The Global ADC Technology Market size was valued at USD 7.60 Bn in 2022 and is expected to reach USD 14.44 Bn by 2029, at a CAGR of 9.6 %.Overview of the ADC Technology Market

Antibody-drug conjugates (ADCs) are designed to achieve selective and precise delivery of cytotoxic drugs, primarily to tumor cells expressing specific antigens, utilizing the specificity of monoclonal antibodies (mAbs). In contrast to conventional cytotoxic drugs, ADCs enhance the effectiveness of their payload while reducing its toxicity. This targeted approach to delivering cytotoxic drugs to cancer cells increases the proportion of drug molecules reaching the tumor site, consequently reducing the minimum effective dose required and raising the maximum tolerated dose. The graphical representation and structural exclusive information showed the dominating region of the ADC Technology Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the ADC Technology Market.To know about the Research Methodology :- Request Free Sample Report

ADC Technology Market Dynamics

The Increasing Prevalence of Oncological Disorders and the Demographic Shift toward an Aging Population are Major Drivers of the ADC Technology Market The rising incidence and prevalence of oncological disorders on a global scale serve as a primary catalyst for the ADC technology market. With cancer continuing to be a significant global health challenge, there is an urgent demand for more effective and precisely targeted therapeutic interventions. The demographic transition toward an aging population is contributing to a heightened demand for innovative cancer treatments. Older individuals are more susceptible to cancer, emphasizing the critical role of advanced therapies like ADCs in addressing the healthcare needs of this demographic segment. Researchers are demonstrating an increasing interest in exploring innovative therapeutic approaches, with ADCs emerging as a particularly promising avenue. This heightened interest stems from the potential of ADCs to provide targeted and potent treatment options across a wide spectrum of tumor Targets. ADCs represent an emerging category of highly potent pharmaceutical drugs that combine elements of immunotherapy and chemotherapy. Their distinctive mode of action and the ability to precisely target specific antigens make them an appealing choice for cancer treatment. ADCs have demonstrated their effectiveness by precisely targeting specific antigens, including ERBB2, CD33, CD19, CD22, MSLN (mesothelin), and numerous others. This versatility in targeting antigens enhances the applicability of ADCs across various cancer Targets in the ADC Technology Market. Off-target toxicities, Aggregation, Drug Resistance, and Stability Testing are the major challenges in the ADC technology Market A significant impediment in ADC development revolves around off-target toxicities stemming from the premature release of cytotoxic small molecules into the bloodstream. The risk of off-target toxicities is compounded when the cytotoxic small molecules possess a higher inherent toxicity in the ADC Technology Market. Resolving this issue is imperative for augmenting the safety profile of ADCs. ADCs are susceptible to aggregation, a phenomenon that can result in structural alterations impeding their capacity to bind to the intended target antigen. Aggregation poses a substantial obstacle, particularly in the initial phases of ADC development. Mitigating this challenge necessitates meticulous formulation and engineering efforts to pre-empt such complications. The degradation induced by aggregation introduces complexities in meeting stability testing requirements, which are indispensable for securing regulatory approval and the registration of ADC-based pharmaceuticals. Balancing long-term stability with the preservation of therapeutic efficacy remains a critical concern in this regard. ADCs are not immune to drug resistance, which curtails their duration of effectiveness. The persistence of drug resistance has been a vexing issue impeding the clinical success of ADC therapies. However, the modular nature of ADCs offers avenues for the modification of components, facilitating the creation of novel compounds capable of circumventing resistance mechanisms. Elevated expression of drug efflux pumps stands as one of the prevalent mechanisms contributing to ADC resistance, underscoring the need for innovative strategies to combat this challenge and extend the clinical utility of the ADC Technology Market.ADC Technology Market Segment Analysis

By Target: When it comes to selecting targets for ADCs, several sub-categories are notable in the ADC Technology Market. Antibody-Protein Toxin Conjugates involves the linkage of monoclonal antibodies to protein toxins, facilitating precise cell destruction. Antibody-chelated radionuclide Conjugates utilize antibodies as vehicles to deliver radionuclides to tumor cells, enabling localized radiation therapy. Antibody-Small-Molecule Drug Conjugates employ antibodies to selectively transport small-molecule drugs to cancer cells. Antibody-enzyme conjugates entail the coupling of antibodies with enzymes to initiate specific biochemical reactions within target cells. In the ADC technology market, Adcertis and Kadcyla stand out as prominent examples, each possessing unique characteristics and End-Users. Additionally, there are other ADC products contributing to the continuously evolving landscape. ADCs hinge on the specificity of antibodies to target cancer cells. Notable examples of mechanisms of action include CD30 Antibodies and HER2 Antibodies. These antibodies pinpoint specific antigens present on the surface of cancer cells, enabling precise and targeted drug delivery. ADCs find End-User in the treatment of a wide spectrum of cancers. Notable indications include Lymphoma, Breast Cancer, Brain Tumor, Lung Cancer, Ovarian Cancer, and several others. The targeted therapeutic potential of ADCs benefits patients across diverse cancer Targets. By Distribution Channel: The Distribution Channels of ADC technology span a spectrum, including Hospitals, Specialty Clinics, and other healthcare facilities. These institutions play a pivotal role in the administration and management of ADC-based treatments in the ADC Technology Industry, ensuring that patients receive the intended therapies effectively. The distribution channels for ADC products encompass Hospital Pharmacies, Retail Pharmacies, and various other avenues. Effective distribution mechanisms are essential to ensure that ADC therapies reach their intended patients efficiently. The ADC technology market derives strength from various technological platforms. Key players like Immunogen Technology, Seattle Genetics Technology, and Immunomedics Technology employ distinct approaches to ADC development, driving innovation within the field. Emerging technologies further contribute to the advancement of ADCs.

ADC Technology Market Regional Analysis

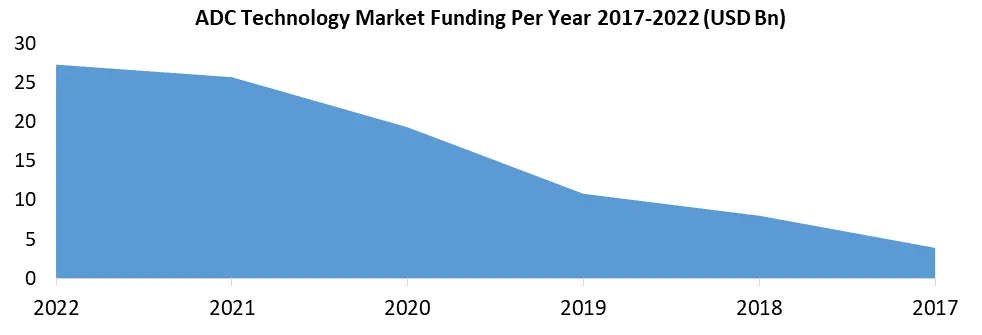

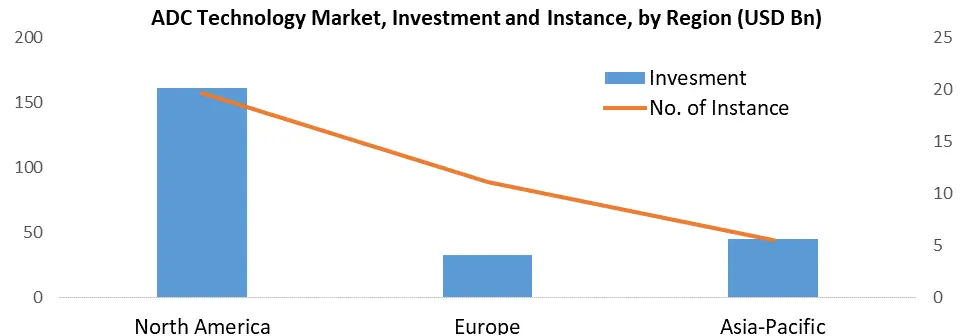

In recent years, the ADC (Antibody-Drug Conjugate) technology market has witnessed significant growth, particularly driven by the emergence of well-funded start-ups and small companies specializing in advanced linkers and potent warheads for ADCs. A mainstream of these advanced firms are grounded in North America, demonstrating the region's dominance in this sector. The United States Food and Drug Administration (FDA) has been prominently involved in swotting and approving ADC therapeutics for cancer treatment, therefore contributing to the region's prominence in the ADC technology landscape. One of the important key drivers for the of antibody-drug conjugates (ADC Technology Market) in North America is the upscaling incidence of cancer, prominently in the United States. On the basis of the data from the American Cancer Society, an estimated 1.9 million cancer diagnoses were projected in the US for the year 2022. This alarming statistic underscores the pressing need for advanced therapeutic options, like ADCs, to combat this growing health challenge effectively. Several risk factors contribute to the high cancer incidence in North America, including tobacco use, excess body weight, excessive alcohol consumption, and exposure to infectious agents. These factors collectively propel the growth of the North American antibody drug conjugate market throughout the forecast period. The region's healthcare landscape is keenly focused on addressing these risk factors and improving cancer care, further facilitating the integration of ADCs into treatment protocols. To enhance the adoption of antibody-drug conjugates among the target population, ADC developers in North America are actively offering patient assistance and support programs. These initiatives play a crucial role in helping patients manage the often substantial medical expenses associated with cancer treatment in the ADC Technology Market. Notable examples of such programs include the Ambrx patient assistance program, Bayer oncology patient assistance program, and Genentech patient assistance program, which underscore the commitment of ADC Technology industry stakeholders to improving patient outcomes.

