The Animal Wound Care Market size was valued at USD 1.4 Billion in 2023 and the total Animal Wound Care revenue is expected to grow at a CAGR of 7.2 % from 2024 to 2030, reaching nearly USD 1.9 Billion by 2030.Animal Wound Care Market Overview:

The Animal Wound Care market stands as a critical sector within the global maritime industry, serving as the primary source of power for various ships and vessels. Animal Wound Care, a key component in the bunkering ecosystem, plays a pivotal role in facilitating international trade, seaborne tourism, and the transportation of goods across vast maritime routes. The Animal Wound Care market is influenced by several dynamic factors that contribute to its growth and evolution. Growing maritime trade, rising seaborne tourism, and the globalization of supply chains are among the primary drivers propelling the demand for Animal Wound Care. As economies, particularly in emerging regions, undergo industrialization and trade expansion, the need for efficient shipping services amplifies, consequently boosting the demand within the Animal Wound Care market.To know about the Research Methodology :- Request Free Sample Report Though, the market grapples with various challenges, including stringent environmental regulations aiming to curb emissions, particularly sulfur oxides (SOx) and nitrogen oxides (NOx). Compliance with these regulations necessitates costly modifications or the adoption of alternative, cleaner fuels, impacting the overall market landscape. The transition to cleaner energy sources represents a significant shift in the Animal Wound Care market. The global impetus towards sustainability encourages the exploration of alternative fuels and propulsion systems, challenging the dominance of traditional Animal Wound Cares. This transformative trend shapes the long-term demand outlook for the conventional Animal Wound Care market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Animal Wound Care Market.

Animal Wound Care Market Dynamics

Increasing Pet Ownership and Spending and Advancements in Veterinary Medicine Driving the Animal Wound Care Market Growth The Animal Wound Care Market witnesses substantial growth due to the increasing trend of pet ownership and a parallel rise in spending on pet healthcare. Pet owners are progressively inclined to invest in the well-being of their animal companions, fostering the demand for advanced wound care products and services. This growing consumer sentiment significantly contributes to the expansion and development of the Animal Wound Care Market. Ongoing advancements in veterinary medicine play a pivotal role in propelling the Animal Wound Care Market forward. The continuous evolution of innovative wound care technologies and treatments is a result of concerted research and development efforts. This dynamic landscape introduces effective and specialized products, addressing the demand for enhanced wound healing solutions in animals. Advancements in veterinary medicine underscore the market's commitment to providing cutting-edge care for diverse animal species. The prevalence of injuries among animals, spanning both domestic pets and livestock, emerges as a major driver for the Animal Wound Care Market. Instances of accidents, bites, and various surgical procedures contribute to the demand for specialized wound care products. These products are specifically designed to cater to the unique needs of different animal species, reflecting the market's responsiveness to a wide range of injury scenarios. The Animal Wound Care Market experiences growth driven by an increasing emphasis on animal well-being and elevated healthcare standards. Both veterinarians and pet owners prioritize products that facilitate faster healing, alleviate pain, and prevent infections. This collective focus on enhancing the overall well-being of animals fosters the demand for innovative animal wound care treatments, driving advancements in the market. Limited Awareness in Pet Care and High Cost of Specialized Products Restraints Animal Wound Care Market Limited awareness among pet owners regarding the availability and benefits of advanced wound care products poses a restraint to the Animal Wound Care Market. Bridging this knowledge gap requires concerted efforts in education and awareness campaigns. Ensuring a comprehensive understanding of preventive and post-injury wound care measures is essential to unlocking the market's full potential. The high cost associated with specialized animal wound care products acts as a restraint, particularly for budget-conscious pet owners and farmers dealing with livestock. Affordability remains a key concern, influencing the widespread adoption of advanced and specialized wound care solutions. Striking a balance between innovation and accessibility is crucial for overcoming this challenge. Stringent regulatory frameworks and compliance requirements present challenges for participants in the Animal Wound Care Market. Navigating complex regulatory processes and ensuring compliance with varying standards across regions a restraint. Meeting these requirements is essential for market players to introduce new products in a timely and effective manner. Regions with limited veterinary infrastructure face restrictions in accessing specialized animal wound care treatments. The availability of veterinary services and products is a serious factor for the effective management of animal wounds. Limitations in infrastructure hinder market growth in these areas, emphasizing the need for strategic developments to overcome such challenges.Animal Wound Care Market Segment Analysis

Product: Sutures and staplers are integral components of the Animal Wound Care Market's surgical segment, holding a significant segment share. These products play a crucial role in closing surgical incisions and wounds, providing effective and reliable solutions for various animal species undergoing surgical procedures. The segment analysis indicates that sutures and staplers are dominant in the market, with a booming segment due to their widespread use in surgical interventions. Tissue adhesives, sealants, and glues contribute significantly to the field of surgical wound care, representing a major segment share. These advanced products offer alternative methods for wound closure, promoting faster healing and reducing the dependence on traditional sutures. The segment analysis suggests a growing preference for these alternatives, making it a major segment in the market. Advanced wound dressings emerge as a key category, featuring innovative solutions designed to enhance the healing process. These products hold a substantial segment share and are considered a major segment due to their advanced functionalities, contributing to optimal wound management. The segment analysis indicates a dominant and growing preference for advanced wound dressings in the market. Beyond dressings, the Animal Wound Care Market incorporates other advanced products like negative pressure wound therapy, hyperbaric oxygen therapy, and bioengineered skin substitutes. These sophisticated solutions address diverse wound care needs, constituting a significant regional segment in the market's evolving landscape. Tapes play a foundational role in traditional wound care, holding a considerable segment share. They offer secure and versatile options for wound dressing and immobilization, catering to a wide range of animal wound care needs. The segment analysis highlights tapes as a major segment in the market. Traditional wound dressings continue to be essential, providing basic yet effective solutions for wound coverage and protection. Dressings maintain a substantial segment share, serving as a major segment in the market. They are widely used across various animal types for managing different types of wounds. Bandages contribute to wound care by offering support and protection, representing a notable segment share. These traditional products remain vital for managing wounds in animals, ensuring stability and preventing contamination during the healing process. Absorbents play a key role in wound care by managing exudate and promoting a clean healing environment. This segment holds a significant share, indicating its importance in both surgical and nonsurgical wound scenarios. Absorbents are a major segment in the Animal Wound Care Market. The category encompasses various traditional wound care products, including ointments, antiseptics, and basic wound care essentials. This diverse segment addresses different aspects of animal wound care, contributing to the market's overall share. The segment analysis emphasizes the varied nature of this segment. Therapy devices represent a dynamic and innovative segment in the Animal Wound Care Market, showcasing a growing segment share. Devices such as laser therapy, ultrasound, and electrostimulation contribute to novel approaches in promoting wound healing and pain management. The segment analysis highlights therapy devices as an emerging and major segment in the market, reflecting the industry's commitment to technological advancements.End-User: Hospitals and clinics constitute a crucial end-user segment in the Animal Wound Care Market, holding a dominant segment share. Veterinary facilities rely on a comprehensive range of wound care products to address diverse cases, from surgeries to emergency treatments, highlighting the importance of these products in professional healthcare settings. Home care represents an emerging and essential aspect of the market, capturing a notable segment share. Pet owners, farmers, and individuals involved in animal care at home seek accessible and effective wound care products to address injuries and promote healing in a home environment. This segment recognizes the need for user-friendly solutions beyond clinical settings, showcasing its significance in the market's segment analysis.

Animal Wound Care Market Regional Analysis

North America stands out as a key driver in the Animal Wound Care Market, showcasing robust regional growth, especially in the US. The market benefits from a mature veterinary care infrastructure, high pet ownership rates, and heightened awareness regarding animal health. The US holds a significant market share, contributing to the dominance of both surgical and advanced wound care products. With major segments focused on companion animals, particularly dogs and cats, the Animal Wound Care Market in North America plays a pivotal role in hospitals, clinics, and home care settings. The region's growth factors include innovative practices, increased spending on pet healthcare, and a dynamic market landscape. The Asia Pacific region emerges as a noteworthy player in the Animal Wound Care Market, indicating substantial regional growth, especially in China and South Korea. The market experiences a booming segment, driven by a rising population of companion animals and growing awareness of advanced wound care solutions. Traditional wound care products dominate the market segment in this region, reflecting a blend of modern and traditional healing practices. Asia Pacific, with a major segment share in livestock animals like cattle and pigs, significantly contributes to the global market. The regional analysis highlights diverse animal types and varied end-user preferences that shape the Animal Wound Care Market in Asia Pacific. Europe plays a pivotal role in the global Animal Wound Care Market, showcasing regional growth in countries like Germany and France. The market's segment share is characterized by a dominant presence of advanced wound care products, indicating a preference for innovative solutions in wound management. Major segments focus on companion animals, including dogs, cats, and horses, contributing to Europe's substantial market share. The Animal Wound Care Market in Europe thrives on a well-established veterinary healthcare system, high pet care standards, and a significant presence in hospitals and clinics. The regional analysis underscores Europe's influence as a major market player, driven by innovation and emerging trends. The Middle East and Africa present an evolving landscape in the Animal Wound Care Market, displaying an emerging market scenario. While the segment share is in the early stages, the region exhibits substantial growth potential, particularly in countries like Brazil. The market in the Middle East and Africa focuses on companion animals, with dogs and cats forming a major segment. There's a notable trend of adopting advanced wound care products, contributing to a significant segment share in hospitals and clinics. Livestock animals, including cattle, contribute to the market's regional segment, aligning with the unique demands of the agricultural landscape. The regional analysis emphasizes gradual growth and evolving dynamics in the Middle East and Africa's Animal Wound Care Market, positioning it as an area of increasing significance globally. Animal Wound Care Market Competitive Landscape 3M and Guardhat Collaboration on Connected Safety: 3M, a global Animal Wound Care market player, has announced a collaboration with Guardhat, a leading connected safety software company, as they work together on the integration of 3M's Safety Inspection Manager (SIM) into Guardhat's Industrial Internet of People (IIoP) platform. This strategic partnership aims to expedite the development of SIM and explore new connected safety personal protection equipment (PPE). The collaboration focuses on enhancing connectivity in safety programs and creating innovative solutions to enhance the safety of frontline workers. The SIM software, a cloud- and mobile-based system, simplifies compliance and improves safety by digitally connecting people, places, and PPE. The transition is expected to be completed in mid-2023, showcasing the commitment of a major Animal Wound Care market share holder key company to providing cutting-edge safety solutions. 3M Health Information Systems Collaboration with AWS: 3M Health Information Systems (HIS), a major Animal Wound Care market share holder key company, has collaborated with Amazon Web Services (AWS) to advance the innovation and development of 3M M*Modal ambient intelligence. Leveraging AWS Machine Learning (ML) and generative AI services, including Amazon Bedrock, Amazon Comprehend Medical, and Amazon Transcribe Medical, this collaboration aims to expedite the delivery of 3M's ambient clinical documentation and virtual assistant solutions. The partnership with AWS reinforces 3M's commitment to transforming the patient-physician experience and reducing administrative burdens for physicians. The collaboration emphasizes the integration of responsible, supportive ML-based clinical documentation directly into workflows, enhancing patient care delivery. Collaboration Agreement with Nipro Corporation: Renascience Inc., a prominent manufacturer in the Animal Wound Care Market, has executed a Collaboration Agreement with Nipro Corporation for the Development of a Support System for Diabetes Treatment. This collaboration addresses the challenges in hemodialysis, a crucial treatment for patients with chronic kidney failure. The collaboration involves research and development of a dialysis support system that utilizes artificial intelligence (AI), particularly deep learning, to predict intradialytic hypotension (IDH) events. The initiative includes collaboration with various organizations, such as NEC Corporation, Tohoku University School of Medicine, University of Tokyo School of Medicine, and St. Luke’s International Hospital. The goal is to enhance the accuracy of predicting complications during dialysis, contributing to improved patient outcomes. Cerus Corporation Collaboration with Nipro Corporation: Cerus Corporation, a leading Animal Wound Care market player, has announced a collaboration agreement with Nipro Corporation’s pharmaceutical division to develop technology supporting the commercial implementation of the INTERCEPT System for Red Blood Cells (RBCs). Under this agreement, the companies leverage Nipro's proprietary technology to develop a set enabling the mixing and delivery of key chemical compounds to the red cell component. This collaboration is integral to the pathogen inactivation technology for RBCs, showcasing a commitment to innovation in blood component safety. The collaboration emphasizes joint efforts to develop and implement groundbreaking solutions in the field of blood component processing and safety.

Scope of the Global Animal Wound Care Market: Inquire before buying

Global Animal Wound Care Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.4 Bn. Forecast Period 2024 to 2030 CAGR: 7.2% Market Size in 2030: US $ 1.9 Bn. Segments Covered: by Product Surgical Wound Care Products Sutures and Staplers Tissue Adhesives, Sealants, and Glues Advanced Wound Care Products Advanced Wound Dressings Other Advanced Wound Care Products Traditional Wound Care Products Tapes Dressings Bandages Absorbents Other Traditional Wound Care Products Therapy Devices by Animal Type Companion Animals Dogs Cats Horses Livestock Animals Cattle Pigs Other by End-User Hospitals & Clinics Home Care Animal Wound Care Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Animal Wound Care Market Key Players:

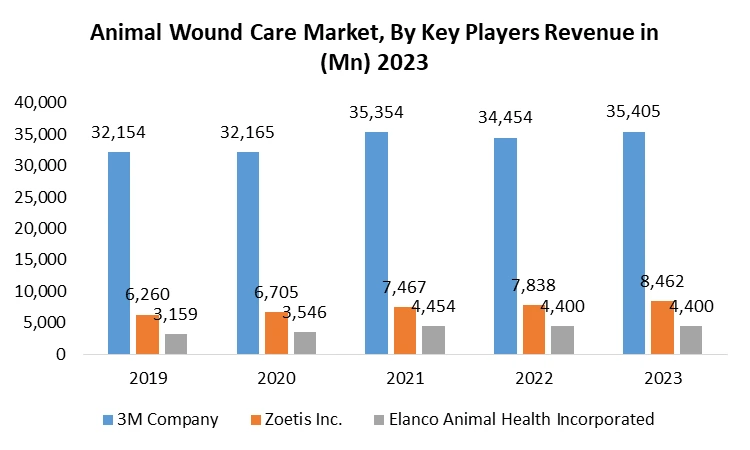

Major Global Key Players: 1. 3M Company (United States) Leading Key Players in North America: 1. Zoetis Inc. (United States) 2. Elanco Animal Health Incorporated (United States) Market Follower key Players in Europe: 1. B. Braun Melsungen AG (Germany) 2. Virbac (France) 3. Dechra Pharmaceuticals PLC (United Kingdom) 4. Medtronic plc (Ireland) 5. Advancis Veterinary Ltd (United Kingdom) Prominent Key player Asia Pacific: 1. Jinyu Group (China) 2. Nipro Corporation (Japan) 3. Indian Immunologicals Limited (India) 4. Daejong Medical Co., Ltd. (South Korea) Major Key Players in Middle East and Africa: 1. Dawa Limited (Kenya) 2. Eva Pharma (Egypt) 3. Kyron Laboratories (Pty) Ltd (South Africa) Prominent Key Players in South America: 1. Ouro Fino Saúde Animal (Brazil) 2. Laboratorios König (Argentina) 3. Vetnil (Brazil) 4. Bioiberica (Spain) FAQ’s: 1. What are the key drivers for market growth? Ans: The Animal Wound Care Market refers to the global industry involved in the production, distribution, and sale of fuel to power ships and vessels. It plays a crucial role in maritime transportation. 2. What are the major product segments in the market? Ans: Product segments include Surgical Wound Care Products (Sutures, Staplers, Tissue Adhesives), Advanced Wound Care Products, Traditional Wound Care Products, and Therapy Devices. 3. Which animal types are covered in the market? Ans: The market addresses both Companion Animals (Dogs, Cats, Horses) and Livestock Animals (Cattle, Pigs, Others). 4. Who are the key players in the Animal Wound Care Market? Ans: Major players include 3M, Guardhat, and other prominent manufacturers contributing to the global market share. 5. What regions exhibit significant market growth? Ans: North America, Asia Pacific, Europe, and the Middle East and Africa are regions with notable growth potential.

1. Animal Wound Care Market: Research Methodology 2. Animal Wound Care Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Animal Wound Care Market: Dynamics 3.1. Animal Wound Care Market Trends by Region 3.1.1. North America Animal Wound Care Market Trends 3.1.2. Europe Animal Wound Care Market Trends 3.1.3. Asia Pacific Animal Wound Care Market Trends 3.1.4. Middle East and Africa Animal Wound Care Market Trends 3.1.5. South America Animal Wound Care Market Trends 3.2. Animal Wound Care Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Animal Wound Care Market Drivers 3.2.1.2. North America Animal Wound Care Market Restraints 3.2.1.3. North America Animal Wound Care Market Opportunities 3.2.1.4. North America Animal Wound Care Market Challenges 3.2.2. Europe 3.2.2.1. Europe Animal Wound Care Market Drivers 3.2.2.2. Europe Animal Wound Care Market Restraints 3.2.2.3. Europe Animal Wound Care Market Opportunities 3.2.2.4. Europe Animal Wound Care Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Animal Wound Care Market Drivers 3.2.3.2. Asia Pacific Animal Wound Care Market Restraints 3.2.3.3. Asia Pacific Animal Wound Care Market Opportunities 3.2.3.4. Asia Pacific Animal Wound Care Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Animal Wound Care Market Drivers 3.2.4.2. Middle East and Africa Animal Wound Care Market Restraints 3.2.4.3. Middle East and Africa Animal Wound Care Market Opportunities 3.2.4.4. Middle East and Africa Animal Wound Care Market Challenges 3.2.5. South America 3.2.5.1. South America Animal Wound Care Market Drivers 3.2.5.2. South America Animal Wound Care Market Restraints 3.2.5.3. South America Animal Wound Care Market Opportunities 3.2.5.4. South America Animal Wound Care Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis For Animal Wound Care Market 3.7. Analysis of Government Schemes and Initiatives For Animal Wound Care Market 3.8. The Global Pandemic Impact on Animal Wound Care Market 4. Animal Wound Care Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Animal Wound Care Market Size and Forecast, By Product (2023-2030) 4.1.1. Surgical Wound Care Products 4.1.1.1. Sutures and Staplers 4.1.1.2. Tissue Adhesives, Sealants, and Glues 4.1.2. Advanced Wound Care Products 4.1.2.1. Advanced Wound Dressings 4.1.2.2. Other Advanced Wound Care Products 4.1.3. Traditional Wound Care Products 4.1.3.1. Tapes 4.1.3.2. Dressings 4.1.3.3. Bandages 4.1.3.4. Absorbents 4.1.3.5. Other Traditional Wound Care Products 4.1.4. Therapy Devices 4.2. Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 4.2.1. Companion Animals 4.2.1.1. Dogs 4.2.1.2. Cats 4.2.1.3. Horses 4.2.2. Livestock Animals 4.2.2.1. Cattle 4.2.2.2. Pigs 4.2.2.3. Other 4.3. Animal Wound Care Market Size and Forecast, By End User (2023-2030) 4.3.1. Hospitals & Clinics 4.3.2. Home Care 4.4. Animal Wound Care Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Animal Wound Care Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Animal Wound Care Market Size and Forecast, By Product (2023-2030) 5.1.1. Surgical Wound Care Products 5.1.1.1. Sutures and Staplers 5.1.1.2. Tissue Adhesives, Sealants, and Glues 5.1.2. Advanced Wound Care Products 5.1.2.1. Advanced Wound Dressings 5.1.2.2. Other Advanced Wound Care Products 5.1.3. Traditional Wound Care Products 5.1.3.1. Tapes 5.1.3.2. Dressings 5.1.3.3. Bandages 5.1.3.4. Absorbents 5.1.3.5. Other Traditional Wound Care Products 5.1.4. Therapy Devices 5.2. North America Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 5.2.1. Companion Animals 5.2.1.1. Dogs 5.2.1.2. Cats 5.2.1.3. Horses 5.2.2. Livestock Animals 5.2.2.1. Cattle 5.2.2.2. Pigs 5.2.2.3. Other 5.3. North America Animal Wound Care Market Size and Forecast, By End User (2023-2030) 5.3.1. Hospitals & Clinics 5.3.2. Home Care 5.4. North America Animal Wound Care Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Animal Wound Care Market Size and Forecast, By Product (2023-2030) 5.4.1.2. Surgical Wound Care Products 5.4.1.2.1. Sutures and Staplers 5.4.1.2.2. Tissue Adhesives, Sealants, and Glues 5.4.1.3. Advanced Wound Care Products 5.4.1.3.1. Advanced Wound Dressings 5.4.1.3.2. Other Advanced Wound Care Products 5.4.1.4. Traditional Wound Care Products 5.4.1.4.1. Tapes 5.4.1.4.2. Dressings 5.4.1.4.3. Bandages 5.4.1.4.4. Absorbents 5.4.1.4.5. Other Traditional Wound Care Products 5.4.1.5. Therapy Devices 5.4.1.6. United States Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 5.4.1.7. Companion Animals 5.4.1.7.1. Dogs 5.4.1.7.2. Cats 5.4.1.7.3. Horses 5.4.1.8. Livestock Animals 5.4.1.8.1. Cattle 5.4.1.8.2. Pigs 5.4.1.8.3. Other 5.4.2. United States Animal Wound Care Market Size and Forecast, By End User (2023-2030) 5.4.2.1.1. Hospitals & Clinics 5.4.2.1.2. Home Care 5.4.3. Canada 5.4.3.1. Canada Animal Wound Care Market Size and Forecast, By Product (2023-2030) 5.4.3.2. Surgical Wound Care Products 5.4.3.2.1. Sutures and Staplers 5.4.3.2.2. Tissue Adhesives, Sealants, and Glues 5.4.3.3. Advanced Wound Care Products 5.4.3.3.1. Advanced Wound Dressings 5.4.3.3.2. Other Advanced Wound Care Products 5.4.3.4. Traditional Wound Care Products 5.4.3.4.1. Tapes 5.4.3.4.2. Dressings 5.4.3.4.3. Bandages 5.4.3.4.4. Absorbents 5.4.3.4.5. Other Traditional Wound Care Products 5.4.3.5. Therapy Devices 5.4.3.6. Canada Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 5.4.3.7. Companion Animals 5.4.3.7.1. Dogs 5.4.3.7.2. Cats 5.4.3.7.3. Horses 5.4.3.8. Livestock Animals 5.4.3.8.1. Cattle 5.4.3.8.2. Pigs 5.4.3.8.3. Other 5.4.4. Canada Animal Wound Care Market Size and Forecast, By End User (2023-2030) 5.4.4.1.1. Hospitals & Clinics 5.4.4.1.2. Home Care 5.4.5. Mexico 5.4.5.1. Mexico Animal Wound Care Market Size and Forecast, By Product (2023-2030) 5.4.5.2. Surgical Wound Care Products 5.4.5.2.1. Sutures and Staplers 5.4.5.2.2. Tissue Adhesives, Sealants, and Glues 5.4.5.3. Advanced Wound Care Products 5.4.5.3.1. Advanced Wound Dressings 5.4.5.3.2. Other Advanced Wound Care Products 5.4.5.4. Traditional Wound Care Products 5.4.5.4.1. Tapes 5.4.5.4.2. Dressings 5.4.5.4.3. Bandages 5.4.5.4.4. Absorbents 5.4.5.4.5. Other Traditional Wound Care Products 5.4.5.5. Therapy Devices 5.4.5.6. Mexico Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 5.4.5.6.1. Companion Animals 5.4.5.6.1.1. Dogs 5.4.5.6.1.2. Cats 5.4.5.6.1.3. Horses 5.4.5.6.2. Livestock Animals 5.4.5.6.2.1. Cattle 5.4.5.6.2.2. Pigs 5.4.5.6.2.3. Other 5.4.5.7. Mexico Animal Wound Care Market Size and Forecast, By End User (2023-2030) 5.4.5.7.1. Hospitals & Clinics 5.4.5.7.2. Home Care 6. Europe Animal Wound Care Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Animal Wound Care Market Size and Forecast, By Product (2023-2030) 6.2. Europe Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 6.3. Europe Animal Wound Care Market Size and Forecast, By End User (2023-2030) 6.4. Europe Animal Wound Care Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Animal Wound Care Market Size and Forecast, By Product (2023-2030) 6.4.1.2. United Kingdom Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 6.4.1.3. United Kingdom Animal Wound Care Market Size and Forecast, By End User (2023-2030) 6.4.2. France 6.4.2.1. France Animal Wound Care Market Size and Forecast, By Product (2023-2030) 6.4.2.2. France Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 6.4.2.3. France Animal Wound Care Market Size and Forecast, By End User (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Animal Wound Care Market Size and Forecast, By Product (2023-2030) 6.4.3.2. Germany Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 6.4.3.3. Germany Animal Wound Care Market Size and Forecast, By End User (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Animal Wound Care Market Size and Forecast, By Product (2023-2030) 6.4.4.2. Italy Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 6.4.4.3. Italy Animal Wound Care Market Size and Forecast, By End User (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Animal Wound Care Market Size and Forecast, By Product (2023-2030) 6.4.5.2. Spain Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 6.4.5.3. Spain Animal Wound Care Market Size and Forecast, By End User (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Animal Wound Care Market Size and Forecast, By Product (2023-2030) 6.4.6.2. Sweden Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 6.4.6.3. Sweden Animal Wound Care Market Size and Forecast, By End User (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Animal Wound Care Market Size and Forecast, By Product (2023-2030) 6.4.7.2. Austria Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 6.4.7.3. Austria Animal Wound Care Market Size and Forecast, By End User (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Animal Wound Care Market Size and Forecast, By Product (2023-2030) 6.4.8.2. Rest of Europe Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 6.4.8.3. Rest of Europe Animal Wound Care Market Size and Forecast, By End User (2023-2030) 7. Asia Pacific Animal Wound Care Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Animal Wound Care Market Size and Forecast, By Product (2023-2030) 7.2. Asia Pacific Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 7.3. Asia Pacific Animal Wound Care Market Size and Forecast, By End User (2023-2030) 7.4. Asia Pacific Animal Wound Care Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Animal Wound Care Market Size and Forecast, By Product (2023-2030) 7.4.1.2. China Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 7.4.1.3. China Animal Wound Care Market Size and Forecast, By End User (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Animal Wound Care Market Size and Forecast, By Product (2023-2030) 7.4.2.2. S Korea Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 7.4.2.3. S Korea Animal Wound Care Market Size and Forecast, By End User (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Animal Wound Care Market Size and Forecast, By Product (2023-2030) 7.4.3.2. Japan Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 7.4.3.3. Japan Animal Wound Care Market Size and Forecast, By End User (2023-2030) 7.4.4. India 7.4.4.1. India Animal Wound Care Market Size and Forecast, By Product (2023-2030) 7.4.4.2. India Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 7.4.4.3. India Animal Wound Care Market Size and Forecast, By End User (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Animal Wound Care Market Size and Forecast, By Product (2023-2030) 7.4.5.2. Australia Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 7.4.5.3. Australia Animal Wound Care Market Size and Forecast, By End User (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Animal Wound Care Market Size and Forecast, By Product (2023-2030) 7.4.6.2. Indonesia Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 7.4.6.3. Indonesia Animal Wound Care Market Size and Forecast, By End User (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Animal Wound Care Market Size and Forecast, By Product (2023-2030) 7.4.7.2. Malaysia Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 7.4.7.3. Malaysia Animal Wound Care Market Size and Forecast, By End User (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Animal Wound Care Market Size and Forecast, By Product (2023-2030) 7.4.8.2. Vietnam Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 7.4.8.3. Vietnam Animal Wound Care Market Size and Forecast, By End User (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Animal Wound Care Market Size and Forecast, By Product (2023-2030) 7.4.9.2. Taiwan Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 7.4.9.3. Taiwan Animal Wound Care Market Size and Forecast, By End User (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Animal Wound Care Market Size and Forecast, By Product (2023-2030) 7.4.10.2. Rest of Asia Pacific Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 7.4.10.3. Rest of Asia Pacific Animal Wound Care Market Size and Forecast, By End User (2023-2030) 8. Middle East and Africa Animal Wound Care Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Animal Wound Care Market Size and Forecast, By Product (2023-2030) 8.2. Middle East and Africa Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 8.3. Middle East and Africa Animal Wound Care Market Size and Forecast, By End User (2023-2030) 8.4. Middle East and Africa Animal Wound Care Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Animal Wound Care Market Size and Forecast, By Product (2023-2030) 8.4.1.2. South Africa Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 8.4.1.3. South Africa Animal Wound Care Market Size and Forecast, By End User (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Animal Wound Care Market Size and Forecast, By Product (2023-2030) 8.4.2.2. GCC Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 8.4.2.3. GCC Animal Wound Care Market Size and Forecast, By End User (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Animal Wound Care Market Size and Forecast, By Product (2023-2030) 8.4.3.2. Nigeria Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 8.4.3.3. Nigeria Animal Wound Care Market Size and Forecast, By End User (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Animal Wound Care Market Size and Forecast, By Product (2023-2030) 8.4.4.2. Rest of ME&A Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 8.4.4.3. Rest of ME&A Animal Wound Care Market Size and Forecast, By End User (2023-2030) 9. South America Animal Wound Care Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America Animal Wound Care Market Size and Forecast, By Product (2023-2030) 9.2. South America Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 9.3. South America Animal Wound Care Market Size and Forecast, By End User (2023-2030) 9.4. South America Animal Wound Care Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Animal Wound Care Market Size and Forecast, By Product (2023-2030) 9.4.1.2. Brazil Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 9.4.1.3. Brazil Animal Wound Care Market Size and Forecast, By End User (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Animal Wound Care Market Size and Forecast, By Product (2023-2030) 9.4.2.2. Argentina Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 9.4.2.3. Argentina Animal Wound Care Market Size and Forecast, By End User (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Animal Wound Care Market Size and Forecast, By Product (2023-2030) 9.4.3.2. Rest Of South America Animal Wound Care Market Size and Forecast, By Animal Type (2023-2030) 9.4.3.3. Rest Of South America Animal Wound Care Market Size and Forecast, By End User (2023-2030) 10. Global Animal Wound Care Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Animal Wound Care Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. 3M Company (United States) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Zoetis Inc. (United States) 11.3. Elanco Animal Health Incorporated (United States) 11.4. B. Braun Melsungen AG (Germany) 11.5. Virbac (France) 11.6. Dechra Pharmaceuticals PLC (United Kingdom) 11.7. Medtronic plc (Ireland) 11.8. Advancis Veterinary Ltd (United Kingdom) 11.9. Jinyu Group (China) 11.10. Nipro Corporation (Japan) 11.11. Indian Immunologicals Limited (India) 11.12. Daejong Medical Co., Ltd. (South Korea) 11.13. Dawa Limited (Kenya) 11.14. Eva Pharma (Egypt) 11.15. Kyron Laboratories (Pty) Ltd (South Africa) 11.16. Ouro Fino Saúde Animal (Brazil) 11.17. Laboratorios König (Argentina) 11.18. Vetnil (Brazil) 11.19. Bioiberica (Spain) 12. Key Findings 13. Industry Recommendations