Polyethylene Insulation Materials Market was valued at USD 21.6 billion in 2024, and total global Polyethylene Insulation Materials Market revenue is expected to grow at a CAGR of 7.8% from 2025 to 2032, reaching nearly USD 39.39 billion.Polyethylene Insulation Materials Market Overview

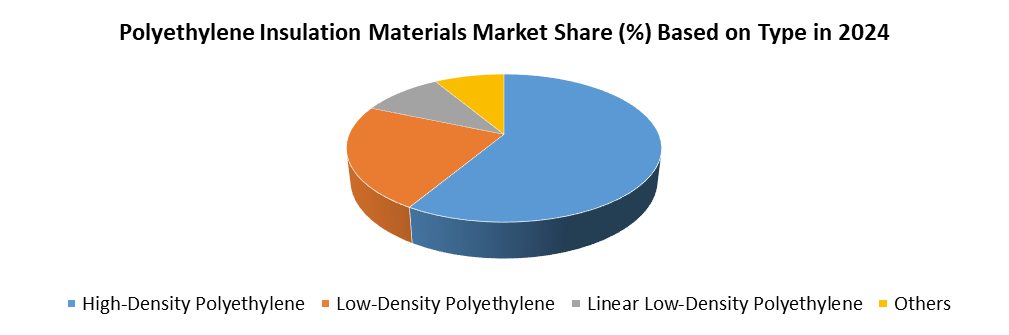

Polyethylene insulation materials are polymer-based solutions produced from high-density polyethylene (HDPE), low-density polyethylene (LDPE), and linear low-density polyethylene (LLDPE). Known for their lightweight nature, moisture resistance, thermal stability, and durability, these materials provide excellent thermal and electrical insulation. They are widely utilized in wires and cables, pipes, fittings, roofing, wall insulation, and consumer products, making them indispensable across construction, electrical, and industrial sectors.To know about the Research Methodology :- Request Free Sample Report The market is witnessing strong growth due to increasing infrastructure and urban development, particularly in emerging economies such as China, India, and Brazil. Rising construction of residential, commercial, and industrial spaces is fueling demand for efficient insulation materials. Additionally, expansion in the electrical and telecommunication industries is creating opportunities, as polyethylene insulation plays a critical role in power transmission and communication networks. Growing emphasis on energy efficiency and sustainability, supported by stricter government regulations, is driving adoption of advanced polyethylene insulation materials. Developments in flame-retardant and fire-resistant variants are opening new avenues, especially for high-rise buildings and critical infrastructure projects where safety is a priority. Among material types, HDPE is the dominant segment due to its superior durability and heat resistance, while wires and cables remain the leading application, driven by global electrification and telecom expansion.

