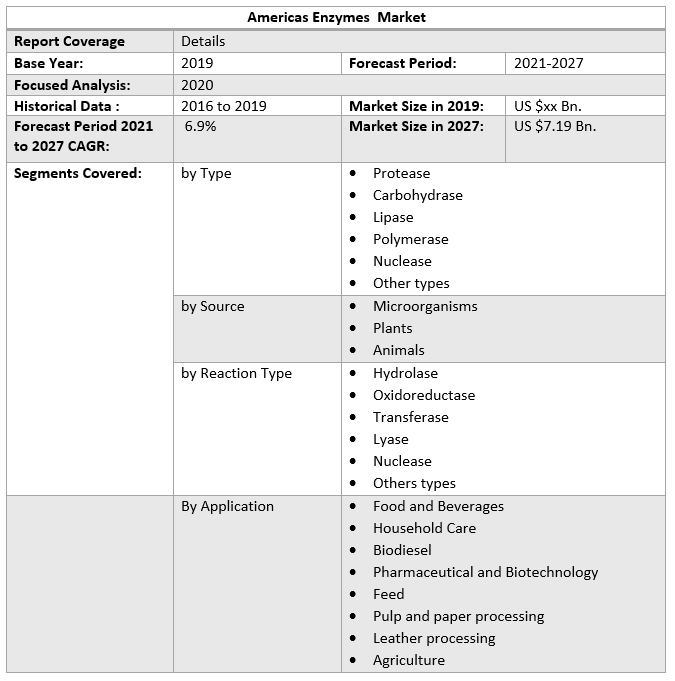

By 2027, the Americas Enzymes market is expected to grow by $7.19 billion, thanks to growth in the type, source, reaction type, application segments. The report analyzes market dynamics by regions and end-user industries.Americas Enzymes Market Overview:

The Americas Enzymes market was valued at US $4.82 Bn. in 2020, and it is expected to grow at US $7.19 Bn. by 2027 with a CAGR of 6.9% during the forecast period. Proteins that act as biocatalysts are known as enzymes. Catalysts help to speed up chemical reactions. Enzymes are biocatalysts that change the rate of biological reactions and achieve the desired effects. They are proteinaceous in nature and have gained a lot of attention in recent years since their numerous applications. Food and animal feed, textiles and detergents, medicines and biotechnology R&D, manufacturing industries and others (pulp and paper, leather, and agriculture) are all using enzymes. Their use in manufacturing processes has resulted in significant cost savings, reduced energy usage, and better substrate activity, all of which have led to the growth of the enzyme business.COVID–19 Influence on Americas Enzymes Market:

On the enzymes market, the COVID-19 crisis is expected to have a positive impact. This is related to a growth in demand for enzymes in nutritional and immunity-boosting products, as well as a change in consumer focus toward home care and an increase in in-house food consumption. However, the businesses are currently facing obstacles as a result of irregular supply chain activities and unclear market conditions as a result of trade restrictions and lockdowns. The growth in demand for enzymes in the food and beverage and pharmaceutical industries is expected to balance this negative impact. As a result of increased awareness about preventive health, nutritional solutions & formulations that support immune health during the pandemic phase, the overall impact is expected to stay positive for leading market companies in the industry.Americas Enzymes Market Dynamics:

Enzymes are used in biotechnological, pharmaceutical, and food & beverage industries, as well as the biofuel business. The spike in demand for enzymes in the pharmaceutical industry to manufacture intermediates in API production for effective pharmaceuticals is expected to drive the growth of the enzymes market in America. In the same way, the ability of an enzyme to convert complex molecules to simpler molecules (starch to glucose) in the food and beverage industry, the removal of fats and oil stains in the detergent industry, bioethanol for biofuel production, and improved bleaching properties in the paper and pulp industries are expected to drive enzyme demand over the forecast period. To customise the product, separate it from its competitors, and enhance its features, producers are using environmentally friendly and modern technology. Manufacturers choose on-site manufacturing for a variety of reasons, including downstream processing, warehousing and shipping large amounts of enzymes, and stabilising agents. These factors are expected to drive the growth of the enzymes market in America over the forecast period. On the other hand, problems such as the handling and safety issues associated with enzymes, as well as their increased sensitivity to temperature and pH, are expected to hinder market growth over the forecast period. Increased awareness of the use of enzymes in protein engineering technologies, as well as larger market potential in South America and North America, are expected to provide lucrative growth opportunities for the market.Americas Enzymes Market Segment Analysis:

On the basis of Type, the Americas Enzymes market is segmented into six types as follows, Protease, Carbohydrase, Lipase, Polymerase and Nuclease, and other types. Carbohydrase dominated the American market in terms of revenue in 2020, with 34.50% of the overall market share. Thanks to increased demand for amylases and pectinases in fruit juice processing for maceration, liquefaction, and clearing to improve product quantity and quality. Amylase, cellulase, lactase, mannanase, and pectinase are the most common carbohydrates used in animal feed, food and beverage, and medicinal applications. Over the forecast timeline, increased usage of carbohydrates as an ingredient and a processing aid in the sugar manufacturing industry is expected to drive segment growth. Proteases are widely used in a variety of industries for protein breakdown, including animal feed, chemicals, detergents, food, and pharmaceuticals. Growing consumer awareness of the importance of proper nutrition has resulted in an increase in protein consumption, which is expected to drive up demand for proteases in the food industry over the forecast period. However, certain hazards associated with these enzymes, such as inflammation and allergic reactions, may limit the growth of the market. Lipases are enzymes that help the body digest, transport, and process dietary lipids like triglycerides, oils, and fats. They are mostly used in the production of biodiesel, which requires the trans-esterification and esterification of glycerides and fatty acids. Furthermore, as compared to other enzymes, the cost of the end product is lower with lipase, which has attracted many manufacturers, driving the growth of the segment over the forecast period. On the basis of Source, the Americas Enzymes market is segmented into three types as follows, Microorganisms, Plants, and Animals. Since of their simple availability and affordable manufacturing costs, microorganisms are the most common source of enzymes. Due to large-scale production, the emergence of genetically engineered microorganisms, and a wide range of applications, the microorganism-derived enzymes segment is expected to dominate the American market in 2019. Purification of microorganism-derived enzymes, on either side, is more difficult than purification of plant enzymes. The use of cutting-edge technology for purifying microbial enzymes raises the total cost of enzyme production. As a result, enzymes made from microbes are more expensive than enzymes derived from plants. Furthermore, thanks to the growth of better purification technologies that require less investment, plant-derived enzymes have the highest growth potential. The segment of plant-derived enzymes is expected to grow with a CAGR of xx% over the forecast period. On the basis of Reaction Type, the Americas Enzymes market is segmented into five types as follows, Hydrolase, Oxidoreductase, Transferase, Lyase, and other reaction types. In 2019, the hydrolases segment accounted for the largest share of the American market, and this trend is expected to continue throughout the forecast period. This is owing to their increased catalytic efficiency, stability, broad substrate specificity, and commercial availability, among other factors. The ability of transferases to transfer acetyl, amino, methyl, and phosphoryl groups from one substrate to another has gained attention in recent years. These enzymes are involved in the formation of fructan, which is beneficial for gut bacteria. They also help in the production of polysaccharides, oligosaccharides, and glycoconjugates.To know about the Research Methodology :- Request Free Sample Report 2019 is considered as a base year to forecast the market from 2021 to 2027. 2020’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years trends are considered while forecasting the market through 2026. 2020 is a year of exception and analyzed especially with the impact of lockdown by region. On the basis of Application Type, the Americas Enzymes market is segmented into six types as follows, Food and Beverages, Household Care, Biodiesel, Pharmaceutical and Biotechnology, Feed, Pulp and paper processing, Leather processing and Agriculture. By application, the household care category dominated the market holding xx% of the market share in 2019. The expansion of the household care category can be linked to factors such as an increase in the usage of enzyme-based products rather than petrochemical-derived components, which harm the environment significantly. Furthermore, the benefits of using enzymes in garment laundering have greatly increased the demand for enzyme-based products. Since they work at lower temperatures and at higher concentrations than chemically based products, they are more environmentally friendly. Household care enzymes are the enzymes present in laundry and dishwashing detergents. Pharmaceutical and biotechnology-based enzymes, on the other hand, have the best growth opportunities during the forecast period. The critical role of enzymes in API manufacturing and therapeutic formulations for diseases like cancer and AIDS drives demand for enzyme-based products, which is expected to drive market growth for pharmaceutical and biotechnological enzymes.

Americas Enzymes Market Regional Insights:

In 2020, North America dominated the market with an approximately 83.50% share. As a result of the existence of key end-user sectors such as personal care and cosmetics, medicines, laundry detergent, and food and beverage, as well as a broad scope for R&D operations in the region's major countries. Since rising product demand from the dairy and brewing industries, the United States dominated the North American market in 2020. The rising demand for dietary fibers and functional foods is expected to be one of the major factors driving carbohydrase demand in the United States. On the account of presence of major companies like as L’Oreal and Procter & Gamble, the personal care applications market in Canada is expected to increase significantly over the forecast period. Furthermore, one of the primary drivers boosting carbohydrase demand in Mexico is expected to be the increased demand for digestible enzymes to improve the nutritional content of the feed. Since increased demand from diverse applications such as animal feed, textile, paper and pulp, personal care, and diagnostics, the market in Central and South America is expected to develop significantly. Enzymes are employed to improve the texture and flavor of food, as well as to break down starch into simpler sugars like those found in pasta and bread. Furthermore, consumer demand for dairy and confectionery products is rising, boosting the market growth in the country over the forecast period. The objective of the report is to present a comprehensive analysis of the Americas Enzymes market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Americas Enzymes market dynamics, structure by analyzing the market segments and project the Americas Enzymes market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Americas Enzymes market make the report investor’s guide.Americas Enzymes Market Scope: Inquire before buying

Americas Enzymes Market, by Region

• North America • South AmericaAmericas Enzymes Market Key Players

• Novozymes • Royal DSM • DuPont • BASF SE • Novus International • Associated British Foods plc • Advanced Enzyme Technologies • Adisseo • OthersFrequently Asked Questions:

1. What is the forecast period considered for the Americas Enzymes market report? Ans. The forecast period for the Americas Enzymes market is 2021-2027. 2. Which key factors are hindering the growth of the Americas Enzymes market? Ans. The handling and safety issues associated with enzymes, as well as their increased sensitivity to temperature and pH are the key factors expected to hinder the growth of the Americas Enzymes market during the forecast period. 3. What is the compound annual growth rate (CAGR) of Americas Enzymes market for the next 6 years? Ans. The Americas Enzymes market is expected to grow at a CAGR of 6.9% during the forecast period (2021-2027). 4. What are the key factors driving the growth of the Americas Enzymes market? Ans. Rising demand for enzymes from growing pharmaceuticals and food & beverages industries are the key factors expected to drive the growth of the Americas Enzymes market during the forecast period. 5. Which are the worldwide major key players covered for the Americas Enzymes market report? Ans. The major key players in the Americas Enzymes market are as follows: Novozymes, DSM, DuPont, BASF SE, Novus International, Associated British Foods plc, Advanced Enzyme Technologies, Adisseo, and others.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Americas Enzymes Market Size, by Market Value (US $ Bn.) 3.1. Americas Enzymes Market Segmentation 3.2. Americas Enzymes Market Segmentation Share Analysis, 2019 3.2.1. By Region (North America, South America) 3.3. Geographical Snapshot of the Americas Enzymes Market 3.4. Geographical Snapshot of the Americas Enzymes Market, By Manufacturer share 4. Americas Enzymes Market Overview, 2019-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Americas Enzymes Products Market 5. Supply Side and Demand Side Indicators 6. Americas Enzymes Market Analysis and Forecast, 2019-2027 6.1. Americas Enzymes Products Market Size & Y-o-Y Growth Analysis. 7. Americas Enzymes Market Analysis and Forecasts, 2019-2027 7.1. Market Size (Value) Estimates & Forecast By Type, 2019-2027 7.1.1. Protease 7.1.2. Carbohydrase 7.1.3. Lipase 7.1.4. Polymerase 7.1.5. Nuclease 7.1.6. Other types 7.2. Market Size (Value) Estimates & Forecast By Source, 2019-2027 7.2.1. Microorganisms 7.2.2. Plants 7.2.3. Animals 7.3. Market Size (Value) Estimates & Forecast By Reaction Type, 2019-2027 7.3.1. Hydrolase 7.3.2. Oxidoreductase 7.3.3. Transferase 7.3.4. Lyase 7.3.5. Nuclease 7.3.6. Other types 7.4. Market Size (Value) Estimates & Forecast By Application, 2019-2027 7.4.1. Food and Beverages 7.4.2. Household care 7.4.3. Biodiesel 7.4.4. Pharmaceutical and Biotechnology 7.4.5. Feed 7.4.6. Pulp and paper processing 7.4.7. Leather processing 7.4.8. Agriculture 8. Americas Enzymes Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2027 8.1.1. North America 8.1.2. South America 9. North America Market Analysis and Forecasts, 2019-2027 9.1. Market Size (Value) Estimates & Forecast By Type, 2019-2027 9.1.1. Protease 9.1.2. Carbohydrase 9.1.3. Lipase 9.1.4. Polymerase 9.1.5. Nuclease 9.1.6. Other types 9.2. Market Size (Value) Estimates & Forecast By Source, 2019-2027 9.2.1. Microorganisms 9.2.2. Plants 9.2.3. Animals 9.3. Market Size (Value) Estimates & Forecast By Reaction Type, 2019-2027 9.3.1. Hydrolase 9.3.2. Oxidoreductase 9.3.3. Transferase 9.3.4. Lyase 9.3.5. Nuclease 9.3.6. Other types 9.4. Market Size (Value) Estimates & Forecast By Application, 2019-2027 9.4.1. Food and Beverages 9.4.2. Household care 9.4.3. Biodiesel 9.4.4. Pharmaceutical and Biotechnology 9.4.5. Feed 9.4.6. Pulp and paper processing 9.4.7. Leather processing 9.4.8. Agriculture 10. North America Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Market Analysis and Forecasts, 2019-2027 11.1. Market Size (Value) Estimates & Forecast By Type, 2019-2027 11.2. Market Size (Value) Estimates & Forecast By Source, 2019-2027 11.3. Market Size (Value) Estimates & Forecast By Reaction Type, 2019-2027 11.4. Market Size (Value) Estimates & Forecast By Application, 2019-2027 12. Canada Market Analysis and Forecasts, 2019-2027 12.1. Market Size (Value) Estimates & Forecast By Type, 2019-2027 12.2. Market Size (Value) Estimates & Forecast By Source, 2019-2027 12.3. Market Size (Value) Estimates & Forecast By Reaction Type, 2019-2027 12.4. Market Size (Value) Estimates & Forecast By Application, 2019-2027 13. Mexico Market Analysis and Forecasts, 2019-2027 13.1. Market Size (Value) Estimates & Forecast By Type, 2019-2027 13.2. Market Size (Value) Estimates & Forecast By Source, 2019-2027 13.3. Market Size (Value) Estimates & Forecast By Reaction Type, 2019-2027 13.4. Market Size (Value) Estimates & Forecast By Application, 2019-2027 14. South America Market Analysis and Forecasts, 2019-2027 14.1. Market Size (Value) Estimates & Forecast By Type, 2019-2027 14.2. Market Size (Value) Estimates & Forecast By Source, 2019-2027 14.3. Market Size (Value) Estimates & Forecast By Reaction Type, 2019-2027 14.4. Market Size (Value) Estimates & Forecast By Application, 2019-2027 15. South America Market Analysis and Forecasts, by Country 15.1. Market Size (Value) Estimates & Forecast by Country, 2019-2027 15.1.1. Brazil 15.1.2. Argentina 15.1.3. Rest of South America 16. Brazil Market Analysis and Forecasts, 2019-2027 16.1. Market Size (Value) Estimates & Forecast By Type, 2019-2027 16.2. Market Size (Value) Estimates & Forecast By Source, 2019-2027 16.3. Market Size (Value) Estimates & Forecast By Reaction Type, 2019-2027 16.4. Market Size (Value) Estimates & Forecast By Application, 2019-2027 17. Argentina Market Analysis and Forecasts, 2019-2027 17.1. Market Size (Value) Estimates & Forecast By Type, 2019-2027 17.2. Market Size (Value) Estimates & Forecast By Source, 2019-2027 17.3. Market Size (Value) Estimates & Forecast By Reaction Type, 2019-2027 17.4. Market Size (Value) Estimates & Forecast By Application, 2019-2027 18. Rest of South America Market Analysis and Forecasts, 2019-2027 18.1. Market Size (Value) Estimates & Forecast By Type, 2019-2027 18.2. Market Size (Value) Estimates & Forecast By Source, 2019-2027 18.3. Market Size (Value) Estimates & Forecast By Reaction Type, 2019-2027 18.4. Market Size (Value) Estimates & Forecast By Application, 2019-2027 19. Competitive Landscape 19.1. Geographic Footprint of Major Players in the Americas Enzymes Products Market 19.2. Competition Matrix 19.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 19.2.2. New Product Launches and Product Enhancements 19.2.3. Market Consolidation 19.2.3.1. M&A by Regions, Investment and Verticals 19.2.3.2. M&A, Forward Integration and Backward Integration 19.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 19.3. Company Profile : Key Players 19.3.1. Novozymes 19.3.1.1. Company Overview 19.3.1.2. Financial Overview 19.3.1.3. Geographic Footprint 19.3.1.4. Product Portfolio 19.3.1.5. Business Strategy 19.3.1.6. Recent Developments 19.3.2. DSM 19.3.3. Du Pont 19.3.4. BASF SE 19.3.5. Novus International 19.3.6. Associated British Foods plc 19.3.7. Advanced Enzymes Technologies 19.3.8. Adisseo 19.3.9. Others 20. Primary Key Insights