ADC Technology Market Competitive Landscape Analysis

In July 2023, AstraZeneca and Daiichi Sankyo's datopotamab deruxtecan emerged as a prominent ADC program. However, investor confidence wavered due to reports of "some" patient fatalities during its initial Phase 3 trial. Nevertheless, the study successfully met its objective by demonstrating that the drug improved progression-free survival compared to standard chemotherapy in second-line non-small cell lung cancer. In May 2023, Sony Corporation and Astellas Pharma Inc. entered a collaborative research agreement aimed at discovering a novel Antibody-Drug Conjugate (ADC) platform for oncology in the ADC Technology Market. Leveraging Sony's unique polymeric material, KIRAVIA ADC is anticipated to selectively deliver anti-cancer drugs to target cells, thereby enhancing efficacy while reducing the side effects associated with anti-cancer drugs attacking normal cells. In April 2023, Germany's BioNTech inked a partnership with the Chinese biotech company DualityBio to jointly develop and commercialize two cancer antibody drug candidates, DB-1303 and DB-1311, as part of a combination therapy for solid tumors. DualityBio will retain commercial rights for mainland China, the Hong Kong Special Administrative Region, and the Macau Special Administrative Region, while BioNTech will have commercial rights for the rest of the world.In January 2023, Bridge Biotherapeutics and Pinotbio signed a memorandum of understanding (MoU) to collaborate on the development of new therapeutic cancer candidates using the antibody drug conjugates platform technology. Under the agreement, Bridge Biotherapeutics will contribute private anticancer targets, while Pinotbio will provide linkers and drugs. In August 2022, GSK made a cash payment of $100 million to Mersana Therapeutics to expand its portfolio by adding a second ADC in the ADC Technology Market. This addition complements GSK's existing approved multiple myeloma drug, Blenrep. The agreement encompasses XMT-2056, Mersana's preclinical ADC asset designed for the treatment of various HER-2 cancers. The global agreement grants GSK an exclusive option to co-develop and commercialize XMT-2056. In July 2023, Ambrx announced that the FDA had granted Fast Track designation to ARX517, its proprietary investigational anti-PSMA antibody-drug conjugate therapy. This designation is for the treatment of patients with metastatic castration-resistant prostate cancer (mCRPC) who have progressed on an androgen receptor pathway inhibitor. In July 2023, Mersana Therapeutics disclosed the publication of the topline data from the UPLIFT clinical trial, which focused on patients with platinum-resistant ovarian cancer. Additionally, the company announced strategic reprioritization efforts in the ADC Technology Industry.

ADC Technology Market Scope: Inquiry Before Buying

ADC Technology Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 7.60 Bn. Forecast Period 2023 to 2029 CAGR: 9.6% Market Size in 2029: US $ 14.44 Bn. Segments Covered: by Target Antibody-Protein Toxin Conjugates Antibody-Chelated Radionuclide Conjugates Antibody-Small-Molecule Drug Conjugates Antibody-Enzyme Conjugates by Product Adcertis Kadcyla Others by Mechanism of Action CD30 Antibodies HER2 Antibodies by Technology Cleavable linkers Non-cleavable linkers Chemical conjugation Enzymatic conjugation by Indication / Application Lymphoma Breast Cancer Brain Tumor Lung Cancer Ovarian Cancer Others by End-Users Hospitals Specialty Clinics Others by Distribution Channel Hospitals Speciality clinics Retail Pharmacy Other healthcare facilities ADC Technology Market, by Regions

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the ADC Technology Market

1. ADC Therapeutics 2. Astellas Pharma 3. AstraZeneca 4. Byondis 5. Daiichi Sankyo 6. Genentech 7. Gilead Sciences 8. ImmunoGen 9. Pfizer 10. RemeGen. 11. BioNTech 12. DualityBio 13. Bridge Biotherapeutics 14. Pinotbio 15. GSK 16. Mersana TherapeuticsFrequently Asked Questions and Answers about ADC Technology Market

1. What is the ADC Technology Market? Ans: ADC technology, or Antibody-Drug Conjugate technology, is a cutting-edge approach in the field of cancer therapeutics that combines monoclonal antibodies with cytotoxic drugs for targeted cancer treatment. 2. Why is ADC technology significant in the market? Ans: ADC technology is significant because it offers precise and targeted delivery of cancer drugs to tumor cells, reducing side effects and increasing treatment efficacy. 3. What is the market size for the ADC Technology Market? Ans: The ADC Technology Market CAGR 9.6 % with 14.44 Bn in 2029. 4. Which regions are driving the growth of the ADC technology market? Ans: North America, with a high incidence of cancer and FDA approvals, is a major driver of ADC technology market growth. 5. What are the primary benefits of ADC technology for cancer treatment? Ans: ADC technology offers benefits such as reduced toxicity, precise targeting of cancer cells, and increased treatment effectiveness, making it a promising avenue for cancer therapy.

