Global AI Sensor Market size was valued at USD 2.92 Bn. in 2022 and the total AI Sensor industry revenue is expected to grow by 35 % from 2023 to 2029, reaching nearly USD 23.86 Bn.AI Sensor Market Overview

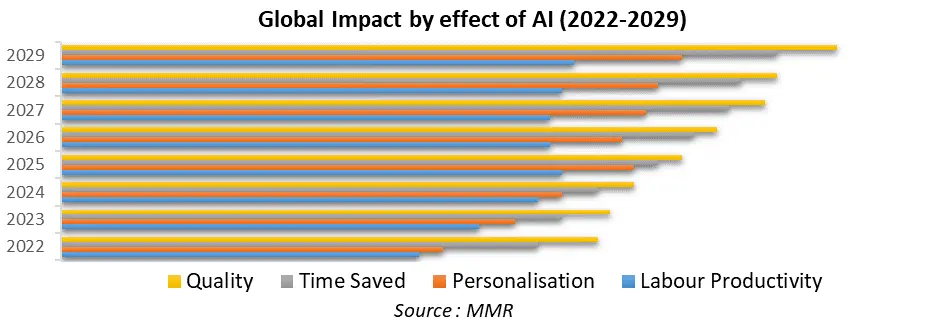

AI is a collective term for computer systems that can sense their environment, think, learn, and take action in response to what they’re sensing and their objectives. The rising urban population and rapidly rising urbanization process lead to a demand for sustainable and effective infrastructure solutions.AI and IoT Technologies are necessary for the growth of smart cities, smart automobiles, and smart homes cannot be achieved without AI Sensors. The AI sensor market is due to the rising popularity of several life-saving devices used in various industries such as hospitals, and automotive for example self-driving functionality in new electric vehicles. The world's growing attention towards digitalization is having a positive impact on market expansion. The rising investment by leading companies in the development and improvement of different AI applications. This factor helps to boost the market growth during the forecast period, it is expected that increasing efforts by tech giants to increase access to AI will promote market growth.To know about the Research Methodology :- Request Free Sample Report AI Sensors Market Trends: As new technologies are gradually adopted and consumers respond to improved products with increased demand, the share of impact from product innovation increases over time. The consumer revolution set off by AI opens the way for massive disruption as both established businesses and new entrants drive innovation and develop new business models. A key part of the impact of AI will come from its ability to make the most of parallel developments such as IoT connectivity and sensor. This will create tremendous growth opportunities for the AI sensor Market Growth.AI sensors helps to enhance labour productivity, save the maximum time, and also provide quality. Therefore the demand for AI sensors increasing during the forecast period. Cloud platforms provide the infrastructure and resources for large-scale data storage, processing, and AI model training. Integrating AI sensors with edge computing and cloud platforms opens up opportunities for more powerful analytics, predictive insights, and distributed intelligence.

AI Sensors Market Dynamics

Drivers: Growing Internet of Things Ecosystem Drives the Market Growth. The IoT ecosystem is a big network of connected devices and sensors that collect as well as share data. AI sensors collect data from different sources such as machines and devices therefore AI is important in the IoT ecosystem. These sensors measure things not only temperature but also humidity, motion, and light, which helps to understand the world in a better way. The rising demand for IoT networks for many devices and systems needs AI sensors and detectors.AI sensors help to personalize the experience in various areas including smart homes as well wearables devices. The AI Sensors collect data from the user preferences and behavior which helps AI algorithms give personalized recommendations and adjust tasks on the basis of individual needs. The growth in IoT ecosystems boost the demand for AI Sensors which improves the experiences of user and provide personalization.AI sensors are important for collecting, analyzing, and understanding the data, which helps IoT systems gain valuable insights and make smart decisions. The expansion of the IoT ecosystem is driving the need for AI sensors. Increasing Demand for Automation Boosts the Market Growth The growing demand for automation in various industries such as manufacturing, automotive, healthcare, and agriculture is significant drives the AI Sensor Market growth. The AI sensors help machines and devices collect real-time data which helps to make intelligent decisions and automate the process. AI sensors also help to increase efficiency, enhance productivity and save time as well as cost. For example, the development of autonomous vehicles largely depends on AI sensors for perception and navigation. Sensors such as LiDAR, radar, and cameras are used to detention and interpret the surrounding environment, allowing vehicles to detect difficulties, recognize traffic signs, and navigate safely. The expanding market for autonomous vehicles is driving the demand for AI sensors. Restrain: Limited Training Data and Algorithm Biases Hamper the Market Growth AI sensors rely on machine learning algorithms that require large amounts of diverse and high-quality training data to perform effectively. However, obtaining such training data can be challenging, especially in niche or specialized applications. Additionally, biased training data can lead to biased AI models, resulting in unfair or discriminatory outcomes. The availability and quality of training data, as well as the potential for algorithmic bias, can create challenges in the development of AI sensors. Developing and implementing AI sensors require expertise in artificial intelligence, data science, and sensor technologies. The limited availability of AI expertise limits innovation and hinders the adoption of AI sensors. Opportunity Advancements in Sensor Technologies Create Lucrative Growth Opportunities for the Market Growing advancement in sensor technology boosts the growth of the AI Sensor Market.New sensor technologies, improved capabilities, and functionalities. These advancements enable AI sensors to capture more accurate and diverse data, expand their sensing range, and enhance their performance in challenging environments. The development of novel sensor technologies presents opportunities for creating innovative AI sensor solutions. AI sensors can leverage edge computing and cloud platforms to enhance their capabilities. Edge computing enables real-time data processing and analysis at the edge of the network, reducing latency and enhancing responsiveness. Cloud platforms provide the infrastructure and resources for large-scale data storage, processing, and AI model training. Integrating AI sensors with edge computing and cloud platforms opens up opportunities for more powerful analytics, predictive insights, and distributed intelligence.Competitive Landscape:

