The Global AdTech Market size was valued at USD 530.2 Billion in 2022 and the total AdTech Market revenue is expected to grow at a CAGR of 13.5 % from 2023 to 2029, reaching nearly USD 1286.50 Billion.AdTech Market Overview:

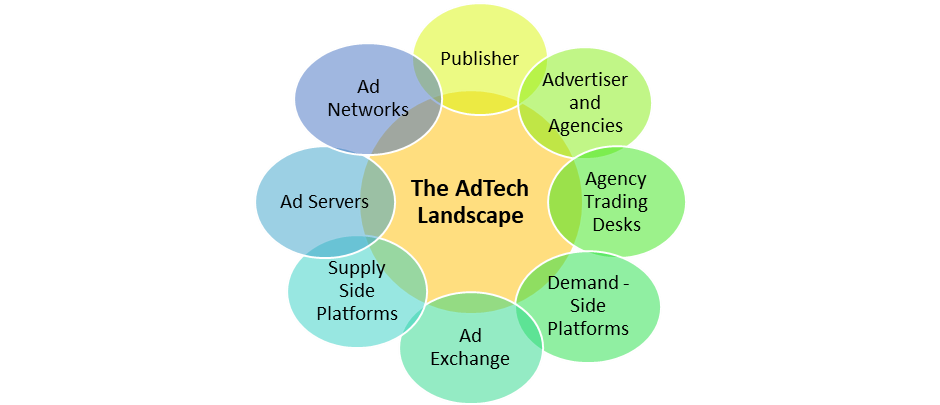

The ever-shifting landscape of advertising, the adoption of advertising Technology, out as a transformative force. As consumer behavior undergoes rapid changes and media consumption patterns evolve, advertisers are increasingly relying on AdTech to revolutionize and target engaged audiences. AdTech encompasses a spectrum of technologies and platforms designed to deliver, measure, and optimize digital advertising campaigns. Key components include programmatic advertising, ad exchanges, and data management platforms. This dynamic field is responding to the current state of consumer behavior and shaping the future of advertising. Machine learning, a cornerstone of AdTech, is continuously advancing, enhancing its ability to process vast amounts of data and consequently optimizing digital campaigns with unprecedented efficiency. Programmatic advertising, an important element of AdTech, continues its upward trajectory. Automation and data-driven decision-making are streamlining ad buying processes, increasing targeting precision, and maximizing campaign effectiveness drives AdTech Market. Beyond these established trends, newer innovations are gaining prominence. Streaming TV ads and audio advertising are emerging as potent avenues within the digital advertising space, adding layers of complexity and opportunity for AdTech Industry. The resilience and adaptability of AdTech are underscored by its role in simplifying and improving digital ad campaigns. As the technology grows more sophisticated, advertisers expect enhanced capabilities in delivering personalized and contextually relevant content to their target audiences which will create lucrative growth opportunities for the AdTech Market.

AdTech Market Scope and Research Methodology:

The scope of the AdTech Market encompasses an in-depth analysis of the global industry. Factors driving market growth, challenges, and opportunities, such as cost reductions, government incentives, environmental concerns, and technological advancements, are analysed. Additionally, the report examines the competitive landscape, investment trends, and regulatory frameworks impacting the AdTech industry. The research methodology employed for AdTech market analysis involves a combination of primary and secondary research. Key market growth drivers and restraints, recent developments, and emerging trends are evaluated using a qualitative and quantitative approach. Market data, statistics, and forecasts are derived from rigorous analysis, modelling, and industry expertise. The report aims to deliver valuable insights for businesses, investors, policymakers, and other stakeholders interested in the solar power generation industry, enabling them to make informed decisions and strategic investments in this rapidly evolving and critical sector.To know about the Research Methodology :- Request Free Sample Report

