The Global Synthetic Rubber Market was valued at USD 29.08 Billion in 2024 and is projected to reach USD 41.61 Billion by 2032, growing at a CAGR of 4.58 %. The global demand for synthetic rubber is witnessing significant growth as industries increasingly rely on high-performance elastomers for automotive, tire manufacturing, construction, and industrial applications. Key materials such as SBR, BR, NBR, EPDM, and IIR are widely used in tires, hoses, gaskets, seals, conveyor belts, and various industrial components. In 2024, global tire production surged, with countries such as China, India, and Japan leading the consumption China alone accounted for over 6 million tons of synthetic rubber, making it the largest global consumer. Innovation is reshaping the synthetic rubber market, with companies like Bridgestone, Goodyear, and Michelin introducing eco-friendly tires using bio-based rubber, recycled carbon black, and sustainable elastomers. Goodyear, for instance, launched a tire composed of 70% sustainable materials, including soybean oil–based rubber. China’s petrochemical capacity projects, India’s Production-Linked Incentive (PLI) program for automotive components, and Japan’s green mobility initiatives are strengthening synthetic rubber production and R&D. Growing EV adoption and demand for heat-resistant, durable elastomers continue to drive robust Synthetic Rubber Market growth globally.To know about the Research Methodology :- Request Free Sample Report

Synthetic Rubber Market Dynamics:

Rising Automotive Tire Demand and Advanced Mobility Trends to drive the Growth of Synthetic Rubber Market The synthetic rubber market is primarily driven by the strong global demand for automotive tires, supported by rising vehicle production and the expansion of electric mobility. Synthetic rubber types such as SBR, BR, and NBR are essential for producing high-performance tires due to their abrasion resistance, flexibility, and durability. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached around 93.5 million units in 2023, reflecting steady recovery in automotive manufacturing. Tire manufacturers like Bridgestone, Michelin, and Goodyear are scaling production to meet increasing replacement and OEM tire demand. Additionally, the EV sector is accelerating market growth, as electric vehicles require low-rolling-resistance tires to improve battery efficiency. For instance, EV sales crossed 14 million units in 2023, with China contributing nearly 60% of global EV demand, directly boosting demand for advanced synthetic rubber formulations. Growth in commercial vehicle fleets for logistics, especially in India, China, and Brazil, further strengthens consumption. This sustained automotive momentum, combined with performance-driven tire innovations, continues to fuel consistent demand for synthetic rubber worldwide.Volatile Raw Material Prices and Environmental Concerns Limits the synthetic rubber market Growth One of the major restraints impacting the synthetic rubber market is the high volatility in raw material pricing, particularly butadiene, styrene, and other petrochemical feedstocks derived from crude oil. Fluctuations in oil prices create instability in production costs, limiting profitability for manufacturers. For instance, butadiene prices surged over 30% in 2023 due to refinery shutdowns in Europe and supply disruptions in Asia, affecting companies like Sinopec, LG Chem, and Arlanxeo. Environmental regulations also pose challenges, as synthetic rubber production generates emissions and waste that must comply with stricter government standards. The EU’s Green Deal and China’s updated emission norms (2024 revision) require manufacturers to invest heavily in cleaner technologies. Additionally, concerns about microplastic release from tire wear estimated at 1 million tonnes annually worldwide are increasing regulatory pressure on rubber producers. These sustainability issues are prompting industries to shift toward eco-friendly alternatives, thereby slowing adoption in some regions. High energy costs, feedstock shortages, and regulatory compliance expenses continue to restrain growth, especially for small and mid-sized rubber processing units. Expansion of Bio-Based Synthetic Rubber and Sustainable Tire Solutions creates lucrative growth opportunities to the market growth Sustainability-driven innovations are creating significant opportunities for the synthetic rubber market, particularly in bio-based materials, recycled rubber, and low-emission manufacturing technologies. Global tire companies are aggressively investing in renewable rubber materials to meet their 2030–2050 sustainability goals. For example, Michelin and Bridgestone are developing bio-SBR and bio-butadiene using plant-based feedstocks. Michelin announced that it aims to produce tires made of 100% sustainable materials by 2050, and in 2023, it successfully tested tires containing 45% recycled and renewable materials. Similarly, Goodyear introduced a tire made with 70% sustainable materials in 2023, including soybean oil-based rubber and recycled plastics. Governments are also supporting sustainable rubber initiatives—Japan and the EU invested over USD 150 million combined in synthetic rubber decarbonization programs in 2024. Growth in green construction materials, medical elastomers, and high-performance seals further adds opportunities for EPDM, NBR, and other advanced polymers. As industries aim to reduce carbon footprints, demand for bio-based and circular-economy-aligned rubber solutions is expected to expand rapidly, opening new revenue channels for manufacturers globally.

Synthetic Rubber Market Segment Analysis:

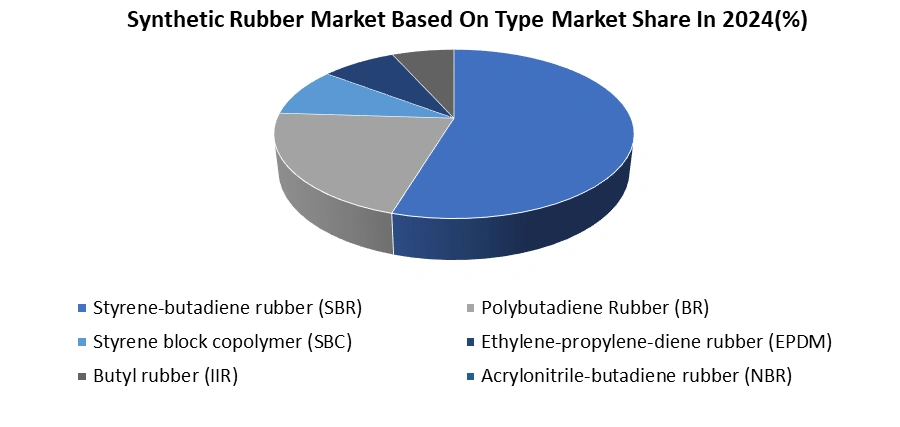

Based on Type, the Synthetic Rubber Market is segmented into Synthetic Rubber Market, Polybutadiene Rubber (BR), Styrene block copolymer (SBC), Ethylene-propylene-diene rubber (EPDM), Butyl rubber (IIR), and Acrylonitrile-butadiene rubber (NBR). Styrene-Butadiene Rubber (SBR) dominated the Synthetic Rubber Market in year 2024.Due to its extensive use in automotive tires, strong performance characteristics, and cost-effectiveness. SBR is the preferred material for tire treads because it offers excellent abrasion resistance, durability, and heat stability qualities essential for passenger cars, commercial vehicles, and electric vehicles. With global tire production rising sharply across China, India, Japan, and South Korea, SBR demand continued to outpace other segments such as Polybutadiene Rubber (BR), Styrene Block Copolymer (SBC), EPDM, Butyl Rubber (IIR), and Acrylonitrile-Butadiene Rubber (NBR). SBR holds the largest share as nearly 50–60% of total synthetic rubber consumption in automotive applications comes from this material. Leading tire manufacturers like Michelin, Bridgestone, Goodyear, and Apollo Tires rely heavily on SBR to produce high-performance and low-rolling-resistance tires. The rapid shift toward EVs further boosts synthetic rubber market demand, making SBR the dominant segment due to its balanced cost, performance, and availability in major production hubs across the Asia-Pacific region.

