and the presence of key manufacturers, mainly in the United States, which accounts for a substantial market share. Ischemic heart disease stands as a significant contributor to mortality and disability in the North American region, with angina being its most prevalent symptom. For example, data from the National Center for Chronic Disease Prevention and Health Promotion, Division for Heart Disease and Stroke Prevention, in February 2022, revealed that ischemic heart disease, claiming 360,900 lives in 2020, is the most common type of heart disease. Coronary artery disease affects approximately 18.2 million individuals aged 20 and older, with adults under the age of 65 accounting for about 2 out of every 10 deaths due to this condition. Similarly, an article titled "Ischemic Heart Disease: Noninvasive Imaging Techniques and Findings," published in RSNA (RadioGraphics) in May 2021, highlighted that in the United States alone, there are approximately 720,000 annual incidents of new coronary events, and the current prevalence of ischemic heart disease is around 18.2 million cases. This higher prevalence of heart diseases is expected to contribute to an increased incidence of angina, thereby driving the angina market towards north. Furthermore, the upswing in the number of ongoing clinical trials is an additional factor fueling the Angina market's growth. As of April 2022, there were 23 active and recruiting clinical trials for angina pectoris within the United States. Collectively, these factors contribute to the sustained growth of the angina market during the forecast period.

Angina Market Scope: Inquire Before Buying

Global Angina Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 9.56 Bn. Forecast Period 2023 to 2029 CAGR: 5.23% Market Size in 2029: US $ 13.66 Bn. Segments Covered: by Drug Class Beta blockers Nitrates & Calcium Channel Blockers Angiotensin-converting Enzyme Inhibitors Others by End User Hospitals Cardiology Centers Others Angina Market,by Regions

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Angina Market

1. Sanofi 2. Pfizer 3. Otsuka Pharmaceutical Co., Ltd. 4. Novartis AG 5. Merck & Co., Inc. 6. Gilead Sciences, Inc. 7. Amgen Inc. 8. Eli Lilly and Company 9. GlaxoSmithKline 10. Axus Cardium Pharmaceuticals 11. LegoChem Biosciences 12. Lee’s Pharmaceutical Holdings 13. Milestone Pharmaceuticals 14. Juventas Therapeutics 15. ViroMed 16. Kuhnil Pharmaceutical 17. Johnson & Johnson 18. Bristol-Myers Squibb Company 19. Abbott 20. Bayer AG Frequently Asked Questions and Answers about Angina Market 1. What factors are driving the growth of the Angina market? Ans: There is a growing demand for more effective and less invasive therapies for angina pectoris, such as minimally invasive procedures and new drug therapies. 2. Which regions are witnessing significant growth in the Angina market? Ans: The North American and European markets are expected to experience the fastest growth, but the Asia Pacific market is also expected to experience strong growth. 3. What is the market size of Angina market? Ans: The Angina Market size was valued at USD 9.56 Bn in 2022 and is expected to reach USD 13.66 Bn by 2029, at a CAGR of 5.23% over the forecast period. 4. What role does sustainability play in the Angina market? Ans: Sustainability plays an increasingly important role in the Angina market, as healthcare providers and pharmaceutical companies seek to reduce their environmental impact and improve patient outcomes. Here are some of the key ways in which sustainability is being incorporated into the Angina market. 5. Which Application segment held the largest market share in the Angina Market? Ans: The Hospitals segment held the largest market share accounting for nearly XX% of the market.

