The Acephate Market size was valued at USD 1.57 Billion in 2024 and the total Acephate revenue is expected to grow at a CAGR of 4.5% from 2025 to 2032, reaching nearly USD 2.23 Billion.Acephate Market Overview:

Acephate Market is an organophosphate foliar insecticide that is generally utilized for controlling aphids, such as resistance species in horticulture and vegetables. This colorless insecticide is applied on various crops or vegetables, including tomatoes, potatoes carrots, and lettuce to control pests such as sawflies, caterpillars, and leaf miners. Acephate is an insecticide made of esters of phosphoric acid, sold in various forms such as soluble powder, emulsifiable concentrates, pressurized aerosol, tree injection systems, and granular formulations. It is an organophosphate foliar insecticide that is primarily used to control pests in agriculture and other settings. Acephate is a popular insecticide used to control pests in agricultural lands and buildings. It’s highly effective against leaf miners, sawflies, and aphids. The Acephate Market is growing due to an increase in agriculture production, disposable income, and population growth. Acephate Market is expected to grow significantly due to the increasing demand for agrochemicals in the agriculture industry. Acephate plays an essential role in farming activities, especially in faster crop production to cater to the growing population. The market is driven by the necessity of agrochemicals in the agriculture industry. The market growth of acephate may be troubled due to the toxic fumes it emits when heated to decomposition. Exposure to acephate can cause mild irritation of the eyes and skin. Acephate is an insecticide that can effectively kill target insects when they come into contact with it or consume it. When insects eat acephate, their bodies convert it into methamidophos, which is a stronger insecticide. Acephate is less toxic to mammals because their bodies don't convert it into methamidophos easily. Both acephate and methamidophos affect the nervous system, causing overactivity in the nerves, muscles, or brain. Acephate is absorbed into plants, so insects that feed on treated plants may consume acephate.To know about the Research Methodology :- Request Free Sample Report

Acephate Market Dynamics:

Acephate Market Drivers:

The Rapid Expansion of Horticulture Production Enhances the Acephate Market Acephate Market is an effective systemic insecticide that finds its main uses in horticulture, where rapid use of insecticides is necessary to control pests that can damage crops and reduce farm production. The high demand for fruits and vegetables that provide critical nutrients for a balanced diet has controlled an increase in horticulture production. According to the Agriculture Ministry of India, horticulture production in India was 330 in 2020, representing a 3% increase from 2019. Also, the US Department of Agriculture projects that horticulture crop production will increase by 14% in the US in 2022. This rapid growth in horticulture production has faster the demand for acephate in pest control applications, thereby positively impacting the growth of the acephate industry during the forecast period.Acephate Market Restraints:

Serve Health Consequences the Restraints of the Acephate Market Acephate is mainly used for pest control, but it has its drawbacks. The toxic fumes formed by acephate can cause severe skin and eye irritation, nausea, abnormal cramps, and rapid heart rate when inhaled. Also, high exposure to acephate can lead to cholinesterase reserve, nervous system damage, respiratory paralysis, and even death. The severe health effects associated with the use of acephate can limit its applicability as an insect control product in agriculture, farmlands, and residential and commercial buildings. This could delay the growth of the acephate market, negatively impacting its size during the forecast period.Acephate Market Opportunity:

Increasing Demand in the Agricultural Sector Boost Acephate Market The expanding agricultural industry is one of the key factors influencing the acephate market. The use of agrochemicals on farmlands is required due to the increased crop formation required to feed the growing population. It is extremely important to farming activity. The primary factors influencing market expansion in the next years are the expanding agricultural sector and the requirement for quicker crop forming. In addition, the increased usage of agrochemicals to protect crops and meet global food demand is boosting market expansion.Competitive Landscape:

