Global Aerospace Robotics Service Market size was valued at USD 4.73 Bn in 2023 and is expected to reach USD 7.22 Bn by 2030, at a CAGR of 6.20% from forecast 2024 to 2030.Aerospace Robotics Service Market Overview

The aerospace robotics service market is showcasing strong growth due to the rising demand for automation and enhanced efficiency within the aerospace industry. The main factors that drive the market are advancements in technology of robotics and AI. This improves productivity, safety, and cost-effectiveness in operations of aerospace. Cobots (collaborative robots) gain popularity as they allow humans and robots to work together safely and efficiently. The integration of AI and machine learning algorithms is enhancing the capabilities of aerospace robots. This enables them to adapt to changing conditions and perform complex tasks with much more independency. North America and Europe currently dominate the market, given their established aerospace industries and advanced infrastructure. The Asia-Pacific region is emerging as a key growth area, driven by the expansion of aerospace manufacturing capabilities and the adoption of robotics in countries such as China, Japan, and India. Despite the challenges posed by the COVID-19 pandemic, the long-term outlook for the aerospace robotics service market remains positive, as the industry gradually recovers and seeks automation solutions to enhance resilience and competitiveness.To know about the Research Methodology :- Request Free Sample Report

Aerospace Robotics Service Market Dynamics

Driving Forces Behind the Growth of the Aerospace Robotics Service Market: Automation and Efficiency, Technological Advancements, Increasing Complexity of Aerospace Operations, and Global Aerospace Industry Expansion The aerospace robotics service market is witnessing significant growth driven by key factors. companies adopt robotics solutions for enhanced productivity and cost reduction because of the increasing demand for automation and improved efficiency within the aerospace industry. Advancements in technology like robotics, artificial intelligence (AI), and automation software, have revolutionized the sector by developing advanced robots capable of performing complex tasks with precision and adaptability. The increasing complexity of aerospace operations along with the expansion of the global aerospace industry, further drives the demand for robotics services. As aircraft and spacecraft designs become more sophisticated, specialized robotics solutions are required to handle intricate manufacturing processes, detailed inspections, and precise maintenance tasks. This market growth presents opportunities for robotics service providers to cater to the evolving needs of the aerospace industry, ensuring streamlined operations, improved productivity, and enhanced safety. With the aerospace industry continuously evolving, the aerospace robotics service market is poised for further expansion and technological innovation. All these factors are expected to accelerate the market growth rate in the next few years. Unleashing Growth Potential: Customization, E-commerce, Smart Technologies, and Sustainability in the Aerospace Robotics Service Market The aerospace robotics service market presents lucrative growth opportunities for providers to meet evolving demands. Customization allows for tailored robotics solutions that align with specific aerospace requirements, while expanding into e-commerce enables broader market reach and convenience. Integration of smart technologies enhances productivity and adaptability, catering to the rising demand for automation in the aerospace industry. Sustainability initiatives like using recycled materials and implementing energy-efficient processes, align with consumer preferences for eco-friendly options. By capitalizing on these opportunities, providers can enhance customer satisfaction, drive market penetration, and foster long-term partnerships. With customization, e-commerce expansion, smart technologies, and sustainability at the forefront, aerospace robotics service providers can differentiate themselves, strengthen brand reputation, and achieve substantial growth in the competitive market. These are all major factors that could impede revenue growth in the market. Addressing Challenges and Restraints in the Aerospace Robotics Service Market: Integration Complexity, Cost Constraints, Regulatory Compliance, and Security Concerns The aerospace robotics service market encounters several challenges and restraints that require strategic approaches to overcome and foster growth in the industry. One key challenge is the complexity of integrating robotics solutions into aerospace operations. Providers must possess expertise in navigating intricate integration processes, collaborating closely with clients to ensure seamless implementation that aligns with existing infrastructure and operations. Cost constraints pose another significant challenge in the aerospace robotics service market. The high initial investment associated with robotics technology and integration can deter some companies from adoption. Providers must address this challenge by offering flexible pricing models and demonstrating long-term cost benefits such as increased efficiency, reduced labour costs, and enhanced productivity, to justify the value proposition. Regulatory compliance is a critical restraint in the aerospace robotics service market due to the stringent regulations and safety standards governing the industry. Providers must ensure that their robotics solutions adhere to all relevant regulations and obtain necessary certifications, instilling confidence in clients and enabling compliance with legal requirements. Security concerns also pose ongoing challenges in the aerospace robotics service market. As robotics systems become more interconnected and integrated into critical aerospace operations, the risk of cyber threats and data breaches increases. Providers must prioritize robust cybersecurity measures, including encryption protocols, secure communication channels, and regular vulnerability assessments, to safeguard sensitive data and protect against potential attacks. Emerging Market Trends in the Aerospace Robotics Service Industry: Autonomous Systems, AI Integration, Industry 4.0, and Safety Enhancements The aerospace robotics service industry is witnessing significant market trends that are transforming the sector. The integration of autonomous systems and artificial intelligence (AI) is gaining prominence, enabling the development of unmanned aerial vehicles (UAVs) and autonomous ground vehicles. These systems operate with minimal human intervention and leverage AI algorithms for advanced decision-making capabilities. Industry 4.0, characterized by automation, data exchange, and digital technologies, is making its mark in the aerospace robotics service market. Connectivity, real-time data analytics, and cloud-based solutions are enhancing robotics services by enabling predictive maintenance, remote monitoring, and optimized resource allocation. This integration improves operational efficiency and cost optimization in the aerospace industry. Safety enhancements are a key focus in the market, driven by the complex and high-stakes nature of aerospace operations. Robotics systems are incorporating advanced sensor technologies, sophisticated algorithms, and collision avoidance systems to mitigate risks and ensure safe operations in aerospace environments. Collaboration between robotics service providers and aerospace companies is another emerging trend. This collaboration harnesses the expertise from both industries to drive innovation and develop customized robotics solutions for aerospace applications. Joint research initiatives and partnerships facilitate knowledge sharing and create synergies for mutual growth. Aerospace Robotics Service Market Segmentation In terms of type, the market is categorized into inspection robots, maintenance robots, logistics robots, and assembly robots. Inspection robots has a market share of approximately 40%, are highly sought-after due to their ability to conduct precise and efficient inspections, ensuring compliance and detecting defects in critical components.% Aerospace Robotics Service Market Share by Type(2023)