1. Angina Market: Research Methodology 2. Angina Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Angina Market: Dynamics 3.1. Angina Market Trends by Region 3.1.1. North America Angina Market Trends 3.1.2. Europe Angina Market Trends 3.1.3. Asia Pacific Angina Market Trends 3.1.4. Middle East and Africa Angina Market Trends 3.1.5. South America Angina Market Trends 3.2. Angina Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Angina Market Drivers 3.2.1.2. North America Angina Market Restraints 3.2.1.3. North America Angina Market Opportunities 3.2.1.4. North America Angina Market Challenges 3.2.2. Europe 3.2.2.1. Europe Angina Market Drivers 3.2.2.2. Europe Angina Market Restraints 3.2.2.3. Europe Angina Market Opportunities 3.2.2.4. Europe Angina Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Angina Market Drivers 3.2.3.2. Asia Pacific Angina Market Restraints 3.2.3.3. Asia Pacific Angina Market Opportunities 3.2.3.4. Asia Pacific Angina Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Angina Market Drivers 3.2.4.2. Middle East and Africa Angina Market Restraints 3.2.4.3. Middle East and Africa Angina Market Opportunities 3.2.4.4. Middle East and Africa Angina Market Challenges 3.2.5. South America 3.2.5.1. South America Angina Market Drivers 3.2.5.2. South America Angina Market Restraints 3.2.5.3. South America Angina Market Opportunities 3.2.5.4. South America Angina Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Angina Market 3.8. Analysis of Government Schemes and Initiatives For Angina Market 3.9. The Global Pandemic Impact on Angina Market 4. Angina Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. Angina Market Size and Forecast, by Drug Class (2022-2029) 4.1.1. Beta blockers 4.1.2. Nitrates & Calcium Channel Blockers 4.1.3. Angiotensin-converting Enzyme Inhibitors 4.1.4. Others 4.2. Angina Market Size and Forecast, by End-User Industry (2022-2029) 4.2.1. Hospitals 4.2.2. Cardiology Centers 4.2.3. Others 4.3. Angina Market Size and Forecast, by Region (2022-2029) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Angina Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. North America Angina Market Size and Forecast, by Drug Class (2022-2029) 5.1.1. Beta blockers 5.1.2. Nitrates & Calcium Channel Blockers 5.1.3. Angiotensin-converting Enzyme Inhibitors 5.1.4. Others 5.2. North America Angina Market Size and Forecast, by End-User Industry (2022-2029) 5.2.1. Hospitals 5.2.2. Cardiology Centers 5.2.3. Others 5.3. North America Angina Market Size and Forecast, by Country (2022-2029) 5.3.1. United States 5.3.1.1. United States Angina Market Size and Forecast, by Drug Class (2022-2029) 5.3.1.1.1. Beta blockers 5.3.1.1.2. Nitrates & Calcium Channel Blockers 5.3.1.1.3. Angiotensin-converting Enzyme Inhibitors 5.3.1.1.4. Others 5.3.1.2. United States Angina Market Size and Forecast, by End-User Industry (2022-2029) 5.3.1.2.1. Hospitals 5.3.1.2.2. Cardiology Centers 5.3.1.2.3. Others 5.3.2. Canada 5.3.2.1. Canada Angina Market Size and Forecast, by Drug Class (2022-2029) 5.3.2.1.1. Beta blockers 5.3.2.1.2. Nitrates & Calcium Channel Blockers 5.3.2.1.3. Angiotensin-converting Enzyme Inhibitors 5.3.2.1.4. Others 5.3.2.2. Canada Angina Market Size and Forecast, by End-User Industry (2022-2029) 5.3.2.2.1. Hospitals 5.3.2.2.2. Cardiology Centers 5.3.2.2.3. Others 5.3.3. Mexico 5.3.3.1. Mexico Angina Market Size and Forecast, by Drug Class (2022-2029) 5.3.3.1.1. Beta blockers 5.3.3.1.2. Nitrates & Calcium Channel Blockers 5.3.3.1.3. Angiotensin-converting Enzyme Inhibitors 5.3.3.1.4. Others 5.3.3.2. Mexico Angina Market Size and Forecast, by End-User Industry (2022-2029) 5.3.3.2.1. Hospitals 5.3.3.2.2. Cardiology Centers 5.3.3.2.3. Others 6. Europe Angina Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Europe Angina Market Size and Forecast, by Drug Class (2022-2029) 6.2. Europe Angina Market Size and Forecast, by End-User Industry (2022-2029) 6.3. Europe Angina Market Size and Forecast, by Country (2022-2029) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Angina Market Size and Forecast, by Drug Class (2022-2029) 6.3.1.2. United Kingdom Angina Market Size and Forecast, by End-User Industry (2022-2029) 6.3.2. France 6.3.2.1. France Angina Market Size and Forecast, by Drug Class (2022-2029) 6.3.2.2. France Angina Market Size and Forecast, by End-User Industry (2022-2029) 6.3.3. Germany 6.3.3.1. Germany Angina Market Size and Forecast, by Drug Class (2022-2029) 6.3.3.2. Germany Angina Market Size and Forecast, by End-User Industry (2022-2029) 6.3.4. Italy 6.3.4.1. Italy Angina Market Size and Forecast, by Drug Class (2022-2029) 6.3.4.2. Italy Angina Market Size and Forecast, by End-User Industry (2022-2029) 6.3.5. Spain 6.3.5.1. Spain Angina Market Size and Forecast, by Drug Class (2022-2029) 6.3.5.2. Spain Angina Market Size and Forecast, by End-User Industry (2022-2029) 6.3.6. Sweden 6.3.6.1. Sweden Angina