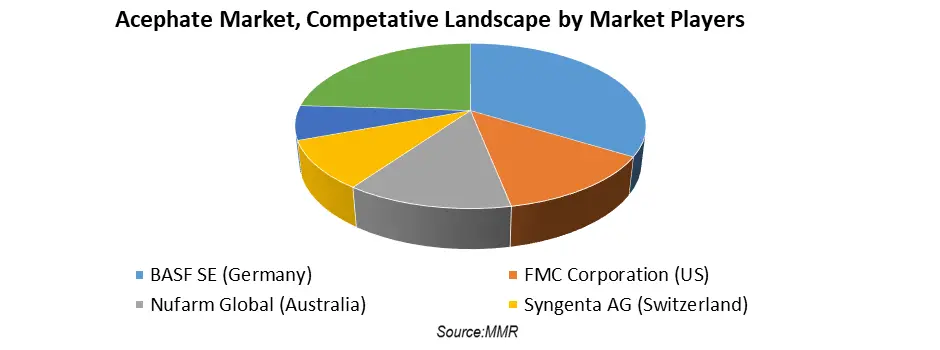

The global acephate market is highly fragmented, with numerous small- and medium-sized manufacturers competing with each other. The top five manufacturers in the market collectively accounted for a share of more than 60.0% in 2018. The market is characterized by the presence of a large number of regional and international players. The leading manufacturers in the market are focusing on expanding their production capacities and product portfolios to gain a larger share of the market. These companies are engaged in strategies such as mergers and acquisitions, product launches and expansions, and partnerships to gain a competitive edge in the market. Bayer and AlphaBio Control (UK) signed a distribution agreement for marketing Flipper developed by AlphaBio Control (UK) in June 2024. The innovative solution Flipper is expected to play a crucial role in Bayer’s tailored solutions, It will combine seeds and traits, biological and chemical crop protection products, and digital services to food the chain and society. Harmful nematodes that feed on the roots of plants can cause major damage to crops, causing billions of dollars in damage. Today, Syngenta Crop Protection, a global leader in agricultural innovation, is launching the world’s first commercial digital solution to diagnose infestations of plant-parasitic nematodes in soybean crops by analyzing photographs taken from satellites.

Acephate Market Segment Analysis:

Based on Type, The Organic chlorine segment dominated the Acephate market in the year 2024 & is expected to continue its dominance during the forecast period. Acephate, made of O, O-dimethyl phosphoramidothioate, is typically found in organic chlorine form and has high water solubility. Due to this, it is highly applicable in the agriculture sector as a powder insecticide. Additionally, the organic chlorine form of acephate has a longer shelf life than the organic phosphorous form, with improved quality and good compatibility with synthetic pyrethroid insecticides, resulting in better pest resistance. The high-performance features of the organic chlorine form of acephate, coupled with its high applicability in the growing agriculture sector, have continued to drive its growth during the forecast period. Based on the Application, The spray segment dominated the Acephate market in the year 2024 & is expected to continue its dominance during the forecast period. Increasing demand for food crops due to population growth & awareness about the benefits of using Acephate. Acephate market is a general-use insecticide registered for use on food crops, agricultural seed and non-bearing plants, institutions, and commercial buildings including public health facilities, sod, golf course turf, ant mounds, and horticultural nursery plants. Technological advancements in the manufacturing process of Acephate and stringent regulations for pesticide usage. As a result, the Market for Acephate is expected to continue to grow in the forecast period.Based on the End-Use, The agriculture segment dominated the Acephate market in the year 2024 & is expected to continue its dominance during the forecast period. Acephate is an organophosphate insecticide, that is primarily used to control the growth of leaf miners and aphids in a variety of fields, mats, and vegetable crops. Agriculture production has increased significantly over the years due to population growth and an increase in disposable income leading to growing food demand. According to the 2021 report of the Food and Agriculture Organization, primary crop production was 4 billion tonnes in 2010, showing a 53% increase from 2000. Additionally, global vegetable production rose to 1125 million tonnes in 2019, showing an increase of up to 65%. Such an increase in agricultural production has accelerated the demand and usage of acephate for insect control in crops, positively impacting the growth of the Acephate Market.

Acephate Market Regional Insights:

Asia Pacific region segment dominated the Acephate market in the year 2024 & is expected to continue its dominance during the forecast period. The Asia Pacific was the largest regional market in terms of consumption and accounted for over 60% of the total revenue share in 2015. The region is expected to continue its dominance over the forecast period owing to high product demand from various end-use industries including agriculture, horticulture, forestry, and others. The growing population coupled with rising disposable income has resulted in an increase in agricultural activities across the Asia Pacific which is likely to propel product demand over the forecast period. In addition, increasing investments by governments in soil health management practices are also expected to drive acephate consumption further. For instance; The Indian Council of Agricultural Research (ICAR) has developed a new generation of biofertilizers that include ICAR-developed Neem-Tek which contains neem extract along with Acyclovir Acid Crystals (ACV).Acephate Market Scope: Inquire before buying

