Optical Sensors Market size was valued at USD 23.04 Bn. in 2024 and the total Global Optical Sensors Market revenue is expected to grow at a CAGR of 11.4% from 2025 to 2032, reaching nearly USD 54.65 Bn. by 2032.Optical Sensors Market Overview:

Optical sensor is a device that detects and measures light and converts it into an electrical signal. These sensors are widely used in applications across automotive, consumer electronics, industrial, healthcare, and environmental monitoring sectors due to their high precision, non-contact sensing capability, and reliability. Optical sensor market growth has been contributing to market growth by increasing smart devices, automation in industrial processes, and environmental sensing and monitoring applications and increasing the growth in IOT ecological mechanisms and wearable devices and increasing the growth of optical sensors. Asia Pacific dominated the optical sensors market due to high electronics production, increasing investments in industrial automation, and robust demand from countries like China, Japan, and South Korea. North America follows closely, driven by advanced R&D, strong presence of sensor technology firms, and increasing adoption in defense and healthcare sectors. Top key players such as Hamamatsu Photonics, STMicroelectronics, ams-OSRAM, and TE Connectivity are competing by technological innovation, miniaturization, sensor fusion capabilities, and integration with AI and edge computing platforms. These firms are evolving to offer high-performance, power-efficient, and multifunctional optical sensors to maintain a competitive advantage. Report covers the optical sensors market dynamics, structure by analyzing the market segments and projecting optical sensors market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies and regional presence in optical sensors market.To know about the Research Methodology :- Request Free Sample Report The rising demand for wearable devices, autonomous vehicles, and smart home systems further propels market expansion. Recent developments by market key players underscore the dynamic nature of the market, with companies such as Texas Instruments, AMS AG, and Broadcom introducing innovative optical sensor solutions for diverse applications. For example, Texas Instruments launched a new optical sensor portfolio for industrial automation, automotive, and consumer electronics applications, offering high precision and reliability. Similarly, AMS AG introduced advanced spectral sensors for mobile devices, enabling accurate color measurement and ambient light sensing, catering to the growing demand for enhanced display performance and camera capabilities in smartphones and tablets. These developments reflect the market's trajectory towards higher performance, integration, and application-specific solutions, driving continued growth and innovation in the market.

Optical Sensors Market Dynamics:

Rising Demand in Consumer Electronics Driving market Growth

The rising integration of optical sensors in smartphones, wearables, and smart home devices, such as optical fingerprint sensors developed by companies such as Synaptics, enhances security and convenience, thus boosting the growth of market. The automotive industry's adoption of optical sensors for applications such as LiDAR and driver monitoring systems, as seen in Velodyne Lidar's advanced sensors for autonomous vehicles, not only improves safety but also drives market demand. Additionally, advancements in healthcare technologies, exemplified by Masimo's optical sensors for pulse oximeters, contribute to accurate and real-time monitoring, expanding the market within the healthcare segment. The growth of industrial automation, driven by companies like Cognex Corporation providing machine vision systems equipped with optical sensors, enhances efficiency and productivity in manufacturing, driving market growth. The emergence of IoT devices, incorporating optical sensors for environmental monitoring and smart home applications offered by companies like Bosch Sensortec, also significantly contributes to market expansion. Similarly, the demand for biometric security solutions, supported by Idex Biometrics' development of fingerprint sensors based on optical technology, drives market growth in the biometrics segment. Moreover, optical sensors' increasing applications in aerospace and defense, environmental monitoring requirements, advancements in display technologies, and the expansion of VR and AR applications further contribute to the market's robust growth trajectory.Alternative Technologies and Sensor Miniaturization Pose Challenges to Optical Sensors Market Growth

