Air Defense System Market size was valued at US$ 37.51 Bn. in 2022 and the total revenue is expected to grow at 7.34% through 2023 to 2029, reaching nearly US$ 61.59 Bn.Air Defense System Market Overview:

The Air Defense System Market report examines the market's growth drivers as well as its segments. Report includes market participants, and regional insights. This market study takes an in-depth look at all of the significant advancements that are currently occurring across all industry sectors. To provide key data analysis for the historical period (2018-2022), statistics, info graphics, & presentations are used. The report examines the Air Defense System markets, Drivers, Restraints, Opportunities, & Challenges. This Maximize report includes investor recommendations based on a detailed analysis of the current competitive landscape of the market. Under the Defense Act, the Air Defense System plays a vital role in contributing to the state's security by providing Tactical Air Defense of its aircraft. Incoming threats include hostile fighter aircraft such as jet fighters, air refuelers, and others, nuclear and conventional missiles, and unmanned aerial vehicles such as surveillance drones.To know about the Research Methodology :- Request Free Sample Report

Dynamics:

Market Drivers Growth in Geopolitical Instability - Geopolitical tensions are developing between countries over a variety of problems. For example, the US-China relationship has deteriorated as a result of COVID-19, the trade war, and other difficulties. Similarly, after capturing Crimea, Russia's relationship with the European Union deteriorated. Such disagreements have prompted concerns about the safety of countries' lands, resulting in a desire for short-range air defense systems, which can kill airborne targets with high accuracy at a short range. As a result, rising geopolitical instabilities are propelling the market for air defense systems forward. Expansion in defense expenditure for air protection frameworks – Many countries in the world like China, India, Russia, Japan, USA, France, Germany, etc. are increasing their defense budget every year to ensure their security from external forces. Since, in warfare the use of missiles and aircrafts have been increased, the air defense system has also more vital for every country. Technological advancements and innovations – Technological innovations and advancements like Missile changing trajectory, increasing range and AI systems in the Air Defense Systems have increased the demand of Air Defense Systems in the world. This is also a driver of the market. Market Restraints High Development Cost – These Air Defense Systems are very expensive and the development cost of the Air Defense Systems is also very high. Several companies and governments are spending substantial amount on R&D on the development of missile defense systems and missile radars. Only few developed and developing countries can afford these Air Defense Systems and deploy them as to deploy these systems you need a good infrastructure too like good ships, good bases to deploy them. This is one of the restraints for the market. Market Opportunities Growing demand from Asia Pacific region – Countries from Asia Pacific region like China, India, Japan, Australia, Korea, etc. are increasing expense on the Air Defense Systems to ensure the safety of their land and stop the entry of any missile, air craft or any other threat for them. This is one of the opportunities for the market to grow. Market Challenges Supply Chain difficulties – The Air Defense Systems are very huge with heavy weight and transporting them one place to another is still a challenge in front of market.Air Defense System Market Segment Analysis

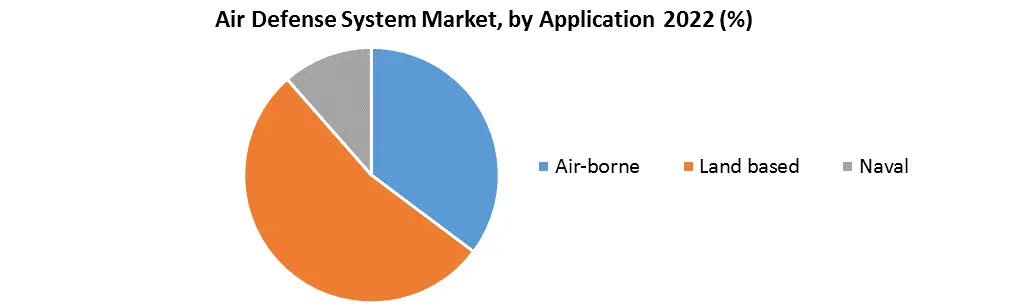

By type, the Air Defense System Market is segmented as Anti-Aircraft system, Missile Defense system and C-RAM System. Missile Defense system dominates the market with the market share of 42.48% in 2022 as it is most important for a country to have among all Air Defense Systems because in most of the war fares, one country attack another through missiles and with a good and effective missile defense system, they can defend themselves. Anti-Aircraft system held the market share of 37.05% in 2022) as after missiles, aircrafts are used in huge amount for air attacks so countries need these systems to protect themselves from aircraft attacks. C-RAM System held the market share of 20.47% in 2022) and is used less due to high cost and the attacks are also not that much so demand is also lower than other 2 types. By Application, the Air Defense System Market is segmented as Air-borne, Land based, Naval. Land based dominates the market with the market share of 48% in the year of 2022 as the Air Defense Systems are majorly deployed in the military bases on land and also these huge, heavy Air Defense Systems are easier to deploy in land and they can be portable too on trucks. Naval held the market share of 37% in 2022 as navy ships are highly capable in sustaining Air Defense Systems and is it also solves the problem of protecting their territory from missile attacks coming from across the oceans. Air-borne has the market share of 15% in 2022 and is at the last as the Air Defense Systems are very heavy and big for any aircraft to handle.