Acephate Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2018 to 2024 Market Size in 2024: USD 1.57 Bn. Forecast Period 2025 to 2032 CAGR: 4.5% Market Size in 2032: USD 2.23 Bn. Segments Covered: by Type Organic Chlorine Organic Phosphorus Carbamate Arsenicals Natural Sources Others by Application Spray Dipping Vat Hand Dressing Others by End–Users Agriculture Animal Husbandry Commercial Others Acephate Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Acephate Market, Key Players

1. BASF SE (Germany) 2. Bayer and AlphaBio Control (UK) 3. Nanjing Red Sun Co., Ltd. (China) 4. Bayer AG (Germany) 5. ChemChina (China) 6. FMC Corporation (US) 7. Corteva (US) 8. Nufarm Global (Australia) 9. UPL (India) 10. Sumitomo Chemical Co., Ltd. (Japan) 11. AMVAC Chemical Corporation (US) 12. Syngenta AG (Switzerland) 13. LUMITOS AG (Germany) 14. ADAMA Ltd. (Israel) 15. Rainbow Agro (China) 16. Oxon Italia S.p.A. (Italy) 17. Marrone Bio Innovations (US) 18. Nissan Chemical Corporation (Japan) 19. Arysta LifeScience Corporation (US)Frequently Asked Questions:

1] What segments are covered in the Global Acephate Market report? Ans. The segments covered in the Acephate Market report are based on Type, Application, End-users, and Region. 2] Which End-Users are expected to hold the highest share in the Global Acephate Market? Ans. The Asia Pacific End-Users are expected to hold the highest share of the Acephate Market. 3] What is the market size of the Global Acephate Market by 2032? Ans. The market size of the Acephate Market by 2032 is expected to reach USD 2.23 Bn. 4] What is the forecast period for the Global Acephate Market? Ans. The forecast period for the Acephate Market is 2025-2032. 5] What was the Global Acephate Market size in 2024? Ans: The Global Acephate Market size was USD 1.57 Billion in 2024.