The high cost of optical sensors hindering adoption of Optical Sensors, particularly in price-sensitive markets. For instance, the cost of advanced LiDAR sensors, like those used in autonomous vehicles, can be prohibitive for widespread deployment, hindering market growth. Technological complexity adds to the challenges, as developing and calibrating optical sensors for precise applications like environmental monitoring demands specialized knowledge, slowing down product development and deployment processes. Limited standardization poses challenges for integration and interoperability, complicating the adoption of optical sensors into existing systems. Regulatory compliance requirements, particularly stringent in industries like healthcare and automotive, also hinder market growth by delaying product launch timelines and increasing compliance costs. Performance variability in optical sensors due to environmental factors and material properties poses challenges, particularly in applications requiring precise measurements such as LiDAR for autonomous vehicles, impacting safety and performance. Competition from alternative technologies such as radar and ultrasonic sensors, along with miniaturization challenges for meeting the demands of wearables and IoT devices, further complicate the market landscape. Environmental limitations, data security concerns in biometric applications, and limited awareness among end-users about the benefits of optical sensors also contribute to the growth challenges faced by the market. Addressing these challenges requires innovative solutions, industry collaboration, and concerted efforts to educate potential customers about the value proposition of optical sensor technologies.Optical Sensors Segment Analysis:

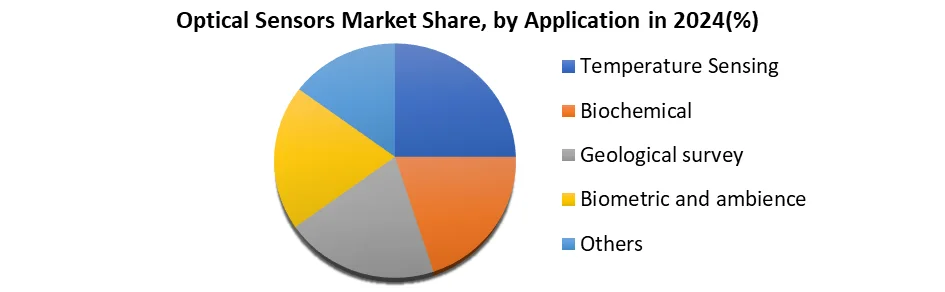

Based on Application, Temperature sensing Optical Sensors dominated the Market in 2024, they have widespread adoption across industries such as automotive, aerospace, and consumer electronics for monitoring and controlling temperature in various environments. Biochemical sensors find extensive use in healthcare for applications like glucose monitoring and DNA sequencing, driving adoption in medical diagnostics and research. Geological survey applications utilize optical sensors for remote sensing and environmental monitoring, particularly in geological exploration and natural disaster management. Biometric and ambience sensing applications encompass security systems, smart homes, and wearable devices, leveraging optical sensors for fingerprint recognition, gesture detection, and ambient light sensing. While temperature sensing and biochemical applications demonstrate high adoption due to their established utility in diverse industries, geological survey and biometric/ambience sensing applications show promise for growth, driven by advancements in sensor technology and expanding applications in emerging sectors like IoT and biometrics.

Optical Sensors Market Regional Insights:

Asia Pacific dominated the Market in 2024 and is expected to dominate during the forecast period (2025-2032)

Asia dominated the Optical Sensors Market in 2024, particularly China is emerging as a large producing region, with a significant number of optical sensor manufacturers contributing to the global supply chain. Companies like Hikvision and Sunny Optical Technology Group are leading players in the region, driving production volumes and technological advancements. North America and Europe stand out as large utilizing regions for Optical Sensors, benefiting from robust demand across various industries, including automotive, healthcare, and consumer electronics. Optical Sensors Market leaders like Texas Instruments and AMS AG contribute to the market's growth in these regions through innovative sensor solutions catering to diverse applications. Regional import-export data reveals intricate supply chain dynamics, with regions like North America importing optical sensors from East Asia to meet domestic demand while simultaneously exporting high-value-added sensor solutions to other markets. For example, North American companies such as FLIR Systems export thermal imaging sensors globally, showcasing the region's role in the optical sensor trade landscape. Similarly, Europe imports optical sensors for applications like automotive safety systems and exports advanced sensors for aerospace and defense applications. These regional insights underscore the interconnectedness of the global market and the importance of understanding regional dynamics for market participants to capitalize on growth opportunities.Optical Sensors Market Competitive Landscape

Top key players such as Hamamatsu Photonics K.K., STMicroelectronics, ams-OSRAM AG, and TE Connectivity are driving innovation through advanced photonic engineering, miniaturization, and smart integration with digital ecosystems. These global leaders are investing in the next generation optical sensing technologies that provide high sensitivity, real -time data acquisition and integration in complex systems in motor vehicle, industrial automation, healthcare and consumer electronics sectors. Hamamatsu Photonics K.K. known for its complete set of high-precision photodiodes and spectrometers are demanding applications in medical diagnostics, scientific instrumentation, and industrial monitoring. STMicroelectronics is known for its robust portfolio of optical sensors integrated into smartphones, automotive driver-assist systems, and industrial automation platforms. With a major focus on scalability and energy efficiency, the company develops smart sensors enabled with AI and edge computing capabilities to meet the growing demand for real-time sensing and analytics. These players continue to shape the competitive landscape through continuous R&D, AI-competent signal processing, and IOT, AR/VR, and healthcare tech providers. Their strategic status focuses on expanding the application range, improving sensor intelligence and aligning with global changes to compact, multifunctional and connected optical sensing solutions.Optical Sensors Market Trends

Photonics & Silicon Integration for AI & Data Centers Ultra-fast optical detectors- TDK unveiled a “spin photo detector” achieving 20-picosecond response times, targeting generative AI and data-center interconnects, with prototype samples expected in 2026. Surge in 3D Sensing & Photoelectric Solutions 3D sensing growth-From robotics and logistics to automotive production, 3D photoelectric sensors (time-of-flight, structured light) are rapidly gaining traction for high-precision spatial mapping. IoT, Wearables & Healthcare Medical-grade wearables- Optical sensors powering pulse oximeters, continuous glucose monitors, and non-invasive health trackers are rapidly expanding in telehealth.Optical Sensors Market Recent Developments

• February 20, 2025, STMicroelectronics, in collaboration with Amazon Web Services (AWS), unveiled an advanced photonics chip for AI data centers. This chip uses light-based transceivers to boost communication speed and reduce power usage in optical modules, with mass production slated at its Crolles plant, France, later in 2025. • January 28, 2025, ams OSRAM AG at SPIE Photonics West 2025 in San Francisco, ams OSRAM showcased its Mira016 low-power, high-quantum-efficiency CMOS NIR image sensor (2D/3D sensing), alongside optical force-sensing modules that enable sleek, touchless control surfaces. • On May 31, 2024, Hamamatsu Photonics completed acquisition of NKT Photonics, merging detectors and high-performance lasers/fiber to bolster quantum, semiconductor metrology, and hyperspectral imaging capabilities.Optical Sensors Market Scope: Inquire before buying

Global Optical Sensors Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 23.04 Bn Forecast Period 2025 to 2032 CAGR: 11.4% Market Size in 2032: USD 54.65 Bn. Segments Covered: by Type Intrinsic Extrinsic by Application Temperature sensing Biochemical Geological survey Biometric and ambience by End-user Oil & gas Aerospace Consumer electronics Medical Others Optical Sensors by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Optical Sensors Key Players are:

North America 1. TE Connectivity (United States) 2. Texas Instruments Inc. (United States) 3. ON Semiconductor (United States) 4. Analog Devices, Inc. (United States) 5. Rockley Photonics (United States) 6. Luna Innovations Inc. (United States) 7. Broadcom Inc. (United States) 8. NeoPhotonics Corporation (United States) Europe 11. ams-OSRAM AG (Austria) 12. STMicroelectronics (Switzerland) 13. First Sensor AG (Germany) 14. Thorlabs, Inc. (Germany) 15. Jenoptik AG (Germany) 16. Zeiss Group (Germany) 17. Alphasense Ltd. (United Kingdom) Asia-Pacific 21. Hamamatsu Photonics K.K. (Japan) 22. Rohm Semiconductor (Japan) 23. Sharp Corporation (Japan) 24. Sony Corporation (Japan) 25. Panasonic Holdings Corporation (Japan) 26. Samsung Electronics Co., Ltd. (South Korea) 27. LG Innotek Co., Ltd. (South Korea) 28. Omron Corporation (Japan)FAQs:

1. Which region has the largest share in the Optical Sensors Market? Ans: The Asia Pacific region held the highest share in 2024 in the Optical Sensors Market. 2. What are the key factors driving the growth of the Optical Sensors Market? Ans: Rising Demand in Consumer Electronics Driving Optical Sensors Market Growth. 3. Who are the key competitors in the Optical Sensors Market? Ans: Hamamatsu Photonics K.K., STMicroelectronics, ams-OSRAM AG, and TE Connectivity are the key competitors in the Optical Sensors Market. 4. What are the opportunities for the Optical Sensors Market? Ans: Expansion of Smart Devices & Wearables creates opportunities in the Optical Sensors Market. 5. Which application segment dominates the Optical Sensors Market? Ans: The Temperature Sensing Optical Sensors segment dominated the Optical Sensors Market.