AdTech Market Trends

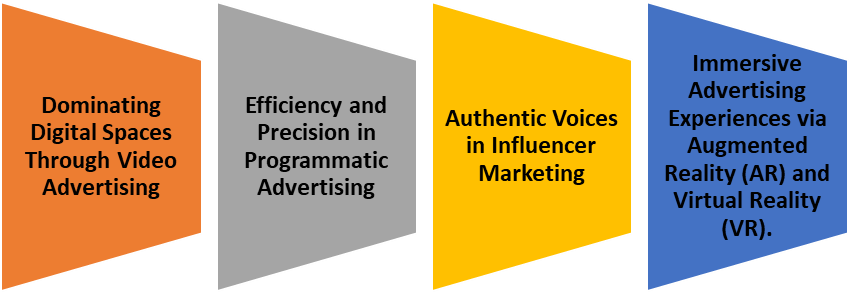

Enhanced Focus on Traffic Quality: AdTech Holding tackles the rising challenge of ensuring traffic quality with ADEX, an in-house anti-fraud solution. Utilizing advanced technologies, ADEX detects and blocks fraudulent traffic in real time, providing transparent statistics for various traffic segments. Certifications from independent third-party organizations enhance transparency, fostering trust in the dynamic digital landscape. Mobile Usage Growth: The exponential growth of monthly smartphone usage to 46GB by 2028, emphasizing the app industry. Their projects, such as AppLabz and Notix, delve into mobile app development, in-app advertising, and push notifications. Advertisers and publishers benefit from comprehensive strategies tailored for the rapidly growing global mobile market. Other Trends

AdTech Market Dynamics

Surge in the adoption of AI converging in Adtech Boost the AdTech Market Growth AI is driving a revolutionary shift in advertising becoming a force shaping a new era of AdTech Market. Advertisers leverage AI to move beyond generic messaging, embracing personalized communication based on individual preferences, buying histories, and online behaviors mined from massive databases. This personalized approach establishes deeper connections with audiences, resulting in heightened engagement and conversion rates. Beyond consumer analysis, AI actively contributes to the creative process, generating visually appealing graphics and compelling prose that resonate with viewers. The ability of AI to evaluate user behavior and contextual factors enables advertisers to serve targeted ads that align with the content customers are currently consuming. In the dynamic landscape of voice and visual search, AI is Important in optimizing ads, and ensuring businesses maintain visibility also facilitates consistent messaging across various channels and devices, promoting continuous brand experiences. The synergy between AI and Adtech transforms the advertising industry, offering supreme personalization, efficiency, and insightful analytics. However, this transformative journey necessitates a commitment to ethical AI practices, user privacy protection, and adept navigation of a complex legal framework. Advertisers embracing AI's potential while upholding ethical standards are positioned to lead a ground-breaking era in advertising, reshaping how companies communicate with customers in the digital age. For Example, in 2021, the market for artificial intelligence (AI) in marketing was estimated at 15.84 billion U.S. dollars.Stringent privacy Regulations and Security Concerns limit the Market Growth The digital marketing and global AdTech industry have seen seismic changes, and online marketers are facing challenges under new privacy laws and regulations. Substantial restrictions on targeted advertising and cookie usage coupled with the emergence of more stringent notice and consent obligations have forced companies to carefully consider their options and compliance approach. The growth of the Adtech Market has been constrained by stringent privacy regulations and escalating security concerns. Regulatory frameworks such as GDPR and CCPA impose strict guidelines on the collection and utilization of personal data, necessitating adjustments in adtech practices. Rising user privacy awareness has prompted individuals to be more discerning about data sharing, compounded by the prevalence of ad blockers that thwart intrusive advertisements. Security vulnerabilities inherent in the vast amounts of data processed by ad tech platforms pose a considerable risk, undermining user trust. Apple's App Tracking Transparency and browser policies limiting third-party cookies further restrict the industry's ability to track users for targeted advertising. Despite these challenges, the adtech sector is witnessing a transformation towards privacy-centric technologies, aiming to deliver personalized advertising experiences without compromising user privacy. The industry's future growth hinges on its ability to navigate this intricate landscape and strike a balance between effective advertising and strong privacy safeguards. Data Protection and Privacy Regulations

Regulation Regulation Scope Regulatory Body/Organization GDPR (General Data Protection Regulation) European Union regulation addressing data protection and privacy for individuals within the EU and EEA. Global impact of dealing with EU/EEA citizen data European Data Protection Board (EDPB) CCPA (California Consumer Privacy Act) California state law grants California consumers rights over their personal information. This applies to businesses collecting/selling personal info of California residents California Attorney General's office IAB Frameworks Developed by the Interactive Advertising Bureau (IAB) to establish self-regulatory practices for adtech. Industry-wide, providing guidelines for responsible data use Interactive Advertising Bureau (IAB) DAA Self-Regulatory Principles Created by the Digital Advertising Alliance (DAA) to address privacy concerns and provide consumer choices. Focused on online advertising, including interest-based advertising Digital Advertising Alliance (DAA) ePrivacy Directive EU directive governing privacy and electronic communications, impacting online advertising practices. EU member states Various national regulatory authorities in the EU LGPD (Lei Geral de Proteção de Dados) Brazilian data protection law influenced by GDPR, regulating the processing of personal data. Applies to the processing of personal data in Brazil National Data Protection Authority (ANPD) - Brazil PIPEDA (Personal Information Protection and Electronic Documents Act) Canadian privacy law governing the private sector's collection, use, and disclosure of personal information. This applies to private-sector organizations engaged in commercial activities Office of the Privacy Commissioner of Canada (OPC) Market Growth Opportunity

Growing Influence of the Digital Native Generation creates lucrative growth opportunities for market growth In the dynamic landscape of social media, the generational shifts in online behaviors present a lucrative opportunity for the AdTech Market. Millennials, constituting up to 61% of users, primarily leverage social platforms for interpersonal connections. Meanwhile, Gen X, mirroring adoption patterns, exhibits an increasing online presence. The digital native Gen Z, comprising Zoomers, stands out as the most digitally immersed cohort, with 66% considering their online identity integral. This shift forces Gen Z to the forefront of innovative trends, reshaping the advertising terrain. Advertisers keenly observe transformative behaviors within this demographic, adapting strategies to resonate with their tech-savvy audience. Emerging trends like TikTok-style indirect promotional ads and influencer marketing gain prominence, capitalizing on the trust young consumers place in relatable influencers. Companies strategically embracing individuality and empowerment in their marketing resonate strongly with young consumers. The ascent of inclusive and dialogue-driven content on social platforms exemplifies this trend. As brands align with the preferences of the digitally native Gen Z, the AdTech market seizes a unique opportunity to evolve, harnessing these trends to establish more impactful and resonant connections with the next wave of consumers.AdTech Market Segment Analysis

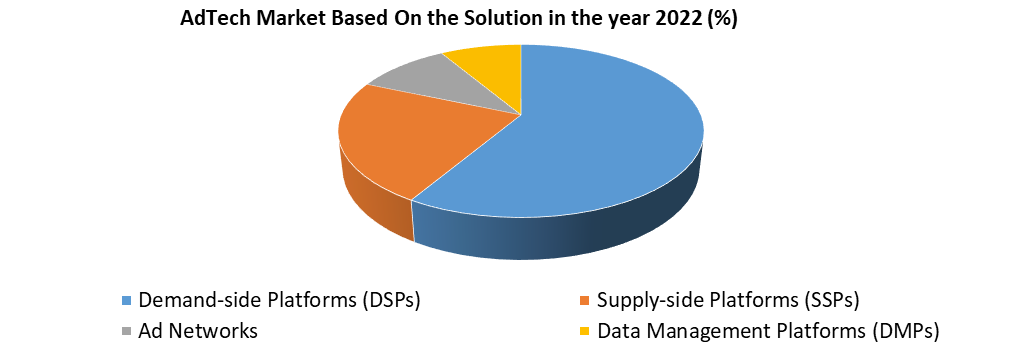

Based on the Solution, The demand side platforms dominates the solution segment of AdTech Market in 2022. DSPs streamline the complex process of purchasing advertising inventory. They introduce efficiency and effectiveness by offering advanced targeting capabilities, making them particularly appealing to advertisers seeking precise audience engagement and optimized campaign performance. The rise of programmatic advertising has accelerates the demand for DSPs. These platforms enable advertisers to efficiently acquire programmatic advertising inventory, surpassing the limitations of traditional methods. DSPs' ability to facilitate real-time bidding and automated purchasing processes enhances their attractiveness. Advertisers benefit from the strategic advantages of reaching specific audiences at scale, maximizing the impact of their campaigns. In essence, DSPs have become the linchpin of modern advertising strategies, providing a comprehensive solution for advertisers to navigate the dynamic landscape of digital advertising. Their adaptability, efficiency, and advanced targeting features position them as indispensable tools in the AdTech ecosystem, solidifying their dominance in the solution segment of the AdTech market.

AdTech Market Regional Analysis:

North America Dominated the AdTech Market in the Year 2022.The Increase in digital advertising adoption is significantly drive the AdTech Market growth. North America stands as a hub in the global digital advertising landscape. The U.S.is increasingly turning to digital advertising, with major players such as Google, Facebook, and Amazon shaping the industry. The growth in North America is driven by changing consumer habits, as more people engage online and on mobile platforms. The Asia Pacific regionIS Fastest growing Region, Due to technological advancements and increased internet and smartphone use IN Countries such as China and India. China, led by tech giants such as Baidu, Alibaba, and Tencent, stands out in revenue. The rise in digital advertising goes beyond online ads, involving the use of data for better customer understanding. Tools including Data Management Platforms and marketing analytics aid businesses in collecting and utilizing data. The region is expected to sustain significant growth, because of its large population, rising income, and the popularity of video platforms and social media, such as YouTube and TikTok.Competitive landscape

The competitive landscape of the global AdTech market is characterized by a mix of large and medium-sized players vying for market share. Key industry participants, such as Facebook, Amazon, Adobe, The Trade Desk, Criteo ,Sizmek and Other. The companies majorly focused on the partnerships, mergers and Acquisitions to expand the market growth. InMobi Technology Services Private Limited partnered with Point Pickup to introduce an innovative product discovery and monetization solution, aiming to elevate media-derived revenues for grocery retail partners. Amazon Inc. took center stage at its unboxed event in New York, unveiling new advertising capabilities designed to simplify the entry for smaller and emerging brands. These enhancements include campaign presets and an uncomplicated video creation tool. In a bid to reinforce adtech protection, Oracle Advertising and Azerion expanded their partnership. By implementing Oracle Advertising bot filtration, they are ensuring a clean supply for marketers through Azerion's proprietary SSP, Improve Digital. Furthermore, Oracle Moat and Anzu.io joined forces to pioneer a first-of-its-kind viewability measurement for in-game ads. Advertisers now have access to third-party viewability verifications and in-view metrics by Oracle Moat, offering transparency and measurement for in-game advertising on mobile and PC. In the strategic realm, ArabyAds acquired Dmenta in 2021, fortifying and complementing their offerings in the Middle East and North Africa region. These proactive initiatives highlight the industry's adaptability to emerging trends and needs in the competitive AdTech landscape.AdTech Market Scope: Inquiry Before Buying

AdTech Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 36.42 Bn. Forecast Period 2023 to 2029 CAGR: 6.3% Market Size in 2029: US $ 55.86 Bn. Segments Covered: by Solution Demand-side Platforms (DSPs) Supply-side Platforms (SSPs) Ad Networks Data Management Platforms (DMPs) Others by Advertising Type Programmatic Advertising Search Advertising Display Advertising Mobile Advertising Native Advertising Others by Enterprise Size Small And Medium Enterprise (SME) Large Enterprise Snack Bars Other by Platform Mobile Web Other by Industry Vertical Media & Entertainment BFSI IT & Telecom Others AdTech Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)AdTech Market Key Players:

1. Google 2. Facebook 3. Amazon 4. Adobe 5. The Trade Desk 6. Criteo 7. Sizmek 8. PubMatic 9. Rubicon Project 10. AdRoll 11. MediaMath 12. Tremor Video 13. InMobi 14. Taboola 15. Outbrain 16. SpotX 17. QuantcastFAQs:

1. What are the growth drivers for the AdTech Market? Ans. Surge in the adoption of AI converging in Adtech Boost the AdTech Market Growth expected to be the major driver for the AdTech Market. 2. What is the major opportunity for the AdTech Market growth? Ans. Emerging technologies like artificial intelligence (AI) and machine learning are being harnessed to optimize ad targeting, automate processes, and enhance overall campaign performance. Expected to be a major Opportunity in the Whole Grain Food Market. 3. Which country is expected to lead the global AdTech Market during the forecast period? Ans. North America is expected to lead the AdTech Market during the forecast period. 4. What is the projected market size and growth rate of the Whole Grain Food Market? Ans. The AdTech Market size was valued at USD 530.2 Billion in 2022 and the total AdTech Market revenue is expected to grow at a CAGR of 13.5% from 2023 to 2029, reaching nearly USD 1286.50 Billion. 5. What segments are covered in the AdTech Market report? Ans. The segments covered in the AdTech Market report are by Solution, Advertising Type, Enterprise Size, Platform, Industry Vertical, and Region.

1. AdTech Market: Research Methodology 2. AdTech Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. AdTech Market: Dynamics 3.1 AdTech Market Trends by Region 3.1.1 North America AdTech Market Trends 3.1.2 Europe AdTech Market Trends 3.1.3 Asia Pacific AdTech Market Trends 3.1.4 Middle East and Africa AdTech Market Trends 3.1.5 South America AdTech Market Trends 3.2 AdTech Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America AdTech Market Drivers 3.2.1.2 North America AdTech Market Restraints 3.2.1.3 North America AdTech Market Opportunities 3.2.1.4 North America AdTech Market Challenges 3.2.2 Europe 3.2.2.1 Europe AdTech Market Drivers 3.2.2.2 Europe AdTech Market Restraints 3.2.2.3 Europe AdTech Market Opportunities 3.2.2.4 Europe AdTech Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific AdTech Market Drivers 3.2.3.2 Asia Pacific AdTech Market Restraints 3.2.3.3 Asia Pacific AdTech Market Opportunities 3.2.3.4 Asia Pacific AdTech Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa AdTech Market Drivers 3.2.4.2 Middle East and Africa AdTech Market Restraints 3.2.4.3 Middle East and Africa AdTech Market Opportunities 3.2.4.4 Middle East and Africa AdTech Market Challenges 3.2.5 South America 3.2.5.1 South America AdTech Market Drivers 3.2.5.2 South America AdTech Market Restraints 3.2.5.3 South America AdTech Market Opportunities 3.2.5.4 South America AdTech Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 By Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives For the AdTech Industry 3.8 The Global Pandemic and Redefining of The Landscape AdTech Market 3.9 Technological Road Map 4. Global AdTech Market: Global Market Size and Forecast by Segmentation (By Value) (2022-2029) 4.1 Global AdTech Market Size and Forecast, by Solution (2022-2029) 4.1.1 Demand-side Platforms (DSPs) 4.1.2 Supply-side Platforms (SSPs) 4.1.3 Ad Networks 4.1.4 Data Management Platforms (DMPs) 4.1.5 Others 4.2 Global AdTech Market Size and Forecast, by Advertising Type (2022-2029) 4.2.1 Programmatic Advertising 4.2.2 Search Advertising 4.2.3 Display Advertising 4.2.4 Mobile Advertising 4.2.5 Native Advertising 4.2.6 Others 4.3 Global AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 4.3.1 Small And Medium Enterprise (SME) 4.3.2 Large Enterprise 4.4 Global AdTech Market Size and Forecast, by Platform (2022-2029) 4.4.1 Mobile 4.4.2 Web 4.4.3 Other 4.5 Global AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 4.5.1 Media & Entertainment 4.5.2 BFSI 4.5.3 IT & Telecom 4.5.4 Others 4.6 Global AdTech Market Size and Forecast, by Region (2022-2029) 4.6.1 North America 4.6.2 Europe 4.6.3 Asia Pacific 4.6.4 Middle East and Africa 4.6.5 South America 5. North America AdTech Market Size and Forecast by Segmentation (By Value) (2022-2029) 5.1 North America AdTech Market Size and Forecast, by Solution (2022-2029) 5.1.1 Demand-side Platforms (DSPs) 5.1.2 Supply-side Platforms (SSPs) 5.1.3 Ad Networks 5.1.4 Data Management Platforms (DMPs) 5.1.5 Others 5.2 North America AdTech Market Size and Forecast, by Advertising Type (2022-2029) 5.2.1 Programmatic Advertising 5.2.2 Search Advertising 5.2.3 Display Advertising 5.2.4 Mobile Advertising 5.2.5 Native Advertising 5.2.6 Others 5.3 North America AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 5.3.1 Small And Medium Enterprise (SME) 5.3.2 Large Enterprise 5.4 North America AdTech Market Size and Forecast, by Platform (2022-2029) 5.4.1 Mobile 5.4.2 Web 5.4.3 Other 5.5 North America AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 5.5.1 Media & Entertainment 5.5.2 BFSI 5.5.3 IT & Telecom 5.5.4 Others 5.6 North America AdTech Market Size and Forecast, by Country (2022-2029) 5.6.1 United States 5.6.1.1 United States AdTech Market Size and Forecast, by Solution (2022-2029) 5.6.1.1.1 Demand-side Platforms (DSPs) 5.6.1.1.2 Supply-side Platforms (SSPs) 5.6.1.1.3 Ad Networks 5.6.1.1.4 Data Management Platforms (DMPs) 5.6.1.1.5 Others 5.6.1.2 United States AdTech Market Size and Forecast, by Advertising Type (2022-2029) 5.6.1.2.1 Programmatic Advertising 5.6.1.2.2 Search Advertising 5.6.1.2.3 Display Advertising 5.6.1.2.4 Mobile Advertising 5.6.1.2.5 Native Advertising 5.6.1.2.6 Others 5.6.1.3 United States AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 5.6.1.3.1 Small And Medium Enterprise (SME) 5.6.1.3.2 Large Enterprise 5.6.1.4 United States AdTech Market Size and Forecast, by Platform (2022-2029) 5.6.1.4.1 Mobile 5.6.1.4.2 Web 5.6.1.4.3 Other 5.6.1.5 United States AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 5.6.1.5.1 Media & Entertainment 5.6.1.5.2 BFSI 5.6.1.5.3 IT & Telecom 5.6.1.5.4 Others 5.6.2 Canada 5.6.2.1 Canada AdTech Market Size and Forecast, by Solution (2022-2029) 5.6.2.1.1 Demand-side Platforms (DSPs) 5.6.2.1.2 Supply-side Platforms (SSPs) 5.6.2.1.3 Ad Networks 5.6.2.1.4 Data Management Platforms (DMPs) 5.6.2.1.5 Others 5.6.2.2 Canada AdTech Market Size and Forecast, by Advertising Type (2022-2029) 5.6.2.2.1 Programmatic Advertising 5.6.2.2.2 Search Advertising 5.6.2.2.3 Display Advertising 5.6.2.2.4 Mobile Advertising 5.6.2.2.5 Native Advertising 5.6.2.2.6 Others 5.6.2.3 Canada AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 5.6.2.3.1 Small And Medium Enterprise (SME) 5.6.2.3.2 Large Enterprise 5.6.2.4 Canada AdTech Market Size and Forecast, by Platform (2022-2029) 5.6.2.4.1 Mobile 5.6.2.4.2 Web 5.6.2.4.3 Other 5.6.2.5 Canada AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 5.6.2.5.1 Media & Entertainment 5.6.2.5.2 BFSI 5.6.2.5.3 IT & Telecom 5.6.2.5.4 Others 5.6.3 Mexico 5.6.3.1 Mexico AdTech Market Size and Forecast, by Solution (2022-2029) 5.6.3.1.1 Demand-side Platforms (DSPs) 5.6.3.1.2 Supply-side Platforms (SSPs) 5.6.3.1.3 Ad Networks 5.6.3.1.4 Data Management Platforms (DMPs) 5.6.3.1.5 Others 5.6.3.2 Mexico AdTech Market Size and Forecast, by Advertising Type (2022-2029) 5.6.3.2.1 Programmatic Advertising 5.6.3.2.2 Search Advertising 5.6.3.2.3 Display Advertising 5.6.3.2.4 Mobile Advertising 5.6.3.2.5 Native Advertising 5.6.3.2.6 Others 5.6.3.3 Mexico AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 5.6.3.3.1 Small And Medium Enterprise (SME) 5.6.3.3.2 Large Enterprise 5.6.3.4 Mexico AdTech Market Size and Forecast, by Platform (2022-2029) 5.6.3.4.1 Mobile 5.6.3.4.2 Web 5.6.3.4.3 Other 5.6.3.5 Mexico AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 5.6.3.5.1 Media & Entertainment 5.6.3.5.2 BFSI 5.6.3.5.3 IT & Telecom 5.6.3.5.4 Others 6. Europe AdTech Market Size and Forecast by Segmentation (By Value) (2022-2029) 6.1 Europe AdTech Market Size and Forecast, by Solution (2022-2029) 6.2 Europe AdTech Market Size and Forecast, by Advertising Type (2022-2029) 6.3 Europe AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 6.4 Europe AdTech Market Size and Forecast, by Platform (2022-2029) 6.5 Europe AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 6.6 Europe AdTech Market Size and Forecast, by Country (2022-2029) 6.6.1 United Kingdom 6.6.1.1 United Kingdom AdTech Market Size and Forecast, by Solution (2022-2029) 6.6.1.2 United Kingdom AdTech Market Size and Forecast, by Advertising Type (2022-2029) 6.6.1.3 United Kingdom AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 6.6.1.4 United Kingdom AdTech Market Size and Forecast, by Platform (2022-2029) 6.6.1.5 United Kingdom AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.2 France 6.6.2.1 France AdTech Market Size and Forecast, by Solution (2022-2029) 6.6.2.2 France AdTech Market Size and Forecast, by Advertising Type (2022-2029) 6.6.2.3 France AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 6.6.2.4 France AdTech Market Size and Forecast, by Platform (2022-2029) 6.6.2.5 France AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.3 Germany 6.6.3.1 Germany AdTech Market Size and Forecast, by Solution (2022-2029) 6.6.3.2 Germany AdTech Market Size and Forecast, by Advertising Type (2022-2029) 6.6.3.3 Germany AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 6.6.3.4 Germany AdTech Market Size and Forecast, by Platform (2022-2029) 6.6.3.5 Germany AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.4 Italy 6.6.4.1 Italy AdTech Market Size and Forecast, by Solution (2022-2029) 6.6.4.2 Italy AdTech Market Size and Forecast, by Advertising Type (2022-2029) 6.6.4.3 Italy AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 6.6.4.4 Italy AdTech Market Size and Forecast, by Platform (2022-2029) 6.6.4.5 Italy AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.5 Spain 6.6.5.1 Spain AdTech Market Size and Forecast, by Solution (2022-2029) 6.6.5.2 Spain AdTech Market Size and Forecast, by Advertising Type (2022-2029) 6.6.5.3 Spain AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 6.6.5.4 Spain AdTech Market Size and Forecast, by Platform (2022-2029) 6.6.5.5 Spain AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.6 Sweden 6.6.6.1 Sweden AdTech Market Size and Forecast, by Solution (2022-2029) 6.6.6.2 Sweden AdTech Market Size and Forecast, by Advertising Type (2022-2029) 6.6.6.3 Sweden AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 6.6.6.4 Sweden AdTech Market Size and Forecast, by Platform (2022-2029) 6.6.6.5 Sweden AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.7 Austria 6.6.7.1 Austria AdTech Market Size and Forecast, by Solution (2022-2029) 6.6.7.2 Austria AdTech Market Size and Forecast, by Advertising Type (2022-2029) 6.6.7.3 Austria AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 6.6.7.4 Austria AdTech Market Size and Forecast, by Platform (2022-2029) 6.6.7.5 Austria AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 6.6.8 Rest of Europe 6.6.8.1 Rest of Europe AdTech Market Size and Forecast, by Solution (2022-2029) 6.6.8.2 Rest of Europe AdTech Market Size and Forecast, by Advertising Type (2022-2029). 6.6.8.3 Rest of Europe AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 6.6.8.4 Rest of Europe AdTech Market Size and Forecast, by Platform (2022-2029) 6.6.8.5 Rest of Europe AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7. Asia Pacific AdTech Market Size and Forecast by Segmentation (By Value) (2022-2029) 7.1 Asia Pacific AdTech Market Size and Forecast, by Solution (2022-2029) 7.2 Asia Pacific AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.3 Asia Pacific AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.4 Asia Pacific AdTech Market Size and Forecast, by Platform (2022-2029) 7.5 Asia Pacific AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6 Asia Pacific AdTech Market Size and Forecast, by Country (2022-2029) 7.6.1 China 7.6.1.1 China AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.1.2 China AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.1.3 China AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.1.4 China AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.1.5 China AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.2 South Korea 7.6.2.1 S Korea AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.2.2 S Korea AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.2.3 S Korea AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.2.4 S Korea AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.2.5 S Korea AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.3 Japan 7.6.3.1 Japan AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.3.2 Japan AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.3.3 Japan AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.3.4 Japan AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.3.5 Japan AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.4 India 7.6.4.1 India AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.4.2 India AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.4.3 India AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.4.4 India AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.4.5 India AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.5 Australia 7.6.5.1 Australia AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.5.2 Australia AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.5.3 Australia AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.5.4 Australia AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.5.5 Australia AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.6 Indonesia 7.6.6.1 Indonesia AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.6.2 Indonesia AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.6.3 Indonesia AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.6.4 Indonesia AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.6.5 Indonesia AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.7 Malaysia 7.6.7.1 Malaysia AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.7.2 Malaysia AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.7.3 Malaysia AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.7.4 Malaysia AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.7.5 Malaysia AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.8 Vietnam 7.6.8.1 Vietnam AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.8.2 Vietnam AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.8.3 Vietnam AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.8.4 Vietnam AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.8.5 Vietnam AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.9 Taiwan 7.6.9.1 Taiwan AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.9.2 Taiwan AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.9.3 Taiwan AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.9.4 Taiwan AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.9.5 Taiwan AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.10 Bangladesh 7.6.10.1 Bangladesh AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.10.2 Bangladesh AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.10.3 Bangladesh AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.10.4 Bangladesh AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.10.5 Bangladesh AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.11 Pakistan 7.6.11.1 Pakistan AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.11.2 Pakistan AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.11.3 Pakistan AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.11.4 Pakistan AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.11.5 Pakistan AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 7.6.12 Rest of Asia Pacific 7.6.12.1 Rest of Asia Pacific AdTech Market Size and Forecast, by Solution (2022-2029) 7.6.12.2 Rest of Asia Pacific AdTech Market Size and Forecast, by Advertising Type (2022-2029) 7.6.12.3 Rest of Asia Pacific AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 7.6.12.4 Rest of Asia Pacific AdTech Market Size and Forecast, by Platform (2022-2029) 7.6.12.5 Rest of Asia Pacific AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 8. Middle East and Africa AdTech Market Size and Forecast by Segmentation (By Value) (2022-2029) 8.1 Middle East and Africa AdTech Market Size and Forecast, by Solution (2022-2029) 8.2 Middle East and Africa AdTech Market Size and Forecast, by Advertising Type (2022-2029) 8.3 Middle East and Africa AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 8.4 Middle East and Africa AdTech Market Size and Forecast, by Platform (2022-2029) 8.5 Middle East and Africa AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 8.6 Middle East and Africa AdTech Market Size and Forecast, by Country (2022-2029) 8.6.1 South Africa 8.6.1.1 South Africa AdTech Market Size and Forecast, by Solution (2022-2029) 8.6.1.2 South Africa AdTech Market Size and Forecast, by Advertising Type (2022-2029) 8.6.1.3 South Africa AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 8.6.1.4 South Africa AdTech Market Size and Forecast, by Platform (2022-2029) 8.6.1.5 South Africa AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 8.6.2 GCC 8.6.2.1 GCC AdTech Market Size and Forecast, by Solution (2022-2029) 8.6.2.2 GCC AdTech Market Size and Forecast, by Advertising Type (2022-2029) 8.6.2.3 GCC AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 8.6.2.4 GCC AdTech Market Size and Forecast, by Platform (2022-2029) 8.6.2.5 GCC AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 8.6.3 Egypt 8.6.3.1 Egypt AdTech Market Size and Forecast, by Solution (2022-2029) 8.6.3.2 Egypt AdTech Market Size and Forecast, by Advertising Type (2022-2029) 8.6.3.3 Egypt AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 8.6.3.4 Egypt AdTech Market Size and Forecast, by Platform (2022-2029) 8.6.3.5 Egypt AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 8.6.4 Nigeria 8.6.4.1 Nigeria AdTech Market Size and Forecast, by Solution (2022-2029) 8.6.4.2 Nigeria AdTech Market Size and Forecast, by Advertising Type (2022-2029) 8.6.4.3 Nigeria AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 8.6.4.4 Nigeria AdTech Market Size and Forecast, by Platform (2022-2029) 8.6.4.5 Nigeria AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 8.6.5 Rest of ME&A 8.6.5.1 Rest of ME&A AdTech Market Size and Forecast, by Solution (2022-2029) 8.6.5.2 Rest of ME&A AdTech Market Size and Forecast, by Advertising Type (2022-2029) 8.6.5.3 Rest of ME&A AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 8.6.5.4 Rest of ME&A AdTech Market Size and Forecast, by Platform (2022-2029) 8.6.5.5 Rest of ME&A AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 9. South America AdTech Market Size and Forecast by Segmentation (By Value) (2022-2029) 9.1 South America AdTech Market Size and Forecast, by Solution (2022-2029) 9.2 South America AdTech Market Size and Forecast, by Advertising Type (2022-2029) 9.3 South America AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 9.4 South America AdTech Market Size and Forecast, by Platform (2022-2029) 9.5 South America AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 9.6 South America AdTech Market Size and Forecast, by Country (2022-2029) 9.6.1 Brazil 9.6.1.1 Brazil AdTech Market Size and Forecast, by Solution (2022-2029) 9.6.1.2 Brazil AdTech Market Size and Forecast, by Advertising Type (2022-2029) 9.6.1.3 Brazil AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 9.6.1.4 Brazil AdTech Market Size and Forecast, by Platform (2022-2029) 9.6.1.5 Brazil AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 9.6.2 Argentina 9.6.2.1 Argentina AdTech Market Size and Forecast, by Solution (2022-2029) 9.6.2.2 Argentina AdTech Market Size and Forecast, by Advertising Type (2022-2029) 9.6.2.3 Argentina AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 9.6.2.4 Argentina AdTech Market Size and Forecast, by Platform (2022-2029) 9.6.2.5 Argentina AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 9.6.3 Rest Of South America 9.6.3.1 Rest Of South America AdTech Market Size and Forecast, by Solution (2022-2029) 9.6.3.2 Rest Of South America AdTech Market Size and Forecast, by Advertising Type (2022-2029) 9.6.3.3 Rest Of South America AdTech Market Size and Forecast, by Enterprise Size(2022-2029) 9.6.3.4 Rest Of South America AdTech Market Size and Forecast, by Platform (2022-2029) 9.6.3.5 Rest Of South America AdTech Market Size and Forecast, by Industry Vertical (2022-2029) 10. Global AdTech Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 Product Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Leading AdTech Global Companies, by market capitalization 10.5 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Google 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Facebook 11.3 Amazon 11.4 Adobe 11.5 The Trade Desk 11.6 Criteo 11.7 Sizmek 11.8 PubMatic 11.9 Rubicon Project 11.10 AdRoll 11.11 MediaMath 11.12 Tremor Video 11.13 InMobi 11.14 Taboola 11.15 Outbrain 11.16 SpotX 11.17 Quantcast 12. Key Findings 13. Industry Recommendations