The Adult Diaper Market size was valued at USD 18.12 Billion in 2023 and the total Adult Diaper Market revenue is expected to grow at a CAGR of 10.7 % from 2024 to 2030, reaching nearly USD 36.91 Billion. Adult diapers, also known as incontinence briefs, are absorbent undergarments designed for individuals experiencing urinary or fecal incontinence. These products aid in managing and containing leaks, providing comfort, hygiene, and dignity for individuals with mobility or health challenges. Factors such as an aging population, increasing incidences of incontinence, and rising awareness of hygiene needs among the elderly and disabled contribute to adult diaper market growth. Major adult diaper market players like Kimberly-Clark Corporation, Procter & Gamble Co., and SCA AB dominate this industry by offering a diverse range of adult diaper products, including both disposable and reusable options. These companies focus on innovation, improving product quality, and addressing comfort and odor control, driving their competitive edge. The primary drivers of the adult diaper market include the increasing aging population globally, which amplifies the demand for these products. Additionally, the growing prevalence of incontinence, both among older adults and younger individuals with health conditions, fuels adult diaper market growth. Advancements in product design, including better absorption, enhanced comfort, and discreetness, further boosts adult diaper market growth. Emerging trends in the adult diaper market involve the development of eco-friendly and sustainable options to address environmental concerns. Manufacturers are exploring materials that are renewable or recycled to cater to environmentally conscious consumers. Another trend is the rise of e-commerce platforms offering convenient access to adult diapers, enhancing adult diaper market reach and accessibility for consumers. Customization of products to meet specific needs, such as sensitive skin or mobility issues, presents opportunities for manufacturers to address niche adult diaper markets and cater to diverse consumer preferences. Recent developments in the adult diaper market include significant innovations by key players. Procter & Gamble's introduction of the "Always Discreet" line, focusing on improved comfort and discretion, highlights the industry's commitment to enhancing product features. Kimberly-Clark, another major player, reported strong sales growth in adult diapers, attributed to increased demand from the aging population and rising incontinence cases. Such advancements and sales growth signify ongoing efforts by industry leaders to meet evolving consumer needs and adult diaper market demands.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

Transition from Reusable to Disposable Adult Diapers: The global population is growing old, with a developing variety of aged individuals who are much more likely to be afflicted by incontinence. According to the United Nations, the range of people aged 60 years and above is anticipated to attain in billion with the aid of 2050. This demographic shift is a giant motive force behind the demand for grown-up diapers. There is a developing awareness of incontinence and its impact on exceptional existence. This has caused a greater demand for products that offer comfort and dignity to folks who suffer from incontinence. Disposable adult diaper market have become popular in recent years, replacing reusable fabric merchandise. Disposable merchandise provides more convenience and is extra hygienic, which has brought about a growth in demand. With growing attention to environmental sustainability, many manufacturers are now growing eco-friendly adult diapers crafted from renewable or recycled substances. This has brought about an extra demand for that merchandise among environmentally aware consumers.Regulatory Hurdles in the Adult Diaper Industry:

Adult diapers are highly priced,which limits their affordability to a few purchasers. This is especially true for individuals who require wonderful, top-rated products, which are even extra expensive. There remains a social stigma attached to incontinence, which makes it difficult for people to talk about their situation. This leads to a reluctance to use adult diapers or other incontinence products, even though they're important. In a few areas, adult diapers are not easily available or available at an excessive price. Although disposable adult diapers are extra convenient, they're additionally an enormous source of waste. This has brought about concerns approximately their effect on the environment, and