The report offers an analysis of the key players in the global AI sensor market. The key players of the global AI sensor market are Teledyne Technologies Incorporated, Robert Bosch GmbH, Goertek Inc., Baidu, Inc., Yokogawa Electric Corporation, Excelitas Technologies Corp., Hokuriku Electric Industry Co., Ltd., Sensata Technologies, Inc., Sensirion AG, Silicon Sensing Systems Limited, Sony Semiconductor Solutions Corporation, MEMSIC Semiconductor Co., Ltd., Movella Inc., Senodia Technologies (Shanghai) Co., Ltd., and STMicroelectronics N.V. Goertek unveils its first smart interactive bracelet reference design for smart glasses, delivering a more immersive visual experience On 5 May 2023. Also, the Lightest and Thinnest Goertek Optics Released a New Generation of Small-size and High-performance AR Display Modules on 9 June 2023. The key players in the global market majorly focus on mergers and acquisitions for portfolio expansion. The companies majorly invest in research and development and the adoption of advanced technology. Those all factors boost overall growth. Based on Technology, Machine learning technology dominates the market growth in the year 2022. Machine learning is a form of AI that can perform a specific task without being explicitly programmed, instead relying on patterns and inferences. Large data sets are collected quickly and cleansed in a structured sequence of steps using networks to determine relevancy and improve accuracy with each data point, providing additional layers of intelligence. The machine operates on diversified learning patterns to accomplish a desired task most efficiently. Machine learning platforms have become foundational to real-time predictive analytics that allows users to better mitigate risks and monitor controls. Due to this factor Machine learning technology has largely been adopted in AI Sensors.Based on Application, The Healthcare segment dominates the Application segment of the Market. In the aftermath of a pandemic, sensor technology's use in the healthcare sector is considerably more obvious. The use of sensor technology in healthcare is more common than ever with the advent of broad digitization and medical facilities transitioning to digital platforms for a number of activities. For instance, sensors are being employed to detect patient movement and monitor vital signs. Life-sustaining implants and other medical devices are made smarter and are better able to track the patient's condition in real-time thanks to sensor technology. The development of such medical gadgets is being accelerated by the expanding population and technological breakthroughs. These advancements are overcoming the difficulty of real-time monitoring and ongoing surveillance of the patient's vitals with the use of sensor technology.

Regional insight: North America region dominates the AI Sensor Market in the year 2022. North America is a significant market for AI Sensors due to the presence of major technological companies. Also, the countries like US, Canada, and Mexico adopted advanced technology and invest huge amounts in research and development. The region witnessed a strong position across the industries such as healthcare, and automotive as well as smart homes. The United States is the major market for AI sensors in North America.Asia Pacific region is the fastest-growing market for AI sensors. Emerging economies such as India, and China rapidly expanding the industrial sector and growing investment in AI technology. The Increasing Adoption of AI Sensorsin Manufacturing, robotics, and smart cities. The region's large population, increasing urbanization, and rising disposable incomes are contributing to the demand for AI sensor applications in areas like consumer electronics, healthcare, and transportation.

