Global Absorbent Mat Market size was valued at USD 3.29 Bn. in 2023 and the total Absorbent Mat revenue is expected to grow by 5.82 % from 2024 to 2030, reaching nearly USD 4.89 Bn.Absorbent Mat Market Overview:

The Absorbent Mat market is a growing industry that encompasses the production, distribution, and sale of specialized mats designed to effectively absorb and contain various types of liquids. These mats are widely used in industrial, commercial, and residential settings to address spillage, leaks, and other liquid-related hazards.To know about the Research Methodology :- Request Free Sample Report The key factors driving the growth of the absorbent mats market include the increasing industrial applications and the need to manage spills effectively, the rise of stringent environmental regulations and the demand for spill response measures, the growing focus on workplace safety and accident prevention, the reliance of the transportation and logistics sector on spill management solutions, the usage of absorbent mats in healthcare and hospitality settings for hygiene and safety purposes, and the market's response to the sustainability trend with eco-friendly and biodegradable options. There is increasing competition from other absorbent products, such as paper towels, rags, and sponges. These products are often cheaper than absorbent mats. Absorbent mats are often more expensive than other absorbent products. This is due to the high cost of the materials used to make them. The absorbent mats market is experiencing robust growth as organizations prioritize safety, environmental responsibility, and regulatory compliance.

Absorbent Mat Market Dynamics

Market Drivers: Increasing regulations regarding spill control, workplace safety, and environmental protection are driving the demand for absorbent mats. Compliance with these regulations is pushing industries to invest in effective spill management solutions. The expansion of industrial sectors, such as manufacturing, oil and gas, and chemicals, is fueling the demand for absorbent mats. Ensuring a safe working environment is a top priority for organizations. Opportunities: The increasing focus on sustainability and environmental responsibility presents an opportunity for the absorbent mat market. The demand for eco-friendly and biodegradable mats that minimize the environmental damage of spills and cleanup is on the rise. Technological advancements in material technology provide opportunities for the development of absorbent mats with improved performance characteristics, such as enhanced absorbency, durability, and chemical resistance. Challenges: Price sensitivity among end-users poses a challenge for the absorbent mat market. While high-quality mats with advanced features can be more expensive, cost-conscious customers opt for lower-priced alternatives, impacting the market share of premium products. Proper disposal of used absorbent mats, particularly those contaminated with hazardous substances, can be a challenge. Restraints: The availability of alternative spill management solutions, such as granular absorbents or absorbent socks, can restrain the growth of the absorbent mat market. In periods of economic downturn, industries reduce their spending on non-essential items, including spill management products. Market Trends: There is a growing trend towards customized absorbent mats that cater to specific industry requirements and applications. Mats with specialized features, such as anti-static properties, chemical resistance, and compatibility with specific liquids, are gaining traction in the market. The market is witnessing an increasing demand for absorbent mats made from recycled materials or those that can be easily recycled after use. Eco-friendly options, such as biodegradable mats or mats made from renewable resources, are becoming popular.Absorbent Mat Market Segment Analysis:

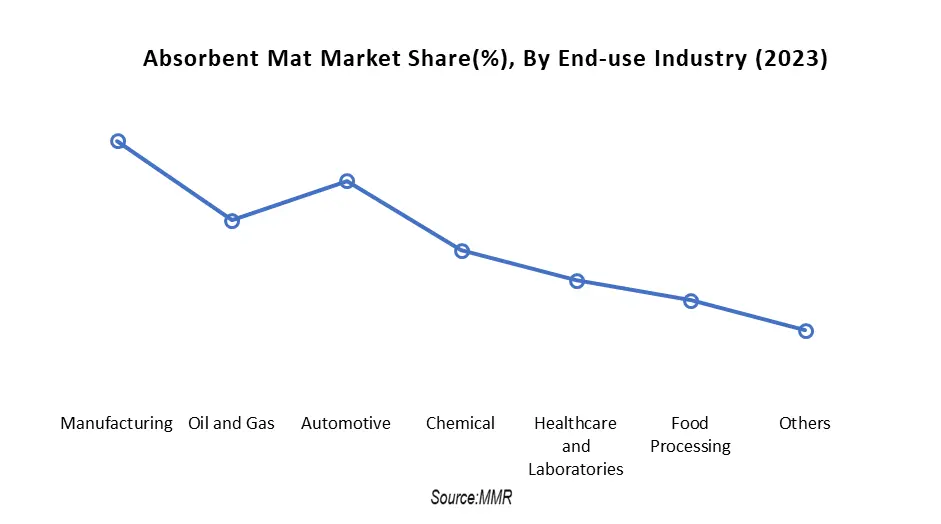

Absorbent Mat Market by Material Polypropylene Absorbent Mats: Polypropylene absorbent mats have the largest market share due to their wide availability, cost-effectiveness, and versatility. They are commonly used in various industries, including manufacturing, automotive, and oil and gas. The market for polypropylene absorbent mats is expected to witness steady growth in the coming years. The key drivers for the growth of polypropylene absorbent mats include their excellent absorbency for oil and hydrocarbon-based fluids, cost-effectiveness, and ease of disposal. PVC Absorbent Mats: PVC absorbent mats hold a notable market share, particularly in industries that require strong chemical resistance. They are commonly used in laboratories, chemical plants, and other environments where there is a high risk of chemical spills. The market for PVC absorbent mats is expected to experience moderate growth. The key drivers for PVC absorbent mats include their excellent chemical resistance, durability, and flexibility. A notable trend in the market is the development of PVC mats with specialized features such as textured surfaces for enhanced slip resistance and high-visibility colors for safety purposes. Nitrile Absorbent Mats: Nitrile absorbent mats have a significant market share, particularly in industries where there is a high risk of oil and chemical spills, such as automotive, oil and gas, and manufacturing. The market for nitrile absorbent mats is expected to witness robust growth. The key drivers for nitrile absorbent mats include their superior absorbency for oils and chemicals, excellent chemical resistance, and durability. A notable trend in the market is the development of nitrile mats with added features such as perforations or dimples for increased surface area and absorbency. Rubber Absorbent Mats: Rubber absorbent mats have a considerable market share, especially in industries where durability and resistance to oils and chemicals are essential, such as manufacturing plants and automotive workshops. The market for rubber absorbent mats is expected to witness steady growth. The key drivers for rubber absorbent mats include their durability, resistance to oils and chemicals, and long lifespan. Others: The market share for absorbent mats made from other materials can vary depending on their specific applications and unique properties. The growth rate for absorbent mats made from other materials depends on the specific industry requirements and trends associated with those materials. The drivers and trends for absorbent mats made from other materials depend on their unique properties and applications. The growth and trends in this segment are influenced by industry-specific needs and advancements in material technology.Absorbent Mat Market by Industry Manufacturing Industry: Absorbent mats used in the manufacturing industry have a significant market share due to the widespread use of fluids and the potential for spills and leaks in manufacturing processes. The market for absorbent mats in the manufacturing industry is expected to witness steady growth. The increasing focus on workplace safety, environmental regulations, and the need for efficient spill management drive the demand for these mats. The key drivers for absorbent mats in the manufacturing industry include the prevention of slip and fall accidents, containment of spills, and protection of equipment. A notable trend in