1. Acephate Market: Research Methodology 2. Acephate Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Acephate Market: Dynamics 3.1 Acephate Market Trends by Region 3.1.1 Global Acephate Market Trends 3.1.2 North America Acephate Market Trends 3.1.3 Europe Acephate Market Trends 3.1.4 Asia Pacific Acephate Market Trends 3.1.5 Middle East and Africa Acephate Market Trends 3.1.6 South America Acephate Market Trends 3.2 Acephate Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Acephate Market Drivers 3.2.1.2 North America Acephate Market Restraints 3.2.1.3 North America Acephate Market Opportunities 3.2.1.4 North America Acephate Market Challenges 3.2.2 Europe 3.2.2.1 Europe Acephate Market Drivers 3.2.2.2 Europe Acephate Market Restraints 3.2.2.3 Europe Acephate Market Opportunities 3.2.2.4 Europe Acephate Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Acephate Market Market Drivers 3.2.3.2 Asia Pacific Acephate Market Restraints 3.2.3.3 Asia Pacific Acephate Market Opportunities 3.2.3.4 Asia Pacific Acephate Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Acephate Market Drivers 3.2.4.2 Middle East and Africa Acephate Market Restraints 3.2.4.3 Middle East and Africa Acephate Market Opportunities 3.2.4.4 Middle East and Africa Acephate Market Challenges 3.2.5 South America 3.2.5.1 South America Acephate Market Drivers 3.2.5.2 South America Acephate Market Restraints 3.2.5.3 South America Acephate Market Opportunities 3.2.5.4 South America Acephate Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Acephate Industry 3.8 The Global Pandemic and Redefining of The Acephate Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global Acephate Trade Analysis (2017-2022) 3.11.1 Global Import of Acephate 3.11.2 Global Export of Acephate 3.12 Global Acephate Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 Acephate Manufacturers: Global Installed Capacity 3.12.4 Analysis by Size of Manufacturer 4. Global Acephate Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 4.1 Global Acephate Market Size and Forecast, By Type (2024-2032) 4.1.1 Organic Chlorine 4.1.2 Organic Phosphorus 4.1.3 Carbamate 4.1.4 Arsenicals 4.1.5 Natural Sources 4.1.6 Others 4.2 Global Acephate Market Size and Forecast, By Application (2024-2032) 4.2.1 Spray 4.2.2 Dipping Vat 4.2.3 Hand Dressing 4.2.4 Others 4.3 Global Acephate Market Size and Forecast, By End–Users (2024-2032) 4.3.1 Agriculture 4.3.2 Animal Husbandry 4.3.3 Commercial 4.3.4 Others 4.4 Global Acephate Market Size and Forecast, by Region (2024-2032) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Acephate Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 5.1 North America Acephate Market Size and Forecast, By Type (2024-2032) 5.1.1 Organic Chlorine 5.1.2 Organic Phosphorus 5.1.3 Carbamate 5.1.4 Arsenicals 5.1.5 Natural Sources 5.1.6 Others 5.2 North America Acephate Market Size and Forecast, By Application (2024-2032) 5.2.1 Spray 5.2.2 Dipping Vat 5.2.3 Hand Dressing 5.2.4 Others 5.3 North America Acephate Market Size and Forecast, By End–Users (2024-2032) 5.3.1 Agriculture 5.3.2 Animal Husbandry 5.3.3 Commercial 5.3.4 Others 5.4 North America Acephate Market Size and Forecast, by Country (2024-2032) 5.4.1 United States 5.4.1.1 United States Acephate Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1 Organic Chlorine 5.4.1.1.2 Organic Phosphorus 5.4.1.1.3 Carbamate 5.4.1.1.4 Arsenicals 5.4.1.1.5 Natural Sources 5.4.1.1.6 Others 5.4.1.2 United States Acephate Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1 Spray 5.4.1.2.2 Dipping Vat 5.4.1.2.3 Hand Dressing 5.4.1.2.4 Others 5.4.1.3 United States Acephate Market Size and Forecast, By End–Users (2024-2032) 5.4.1.3.1 Agriculture 5.4.1.3.2 Animal Husbandry 5.4.1.3.3 Commercial 5.4.1.3.4 Others 5.4.2 Canada 5.4.2.1 Canada Acephate Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1 Organic Chlorine 5.4.2.1.2 Organic Phosphorus 5.4.2.1.3 Carbamate 5.4.2.1.4 Arsenicals 5.4.2.1.5 Natural Sources 5.4.2.1.6 Others 5.4.2.2 Canada Acephate Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1 Spray 5.4.2.2.2 Dipping Vat 5.4.2.2.3 Hand Dressing 5.4.2.2.4 Others 5.4.2.3 Canada Acephate Market Size and Forecast, By End–Users (2024-2032) 5.4.2.3.1 Agriculture 5.4.2.3.2 Animal Husbandry 5.4.2.3.3 Commercial 5.4.2.3.4 Otherse 5.4.3 Mexico 5.4.3.1 Mexico Acephate Market Size and Forecast, By Type (2024-2032) 5.4.3.1.1 Organic Chlorine 5.4.3.1.2 Organic Phosphorus 5.4.3.1.3 Carbamate 5.4.3.1.4 Arsenicals 5.4.3.1.5 Natural Sources 5.4.3.1.6 Others 5.4.3.2 Mexico Acephate Market Size and Forecast, By Application (2024-2032) 5.4.3.2.1 Spray 5.4.3.2.2 Dipping Vat 5.4.3.2.3 Hand Dressing 5.4.3.2.4 Others 