The 3D Camera Market size was valued at USD 5.68 Billion in 2023 and the total Global Deep Learning revenue is expected to grow at a CAGR of 31.2% from 2023 to 2030, reaching nearly USD 37.98 Billion in 2030. 3D Camera Market Objectives: Maximize Market Research conducted a brief analysis of the 3D Camera Market. The purpose of this research is to provide stakeholders in the industry with a thorough insight into the 3D Camera Market. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers. The research is an investor's guide since it depicts the competitive analysis of major competitors in the 3D Camera market by product, price, financial situation, product portfolio, growth plans, and geographical presence.3D Camera Market Overview:

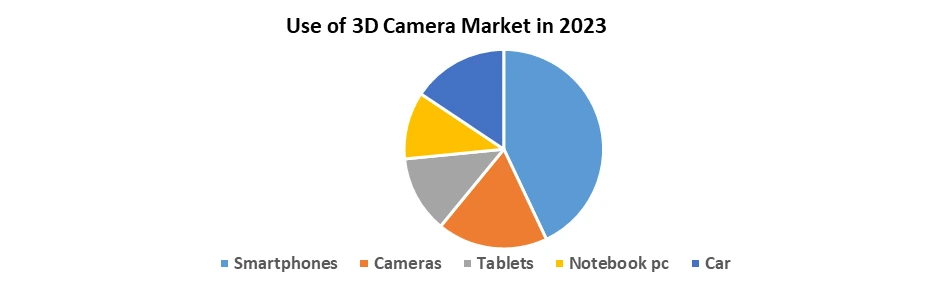

The 3D camera market refers to a segment of the global digital camera business that focuses on catering to consumers and professionals who have the ability to capture photos with depth perception. 3D cameras are often available in smartphones, tablets, and other electronic appliances like augmented reality (AR), virtual reality (VR), and 3D photography. It is useful in entertainment and gaming purposes.To know about the Research Methodology :- Request Free Sample Report The 3D Camera Market has grown significantly in recent years due to rising demand from many industries and advancements in technologies including a variety of 3D imaging techniques like stereoscopic, time of flight (ToF), and structured light. The 3D cameras play a key role in the automobile sector such as advanced driver-assistance systems (ADAS) and self-driving cars. These 3D cameras help in providing object recognition, and depth perception, and enhancing overall safety. The ability to record depth data helps enhance scene analysis and object tracking also useful in security and surveillance systems to enhance monitoring capabilities. 3D cameras are widely used in industrial settings for various tasks such as optical gauging, non-contact 3D measurements, barcode and OCR reading, and process automation. The ability to capture more detailed information of object, including its size, shape, and position, which is essential for handling and other operations in industrial settings. Asia-Pacific region shows tremendous growth with increasing market share due to an increase in the utilization of 3D Camera technology and demands for entertainment industries. Leading companies in the 3D camera sector, including Sony Corporation, Panasonic Corporation, and Samsung Electronics Co., utilize broad techniques to build on and broaden their market impact. A key component of their strategy is their constant commitment to research and development (R&D) to maintain a leading position in technological development.

3D Camera Market Dynamics

Rapid Technological Progress Propelling 3D Camera Implementation in the Automotive Industry The automobile industry has been driving the adoption of 3D cameras and the speedy advancement of technology. Many sectors, include machine vision, car production, automotive inspections, 3D mapping, and autonomous vehicles. ZF has created a 3D internal camera for the IOS platform which quickly improves the automation and recognises the location of car. Use these 3D cameras. Companies like Foresight, Cognex, Sony, and Zivid are providing 3D camera solutions that are specifically designed to meet the demands of the automobile sector. Accurate measurements of complex components, increased production productivity and precision, automated inspections, and improved vehicle safety and user experience are all made possible by these technologies. 1. The demand for improved visual applications in the entertainment industry which driving the 3D Camera Market. Weta Digital produced camera for utilized in Hollywood movie shooting. The increasing use of 3D cameras has led to a rise in popularity for 3D filming.