this Absorbent Mat Market is the development of absorbent mats with high durability, chemical resistance, and specialized features such as perforations for easy tearing or dimples for increased absorbency. Automotive Industry: Absorbent mats used in the automotive industry hold a significant market share due to the potential for oil, coolant, and other fluid spills in automotive repair and maintenance operations. The Absorbent Mat Market in the automotive industry is expected to experience moderate growth. Factors such as increased emphasis on workplace safety, environmental regulations, and the need for effective spill control drive the demand for these mats. The key drivers for absorbent mats in the automotive industry include their ability to quickly absorb oils and fluids, prevent floor contamination, and ensure a clean and safe working environment. A notable trend in this market is the development of mats with specific features such as anti-slip coatings, anti-static properties, or custom shapes for fitting around vehicles and equipment. Oil and Gas Industry: The Absorbent Mat Market in the oil and gas industry is expected to witness robust growth. The stringent environmental regulations focus on spill response and control, and the emphasis on worker safety drives the demand for these mats. The key drivers for absorbent mats in the oil and gas industry include their superior absorbency for oil and chemicals, durability, and compliance with industry standards. A notable trend in this market is the development of mats with enhanced chemical resistance, fire retardancy, and anti-static properties to meet the specific requirements of the oil and gas sector. Chemical Industry: Absorbent mats used in the chemical industry hold a notable market share due to the potential for chemical spills and leaks during the storage, handling, and transportation of hazardous substances. The Absorbent Mat Market in the chemical industry is expected to witness steady growth. The stringent regulations regarding spill management, focus on worker safety, and prevention of environmental contamination drive the demand for these mats. The key drivers for absorbent mats in the chemical industry include their chemical resistance, fast absorbency, and ability to mitigate the risks associated with chemical spills. Healthcare and Laboratories: Absorbent mats used in healthcare facilities and laboratories have a significant market share due to the need for spill control and containment of potentially hazardous substances. The market for absorbent mats in healthcare and laboratories is expected to experience moderate growth. Factors such as stringent regulations, emphasis on infection control, and the need for a safe and clean working environment drive the demand for these mats. The key drivers for absorbent mats in healthcare and laboratories include their ability to quickly absorb liquids, prevent cross-contamination, and provide a safe surface for personnel. A notable trend in the Absorbent Mat Market is the development of mats with antimicrobial properties, low-lint construction, and compliance with healthcare and laboratory standards. Food Processing Industry: Absorbent mats used in the food processing industry have a significant market share due to the potential for liquid spills and contamination during food production and processing operations. The market for absorbent mats in the food processing industry is expected to witness steady growth.

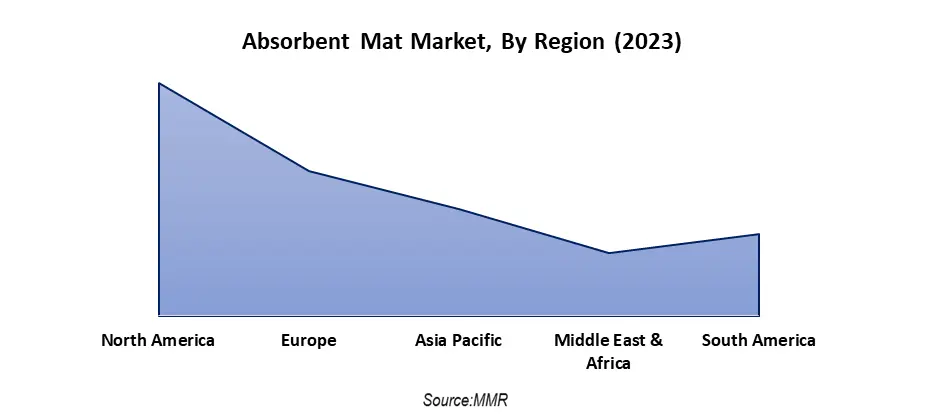

Absorbent Mat Market by Region

North America: North America holds a significant share of the market. The region is characterized by stringent regulations about workplace safety and environmental protection, driving the demand for effective spill management solutions. There is an increasing focus on eco-friendly and sustainable absorbent mats in North America, with a growing preference for products made from recycled materials. Customized mats designed for specific applications, such as oil and gas, manufacturing, and healthcare, are gaining traction in the region. Stringent regulatory standards, emphasis on workplace safety, and the presence of key industries such as manufacturing, automotive, and chemicals drive the absorbent mat market in North America. Europe: Europe represents a mature market for absorbent mats. The region is characterized by strict regulations and a strong focus on environmental sustainability. The presence of a robust industrial sector and a high level of awareness regarding spill control contribute to the market's growth. Eco-friendly and biodegradable absorbent mats are gaining popularity in Europe as organizations aim to reduce their environmental footprint. There is also a rising demand for customized mats tailored to specific industry requirements, such as the oil and gas, pharmaceutical, and food processing sectors. Stringent environmental regulations, workplace safety norms, and the need for spill control in various industries drive the market in Europe. Asia Pacific: The Asia Pacific region is witnessing rapid industrialization, leading to significant growth in the absorbent mat market. The expanding manufacturing sector, increasing awareness of workplace safety, and growing environmental concerns contribute to market growth. The demand for absorbent mats in Asia Pacific is driven by the development of specialized mats for specific industries, such as electronics, automotive, and food processing. The region is also experiencing a shift towards sustainable and cost-effective absorbent mat solutions. Economic growth, industrial development, stringent regulations, and increasing focus on workplace safety in countries like China, India, Japan, and South Korea are key drivers of the absorbent mat market in the Asia Pacific region. Latin America: Latin America represents a growing market for absorbent mats. The region is witnessing an increase in industrial activities across various sectors, including oil and gas, mining, and manufacturing, which drives the demand for spill management solutions. There is a rising demand for cost-effective and efficient absorbent mats in Latin America, particularly in countries like Brazil and Mexico. Customized mats with enhanced absorbency and durability are gaining traction in the region. Industrial growth, emphasis on workplace safety, increasing regulations, and the need for effective spill control drive the absorbent mat market in Latin America. Middle East and Africa: The absorbent mat market in the Middle East and Africa is influenced by the presence of the oil and gas industry and the growing manufacturing sector. The region experiences high demand for absorbent mats in industries such as petrochemicals, mining, and construction. The focus in the region is on absorbent mats with high absorbency and chemical resistance, suitable for managing hazardous spills. There is also a growing trend towards mats with fire-resistant properties in sectors like oil and gas. The presence of major oil-producing nations, industrial growth, strict safety regulations, and environmental concerns drive the absorbent mat market in the Middle East and Africa.

Absorbent Mat Market Competitive Analysis

The absorbent mat market is highly competitive, with several key players vying for market share. The competition is driven by factors such as product quality, innovation, pricing strategies, distribution networks, and customer relationships. 3M is a leading player in the market, offering a wide range of innovative and high-quality absorbent mat solutions. They have a strong market presence, extensive distribution networks, and a reputation for providing reliable and effective spill management products. Brady Corporation is another major player in the market, known for its comprehensive range of absorbent mat products. They specialize in providing customizable and high-performance mats designed to meet specific industry needs New Pig Corporation is a prominent player in the market, specializing in innovative and durable absorbent mat solutions. They offer a wide range of mats with varying absorbent capacities, materials, and sizes to cater to diverse industry requirements. ESP Sorbents is an emerging player in the market, known for its cost-effective and high-quality absorbent mat solutions. They focus on providing absorbent mats that are efficient in absorbing oils, chemicals, and other liquids. ESP Sorbents caters to a wide range of industries, including manufacturing, automotive, and healthcare, with a reputation for delivering reliable and effective spill response products. The market is witnessing a growing trend towards sustainable and eco-friendly absorbent mat solutions. Key players are focusing on developing mats made from recycled materials, biodegradable options, and products with reduced environmental impact. There is an increasing demand for absorbent mats tailored to specific industry needs and applications. Key players are developing mats with specialized features, such as anti-static properties, flame resistance, and unique shapes or sizes to address the diverse requirements of different sectors. The competitive landscape of the absorbent mat market is dynamic, with established players like 3M, Brady Corporation, New Pig Corporation, and emerging companies like ESP Sorbents striving to differentiate themselves through product quality, innovation, and customer-centric strategies. Continuous investment in research and development, strategic partnerships, and a focus on customer relationships are key factors that contribute to a company's competitive advantage in the market.Absorbent Mat Market Scope: Inquire before buying

Global Absorbent Mat Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.29 Bn. Forecast Period 2024 to 2030 CAGR: 5.82% Market Size in 2030: US $ 4.89 Bn. Segments Covered: by Material Type Polypropylene Mats PVC Mats Nitrile Mats Rubber Mats Others by End Use Industry Manufacturing Automotive Oil and Gas Chemical Healthcare and Laboratories Food Processing by Distribution Channel Direct sales from manufacturers Distribution through wholesalers Retail sales Online sales platforms Absorbent Mat Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Absorbent Mat Market Key Players

1. 3M Company - United States 2. Brady Corporation - United States 3. New Pig Corporation - United States 4. ESP Sorbents - United States 5. Kimberly-Clark Corporation - United States 6. Oil-Dri Corporation of America - United States 7. Meltblown Technologies - United States 8. Fentex Limited - United Kingdom 9. Decorus Europe - France 10. 4EVR Plastic Products - United Kingdom 11. Denios AG - Germany 12. Sirane Ltd - United Kingdom 13. SpillTech - United States 14. Monarch Green, Inc. - United States 15. American Textile & Supply, Inc. - United States 16. AIRE Industrial - United States 17. Meltblown Technologies - United States 18. ESP US - United States 19. SPC Industrial - United States 20. PIG® - United States 21. Brady SPC - United States 22. Cushion-Pack - United States 23. Darcy Spillcare Manufacture - United Kingdom 24. Keller-Heartt Oil - United States 25. Chemtex - United States Frequently Asked Questions: 1. What are the common applications of absorbent mats? Ans. Absorbent mats are commonly used for spill response and cleanup, floor protection, workstation maintenance, hygiene and safety, and anti-fatigue purposes. 2. What is the most commonly used material for absorbent mats? Ans. Polypropylene is the most commonly used material for absorbent mats due to its high absorbency, durability, and resistance to chemicals and oils. 3. Can absorbent mats be reused? Ans. Yes, depending on the material and level of contamination, some absorbent mats, such as polyester mats, can be laundered and reused multiple times. 4. Are there eco-friendly options available in the market? Ans. Yes, there are eco-friendly options available in the market, including mats made from recycled materials or natural fibers like cotton. 5. How do I choose the right absorbent mat for my needs? Ans. Consider factors such as the type of liquid, absorbency capacity, size, shape, and specific application requirements when selecting the right absorbent mat for your needs.