a developing call for extra sustainable and green alternatives. The adult diaper market faces various rules that affect the development and distribution of these merchandise. Compliance with guidelines is high-priced and time-consuming, which restricts the growth of the enterprise. E-commerce Growth and Online Retail Opportunities: The adult diaper market remains relatively underdeveloped in many developing economies, which presents an opportunity for manufacturers to make bigger in new adult diaper markets. The global populace is getting older, which is driving demand for grown-up diapers. This provides an extensive opportunity for manufacturers to develop new and revolutionary products that meet the wishes of this developing demographic. Many consumers have specific needs and options on the subject of adult diapers, along with those with touchy pores and skin or mobility issues. Manufacturers broaden customized merchandise that meets those specific desires, presenting an extra personalized solution for consumers. The upward push of e-trade has made it less complicated for consumers to purchase personal diapers online, which has led to the increase of online outlets focusing on these products. This offers a possibility for manufacturers to accomplice with these outlets and increase their attain to new clients. As consumers emerge as more environmentally aware, there's a growing demand for green grown-up diapers. Manufacturers expand and adult diaper market sustainable merchandise that meets this demand. Demand for Sustainable and Eco-friendly Diapers: There is a growing trend towards disposable grown-up diapers, which provide extra convenience and hygiene compared to reusable material merchandise. This trend is predicted to continue to drive the adult diaper market, as more purchasers are looking for merchandise that is smooth to use and do away with. The rise of e-commerce has made it less complicated for customers to buy personal diapers online, with many stores that specialize in those products. This fashion is expected to keep, with extra clients turning to online retailers for their incontinence desires. As customers come to be extra environmentally aware, there's a growing call for sustainable and eco-friendly personal adult diaper market. Manufacturers are responding to this trend with the aid of growing merchandise crafted from renewable or recycled materials. Many customers have specific wishes and choices in terms of grown-up diapers, which include people with touchy pores and skin or mobility troubles. Manufacturers are developing custom-designed products that meet these unique needs, imparting a more personalized solution for consumers. There have been sizable technological advancements in the layout and manufacturing of adult diapers, resulting in products that are greater snug, absorbent, and discreet. New materials and manufacturing strategies have enabled the improvement of thinner and greater breathable merchandise that is snugger to wear.Adult Diaper Market Segment Analysis:

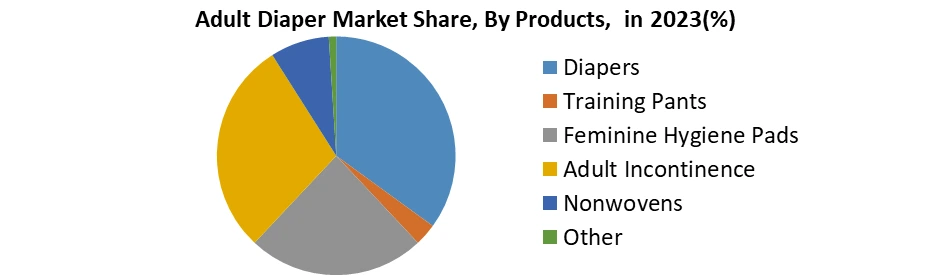

Based on Product Type, The adult diaper market presents a diversified segment analysis based on product types such as Tape type, Adult Pull-Up Pants, Pads, and Others. Tape-type adult diaper products are designed for convenience, offering easy application and removal, commonly used in healthcare settings. Adult Pull-Up Pants, resembling regular underwear, provide a sense of normalcy and are increasingly favored due to their discretion and comfort, finding applications among active individuals. Pads, similar to feminine hygiene products, offer targeted absorption and are preferred for light to moderate incontinence. Other variants, including specialized designs or innovative features, cater to specific needs, potentially niche adult diaper markets. Presently, the dominant segment in the adult diaper market is the Adult Pull-Up Pants due to their evolving adoption among users seeking discreet and comfortable options, especially in Western adult diaper markets. However, Tape-type products hold a substantial share owing to their historical use in healthcare settings. The trend suggests a gradual rise in the dominance of Adult Pull-Up Pants driven by their user-friendly nature and growing acceptance in both institutional and retail scenarios. As innovations in design and functionality continue to drive consumer preferences, the market is witnessing an expansion in product offerings, especially in the pull-up pants segment, aiming to capture a broader consumer base seeking convenience and comfort in adult diaper products.