Technology segmentation covers the various technologies employed like AI-enabled robots, collaborative robots (cobots), unmanned aerial vehicles (UAVs), and exoskeletons. AI-enabled robots, capturing around 35% of the market, leverage advanced algorithms to analyze complex data, make intelligent decisions, and adapt to changing environments, making them indispensable in aerospace applications. The component segment highlights the key elements that constitute aerospace robotics systems, such as sensors, actuators, software, and control systems. Sensors, accounting for approximately 30% of the market share, play a pivotal role in providing real-time data on critical parameters, facilitating precise control and feedback mechanisms for optimal performance. Function-based segmentation focuses on the primary operational functions of aerospace robotics services, including inspection, maintenance, assembly, and payload handling. Maintenance robots, commanding a significant market share of around 45%, streamline maintenance processes, minimize downtime, and enhance operational efficiency by conducting repairs, component replacements, and ensuring overall system performance.

Aerospace Robotics Service Market Regional Insight

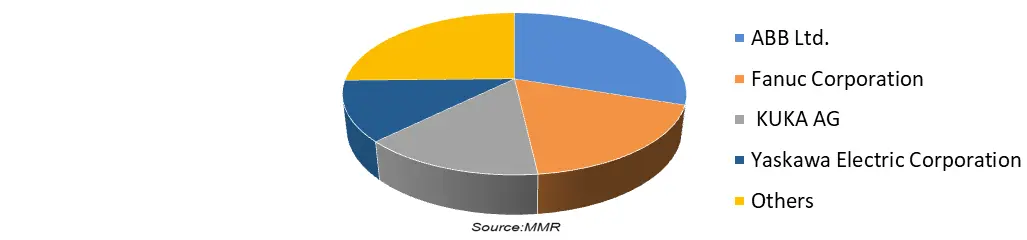

In the aerospace robotics service market, North America dominates with a substantial market share of approximately 45% in 2023. The region's established aerospace industry, technological advancements, and strong investment in research and development drive the demand for robotics services. The United States, in particular, plays a pivotal role, housing key aerospace manufacturers, space agencies, and defence contractors. The market in North America benefits from a highly skilled workforce, a focus on innovation, and robust government support for aerospace initiatives. Europe is also a prominent player in the aerospace robotics service market, capturing around 30% market share in 2023. The region has advanced aerospace capabilities, a strong manufacturing base, and a culture of precision engineering. Germany, France, and the United Kingdom have done huge investments in automation and robotics. Europe's focus on cutting-edge technologies, such as AI and autonomous systems, contributes to the demand for robotics services in the aerospace sector. Asia Pacific showcases substantial growth potential in the aerospace robotics service market, accounting for approximately 20% market share in 2023. The region's rapid economic growth, expanding aerospace sector, and increasing defence budgets drive the demand for robotics solutions. Countries like China, Japan, and India are at the forefront of aerospace advancements, with a focus on enhancing manufacturing processes, improving operational efficiency, and expanding their presence in the global aerospace market. Latin America and the Middle East & Africa regions hold smaller market shares in the market, each accounting for around 2-3% in 2023. These regions are witnessing growing investments in aerospace infrastructure, increasing air travel, and expanding defense capabilities. Brazil, Mexico, the United Arab Emirates, and Saudi Arabia are among the key countries driving market growth in their respective regions, leveraging robotics services to enhance aerospace operations and capabilities. Aerospace Robotics Service Market Competitive Landscape The detailed report on the Market provides analysis of each company's SWOT analysis, financial performance, and other factors. The company’s internal strengths and weaknesses, external opportunities and threats, and financial stability is provided in the report. The report enables stakeholders to assess the market dynamics, make informed business decisions, and identify growth opportunities. Several major players have emerged in the Market, each employing various strategies to enhance their market presence and solidify their positions. These key players include ABB Ltd., Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, and Universal Robots. They have demonstrated their commitment to the industry through substantial investments in research and development initiatives.Aerospace Robotics Service Market Share, By Key Players in 2023 (%)

Aerospace Robotics Service Market Scope : Inquire Before Buying

Global Aerospace Robotics Service Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.73 Bn. Forecast Period 2024 to 2030 CAGR: 6.20% Market Size in 2030: US $ 7.22 Bn. Segments Covered: by Type Inspection robots Maintenance robots Logistics robots Assembly robots by Technology AI-enabled robots, collaborative robots (cobots) Unmanned aerial vehicles (uavs) Exoskeletons by Component Sensors Actuators Software Control systems by Function Inspection Maintenance Assembly Payload handling Aerospace Robotics Service Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Aerospace Robotics Service Market, Key Players are

1. ABB Ltd. 2. KUKA AG 3. Fanuc Corporation 4. Yaskawa Electric Corporation 5. Kawasaki Heavy Industries Ltd. 6. Universal Robots A/S 7. Adept Technology Inc. 8. Staubli International AG 9. Comau S.p.A. 10. Nachi-Fujikoshi Corporation 11. Epson Robots 12. Denso Corporation 13. Midea Group (KUKA AG subsidiary) 14. Mitsubishi Electric Corporation 15. Omron Corporation 16. Precise Automation Inc. 17. Siasun Robot & Automation Co., Ltd. 18. Schunk GmbH & Co. KG 19. FANUC America Corporation 20. YRG Inc. (Yaskawa Motoman Robotics subsidiary)Frequently Asked Questions:

1] What is the growth rate of the Global Market? Ans. The Global Market is growing at a significant rate of 6.20% during the forecast period. 2] Which region is expected to dominate the Global Market? Ans. The North America region is expected to dominate the Market during the forecast period. 3] What is the expected Global Market size by 2030? Ans. The market size is expected to reach USD 7.22 Bn by 2030. 4] Which are the top players in the Global Market? Ans. The major top players in the Global Market are ABB Ltd., Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, and Universal Robots.