1. Absorbent Mat Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Absorbent Mat Market: Dynamics 2.1. Absorbent Mat Market Trends by Region 2.1.1. North America Absorbent Mat Market Trends 2.1.2. Europe Absorbent Mat Market Trends 2.1.3. Asia Pacific Absorbent Mat Market Trends 2.1.4. Middle East and Africa Absorbent Mat Market Trends 2.1.5. South America Absorbent Mat Market Trends 2.2. Absorbent Mat Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Absorbent Mat Market Drivers 2.2.1.2. North America Absorbent Mat Market Restraints 2.2.1.3. North America Absorbent Mat Market Opportunities 2.2.1.4. North America Absorbent Mat Market Challenges 2.2.2. Europe 2.2.2.1. Europe Absorbent Mat Market Drivers 2.2.2.2. Europe Absorbent Mat Market Restraints 2.2.2.3. Europe Absorbent Mat Market Opportunities 2.2.2.4. Europe Absorbent Mat Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Absorbent Mat Market Drivers 2.2.3.2. Asia Pacific Absorbent Mat Market Restraints 2.2.3.3. Asia Pacific Absorbent Mat Market Opportunities 2.2.3.4. Asia Pacific Absorbent Mat Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Absorbent Mat Market Drivers 2.2.4.2. Middle East and Africa Absorbent Mat Market Restraints 2.2.4.3. Middle East and Africa Absorbent Mat Market Opportunities 2.2.4.4. Middle East and Africa Absorbent Mat Market Challenges 2.2.5. South America 2.2.5.1. South America Absorbent Mat Market Drivers 2.2.5.2. South America Absorbent Mat Market Restraints 2.2.5.3. South America Absorbent Mat Market Opportunities 2.2.5.4. South America Absorbent Mat Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Absorbent Mat Industry 2.8. Analysis of Government Schemes and Initiatives For Absorbent Mat Industry 2.9. Absorbent Mat Market Trade Analysis 2.10. The Global Pandemic Impact on Absorbent Mat Market 3. Absorbent Mat Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 3.1.1. Polypropylene Mats 3.1.2. PVC Mats 3.1.3. Nitrile Mats 3.1.4. Rubber Mats 3.1.5. Others 3.2. Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 3.2.1. Manufacturing 3.2.2. Automotive 3.2.3. Oil and Gas 3.2.4. Chemical 3.2.5. Healthcare and Laboratories 3.2.6. Food Processing 3.3. Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Direct sales from manufacturers 3.3.2. Distribution through wholesalers 3.3.3. Retail sales 3.3.4. Online sales platforms 3.4. Absorbent Mat Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Absorbent Mat Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 4.1.1. Polypropylene Mats 4.1.2. PVC Mats 4.1.3. Nitrile Mats 4.1.4. Rubber Mats 4.1.5. Others 4.2. North America Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 4.2.1. Manufacturing 4.2.2. Automotive 4.2.3. Oil and Gas 4.2.4. Chemical 4.2.5. Healthcare and Laboratories 4.2.6. Food Processing 4.3. North America Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Direct sales from manufacturers 4.3.2. Distribution through wholesalers 4.3.3. Retail sales 4.3.4. Online sales platforms 4.4. North America Absorbent Mat Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 4.4.1.1.1. Polypropylene Mats 4.4.1.1.2. PVC Mats 4.4.1.1.3. Nitrile Mats 4.4.1.1.4. Rubber Mats 4.4.1.1.5. Others 4.4.1.2. United States Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 4.4.1.2.1. Manufacturing 4.4.1.2.2. Automotive 4.4.1.2.3. Oil and Gas 4.4.1.2.4. Chemical 4.4.1.2.5. Healthcare and Laboratories 4.4.1.2.6. Food Processing 4.4.1.3. United States Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Direct sales from manufacturers 4.4.1.3.2. Distribution through wholesalers 4.4.1.3.3. Retail sales 4.4.1.3.4. Online sales platforms 4.4.2. Canada 4.4.2.1. Canada Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 4.4.2.1.1. Polypropylene Mats 4.4.2.1.2. PVC Mats 4.4.2.1.3. Nitrile Mats 4.4.2.1.4. Rubber Mats 4.4.2.1.5. Others 4.4.2.2. Canada Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 4.4.2.2.1. Manufacturing 4.4.2.2.2. Automotive 4.4.2.2.3. Oil and Gas 4.4.2.2.4. Chemical 4.4.2.2.5. Healthcare and Laboratories 4.4.2.2.6. Food Processing 4.4.2.3. Canada Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Direct sales from manufacturers 4.4.2.3.2. Distribution through wholesalers 4.4.2.3.3. Retail sales 4.4.2.3.4. Online sales platforms 4.4.3. Mexico 4.4.3.1. Mexico Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 4.4.3.1.1. Polypropylene Mats 4.4.3.1.2. PVC Mats 4.4.3.1.3. Nitrile Mats 4.4.3.1.4. Rubber Mats 4.4.3.1.5. Others 4.4.3.2. Mexico Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 4.4.3.2.1. Manufacturing 4.4.3.2.2. Automotive 4.4.3.2.3. Oil and Gas 4.4.3.2.4. Chemical 4.4.3.2.5. Healthcare and Laboratories 4.4.3.2.6. Food Processing 4.4.3.3. Mexico Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Direct sales from manufacturers 4.4.3.3.2. Distribution through wholesalers 4.4.3.3.3. Retail sales 4.4.3.3.4. Online sales platforms 5. Europe Absorbent Mat Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 5.2. Europe Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 5.3. Europe Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Absorbent Mat Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 5.4.1.2. United Kingdom Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 5.4.1.3. United Kingdom Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 5.4.2.2. France Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 5.4.2.3. France Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 