5.4.3.3 Mexico Acephate Market Size and Forecast, By End–Users (2024-2032) 5.4.3.3.1 Agriculture 5.4.3.3.2 Animal Husbandry 5.4.3.3.3 Commercial 5.4.3.3.4 Others 6. Europe Acephate Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 6.1 Europe Acephate Market Size and Forecast, By Type (2024-2032) 6.2 Europe Acephate Market Size and Forecast, By Application (2024-2032) 6.3 Europe Acephate Market Size and Forecast, By End–Users (2024-2032) 6.4 Europe Acephate Market Size and Forecast, by Country (2024-2032) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Acephate Market Size and Forecast, By Type (2024-2032) 6.4.1.2 United Kingdom Acephate Market Size and Forecast, By Application (2024-2032) 6.4.1.3 United Kingdom Acephate Market Size and Forecast, By End–Users (2024-2032) 6.4.2 France 6.4.2.1 France Acephate Market Size and Forecast, By Type (2024-2032) 6.4.2.2 France Acephate Market Size and Forecast, By Application (2024-2032) 6.4.2.3 France Acephate Market Size and Forecast, By End–Users (2024-2032) 6.4.3 Germany 6.4.3.1 Germany Acephate Market Size and Forecast, By Type (2024-2032) 6.4.3.2 Germany Acephate Market Size and Forecast, By Application (2024-2032) 6.4.3.3 Germany Acephate Market Size and Forecast, By End–Users (2024-2032) 6.4.4 Italy 6.4.4.1 Italy Acephate Market Size and Forecast, By Type (2024-2032) 6.4.4.2 Italy Acephate Market Size and Forecast, By Application (2024-2032) 6.4.4.3 Italy Acephate Market Size and Forecast, By End–Users (2024-2032) 6.4.5 Spain 6.4.5.1 Spain Acephate Market Size and Forecast, By Type (2024-2032) 6.4.5.2 Spain Acephate Market Size and Forecast, By Application (2024-2032) 6.4.5.3 Spain Acephate Market Size and Forecast, By End–Users (2024-2032) 6.4.6 Sweden 6.4.6.1 Sweden Acephate Market Size and Forecast, By Type (2024-2032) 6.4.6.2 Sweden Acephate Market Size and Forecast, By Application (2024-2032) 6.4.6.3 Sweden Acephate Market Size and Forecast, By End–Users (2024-2032) 6.4.7 Austria 6.4.7.1 Austria Acephate Market Size and Forecast, By Type (2024-2032) 6.4.7.2 Austria Acephate Market Size and Forecast, By Application (2024-2032) 6.4.7.3 Austria Acephate Market Size and Forecast, By End–Users (2024-2032) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Acephate Market Size and Forecast, By Type (2024-2032) 6.4.8.2 Rest of Europe Acephate Market Size and Forecast, By Application (2024-2032). 6.4.8.3 Rest of Europe Acephate Market Size and Forecast, By End–Users (2024-2032) 7. Asia Pacific Acephate Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 7.1 Asia Pacific Acephate Market Size and Forecast, By Type (2024-2032) 7.2 Asia Pacific Acephate Market Size and Forecast, By Application (2024-2032) 7.3 Asia Pacific Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4 Asia Pacific Acephate Market Size and Forecast, by Country (2024-2032) 7.4.1 China 7.4.1.1 China Acephate Market Size and Forecast, By Type (2024-2032) 7.4.1.2 China Acephate Market Size and Forecast, By Application (2024-2032) 7.4.1.3 China Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4.2 South Korea 7.4.2.1 S Korea Acephate Market Size and Forecast, By Type (2024-2032) 7.4.2.2 S Korea Acephate Market Size and Forecast, By Application (2024-2032) 7.4.2.3 S Korea Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4.3 Japan 7.4.3.1 Japan Acephate Market Size and Forecast, By Type (2024-2032) 7.4.3.2 Japan Acephate Market Size and Forecast, By Application (2024-2032) 7.4.3.3 Japan Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4.4 India 7.4.4.1 India Acephate Market Size and Forecast, By Type (2024-2032) 7.4.4.2 India Acephate Market Size and Forecast, By Application (2024-2032) 7.4.4.3 India Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4.5 Australia 7.4.5.1 Australia Acephate Market Size and Forecast, By Type (2024-2032) 7.4.5.2 Australia Acephate Market Size and Forecast, By Application (2024-2032) 7.4.5.3 Australia Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4.6 Indonesia 7.4.6.1 Indonesia Acephate Market Size and Forecast, By Type (2024-2032) 7.4.6.2 Indonesia Acephate Market Size and Forecast, By Application (2024-2032) 7.4.6.3 Indonesia Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4.7 Malaysia 7.4.7.1 Malaysia Acephate Market Size and Forecast, By Type (2024-2032) 7.4.7.2 Malaysia Acephate Market Size and Forecast, By Application (2024-2032) 7.4.7.3 Malaysia Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4.8 Vietnam 7.4.8.1 Vietnam Acephate Market Size and Forecast, By Type (2024-2032) 7.4.8.2 Vietnam Acephate Market Size and Forecast, By Application (2024-2032) 7.4.8.3 Vietnam Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4.9 