3D Camera Market Trends:

In Australia, Innovation and development are driven by increasing adoption in industries such as gaming, healthcare, and real estate. The development and uptake of 3D imaging technologies in Australia are supported by current developments and advances in the field. 3D Camera Market Trends include the integration of 3D cameras with artificial intelligence (AI) for more advanced image processing, Improved depth-sensing technologies, and enlargement into developing markets. 1. Geographic awareness and drone integration for mapping and surveillance drives market growth and improves the use of 3D cameras beyond conventional uses. Grabbing Opportunities in the ADAS 3D Camera Market Advanced driver-assistance systems (ADAS) utilize 3D cameras for functions such as lane departure warning, parking assistance, and collision avoidance. Opportunities for 3D camera technology exist in the growing field of autonomous cars. In Japan, 3D Camera market technological innovation provides opportunities for advanced 3D imaging research, development, and application. Collaborations between tech companies with industries including gaming, healthcare, and automobiles promote innovation and commercial growth. Augmented reality (AR) and virtual reality (VR): To provide immersive experiences for VR and AR applications, 3D cameras are essential. Good 3D imaging solutions are getting progressively more in demand as these technologies advance Virtual reality (VR) and augmented reality (AR) innovations are being propelled by the broad adoption of 3D cameras. Significantly, 3D cameras record small details that increase the sense of depth and reality of AR/VR experiences. The ability of 3D cameras to monitor gestures and body movements makes it easier for users to engage more naturally and intuitively with virtual items. This allows users to handle things in AR/VR environments with hand gestures.3D Camera Market Segmentation:

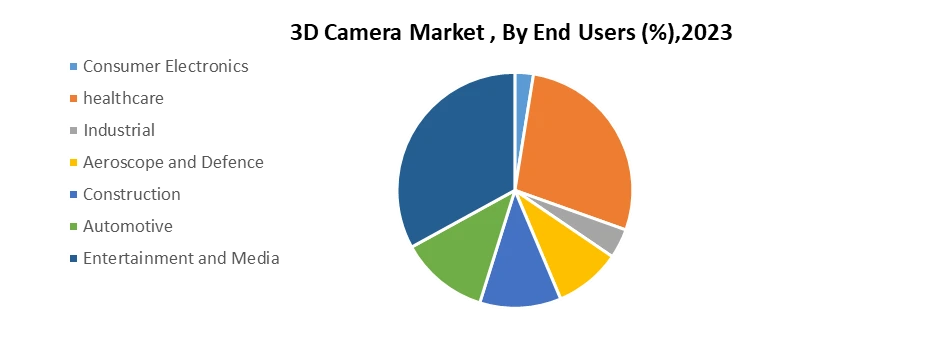

Based on Image Detection Techniques, Stereo vision dominates the 3D Camera Market with a share of 61.76% in 2023. Stereo vision is used in Robotics, 3D modelling, virtual reality, and autonomous vehicles. Stereo vision increases used in smartphones and gaming supports and 3D scanning. 1. In December 2023, stereo labs launched ZED-X used as automation in the process of robotics. 2. Intel Real Sense camera combines active IR pattern emitters with IR stereo cameras so under low light conditions depth camera works very well. Based on End Users, According to MMR analysis, Entertainment, and media dominated the 3D Camera market with 39% market share in 2023 and maintained its dominance till 2030. High-end cinema cameras excel in capturing exceptional quality footage, while professional DSLRs are the preferred choice of photographers involved in fashion, events, and various creative pursuits. The Aerospace & Defence industry growing rapidly as cameras play an important role in surveillance, reconnaissance, and target acquisition. In healthcare, cameras are utilised for medical imaging, including X-rays, endoscopy, and ultrasound. These cameras assist in diagnosis, surgical procedures, and medical research, allowing medical professionals to visualize and analyse internal structures and abnormalities.

3D Camera Market Regional Analysis:

Asia-Pacific region dominates the global 3D Camera Market with the largest market share accounting of 39.1% in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. Because of the increasing penetration of Smartphones, Improving the entertainment sector, rising disposable income, and having few cameras. North America is the fastest-growing region in the market. The time of flight is technology expected to grow rapidly in the North American region. The time of flight technologies include object detection sensors, Robot navigation, and car tracking sensors. Time of flight sensors are useful in estimating the distance between two sites based on the duration it requires photons to go across.3D Camera Market Competitive Landscape: Leading companies in the 3D camera sector, including Sony Corporation, Panasonic Corporation, and Samsung Electronics Co., utilize broad techniques to build on and broaden their market impact. A key component of their strategy is their constant commitment to research and development (R&D) to maintain a leading position in technological development. 1. Hangzhou, China, 2 June 2023, Launched Rex 3D and Cruiser 2 as the first smart pan & tilt smart indoor and outdoor security camera equipped with IMOU sense, which is self-developed AI algorithm matrix by IMOU. 2. In February 2023, Alsontech Company offered features of Alsontech’s advanced binocular imaging technology, a 3D version of the industrial Robot, and AT –S1000-6C-S3 a Nano series used in industrial automation and operational stability. 3. In January 2023, Orbbec introduced the Gemini 2, their newest 3D camera, at the CES 2023 convention in Las Vegas in January 2023. This camera has a next-generation depth engine chip installed. Utilized measuring distances between 0 to 10 meters. 4. In December 2022, Faro announced the acquisition of Site Scope, an innovator in LIDAR 3D scanning software solutions of the AEC and O&M markets. LIDAR devices are equipped with indoor spaces digitally, and reading entry points to scan physical spaces range.

3D Camera Market Scope: Inquire before buying

Global 3D Camera Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.68 Bn. Forecast Period 2024 to 2030 CAGR: 31.2% Market Size in 2030: US $ 37.98 Bn. Segments Covered: by Image Detection Techniques Structured light Imaging Stereoscopic Imaging Time of Flight by Type Target camera Target-Free camera by End Users Consumer Electronics Healthcare Industrial Aeroscope and Defence Construction Automotive Media and Entertainment 3D Camera Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)3D Camera Market Key players:

1. Canon Inc. 2. Sony Group Corporation. 3. Samsung Electronics Co. Ltd. 4. Matterport 5. Intel Corporation. 6. Ricoh Co.Ltd. 7. FARO Technologies Inc. 8. Nikon Corporation. 9. LG Corporation. 10. Texas Instruments. 11. Panasonic Holdings Corporation. 12. Eastman Kodak Company. 13. GoPro, Inc. 14. Orbbec 3D Technology International Inc. 15. Stereolabs Inc. 16. Vuze Camera 17. Insta 360 18. HTC Corporation Frequently Asked Questions: 1] What segments are covered in the Global 3D Camera Market report? Ans. The segments covered in the Market report are based on Type, By Image Detection Techniques, End-User Industry, and Region. 2] Which region is expected to hold the highest share of the Global 3D Camera Market? Ans. The Asia Pacific region is expected to hold the highest share of the Market. 3] What is the market size of the Global 3D Camera Market by 2029? Ans. The market size of the 3D Camera Market by 2030 is expected to reach US$ 37.98 Bn. 4] What is the forecast period for the Global 3D Camera Market? Ans. The forecast period for the 3D Camera Market is 2024-2030. 5] What is the expected CAGR for the 3D Camera Market from 2024 to 2030? Ans. The 3D Camera Market is expected CAGR is 31.2% from 2024 to 2030

1. 3D Camera Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. 3D Camera Market: Dynamics 2.1. 3D Camera Market Trends by Region 2.1.1. North America 3D Camera Market Trends 2.1.2. Europe 3D Camera Market Trends 2.1.3. Asia Pacific 3D Camera Market Trends 2.1.4. Middle East and Africa 3D Camera Market Trends 2.1.5. South America 3D Camera Market Trends 2.2. 3D Camera Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America 3D Camera Market Drivers 2.2.1.2. North America 3D Camera Market Restraints 2.2.1.3. North America 3D Camera Market Opportunities 2.2.1.4. North America 3D Camera Market Challenges 2.2.2. Europe 2.2.2.1. Europe 3D Camera Market Drivers 2.2.2.2. Europe 3D Camera Market Restraints 2.2.2.3. Europe 3D Camera Market Opportunities 2.2.2.4. Europe 3D Camera Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific 3D Camera Market Drivers 2.2.3.2. Asia Pacific 3D Camera Market Restraints 2.2.3.3. Asia Pacific 3D Camera Market Opportunities 2.2.3.4. Asia Pacific 3D Camera Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa 3D Camera Market Drivers 2.2.4.2. Middle East and Africa 3D Camera Market Restraints 2.2.4.3. Middle East and Africa 3D Camera Market Opportunities 2.2.4.4. Middle East and Africa 3D Camera Market Challenges 2.2.5. South America 2.2.5.1. South America 3D Camera Market Drivers 2.2.5.2. South America 3D Camera Market Restraints 2.2.5.3. South America 3D Camera Market Opportunities 2.2.5.4. South America 3D Camera Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For 3D Camera Industry 2.8. Analysis of Government Schemes and Initiatives For 3D Camera Industry 2.9. 3D Camera Market Trade Analysis 2.10. The Global Pandemic Impact on 3D Camera Market 3. 3D Camera Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 3.1.1. Structured light Imaging 3.1.2. Stereoscopic Imaging 3.1.3. Time of Flight 3.2. 3D Camera Market Size and Forecast, by Type (2023-2030) 3.2.1. Target camera 3.2.2. Target-Free camera 3.3. 3D Camera Market Size and Forecast, by End User (2023-2030) 3.3.1. Consumer Electronics 3.3.2. Healthcare 3.3.3. Industrial 3.3.4. Aeroscope and Defence 3.3.5. Construction 3.3.6. Automotive 3.3.7. Media and Entertainment 3.4. 3D Camera Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America 3D Camera Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 4.1.1. Structured light Imaging 4.1.2. Stereoscopic Imaging 4.1.3. Time of Flight 4.2. North America 3D Camera Market Size and Forecast, by Type (2023-2030) 4.2.1. Target camera 4.2.2. Target-Free camera 4.3. North America 3D Camera Market Size and Forecast, by End User (2023-2030) 4.3.1. Consumer Electronics 4.3.2. Healthcare 4.3.3. Industrial 4.3.4. Aeroscope and Defence 4.3.5. Construction 4.3.6. Automotive 4.3.7. Media and Entertainment 4.4. North America 3D Camera Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 4.4.1.1.1. Structured light Imaging 4.4.1.1.2. Stereoscopic Imaging 4.4.1.1.3. Time of Flight 4.4.1.2. United States 3D Camera Market Size and Forecast, by Type (2023-2030) 4.4.1.2.1. Target camera 4.4.1.2.2. Target-Free camera 4.4.1.3. United States 3D Camera Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Consumer Electronics 4.4.1.3.2. Healthcare 4.4.1.3.3. Industrial 4.4.1.3.4. Aeroscope and Defence 4.4.1.3.5. Construction 4.4.1.3.6. Automotive 4.4.1.3.7. Media and Entertainment 4.4.2. Canada 4.4.2.1. Canada 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 4.4.2.1.1. Structured light Imaging 4.4.2.1.2. Stereoscopic Imaging 4.4.2.1.3. Time of Flight 4.4.2.2. Canada 3D Camera Market Size and Forecast, by Type (2023-2030) 4.4.2.2.1. Target camera 4.4.2.2.2. Target-Free camera 4.4.2.3. Canada 3D Camera Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Consumer Electronics 4.4.2.3.2. Healthcare 4.4.2.3.3. Industrial 4.4.2.3.4. Aeroscope and Defence 4.4.2.3.5. Construction 4.4.2.3.6. Automotive 4.4.2.3.7. Media and Entertainment 4.4.3. Mexico 4.4.3.1. Mexico 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 4.4.3.1.1. Structured light Imaging 4.4.3.1.2. Stereoscopic Imaging 4.4.3.1.3. Time of Flight 4.4.3.2. Mexico 3D Camera Market Size and Forecast, by Type (2023-2030) 4.4.3.2.1. Target camera 4.4.3.2.2. Target-Free camera 4.4.3.3. Mexico 3D Camera Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Consumer Electronics 4.4.3.3.2. Healthcare 4.4.3.3.3. Industrial 4.4.3.3.4. Aeroscope and Defence 4.4.3.3.5. Construction 4.4.3.3.6. Automotive 4.4.3.3.7. Media and Entertainment 5. Europe 3D Camera Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 5.2. Europe 3D Camera Market Size and Forecast, by Type (2023-2030) 5.3. Europe 3D Camera Market Size and Forecast, by End User (2023-2030) 5.4. Europe 3D Camera Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 5.4.1.2. United Kingdom 3D Camera Market Size and Forecast, by Type (2023-2030) 5.4.1.3. United Kingdom 3D Camera Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 5.4.2.2. France 3D Camera Market Size and Forecast, by Type (2023-2030) 5.4.2.3. France 3D Camera Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 5.4.3.2. Germany 3D Camera Market Size and Forecast, by Type (2023-2030) 5.4.3.3. Germany 3D Camera Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 5.4.4.2. Italy 3D Camera Market Size and Forecast, by Type (2023-2030) 5.4.4.3. Italy 3D Camera Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 5.4.5.2. Spain 3D Camera Market Size and Forecast, by Type (2023-2030) 5.4.5.3. Spain 3D Camera Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 5.4.6.2. Sweden 3D Camera Market Size and Forecast, by Type (2023-2030) 5.4.6.3. Sweden 3D Camera Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 5.4.7.2. Austria 3D Camera Market Size and Forecast, by Type (2023-2030) 5.4.7.3. Austria 3D Camera Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 5.4.8.2. Rest of Europe 3D Camera Market Size and Forecast, by Type (2023-2030) 5.4.8.3. Rest of Europe 3D Camera Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific 3D Camera Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 6.2. Asia Pacific 3D Camera Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific 3D Camera Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific 3D Camera Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 6.4.1.2. China 3D Camera Market Size and Forecast, by Type (2023-2030) 6.4.1.3. China 3D Camera Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 6.4.2.2. S Korea 3D Camera Market Size and Forecast, by Type (2023-2030) 6.4.2.3. S Korea 3D Camera Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 6.4.3.2. Japan 3D Camera Market Size and Forecast, by Type (2023-2030) 6.4.3.3. Japan 3D Camera Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 6.4.4.2. India 3D Camera Market Size and Forecast, by Type (2023-2030) 6.4.4.3. India 3D Camera Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 6.4.5.2. Australia 3D Camera Market Size and Forecast, by Type (2023-2030) 6.4.5.3. Australia 3D Camera Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 6.4.6.2. Indonesia 3D Camera Market Size and Forecast, by Type (2023-2030) 6.4.6.3. Indonesia 3D Camera Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 6.4.7.2. Malaysia 3D Camera Market Size and Forecast, by Type (2023-2030) 6.4.7.3. Malaysia 3D Camera Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 6.4.8.2. Vietnam 3D Camera Market Size and Forecast, by Type (2023-2030) 6.4.8.3. Vietnam 3D Camera Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 6.4.9.2. Taiwan 3D Camera Market Size and Forecast, by Type (2023-2030) 6.4.9.3. Taiwan 3D Camera Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 6.4.10.2. Rest of Asia Pacific 3D Camera Market Size and Forecast, by Type (2023-2030) 6.4.10.3. Rest of Asia Pacific 3D Camera Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa 3D Camera Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 7.2. Middle East and Africa 3D Camera Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa 3D Camera Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa 3D Camera Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 7.4.1.2. South Africa 3D Camera Market Size and Forecast, by Type (2023-2030) 7.4.1.3. South Africa 3D Camera Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 7.4.2.2. GCC 3D Camera Market Size and Forecast, by Type (2023-2030) 7.4.2.3. GCC 3D Camera Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 7.4.3.2. Nigeria 3D Camera Market Size and Forecast, by Type (2023-2030) 7.4.3.3. Nigeria 3D Camera Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 7.4.4.2. Rest of ME&A 3D Camera Market Size and Forecast, by Type (2023-2030) 7.4.4.3. Rest of ME&A 3D Camera Market Size and Forecast, by End User (2023-2030) 8. South America 3D Camera Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 8.2. South America 3D Camera Market Size and Forecast, by Type (2023-2030) 8.3. South America 3D Camera Market Size and Forecast, by End User(2023-2030) 8.4. South America 3D Camera Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 8.4.1.2. Brazil 3D Camera Market Size and Forecast, by Type (2023-2030) 8.4.1.3. Brazil 3D Camera Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 8.4.2.2. Argentina 3D Camera Market Size and Forecast, by Type (2023-2030) 8.4.2.3. Argentina 3D Camera Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America 3D Camera Market Size and Forecast, by Image Detection Techniques (2023-2030) 8.4.3.2. Rest Of South America 3D Camera Market Size and Forecast, by Type (2023-2030) 8.4.3.3. Rest Of South America 3D Camera Market Size and Forecast, by End User (2023-2030) 9. Global 3D Camera Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading 3D Camera Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Canon Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sony Group Corporation. 10.3. Samsung Electronics Co. Ltd. 10.4. Matterport 10.5. Intel Corporation. 10.6. Ricoh Co.Ltd. 10.7. FARO Technologies Inc. 10.8. Nikon Corporation. 10.9. LG Corporation. 10.10. Texas Instruments. 10.11. Panasonic Holdings Corporation. 10.12. Eastman Kodak Company. 10.13. GoPro, Inc. 10.14. Orbbec 3D Technology International Inc. 10.15. Stereolabs Inc. 10.16. Vuze Camera 10.17. Insta 360 10.18. HTC Corporation 11. Key Findings 12. Industry Recommendations 13. 3D Camera Market: Research Methodology 14. Terms and Glossary