Adult Diaper Market Regional Insights:

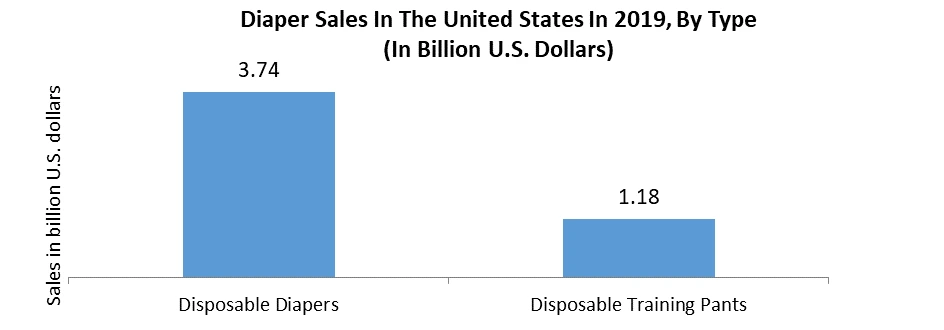

The North American Adult Diaper market, led by the United States, stands as one of the largest adult diaper markets globally in 2023. Dominated by major players like Kimberly-Clark and Procter & Gamble, it is fueled by an aging population and a heightened awareness of incontinence issues. The region's market is primarily segmented into disposable and reusable adult diapers, with a stronghold in retail distribution. With the aging population continuing to rise, especially in the US, this market is expected to sustain its dominance. Smaller players like First Quality Enterprises and Attends Healthcare Products also contribute to the market's growth potential through their niche offerings and innovative solutions. Europe, encompassing nations like the UK, France, and Germany, also boasts a substantial market share for adult diapers market. Essity AB and Ontex International lead this region's market, propelled by an aging demographic and an increasing focus on incontinence awareness. Similar to North America, the market in Europe is divided between disposable and reusable adult diapers, with both retail and e-commerce channels being prominent. The European market, particularly in countries like Germany, anticipates sustained growth due to a rising and aging population. Companies such as Paul Hartmann AG and Abena A/S contribute to this growth through their innovations and strategic market penetration. The Asia-Pacific region stands out as the fastest-growing market for adult diapers, driven by countries like Japan and China, characterized by a rapidly aging populace and escalating awareness of incontinence. Unicharm Corporation and Kimberly-Clark are key players in this region, with a significant market presence. The market is segmented similarly into disposable and reusable adult diapers, focusing on retail and e-commerce channels. The Japanese adult diaper market, already the largest in Asia, is expected to maintain dominance due to its rapidly aging population. However, China's adult diaper market is swiftly evolving, spurred by a substantial aging demographic and increasing incontinence awareness, presenting significant growth opportunities. Other players like SCA Hygiene Products and Essity AB contribute to this market's growth. The Middle East and African adult diaper market displays steady growth, fueled by an aging population and a growing understanding of incontinence. SCA Hygiene Products and Essity AB dominate this market, emphasizing disposable and reusable adult diapers, distributed mainly through retail channels. South America, particularly Brazil, Argentina, and other countries, showcases a burgeoning adult diaper market, primarily driven by an aging population and rising incontinence awareness. SCA Hygiene Products and Ontex International lead this market, with a focus on disposable and reusable adult diapers primarily distributed through retail channels. The Brazilian adult diaper market's prominence in South America is expected to continue its growth trajectory due to an increasing aging demographic. Players like Kimberly-Clark and Essity AB are anticipated to contribute to this market's growth through their strategic initiatives and product innovations.

Competitive Landscape

The adult diaper market is fiercely competitive, led by major players like Kimberly-Clark Corporation, Procter & Gamble Co., SCA AB, Essity AB, and Ontex Group NV. These industry giants offer a diverse range of adult diaper products, encompassing both disposable and reusable options, aiming to cater to the diverse preferences and needs of consumers worldwide. The companies are constantly striving to differentiate themselves by introducing innovative features that enhance the functionality and comfort of adult diapers. Features such as improved absorption capacity, odor control, and overall comfort are crucial elements driving market growth and consumer preference. Additionally, a strong focus on R&D and product innovation remains pivotal for companies to stay ahead in this competitive arena. Procter & Gamble (P&G) made a significant move in this market by launching "Always Discreet," a new line of adult diapers. These diapers are designed to be more comfortable, discreet, and available in various sizes and styles, catering to a wide range of consumer preferences. This development aims to address specific needs, enhancing consumer satisfaction and potentially capturing new adult diaper market segments seeking improved products. Kimberly-Clark, another major player in the market, witnessed robust growth in its adult diaper sales in the fourth quarter of 2023. The company attributes this growth to increased demand driven by the aging population and the rising incidence of incontinence. Such adult diaper market trends and the growing demand for adult diapers, especially in regions with aging populations, provide key insights into the adult diaper market's potential growth trajectory. Recent developments and innovations by these market leaders have been instrumental in driving market growth. Enhanced product offerings, emphasizing comfort, discretion, and performance, align with the increasing demand for more advanced and user-friendly adult diaper solutions. Moreover, heightened awareness of incontinence-related issues among aging populations worldwide contributes to a growing consumer base, further fueling market growth. These innovations, coupled with strategic pricing strategies and robust distribution networks, will play a crucial role in shaping the competitive landscape and driving sustained growth in the global adult diaper market.Adult Diaper Market Scope: Inquire before buying

Adult Diaper Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 18.12 Bn Forecast Period 2024 to 2030 CAGR: 10.7 % Market Size in 2030: USD 36.91 Bn. Segments Covered: by Product Type Tape type Adult Pull-Up Pants Pads Others by Gender Men Women by Age Older Adults Those With Disabilities by Distribution Channel Retail Stores Online Retailers Institutional Sales to Hospitals or Care Homes Adult Diaper Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Adult Diaper Market Key Players:

1. Abena 2. Attends Healthcare Products 3. Care4hygiene 4. Chiaus 5. Covidien 6. Daio paper corporation 7. Domtar Corporation 8. Drylock Technologies 9. Essity AB 10. Ever Green 11. First Quality Enterprises 12. Hengan international group co. ltd. 13. Kimberly Clark 14. Industrial Development Co. 15. Linette 16. Nobel Hygiene 17. Ontex International 18. Paul Hartmann AG 19. Principle Business Enterprises 20. Procter & Gamble 21. SCA Hygiene Products 22. Svenska cellulose AB 23. Tykables 24. TZMO SA 25. Unicharm Corporation FAQs: 1. What are the growth drivers for the Adult Diaper Market? Ans. Transition from Reusable to Disposable Adult Diapers and is expected to be the major driver for the Adult Diaper Market. 2. What is the major opportunity for the Adult Diaper Market growth? Ans. E-commerce Growth and Online Retail Opportunities is expected to be a major Opportunity In the Adult Diaper Market. 3. Which country is expected to lead the global Adult Diaper Market during the forecast period? Ans. North America is expected to lead the Adult Diaper Market during the forecast period. 4. What is the projected market size and growth rate of the Adult Diaper Market? Ans. The Adult Diaper Market size was valued at USD 18.12 Billion in 2023 and the total Adult Diaper Market revenue is expected to grow at a CAGR of 10.7 % from 2024 to 2030, reaching nearly USD 36.91 Billion. 5. What segments are covered in the Adult Diaper Market report? Ans. The segments covered in the Adult Diaper Market report are by Product, Type, Gender, Age, Distribution Channel, and Region.