Polyethylene Insulation Materials Market Dynamics

Rising Demand from Electrical Electronics Automotive and Construction Sectors to Drive the Polyethylene Insulation Materials Market Growth Polyethylene insulation is becoming more used in the electrical and electronics industries. For electrical insulation and film packaging, polyethylene insulation material is preferred. Many electronic appliances, such as smart phones, watches, TVs, refrigerators, security systems, and environmentally friendly electric automobiles, benefited from the digital economy. Over the next three decades, Asia-energy Pacific's consumption is expected to increase by 48 %. China will account for 30% of energy growth until 2030. During the forecast period, polyethylene Insulation material market is expected to be driven by rising electricity usage in businesses, as well as growing electronics and electrical production. The growth in automotive production is a primary element influencing the growth of polyethylene insulation materials market. Polyethylene Insulation materials come in a variety of densities and molecular weight grades, with durability that outlasts steel in some applications. As a result, the need for polyethylene insulation materials in the automotive market is increasing. The Middle East and North Africa region is witnessing an urbanization trend that result in a high number of people migrating to major cities. The construction business in these areas is growing at a 10% annual rate. It boosts polyethylene Insulation material usage and growth in the Middle East and North Africa. Impact of Substitutes and Raw Material Volatility to Restrain the Polyethylene Insulation Materials Market Growth The polyethylene insulation materials market faces significant restraints due to competition from substitutes and volatility in raw material costs. Substitute materials such as expanded polyethylene (EPE) foam, polyurethane foam, polystyrene foam, mineral wool, and emerging bio-based insulation solutions provide strong alternatives with distinct advantages. Many offers superior fire resistance, acoustic performance, and sustainability benefits, making them increasingly attractive in applications like construction, automotive, and packaging. For instance, EPE foam is gaining traction for its lightweight cushioning and eco-friendly appeal, while polyurethane foams and mineral wool are widely used where fire safety and energy efficiency are critical. This competitive landscape limits polyethylene insulation’s pricing power and adoption in specialized markets. Raw material volatility intensifies challenges. Since polyethylene is derived from petrochemical feedstocks, crude oil and natural gas price fluctuations directly impact resin costs. Geopolitical tensions, such as the Russia-Ukraine conflict, and supply chain disruptions in 2024–2025 have caused sharp price hikes, raised production costs and reduced margins. Additionally, regulatory pressures promoting recycled or bio-based materials push manufacturers to consider alternatives. These combined factors create economic and operational hurdles, restraining polyethylene insulation’s growth and encouraging diversification toward more sustainable and cost-stable insulation solutions. High Production Costs, Environmental Concerns and Technical Barriers to Challenge the Polyethylene Insulation Materials Market Growth Polyethylene insulation material has a high manufacturing cost, which translates to a high cost of completed items. Second, the raw material utilized in the manufacture of polyethylene insulation material is expensive. Because of the high precision of temperature control required in their fabrication, these materials need highly trained personnel. There is currently no substitute for lowering the cost of producing polyethylene insulation materials. These are the primary restraints that will have an impact on the polyethylene Insulation materials market in future. Producing polyethylene insulation material consumes a lot of energy and produces a lot of CO2, a greenhouse gas that contributes to global warming and climate change. Polyethylene insulation takes a long time to degrade and found in landfills for decades. Incineration is the only way to get rid of polyethylene insulation material without emitting dangerous gases. Though the majority of plastic polymers can be recycled technically, there are many different varieties to filter through, which is time-consuming and costly. These are the primary restraints that have an impact on the polyethylene Insulation materials market.Polyethylene Insulation Materials Market Segment Analysis

Based on Type, the Polyethylene Insulation Materials Market is segmented into the High-Density Polyethylene, Low-Density Polyethylene, Linear Low-Density Polyethylene and Others High-Density Polyethylene category dominated the polyethylene insulation materials market in 2024.HDPE is a durable and cost-effective polyethylene. It is produced at a lower temperature and under lower pressure. High tensile strength, weather and water resistance, translucency, high toughness at low temperatures, and chemical resistance are all advantages of HDPE. It possesses good resistance to solvents, dilutes acids, alkalis, and alcohols, as well as a moderate resistance to oils and greases. It has excellent electrical insulation characteristics. HDPE found in a wide range of items. Crates, trays, ice boxes, and caps on bottles, drums, and bulk containers are just a few of the packaging applications. HDPE is used to make one-third of all toys in the world. HDPE is often utilized to manufacture pipes because of its durability and chemical resistance.

Polyethylene Insulation Materials Market Regional Analysis

Europe dominated Polyethylene Insulation Materials Market in 2024, supported by strong construction activity, strict energy efficiency regulations, and advanced manufacturing capabilities. The region’s emphasis on sustainable infrastructure development, particularly in Germany, France, and the UK, has created significant demand for effective insulation solutions. Rapid growth in residential, commercial, and industrial construction, coupled with government-backed energy renovation programs, has further boosted the adoption of polyethylene insulation. The European Union’s stringent directives, such as the Energy Performance of Buildings Directive (EPBD), mandate high thermal insulation standards to reduce energy consumption and carbon emissions. This regulatory framework has positioned polyethylene insulation as a preferred choice due to its superior thermal resistance, moisture control, and ease of installation. Additionally, rising environmental awareness and consumer preference for recyclable and energy-efficient products continue to reinforce demand. Technological innovation has also played a crucial role in Europe’s leadership. Manufacturers in the region are introducing advanced polyethylene insulation products, including flame-retardant, UV-resistant, and high-performance variants, to cater to construction and electrical applications. Well-established players such as BASF SE, Saint-Gobain S.A., Evonik Industries, and Sika AG drive market growth through sustainable product portfolios and robust supply chains. Germany leads the regional market, with a strong construction sector and substantial investments in energy efficiency, recording a market volume of 159.12 kilo tonnes in LDPE insulation in 2023. France and the UK are witnessing steady growth, driven by infrastructure upgrades and green building initiatives. Polyethylene Insulation Materials Market Competitive Landscape The polyethylene insulation materials market is driven significantly by regulatory policies promoting energy efficiency and sustainable construction across major regions. In the U.S., the Department of Energy enforces strict insulation standards, while the European Union’s Energy Performance of Buildings Directive (EPBD) mandates high thermal performance. Similarly, China’s “14th Five-Year Plan” prioritizes advanced insulation materials to reduce energy consumption. These initiatives have intensified competition among leading players. Dow Inc. (USA) maintains a leadership position through strong R&D, developing high-performance polyethylene insulation solutions tailored for construction and industrial applications. ExxonMobil Corporation (USA) leverages its robust supply chain and advanced polymer technologies to secure a competitive edge across global markets. LyondellBasell Industries (Netherlands) focuses on sustainable polyethylene innovations, aligning with circular economy goals. BASF SE (Germany) strengthens its position with a diversified product portfolio and global presence, serving multiple industries. Together, these players drive innovation, sustainability, and global market penetration. Polyethylene Insulation Materials Market Key TrendsPolyethylene Insulation Materials Market Recent Developments In June 20, 2024, Dow announced the acquisition of Circulus, a North American polyethylene recycler, to strengthen its mechanical recycling portfolio. The deal includes two facilities in Oklahoma and Alabama with a combined annual capacity of 50,000 metric tons of post-consumer resin. This move supports Dow’s 2030 “Transform the Waste” goal.

