Ambulatory X-Ray Devices Market size was valued at USD 1.88 Bn. in 2023 and the total revenue is expected to grow by 4.6% from 2024 to 2030, reaching nearly USD 2.57 Bn.Ambulatory X-Ray Devices Market Overview:

Ambulatory X-ray devices, also known as portable or handheld X-ray machines, offer the convenience of easy transportation and usage outside of traditional radiology or imaging departments. These compact devices have gained popularity in recent years due to their versatility and convenience. Their portable nature allows for greater flexibility in providing diagnostic imaging services. Additionally, ambulatory X-ray devices enable healthcare professionals to perform X-ray examinations in various settings, enhancing patient care and reducing the need for patient transfers. The demand for point-of-care imaging is growing rapidly, driven by the need for faster diagnosis and treatment of patients in emergency departments, intensive care units, and other critical care settings are boosting the demand for Ambulatory X-Ray Devices Market. The prevalence of chronic diseases such as cancer, cardiovascular disease, and respiratory disease is increasing globally. Ambulatory X-ray devices are becoming increasingly portable, lightweight, and user-friendly, making them more accessible and easier to use for healthcare professionals. This is driving the adoption of the Ambulatory X-Ray Devices Market in a wide range of healthcare settings. In addition, ambulatory X-ray devices are commonly used in emergency departments, intensive care units, and other critical care settings, where they provide healthcare professionals with the ability to quickly obtain high-quality diagnostic images at the patient's bedside. They are also used in imaging-guided procedures, such as biopsies and catheterizations. Overall, the use of ambulatory X-ray devices is expected to continue to grow in the forecast years as healthcare professionals increasingly seek out point-of-care imaging solutions that are convenient, efficient, and reliable. Overall, the use of ambulatory X-ray devices market is expected to continue to grow in the forecast years as healthcare professionals increasingly seek out point-of-care imaging solutions that are convenient, efficient, and reliable. The demand for medical devices increased by 43% in the year 2023 according to MMR research.To know about the Research Methodology :- Request Free Sample Report

Ambulatory X-Ray Devices Market

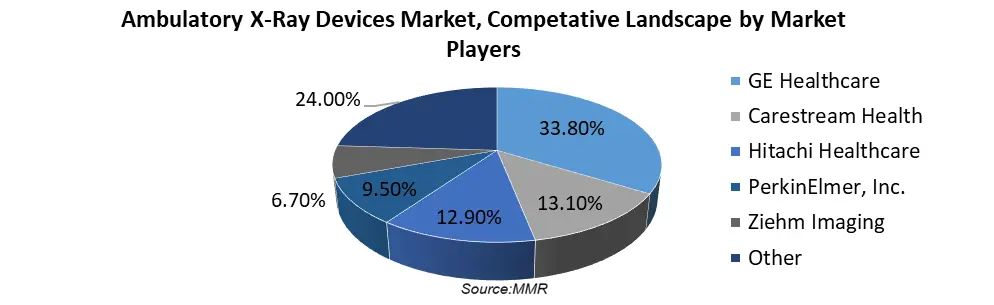

Competitive Landscape: The ambulatory X-ray devices market is highly competitive, with many key players operating in the industry. Some of the leading companies in this market include GE Healthcare, one of the leading providers of ambulatory X-ray devices, which has been actively involved in product development and innovation to stay competitive in the market. Some of the recent developments by GE Healthcare in the ambulatory X-ray devices market include: Launch of the Optima XR240amx: In 2021, GE Healthcare launched the Optima XR240amx, a mobile X-ray system designed for ambulatory and critical care imaging. The system features advanced imaging technologies, such as the FlashPad HD detector, to improve image quality and reduce dose. Introduction of the AMX 240: In 2020, GE Healthcare introduced the AMX 240, a mobile X-ray system designed for high-volume imaging in various settings, including hospitals, clinics, and emergency departments. The system features a lightweight design, advanced imaging capabilities, and easy maneuverability. Partnership with Osso VR: In 2019, GE Healthcare partnered with Osso VR, a virtual reality surgical training platform, to provide training and education for healthcare professionals on the use of GE Healthcare's X-ray systems. The partnership aimed to improve training and education for healthcare professionals and ultimately enhance patient outcomes. Development of the Optima XR220amx: In 2018, GE Healthcare developed the Optima XR220amx, a mobile X-ray system designed for point-of-care imaging. The system features a compact design, advanced imaging capabilities, and easy maneuverability, making it suitable for use in various clinical settings. These developments by GE Healthcare demonstrate the company's commitment to innovation and product development in the ambulatory X-ray devices market. Other key players in the ambulatory X-ray devices market include Carestream Health, Hitachi Healthcare, PerkinElmer, Inc., and Ziehm Imaging. The competition in Ambulatory X-Ray Devices Market is intense, with companies competing on factors such as product quality, price, and innovation. Some of the key factors driving the market growth include the rising prevalence of chronic diseases, increasing demand for portable and lightweight imaging devices, and technological advancements in X-ray devices.

Market Dynamics:

Increasing demand for point-of-care imaging There is a growing demand for point-of-care imaging in healthcare settings, particularly in emergency departments and intensive care units. Ambulatory X-ray devices offer a convenient and efficient solution for obtaining diagnostic images at the patient's bedside, which can help to improve patient outcomes. The demand for Ambulatory X-Ray Devices increased by 23% in 2023. Chronic diseases such as cancer, cardiovascular disease, and respiratory disease are on the rise globally. Diagnostic imaging tests such as X-rays are often used to detect and monitor these conditions. The increasing prevalence of chronic diseases is expected to drive the demand for ambulatory X-ray devices. The prevalence of chronic diseases such as cancer, cardiovascular disease, and respiratory disease is increasing globally. Ambulatory X-ray devices are commonly used in the diagnosis and monitoring of these conditions, providing healthcare professionals with a convenient and efficient way to obtain diagnostic images. Ambulatory X-ray devices are often more cost-effective than traditional fixed X-ray machines, as they eliminate the need for expensive infrastructure and maintenance costs. This makes them an attractive option for smaller healthcare facilities and clinics. Overall, the ambulatory X-ray devices market is expected to continue to grow in the forecast years due to these factors, as well as the increasing demand for faster and more efficient healthcare services. High cost of the Ambulatory X-Ray Devices Ambulatory X-ray devices are expensive, particularly for smaller healthcare facilities and clinics. This limits their adoption in the Ambulatory X-Ray Devices market and is a barrier to growth. There are some safety concerns associated with the use of ambulatory X-ray devices, particularly with regard to radiation exposure. Healthcare professionals must be trained to operate these devices safely, and proper safety measures must be put in place to minimize the risk of radiation exposure. Ambulatory X-ray devices are subject to regulation by government agencies, and obtaining regulatory approval can be a lengthy and costly process. This can slow down the introduction of new devices to the market. These restraints limit the growth of the ambulatory X-ray devices market to some extent. Advancements in imaging technology Ambulatory X-ray devices are equipped with advanced imaging technologies such as digital imaging, wireless connectivity, and image processing software. These technologies allow for real-time image transmission and analysis, enabling healthcare professionals to make faster and more accurate diagnoses. Ambulatory X-ray devices are becoming increasingly portable, lightweight, and user-friendly, making them more accessible and easier to use for healthcare professionals. This is driving the adoption of these devices in a wide range of healthcare settings and is expected to continue during the forecast period boosting the demand for the Ambulatory X-Ray Devices Market. The demand for mobile and portable diagnostic devices is increasing as they offer greater convenience and flexibility to patients and healthcare professionals. This trend is expected to drive the demand for the ambulatory X-ray devices market, which are portable and can be easily transported to the patient's location. The global population is aging, and this trend is expected to continue in the forecast years. According to the World Health Organization, the number of people aged 60 years and above is expected to double by 2050. This demographic shift is expected to increase the demand for ambulatory X-ray devices, as older adults are more likely to require diagnostic imaging tests. The development of new technologies such as digital X-ray imaging and wireless X-ray detectors is expected to drive the growth of the ambulatory X-ray devices market. These technologies offer greater image quality, faster image acquisition times, and improved patient safety. The ambulatory X-ray devices market is expected to grow significantly in emerging markets such as China, India, and Brazil. The growing demand for healthcare services in these countries, coupled with increasing government investments in healthcare infrastructure, is expected to drive the growth of the market in these regions. The ambulatory X-ray devices market is expected to experience significant growth in the forecast years, driven by several factors such as increasing demand for mobile and portable devices, the aging population, and the growing prevalence of chronic diseases.Ambulatory X-Ray Devices Market Segment Analysis:

Based on Type, The standalone segment dominated the ambulatory X-Ray devices market size in 2023, owing to an increase in the prevalence of chronic conditions and, as a result, an increase in X-ray imaging for disease diagnosis. Standalone ambulatory X-ray devices are portable imaging systems that can be used to perform diagnostic X-ray procedures outside of traditional hospital or clinic settings. One of the key benefits of standalone ambulatory X-ray devices is their portability. These devices can be easily transported to different locations, allowing healthcare providers to offer diagnostic imaging services in more convenient settings. This can help to reduce the burden on hospital-based imaging facilities, which can be expensive and time-consuming for patients. Standalone ambulatory X-ray devices also offer several other benefits, including faster turnaround times for diagnostic imaging results, reduced patient wait times, and improved patient satisfaction. Standalone ambulatory X-ray devices offer an efficient and effective way to provide diagnostic imaging services outside of traditional hospital or clinic settings. These devices are ideal for use in ambulatory care settings where convenience, speed, and portability are essential. The mobile segment is expected to grow at the fastest rate during the forecast period, owing to the increased adoption of mobile X-ray devices in hospitals and other diagnostic centers. The advantages offered by these mobile devices, such as greater mobility and portability, better speed, safer operation, cost-effectiveness, no special installation process, flexibility of operation, and improved patient care quality, are attributed to their adoption. Based on the Application, The orthopedic segment has been a dominant player in the ambulatory X-ray devices market in the year 2023, due to the increasing demand for diagnostic imaging in orthopedic applications. Orthopedic injuries and disorders are common, and the need for diagnostic imaging is often necessary to assess the severity of the condition, determine the appropriate treatment plan, and monitor the progress of the healing process. Ambulatory X-ray devices are well-suited for orthopedic applications due to their portability and ability to capture high-quality images. They can be used to perform diagnostic imaging tests such as X-rays, CT scans, and MRI scans in a variety of settings, including urgent care clinics, physician offices, and mobile imaging services. The orthopedic segment of the ambulatory X-ray devices market is expected to continue to grow in the forecast years, driven by several factors. These include the increasing incidence of orthopedic injuries and disorders, the aging population, and the growing demand for minimally invasive orthopedic procedures. In addition, technological advancements in imaging technologies such as digital X-ray imaging, computed tomography (CT), and magnetic resonance imaging (MRI) have enabled healthcare providers to capture high-quality images of the musculoskeletal system, which is essential for the diagnosis and treatment of orthopedic conditions. Overall, the orthopedic segment of the ambulatory X-ray devices market is expected to continue to dominate in the forecast years, driven by the increasing demand for diagnostic imaging in orthopedic applications, the aging population, and the growing demand for minimally invasive orthopedic procedures. Based on the End-user, The hospital segment has been a dominant player in the ambulatory X-ray devices market in the year 2023, due to the large volume of diagnostic imaging procedures performed in hospital settings. Hospitals have a high demand for diagnostic imaging tests such as X-rays, CT scans, and MRI scans, and ambulatory X-ray devices are often used to perform these tests in hospital emergency rooms, outpatient clinics, and mobile imaging services. The hospital segment of the ambulatory X-ray devices market is expected to continue to grow in the forecast years, driven by several factors. These include the increasing demand for healthcare services, the growing incidence of chronic diseases, and the aging population. In addition, hospitals are increasingly focused on improving patient care and reducing costs, and ambulatory X-ray devices can help to achieve these goals. By using portable imaging devices, hospitals can reduce patient wait times, improve patient satisfaction, and reduce the need for expensive and time-consuming hospital-based imaging facilities.Ambulatory X-Ray Devices Market Regional Insights:

North America dominated the ambulatory X-ray devices market in 2023 and is expected to maintain its dominance during the forecast period. This is primarily due to the presence of well-established healthcare infrastructure, the increasing prevalence of chronic diseases, and the high demand for advanced diagnostic imaging technologies in the region. The United States and Canada are the major contributors to the ambulatory X-ray devices market in North America. The United States, in particular, has a large population base, high healthcare expenditure, and advanced healthcare infrastructure, which has led to the growth of the market in the region. The Asia-Pacific region is expected to grow at the highest rate during the forecast period in the ambulatory X-ray devices market. This growth can be attributed to several factors, including increasing healthcare expenditure, rising awareness about early disease detection, and the growing demand for advanced diagnostic imaging technologies in the region. In addition, the region has a large and growing population base, which has resulted in a high prevalence of chronic diseases such as cancer, cardiovascular diseases, and respiratory diseases. This has led to increasing demand for diagnostic imaging tests, such as X-rays, CT scans, and MRI scans, which are expected to drive the growth of the ambulatory X-ray devices market in the region. The growing trend towards telemedicine and remote healthcare services is also expected to drive the growth of the market in the region. Countries such as China, India, and Japan are expected to be the major contributors to the growth of the ambulatory X-ray devices market in the Asia-Pacific region. These countries have large populations, high healthcare expenditures, and an increasing focus on healthcare infrastructure development, which is expected to drive the growth of the market.Ambulatory X-Ray Devices Market Scope: Inquire before buying

Ambulatory X-Ray Devices Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.88 Bn. Forecast Period 2024 to 2030 CAGR: 4.6% Market Size in 2030: US $ 2.57 Bn. Segments Covered: by Type Standalone Mobile by Application Orthopedic Cancer Cardiovascular Others by End-user Hospitals Ambulatory Surgical Centers Others Ambulatory X-Ray Devices Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Ambulatory X-Ray Devices Market, Key Players are

1.Agfa-Gevaert Group. 2.Allengers 3.Amrad Medical Equipment 4.Bennett Village 5.Canon Inc. 6.Carestream Health, Inc 7.Cuattro LLC, 8.FUJIFILM Corporation 9.GE Healthcare 10.General Electric Company 11.Hitachi Ltd. 12.Konica Minolta 13.Koninklijke Philips N.V. 14.MinXray Inc. 15.Oehm und Rehbein GmbH 16.PerkinElmer, Inc.. 17.SAMSUNG 18.Shimadzu Corporation 19.Siemens AG 20.Source-Ray, Inc 21.Source-Ray, Inc. 22.Toshiba Corporation 23.Varian Medical Systems, Inc. 24.Ziehm Imaging Frequently Asked Questions: 1] What segments are covered in the Global Ambulatory X-Ray Devices Market report? Ans. The segments covered in the Ambulatory X-Ray Devices Market report are based on Type, Application, End-user and Region. 2] Which region is expected to hold the highest share in the Global Ambulatory X-Ray Devices Market? Ans. The North America region is expected to hold the highest share of the Ambulatory X-Ray Devices Market. 3] What is the market size of the Global Market by 2030? Ans. The market size of the Ambulatory X-Ray Devices Market by 2030 is expected to reach US$ 2.57 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Ambulatory X-Ray Devices Market is 2024-2030. 5] What was the market size of the Global Market in 2023? Ans. The market size of the Ambulatory X-Ray Devices Market in 2023 was valued at US$ 1.88 Bn.

1. Global Ambulatory X-Ray Devices Market: Research Methodology 2. Global Ambulatory X-Ray Devices Market: Executive Summary 3. Global Ambulatory X-Ray Devices Market: Competitive Landscape • MMR Competition Matrix • Competitive Landscape • Key Players Benchmarking • Global Market Key Player Ranking Analysis • Market Structure o Market Leaders o Market Followers o Emerging Players • Consolidation of the Market 4. Global Ambulatory X-Ray Devices Market: Dynamics • Market Trends by region o North America o Europe o Asia Pacific o Middle East and Africa o South America • Market Drivers by Region o North America o Europe o Asia Pacific o Middle East and Africa o South America • Market Restraints • Market Opportunities • Market Challenges • PORTER’s Five Forces Analysis • PESTLE • Value Chain Analysis o Regulatory Landscape by Region o North America o Europe o Asia Pacific o Middle East and Africa o South America • COVID-19 Impact on the Market 5. Global Ambulatory X-Ray Devices Market: Segmentation (by Value and Volume) • Global Ambulatory X-Ray Devices Market, by Type (2023-2030) o Standalone o Mobile • Global Ambulatory X-Ray Devices Market, by Application (2023-2030) o Orthopedic o Cancer o Cardiovascular o Others • Global Ambulatory X-Ray Devices Market, by End-user (2023-2030) o Hospitals o Ambulatory Surgical Centers o Others 6. North America Ambulatory X-Ray Devices Market (by Value and Volume) • North America Ambulatory X-Ray Devices Market, by Type (2023-2030) o Standalone o Mobile • North America Ambulatory X-Ray Devices Market, by Application (2023-2030) o Orthopedic o Cancer o Cardiovascular o Others • North America Ambulatory X-Ray Devices Market, by End-user (2023-2030) o Hospitals o Ambulatory Surgical Centers o Others • North America Ambulatory X-Ray Devices Market, by Country (2023-2030) o United States o Canada o Mexico 7. Europe Ambulatory X-Ray Devices Market (by Value and Volume) • Europe Ambulatory X-Ray Devices Market, by Type (2023-2030) • Europe Ambulatory X-Ray Devices Market, by Application (2023-2030) • Europe Ambulatory X-Ray Devices Market, by End-user (2023-2030) • Europe Ambulatory X-Ray Devices Market, by Country (2023-2030) o UK o France o Germany o Italy o Spain o Sweden o Austria o Rest of Europe 8. Asia Pacific Ambulatory X-Ray Devices Market (by Value and Volume) • Asia Pacific Ambulatory X-Ray Devices Market, by Type (2023-2030) • Asia Pacific Ambulatory X-Ray Devices Market, by Application (2023-2030) • Asia Pacific Ambulatory X-Ray Devices Market, by End-user (2023-2030) • Asia Pacific Ambulatory X-Ray Devices Market, by Country (2023-2030) o China o S Korea o Japan o India o Australia o Indonesia o Malaysia o Vietnam o Taiwan o Bangladesh o Pakistan o Other Asia Pacific 9. Middle East and Africa Ambulatory X-Ray Devices Market (by Value and Volume) • Middle East and Africa Ambulatory X-Ray Devices Market, by Type (2023-2030) • Middle East and Africa Ambulatory X-Ray Devices Market, by Application (2023-2030) • Middle East and Africa Ambulatory X-Ray Devices Market, by End-user (2023-2030) • Middle East and Africa Ambulatory X-Ray Devices Market, by Country (2023-2030) o South Africa o GCC o Egypt o Nigeria o Rest of ME&A 10. South America Ambulatory X-Ray Devices Market (by Value and Volume) • South America Ambulatory X-Ray Devices Market, by Type (2023-2030) • South America Ambulatory X-Ray Devices Market, by Application (2023-2030) • South America Ambulatory X-Ray Devices Market, by End-user (2023-2030) • South America Ambulatory X-Ray Devices Market, by Country (2023-2030) o Brazil o Argentina o Rest Of South America 11. Company Profile: Key players • Agfa-Gevaert Group. o Company Overview o Financial Overview o Business Portfolio o SWOT Analysis o Business Strategy o Recent Developments • Allengers • Amrad Medical Equipments • Bennett Village • Canon Inc. • Carestream Health, Inc • Cuattro LLC, • FUJIFILM Corporation • GE Healthcare • General Electric Company • Hitachi Ltd. • Konica Minolta • Koninklijke Philips N.V. • MinXray Inc. • Oehm und Rehbein GmbH • PerkinElmer, Inc. • SAMSUNG • Shimadzu Corporation • Siemens AG • Source-Ray, Inc • Source-Ray, Inc. • Toshiba Corporation • Varian Medical Systems, Inc. • Ziehm Imaging 12. Key Findings 13. Industry Recommendation