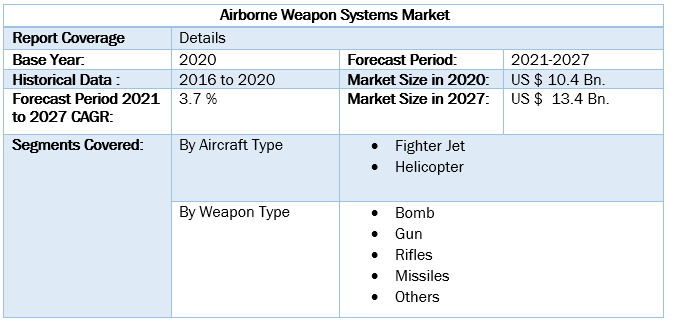

Airborne Weapon System Market size was valued at US$ 10.4 Bn. in 2020. Fighter Jet, one of the segments reviewed in our report is dominating the market.To know about the Research Methodology :- Request Free Sample Report 2020 is considered as a base year to forecast the Market from 2021 to 2027. 2020’s Market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years trends are considered while forecasting the Market through 2027. 2020 is a year of exception and analyzed specially with the impact of lockdown by region.

Airborne Weapon System Market Overview:

As war disputes between enemy countries continue to rise across the globe, increasingly governments are establishing fleets of airborne weapon systems to improve in-land safety and security. A massive rise in terrorism activities is also compelling the augmented adoption of airborne weapon systems, driving global demand. Furthermore, ammunition handling system integration across the globe by emerging players in the market is considered to drive the demand for the airborne weapons. Airborne weapons system market is expected to register CAGR of approximately 3.7% during the forecast period.Airborne Weapon System Market Dynamics:

Developments across the Asia Pacific market is expected to prove to be highly promising for companies operating in the airborne weapon system market. The market is also driven by the vast pace of developments witnessed in the field of sensors, electronics, and associated technologies in the past few years. The steady rise in military and defense spending of countries across regions is also leading to the increased adoption of airborne weapon systems. All these factors are estimated to empower manufacturers to focus more on the development of innovative, advanced, and more accurate targeting technologies in the forecast period. Moreover, increasing political pressure in China, North Korea, Israel and other countries is playing a vital role in the airborne weapon system market. According to Defense Ministry of USA, The performance of United States weapon systems are unmatched, ensuring that U.S. military forces have a tactical combat advantage over any opposition in any environmental situation. The Fiscal Year (FY) 2022 acquisition RDT& E backing requested by the Department of Defense (DoD) totals $245.6 billion, which includes funding totaling $133.6 billion for Procurement and $112.0 billion for research and development. According to Statista, Global military expenditure in 2020 was accounted for 1.93 Trillion USD and change of military spending by North Africa in 2015 to 2020 was 28%. More trends and statistics of the market are covered in the report while taking 2020 as base year and 2016 as historical period.Increasing funding by governments in the defense and aerospace sector along with rapid advancements in Command, Control, Communications, Computers, and Intelligence (C4I) Systems are the factors expected to drive the demand for the product. On the other hand, missile defense and defeat programs carried out by developing nations is hampering the market growth. Moreover, according to IHL, there are ethical and moral challenges that need to be considered carefully. There is the related question of whether the principles of humanity and the decrees of public morality (the Martens Clause) allow life and death decisions to be taken by a machine with little or no human control.

Airborne Weapon Systems Market Segment Analysis:

By Aircraft Type, airborne weapon systems market is segmented into Fighter Jets and Helicopters. Fighter Jets segment is dominating the market with CAGR of approximately 7.3% during year 2018-2020. Factors attributing the growth of the segment is increasing requirement of military surveillance and threat detection and defense capabilities in the battlefield. Increasing inclination of system manufacturers towards self-protection EW suits with missile defense implementation is driving the demand for jets in the market. Helicopters are the second dominating segment in the market accounting with 35% market share owing to increasing need for add on weponization in the warfare.By Weapon Type, airborne weapon systems market is divided into Bomb, guns, rifles, missiles and others. Missiles is the dominating segment in the market with approximately 30% market share. Factors driving the segment growth are increasing threat of aerial attack and increasing solutions and planning for counterattacking the threats. Moreover, missiles provide the extra edge to the army in terms of ballistic power and suppression of the attack more effectively.