Key Trend Market Implication Bio-based polyethylene insulation Rising demand due to stringent environmental regulations in Europe and North America. Recyclable insulation materials Increased adoption in the automotive and packaging sectors to meet circular economy goals. Flame-retardant innovations Growth in industrial and construction applications for safety compliance. Expansion in emerging markets Companies investing in Asia and South America due to booming construction activities. Lightweight insulation for EVs Higher demand from electric vehicle manufacturers for battery thermal management. Polyethylene Insulation Materials Market Scope: Inquiry Before Buying

Global Polyethylene Insulation Materials Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 21.6 Bn. Forecast Period 2025 to 2032 CAGR: 7.8% Market Size in 2032: USD 39.39 Bn. Segments Covered: by Type High-Density Polyethylene Low-Density Polyethylene Linear Low-Density Polyethylene Others by Application Wires & Cables Packaging Consumers Goods Pipes & Fittings Roof & Wall Insulation Others Polyethylene Insulation Materials Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Polyethylene Insulation Materials Market, Key Players

North America 1. Dow Inc. (USA) 2. ExxonMobil Corporation (USA) 3. DuPont de Nemours, Inc. (USA) 4. Chevron Phillips Chemical Company (USA) 5. Westlake Chemical Corporation (USA) 6. Huntsman Corporation (USA) 7. Celanese Corporation (USA) Europe 8. LyondellBasell Industries (Netherlands) 9. BASF SE (Germany) 10. Borealis AG (Austria) 11. SABIC (Saudi Arabia, with major operations in Europe) 12. INEOS Group (UK) 13. Solvay SA (Belgium) 14. Arkema SA (France) Asia Pacific 15. LG Chem (South Korea) 16. Mitsui Chemicals, Inc. (Japan) 17. Sumitomo Chemical Co., Ltd. (Japan) 18. Sinopec (China) 19. Reliance Industries Limited (India) 20. Formosa Plastics Corporation (Taiwan) 21. Hanwha Solutions (South Korea) Middle East & Africa 22. Saudi Basic Industries Corporation (SABIC) (Saudi Arabia) 23. Borouge (UAE) 24. Qatar Petrochemical Company (QAPCO) (Qatar) South America 25. Braskem SA (Brazil) 26. Petroquimica Suape (Brazil) 27. Mexichem (Mexico)Frequently Asked Questions

1. Which region has the largest share in the Global Polyethylene Insulation Materials Market? Ans: The Europe region held the highest share in 2024. 2. What is the growth rate of the Global Polyethylene Insulation Materials Market? Ans: The Global Polyethylene Insulation Materials Market is growing at a CAGR of 7.8% during the forecasting period 2025-2032 3. What is scope of the Global Polyethylene Insulation Materials Market report? Ans: Global Polyethylene Insulation Materials Market report helps with the PESTEL, Porter's, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Polyethylene Insulation Materials Market? Ans: The important key players in the Global Polyethylene Insulation Materials Market include Dow, ExxonMobil, LyondellBasell, and Borealis due to advanced product offerings and global manufacturing capabilities. 5. What is the study period of this Market? Ans: The Global Polyethylene Insulation Materials Market is studied from 2025 to 2032.