1. ADC Technology Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. ADC Technology Market: Dynamics 2.1. ADC Technology Market Trends by Region 2.1.1. North America ADC Technology Market Trends 2.1.2. Europe ADC Technology Market Trends 2.1.3. Asia Pacific ADC Technology Market Trends 2.1.4. Middle East and Africa ADC Technology Market Trends 2.1.5. South America ADC Technology Market Trends 2.2. ADC Technology Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America ADC Technology Market Drivers 2.2.1.2. North America ADC Technology Market Restraints 2.2.1.3. North America ADC Technology Market Opportunities 2.2.1.4. North America ADC Technology Market Challenges 2.2.2. Europe 2.2.2.1. Europe ADC Technology Market Drivers 2.2.2.2. Europe ADC Technology Market Restraints 2.2.2.3. Europe ADC Technology Market Opportunities 2.2.2.4. Europe ADC Technology Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific ADC Technology Market Drivers 2.2.3.2. Asia Pacific ADC Technology Market Restraints 2.2.3.3. Asia Pacific ADC Technology Market Opportunities 2.2.3.4. Asia Pacific ADC Technology Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa ADC Technology Market Drivers 2.2.4.2. Middle East and Africa ADC Technology Market Restraints 2.2.4.3. Middle East and Africa ADC Technology Market Opportunities 2.2.4.4. Middle East and Africa ADC Technology Market Challenges 2.2.5. South America 2.2.5.1. South America ADC Technology Market Drivers 2.2.5.2. South America ADC Technology Market Restraints 2.2.5.3. South America ADC Technology Market Opportunities 2.2.5.4. South America ADC Technology Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For ADC Technology Industry 2.8. Analysis of Government Schemes and Initiatives For ADC Technology Industry 2.9. ADC Technology Market Trade Analysis 2.10. The Global Pandemic Impact on ADC Technology Market 3. ADC Technology Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. ADC Technology Market Size and Forecast, by Target (2022-2029) 3.1.1. Antibody-Protein Toxin Conjugates 3.1.2. Antibody-Chelated Radionuclide Conjugates 3.1.3. Antibody-Small-Molecule Drug Conjugates 3.1.4. Antibody-Enzyme Conjugates 3.2. ADC Technology Market Size and Forecast, by Product (2022-2029) 3.2.1. Adcertis 3.2.2. Kadcyla 3.2.3. Others 3.3. ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 3.3.1. CD30 Antibodies 3.3.2. HER2 Antibodies 3.4. ADC Technology Market Size and Forecast, by Technology (2022-2029) 3.4.1. Cleavable linkers 3.4.2. Non-cleavable linkers 3.4.3. Chemical conjugation 3.4.4. Enzymatic conjugation 3.5. ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 3.5.1. Lymphoma 3.5.2. Breast Cancer 3.5.3. Brain Tumor 3.5.4. Lung Cancer 3.5.5. Ovarian Cancer 3.5.6. Others 3.6. ADC Technology Market Size and Forecast, by End-Users (2022-2029) 3.6.1. Hospitals 3.6.2. Specialty Clinics 3.6.3. Others 3.7. ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 3.7.1. Hospitals 3.7.2. Speciality clinics 3.7.3. Retail Pharmacy 3.7.4. Other healthcare facilities 3.8. ADC Technology Market Size and Forecast, by Region (2022-2029) 3.8.1. North America 3.8.2. Europe 3.8.3. Asia Pacific 3.8.4. Middle East and Africa 3.8.5. South America 4. North America ADC Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America ADC Technology Market Size and Forecast, by Target (2022-2029) 4.1.1. Antibody-Protein Toxin Conjugates 4.1.2. Antibody-Chelated Radionuclide Conjugates 4.1.3. Antibody-Small-Molecule Drug Conjugates 4.1.4. Antibody-Enzyme Conjugates 4.2. North America ADC Technology Market Size and Forecast, by Product (2022-2029) 4.2.1. Adcertis 4.2.2. Kadcyla 4.2.3. Others 4.3. North America ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 4.3.1. CD30 Antibodies 4.3.2. HER2 Antibodies 4.4. North America ADC Technology Market Size and Forecast, by Technology (2022-2029) 4.4.1. Cleavable linkers 4.4.2. Non-cleavable linkers 4.4.3. Chemical conjugation 4.4.4. Enzymatic conjugation 4.5. North America ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 4.5.1. Lymphoma 4.5.2. Breast Cancer 4.5.3. Brain Tumor 4.5.4. Lung Cancer 4.5.5. Ovarian Cancer 4.5.6. Others 4.6. North America ADC Technology Market Size and Forecast, by End-Users (2022-2029) 4.6.1. Hospitals 4.6.2. Specialty Clinics 4.6.3. Others 4.7. North America ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 4.7.1. Hospitals 4.7.2. Speciality clinics 4.7.3. Retail Pharmacy 4.7.4. Other healthcare facilities 4.8. North America ADC Technology Market Size and Forecast, by Country (2022-2029) 4.8.1. United States 4.8.1.1. United States ADC Technology Market Size and Forecast, by Target (2022-2029) 4.8.1.1.1. Antibody-Protein Toxin Conjugates 4.8.1.1.2. Antibody-Chelated Radionuclide Conjugates 4.8.1.1.3. Antibody-Small-Molecule Drug Conjugates 4.8.1.1.4. Antibody-Enzyme Conjugates 4.8.1.2. United States ADC Technology Market Size and Forecast, by Product (2022-2029) 4.8.1.2.1. Adcertis 4.8.1.2.2. Kadcyla 4.8.1.2.3. Others 4.8.1.3. United States ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 4.8.1.3.1. CD30 Antibodies 4.8.1.3.2. HER2 Antibodies 4.8.1.4. United States ADC Technology Market Size and Forecast, by Technology (2022-2029) 4.8.1.4.1. Cleavable