Synthetic Rubber Market Regional Analysis:

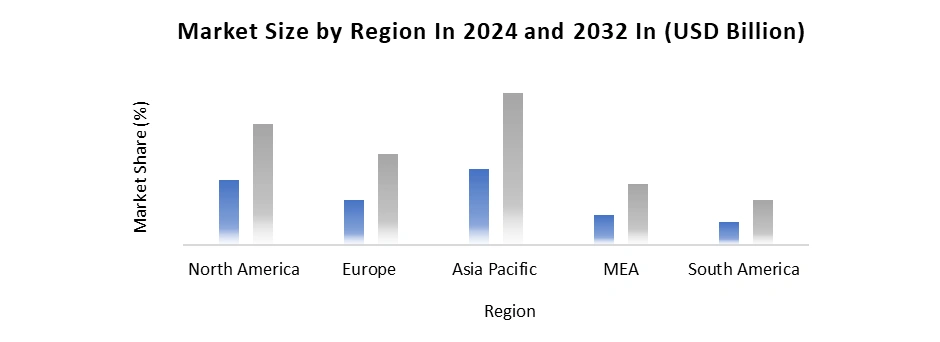

Asia Pacific Dominated the Synthetic Rubber Market in year 2024. Due to its strong manufacturing ecosystem, high automotive production, and expanding tire industry, all of which significantly boosted synthetic rubber demand, especially for SBR, BR, NBR, and EPDM grades. China remained the largest contributor, driven by massive automotive output and tire manufacturing hubs supplying both domestic and export markets. Japan and South Korea also played a key role with advanced synthetic rubber production capabilities, producing high-quality EPDM and specialty elastomers used in automotive seals, industrial belts, and electronics. India recorded rapid growth, as rising vehicle sales and infrastructure expansion increased demand for industrial rubber and automotive tires. Southeast Asian countries like Thailand, Indonesia, and Vietnam strengthened their presence through growing import volumes and expanding rubber-processing industries. Major manufacturers such as Sinopec, LG Chem, Arlanxeo, and Kumho Petrochemical continued capacity expansion across Asia, attracting tire companies such as bridgestone, Goodyear, and Michelin. Strong industrialization, cost-effective production, and growing EV adoption collectively positioned Asia-Pacific as the global leader in the synthetic rubber industry.

Synthetic Rubber Market Competitive Landscape:

The Synthetic Rubber Market is highly competitive, driven by global synthetic rubber manufacturers, integrated petrochemical companies, and leading tire producers expanding their SBR, BR, NBR, and EPDM portfolios. Key players such as Sinopec, Arlanxeo, Lanxess, Kumho Petrochemical, JSR Corporation, LG Chem, Synthos, Reliance Industries, Shell, and ExxonMobil focus on strengthening production of styrene-butadiene rubber, butadiene rubber, and industrial rubber used across automotive, construction, and manufacturing sectors. Companies are investing heavily in sustainable synthetic rubber, bio-based rubber, and recycled rubber solutions to meet rising demand for EV tire materials, low-rolling-resistance tires, and eco-friendly elastomers. Global tire leaders including Bridgestone, Goodyear, and Michelin are partnering with chemical companies to develop advanced synthetic rubber for automotive tires, enhancing durability, heat resistance, and performance for electric and hybrid vehicles. Several producers are expanding capacity in Asia-Pacific due to strong synthetic rubber market demand from China, India, and Southeast Asia. Strategic moves include acquisitions, capacity expansions, long-term supply contracts, and innovations in synthetic rubber production, helping companies strengthen market share in this highly evolving synthetic rubber industry.Synthetic Rubber Market: Recent Development

1. In June 2023: Apcotex Industries Limited invested USD 24.13 million to expand two of its rubber manufacturing projects. This strategic investment aims to strengthen the company’s production capabilities and increase revenue from its synthetic rubber segment. 2. In April 2023: Sinopec announced an expansion of its styrene-butadiene (SBC) production capacity by 170,000 tons per year at its facilities in Hainan, China. This move is intended to enhance Sinopec’s market presence and support the growing synthetic rubber demand within China.Synthetic Rubber Market Scope: Inquiry Before Buying

Synthetic Rubber Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 29.08 Bn. Forecast Period 2025 to 2032 CAGR: 4.58% Market Size in 2032: USD 41.61 Bn. Segments Covered: by Type Styrene-butadiene rubber (SBR) Polybutadiene Rubber (BR) Styrene block copolymer (SBC) Ethylene-propylene-diene rubber (EPDM) Butyl rubber (IIR) Acrylonitrile-butadiene rubber (NBR) by Form Type Solid Liquid by Application Tire Automotive Footwear Industrial Goods Consumer Goods Textile Others by End User Transportation Building & Construction Medical Textile & Apparel Food & Beverage Other Synthetic Rubber Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Synthetic Rubber Key Players

1. Sinopec 2. Arlanxeo 3. Kumho Petrochemical 4. JSR Corporation 5. LG Chem 6. Lanxess AG 7. ExxonMobil Chemical 8. Shell Chemicals 9. Synthos S.A. 10. Reliance Industries Limited (RIL) 11. Bridgestone Corporation 12. Michelin Group 13. Goodyear Tire & Rubber Company 14. Indian Oil Corporation Limited (IOCL) 15. Apcotex Industries Limited 16. Versalis (ENI Group) 17. Sibur (Russia) 18. Zeon Corporation 19. Nizhnekamskneftekhim (NKNK) 20. Trinseo 21. Kraton Corporation 22. TSRC Corporation (Taiwan Synthetic Rubber Corp.) 23. Lion Elastomers 24. Korea Kumho Petrochemical Company (KKPC) 25. Formosa Petrochemical Corporation 26. PetroChina Company Limited 27. Hainan Rubber Group 28. Shanxi Synthetic Rubber Group 29. Yokohama Rubber Company 30. Huntsman CorporationFrequently Asked Questions:

1. Which region has the largest share in Global Synthetic Rubber Market? Ans: Asia Pacific region held the highest share in 2024. 2. What is the growth rate of Global Synthetic Rubber Market? Ans: The Global Synthetic Rubber Market is growing at a CAGR of 4.58 % during forecasting period 2025-2032. 3. What is scope of the Global market report? Ans: Global market report helps with the PESTEL, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global market? Ans: The important key players in the Global Synthetic Rubber Market are Sinopec, Arlanxeo, Kumho Petrochemical, JSR Corporation, LG Chem and Others 5. What was the Global Synthetic Rubber Market size in 2024? Ans: The Global Synthetic Rubber Market size was USD 29.08 Billion in 2024.