Taiwan 7.4.9.1 Taiwan Acephate Market Size and Forecast, By Type (2024-2032) 7.4.9.2 Taiwan Acephate Market Size and Forecast, By Application (2024-2032) 7.4.9.3 Taiwan Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Acephate Market Size and Forecast, By Type (2024-2032) 7.4.10.2 Bangladesh Acephate Market Size and Forecast, By Application (2024-2032) 7.4.10.3 Bangladesh Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4.11 Pakistan 7.4.11.1 Pakistan Acephate Market Size and Forecast, By Type (2024-2032) 7.4.11.2 Pakistan Acephate Market Size and Forecast, By Application (2024-2032) 7.4.11.3 Pakistan Acephate Market Size and Forecast, By End–Users (2024-2032) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Acephate Market Size and Forecast, By Type (2024-2032) 7.4.12.2 Rest of Asia PacificAcephate Market Size and Forecast, By Application (2024-2032) 7.4.12.3 Rest of Asia Pacific Acephate Market Size and Forecast, By End–Users (2024-2032) 8. Middle East and Africa Acephate Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 8.1 Middle East and Africa Acephate Market Size and Forecast, By Type (2024-2032) 8.2 Middle East and Africa Acephate Market Size and Forecast, By Application (2024-2032) 8.3 Middle East and Africa Acephate Market Size and Forecast, By End–Users (2024-2032) 8.4 Middle East and Africa Acephate Market Size and Forecast, by Country (2024-2032) 8.4.1 South Africa 8.4.1.1 South Africa Acephate Market Size and Forecast, By Type (2024-2032) 8.4.1.2 South Africa Acephate Market Size and Forecast, By Application (2024-2032) 8.4.1.3 South Africa Acephate Market Size and Forecast, By End–Users (2024-2032) 8.4.2 GCC 8.4.2.1 GCC Acephate Market Size and Forecast, By Type (2024-2032) 8.4.2.2 GCC Acephate Market Size and Forecast, By Application (2024-2032) 8.4.2.3 GCC Acephate Market Size and Forecast, By End–Users (2024-2032) 8.4.3 Egypt 8.4.3.1 Egypt Acephate Market Size and Forecast, By Type (2024-2032) 8.4.3.2 Egypt Acephate Market Size and Forecast, By Application (2024-2032) 8.4.3.3 Egypt Acephate Market Size and Forecast, By End–Users (2024-2032) 8.4.4 Nigeria 8.4.4.1 Nigeria Acephate Market Size and Forecast, By Type (2024-2032) 8.4.4.2 Nigeria Acephate Market Size and Forecast, By Application (2024-2032) 8.4.4.3 Nigeria Acephate Market Size and Forecast, By End–Users (2024-2032) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Acephate Market Size and Forecast, By Type (2024-2032) 8.4.5.2 Rest of ME&A Acephate Market Size and Forecast, By Application (2024-2032) 8.4.5.3 Rest of ME&A Acephate Market Size and Forecast, By End–Users (2024-2032) 9. South America Acephate Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2032) 9.1 South America Acephate Market Size and Forecast, By Type (2024-2032) 9.2 South America Acephate Market Size and Forecast, By Application (2024-2032) 9.3 South America Acephate Market Size and Forecast, By End–Users (2024-2032) 9.4 South America Acephate Market Size and Forecast, by Country (2024-2032) 9.4.1 Brazil 9.4.1.1 Brazil Acephate Market Size and Forecast, By Type (2024-2032) 9.4.1.2 Brazil Acephate Market Size and Forecast, By Application (2024-2032) 9.4.1.3 Brazil Acephate Market Size and Forecast, By End–Users (2024-2032) 9.4.2 Argentina 9.4.2.1 Argentina Acephate Market Size and Forecast, By Type (2024-2032) 9.4.2.2 Argentina Acephate Market Size and Forecast, By Application (2024-2032) 9.4.2.3 Argentina Acephate Market Size and Forecast, By End–Users (2024-2032) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Acephate Market Size and Forecast, By Type (2024-2032) 9.4.3.2 Rest Of South America Acephate Market Size and Forecast, By Application (2024-2032) 9.4.3.3 Rest Of South America Acephate Market Size and Forecast, By End–Users (2024-2032) 10. Global Acephate Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2022 10.3.9 No. of Stores 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Acephate Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 BASF SE (Germany) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Bayer and AlphaBio Control (UK) 11.3 Nanjing Red Sun Co., Ltd. (China) 11.4 Bayer AG (Germany) 11.5 ChemChina (China) 11.6 FMC Corporation (US) 11.7 Corteva (US) 11.8 Nufarm Global (Australia) 11.9 UPL (India) 11.10 Sumitomo Chemical Co., Ltd. (Japan) 11.11 AMVAC Chemical Corporation (US) 11.12 Syngenta AG (Switzerland) 11.13 LUMITOS AG (Germany) 11.14 ADAMA Ltd. (Israel) 11.15 Rainbow Agro (China) 11.16 Oxon Italia S.p.A. (Italy) 11.17 Marrone Bio Innovations (US) 11.18 Nissan Chemical Corporation (Japan) 11.19 Arysta LifeScience Corporation (US) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary