Hydrogen Generation Market reached a value of US $ 160.79 Bn. in 2022. Hydrogen Generation market size is estimated to grow at a CAGR of 6.3%.Hydrogen Generation Market Overview:

Hydrogen is produced utilising a variety of procedures and resources. For instance, the thermochemical method requires the use of fossil fuels to release hydrogen, whereas other systems use electrolysis or solar energy to split water into hydrogen and oxygen. At the moment, new technologies based on bacteria and algae are being introduced, which are likewise cost-effective, efficient, and environmentally friendly. The demand for hydrogen generation is now increasing in the refining of petroleum, the treatment of metals, the production of fertilizers, and the processing of food goods. In 2022, Hydrogen was the world's 322nd most traded product, and trade in Hydrogen represent 0.055% of total global trade. In 2022 the top exporters of Hydrogen were China (US $1520 Mn.), the United States (US $1381 Mn.), Germany (US $1042 Mn.), South Korea (US $558 Mn.), and Qatar (US $521 Mn.), while the top importers of Hydrogen were China (US $1651 Mn.), Japan (US $1183 Mn.), Germany (US $995 Mn.), United States (US $668 Mn.), and South Korea (the US $667Mn.).To know about the Research Methodology :- Request Free Sample Report

Hydrogen Generation Market Dynamics:

Hydrogen may be obtained from fossil fuels and biomass, as well as water and a combination of the two. Natural gas is now the most common source of hydrogen generation, accounting for roughly three-quarters of the total dedicated hydrogen production of around 0.070 billion metric tonnes per year. This accounts for around 6% of global natural gas consumption. Due to its dominance in China, gas is followed by coal, with oil and electricity accounting for a modest portion of total production. International cooperation is essential to accelerating the global adoption of clean hydrogen. Governments working together to scale up hydrogen can help encourage investments in factories and infrastructure, lowering costs and allowing for the sharing of information and best practices. International hydrogen trade will benefit from unified standards. The IEA will continue to provide rigorous analysis and policy guidance to enhance international cooperation and perform effective progress tracking in the years ahead as the global energy organisation that covers all fuels and technologies. The growing energy demand along with the rising environmental concerns are fueling the need for sustainable energy sources like hydrogen. In addition, governments across the globe are enacting strict rules to limit carbon emissions in the automobile sector, which is driving up EV sales around the world. The widespread use of hydrogen as a coolant in power plant generators is boosting the hydrogen generation market growth across the globe. Hydrogen helps in the resolution of several pressing energy issues. It proposes solutions to decarbonize several industries, including long-haul transportation, chemicals, and iron and steel, were major reductions in emissions are proving challenging. It is also helping in the improvement of air quality and the enhancement of energy security. In 2022, global energy-related CO2 emissions reached an all-time high, despite very ambitious international climate goals. Outdoor air pollution is also a major issue, with over 3 million people dying prematurely each year across the globe. Currently, producing hydrogen from low-carbon energy is prohibitively expensive. According to an IEA analysis, the cost of creating hydrogen from renewable electricity might drop by 30% by 2030 as a combination of falling renewable energy costs and the scaling up of hydrogen production. Mass production is expected to help fuel cells, refueling equipment, and electrolysers, which create hydrogen from electricity and water.Hydrogen Generation Market Segment Analysis:

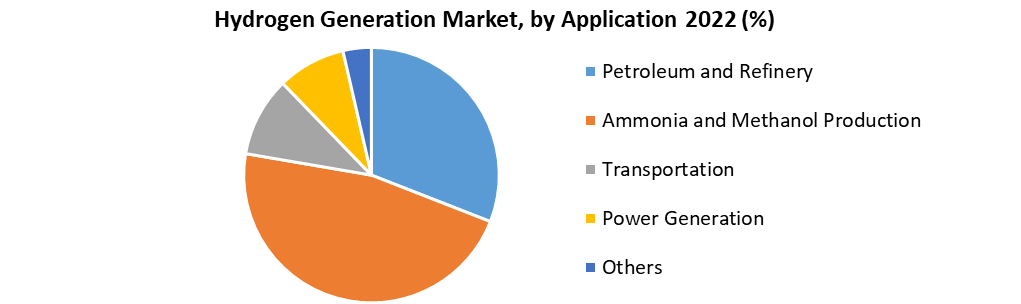

Based on the Type, the Hydrogen Generation Market is segmented into Merchant and Captive. The Merchant segment held the largest market share, accounting for 58% in 2022. Merchant hydrogen is generated by water electrolysis and natural gas processes, which minimize the need for transportation of fuel along with a need for construction of new hydrogen generation infrastructure. The merchant hydrogen generation cost conveyance and distribution of hydrogen are boosting the hydrogen generation market growth during the forecast period.Based on the Application, the Hydrogen Generation Market is segmented into Petroleum and Refinery, Ammonia and Methanol Production, Transportation, Power Generation, and Others. The Ammonia and Methanol production segment held the largest market share, accounting for 38% in 2022. Ammonia plants consume a considerable portion of the hydrogen produced. Hydrogen is typically manufactured on-site in ammonia facilities using fossil fuel as a feedstock. With its ease of use and low cost, this application has traditionally had a huge consumer base. Ammonia is used extensively in the fertiliser manufacturing process. The Transportation segment is expected to grow at a CAGR of xx% during the forecast period. The segment growth is attributed to the rapid increase in demand for Fuel Cell Electric Vehicles (FCEV) across the globe. Hydrogen is used in various types of transportation, including buses, trains, and fuel cell electric vehicles. Hydrogen is more fuel-efficient than traditional internal combustion engines and releases no exhaust pollution.

Hydrogen Generation Market Regional Insights:

Asia Pacific region held the largest market share accounted for 35 % in 2022. The growing economic performance, along with high investments in R&D in developing countries of Asia Pacific, such as China, Japan, South Korea, India, and Australia is expected to boost the hydrogen generation market growth in the region. In addition, commercialising fuel cells in the region is also driving the market growth. For instance, Japan was the first country to commercialise fuel cells, and it is now supporting efforts to employ them in household and automobile applications. Its goal is to mass-produce green hydrogen. To meet global carbon emission limits, the country is expected to have 200, 00 green hydrogen fuel cell vehicles and 320 hydrogen recharging stations by 2025. Singapore, India, and Malaysia have all expressed interest in fuel cells and have recently launched or are planning to launch specific programs to promote them in their respective markets. In March 2021, the Ministry of Economy, Trade, and Industry (METI) India updated the national hydrogen strategy to place 200000 FCEV units by 2025, and 800000 units by 2030. North America region is expected to witness significant growth at a CAGR of xx% during the forecast period. The US Department of Energy (DOE) promotes the R&D of a wide range of methods for producing hydrogen by net-zero-carbon pathways. In support of the Hydrogen Energy Earth shot goal of reducing the cost of clean hydrogen by 80% to $1 per kg in a decade, DOE's Hydrogen and Fuel Cell Technologies Office is focusing on developing technologies that can produce hydrogen for $2/kg by 2025 and $1/kg by 2030 via net-zero-carbon pathways. The objective of the report is to present a comprehensive analysis of the Hydrogen Generation Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Hydrogen Generation Market dynamic, structure by analyzing the market segments and projecting the Hydrogen Generation Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Hydrogen Generation Market make the report investor’s guide.Hydrogen Generation Market Scope: Inquire before buying

Hydrogen Generation Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 160.79 Bn. Forecast Period 2023 to 2029 CAGR: 6.3% Market Size in 2029: US $ 246.60 Bn. Segments Covered: by Type Merchant Captive by Technology Steam Methane Reforming Coal Gasification by Application Petroleum and Refinery Ammonia and Methanol Production Transportation Power Generation Others Hydrogen Generation Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hydrogen Generation Market, Key Players:

1. Showa Denko K.K. 2. Messer Group GmbH 3. Caloric Anlagenbau GmbH 4. Nuvera Fuel Cells 5. Xebec Adsorption Inc. 6. Taiyo Nippon Sanso Corporation 7. Hydrogenics 8. Praxair Technology, Inc. 9. Iwatani Corporation 10.Air Products & Chemicals 11.Ally Hi-Tech 12.Aquahydrex 13.Atawey 14.Claind 15.Cummins 16.Electrochaea 17.Enapter 18.Engie 19.Fuel Cell Energy 20.Green Hydrogen Systems 21.Hiringa Energy 22.ITM Power 23.Linde Frequently Asked Questions: 1] What segments are covered in the Hydrogen Generation Market report? Ans. The segments covered in the Hydrogen Generation Market report are based on Type, Technology, and Application. 2] Which region is expected to hold the highest share in the Hydrogen Generation Market? Ans. The Asia Pacific region is expected to hold the highest share in the Hydrogen Generation Market. 3] What is the market size of the Hydrogen Generation Market by 2029? Ans. The market size of the Hydrogen Generation Market by 2029 is US $ 246.60 Bn. 4] What is the forecast period for the Hydrogen Generation Market? Ans. The Forecast period for the Hydrogen Generation Market is 2023-2029. 5] What was the market size of the Hydrogen Generation Market in 2022? Ans. The market size of the Hydrogen Generation Market in 2022 was US $ 160.79 Bn.

Global Hydrogen Generation Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 1.4. Key Questions Answered 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations Used 2.3. Research Methodology 3. Executive Summary 3.1. Global Hydrogen Generation Market Size, by Market Value (US$ Mn) and Market, by Region 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.3. Drivers and Restraints Snapshot Analysis 4.3.1. Drivers 4.3.2. Restraints 4.3.3. Opportunities 4.3.4. Porter’s Analysis 4.3.5. Value Chain Analysis 4.3.6. SWOT Analysis 5. Global Hydrogen Generation Market Analysis and Forecast 5.1. Global Hydrogen Generation Market Analysis and Forecast 5.2. Global Hydrogen Generation Market Size& Y-o-Y Growth Analysis 5.2.1. North America 5.2.2. Europe 5.2.3. Asia Pacific 5.2.4. Middle East & Africa 5.2.5. Latin America 6. Global Hydrogen Generation Market Analysis and Forecast, by Delivery Mode 6.1. Introduction and Definition 6.2. Key Findings 6.3. Global Hydrogen Generation Market Value Share Analysis, by Delivery Mode 6.4. Market Size (US$ Mn) Forecast, by Delivery Mode 6.5. Global Hydrogen Generation Market Analysis, by Delivery Mode 6.6. Hydrogen Generation Market Attractiveness Analysis, by Delivery Mode 7. Global Hydrogen Generation Market Analysis and Forecast, by Process 7.1. Introduction and Definition 7.2. Global Hydrogen Generation Market Value Share Analysis, by Process 7.3. Market Size (US$ Mn) Forecast, by Process 7.4. Global Hydrogen Generation Market Analysis, by Process 7.5. Global Hydrogen Generation Market Attractiveness Analysis, by Process 8. Global Hydrogen Generation Market Analysis and Forecast, by Application 8.1. Introduction and Definition 8.2. Global Hydrogen Generation Market Value Share Analysis, by Application 8.3. Market Size (US$ Mn) Forecast, by Application 8.4. Global Hydrogen Generation Market Analysis, by Application 8.5. Global Hydrogen Generation Market Attractiveness Analysis, by Application 9. Global Hydrogen Generation Market Analysis, by Region 9.1. Global Hydrogen Generation Market Value Share Analysis, by Region 9.2. Market Size (US$ Mn) Forecast, by Region 9.3. Global Hydrogen Generation Market Attractiveness Analysis, by Region 10. North America Hydrogen Generation Market Analysis 10.1. Key Findings 10.2. North America Hydrogen Generation Market Overview 10.3. North America Hydrogen Generation Market Value Share Analysis, by Delivery Mode 10.4. North America Hydrogen Generation Market Forecast, by Delivery Mode 10.4.1. Captive 10.4.2. Merchant 10.5. North America Hydrogen Generation Market Value Share Analysis, by Process 10.6. North America Hydrogen Generation Market Forecast, by Process 10.6.1. Steam Reformer 10.6.2. Electrolysis 10.7. North America Hydrogen Generation Market Value Share Analysis, by Application 10.8. North America Hydrogen Generation Market Forecast, by Application 10.8.1. Petroleum Refinery 10.8.2. Chemical 10.8.3. Metal 10.9. North America Hydrogen Generation Market Value Share Analysis, by Country 10.10. North America Hydrogen Generation Market Forecast, by Country 10.10.1.1. U.S., 2021–2029 10.10.1.2. Canada, 2021–2029 10.11. North America Hydrogen Generation Market Analysis, by Country 10.12. U.S. Hydrogen Generation Market Forecast, by Delivery Mode 10.12.1. Captive 10.12.2. Merchant 10.13. U.S. Hydrogen Generation Market Forecast, by Process 10.13.1. Steam Reformer 10.13.2. Electrolysis 10.14. U.S. Hydrogen Generation Market Forecast, by Application 10.14.1. Petroleum Refinery 10.14.2. Chemical 10.14.3. Metal 10.15. Canada Hydrogen Generation Market Forecast, by Delivery Mode 10.15.1. Captive 10.15.2. Merchant 10.16. Canada Hydrogen Generation Market Forecast, by Process 10.16.1. Steam Reformer 10.16.2. Electrolysis 10.17. Canada Hydrogen Generation Market Forecast, by Application 10.17.1. Petroleum Refinery 10.17.2. Chemical 10.17.3. Metal 10.18. North America Hydrogen Generation Market Attractiveness Analysis 10.18.1. By Delivery Mode 10.18.2. By Process 10.18.3. By Application 10.19. PEST Analysis 11. Europe Hydrogen Generation Market Analysis 11.1. Key Findings 11.2. Europe Hydrogen Generation Market Overview 11.3. Europe Hydrogen Generation Market Value Share Analysis, by Delivery Mode 11.4. Europe Hydrogen Generation Market Forecast, by Delivery Mode 11.4.1. Captive 11.4.2. Merchant 11.5. Europe Hydrogen Generation Market Value Share Analysis, by Process 11.6. Europe Hydrogen Generation Market Forecast, by Process 11.6.1. Steam Reformer 11.6.2. Electrolysis 11.7. Europe Hydrogen Generation Market Value Share Analysis, by Application 11.8. Europe Hydrogen Generation Market Forecast, by Application 11.8.1. Petroleum Refinery 11.8.2. Chemical 11.8.3. Metal 11.9. Europe Hydrogen Generation Market Value Share Analysis, by Country 11.10. Europe Hydrogen Generation Market Forecast, by Country 11.10.1.1. Germany 11.10.1.2. U.K. 11.10.1.3. France 11.10.1.4. Italy 11.10.1.5. Spain 11.10.1.6. Rest of Europe 11.11. Europe Hydrogen Generation Market Analysis, by Country/ Sub-region 11.12. Germany Hydrogen Generation Market Forecast, by Delivery Mode 11.12.1. Captive 11.12.2. Merchant 11.13. Germany Hydrogen Generation Market Forecast, by Process 11.13.1. Steam Reformer 11.13.2. Electrolysis 11.14. Germany Hydrogen Generation Market Forecast, by Application 11.14.1. Petroleum Refinery 11.14.2. Chemical 11.14.3. Metal 11.15. U.K. Hydrogen Generation Market Forecast, by Delivery Mode 11.15.1. Captive 11.15.2. Merchant 11.16. U.K. Hydrogen Generation Market Forecast, by Process 11.16.1. Steam Reformer 11.16.2. Electrolysis 11.17. U.K. Hydrogen Generation Market Forecast, by Application 11.17.1. Petroleum Refinery 11.17.2. Chemical 11.17.3. Metal 11.18. France Hydrogen Generation Market Forecast, by Delivery Mode 11.18.1. Captive 11.18.2. Merchant 11.19. France Hydrogen Generation Market Forecast, by Process 11.19.1. Steam Reformer 11.19.2. Electrolysis 11.20. France Hydrogen Generation Market Forecast, by Application 11.20.1. Petroleum Refinery 11.20.2. Chemical 11.20.3. Metal 11.21. Italy Hydrogen Generation Market Forecast, by Delivery Mode 11.21.1. Captive 11.21.2. Merchant 11.22. Italy Hydrogen Generation Market Forecast, by Process 11.22.1. Steam Reformer 11.22.2. Electrolysis 11.23. Italy Hydrogen Generation Market Forecast, by Application 11.23.1. Petroleum Refinery 11.23.2. Chemical 11.23.3. Metal 11.24. Spain Hydrogen Generation Market Forecast, by Delivery Mode 11.24.1. Captive 11.24.2. Merchant 11.25. Spain Hydrogen Generation Market Forecast, by Process 11.25.1. Steam Reformer 11.25.2. Electrolysis 11.26. Spain Hydrogen Generation Market Forecast, by Application 11.26.1. Petroleum Refinery 11.26.2. Chemical 11.26.3. Metal 11.27. Rest of Europe Hydrogen Generation Market Forecast, by Delivery Mode 11.27.1. Captive 11.27.2. Merchant 11.28. Rest of Europe Hydrogen Generation Market Forecast, by Process 11.28.1. Steam Reformer 11.28.2. Electrolysis 11.29. Rest of Europe Hydrogen Generation Market Forecast, by Application 11.29.1. Petroleum Refinery 11.29.2. Chemical 11.29.3. Metal 11.30. Europe Hydrogen Generation Market Attractiveness Analysis 11.30.1. By Delivery Mode 11.30.2. By Process 11.30.3. By Application 11.31. PEST Analysis 12. Asia Pacific Hydrogen Generation Market Analysis 12.1. Key Findings 12.2. Asia Pacific Hydrogen Generation Market Overview 12.3. Asia Pacific Hydrogen Generation Market Value Share Analysis, by Delivery Mode 12.4. Asia Pacific Hydrogen Generation Market Forecast, by Delivery Mode 12.4.1. Captive 12.4.2. Merchant 12.5. Asia Pacific Hydrogen Generation Market Value Share Analysis, by Process 12.6. Asia Pacific Hydrogen Generation Market Forecast, by Process 12.6.1. Steam Reformer 12.6.2. Electrolysis 12.7. Asia Pacific Hydrogen Generation Market Value Share Analysis, by Application 12.8. Asia Pacific Hydrogen Generation Market Forecast, by Application 12.8.1. Petroleum Refinery 12.8.2. Chemical 12.8.3. Metal 12.9. Asia Pacific Hydrogen Generation Market Value Share Analysis, by Country 12.10. Asia Pacific Hydrogen Generation Market Forecast, by Country 12.10.1. China, 2021–2029 12.10.2. India, 2021–2029 12.10.3. Japan, 2021–2029 12.10.4. ASEAN, 2021–2029 12.10.5. Rest of Asia Pacific, 2021–2029 12.11. Asia Pacific Hydrogen Generation Market Analysis, by Country/ Sub-region 12.12. China Hydrogen Generation Market Forecast, by Delivery Mode 12.12.1. Captive 12.12.2. Merchant 12.13. China Hydrogen Generation Market Forecast, by Process 12.13.1. Steam Reformer 12.13.2. Electrolysis 12.14. China Hydrogen Generation Market Forecast, by Application 12.14.1. Petroleum Refinery 12.14.2. Chemical 12.14.3. Metal 12.15. India Hydrogen Generation Market Forecast, by Delivery Mode 12.15.1. Captive 12.15.2. Merchant 12.16. India Hydrogen Generation Market Forecast, by Process 12.16.1. Steam Reformer 12.16.2. Electrolysis 12.17. India Hydrogen Generation Market Forecast, by Application 12.17.1. Petroleum Refinery 12.17.2. Chemical 12.17.3. Metal 12.18. Japan Hydrogen Generation Market Forecast, by Delivery Mode 12.18.1. Captive 12.18.2. Merchant 12.19. Japan Hydrogen Generation Market Forecast, by Process 12.19.1. Steam Reformer 12.19.2. Electrolysis 12.20. Japan Hydrogen Generation Market Forecast, by Application 12.20.1. Petroleum Refinery 12.20.2. Chemical 12.20.3. Metal 12.21. ASEAN Hydrogen Generation Market Forecast, by Delivery Mode 12.21.1. Captive 12.21.2. Merchant 12.22. ASEAN Hydrogen Generation Market Forecast, by Process 12.22.1. Steam Reformer 12.22.2. Electrolysis 12.23. ASEAN Hydrogen Generation Market Forecast, by Application 12.23.1. Petroleum Refinery 12.23.2. Chemical 12.23.3. Metal 12.24. Rest of Asia Pacific Hydrogen Generation Market Forecast, by Delivery Mode 12.24.1. Captive 12.24.2. Merchant 12.25. Rest of Asia Pacific Hydrogen Generation Market Forecast, by Process 12.25.1. Steam Reformer 12.25.2. Electrolysis 12.26. Rest of Asia Pacific Hydrogen Generation Market Forecast, by Application 12.26.1. Petroleum Refinery 12.26.2. Chemical 12.26.3. Metal 12.27. Asia Pacific Hydrogen Generation Market Attractiveness Analysis 12.27.1. By Delivery Mode 12.27.2. By Process 12.27.3. By Application 12.28. PEST Analysis 13. Middle East & Africa Hydrogen Generation Market Analysis 13.1. Key Findings 13.2. Middle East & Africa Hydrogen Generation Market Overview 13.3. Middle East & Africa Hydrogen Generation Market Value Share Analysis, by Delivery Mode 13.4. Middle East & Africa Hydrogen Generation Market Forecast, by Delivery Mode 13.4.1. Captive 13.4.2. Merchant 13.5. Middle East & Africa Hydrogen Generation Market Value Share Analysis, by Process 13.6. Middle East & Africa Hydrogen Generation Market Forecast, by Process 13.6.1. Steam Reformer 13.6.2. Electrolysis 13.7. Middle East & Africa Hydrogen Generation Market Value Share Analysis, by Application 13.8. Middle East & Africa Hydrogen Generation Market Forecast, by Application 13.8.1. Petroleum Refinery 13.8.2. Chemical 13.8.3. Metal 13.9. Middle East & Africa Hydrogen Generation Market Value Share Analysis, by Country 13.10. Middle East & Africa Hydrogen Generation Market Forecast, by Country 13.10.1. GCC, 2021–2029 13.10.2. South Africa, 2021–2029 13.10.3. Rest of Middle East & Africa, 2021–2029 13.11. Middle East & Africa Hydrogen Generation Market Analysis, by Country/ Sub-region 13.12. GCC Hydrogen Generation Market Forecast, by Delivery Mode 13.12.1. Captive 13.12.2. Merchant 13.13. GCC Hydrogen Generation Market Forecast, by Process 13.13.1. Steam Reformer 13.13.2. Electrolysis 13.14. GCC Hydrogen Generation Market Forecast, by Application 13.14.1. Petroleum Refinery 13.14.2. Chemical 13.14.3. Metal 13.15. South Africa Hydrogen Generation Market Forecast, by Delivery Mode 13.15.1. Captive 13.15.2. Merchant 13.16. South Africa Hydrogen Generation Market Forecast, by Process 13.16.1. Steam Reformer 13.16.2. Electrolysis 13.17. South Africa Hydrogen Generation Market Forecast, by Application 13.17.1. Petroleum Refinery 13.17.2. Chemical 13.17.3. Metal 13.18. Rest of Middle East & Africa Hydrogen Generation Market Forecast, by Delivery Mode 13.18.1. Captive 13.18.2. Merchant 13.19. Rest of Middle East & Africa Hydrogen Generation Market Forecast, by Process 13.19.1. Steam Reformer 13.19.2. Electrolysis 13.20. Rest of Middle East & Africa Hydrogen Generation Market Forecast, by Application 13.20.1. Petroleum Refinery 13.20.2. Chemical 13.20.3. Metal 13.21. Middle East & Africa Hydrogen Generation Market Attractiveness Analysis 13.21.1. By Delivery Mode 13.21.2. By Process 13.21.3. By Application 13.22. PEST Analysis 14. Latin America Hydrogen Generation Market Analysis 14.1. Key Findings 14.2. Latin America Hydrogen Generation Market Overview 14.3. Latin America Hydrogen Generation Market Value Share Analysis, by Delivery Mode 14.4. Latin America Hydrogen Generation Market Forecast, by Delivery Mode 14.4.1. Captive 14.4.2. Merchant 14.5. Latin America Hydrogen Generation Market Value Share Analysis, by Process 14.6. Latin America Hydrogen Generation Market Forecast, by Process 14.6.1. Steam Reformer 14.6.2. Electrolysis 14.7. Latin America Hydrogen Generation Market Value Share Analysis, by Application 14.8. Latin America Hydrogen Generation Market Forecast, by Application 14.8.1. Petroleum Refinery 14.8.2. Chemical 14.8.3. Metal 14.9. Latin America Hydrogen Generation Market Value Share Analysis, by Country 14.10. Latin America Hydrogen Generation Market Forecast, by Country 14.10.1.1. Brazil, 2021–2029 14.10.1.2. Mexico, 2021–2029 14.10.1.3. Rest of Latin America, 2021–2029 14.11. Latin America Hydrogen Generation Market Analysis, by Country/ Sub-region 14.12. Brazil Hydrogen Generation Market Forecast, by Delivery Mode 14.12.1. Captive 14.12.2. Merchant 14.13. Brazil Hydrogen Generation Market Forecast, by Process 14.13.1. Steam Reformer 14.13.2. Electrolysis 14.14. Brazil Hydrogen Generation Market Forecast, by Application 14.14.1. Petroleum Refinery 14.14.2. Chemical 14.14.3. Metal 14.15. Mexico Hydrogen Generation Market Forecast, by Delivery Mode 14.15.1. Captive 14.15.2. Merchant 14.16. Mexico Hydrogen Generation Market Forecast, by Process 14.16.1. Steam Reformer 14.16.2. Electrolysis 14.17. Mexico Hydrogen Generation Market Forecast, by Application 14.17.1. Petroleum Refinery 14.17.2. Chemical 14.17.3. Metal 14.18. Rest of Latin America Hydrogen Generation Market Forecast, by Delivery Mode 14.18.1. Captive 14.18.2. Merchant 14.19. Rest of Latin America Hydrogen Generation Market Forecast, by Process 14.19.1. Steam Reformer 14.19.2. Electrolysis 14.20. Rest of Latin America Hydrogen Generation Market Forecast, by Application 14.20.1. Petroleum Refinery 14.20.2. Chemical 14.20.3. Metal 14.21. Latin America Hydrogen Generation Market Attractiveness Analysis 14.21.1. By Delivery Mode 14.21.2. By Process 14.21.3. By Application 14.22. PEST Analysis 15. Company Profiles 15.1. Market Share Analysis, by Company 15.2. Competition Matrix 15.3. Company Profiles: Key Players 15.3.1. Showa Denko K.K. 15.3.1.1. Company Overview 15.3.1.2. Financial Overview 15.3.1.3. Business Strategy 15.3.1.4. Recent Developments 15.3.1.5. Manufacturing Footprint 15.3.2. Messer Group GmbH 15.3.3. Caloric Anlagenbau GmbH 15.3.4. Nuvera Fuel Cells 15.3.5. Xebec Adsorption Inc 15.3.6. Taiyo Nippon Sanso Corporation 15.3.7. Hydrogenics 15.3.8. Praxair Technology, Inc 15.3.9. Iwatani Corporation 15.3.10. Air Products & Chemicals 15.3.11. Ally Hi Tech 15.3.12. Aquahydrex 15.3.13. Atawey 15.3.14. Claind 15.3.15. Cummins 15.3.16. Electrochaea 15.3.17. Enapter 15.3.18. Engie 15.3.19. Fuel Cell Energy 15.3.20. Green Hydrogen Systems 15.3.21. Hiringa Energy 15.3.22. ITM Power 15.3.23. Linde 15.3.24. Mcphy Energy 16. Primary Key Insights