1. Synthetic Rubber Market: Research Methodology 2. Synthetic Rubber Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Synthetic Rubber Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. End User Segment 3.3.5. Revenue (2024) 3.3.6. Profit Margin (%) 3.4. Mergers and Acquisitions Details 4. Synthetic Rubber Market: Dynamics 4.1. Synthetic Rubber Market Trends 4.2. Synthetic Rubber Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for the Synthetic Rubber Market 5. Synthetic Rubber Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Ton) (2024-2032) 5.1. Synthetic Rubber Market Size and Forecast, By Type (2024-2032) 5.1.1. Styrene-butadiene rubber (SBR) 5.1.2. Polybutadiene Rubber (BR) 5.1.3. Styrene block copolymer (SBC) 5.1.4. Ethylene-propylene-diene rubber (EPDM) 5.1.5. Butyl rubber (IIR) 5.1.6. Acrylonitrile-butadiene rubber (NBR) 5.2. Synthetic Rubber Market Size and Forecast, By Form Type (2024-2032) 5.2.1. Solid 5.2.2. Liquid 5.3. Synthetic Rubber Market Size and Forecast, By Application (2024-2032) 5.3.1. Tire 5.3.2. Automotive 5.3.3. Footwear 5.3.4. Industrial Goods 5.3.5. Consumer Goods 5.3.6. Textile 5.3.7. Others 5.4. Synthetic Rubber Market Size and Forecast, By End User (2024-2032) 5.4.1. Transportation 5.4.2. Building & Construction 5.4.3. Medical 5.4.4. Textile & Apparel 5.4.5. Food & Beverage 5.4.6. Other 5.5. Synthetic Rubber Market Size and Forecast, by Region (2024-2032) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Synthetic Rubber Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Ton) (2024-2032) 6.1. North America Synthetic Rubber Market Size and Forecast, By Type (2024-2032) 6.2. North America Synthetic Rubber Market Size and Forecast, By Form Type (2024-2032) 6.3. North America Synthetic Rubber Market Size and Forecast, By Application (2024-2032) 6.4. North America Synthetic Rubber Market Size and Forecast, By End User (2024-2032) 6.5. North America Synthetic Rubber Market Size and Forecast, by Country (2024-2032) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Synthetic Rubber Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Ton) (2024-2032) 7.1. Europe Synthetic Rubber Market Size and Forecast, By Type (2024-2032) 7.2. Europe Synthetic Rubber Market Size and Forecast, By Form Type (2024-2032) 7.3. Europe Synthetic Rubber Market Size and Forecast, By Application (2024-2032) 7.4. Europe Synthetic Rubber Market Size and Forecast, By End User (2024-2032) 7.5. Europe Synthetic Rubber Market Size and Forecast, by Country (2024-2032) 7.5.1. United Kingdom 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Russia 7.5.7. Rest of Europe 8. Asia Pacific Synthetic Rubber Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Ton) (2024-2032) 8.1. Asia Pacific Synthetic Rubber Market Size and Forecast, By Type (2024-2032) 8.2. Asia Pacific Synthetic Rubber Market Size and Forecast, By Form Type (2024-2032) 8.3. Asia Pacific Synthetic Rubber Market Size and Forecast, By Application (2024-2032) 8.4. Asia Pacific Synthetic Rubber Market Size and Forecast, By End User (2024-2032) 8.5. Asia Pacific Synthetic Rubber Market Size and Forecast, by Country (2024-2032) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Rest of Asia Pacific 9. Middle East and Africa Synthetic Rubber Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Ton) (2024-2032) 9.1. Middle East and Africa Synthetic Rubber Market Size and Forecast, By Type (2024-2032) 9.2. Middle East and Africa Synthetic Rubber Market Size and Forecast, By Form Type (2024-2032) 9.3. Middle East and Africa Synthetic Rubber Market Size and Forecast, By Application (2024-2032) 9.4. Middle East and Africa Synthetic Rubber Market Size and Forecast, By End User (2024-2032) 9.5. Middle East and Africa Synthetic Rubber Market Size and Forecast, by Country (2024-2032) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Nigeria 9.5.4. Rest of ME&A 10. South America Synthetic Rubber Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Ton) (2024-2032) 10.1. South America Synthetic Rubber Market Size and Forecast, By Type (2024-2032) 10.2. South America Synthetic Rubber Market Size and Forecast, By Form Type (2024-2032) 10.3. South America Synthetic Rubber Market Size and Forecast, By Application (2024-2032) 10.4. South America Synthetic Rubber Market Size and Forecast, By End User (2024-2032) 10.5. South America Synthetic Rubber Market Size and Forecast, by Country (2024-2032) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Colombia 10.5.4. Chile 10.5.5. Rest Of South America 11. Company Profile: Key Players 11.1. Sinopec 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Arlanxeo 11.3. Kumho Petrochemical 11.4. JSR Corporation 11.5. LG Chem 11.6. Lanxess AG 11.7. ExxonMobil Chemical 11.8. Shell Chemicals 11.9. Synthos S.A. 11.10. Reliance Industries Limited (RIL) 11.11. Bridgestone Corporation 11.12. Michelin Group 11.13. Goodyear Tire & Rubber Company 11.14. Indian Oil Corporation Limited (IOCL) 11.15. Apcotex Industries Limited 11.16. Versalis (ENI Group) 11.17. Sibur (Russia) 11.18. Zeon Corporation 11.19. Nizhnekamskneftekhim (NKNK) 11.20. Trinseo 11.21. Kraton Corporation 11.22. TSRC Corporation (Taiwan Synthetic Rubber Corp.) 11.23. Lion Elastomers 11.24. Korea Kumho Petrochemical Company (KKPC) 11.25. Formosa Petrochemical Corporation 11.26. PetroChina Company Limited 11.27. Hainan Rubber Group 11.28. Shanxi Synthetic Rubber Group 11.29. Yokohama Rubber Company 11.30. Huntsman Corporation 12. Key Findings 13. Analyst Recommendations