1. Polyethylene Insulation Materials Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Polyethylene Insulation Materials Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Polyethylene Insulation Materials Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Polyethylene Insulation Materials Market: Dynamics 3.1. Polyethylene Insulation Materials Market Trends by Region 3.1.1. North America Polyethylene Insulation Materials Market Trends 3.1.2. Europe Polyethylene Insulation Materials Market Trends 3.1.3. Asia Pacific Polyethylene Insulation Materials Market Trends 3.1.4. Middle East and Africa Polyethylene Insulation Materials Market Trends 3.1.5. South America Polyethylene Insulation Materials Market Trends 3.2. Polyethylene Insulation Materials Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Polyethylene Insulation Materials Market Drivers 3.2.1.2. North America Polyethylene Insulation Materials Market Restraints 3.2.1.3. North America Polyethylene Insulation Materials Market Opportunities 3.2.1.4. North America Polyethylene Insulation Materials Market Challenges 3.2.2. Europe 3.2.2.1. Europe Polyethylene Insulation Materials Market Drivers 3.2.2.2. Europe Polyethylene Insulation Materials Market Restraints 3.2.2.3. Europe Polyethylene Insulation Materials Market Opportunities 3.2.2.4. Europe Polyethylene Insulation Materials Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Polyethylene Insulation Materials Market Drivers 3.2.3.2. Asia Pacific Polyethylene Insulation Materials Market Restraints 3.2.3.3. Asia Pacific Polyethylene Insulation Materials Market Opportunities 3.2.3.4. Asia Pacific Polyethylene Insulation Materials Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Polyethylene Insulation Materials Market Drivers 3.2.4.2. Middle East and Africa Polyethylene Insulation Materials Market Restraints 3.2.4.3. Middle East and Africa Polyethylene Insulation Materials Market Opportunities 3.2.4.4. Middle East and Africa Polyethylene Insulation Materials Market Challenges 3.2.5. South America 3.2.5.1. South America Polyethylene Insulation Materials Market Drivers 3.2.5.2. South America Polyethylene Insulation Materials Market Restraints 3.2.5.3. South America Polyethylene Insulation Materials Market Opportunities 3.2.5.4. South America Polyethylene Insulation Materials Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Polyethylene Insulation Materials Industry 3.8. Analysis of Government Schemes and Initiatives For Polyethylene Insulation Materials Industry 3.9. Polyethylene Insulation Materials Market Trade Analysis 3.10. The Global Pandemic Impact on Polyethylene Insulation Materials Market 4. Polyethylene Insulation Materials Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 4.1.1. High-Density Polyethylene 4.1.2. Low-Density Polyethylene 4.1.3. Linear Low-Density Polyethylene 4.1.4. Others 4.2. Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 4.2.1. Wires & Cables 4.2.2. Packaging 4.2.3. Consumers Goods 4.2.4. Pipes & Fittings 4.2.5. Roof & Wall Insulation 4.2.6. Others 4.3. Polyethylene Insulation Materials Market Size and Forecast, by Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Polyethylene Insulation Materials Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 5.1.1. High-Density Polyethylene 5.1.2. Low-Density Polyethylene 5.1.3. Linear Low-Density Polyethylene 5.1.4. Others 5.2. North America Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 5.2.1. Wires & Cables 5.2.2. Packaging 5.2.3. Consumers Goods 5.2.4. Pipes & Fittings 5.2.5. Roof & Wall Insulation 5.2.6. Others 5.3. North America Polyethylene Insulation Materials Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 5.3.1.1.1. High-Density Polyethylene 5.3.1.1.2. Low-Density Polyethylene 5.3.1.1.3. Linear Low-Density Polyethylene 5.3.1.1.4. Others 5.3.1.2. United States Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 5.3.1.2.1. Wires & Cables 5.3.1.2.2. Packaging 5.3.1.2.3. Consumers Goods 5.3.1.2.4. Pipes & Fittings 5.3.1.2.5. Roof & Wall Insulation 5.3.1.2.6. Others 5.3.2. Canada 5.3.2.1. Canada Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 5.3.2.1.1. High-Density Polyethylene 5.3.2.1.2. Low-Density Polyethylene 5.3.2.1.3. Linear Low-Density Polyethylene 5.3.2.1.4. Others 5.3.2.2. Canada Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 5.3.2.2.1. Wires & Cables 5.3.2.2.2. Packaging 5.3.2.2.3. Consumers Goods 5.3.2.2.4. Pipes & Fittings 5.3.2.2.5. Roof & Wall Insulation 5.3.2.2.6. Others 5.3.3. Mexico 5.3.3.1. Mexico Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 5.3.3.1.1. High-Density Polyethylene 5.3.3.1.2. Low-Density Polyethylene 5.3.3.1.3. Linear Low-Density Polyethylene 5.3.3.1.4. Others 5.3.3.2. Mexico Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 5.3.3.2.1. Wires & Cables 5.3.3.2.2. Packaging 5.3.3.2.3. Consumers Goods 5.3.3.2.4. Pipes & Fittings 