1. Adult Diaper Market: Research Methodology 2. Adult Diaper Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Adult Diaper Market: Dynamics 3.1 Adult Diaper Market Trends by Region 3.1.1 North America Adult Diaper Market Trends 3.1.2 Europe Adult Diaper Market Trends 3.1.3 Asia Pacific Adult Diaper Market Trends 3.1.4 Middle East and Africa Adult Diaper Market Trends 3.1.5 South America Adult Diaper Market Trends 3.2 Adult Diaper Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Adult Diaper Market Drivers 3.2.1.2 North America Adult Diaper Market Restraints 3.2.1.3 North America Adult Diaper Market Opportunities 3.2.1.4 North America Adult Diaper Market Challenges 3.2.2 Europe 3.2.2.1 Europe Adult Diaper Market Drivers 3.2.2.2 Europe Adult Diaper Market Restraints 3.2.2.3 Europe Adult Diaper Market Opportunities 3.2.2.4 Europe Adult Diaper Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Adult Diaper Market Drivers 3.2.3.2 Asia Pacific Adult Diaper Market Restraints 3.2.3.3 Asia Pacific Adult Diaper Market Opportunities 3.2.3.4 Asia Pacific Adult Diaper Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Adult Diaper Market Drivers 3.2.4.2 Middle East and Africa Adult Diaper Market Restraints 3.2.4.3 Middle East and Africa Adult Diaper Market Opportunities 3.2.4.4 Middle East and Africa Adult Diaper Market Challenges 3.2.5 South America 3.2.5.1 South America Adult Diaper Market Drivers 3.2.5.2 South America Adult Diaper Market Restraints 3.2.5.3 South America Adult Diaper Market Opportunities 3.2.5.4 South America Adult Diaper Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Adult Diaper Industry 3.8 The Global Pandemic and Redefining of The Adult Diaper Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 4. Global Adult Diaper Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 4.1 Global Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 4.1.1 Tape type 4.1.2 Adult Pull-Up Pants 4.1.3 Pads 4.1.4 Others 4.2 Global Adult Diaper Market Size and Forecast, By Gender (2023-2030) 4.2.1 Men 4.2.2 Women 4.3 Global Adult Diaper Market Size and Forecast, By Age (2023-2030) 4.3.1 Older Adults 4.3.2 Those With Disabilities 4.4 Global Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 4.4.1 Retail Stores 4.4.2 Online Retailers 4.4.3 Institutional Sales to Hospitals or Care Homes 4.5 Global Adult Diaper Market Size and Forecast, by Region (2023-2030) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Adult Diaper Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 5.1 North America Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 5.1.1 Tape type 5.1.2 Adult Pull-Up Pants 5.1.3 Pads 5.1.4 Others 5.2 North America Adult Diaper Market Size and Forecast, By Gender (2023-2030) 5.2.1 Men 5.2.2 Women 5.3 North America Adult Diaper Market Size and Forecast, By Age (2023-2030) 5.3.1 Older Adults 5.3.2 Those With Disabilities 5.4 North America Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 5.4.1 Retail Stores 5.4.2 Online Retailers 5.4.3 Institutional Sales to Hospitals or Care Homes 5.5 North America Adult Diaper Market Size and Forecast, by Country (2023-2030) 5.5.1 United States 5.5.1.1 United States Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 5.5.1.1.1 Tape type 5.5.1.1.2 Adult Pull-Up Pants 5.5.1.1.3 Pads 5.5.1.1.4 Others 5.5.1.2 United States Adult Diaper Market Size and Forecast, By Gender (2023-2030) 5.5.1.2.1 Men 5.5.1.2.2 Women 5.5.1.3 United States Adult Diaper Market Size and Forecast, By Age (2023-2030) 5.5.1.3.1 Older Adults 5.5.1.3.2 Those With Disabilities 5.5.1.4 United States Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 5.5.1.4.1 Retail Stores 5.5.1.4.2 Online Retailers 5.5.1.4.3 Institutional Sales to Hospitals or Care Homes 5.5.2 Canada 5.5.2.1 Canada Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 5.5.2.1.1 Tape type 5.5.2.1.2 Adult Pull-Up Pants 5.5.2.1.3 Pads 5.5.2.1.4 Others 5.5.2.2 Canada Adult Diaper Market Size and Forecast, By Gender (2023-2030) 5.5.2.2.1 Men 5.5.2.2.2 Women 5.5.2.3 Canada Adult Diaper Market Size and Forecast, By Age (2023-2030) 5.5.2.3.1 Older Adults 5.5.2.3.2 Those With Disabilities 5.5.2.4 Canada Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 5.5.2.4.1 Retail Stores 5.5.2.4.2 Online Retailers 5.5.2.4.3 Institutional Sales to Hospitals or Care Homes 5.5.3 Mexico 5.5.3.1 Mexico Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 5.5.3.1.1 Tape type 5.5.3.1.2 Adult Pull-Up Pants 5.5.3.1.3 Pads 5.5.3.1.4 Others 5.5.3.2 Mexico Adult Diaper Market Size and Forecast, By Gender (2023-2030) 5.5.3.2.1 Men 5.5.3.2.2 Women 5.5.3.3 Mexico Adult Diaper Market Size and Forecast, By Age (2023-2030) 5.5.3.3.1 Older Adults 5.5.3.3.2 Those With Disabilities 5.5.3.4 Mexico Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 5.5.3.4.1 Retail Stores 5.5.3.4.2 Online Retailers 5.5.3.4.3 Institutional Sales to Hospitals or Care Homes 6. Europe Adult Diaper Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 6.1 Europe Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 6.2 Europe Adult Diaper Market Size and Forecast, By Gender (2023-2030) 6.3 Europe Adult Diaper Market Size and Forecast, By Age (2023-2030) 6.4 Europe Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 6.5 Europe Adult Diaper Market Size and Forecast, by Country (2023-2030) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 6.5.1.2 United Kingdom Adult Diaper Market Size and Forecast, By Gender (2023-2030) 6.5.1.3 United Kingdom Adult Diaper Market Size and Forecast, By Age (2023-2030) 6.5.1.4 United Kingdom Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.2 France 6.5.2.1 France Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 6.5.2.2 France Adult Diaper Market Size and Forecast, By Gender (2023-2030) 6.5.2.3 France Adult Diaper Market Size and Forecast, By Age (2023-2030) 6.5.2.4 France Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.3 Germany 6.5.3.1 Germany Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 6.5.3.2 Germany Adult Diaper Market Size and Forecast, By Gender (2023-2030) 6.5.3.3 Germany Adult Diaper Market Size and Forecast, By Age (2023-2030) 6.5.3.4 Germany Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.4 Italy 6.5.4.1 Italy Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 6.5.4.2 Italy Adult Diaper Market Size and Forecast, By Gender (2023-2030) 6.5.4.3 Italy Adult Diaper Market Size and Forecast, By Age (2023-2030) 6.5.4.4 Italy Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.5 Spain 6.5.5.1 Spain Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 6.5.5.2 Spain Adult Diaper Market Size and Forecast, By Gender (2023-2030) 6.5.5.3 Spain Adult Diaper Market Size and Forecast, By Age (2023-2030) 6.5.5.4 Spain Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.6 Sweden 6.5.6.1 Sweden Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 6.5.6.2 Sweden Adult Diaper Market Size and Forecast, By Gender (2023-2030) 6.5.6.3 Sweden Adult Diaper Market Size and Forecast, By Age (2023-2030) 6.5.6.4 Sweden Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.7 Austria 6.5.7.1 Austria Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 6.5.7.2 Austria Adult Diaper Market Size and Forecast, By Gender (2023-2030) 6.5.7.3 Austria Adult Diaper Market Size and Forecast, By Age (2023-2030) 6.5.7.4 Austria Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 6.5.8.2 Rest of Europe Adult Diaper Market Size and Forecast, By Gender (2023-2030). 6.5.8.3 Rest of Europe Adult Diaper Market Size and Forecast, By Age (2023-2030) 6.5.8.4 Rest of Europe Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7. Asia Pacific Adult Diaper Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 7.1 Asia Pacific Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.2 Asia Pacific Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.3 Asia Pacific Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.4 Asia Pacific Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5 Asia Pacific Adult Diaper Market Size and Forecast, by Country (2023-2030) 7.5.1 China 7.5.1.1 China Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.1.2 China Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.1.3 China Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.1.4 China Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.2 South Korea 7.5.2.1 S Korea Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.2.2 S Korea Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.2.3 S Korea Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.2.4 S Korea Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.3 Japan 7.5.3.1 Japan Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.3.2 Japan Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.3.3 Japan Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.3.4 Japan Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.4 India 7.5.4.1 India Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.4.2 India Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.4.3 India Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.4.4 India Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.5 Australia 7.5.5.1 Australia Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.5.2 Australia Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.5.3 Australia Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.5.4 Australia Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.6 Indonesia 7.5.6.1 Indonesia Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.6.2 Indonesia Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.6.3 Indonesia Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.6.4 Indonesia Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.7 Malaysia 7.5.7.1 Malaysia Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.7.2 Malaysia Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.7.3 Malaysia Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.7.4 Malaysia Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.8 Vietnam 7.5.8.1 Vietnam Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.8.2 Vietnam Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.8.3 Vietnam Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.8.4 Vietnam Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.9 Taiwan 7.5.9.1 Taiwan Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.9.2 Taiwan Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.9.3 Taiwan Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.9.4 Taiwan Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.10.2 Bangladesh Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.10.3 Bangladesh Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.10.4 Bangladesh Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.11 Pakistan 7.5.11.1 Pakistan Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.11.2 Pakistan Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.11.3 Pakistan Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.11.4 Pakistan Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 7.5.12.2 Rest of Asia Pacific Adult Diaper Market Size and Forecast, By Gender (2023-2030) 7.5.12.3 Rest of Asia Pacific Adult Diaper Market Size and Forecast, By Age (2023-2030) 7.5.12.4 Rest of Asia Pacific Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 8. Middle East and Africa Adult Diaper Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 8.1 Middle East and Africa Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 8.2 Middle East and Africa Adult Diaper Market Size and Forecast, By Gender (2023-2030) 8.3 Middle East and Africa Adult Diaper Market Size and Forecast, By Age (2023-2030) 8.4 Middle East and Africa Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 8.5 Middle East and Africa Adult Diaper Market Size and Forecast, by Country (2023-2030) 8.5.1 South Africa 8.5.1.1 South Africa Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 8.5.1.2 South Africa Adult Diaper Market Size and Forecast, By Gender (2023-2030) 8.5.1.3 South Africa Adult Diaper Market Size and Forecast, By Age (2023-2030) 8.5.1.4 South Africa Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 8.5.2 GCC 8.5.2.1 GCC Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 8.5.2.2 GCC Adult Diaper Market Size and Forecast, By Gender (2023-2030) 8.5.2.3 GCC Adult Diaper Market Size and Forecast, By Age (2023-2030) 8.5.2.4 GCC Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 8.5.3 Egypt 8.5.3.1 Egypt Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 8.5.3.2 Egypt Adult Diaper Market Size and Forecast, By Gender (2023-2030) 8.5.3.3 Egypt Adult Diaper Market Size and Forecast, By Age (2023-2030) 8.5.3.4 Egypt Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 8.5.4 Nigeria 8.5.4.1 Nigeria Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 8.5.4.2 Nigeria Adult Diaper Market Size and Forecast, By Gender (2023-2030) 8.5.4.3 Nigeria Adult Diaper Market Size and Forecast, By Age (2023-2030) 8.5.4.4 Nigeria Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 8.5.5.2 Rest of ME&A Adult Diaper Market Size and Forecast, By Gender (2023-2030) 8.5.5.3 Rest of ME&A Adult Diaper Market Size and Forecast, By Age (2023-2030) 8.5.5.4 Rest of ME&A Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 9. South America Adult Diaper Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 9.1 South America Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 9.2 South America Adult Diaper Market Size and Forecast, By Gender (2023-2030) 9.3 South America Adult Diaper Market Size and Forecast, By Age (2023-2030) 9.4 South America Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 9.5 South America Adult Diaper Market Size and Forecast, by Country (2023-2030) 9.5.1 Brazil 9.5.1.1 Brazil Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 9.5.1.2 Brazil Adult Diaper Market Size and Forecast, By Gender (2023-2030) 9.5.1.3 Brazil Adult Diaper Market Size and Forecast, By Age (2023-2030) 9.5.1.4 Brazil Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 9.5.2 Argentina 9.5.2.1 Argentina Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 9.5.2.2 Argentina Adult Diaper Market Size and Forecast, By Gender (2023-2030) 9.5.2.3 Argentina Adult Diaper Market Size and Forecast, By Age (2023-2030) 9.5.2.4 Argentina Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Adult Diaper Market Size and Forecast, By Product Type (2023-2030) 9.5.3.2 Rest Of South America Adult Diaper Market Size and Forecast, By Gender (2023-2030) 9.5.3.3 Rest Of South America Adult Diaper Market Size and Forecast, By Age (2023-2030) 9.5.3.4 Rest Of South America Adult Diaper Market Size and Forecast, By Distribution Channel (2023-2030) 10. Global Adult Diaper Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Gender Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Adult Diaper Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Abena 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Attends Healthcare Product Types 11.3 Care4hygiene 11.4 Chiaus 11.5 Covidien 11.6 Daio paper corporation 11.7 Domtar Corporation 11.8 Drylock Technologies 11.9 Essity AB 11.10 Ever Green 11.11 First Quality Enterprises 11.12 Hengan international group co. ltd. 11.13 Kimberly Clark 11.14 Industrial Development Co. 11.15 Linette 11.16 Nobel Hygiene 11.17 Ontex International 11.18 Paul Hartmann AG 11.19 Principle Business Enterprises 11.20 Procter & Gamble 11.21 SCA Hygiene Product Types 11.22 Svenska cellulose AB 11.23 Tykables 11.24 TZMO SA 11.25 Unicharm Corporation 12. Key Findings 13. Industry Recommendations