Aesthetic Medical Devices Market size was valued at USD 21.39 Billion in 2023 and the total Aesthetic Medical Devices revenue is expected to grow at a CAGR of 12.8% from 2024 to 2030, reaching nearly USD 49.72 Billion.Aesthetic Medical Devices Market Overview:

Aesthetics Medical refers to the application of different therapies to improve the aesthetic appearance of an individual by removing characteristics such as excess fat, skin laxity, stretchmarks, moles, scars, unnecessary hair, dark spots, skin discoloration, and wrinkles. Aesthetic medicine involves surgical and non-surgical methods to improve a person's physical appearance. Besides that, deformities caused by trauma, accident, or other congenital diseases are rectified through the use of medical aesthetic devices or implants. The adoption of aesthetic medical devices has become increasingly popular among the young generation over the years. It is now the most popular medical procedure for retaining attractiveness or, to some extent, reversing the aging process. In today's highly advanced technological world, the medical aesthetic is significantly increasing, and a rising number of individuals are conscious of the advantages of such treatments and how they may enhance living. People now have more alternatives than ever before thanks to cutting-edge technology finding their way into the world of medical aesthetics, hence boosting the aesthetic medical devices market growth. The rise in the prevalence of congenital facial and dental deformities, as well as the increased awareness of aesthetic appearance, boosts the aesthetic medical devices market growth. Aesthetic treatments have grown in popularity throughout the years. Since its introduction in the 1990s, invasive cosmetic surgery has not become one of the most popular surgical procedures to enhance looks and lifestyle. Additionally, with the advancement of new technologies and medical aesthetic devices, the procedures frequently provide immediate, apparent effects at substantial costs. This has resulted in a rise in the number of individuals seeking noninvasive procedures including Platelet-Rich Plasma (PRP), medical facials, skin tightening, and body sculpting. The impact of social media, as well as increasing knowledge of the benefits of such treatments, have raised the demand for medical aesthetic devices and increased the aesthetic devices market growth.Aesthetic Medical Devices Market Trends:

High Demand for PRP (Platelet-Rich Plasma) Treatments in the Aesthetic Medical Devices Market Treatments using Platelet-Rich Plasma (PRP) are commonly utilized for face rejuvenation, acne scarring, and hair loss. PRP treatments are perfect for treating fine lines, wrinkles, sagging skin, and uneven-tone skin when it comes to boosting aesthetics and combating the indications of aging. PRP treatments utilize the patient's blood to stimulate collagen formation and give the patient a younger appearance. PRP therapy has grown in popularity since it is an allergy-free, all-natural procedure. In terms of preventing hair loss, PRP is most effective since it induces inflammatory reactions that stimulate growth factors that prevent hair loss. Additionally, PRP treatments provide benefits within a few days, while outcomes may vary from patient to patient. Non-surgical fat reduction People choose non-surgical therapies because they need less recovery time, have better outcomes, and cause less discomfort. As a result, the nonsurgical fat reduction has become the most popular and long-lasting trend in the aesthetic medical devices market. These therapies target fat cells in troublesome parts of the body such as the belly, thighs, upper arms, and bottom. These non-surgical body contouring treatments do not include laser fat removal techniques or anesthesia, sutures, incisions, or a lengthy recuperation period.To know about the Research Methodology :- Request Free Sample Report

Aesthetic Medical Devices Market Competitive Landscape:

The aesthetic medical devices market is highly fragmented with many domestic players competing with global leaders of the market. However, a stringent regulatory certification procedure makes it difficult for new devices/ implants to enter the market. The increasing adoption of new technology for superior medication and technological advancement are the primary factors influencing rivalry among players. Leading firms have used mergers and acquisitions as a crucial strategy to maintain their position in the market. In December 2021, Allergen Aesthetics, a division of AbbVie, purchased Soliton, Inc., a medical technology firm. This purchase is intended to expand its non-invasive body sculpting therapy range. In September 2020, Allergan Aesthetics, a division of AbbVie, and Skinbetter Science have announced the start of the DREAM: Driving Racial Equity in Aesthetic Medicine program. The Dream Initiative™ is dedicated to promoting racial and cultural diversity, inclusiveness, respect, and understanding in the disciplines of plastic surgery and dermatology. Galderma announced a large investment in its aesthetic portfolio in March 2020, including the growth of its US salesforce and digital developments in ASPIRE Galderma Rewards. These investments have helped it to improve its position in the aesthetics medical devices market. Revelle Aesthetics, Inc., a Med Tech firm focused on redesigning precision technologies, has introduced AvéliTM, a unique aesthetic medical device. For years, the firm has been focusing on developing smart aesthetic gadgets that provide beneficial outcomes for both women and healthcare practitioners. Such advancements have piqued the interest of both customers and investors, driving the growth of the aesthetic medical devices market. Several start-ups have received million-dollar investments in recent years to create revolutionary medical aesthetic devices that need minimally invasive treatments. Additionally, manufacturers and researchers have concentrated on extending the life of aesthetic implants through the introduction of novel coatings and materials. A team of Australian researchers from Flinders University, RMIT, and Swinburne University, for example, has developed a novel method for improving the antimicrobial resistance of aesthetic implants and extending their life. These all factors are expected to influence the aesthetic medical devices market growth during the forecast period.

Aesthetic Medical Devices Market Dynamics:

Increasing minimally invasive and noninvasive aesthetic surgeries The increasing number of aesthetic procedures with minimally invasive and noninvasive aesthetic techniques for improving physical appearance is expected to be the primary growth driver for the global aesthetic medical devices market as it generates a high demand for the devices. A significant population of people receiving cosmetic treatments for physical applications such as hair procedures, tattoos, skin resurfacing, and the reduction of fine lines, wrinkles, and dark spots, leads to strong product demand. The number of minimally invasive cosmetic operations has surged by 200% since 2000, with no signs of slowing. The growing geriatric population, as well as an enhanced lifestyle that necessitates better physical appearance, is expected to make a significant contribution to the market's growth. In addition, rapidly increasing disposable income, growing social awareness, high demand for these surgeries in the entertainment industry, rising prevalence of breast cancer, government initiatives in developing countries, and an increase in the number of traumatic injuries requiring reconstructive changes are expected to increase the prevalence of these surgeries, thereby aiding the market growth. Besides that, Technological developments and unique product acceptance are expected to increase the demand for the aesthetic medical devices market during the forecast period.For example, Alma Lasers reported the FDA authorization of Alma Hybrid for skin resurfacing in July 2022. The increasing use of advanced devices among consumers is expected to drive up demand for such devices. The increasing acceptance of technical improvements in devices, as well as a shift in preference from conventional to modern approaches, are expected to drive the growth of the aesthetic medical devices market throughout the forecast period. High Cost of aesthetic medical devices The high cost of aesthetic medical devices and aesthetic treatments is expected to restrain the aesthetic medical devices market growth. The expenditure of treatments for a prolonged period of time is challenging for the common person to afford. The use of critical care and intensive care unit services is increasing significantly around the world, and the high cost of these treatments is a critical concern in today's healthcare system. Modern energy-based technologies that use advanced modalities such as plasma, laser, and others assist in tone and tightening specific body areas by eliminating fats. The price of energy-based devices differs significantly depending on their efficiency, lifespan, and company. The primary aspects that influence the cost of aesthetic surgeries are the medical institution or clinic used for the treatment, the technology utilized, the affected areas, the length of the patient's stay, and the complexity of the procedure, among others. The procedure's high cost is owing to the multiple checkpoints of the surgery, as well as the utilization of high-tech modalities to accomplish such treatments. Because the cost of highly technological aesthetic medical devices is high, the treatment cost rises accordingly, and the high cost of the surgery is expected to hamper the aesthetic medical devices market growth during the forecast period. Meanwhile, even though botulinum toxin has multiple therapeutic and cosmetic uses, the high cost and different adverse effects of botulinum toxin are expected to limit the growth of the aesthetic medical devices market during the forecast period. For example, the average cost of botox (100 Unit Vials) in the United States (North America) is roughly USD 437. Growing incidences of adverse consequences from cosmetic surgery, as well as the high costs of products and technologies, are expected to restrain the market growth.