linkers 4.8.1.4.2. Non-cleavable linkers 4.8.1.4.3. Chemical conjugation 4.8.1.4.4. Enzymatic conjugation 4.8.1.5. United States ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 4.8.1.5.1. Lymphoma 4.8.1.5.2. Breast Cancer 4.8.1.5.3. Brain Tumor 4.8.1.5.4. Lung Cancer 4.8.1.5.5. Ovarian Cancer 4.8.1.5.6. Others 4.8.1.6. United States ADC Technology Market Size and Forecast, by End-Users (2022-2029) 4.8.1.6.1. Hospitals 4.8.1.6.2. Specialty Clinics 4.8.1.6.3. Others 4.8.1.7. United States ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 4.8.1.7.1. Hospitals 4.8.1.7.2. Speciality clinics 4.8.1.7.3. Retail Pharmacy 4.8.1.7.4. Other healthcare facilities 4.8.2. Canada 4.8.2.1. Canada ADC Technology Market Size and Forecast, by Target (2022-2029) 4.8.2.1.1. Antibody-Protein Toxin Conjugates 4.8.2.1.2. Antibody-Chelated Radionuclide Conjugates 4.8.2.1.3. Antibody-Small-Molecule Drug Conjugates 4.8.2.1.4. Antibody-Enzyme Conjugates 4.8.2.2. Canada ADC Technology Market Size and Forecast, by Product (2022-2029) 4.8.2.2.1. Adcertis 4.8.2.2.2. Kadcyla 4.8.2.2.3. Others 4.8.2.3. Canada ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 4.8.2.3.1. CD30 Antibodies 4.8.2.3.2. HER2 Antibodies 4.8.2.4. Canada ADC Technology Market Size and Forecast, by Technology (2022-2029) 4.8.2.4.1. Cleavable linkers 4.8.2.4.2. Non-cleavable linkers 4.8.2.4.3. Chemical conjugation 4.8.2.4.4. Enzymatic conjugation 4.8.2.5. Canada ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 4.8.2.5.1. Lymphoma 4.8.2.5.2. Breast Cancer 4.8.2.5.3. Brain Tumor 4.8.2.5.4. Lung Cancer 4.8.2.5.5. Ovarian Cancer 4.8.2.5.6. Others 4.8.2.6. Canada ADC Technology Market Size and Forecast, by End-Users (2022-2029) 4.8.2.6.1. Hospitals 4.8.2.6.2. Specialty Clinics 4.8.2.6.3. Others 4.8.2.7. Canada ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 4.8.2.7.1. Hospitals 4.8.2.7.2. Speciality clinics 4.8.2.7.3. Retail Pharmacy 4.8.2.7.4. Other healthcare facilities 4.8.3. Mexico 4.8.3.1. Mexico ADC Technology Market Size and Forecast, by Target (2022-2029) 4.8.3.1.1. Antibody-Protein Toxin Conjugates 4.8.3.1.2. Antibody-Chelated Radionuclide Conjugates 4.8.3.1.3. Antibody-Small-Molecule Drug Conjugates 4.8.3.1.4. Antibody-Enzyme Conjugates 4.8.3.2. Mexico ADC Technology Market Size and Forecast, by Product (2022-2029) 4.8.3.2.1. Adcertis 4.8.3.2.2. Kadcyla 4.8.3.2.3. Others 4.8.3.3. Mexico ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 4.8.3.3.1. CD30 Antibodies 4.8.3.3.2. HER2 Antibodies 4.8.3.4. Mexico ADC Technology Market Size and Forecast, by Technology (2022-2029) 4.8.3.4.1. Cleavable linkers 4.8.3.4.2. Non-cleavable linkers 4.8.3.4.3. Chemical conjugation 4.8.3.4.4. Enzymatic conjugation 4.8.3.5. Mexico ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 4.8.3.5.1. Lymphoma 4.8.3.5.2. Breast Cancer 4.8.3.5.3. Brain Tumor 4.8.3.5.4. Lung Cancer 4.8.3.5.5. Ovarian Cancer 4.8.3.5.6. Others 4.8.3.6. Mexico ADC Technology Market Size and Forecast, by End-Users (2022-2029) 4.8.3.6.1. Hospitals 4.8.3.6.2. Specialty Clinics 4.8.3.6.3. Others 4.8.3.7. Mexico ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 4.8.3.7.1. Hospitals 4.8.3.7.2. Speciality clinics 4.8.3.7.3. Retail Pharmacy 4.8.3.7.4. Other healthcare facilities 5. Europe ADC Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe ADC Technology Market Size and Forecast, by Target (2022-2029) 5.2. Europe ADC Technology Market Size and Forecast, by Product (2022-2029) 5.3. Europe ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 5.4. Europe ADC Technology Market Size and Forecast, by Technology (2022-2029) 5.5. Europe ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 5.6. Europe ADC Technology Market Size and Forecast, by End-Users (2022-2029) 5.7. Europe ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 5.8. Europe ADC Technology Market Size and Forecast, by Country (2022-2029) 5.8.1. United Kingdom 5.8.1.1. United Kingdom ADC Technology Market Size and Forecast, by Target (2022-2029) 5.8.1.2. United Kingdom ADC Technology Market Size and Forecast, by Product (2022-2029) 5.8.1.3. United Kingdom ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 5.8.1.4. United Kingdom ADC Technology Market Size and Forecast, by Technology (2022-2029) 5.8.1.5. United Kingdom ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 5.8.1.6. United Kingdom ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 5.8.1.7. United Kingdom ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 5.8.2. France 5.8.2.1. France ADC Technology Market Size and Forecast, by Target (2022-2029) 5.8.2.2. France ADC Technology Market Size and Forecast, by Product (2022-2029) 5.8.2.3. France ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 5.8.2.4. France ADC Technology Market Size and Forecast, by Technology (2022-2029) 5.8.2.5. France ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 5.8.2.6. France ADC Technology Market Size and Forecast, by End-Users (2022-2029) 5.8.2.7. France ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 5.8.3. Germany 5.8.3.1. Germany ADC Technology Market Size and Forecast, by Target (2022-2029) 5.8.3.2. Germany ADC Technology Market Size and Forecast, by Product (2022-2029) 