1. Aerospace Robotics Service Market: Research Methodology 2. Aerospace Robotics Service Market: Executive Summary 3. Aerospace Robotics Service Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Aerospace Robotics Service Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Aerospace Robotics Service Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Aerospace Robotics Service Market Size and Forecast, by Type (2023-2030) 5.1.1. Inspection robots 5.1.2. Maintenance robots 5.1.3. Logistics robots 5.1.4. Assembly robots 5.2. Aerospace Robotics Service Market Size and Forecast, by Technology (2023-2030) 5.2.1. AI-enabled robots, collaborative robots (cobots) 5.2.2. Unmanned aerial vehicles (uavs) 5.2.3. Exoskeletons 5.3. Aerospace Robotics Service Market Size and Forecast, by Component (2023-2030) 5.3.1. Sensors 5.3.2. Actuators 5.3.3. Software 5.3.4. Control systems 5.4. Aerospace Robotics Service Market Size and Forecast, by Function (2023-2030) 5.4.1. Inspection 5.4.2. Maintenance 5.4.3. Assembly 5.4.4. Payload handling 5.5. Aerospace Robotics Service Market Size and Forecast, by region (2023-2030) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Aerospace Robotics Service Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Aerospace Robotics Service Market Size and Forecast, by Type (2023-2030) 6.1.1. Inspection robots 6.1.2. Maintenance robots 6.1.3. Logistics robots 6.1.4. Assembly robots 6.2. North America Aerospace Robotics Service Market Size and Forecast, by Technology (2023-2030) 6.2.1. AI-enabled robots, collaborative robots (cobots) 6.2.2. Unmanned aerial vehicles (uavs) 6.2.3. Exoskeletons 6.3. North America Aerospace Robotics Service Market Size and Forecast, by Component (2023-2030) 6.3.1. Sensors 6.3.2. Actuators 6.3.3. Software 6.3.4. Control systems 6.4. North America Aerospace Robotics Service Market Size and Forecast, by Function (2023-2030) 6.4.1. Inspection 6.4.2. Maintenance 6.4.3. Assembly 6.4.4. Payload handling 6.5. North America Aerospace Robotics Service Market Size and Forecast, by Country (2023-2030) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Aerospace Robotics Service Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Aerospace Robotics Service Market Size and Forecast, by Type (2023-2030) 7.1.1. Inspection robots 7.1.2. Maintenance robots 7.1.3. Logistics robots 7.1.4. Assembly robots 7.2. Europe Aerospace Robotics Service Market Size and Forecast, by Technology (2023-2030) 7.2.1. AI-enabled robots, collaborative robots (cobots) 7.2.2. Unmanned aerial vehicles (uavs) 7.2.3. Exoskeletons 7.3. Europe Aerospace Robotics Service Market Size and Forecast, by Component (2023-2030) 7.3.1. Sensors 7.3.2. Actuators 7.3.3. Software 7.3.4. Control systems 7.4. Europe Aerospace Robotics Service Market Size and Forecast, by Function (2023-2030) 7.4.1. Inspection 7.4.2. Maintenance 7.4.3. Assembly 7.4.4. Payload handling 7.5. Europe Aerospace Robotics Service Market Size and Forecast, by Country (2023-2030) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Aerospace Robotics Service Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Aerospace Robotics Service Market Size and Forecast, by Type (2023-2030) 8.1.1. Inspection robots 8.1.2. Maintenance robots 8.1.3. Logistics robots 8.1.4. Assembly robots 8.2. Asia Pacific Aerospace