Global Solid State and Polymer Battery Market size was valued at USD 2.22 Bn. in 2024, and the total Solid State and Polymer Battery Market revenue is expected to grow by 31.5% from 2025 to 2032, reaching nearly USD 19.85 Bn.Solid State and Polymer Battery Market Overview:

Solid-state and polymer batteries function similarly to traditional battery systems, with solid or semi-solid electrolytes, which use an alternative to the liquid or gel electrolytes in today's conventional systems. Solid-state and polymer batteries are becoming widespread in a variety of sectors, including electric vehicles (EVs), consumer electronics, medical devices, and renewable energy storage, since these next-generation batteries have traits, including being safer than traditional batteries, increased energy density storage, and longer life cycles compared to conventional batteries. Solid-state and polymer batteries have the advantages of eliminating liquid-electrolyte leakage, limiting flammable materials, and providing a faster recharge, with significant opportunities in next-generation mobility and high-performance portable applications. This sector is also being driven by strong demand from an Asia-Pacific viewing market due to the significant EV component manufacturing, the rate at which EV applications are being adopted in this region, and the abundance of government funding for R&D, with notable driving countries being Japan, China, and South Korea. North America and Europe are also pursuing solid-state batteries through strategic OEM partnerships, development of local gigafactories, and programs focused on policies and incentives. The report also covered the market drivers such as the increase in EV adoption, improvements to performance and safety, and sustainability objectives, as well as challenges like technological complexity, high costs of production, and risk of dendrite formation. The regional elements of the market were listed, noting that there would be the largest number of opportunities in the Asia-Pacific region, although North America and Europe were commercial opportunities to watch. Top competitors such as QuantumScape, 24M Technologies, Solid Power, Panasonic, ProLogium, and Blue Solutions are disrupting the competitive market for scalable battery chemistries, hybrid configurations, and proprietary electrolytic technologies. Some government policies, such as the U.S. Inflation Reduction Act, the EU Battery Directive, and India's PLI Scheme, are optimizing the momentum for sometimes localization and development of next-generation advanced battery manufacturing. Overall, the solid-state and polymer battery's position is a key enabler of clean high-performance energy systems, benefiting the electrification and decarbonization of the future.To know about the Research Methodology :- Request Free Sample Report

Global Solid State and Polymer Battery Market Dynamics:

Rising Demand for Electric Vehicles to Drive Solid-State and Polymer Battery Market Growth Through Enhanced Safety and Energy Density The increasing demand for electric vehicles (EVs) to drive the expansion of solid-state battery investments as the next generation of batteries provides several advantages over traditional lithium-ion systems. Solid-state batteries have a substantially larger energy density, which is an advantage in that it enables a greater driving range to eliminate one of the user’s biggest concerns. They also allow for faster charging, due to inherent thermal stability and ionic conductivity; again, minimizing user downtime. The solid, non-aging standard also keeps the batteries safer, as there is no risk of leakage or thermal runaway (explosion) that standard batteries experience. Automotive "big boys" like Toyota, BMW, Ford, and VW are pouring considerable funds and resources toward the development of solid-state batteries, with many banking on the commercial launch in vehicles by the end of the decade. Persistent Technological Barriers, Such as Dendrite Formation and Interface Resistance, Pose Restraints on Solid-State and Polymer Battery Market Growth Technological obstacles continue to create considerable limitations on the commercial scalability of solid-state and polymer batteries. One concern that has gained attention among researchers is the formation of lithium dendrites. These structures resemble needles and can grow through the solid electrolyte, creating a short circuit if they breach either surface, creating a hazardous safety issue and significantly shortening battery life. Additionally, many that are considered solid electrolytes are still considered solid; therefore, potential ionic conductivity losses at temperatures (room temperature) are still major hurdles to deal with, which further decrease total power output and battery efficiency. For solid-state batteries, another major problem is the resistance at the interface between electrode materials and solid electrolytes, which is where ion transfer occurs, and energy losses ultimately happen. Collaborative R&D Initiatives and Strategic Investments to Create Opportunities for Sustainable Growth in the Solid-State and Polymer Battery Market Collaborative alliances and investments are vital for driving strategic development and commercial adoption of solid-state and polymer battery technology. Some solid-state batteries are still in early commercial deployment, so they are teaming with automakers, battery manufacturers, startups, and tech companies, building coalitions of resources, skills, and lowering time to market. As an example, partnerships formed between major brands and startups such as Toyota, BMW, and Ford with QuantumScape and Solid Power, to develop co-production lines for batteries and prototypes. These strategic partnerships have included large investments along with technical assistance and long-term supply agreements to help maximize the scale of R&D and work on technical impediments such as interface stability, ionic conductivity, and manufacturability.Global Solid State and Polymer Battery Market Segment Analysis

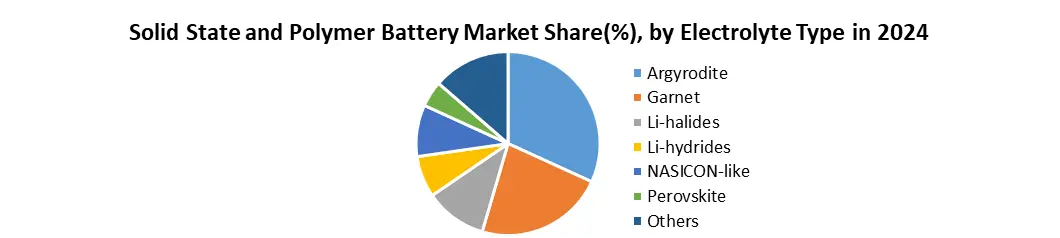

By Cell Type, the Solid State and Polymer Battery Market is segmented into Bulk Solid-State and Polymer Batteries and Thin-Film Batteries. The Bulk Solid-State and Polymer Batteries segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. The predominance of bulk batteries can be attributed to their energy density, power output, and application in higher ambient demand situations such as electric vehicles (EVs), grid and storage, and aerospace. Manufacturers of electric vehicles and battery developers are currently reallocating capital to bulk battery technologies to meet the consumer demand for longer-range, safer electric vehicles. This is being supported through company-based R&D initiatives of existing automobile manufacturers (e.g., Toyota, BMW) and battery developers like QuantumScape. By Electrolyte Type, the solid-state and polymer battery market is segmented into Argyrodite, Garnet, Li-halides, Li-hydrides, NASICON-like, Perovskite, and Others. Argyrodite-type solid electrolytes segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. Argyrodite-type solid electrolytes account for a market share of approximately 30–35%. Argyrodite-type electrolytes (typically sulfide-based) are favorable due to their high ionic conductivity at room temperature, good mechanical flexibility, and low boundary resistance, all of which benefit the electric vehicle (EV) market in terms of performance and safety.

Solid State and Polymer Battery Market Regional Insights:

Region-wise, Asia Pacific held the largest market share in 2024 and is expected to maintain its dominance at a CAGR of xx% during the forecast period. Economies such as China, Japan, South Korea, and India are the major key contributors behind the growth of the market. The growth is attributed to the rising adoption of solid-state and polymer batteries in the automotive industry. Increasing use of solid state and polymer batteries in grid energy storage, portable electrochemical devices, and in electric vehicles, massive presence of solid state and polymer battery manufacturers, and rising adoption in wearable and consumer electronics applications are driving the growth of the market. Solid State and Polymer Battery Market Competitive Landscape The Solid-State and Polymer Battery Market is becoming very competitive and presents an opportunity for key innovators to commercialize safer and more efficient next-generation battery technology. Companies like 24M Technologies and Blue Solutions (Bolloré Group), which are developing differentiated ways of achieving the growing storage needs for energy in both mobility and stationary applications, are examples of potential commercial success. In 2024, 24M Technologies (USA) had USD 29 million in revenue from its SemiSolid™ lithium-metal platform and made pilot-scale deliveries to mobility and energy storage OEMs. The company introduced a new electrolyte formulation, Eternalyte™, and opened a facility in Thailand capable of supporting 100 MWh of production to further commercial scale validation and manufacturing; 24M also raised USD 87 million in Series H funding to grow commercialization and scale globally. Blue Solutions (France), the first company to bring a polymer-based solid-state battery to market, continues to supply full electric battery systems (in the form of modular battery systems) primarily for electric buses, light mobility vehicles, and stationary storage. The company reported USD 90 million in revenue in 2024, and also maintained steady orders from established transit clients and electric mobility markets in Europe and Africa from government-subsidized electrification programs. Both companies are developing next-gen material systems, long-cycle performance, and scalable battery manufacturing. Solid State and Polymer Battery Market Recent Development • On February 5, 2025, Ilika plc (UK) announced that they are anticipating the opening of their Goliath solid-state battery production line with their parters, the UK Battery Industrialisation Centre (UKBIC), and Mpac, and they have shipped some 2 Ah P1 protos, as well as ramping testing on 10 Ah D6 cells destined automotive use. They are targeting ramp-up for June 2025, and their solid-state lithium battery technology was previously unveiled at the Advanced Automotive Battery Conference in Cologne, Germany, in 2021. • On July 11, 2024, QuantumScape Corporation (USA) announced Volkswagen Group's PowerCo has obtained a non-exclusive license to manufacture up to 40 GWh/year (expandable to 80 GWh) using QuantumScape's solid-state lithium-metal battery technology (having taken the necessary steps toward mass-production of the QSE 5 as part of VW's EV development too). • Panasonic Holdings Corporation (Japan), according to their CTO Ogawa Tachio, is sponsoring additional development on solid-state technology, and aims for mass production by 2029 for drones, with examples of prototypes available to charge between 10-80% in 3 minutes. • Solid Power announced in May 2025 that it is constructing its continuous electrolyte production pilot line and that Q1 2025 expenditure will support rapid deployment of processes, along with customer-directed R&D. • In March 2025, 24M was covered in Fast Company as one of the World’s Most Innovative Companies due to its progress in safety, performance, sustainability, recyclability, and fast charge. Solid State and Polymer Battery Market Recent Trends Commercialization of EV-Grade Solid-State Batteries Solid-state batteries are moving closer to mass production, particularly for electric vehicles (EVs). Several automakers are announcing timelines and pilot lines. Toyota plans to launch its first EV with solid-state batteries by 2027, claiming a range of over 1,000 km and charging in 10 minutes. Strategic OEM-Startup Collaborations Automotive giants are partnering with battery startups to accelerate development and secure future supply. BMW and Ford have partnered with Solid Power to co-develop sulfide-based solid-state batteries and gain pilot production access. Hybrid and Composite Electrolyte Development To overcome ionic conductivity and stability challenges, manufacturers are combining ceramic and polymer materials. Samsung SDI is developing a hybrid solid-state battery combining ceramic electrolytes with polymers for flexibility and high conductivity.Solid State and Polymer Battery Market Scope : Inquiry Before Buying

Solid State and Polymer Battery Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.22 Bn. Forecast Period 2025 to 2032 CAGR: 31.5% Market Size in 2032: USD 19.85 Bn. Segments Covered: by Cell Type Thin Film Solid State and Polymer Battery, Bulk Solid State and Polymer Battery by Electrolyte Type Argyrodite Garnet Li-halides Li-hydrides NASICON-like Perovskite Others ype4 by Industry IT and Telecommunication Automotive Defense and Aerospace Consumer Electronics Others Solid State and Polymer Battery Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)North America Solid State and Polymer Battery Market Key Players

1. 24M Technologies (USA) 2. Blue Solutions (Canada) 3. FlashCharge Batteries LLC (USA) 4. Johnson Battery Technologies, Inc. (USA) 5. Planar Energy (USA) 6. PolyPlus Battery Company (USA) 7. Prieto Battery Inc. (USA) 8. Sakti (Sakti3, acquired by Dyson) (USA) 9. QuantumScape (USA) 10. Solid Power (USA) 11. SolidEnergy Systems (SES AI Corporation) (USA) 12. Seeo, Inc. (acquired by Bosch) (USA) Europe Solid State and Polymer Battery Market Key Players 1. Ilika plc (UK) 2. EMPA (Switzerland) 3. Blue Solutions (France) Asia Pacific Solid State and Polymer Battery Market Key Players 1. Hitachi Zosen Corporation (Japan) 2. Panasonic Holdings Corporation (Japan) 3. KalpTree Energy (India)Frequently Asked Questions:

1. Which region has the largest share in the Global Solid State and Polymer Battery Market? Ans: The Asia Pacific region held the highest share in 2024. 2. What is the growth rate of the Global Solid State and Polymer Battery Market? Ans: The Global Market is expected to grow at a CAGR of 31.5% during the forecast period 2025-2032. 3. What is the scope of the Global Solid State and Polymer Battery Market report? Ans: The Global Solid State and Polymer Battery Market report helps with the PESTEL, Porter's, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Global Solid State and Polymer Battery Market? Ans: The important key players in the Global Solid State and Polymer Battery Market are – FlashCharge Batteries LLC (USA), Johnson Battery Technologies, Inc. (USA), Planar Energy (USA), PolyPlus Battery Company (USA), Prieto Battery Inc. (USA), etc. 5. What is the study period of this market? Ans: The Global Solid State and Polymer Battery Market is studied from 2024 to 2032.

1. Solid State and Polymer Battery Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Solid State and Polymer Battery Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Solid State and Polymer Battery Market: Dynamics 3.1. Region-wise Trends of Solid State and Polymer Battery Market 3.1.1. North America Solid State and Polymer Battery Market Trends 3.1.2. Europe Solid State and Polymer Battery Market Trends 3.1.3. Asia Pacific Solid State and Polymer Battery Market Trends 3.1.4. Middle East and Africa Solid State and Polymer Battery Market Trends 3.1.5. South America Solid State and Polymer Battery Market Trends 3.2. Solid State and Polymer Battery Market Dynamics 3.2.1. Global Solid State and Polymer Battery Market Drivers 3.2.1.1. Rising Demand for Electric Vehicles 3.2.2. Global Solid State and Polymer Battery Market Restraints 3.2.3. Global Solid State and Polymer Battery Market Opportunities 3.2.3.1. Strategic Collaborations and Investments 3.2.4. Global Solid State and Polymer Battery Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Government Incentives for EVs 3.4.2. High Initial R&D and Manufacturing Costs 3.4.3. Rising Consumer Awareness of Battery Safety 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Solid State and Polymer Battery Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 4.1.1. Thin Film Solid State and Polymer Battery 4.1.2. Bulk Solid State and Polymer Battery 4.2. Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 4.2.1. Argyrodite 4.2.2. Garnet 4.2.3. Li-halides 4.2.4. Li-hydrides 4.2.5. NASICON-like 4.2.6. Perovskite 4.2.7. Others 4.3. Solid State and Polymer Battery Market Size and Forecast, By Industry (2024-2032) 4.3.1. IT and Telecommunication 4.3.2. Automotive 4.3.3. Defense and Aerospace 4.3.4. Consumer Electronics 4.3.5. Others 4.4. Solid State and Polymer Battery Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Solid State and Polymer Battery Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 5.1.1. Thin Film Solid State and Polymer Battery 5.1.2. Bulk Solid State and Polymer Battery 5.2. North America Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 5.2.1. Argyrodite 5.2.2. Garnet 5.2.3. Li-halides 5.2.4. Li-hydrides 5.2.5. NASICON-like 5.2.6. Perovskite 5.2.7. Others 5.3. North America Solid State and Polymer Battery Market Size and Forecast, By Industry (2024-2032) 5.3.1. IT and Telecommunication 5.3.2. Automotive 5.3.3. Defense and Aerospace 5.3.4. Consumer Electronics 5.3.5. Others 5.4. North America Solid State and Polymer Battery Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 5.4.1.1.1. Thin Film Solid State and Polymer Battery 5.4.1.1.2. Bulk Solid State and Polymer Battery 5.4.1.2. United States Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 5.4.1.2.1. Argyrodite 5.4.1.2.2. Garnet 5.4.1.2.3. Li-halides 5.4.1.2.4. Li-hydrides 5.4.1.2.5. NASICON-like 5.4.1.2.6. Perovskite 5.4.1.2.7. Others 5.4.1.3. Others United States Solid State and Polymer Battery Market Size and Forecast, By Industry (2024-2032) 5.4.1.3.1. IT and Telecommunication 5.4.1.3.2. Automotive 5.4.1.3.3. Defense and Aerospace 5.4.1.3.4. Consumer Electronics 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 5.4.2.1.1. Thin Film Solid State and Polymer Battery 5.4.2.1.2. Bulk Solid State and Polymer Battery 5.4.2.2. Canada Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 5.4.2.2.1. Argyrodite 5.4.2.2.2. Garnet 5.4.2.2.3. Li-halides 5.4.2.2.4. Li-hydrides 5.4.2.2.5. NASICON-like 5.4.2.2.6. Perovskite 5.4.2.2.7. Others 5.4.2.3. Canada Solid State and Polymer Battery Market Size and Forecast, By Industry (2024-2032) 5.4.2.3.1. IT and Telecommunication 5.4.2.3.2. Automotive 5.4.2.3.3. Defense and Aerospace 5.4.2.3.4. Consumer Electronics 5.4.2.3.5. Others 5.4.2.4. Mexico Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 5.4.2.4.1. Thin Film Solid State and Polymer Battery 5.4.2.4.2. Bulk Solid State and Polymer Battery 5.4.2.5. Mexico Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 5.4.2.5.1. Argyrodite 5.4.2.5.2. Garnet 5.4.2.5.3. Li-halides 5.4.2.5.4. Li-hydrides 5.4.2.5.5. NASICON-like 5.4.2.5.6. Perovskite 5.4.2.5.7. Others 5.4.2.6. Mexico Solid State and Polymer Battery Market Size and Forecast, By Industry (2024-2032) 5.4.2.6.1. IT and Telecommunication 5.4.2.6.2. Automotive 5.4.2.6.3. Defense and Aerospace 5.4.2.6.4. Consumer Electronics 5.4.2.6.5. Others 6. Europe Solid State and Polymer Battery Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 6.2. Europe Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 6.3. Europe Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 6.4. Europe Solid State and Polymer Battery Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 6.4.1.2. United Kingdom Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 6.4.1.3. United Kingdom Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 6.4.2. France 6.4.2.1. France Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 6.4.2.2. France Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 6.4.2.3. France Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 6.4.3.2. Germany Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 6.4.3.3. Germany Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 6.4.4.2. Italy Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 6.4.4.3. Italy Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 6.4.5.2. Spain Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 6.4.5.3. Spain Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 6.4.6.2. Sweden Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 6.4.6.3. Sweden Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 6.4.7.2. Austria Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 6.4.7.3. Austria Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 6.4.8.2. Rest of Europe Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 6.4.8.3. Rest of Europe Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7. Asia Pacific Solid State and Polymer Battery Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.2. Asia Pacific Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.3. Asia Pacific Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7.4. Asia Pacific Solid State and Polymer Battery Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.4.1.2. China Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.4.1.3. China Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.4.2.2. S Korea Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.4.2.3. S Korea Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.4.3.2. Japan Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.4.3.3. Japan Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7.4.4. India 7.4.4.1. India Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.4.4.2. India Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.4.4.3. India Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.4.5.2. Australia Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.4.5.3. Australia Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.4.6.2. Indonesia Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.4.6.3. Indonesia Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.4.7.2. Philippines Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.4.7.3. Philippines Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.4.8.2. Malaysia Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.4.8.3. Malaysia Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.4.9.2. Vietnam Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.4.9.3. Vietnam Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.4.10.2. Thailand Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.4.10.3. Thailand Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 7.4.11.3. Rest of Asia Pacific Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 8. Middle East and Africa Solid State and Polymer Battery Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 8.2. Middle East and Africa Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 8.3. Middle East and Africa Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 8.4. Middle East and Africa Solid State and Polymer Battery Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 8.4.1.2. South Africa Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 8.4.1.3. South Africa Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 8.4.2.2. GCC Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 8.4.2.3. GCC Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 8.4.3.2. Nigeria Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 8.4.3.3. Nigeria Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 8.4.4.2. Rest of ME&A Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 8.4.4.3. Rest of ME&A Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 9. South America Solid State and Polymer Battery Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 9.2. South America Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 9.3. South America Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 9.4. South America Solid State and Polymer Battery Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 9.4.1.2. Brazil Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 9.4.1.3. Brazil Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 9.4.2.2. Argentina Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 9.4.2.3. Argentina Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Solid State and Polymer Battery Market Size and Forecast, By Cell Type (2024-2032) 9.4.3.2. Rest of South America Solid State and Polymer Battery Market Size and Forecast, By Electrolyte Type (2024-2032) 9.4.3.3. Rest of South America Solid State and Polymer Battery Market Size and Forecast, Industry (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. 24M Technologies (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Blue Solutions (Canada) 10.3. FlashCharge Batteries LLC (USA) 10.4. Johnson Battery Technologies, Inc. (USA) 10.5. Planar Energy (USA) 10.6. PolyPlus Battery Company (USA) 10.7. Prieto Battery Inc. (USA) 10.8. Sakti (Sakti3, acquired by Dyson) (USA) 10.9. QuantumScape (USA) 10.10. Solid Power (USA) 10.11. SolidEnergy Systems (SES AI Corporation) (USA) 10.12. Seeo, Inc. (acquired by Bosch) (USA) 10.13. Ilika plc (UK) 10.14. EMPA (Switzerland) 10.15. Blue Solutions (France) 10.16. Hitachi Zosen Corporation (Japan) 10.17. Panasonic Holdings Corporation (Japan) 10.18. KalpTree Energy (India) 11. Key Findings 12. Analyst Recommendations 13. Solid State and Polymer Battery Market: Research Methodology