5.8.3.3. Germany ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 5.8.3.4. Germany ADC Technology Market Size and Forecast, by Technology (2022-2029) 5.8.3.5. Germany ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 5.8.3.6. Germany ADC Technology Market Size and Forecast, by End-Users (2022-2029) 5.8.3.7. Germany ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 5.8.4. Italy 5.8.4.1. Italy ADC Technology Market Size and Forecast, by Target (2022-2029) 5.8.4.2. Italy ADC Technology Market Size and Forecast, by Product (2022-2029) 5.8.4.3. Italy ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 5.8.4.4. Italy ADC Technology Market Size and Forecast, by Technology (2022-2029) 5.8.4.5. Italy ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 5.8.4.6. Italy ADC Technology Market Size and Forecast, by End-Users (2022-2029) 5.8.4.7. Italy ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 5.8.5. Spain 5.8.5.1. Spain ADC Technology Market Size and Forecast, by Target (2022-2029) 5.8.5.2. Spain ADC Technology Market Size and Forecast, by Product (2022-2029) 5.8.5.3. Spain ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 5.8.5.4. Spain ADC Technology Market Size and Forecast, by Technology (2022-2029) 5.8.5.5. Spain ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 5.8.5.6. Spain ADC Technology Market Size and Forecast, by End-Users (2022-2029) 5.8.5.7. Spain ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 5.8.6. Sweden 5.8.6.1. Sweden ADC Technology Market Size and Forecast, by Target (2022-2029) 5.8.6.2. Sweden ADC Technology Market Size and Forecast, by Product (2022-2029) 5.8.6.3. Sweden ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 5.8.6.4. Sweden ADC Technology Market Size and Forecast, by Technology (2022-2029) 5.8.6.5. Sweden ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 5.8.6.6. Sweden ADC Technology Market Size and Forecast, by End-Users (2022-2029) 5.8.6.7. Sweden ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 5.8.7. Austria 5.8.7.1. Austria ADC Technology Market Size and Forecast, by Target (2022-2029) 5.8.7.2. Austria ADC Technology Market Size and Forecast, by Product (2022-2029) 5.8.7.3. Austria ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 5.8.7.4. Austria ADC Technology Market Size and Forecast, by Technology (2022-2029) 5.8.7.5. Austria ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 5.8.7.6. Austria ADC Technology Market Size and Forecast, by End-Users (2022-2029) 5.8.7.7. Austria ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 5.8.8. Rest of Europe 5.8.8.1. Rest of Europe ADC Technology Market Size and Forecast, by Target (2022-2029) 5.8.8.2. Rest of Europe ADC Technology Market Size and Forecast, by Product (2022-2029) 5.8.8.3. Rest of Europe ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 5.8.8.4. Rest of Europe ADC Technology Market Size and Forecast, by Technology (2022-2029) 5.8.8.5. Rest of Europe ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 5.8.8.6. Rest of Europe ADC Technology Market Size and Forecast, by End-Users (2022-2029) 5.8.8.7. Rest of Europe ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific ADC Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific ADC Technology Market Size and Forecast, by Target (2022-2029) 6.2. Asia Pacific ADC Technology Market Size and Forecast, by Product (2022-2029) 6.3. Asia Pacific ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 6.4. Asia Pacific ADC Technology Market Size and Forecast, by Technology (2022-2029) 6.5. Asia Pacific ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 6.6. Asia Pacific ADC Technology Market Size and Forecast, by End-Users (2022-2029) 6.7. Asia Pacific ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 6.8. Asia Pacific ADC Technology Market Size and Forecast, by Country (2022-2029) 6.8.1. China 6.8.1.1. China ADC Technology Market Size and Forecast, by Target (2022-2029) 6.8.1.2. China ADC Technology Market Size and Forecast, by Product (2022-2029) 6.8.1.3. China ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 6.8.1.4. China ADC Technology Market Size and Forecast, by Technology (2022-2029) 6.8.1.5. China ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 6.8.1.6. China ADC Technology Market Size and Forecast, by End-Users (2022-2029) 6.8.1.7. China ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 6.8.2. S Korea 6.8.2.1. S Korea ADC Technology Market Size and Forecast, by Target (2022-2029) 6.8.2.2. S Korea ADC Technology Market Size and Forecast, by Product (2022-2029) 6.8.2.3. S Korea ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 6.8.2.4. S Korea ADC Technology Market Size and Forecast, by Technology (2022-2029) 6.8.2.5. S Korea ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 6.8.2.6. S Korea ADC Technology Market Size and Forecast, by End-Users (2022-2029) 6.8.2.7. S Korea ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 6.8.3. Japan 6.8.3.1. Japan ADC Technology Market Size and Forecast, by Target (2022-2029) 6.8.3.2. Japan ADC Technology Market Size and Forecast, by Product (2022-2029) 6.8.3.3. Japan ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 6.8.3.4. Japan ADC Technology Market Size and Forecast, by Technology (2022-2029) 6.8.3.5. Japan ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 6.8.3.6. Japan ADC Technology Market Size and Forecast, by End-Users (2022-2029) 6.8.3.7. Japan ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 6.8.4. India 6.8.4.1. India ADC Technology Market Size and Forecast, by Target (2022-2029) 6.8.4.2. India ADC Technology Market Size and Forecast, by Product (2022-2029) 6.8.4.3. India ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 6.8.4.4. India ADC Technology Market Size and Forecast, by Technology (2022-2029) 6.8.4.5. India ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 6.8.4.6. India ADC Technology Market Size and Forecast, by End-Users (2022-2029) 6.8.4.7. India ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 6.8.5. Australia 6.8.5.1. Australia ADC Technology Market Size and Forecast, by Target (2022-2029) 6.8.5.2. Australia ADC Technology Market Size and Forecast, by Product (2022-2029) 6.8.5.3. Australia ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 6.8.5.4. Australia ADC Technology Market Size and Forecast, by Technology (2022-2029) 6.8.5.5. Australia ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 6.8.5.6. Australia ADC Technology Market Size and Forecast, by End-Users (2022-2029) 6.8.5.7. Australia ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 6.8.6. Indonesia 6.8.6.1. Indonesia ADC Technology Market Size and Forecast, by Target (2022-2029) 6.8.6.2. Indonesia ADC Technology Market Size and Forecast, by Product (2022-2029) 6.8.6.3. Indonesia ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 6.8.6.4. Indonesia ADC Technology Market Size and Forecast, by Technology (2022-2029) 6.8.6.5. Indonesia ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 6.8.6.6. Indonesia ADC Technology Market Size and Forecast, by End-Users (2022-2029) 6.8.6.7. Indonesia ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 6.8.7. Malaysia 6.8.7.1. Malaysia ADC Technology Market Size and Forecast, by Target (2022-2029) 6.8.7.2. Malaysia ADC Technology Market Size and Forecast, by Product (2022-2029) 6.8.7.3. Malaysia ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 6.8.7.4. Malaysia ADC Technology Market Size and Forecast, by Technology (2022-2029) 6.8.7.5. Malaysia ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 6.8.7.6. Malaysia ADC Technology Market Size and Forecast, by End-Users (2022-2029) 6.8.7.7. Malaysia ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 6.8.8. Vietnam 6.8.8.1. Vietnam ADC Technology Market Size and Forecast, by Target (2022-2029) 6.8.8.2. Vietnam ADC Technology Market Size and Forecast, by Product (2022-2029) 6.8.8.3. Vietnam ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 6.8.8.4. Vietnam ADC Technology Market Size and Forecast, by Technology (2022-2029) 6.8.8.5. Vietnam ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 6.8.8.6. Vietnam ADC Technology Market Size and Forecast, by End-Users (2022-2029) 6.8.8.7. Vietnam ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 6.8.9. Taiwan 6.8.9.1. Taiwan ADC Technology Market Size and Forecast, by Target (2022-2029) 6.8.9.2. Taiwan ADC Technology Market Size and Forecast, by Product (2022-2029) 6.8.9.3. Taiwan ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 6.8.9.4. Taiwan ADC Technology Market Size and Forecast, by Technology (2022-2029) 6.8.9.5. Taiwan ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 6.8.9.6. Taiwan ADC Technology Market Size and Forecast, by End-Users (2022-2029) 6.8.9.7. Taiwan ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 6.8.10. Rest of Asia Pacific 6.8.10.1. Rest of Asia Pacific ADC Technology Market Size and Forecast, by Target (2022-2029) 6.8.10.2. Rest of Asia Pacific ADC Technology Market Size and Forecast, by Product (2022-2029) 6.8.10.3. Rest of Asia Pacific ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 6.8.10.4. Rest of Asia Pacific ADC Technology Market Size and Forecast, by Technology (2022-2029) 6.8.10.5. Rest of Asia Pacific ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 6.8.10.6. Rest of Asia Pacific ADC Technology Market Size and Forecast, by End-Users (2022-2029) 6.8.10.7. Rest of Asia Pacific ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa ADC Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa ADC Technology Market Size and Forecast, by Target (2022-2029) 7.2. Middle East and Africa ADC Technology Market Size and Forecast, by Product (2022-2029) 7.3. Middle East and Africa ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 7.4. Middle East and Africa ADC Technology Market Size and Forecast, by Technology (2022-2029) 7.5. Middle East and Africa ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 7.6. Middle East and Africa ADC Technology Market Size and Forecast, by End-Users (2022-2029) 7.7. Middle East and Africa ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 7.8. Middle East and Africa ADC Technology Market Size and Forecast, by Country (2022-2029) 7.8.1. South Africa 7.8.1.1. South Africa ADC Technology Market Size and Forecast, by Target (2022-2029) 7.8.1.2. South Africa ADC Technology Market Size and Forecast, by Product (2022-2029) 7.8.1.3. South