Airborne Weapon Systems Regional Insights:

North America is the dominating region in the market with approximately 38% market share owing to increasing government investments in RADAR and air defense mechanism in 2020 as US was on brink of air strikes threats by North Korea and China. Moreover, requirement for new weaponry and weapon systems for countries’ defense systems is considered to drive the growth of the North American region. Besides, high no. of key players in the region and increasing export compatibilism by them is driving the product demand and manufacturing of the product in the region. According to US DoD, funding for aircraft R & D, aircraft procurement, initial spares, and aircraft support equipment is accounted for 52.4 billion USD. The single largest defense program, the 5th generation F-35 Joint Strike Fighter (JSF), request of 12 billion USD for 85 aircraft for the Navy (F-35C), Marine Corps (F-35B & C) and Air Force (F-35A), which also includes the Continuous Competence Progress and Delivery (C2D2) Block IV modification program which aims to bring aircraft procured in prior fiscal years to the Block IV configuration. MEA and GCC countries are expected to show bolstering growth in the market as Saudi Arabia is announced as highest military expenditure making country across the globe with 8% military expenditure as % of GDP. Moreover, political instability and terrorism in Iraq, Iran, Israel and Palestine and advanced weaponry introduced by terrorist organizations has forced the nations to invest more in defense systems. APAC is accounted for approximately 20% market share as political tensions between China, Afghanistan and India is rising day by day. Moreover, India is highly implementing the military expenditure in combat helicopters concept with help of EU countries including France, Italy and UK. Moreover, The Russians have also developed the state of the art AH in the Ka-50 and MI-28. This decision was taken after their experience in Afghanistan with the MI-24 AH, which was basically an armed helicopter and hence not suited for a typical AH role. The Ka 50 is the world’s first coaxial, single seat AH. The MI- 28 on the other hand is roughly equivalent of the Apache Longbow but without the significant Command and Control linkup.The objective of the report is to present a comprehensive analysis of the Airborne Weapon Systems Market to the stakeholders in the industry. The past and current status of the industry with the forecasted Market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include Market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the Market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Airborne Weapon Systems Market dynamics, structure by analyzing the Market segments and project the Airborne Weapon Systems Market size. Clear representation of competitive analysis of key players by Type, price, financial position, Type portfolio, growth strategies, and regional presence in the Airborne Weapon Systems Market make the report investor’s guide.

Airborne Weapon Systems Market Scope: Inquire before buying

Airborne Weapon Systems Market, by Region

• North America • Europe • Asia Pacific • Middle East and Africa • South AmericaAirborne Weapon Systems Market Key Players

• Safran Electronics & Defense • FN Herstal • Boeing • BAE System • Airbus • Rheinmetall AG • Raytheon Company • SAAB AB • Lockheed Martin Corporation • Ultra-Electronics • Israel Aerospace Industries • L3Harris Technologies, Inc. • Aselsan AS • Leonardo SPA • Northdrop Grumman Corporation • Textron SystemsFAQ’S:

1) What is the market share of the Global Airborne Weapon Systems Market in 2020? Answer: The Airborne Weapon Systems Market was valued at the US $ 10.3 Billion in the year 2020. 2) Which is the dominating region for the Airborne Weapon Systems Market? Answer: North America is the dominating region in the market with approximately 38% market share owing to increasing government investments in RADAR and air defense mechanism in 2020 as US was on brink of air strikes threats by North Korea and China. 3) What are the key players in the Airborne Weapon Systems Market? Answer: Safran Electronics & Defense, FN Herstal, Boeing, BAE System, Airbus, Rheinmetall AG, Raytheon Company, SAAB AB, Lockheed Martin Corporation, Ultra-Electronics, Israel Aerospace Industries, L3Harris Technologies, Inc., Aselsan AS, Leonardo SPA, Northdrop Grumman Corporation, Textron Systems 4) Which factor acts as the driving factor for the growth of the Airborne Weapon Systems Market? Answer: The market is driven by the vast pace of developments witnessed in the field of sensors, electronics, and associated technologies in the past few years. 5) What factors are restraining the growth of the Airborne Weapon Systems Market? Answer: The High cost associated with the installation and maintenance of the airborne systems is the restraining factor hampering the market growth.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Airborne Weapon Systems Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Airborne Weapon Systems Size Market 3.4. Geographical Snapshot of the Airborne Weapon Systems Market, By Manufacturer share 4. Airborne Weapon Systems Market Overview, 2020-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Type of Bucket of Buyers/Consumers 4.1.6.3. Bargaining Type of Bucket of Suppliers 4.1.6.4. Threat of Substitute Technologies 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Airborne Weapon Systems Market 5. Supply Side and Demand Side Indicators 6. Airborne Weapon Systems Market Analysis and Forecast, 2020-2027 6.1. Airborne Weapon Systems Market Size & Y-o-Y Growth Analysis. 7. Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 7.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 7.1.1. Fighter Jet 7.1.2. Helicopter 7.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 7.2.1. Bomb 7.2.2. Gun 7.2.3. Rifles 7.2.4. Missiles 7.2.5. Others 8. Airborne Weapon Systems Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2020-2027 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 9.1.1. Fighter Jet 9.1.2. Helicopter 9.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 9.2.1. Bomb 9.2.2. Gun 9.2.3. Rifles 9.2.4. Missiles 9.2.5. Others 10. North America Airborne Weapon Systems Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2020-2027 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 11.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 11.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 12. Canada Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 12.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 12.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 13. Mexico Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 13.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 13.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 14. Europe Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 14.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 14.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 15. Europe Airborne Weapon Systems Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2020-2027 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 16.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 16.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 17. France Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 17.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 17.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 18. Germany Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 18.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 18.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 19. Italy Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 19.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 19.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 20. Spain Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 20.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 20.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 21. Sweden Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 21.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 21.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 22. CIS Countries Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 22.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 22.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 23. Rest of Europe Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 23.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 23.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 24. Asia Pacific Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 24.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 24.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 25. Asia Pacific Airborne Weapon Systems Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2020-2027 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 26.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 26.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 27. India Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 27.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 27.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 28. Japan Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 28.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 28.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 29. South Korea Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 29.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 29.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 30. Australia Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 30.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 30.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 31. ASEAN Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 31.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 31.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 32. Rest of Asia Pacific Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 32.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 32.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 33. Middle East Africa Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 33.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 33.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 34. Middle East Africa Airborne Weapon Systems Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2020-2027 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 35.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 35.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 36. GCC Countries Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 36.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 36.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 37. Egypt Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 37.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 37.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 38. Nigeria Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 38.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 38.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 39. Rest of ME&A Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 39.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 39.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 40. South America Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 40.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 40.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 40.3. 2027 41. South America Airborne Weapon Systems Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2020-2027 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 42.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 42.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 43. Argentina Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 43.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 44. Rest of South America Airborne Weapon Systems Market Analysis and Forecasts, 2020-2027 44.1. Market Size (Value) Estimates & Forecast By Aircraft Type, 2020-2027 44.2. Market Size (Value) Estimates & Forecast By Weapon Type, 2020-2027 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Airborne Weapon Systems Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile : Key Players 45.3.1. Safran Electronics and Defense 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. FN Herstal 45.3.3. Boeing 45.3.4. BAE System 45.3.5. Airbus 45.3.6. Rheinmetall AG 45.3.7. Raytheon Company 45.3.8. SAAB AB 45.3.9. Lockheed Martin Corporation 45.3.10. Ultra-Electronics 45.3.11. Israel Aerospace Industries 45.3.12. L3Harris Technologies, Inc. 45.3.13. Aselsan AS 45.3.14. Leonardo SPA 45.3.15. Northdrop Grumman Corporation 45.3.16. Textron Systems