Market Size and Forecast, by Drug Class (2022-2029) 6.3.6.2. Sweden Angina Market Size and Forecast, by End-User Industry (2022-2029) 6.3.7. Austria 6.3.7.1. Austria Angina Market Size and Forecast, by Drug Class (2022-2029) 6.3.7.2. Austria Angina Market Size and Forecast, by End-User Industry (2022-2029) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Angina Market Size and Forecast, by Drug Class (2022-2029) 6.3.8.2. Rest of Europe Angina Market Size and Forecast, by End-User Industry (2022-2029) 7. Asia Pacific Angina Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 7.1. Asia Pacific Angina Market Size and Forecast, by Drug Class (2022-2029) 7.2. Asia Pacific Angina Market Size and Forecast, by End-User Industry (2022-2029) 7.3. Asia Pacific Angina Market Size and Forecast, by Country (2022-2029) 7.3.1. China 7.3.1.1. China Angina Market Size and Forecast, by Drug Class (2022-2029) 7.3.1.2. China Angina Market Size and Forecast, by End-User Industry (2022-2029) 7.3.2. S Korea 7.3.2.1. S Korea Angina Market Size and Forecast, by Drug Class (2022-2029) 7.3.2.2. S Korea Angina Market Size and Forecast, by End-User Industry (2022-2029) 7.3.3. Japan 7.3.3.1. Japan Angina Market Size and Forecast, by Drug Class (2022-2029) 7.3.3.2. Japan Angina Market Size and Forecast, by End-User Industry (2022-2029) 7.3.4. India 7.3.4.1. India Angina Market Size and Forecast, by Drug Class (2022-2029) 7.3.4.2. India Angina Market Size and Forecast, by End-User Industry (2022-2029) 7.3.5. Australia 7.3.5.1. Australia Angina Market Size and Forecast, by Drug Class (2022-2029) 7.3.5.2. Australia Angina Market Size and Forecast, by End-User Industry (2022-2029) 7.3.6. Indonesia 7.3.6.1. Indonesia Angina Market Size and Forecast, by Drug Class (2022-2029) 7.3.6.2. Indonesia Angina Market Size and Forecast, by End-User Industry (2022-2029) 7.3.7. Malaysia 7.3.7.1. Malaysia Angina Market Size and Forecast, by Drug Class (2022-2029) 7.3.7.2. Malaysia Angina Market Size and Forecast, by End-User Industry (2022-2029) 7.3.8. Rest of Asia Pacific 7.3.8.1. Rest of Asia Pacific Angina Market Size and Forecast, by Drug Class (2022-2029) 7.3.8.2. Rest of Asia Pacific Angina Market Size and Forecast, by End-User Industry (2022-2029) 8. Middle East and Africa Angina Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 8.1. Middle East and Africa Angina Market Size and Forecast, by Drug Class (2022-2029) 8.2. Middle East and Africa Angina Market Size and Forecast, by End-User Industry (2022-2029) 8.3. Middle East and Africa Angina Market Size and Forecast, by Country (2022-2029) 8.3.1. South Africa 8.3.1.1. South Africa Angina Market Size and Forecast, by Drug Class (2022-2029) 8.3.1.2. South Africa Angina Market Size and Forecast, by End-User Industry (2022-2029) 8.3.2. GCC 8.3.2.1. GCC Angina Market Size and Forecast, by Drug Class (2022-2029) 8.3.2.2. GCC Angina Market Size and Forecast, by End-User Industry (2022-2029) 8.3.3. Nigeria 8.3.3.1. Nigeria Angina Market Size and Forecast, by Drug Class (2022-2029) 8.3.3.2. Nigeria Angina Market Size and Forecast, by End-User Industry (2022-2029) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Angina Market Size and Forecast, by Drug Class (2022-2029) 8.3.4.2. Rest of ME&A Angina Market Size and Forecast, by End-User Industry (2022-2029) 9. South America Angina Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 9.1. South America Angina Market Size and Forecast, by Drug Class (2022-2029) 9.2. South America Angina Market Size and Forecast, by End-User Industry (2022-2029) 9.3. South America Angina Market Size and Forecast, by Country (2022-2029) 9.3.1. Brazil 9.3.1.1. Brazil Angina Market Size and Forecast, by Drug Class (2022-2029) 9.3.1.2. Brazil Angina Market Size and Forecast, by End-User Industry (2022-2029) 9.3.2. Argentina 9.3.2.1. Argentina Angina Market Size and Forecast, by Drug Class (2022-2029) 9.3.2.2. Argentina Angina Market Size and Forecast, by End-User Industry (2022-2029) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Angina Market Size and Forecast, by Drug Class (2022-2029) 9.3.3.2. Rest Of South America Angina Market Size and Forecast, by End-User Industry (2022-2029) 10. Global Angina Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Angina Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Sanofi. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Pfizer 11.3. Otsuka Pharmaceutical Co., Ltd. 11.4. Novartis AG 11.5. Merck & Co., Inc. 11.6. Gilead Sciences, Inc. 11.7. Amgen Inc. 11.8. Eli Lilly and Company 11.9. GlaxoSmithKline 11.10. Axus Cardium Pharmaceuticals 11.11. LegoChem Biosciences 11.12. Lee’s Pharmaceutical Holdings 11.13. Milestone Pharmaceuticals 11.14. Juventas Therapeutics 11.15. ViroMed 11.16. Kuhnil Pharmaceutical 11.17. Johnson & Johnson 11.18. Bristol-Myers Squibb Company 11.19. Abbott 11.20. Bayer AG 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary