Vacuum Gas Oil Market size was valued at USD 369.40 Billion in 2023 and the Vacuum Gas Oil Market revenue is expected to reach USD 488.45 Billion by 2030, at a CAGR of 5.8 % over the forecast period.Vacuum Gas Oil Market Overview

Vacuum gas oil (VGO) is a heavy oil that is a byproduct of shale oil extraction and petroleum distillation. It is a semi-liquid form of oil gas produced in a distillery vacuum refinement unit. VGO is a key feedstock for fluid catalytic crackers, which are used to create transportation fuels and other by-products. VGO can be refined in a catalytic cracking unit to produce components that can be blended into diesel and gasoline. VGO is traded based on its sulfur content, with a higher value than crude because it can be processed to produce more gasoline. Vacuum Gas Oils are not limited to a specific geographical region. The market has a global presence, with consumers across different continents showing interest in these supplements. This Vacuum Gas Oil Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Vacuum Gas Oil Market report showcases the Vacuum Gas Oil market situation with Dynamics, Market Segment, Regional Analysis, and Top competitor's Market Position.To know about the Research Methodology :- Request Free Sample Report

Vacuum Gas Oil Market Dynamics

The global vacuum gas oil (VGO) market is driven by an increase in demand for gasoline and diesel. The rise of e-commerce has led to more delivery vehicles on the roads, boosting the need for fuel. Additionally, the construction industry heavily relies on diesel-powered machinery, contributing to the growing demand. Moreover, diesel generators are in demand for backup power systems as electricity needs increase globally. These factors are expected to drive the growth of the vacuum gas oil market during the forecast period. Technological advancements in refining processes play a pivotal role in the vacuum gas oil market growth. Innovations in refining technologies enhance the efficiency of VGO conversion into valuable end-products, meeting stringent environmental standards and improving overall refining capabilities. Fluid catalytic cracking is one of the composites and substantially utilized procedures in petroleum filters. It is utilized to operate heavy crude oils into gasoline engine powers, light alkenes, propellants, and other products. Fluid catalytic breaking of vacuum gas oil results in a broad range of products like methane, hydrogen, and massive chemical compounds like coke. Also, the planning of hydrocracking of vacuum gas oil relies on the variety of compulsions utilized. The utilization of vacuum gas oil in the manufacturing of diesel is likely to increase the need for oil in the market. An increase in expenditure in growth and development in hydrocracking and fluid alkaline procedures is assisting gain adequate production from this procedure. Therefore, vacuum gas oil can assist retrieve the need for diesel in the vacuum gas oil market. The need for vacuum gas oil in heavy fuel oils is rising because of the increase in need in the marine market. Development in sea dealing and marine investigation is expected to increase the vacuum gas oil market in the forthcoming year. Factors like the strong recovery of diesel and the escalating employment of VGO to supply bunker fuels are driving the worldwide vacuum gas oil industry for vacuum gas oil. Increased investments in research and development activities, along with growing calls from the Asia-Pacific region, are predicted to create new opportunities for vacuum gas oil market development in the coming years. The growing call for fossil fuels around the world, as well as growing investments in research and development, are predicted to positively influence the outlook for the vacuum gas oil industry. The growing maritime industry is predicted to increase the need for VGO as fuel for offshore cargo ships and other vessels. In an average complex processing facility, for example, it is normal in the United States, especially on the Gulf Coast, for the VGO is further prepared in one of two types of synergistic splitting units. These "breakdown" units use a mixture of heat and voltage pulses to break the VGO into lighter parts of mixed gas and diesel. Based on this simplicity of vacuum gas oil units, the world vacuum gas oil market is expanding considerably today.Vacuum Gas Oil Market Segment Analysis

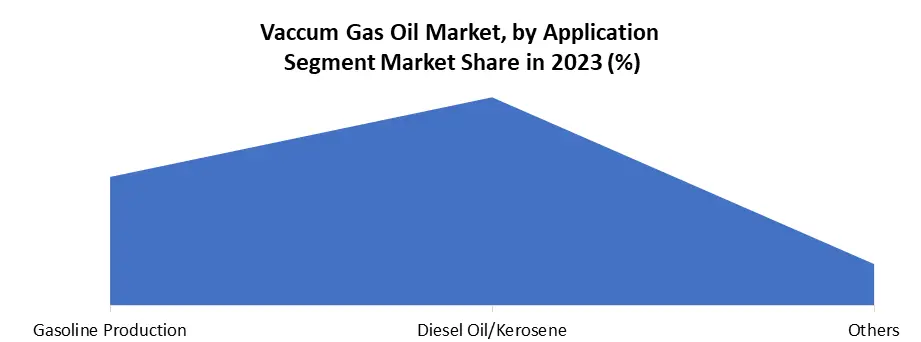

Vacuum Gas Oil Market is segregated based on Product (Heavy vacuum Gas Oil and Light vacuum gas oil), Sulfur Content (Low Sulfur VGO and High Sulfur VGO), Application (Gasoline Production and Diesel Oil/Production), and Region (North America, Europe, Asia Pacific, Middle East, and Africa, and Latin America). Vacuum Gas Oil or VGO belongs to the petroleum hydrocarbon distillation heavy film. Vacuum Gas Oil is also familiar as cat feed. Vacuum Gas Oil is one of the two productions of the vacuum processing tower. Vacuum Gas oil is the neutral substance of the two. The major utilization of vacuum gas oil is in the shape of feed-in splitting components like fluid reactant breaker or the hydrocracker. These splitting components improve vacuum gas into substances having higher principles, i.e. gasoline and generator. If not improved, vacuum gas oil is mixed into unused power oil. However, this is completely infrequent as the principles of vacuum gas oil are substantially higher as a purpose for the mean of improving. The rising need for oil from China and India is operating the worldwide vacuum gas oil market. Moving to the vacuum purification procedure, the vacuum concentrates, light vacuum gas oil and heavy vacuum gas soil can be prepared by some modern FCC procedures. Therefore, hydrocarbon is more constant for use in the transformation of LVGO and HVGO into light and middle distillation, utilizing specific compulsion and hydrogen. Low sulfur vacuum gas oil (VGO) is a critical segment in the refining industry, characterized by a reduced sulfur content, typically meeting or exceeding stringent environmental regulations. The demand for low-sulfur VGO has witnessed significant growth due to global efforts to curb emissions and comply with cleaner fuel standards. This type of VGO is preferred for its environmental benefits, contributing to the production of cleaner fuels such as low-sulfur diesel. Refineries investing in technologies to reduce sulfur content in their products and comply with changing emission standards are driving the market for low-sulfur vacuum gas oil market dynamics for this segment are influenced by regulatory changes, advancements in desulfurization technologies, and the global shift towards cleaner energy sources. High sulfur vacuum gas oil (VGO) constitutes another significant segment, known for its comparatively higher sulfur content. While facing regulatory challenges in certain regions due to emissions concerns, high-sulfur VGO remains essential for specific refining processes. This type of VGO finds applications in units equipped with sulfur recovery technologies, allowing for the extraction of sulfur compounds before reaching the final products. The vacuum gas oil market dynamics for high sulfur VGO are influenced by factors such as regional emission standards, technological advancements in sulfur removal processes, and the demand for specific end-products where higher sulfur content is acceptable. The r high sulfur vacuum gas oil market continues to adapt to changing regulatory landscapes and technological innovations in the refining industry.

Vacuum Gas Oil Market Regional Analysis

North America stands as a dominant player in the global vacuum gas oil market. The region's advanced refining infrastructure and substantial energy consumption contribute to a robust demand for VGO. North America's vacuum gas oil market dynamics are shaped by factors such as the changing regulatory landscape, technological advancements in refining processes, and the demand for cleaner fuels. The region's emphasis on sustainability and adherence to environmental standards influences the production and consumption patterns of VGO, with a keen focus on meeting stringent emission regulations. Europe plays a pivotal role in the vacuum gas oil market, with its well-established refining sector and commitment to environmental regulations. The region's demand for VGO is influenced by factors such as the transition to cleaner energy sources, advancements in refining technologies, and the growing need for low-sulfur fuels. Europe's refining vacuum gas oil industry is adapting to meet changing emission standards, driving the market for VGO with a focus on reducing sulfur content and producing cleaner fuels. Asia Pacific emerges as a key growth region in the market, driven by rapid industrialization, urbanization, and increasing energy consumption. The region's refining capacity expansion, particularly in countries like China and India, contributes to a rising demand for VGO. The vacuum gas oil market dynamics in Asia Pacific are influenced by factors including economic growth, rising demand for transportation fuels, and advancements in refining processes. The region's role in the global vacuum gas oil market is characterized by a balance between traditional energy needs and a growing emphasis on adopting cleaner and more sustainable refining practices.

Vacuum Gas Oil Market Scope: Inquiry Before Buying

Global Vacuum Gas Oil Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 369.40 Bn. Forecast Period 2024 to 2030 CAGR: 5.8% Market Size in 2030: US $ 488.45 Bn. Segments Covered: by Product Heavy Vacuum Gas Oil Light Vacuum Gas Oil by Sulfur Content Low Sulfur VGO High Sulfur VGO by Application Gasoline Production Diesel Oil/Kerosene Others Vacuum Gas Oil Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Vacuum Gas Oil Key Players Includes

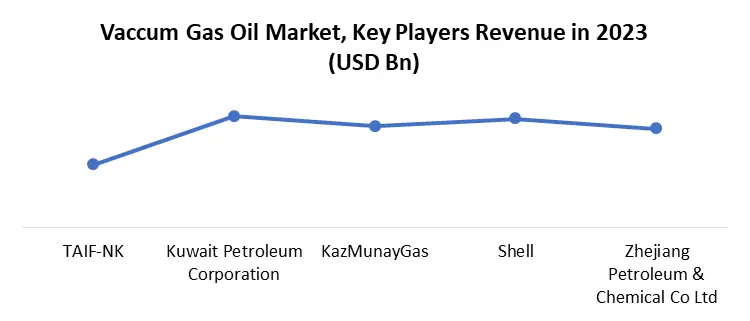

1. TAIF-NK (Russia) 2. Kuwait Petroleum Corporation (Kuwait) 3. KazMunayGas (Kazakhstan) 4. Shell (U.S.) 5. Zhejiang Petroleum & Chemical Co Ltd, (China) 6. Neste (Finland) 7. Vertex (U.S.) 8. LUKOIL (Russia) 9. Exxon Mobil Corporation (U.S.) 10. Saudi Arabian Oil Co. (Saudi Arabia) 11. China National Petroleum Corporation (China) 12. BP plc (U.K.) 13. Shell plc (U.K.) 14. PDVSA - Petróleos de Venezuela, SA. (Venezuela) 15. Gazprom (Russia) 16. Chevron Corporation. (U.S.) 17. Petrobras (Brazil) 18. LUKOIL (Russia) 19. ROSNEFT (Russia) 20. Abu Dhabi National Oil Company (U.A.E) 21. China Petrochemical Corporation. (China) Frequently Asked Questions 1. Which region has the largest share in the Global Market? Ans: North American region holds the highest share in 2023. 2. What is the growth rate of the Global Market? Ans: The Global Market is growing at a CAGR of 5.8 % during the forecasting period 2023-2030. 3. What is the scope of the Global market report? Ans: The Global Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global market? Ans: The important key players in the Global Market are – TAIF-NK, Kuwait Petroleum Corporation, Exxon Mobil Corporation, KazMunayGas, Axeon Specialty Products, U.S. Oil and Refining Co, Royal Dutch Shell, Neste, Vertex Energy Inc, LUKOIL, Gazprom Neft, and Honeywell UOP. 5. What is the study period of this market? Ans: The Global Market is studied from 2023 to 2030.

1. Vacuum Gas Oil Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Vacuum Gas Oil Market: Dynamics 2.1. Vacuum Gas Oil Market Trends by Region 2.1.1. North America Vacuum Gas Oil Market Trends 2.1.2. Europe Vacuum Gas Oil Market Trends 2.1.3. Asia Pacific Vacuum Gas Oil Market Trends 2.1.4. Middle East and Africa Vacuum Gas Oil Market Trends 2.1.5. South America Vacuum Gas Oil Market Trends 2.2. Vacuum Gas Oil Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Vacuum Gas Oil Market Drivers 2.2.1.2. North America Vacuum Gas Oil Market Restraints 2.2.1.3. North America Vacuum Gas Oil Market Opportunities 2.2.1.4. North America Vacuum Gas Oil Market Challenges 2.2.2. Europe 2.2.2.1. Europe Vacuum Gas Oil Market Drivers 2.2.2.2. Europe Vacuum Gas Oil Market Restraints 2.2.2.3. Europe Vacuum Gas Oil Market Opportunities 2.2.2.4. Europe Vacuum Gas Oil Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Vacuum Gas Oil Market Drivers 2.2.3.2. Asia Pacific Vacuum Gas Oil Market Restraints 2.2.3.3. Asia Pacific Vacuum Gas Oil Market Opportunities 2.2.3.4. Asia Pacific Vacuum Gas Oil Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Vacuum Gas Oil Market Drivers 2.2.4.2. Middle East and Africa Vacuum Gas Oil Market Restraints 2.2.4.3. Middle East and Africa Vacuum Gas Oil Market Opportunities 2.2.4.4. Middle East and Africa Vacuum Gas Oil Market Challenges 2.2.5. South America 2.2.5.1. South America Vacuum Gas Oil Market Drivers 2.2.5.2. South America Vacuum Gas Oil Market Restraints 2.2.5.3. South America Vacuum Gas Oil Market Opportunities 2.2.5.4. South America Vacuum Gas Oil Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Vacuum Gas Oil Industry 2.8. Analysis of Government Schemes and Initiatives For Vacuum Gas Oil Industry 2.9. Vacuum Gas Oil Market Trade Analysis 2.10. The Global Pandemic Impact on Vacuum Gas Oil Market 3. Vacuum Gas Oil Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 3.1.1. Heavy Vacuum Gas Oil 3.1.2. Light Vacuum Gas Oil 3.2. Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 3.2.1. Low Sulfur VGO 3.2.2. High Sulfur VGO 3.3. Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 3.3.1. Gasoline Production 3.3.2. Diesel Oil/Kerosene 3.3.3. Others 3.4. Vacuum Gas Oil Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Vacuum Gas Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 4.1.1. Heavy Vacuum Gas Oil 4.1.2. Light Vacuum Gas Oil 4.2. North America Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 4.2.1. Low Sulfur VGO 4.2.2. High Sulfur VGO 4.3. North America Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 4.3.1. Gasoline Production 4.3.2. Diesel Oil/Kerosene 4.3.3. Others 4.4. North America Vacuum Gas Oil Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Heavy Vacuum Gas Oil 4.4.1.1.2. Light Vacuum Gas Oil 4.4.1.2. United States Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 4.4.1.2.1. Low Sulfur VGO 4.4.1.2.2. High Sulfur VGO 4.4.1.3. United States Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Gasoline Production 4.4.1.3.2. Diesel Oil/Kerosene 4.4.1.3.3. Others 4.4.2. Canada 4.4.2.1. Canada Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Heavy Vacuum Gas Oil 4.4.2.1.2. Light Vacuum Gas Oil 4.4.2.2. Canada Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 4.4.2.2.1. Low Sulfur VGO 4.4.2.2.2. High Sulfur VGO 4.4.2.3. Canada Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Gasoline Production 4.4.2.3.2. Diesel Oil/Kerosene 4.4.2.3.3. Others 4.4.3. Mexico 4.4.3.1. Mexico Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Heavy Vacuum Gas Oil 4.4.3.1.2. Light Vacuum Gas Oil 4.4.3.2. Mexico Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 4.4.3.2.1. Low Sulfur VGO 4.4.3.2.2. High Sulfur VGO 4.4.3.3. Mexico Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Gasoline Production 4.4.3.3.2. Diesel Oil/Kerosene 4.4.3.3.3. Others 5. Europe Vacuum Gas Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 5.2. Europe Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 5.3. Europe Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 5.4. Europe Vacuum Gas Oil Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 5.4.1.3. United Kingdom Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 5.4.2.3. France Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 5.4.3.3. Germany Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 5.4.4.3. Italy Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 5.4.5.3. Spain Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 5.4.6.3. Sweden Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 5.4.7.3. Austria Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 5.4.8.3. Rest of Europe Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Vacuum Gas Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 6.3. Asia Pacific Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Vacuum Gas Oil Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 6.4.1.3. China Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 6.4.2.3. S Korea Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 6.4.3.3. Japan Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 6.4.4.3. India Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 6.4.5.3. Australia Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 6.4.6.3. Indonesia Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 6.4.7.3. Malaysia Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 6.4.8.3. Vietnam Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 6.4.9.3. Taiwan Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 6.4.10.3. Rest of Asia Pacific Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Vacuum Gas Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 7.3. Middle East and Africa Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Vacuum Gas Oil Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 7.4.1.3. South Africa Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 7.4.2.3. GCC Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 7.4.3.3. Nigeria Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 7.4.4.3. Rest of ME&A Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 8. South America Vacuum Gas Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 8.2. South America Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 8.3. South America Vacuum Gas Oil Market Size and Forecast, by Application(2023-2030) 8.4. South America Vacuum Gas Oil Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 8.4.1.3. Brazil Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 8.4.2.3. Argentina Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Vacuum Gas Oil Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America Vacuum Gas Oil Market Size and Forecast, by Sulfur Content (2023-2030) 8.4.3.3. Rest Of South America Vacuum Gas Oil Market Size and Forecast, by Application (2023-2030) 9. Global Vacuum Gas Oil Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Vacuum Gas Oil Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. TAIF-NK (Russia) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Kuwait Petroleum Corporation (Kuwait) 10.3. KazMunayGas (Kazakhstan) 10.4. Shell (U.S.) 10.5. Zhejiang Petroleum & Chemical Co Ltd, (China) 10.6. Neste (Finland) 10.7. Vertex (U.S.) 10.8. LUKOIL (Russia) 10.9. Exxon Mobil Corporation (U.S.) 10.10. Saudi Arabian Oil Co. (Saudi Arabia) 10.11. China National Petroleum Corporation (China) 10.12. BP plc (U.K.) 10.13. Shell plc (U.K.) 10.14. PDVSA - Petróleos de Venezuela, SA. (Venezuela) 10.15. Gazprom (Russia) 10.16. Chevron Corporation. (U.S.) 10.17. Petrobras (Brazil) 10.18. LUKOIL (Russia) 10.19. ROSNEFT (Russia) 10.20. Abu Dhabi National Oil Company (U.A.E) 10.21. China Petrochemical Corporation. (China) 11. Key Findings 12. Industry Recommendations 13. Vacuum Gas Oil Market: Research Methodology 14. Terms and Glossary