Africa ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 7.8.1.4. South Africa ADC Technology Market Size and Forecast, by Technology (2022-2029) 7.8.1.5. South Africa ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 7.8.1.6. South Africa ADC Technology Market Size and Forecast, by End-Users (2022-2029) 7.8.1.7. South Africa ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 7.8.2. GCC 7.8.2.1. GCC ADC Technology Market Size and Forecast, by Target (2022-2029) 7.8.2.2. GCC ADC Technology Market Size and Forecast, by Product (2022-2029) 7.8.2.3. GCC ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 7.8.2.4. GCC ADC Technology Market Size and Forecast, by Technology (2022-2029) 7.8.2.5. GCC ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 7.8.2.6. GCC ADC Technology Market Size and Forecast, by End-Users (2022-2029) 7.8.2.7. GCC ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 7.8.3. Nigeria 7.8.3.1. Nigeria ADC Technology Market Size and Forecast, by Target (2022-2029) 7.8.3.2. Nigeria ADC Technology Market Size and Forecast, by Product (2022-2029) 7.8.3.3. Nigeria ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 7.8.3.4. Nigeria ADC Technology Market Size and Forecast, by Technology (2022-2029) 7.8.3.5. Nigeria ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 7.8.3.6. Nigeria ADC Technology Market Size and Forecast, by End-Users (2022-2029) 7.8.3.7. Nigeria ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 7.8.4. Rest of ME&A 7.8.4.1. Rest of ME&A ADC Technology Market Size and Forecast, by Target (2022-2029) 7.8.4.2. Rest of ME&A ADC Technology Market Size and Forecast, by Product (2022-2029) 7.8.4.3. Rest of ME&A ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 7.8.4.4. Rest of ME&A ADC Technology Market Size and Forecast, by Technology (2022-2029) 7.8.4.5. Rest of ME&A ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 7.8.4.6. Rest of ME&A ADC Technology Market Size and Forecast, by End-Users (2022-2029) 7.8.4.7. Rest of ME&A ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America ADC Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America ADC Technology Market Size and Forecast, by Target (2022-2029) 8.2. South America ADC Technology Market Size and Forecast, by Product (2022-2029) 8.3. South America ADC Technology Market Size and Forecast, by Mechanism of Action(2022-2029) 8.4. South America ADC Technology Market Size and Forecast, by Technology (2022-2029) 8.5. South America ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 8.6. South America ADC Technology Market Size and Forecast, by End-Users (2022-2029) 8.7. South America ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 8.8. South America ADC Technology Market Size and Forecast, by Country (2022-2029) 8.8.1. Brazil 8.8.1.1. Brazil ADC Technology Market Size and Forecast, by Target (2022-2029) 8.8.1.2. Brazil ADC Technology Market Size and Forecast, by Product (2022-2029) 8.8.1.3. Brazil ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 8.8.1.4. Brazil ADC Technology Market Size and Forecast, by Technology (2022-2029) 8.8.1.5. Brazil ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 8.8.1.6. Brazil ADC Technology Market Size and Forecast, by End-Users (2022-2029) 8.8.1.7. Brazil ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 8.8.2. Argentina 8.8.2.1. Argentina ADC Technology Market Size and Forecast, by Target (2022-2029) 8.8.2.2. Argentina ADC Technology Market Size and Forecast, by Product (2022-2029) 8.8.2.3. Argentina ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 8.8.2.4. Argentina ADC Technology Market Size and Forecast, by Technology (2022-2029) 8.8.2.5. Argentina ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 8.8.2.6. Argentina ADC Technology Market Size and Forecast, by End-Users (2022-2029) 8.8.2.7. Argentina ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 8.8.3. Rest Of South America 8.8.3.1. Rest Of South America ADC Technology Market Size and Forecast, by Target (2022-2029) 8.8.3.2. Rest Of South America ADC Technology Market Size and Forecast, by Product (2022-2029) 8.8.3.3. Rest Of South America ADC Technology Market Size and Forecast, by Mechanism of Action (2022-2029) 8.8.3.4. Rest Of South America ADC Technology Market Size and Forecast, by Technology (2022-2029) 8.8.3.5. Rest Of South America ADC Technology Market Size and Forecast, by Indication / Application (2022-2029) 8.8.3.6. Rest Of South America ADC Technology Market Size and Forecast, by End-Users (2022-2029) 8.8.3.7. Rest Of South America ADC Technology Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global ADC Technology Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading ADC Technology Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ADC Therapeutics 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Astellas Pharma 10.3. AstraZeneca 10.4. Byondis 10.5. Daiichi Sankyo 10.6. Genentech 10.7. Gilead Sciences 10.8. ImmunoGen 10.9. Pfizer 10.10. RemeGen. 10.11. BioNTech 10.12. DualityBio 10.13. Bridge Biotherapeutics 10.14. Pinotbio 10.15. GSK 10.16. Mersana Therapeutics 11. Key Findings 12. Industry Recommendations 13. ADC Technology Market: Research Methodology 14. Terms and Glossary