Robotics Service Market Size and Forecast, by Technology (2023-2030) 8.2.1. AI-enabled robots, collaborative robots (cobots) 8.2.2. Unmanned aerial vehicles (uavs) 8.2.3. Exoskeletons 8.3. Asia Pacific Aerospace Robotics Service Market Size and Forecast, by Component (2023-2030) 8.3.1. Sensors 8.3.2. Actuators 8.3.3. Software 8.3.4. Control systems 8.4. Asia Pacific Aerospace Robotics Service Market Size and Forecast, by Function (2023-2030) 8.4.1. Inspection 8.4.2. Maintenance 8.4.3. Assembly 8.4.4. Payload handling 8.5. Asia Pacific Aerospace Robotics Service Market Size and Forecast, by Country (2023-2030) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Aerospace Robotics Service Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Aerospace Robotics Service Market Size and Forecast, by Type (2023-2030) 9.1.1. Inspection robots 9.1.2. Maintenance robots 9.1.3. Logistics robots 9.1.4. Assembly robots 9.2. Middle East and Africa Aerospace Robotics Service Market Size and Forecast, by Technology (2023-2030) 9.2.1. AI-enabled robots, collaborative robots (cobots) 9.2.2. Unmanned aerial vehicles (uavs) 9.2.3. Exoskeletons 9.3. Middle East and Africa Aerospace Robotics Service Market Size and Forecast, by Component (2023-2030) 9.3.1. Sensors 9.3.2. Actuators 9.3.3. Software 9.3.4. Control systems 9.4. Middle East and Africa Aerospace Robotics Service Market Size and Forecast, by Function (2023-2030) 9.4.1. Inspection 9.4.2. Maintenance 9.4.3. Assembly 9.4.4. Payload handling 9.5. Middle East and Africa Aerospace Robotics Service Market Size and Forecast, by Country (2023-2030) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Aerospace Robotics Service Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Aerospace Robotics Service Market Size and Forecast, by Type (2023-2030) 10.1.1. Inspection robots 10.1.2. Maintenance robots 10.1.3. Logistics robots 10.1.4. Assembly robots 10.2. South America Aerospace Robotics Service Market Size and Forecast, by Technology (2023-2030) 10.2.1. AI-enabled robots, collaborative robots (cobots) 10.2.2. Unmanned aerial vehicles (uavs) 10.2.3. Exoskeletons 10.3. South America Aerospace Robotics Service Market Size and Forecast, by Component (2023-2030) 10.3.1. Sensors 10.3.2. Actuators 10.3.3. Software 10.3.4. Control systems 10.4. South America Aerospace Robotics Service Market Size and Forecast, by Function (2023-2030) 10.4.1. Inspection 10.4.2. Maintenance 10.4.3. Assembly 10.4.4. Payload handling 10.5. South America Aerospace Robotics Service Market Size and Forecast, by Country (2023-2030) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. ABB Ltd 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. KUKA AG 11.3. Fanuc Corporation 11.4. Yaskawa Electric Corporation 11.5. Kawasaki Heavy Industries Ltd. 11.6. Universal Robots A/S 11.7. Adept Technology Inc. 11.8. Stäubli International AG 11.9. Comau S.p.A. 11.10. Nachi-Fujikoshi Corporation 11.11. Epson Robots 11.12. Denso Corporation 11.13. Midea Group (KUKA AG subsidiary) 11.14. Mitsubishi Electric Corporation 11.15. Omron Corporation 11.16. Precise Automation Inc. 11.17. Siasun Robot & Automation Co., Ltd. 11.18. Schunk GmbH & Co. KG 11.19. FANUC America Corporation 11.20. YRG Inc. (Yaskawa Motoman Robotics subsidiary) 12. Key Findings 13. Industry Recommendation