Regional Insights:

North America held the largest market share of 33.51% followed by Asia Pacific with the market share of 30.61% in 2022 as these 2 regions have the countries with biggest defense budgets and huge war histories. Countries like India, China, Japan, Russia, USA invest huge amounts in R&D of Air Defense Systems and hence have these huge market shares with them. Asia Pacific is expected to grow at highest rate and become the market leader by the end of the forecast period. Europe held the market share of 23.6% in 2022 due to countries like France and Germany who make, buy and sell this technology in large numbers. Middle east & Africa held the market share of 8.28% in 2022 as the Arab countries are always in war state and they need these Air Defense Systems but they are less in quantity so the market share is also small. South America is the country with minimum war history and don’t fight a lot with other countries so the demand of Air Defense Systems is less and hence, the market share is only 4% in 2022. The objective of the report is to present a comprehensive analysis of the Air Defense System market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Air Defense System market dynamics, structure by analyzing the market segments and project the Air Defense System market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Air Defense System market make the report investor’s guide.Air Defense System Market Scope: Inquire before buying

Global Air Defense System Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 37.51 Bn. Forecast Period 2023 to 2029 CAGR: 7.34% Market Size in 2029: US $ 61.59 Bn. Segments Covered: by Type Missile Defense System Aircraft Defense System C-RAM System by Application Air-borne Land based Naval by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Air Defense System Market Key Players

1. Almaz -Antey Air and space defense corp. 2. ASELSAN AS 3. BAE Systems Plc 4. Elbit Systems Ltd. 5. General Dynamics Corp. 6. Hanwha Aerospace CO. LTD. 7. Israel Aerospace Industries Ltd. 8. Kongsberg Gruppen ASA 9. L3Harris Technologies Inc. 10.Leonardo Spa 11.Lockheed Martin Corp. 12.Northrop Grumman Corp. 13.Rafael Advanced Defense Systems Ltd. 14.Raytheon Technologies Corp. 15.Rheinmetall AG 16.Saab AB 17.Thales Group 18.The Boeing Co. 19.General Atomics Frequently Asked Questions: 1] What segments are covered in the Air Defense System Market report? Ans. The segments covered in the market report are based on Type and Application. 2] Which region is expected to hold the highest share in the market? Ans. The Asia Pacific is expected to hold the highest share in the market. 3] What is the market size volume of the Air Defense System Market by 2029? Ans. The market size of the market by 2029 is expected to reach at US$ 61.59 Bn. 4] What is the forecast period for the market? Ans. The forecast period for the market is 2023-2029. 5] What was the market size volume of the Air Defense System Market in 2022? Ans. The market size of the market in 2022 was valued at US$ 37.51 Bn.

1. Air Defense System Market: Research Methodology 2. Air Defense System Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Air Defense System Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Air Defense System Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Air Defense System Market Segmentation 4.1. Air Defense System Market, by Type (2022-2029) • Missile Defense system • Aircraft Defense system • C-RAM system 4.2. Air Defense System Market , by Application (2022-2029) • Naval • Air-borne • Land based 5. North America Air Defense System Market (2022-2029) 5.1. North America Air Defense System Market , by Type (2022-2029) 5.1.1. Missile Defense system 5.1.2. Aircraft Defense system 5.1.3. C-RAM system 5.2. North America Air Defense System Market , by Application (2022-2029) 5.2.1. Naval 5.2.2. Air-borne 5.2.3. Land based 5.3. North America Air Defense System Market , by Country (2022-2029) • US • Canada • Mexico 6. European Air Defense System Market (2022-2029) 6.1. European Air Defense System Market , by Type (2022-2029) 6.2. European Air Defense System Market , by Application (2022-2029) 6.3. European Air Defense System Market , by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Air Defense System Market (2022-2029) 7.1. Asia Pacific Air Defense System Market , by Type (2022-2029) 7.2. Asia Pacific Air Defense System Market , by Application (2022-2029) 7.3. Asia Pacific Air Defense System Market , by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Air Defense System Market (2022-2029) 8.1. Middle East and Africa Air Defense System Market , by Type (2022-2029) 8.2. Middle East and Africa Air Defense System Market , by Application (2022-2029) 8.3. Middle East and Africa Air Defense System Market , by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Air Defense System Market (2022-2029) 9.1. South America Air Defense System Market , by Type (2022-2029) 9.2. South America Air Defense System Market , by Application (2022-2029) 9.3. South America Air Defense System Market , by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Almaz -Antey Air and space defense corp. 10.2. ASELSAN AS 10.3. BAE Systems Plc 10.4. Elbit Systems Ltd. 10.5. General Dynamics Corp. 10.6. Hanwha Aerospace CO. LTD. 10.7. Israel Aerospace Industries Ltd. 10.8. Kongsberg Gruppen ASA 10.9. L3Harris Technologies Inc. 10.10. Leonardo Spa 10.11. Lockheed Martin Corp. 10.12. Northrop Grumman Corp. 10.13. Rafael Advanced Defense Systems Ltd. 10.14. Raytheon Technologies Corp. 10.15. Rheinmetall AG 10.16. Saab AB 10.17. Thales Group 10.18. The Boeing Co. 10.19. General Atomics