5.4.3.2. Germany Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 5.4.3.3. Germany Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 5.4.4.2. Italy Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 5.4.4.3. Italy Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 5.4.5.2. Spain Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 5.4.5.3. Spain Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 5.4.6.2. Sweden Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 5.4.6.3. Sweden Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 5.4.7.2. Austria Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 5.4.7.3. Austria Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 5.4.8.2. Rest of Europe Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 5.4.8.3. Rest of Europe Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Absorbent Mat Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 6.2. Asia Pacific Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 6.3. Asia Pacific Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Absorbent Mat Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 6.4.1.2. China Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 6.4.1.3. China Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 6.4.2.2. S Korea Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 6.4.2.3. S Korea Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 6.4.3.2. Japan Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 6.4.3.3. Japan Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 6.4.4.2. India Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 6.4.4.3. India Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 6.4.5.2. Australia Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 6.4.5.3. Australia Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 6.4.6.2. Indonesia Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 6.4.6.3. Indonesia Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 6.4.7.2. Malaysia Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 6.4.7.3. Malaysia Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 6.4.8.2. Vietnam Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 6.4.8.3. Vietnam Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 6.4.9.2. Taiwan Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 6.4.9.3. Taiwan Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 6.4.10.3. Rest of Asia Pacific Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Absorbent Mat Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 7.2. Middle East and Africa Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 7.3. Middle East and Africa Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Absorbent Mat Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 7.4.1.2. South Africa Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 7.4.1.3. South Africa Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 7.4.2.2. GCC Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 7.4.2.3. GCC Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 7.4.3.2. Nigeria Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 7.4.3.3. Nigeria Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 7.4.4.2. Rest of ME&A Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 7.4.4.3. Rest of ME&A Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Absorbent Mat Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 8.2. South America Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 8.3. South America Absorbent Mat Market Size and Forecast, by Distribution Channel(2023-2030) 8.4. South America Absorbent Mat Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 8.4.1.2. Brazil Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 8.4.1.3. Brazil Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 8.4.2.2. Argentina Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 8.4.2.3. Argentina Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Absorbent Mat Market Size and Forecast, by Material Type (2023-2030) 8.4.3.2. Rest Of South America Absorbent Mat Market Size and Forecast, by End-use Industry (2023-2030) 8.4.3.3. Rest Of South America Absorbent Mat Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Absorbent Mat Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Absorbent Mat Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. 3M Company - United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Brady Corporation - United States 10.3. New Pig Corporation - United States 10.4. ESP Sorbents - United States 10.5. Kimberly-Clark Corporation - United States 10.6. Oil-Dri Corporation of America - United States 10.7. Meltblown Technologies - United States 10.8. Fentex Limited - United Kingdom 10.9. Decorus Europe - France 10.10. 4EVR Plastic Products - United Kingdom 10.11. Denios AG - Germany 10.12. Sirane Ltd - United Kingdom 10.13. SpillTech - United States 10.14. Monarch Green, Inc. - United States 10.15. American Textile & Supply, Inc. - United States 10.16. AIRE Industrial - United States 10.17. Meltblown Technologies - United States 10.18. ESP US - United States 10.19. SPC Industrial - United States 10.20. PIG® - United States 10.21. Brady SPC - United States 10.22. Cushion-Pack - United States 10.23. Darcy Spillcare Manufacture - United Kingdom 10.24. Keller-Heartt Oil - United States 10.25. Chemtex - United States 11. Key Findings 12. Industry Recommendations 13. Absorbent Mat Market: Research Methodology 14. Terms and Glossary