Aesthetic Medical Devices Market Segment Analysis:

Based on the Product, the Facial Aesthetic Devices segment held the largest revenue share of 33.4% of the global aesthetic medical devices market in 2023. The segment is further expected to grow at a CAGR of 11.8% during the forecast period and offers high growth potential for leading market players. The number of minimally invasive facial aesthetic procedures performed annually continues to increase worldwide. In 2017, more than 8.5 million nonsurgical injection procedures were performed globally, an increase of almost 850 000 from 2015. As a result, the rise in facial aesthetic surgeries/ treatments is expected to increase segment growth during the forecast period. The Botulinum toxin subsegment is expected to hold the largest market share and dominate the aesthetic medical devices market by 2030. The bacteria Clostridium botulinum produces botulinum toxin, a neurotoxic protein. Botulinum toxin injections are known to block nerve impulses to the muscle into which they are administered. As the muscle/ tissue cannot bind without a signal, it reduces or decreases unnecessary facial wrinkles or appearance. As a result, much-diluted botulinum toxin concentrations are utilized for both cosmetic and non-cosmetic applications, such as treating frown lines between the eyebrows, dystonia, chronic migraine, and other conditions. Factors such as the popularity of botulinum toxin operations among young adults, the rise in demand for less invasive cosmetic methods, an increase in the number of beauty-conscious populations, and product launches are boosting segment growth during the forecast period.Botulinum toxin Type A has become one of the popular minimally invasive cosmetic treatments among patients in 2022-2023, according to the MMR analysis. It is also estimated that individuals between the ages of 31 and 45 are the most likely to pursue botulinum toxin-type cosmetic treatments. Additionally, according to an ISAPS report issued in December 2022, 43.2% of all non-surgical cosmetic treatments performed globally in 2020 were Botulinum Toxin therapies. It was said that 6,213,859 botulinum toxin operations were carried out. Such an increasing adoption of botulinum toxin surgeries is expected to generate high demand for it and thus drive the growth of the market segment. The market's top companies are also investing more in the import and export of botulinum toxin goods, as well as in technical improvements. For example, Revance Therapeutics Inc. gained FDA clearance for DAXXIFY (DaxibotulinumtoxinA-land) for injection in September 2022 for the temporary treatment of moderate to severe frown lines (glabellar lines) in adults. This is also expected to support segment growth.

Aesthetic Medical Devices Market Regional Insights:

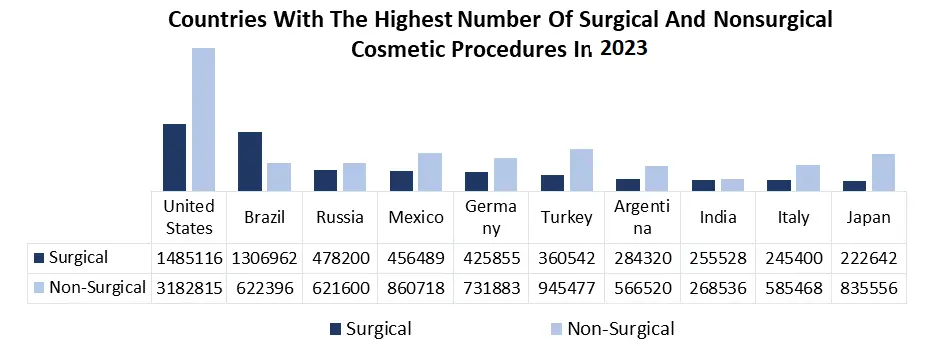

The North American region held the largest market share of 36.5% of the global aesthetic medical devices market in 2022. The region is expected to grow at the highest CAGR and is expected to maintain its dominance in terms of value and volume by 2029. The increasing number of aesthetic surgeries, the high number of minimally invasive procedures, increasing consciousness about physical appearances & beauty treatments, and the rising adoption of technologically advanced devices in the region are expected to be the key factors driving the North American Aesthetic Medical Devices Market growth during the forecast period. In addition, the high presence of leading players is expected to be the primary growth factor for regional growth. The increased number of aesthetic surgeries in the region is expected to generate high demand for aesthetic devices, hence driving the aesthetic medical devices market growth in the North American region. According to the MMR survey 2022, approximately 1.4 million surgical and non-surgical treatments were performed in the United States in 2022, a 40% increase over operations conducted in the previous year. Additionally, 860,718 cosmetic operations were conducted in Mexico 2022 in December, with 456,489 being aesthetic surgical procedures and 404,229 being non-surgical aesthetic procedures. The region's high concentration of major companies, rising adoption of technological advancements, and innovation associated with product launches all play important roles in the region's market growth. For example, in April 2022, Alma Lasers introduced Alma PrimeX, the final non-invasive marketplace for body contouring and skin rejuvenation. Additionally, strategic approaches adopted by market players to improve their position contribute to the region's market growth. For example, NanoPass Technologies and Aesthetic Management Partners (AMP) entered a deal in November 2022 to commercialize NanoPass' MicronJet 600 intradermal delivery device in the United States.The U.S. market dominated the aesthetic medical devices market in terms of value and volume in 2022. The country is expected to generate high growth potential for market players during the forecast period. The increased number of cosmetic treatments across the country is because of the rising awareness about physical appearances and the rise in the launch of technologically advanced devices in the country is expected to be the major growth driver for the market. According to the International Society of Aesthetic Plastic Surgery 2019, around 1.4 million surgical and 2.6 million non-surgical treatments were performed in the United States. Additionally, the increase in investment for various companies is aiding the country's growth in these markets. For example, Cartessa Aesthetics, a business created in 2017, received USD 35 million in April 2021 to assist the firm's rapid growth, including distribution, marketing, and the launch of new technologies.

Aesthetic Medical Devices Market Scope: Inquiry Before Buying

Aesthetic Medical Devices Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 21.39 Billion. Forecast Period 2024 to 2030 CAGR: 12.8% Market Size in 2030: USD 49.72 Billion. Segments Covered: by Product 1. Facial Aesthetic Devices 1. Botulinum toxin 2. Derma Fillers 3. Microdermabrasion products 4. Chemical peels 2. Cosmetic Implants 1. Breast implants 2. Gluteal implants 3. Facial implants 3.Skin Aesthetic Devices 1. Nonsurgical skin tightening devices 2. Laser skin resurfacing devices 3. Microneedling products 4. Light therapy devices 4. Body Contouring Devices 1. Nonsurgical fat reduction devices 2. Cellulite reduction devices 3. Liposuction devices 5. Physician-Dispensed Cosmeceuticals & Skin Lighteners 6. Hair Removal Devices 1. LASER hair removal devices 2. IPL hair removal devices 7. Tattoo Removal Devices 8. Thread Lift Products 9. Physician-Dispensed Eyelash Products 10. Nail Treatment laser Devices by Technology 1. Radiofrequency technology 2. Microcurrent Technology 3. Ultrasound Technology 4. Laser Technology 5. Plasma Therapy by End User 1. Clinics, Hospitals, And Medical Spas 2. Beauty Centers 3. Home Care Settings 4. Others Aesthetic Medical Devices Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Aesthetic Medical Devices Market, Key Players are:

1. Mentor Worldwide LLC (Johnson & Johnson) (U.S.) 2. Syneron Medical Ltd. (Candela Corporation) (U.S.) 3. Sciton, Inc. (U.S.) 4. Fotona (U.S.) 5. Solta Medical (Valeant Pharmaceuticals) (U.S.) 6. BTL INDUSTRIES, Inc. (U.S.) 7. Genesis Biosystems, Inc. (U.S.) 8. Implantech (U.S.) 9. Galderma (Switzerland) 10. Cutera Inc. (U.S.) 11. Venus Concept (Canada) 12. Lutronic (U.S.) 13. Sientra Inc. (California) 14. Aesthetic Management Partners (U.S.) 15. Cartessa Aesthetic (U.S.) 16. Apyx Medical (U.S.) 17. Zimmer Biomet (U.S.) 18. Implantech (U.S.) 19. GALDERMA Laboratories (U.S.) 20. Candela Corporation (U.S.) 21. Cynosure (U.S.) 22. Viora (New York) 23. Alma Lasers (Fosun Pharmaceutical Co., Ltd.) (Chicago) 24. Hologic, Inc. (U.S.) 25. Novartis AG (Switzerland) 26. Allergan plc (AbbVie Inc.) (Ireland) 27. Merz Pharma (Germany) 28. El.En. (Italy) 29. Lumenis Ltd. (Israel) 30. Bausch Health Companies Inc. (Germany) 31. InMode (Israel) 32. Anika Therapeutics, Inc. 33. Ulthera (India) FAQs: 1. What are the growth drivers for the Aesthetic Medical Devices market? Ans. The rise in the prevalence of congenital facial and dental deformities, as well as the increased awareness of aesthetic appearance are expected to be the major driver for the Aesthetic Medical Devices market. 2. What is the major restraint for the Aesthetic Medical Devices market growth? Ans. The High Cost of aesthetic medical devices are expected to be the major restraining factor for the Aesthetic Medical Devices market growth. 3. Which region is expected to lead the global Aesthetic Medical Devices market during the forecast period? Ans. The North American region is expected to lead the global Aesthetic Medical Devices market during the forecast period due to the increasing number of aesthetic surgeries, the high number of minimally invasive procedures, increasing consciousness about physical appearances & beauty treatments, and the rising adoption of technologically advanced devices in the region. 4. What is the projected market size & growth rate of the Aesthetic Medical Devices Market? Ans. The Aesthetic Medical Devices Market size was valued at USD 21.39 Billion in 2023 and the total Aesthetic Medical Devices revenue is expected to grow at a CAGR of 12.8% from 2024 to 2030, reaching nearly USD 49.72 Billion. 5. What segments are covered in the Aesthetic Medical Devices Market report? Ans. The segments covered in the Aesthetic Medical Devices market report are Product, Technology, End User, and Region.

1. Global Aesthetic Medical Devices Market: Research Methodology 2. Global Aesthetic Medical Devices Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Aesthetic Medical Devices Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Aesthetic Medical Devices Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Aesthetic Medical Devices Market Segmentation 4.1 Global Aesthetic Medical Devices Market, by Product (2023-2030) • Facial Aesthetic Devices o Botulinum toxin o Derma Fillers o Microdermabrasion products o Chemical peels • Cosmetic Implants o Breast implants o Gluteal implants o Facial implants • Skin Aesthetic Devices o Nonsurgical skin tightening devices o Laser skin resurfacing devices o Microneedling products o Light therapy devices • Body Contouring Devices o Nonsurgical fat reduction devices o Cellulite reduction devices o Liposuction devices • Physician-Dispensed Cosmeceuticals & Skin Lighteners • Hair Removal Devices o LASER hair removal devices o IPL hair removal devices • Tattoo Removal Devices • Thread Lift Products • Physician-Dispensed Eyelash Products • Nail Treatment laser Devices 4.2 Global Aesthetic Medical Devices Market, by Technology (2023-2030) • Radiofrequency technology • Microcurrent Technology • Ultrasound Technology • Laser Technology • Plasma Therapy 4.3 Global Aesthetic Medical Devices Market, by End User (2023-2030) • Clinics, Hospitals, And Medical Spas • Beauty Centers • Home Care Settings • Others 5. North America Aesthetic Medical Devices Market(2023-2030) 5.1 North America Aesthetic Medical Devices Market, by Product (2023-2030) • Facial Aesthetic Devices o Botulinum toxin o Derma Fillers o Microdermabrasion products o Chemical peels • Cosmetic Implants o Breast implants o Gluteal implants o Facial implants • Skin Aesthetic Devices o Nonsurgical skin tightening devices o Laser skin resurfacing devices o Microneedling products o Light therapy devices • Body Contouring Devices o Nonsurgical fat reduction devices o Cellulite reduction devices o Liposuction devices • Physician-Dispensed Cosmeceuticals & Skin Lighteners • Hair Removal Devices o LASER hair removal devices o IPL hair removal devices • Tattoo Removal Devices • Thread Lift Products • Physician-Dispensed Eyelash Products • Nail Treatment laser Devices 5.2 North America Aesthetic Medical Devices Market, by Technology (2023-2030) • Radiofrequency technology • Microcurrent Technology • Ultrasound Technology • Laser Technology • Plasma Therapy 5.3 North America Aesthetic Medical Devices Market, by End User (2023-2030) • Clinics, Hospitals, And Medical Spas • Beauty Centers • Home Care Settings • Others 5.4 North America Aesthetic Medical Devices Market, by Country (2023-2030) • United States • Canada • Mexico 6. Europe Aesthetic Medical Devices Market (2023-2030) 6.1. European Aesthetic Medical Devices Market, by Product (2023-2030) 6.2. European Aesthetic Medical Devices Market, by Technology (2023-2030) 6.3. European Aesthetic Medical Devices Market, by End User (2023-2030) 6.4. European Aesthetic Medical Devices Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Aesthetic Medical Devices Market (2023-2030) 7.1. Asia Pacific Aesthetic Medical Devices Market, by Product (2023-2030) 7.2. Asia Pacific Aesthetic Medical Devices Market, by Technology (2023-2030) 7.3. Asia Pacific Aesthetic Medical Devices Market, by End User (2023-2030) 7.4. Asia Pacific Aesthetic Medical Devices Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Aesthetic Medical Devices Market (2023-2030) 8.1 Middle East and Africa Aesthetic Medical Devices Market, by Product (2023-2030) 8.2. Middle East and Africa Aesthetic Medical Devices Market, by Technology (2023-2030) 8.3. Middle East and Africa Aesthetic Medical Devices Market, by End User (2023-2030) 8.4. Middle East and Africa Aesthetic Medical Devices Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Aesthetic Medical Devices Market (2023-2030) 9.1. South America Aesthetic Medical Devices Market, by Product (2023-2030) 9.2. South America Aesthetic Medical Devices Market, by Technology (2023-2030) 9.3. South America Aesthetic Medical Devices Market, by End User (2023-2030) 9.4 South America Aesthetic Medical Devices Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Allergan plc (AbbVie Inc.) (Ireland) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Mentor Worldwide LLC (Johnson & Johnson) (U.S.) 10.3 Alma Lasers (Fosun Pharmaceutical Co., Ltd.) (Chicago) 10.4 Hologic, Inc. (U.S.) 10.5 Novartis AG (Switzerland) 10.6 Syneron Medical Ltd. (Candela Corporation) (U.S.) 10.7 Sciton, Inc. (U.S.) 10.8 Fotona (U.S.) 10.9 Solta Medical (Valeant Pharmaceuticals) (U.S.) 10.10 Ulthera (India) 10.11 BTL INDUSTRIES, Inc. (U.S.) 10.12 Genesis Biosystems, Inc. (U.S.) 10.13 Implantech (U.S.) 10.14 Galderma (Switzerland) 10.15 Merz Pharma (Germany) 10.16 El.En. (Italy) 10.17 Cutera Inc. (U.S.) 10.18 Venus Concept (Canada) 10.19 Lutronic (U.S.) 10.20 Lumenis Ltd. (Israel) 10.21 Bausch Health Companies Inc. (Germany) 10.22 Candela Corporation (U.S.) 10.23 InMode (Israel) 10.24 Cynosure (U.S.) 10.25 Anika Therapeutics, Inc. 10.26 GALDERMA Laboratories 10.27 Viora (New York) 10.28 Sientra Inc. (California) 10.29 Aesthetic Management Partners (U.S.) 10.30 Cartessa Aesthetic (U.S.) 10.31 Apyx Medical (U.S.) 10.32 Zimmer Biomet (U.S.) 10.33 Implantech (U.S.)