5.3.3.2.5. Roof & Wall Insulation 5.3.3.2.6. Others 6. Europe Polyethylene Insulation Materials Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 6.2. Europe Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 6.3. Europe Polyethylene Insulation Materials Market Size and Forecast, by Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 6.3.1.2. United Kingdom Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 6.3.2. France 6.3.2.1. France Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 6.3.2.2. France Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 6.3.3. Germany 6.3.3.1. Germany Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 6.3.3.2. Germany Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 6.3.4. Italy 6.3.4.1. Italy Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 6.3.4.2. Italy Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 6.3.5. Spain 6.3.5.1. Spain Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 6.3.5.2. Spain Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 6.3.6.2. Sweden Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 6.3.7. Austria 6.3.7.1. Austria Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 6.3.7.2. Austria Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 6.3.8.2. Rest of Europe Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Polyethylene Insulation Materials Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 7.3. Asia Pacific Polyethylene Insulation Materials Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 7.3.1.2. China Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 7.3.2.2. S Korea Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 7.3.3.2. Japan Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 7.3.4. India 7.3.4.1. India Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 7.3.4.2. India Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 7.3.5.2. Australia Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 7.3.6.2. Indonesia Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 7.3.7. Malaysia 7.3.7.1. Malaysia Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 7.3.7.2. Malaysia Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 7.3.8. Vietnam 7.3.8.1. Vietnam Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 7.3.8.2. Vietnam Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 7.3.9. Taiwan 7.3.9.1. Taiwan Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 7.3.9.2. Taiwan Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 7.3.10.2. Rest of Asia Pacific Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Polyethylene Insulation Materials Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 8.3. Middle East and Africa Polyethylene Insulation Materials Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 8.3.1.2. South Africa Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 8.3.2.2. GCC Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 8.3.3. Nigeria 8.3.3.1. Nigeria Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 8.3.3.2. Nigeria Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 8.3.4.2. Rest of ME&A Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 9. South America Polyethylene Insulation Materials Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 9.2. South America Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 9.3. South America Polyethylene Insulation Materials Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 9.3.1.2. Brazil Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 9.3.2.2. Argentina Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Polyethylene Insulation Materials Market Size and Forecast, by Type (2024-2032) 9.3.3.2. Rest Of South America Polyethylene Insulation Materials Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Dow Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. ExxonMobil Corporation (USA) 10.3. DuPont de Nemours, Inc. (USA) 10.4. Chevron Phillips Chemical Company (USA) 10.5. Westlake Chemical Corporation (USA) 10.6. Huntsman Corporation (USA) 10.7. Celanese Corporation (USA) 10.8. LyondellBasell Industries (Netherlands) 10.9. BASF SE (Germany) 10.10. Borealis AG (Austria) 10.11. SABIC (Saudi Arabia, with major operations in Europe) 10.12. INEOS Group (UK) 10.13. Solvay SA (Belgium) 10.14. Arkema SA (France) 10.15. LG Chem (South Korea) 10.16. Mitsui Chemicals, Inc. (Japan) 10.17. Sumitomo Chemical Co., Ltd. (Japan) 10.18. Sinopec (China) 10.19. Reliance Industries Limited (India) 10.20. Formosa Plastics Corporation (Taiwan) 10.21. Hanwha Solutions (South Korea) 10.22. Saudi Basic Industries Corporation (SABIC) (Saudi Arabia) 10.23. Borouge (UAE) 10.24. Qatar Petrochemical Company (QAPCO) (Qatar) 10.25. Braskem SA (Brazil) 10.26. Petroquimica Suape (Brazil) 10.27. Mexichem (Mexico) 11. Key Findings 12. Industry Recommendations 13. Polyethylene Insulation Materials Market: Research Methodology 14. Terms and Glossary