AI Sensors Market Scope: Inquire before buying

Global AI Sensors Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 2.92 Bn. Forecast Period 2023 to 2029 CAGR: 35 % Market Size in 2029: US $ 23.86 Bn. Segments Covered: by Sensor Type Motion Sensor Pressure Sensor Temperature Sensor Optical Sensor Others by Type Neural Networks Case-based Reasoning Inductive Learning Ambient-Intelligence by Application Automotive Consumer Electronics Manufacturing Healthcare Others by Technology Machine Learning Natural Language Processing Context-Aware Computing Computer Vision AI Sensors Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)AI Sensor Market Key Players

1. Teledyne Technologies Incorporated 2. Robert Bosch GmbH 3. Goertek Inc. 4. Baidu, Inc. 5. Yokogawa Electric Corporation 6. Excelitas Technologies Corp. 7. Hokuriku Electric Industry Co., Ltd. 8. Sensata Technologies, Inc. 9. Sensirion AG 10. Silicon Sensing Systems Limited 11. Sony Semiconductor Solutions Corporation 12. MEMSIC Semiconductor Co., Ltd. 13. Movella Inc. 14. Senodia Technologies (Shanghai) Co., Ltd., 15. STMicroelectronics N.V.R Frequently Asked Questions: 1] What segments are covered in the Global AI Sensor Market report? Ans. The segments covered in the AI Sensor Market report are based on Sensor Type, Type, Application, Technology, and Region. 2] Which region is expected to hold the highest share in the Global AI Sensor Market? Ans. The North America region is expected to hold the highest share of the AI Sensor Market. 3] What is the market size of the Global AI Sensor Market by 2029? Ans. The market size of the AI Sensor Market by 2029 is expected to reach US$ 23.86 Bn. 4] What is the forecast period for the Global AI Sensor Market? Ans. The forecast period for the AI Sensor Market is 2023-2029. 5] What was the market size of the Global AI Sensor Market in 2022? Ans. The market size of the AI Sensor Market in 2022 was valued at US$ 2.92 Bn.

Table of Content 1. AISensor Market: Research Methodology 2. AI Sensor Market: Executive Summary 3. AI Sensor Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. AI Sensor Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. AI Sensor Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. AI Sensor Market Size and Forecast, by Sensor Type (2022-2029) 5.1.1. Motion Sensor 5.1.2. Pressure Sensor 5.1.3. Temperature Sensor 5.1.4. Optical Sensor 5.1.5. Other 5.2. AI Sensor Market Size and Forecast, by Type (2022-2029) 5.2.1. Neural Networks 5.2.2. Case-based Reasoning 5.2.3. Inductive Learning 5.2.4. Ambient-Intelligence 5.3. AI Sensor Market Size and Forecast, by Application (2022-2029) 5.3.1. Automotive 5.3.2. Consumer Electronics 5.3.3. Manufacturing 5.3.4. Healthcare 5.3.5. Others 5.4. AI Sensor Market Size and Forecast, by Technology (2022-2029) 5.4.1. Machine Learning 5.4.2. Natural Language Processing 5.4.3. Context-Aware Computing 5.4.4. Computer Vision 5.5. AI Sensor Market Size and Forecast, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America AI Sensor Market Size and Forecast (by Value USD and Volume Units) 6.1. North America AI Sensor Market Size and Forecast, by Sensor Type (2022-2029) 6.1.1. Motion Sensor 6.1.2. Pressure Sensor 6.1.3. Temperature Sensor 6.1.4. Optical Sensor 6.1.5. Other 6.2. North America AI Sensor Market Size and Forecast, by Type (2022-2029) 6.2.1. Neural Networks 6.2.2. Case-based Reasoning 6.2.3. Inductive Learning 6.2.4. Ambient-Intelligence 6.3. North America AI Sensor Market Size and Forecast, by Application (2022-2029) 6.3.1. Automotive 6.3.2. Consumer Electronics 6.3.3. Manufacturing 6.3.4. Healthcare 6.3.5. Others 6.4. North America AI Sensor Market Size and Forecast, by Technology (2022-2029) 6.4.1. Machine Learning 6.4.2. Natural Language Processing 6.4.3. Context-Aware Computing 6.4.4. Computer Vision 6.5. North America AI Sensor Market Size and Forecast, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe AI Sensor Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe AI Sensor Market Size and Forecast, by Sensor Type (2022-2029) 7.1.1. Motion Sensor 7.1.2. Pressure Sensor 7.1.3. Temperature Sensor 7.1.4. Optical Sensor 7.1.5. Other 7.2. Europe AI Sensor Market Size and Forecast, by Type (2022-2029) 7.2.1. Neural Networks 7.2.2. Case-based Reasoning 7.2.3. Inductive Learning 7.2.4. Ambient-Intelligence 7.3. Europe AI Sensor Market Size and Forecast, by Application (2022-2029) 7.3.1. Automotive 7.3.2. Consumer Electronics 7.3.3. Manufacturing 7.3.4. Healthcare 7.3.5. Others 7.4. Europe AI Sensor Market Size and Forecast, by Technology (2022-2029) 7.4.1. Machine Learning 7.4.2. Natural Language Processing 7.4.3. Context-Aware Computing 7.4.4. Computer Vision 7.5. Europe AI Sensor Market Size and Forecast, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific AI Sensor Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific AI Sensor Market Size and Forecast, by Sensor Type (2022-2029) 8.1.1. Motion Sensor 8.1.2. Pressure Sensor 8.1.3. Temperature Sensor 8.1.4. Optical Sensor 8.1.5. Other 8.2. Asia Pacific AI Sensor Market Size and Forecast, by Type (2022-2029) 8.2.1. Neural Networks 8.2.2. Case-based Reasoning 8.2.3. Inductive Learning 8.2.4. Ambient-Intelligence 8.3. Asia Pacific AI Sensor Market Size and Forecast, by Application (2022-2029) 8.3.1. Automotive 8.3.2. Consumer Electronics 8.3.3. Manufacturing 8.3.4. Healthcare 8.3.5. Others 8.4. Asia Pacific AI Sensor Market Size and Forecast, by Technology (2022-2029) 8.4.1. Machine Learning 8.4.2. Natural Language Processing 8.4.3. Context-Aware Computing 8.4.4. Computer Vision 8.5. Asia Pacific AI Sensor Market Size and Forecast, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa AI Sensor Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa AI Sensor Market Size and Forecast, by Sensor Type (2022-2029) 9.1.1. Motion Sensor 9.1.2. Pressure Sensor 9.1.3. Temperature Sensor 9.1.4. Optical Sensor 9.1.5. Other 9.2. Middle East and Africa AI Sensor Market Size and Forecast, by Type (2022-2029) 9.2.1. Neural Networks 9.2.2. Case-based Reasoning 9.2.3. Inductive Learning 9.2.4. Ambient-Intelligence 9.3. Middle East and Africa AI Sensor Market Size and Forecast, by Application (2022-2029) 9.3.1. Automotive 9.3.2. Consumer Electronics 9.3.3. Manufacturing 9.3.4. Healthcare 9.3.5. Others 9.4. Middle East and Africa AI Sensor Market Size and Forecast, by Technology (2022-2029) 9.4.1. Machine Learning 9.4.2. Natural Language Processing 9.4.3. Context-Aware Computing 9.4.4. Computer Vision 9.5. Middle East and Africa AI Sensor Market Size and Forecast, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America AI Sensor Market Size and Forecast (by Value USD and Volume Units) 10.1. South America AI Sensor Market Size and Forecast, by Sensor Type (2022-2029) 10.1.1. Motion Sensor 10.1.2. Pressure Sensor 10.1.3. Temperature Sensor 10.1.4. Optical Sensor 10.1.5. Other 10.2. South America AI Sensor Market Size and Forecast, by Type (2022-2029) 10.2.1. Neural Networks 10.2.2. Case-based Reasoning 10.2.3. Inductive Learning 10.2.4. Ambient-Intelligence 10.3. South America AI Sensor Market Size and Forecast, by Application (2022-2029) 10.3.1. Automotive 10.3.2. Consumer Electronics 10.3.3. Manufacturing 10.3.4. Healthcare 10.3.5. Others 10.4. South America AI Sensor Market Size and Forecast, by Technology (2022-2029) 10.4.1. Machine Learning 10.4.2. Natural Language Processing 10.4.3. Context-Aware Computing 10.4.4. Computer Vision 10.5. South America AI Sensor Market Size and Forecast, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Teledyne Technologies Incorporated 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Robert Bosch GmbH 11.3. Goertek Inc. 11.4. Baidu, Inc. 11.5. Yokogawa Electric Corporation 11.6. Excelitas Technologies Corp. 11.7. Hokuriku Electric Industry Co., Ltd. 11.8. Sensata Technologies, Inc. 11.9. Sensirion AG 11.10. Silicon Sensing Systems Limited 11.11. Sony Semiconductor Solutions Corporation 11.12. MEMSIC Semiconductor Co., Ltd. 11.13. Movella Inc. 11.14. Senodia Technologies (Shanghai) Co., Ltd., 11.15. STMicroelectronics N.V. 12. Key Findings 13. Industry Recommendation