1. Optical Sensors Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Optical Sensors Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Optical Sensors Market: Dynamics 3.1. Region wise Trends of Optical Sensors Market 3.1.1. North America Optical Sensors Market Trends 3.1.2. Europe Optical Sensors Market Trends 3.1.3. Asia Pacific Optical Sensors Market Trends 3.1.4. Middle East and Africa Optical Sensors Market Trends 3.1.5. South America Optical Sensors Market Trends 3.2. Optical Sensors Market Dynamics 3.2.1. Optical Sensors Market Drivers 3.2.1.1. Growth in smart devices 3.2.1.2. Medical sensing adoption 3.2.2. Optical Sensors Market Restraints 3.2.3. Optical Sensors Market Opportunities 3.2.3.1. Wearables and health monitoring 3.2.3.2. ADAS and LiDAR in vehicles 3.2.4. Optical Sensors Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Rising investments in automotive automation 3.4.2. Shift toward smart and connected lifestyles 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Optical Sensors Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Optical Sensors Market Size and Forecast, By Type (2024-2032) 4.1.1. Intrinsic 4.1.2. Extrinsic 4.2. Optical Sensors Market Size and Forecast, By Application (2024-2032) 4.2.1. Temperature sensing 4.2.2. Biochemical 4.2.3. Geological survey 4.2.4. Biometric and ambience 4.3. Optical Sensors Market Size and Forecast, By End-user (2024-2032) 4.3.1. Oil & gas 4.3.2. Aerospace 4.3.3. Consumer electronics 4.3.4. Medical 4.3.5. Others 4.4. Optical Sensors Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Optical Sensors Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Optical Sensors Market Size and Forecast, By Type (2024-2032) 5.1.1. Intrinsic 5.1.2. Extrinsic 5.2. North America Optical Sensors Market Size and Forecast, By Application (2024-2032) 5.2.1. Temperature sensing 5.2.2. Biochemical 5.2.3. Geological survey 5.2.4. Biometric and ambience 5.3. North America Optical Sensors Market Size and Forecast, By End-user (2024-2032) 5.3.1. Oil & gas 5.3.2. Aerospace 5.3.3. Consumer electronics 5.3.4. Medical 5.3.5. Others 5.4. North America Optical Sensors Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Optical Sensors Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. Intrinsic 5.4.1.1.2. Extrinsic 5.4.1.2. United States Optical Sensors Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. Temperature sensing 5.4.1.2.2. Biochemical 5.4.1.2.3. Geological survey 5.4.1.2.4. Biometric and ambience 5.4.1.3. Others United States Optical Sensors Market Size and Forecast, By End-user (2024-2032) 5.4.1.3.1. Oil & gas 5.4.1.3.2. Aerospace 5.4.1.3.3. Consumer electronics 5.4.1.3.4. Medical 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Optical Sensors Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. Intrinsic 5.4.2.1.2. Extrinsic 5.4.2.2. Canada Optical Sensors Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1. Temperature sensing 5.4.2.2.2. Biochemical 5.4.2.2.3. Geological survey 5.4.2.2.4. Biometric and ambience 5.4.2.3. Canada Optical Sensors Market Size and Forecast, By End-user (2024-2032) 5.4.2.3.1. Oil & gas 5.4.2.3.2. Aerospace 5.4.2.3.3. Consumer electronics 5.4.2.3.4. Medical 5.4.2.3.5. Others 5.4.2.4. Mexico Optical Sensors Market Size and Forecast, By Type (2024-2032) 5.4.2.4.1. Intrinsic 5.4.2.4.2. Extrinsic 5.4.2.5. Mexico Optical Sensors Market Size and Forecast, By Application (2024-2032) 5.4.2.5.1. Temperature sensing 5.4.2.5.2. Biochemical 5.4.2.5.3. Geological survey 5.4.2.5.4. Biometric and ambience 5.4.2.6. Mexico Optical Sensors Market Size and Forecast, By End-user (2024-2032) 5.4.2.6.1. Oil & gas 5.4.2.6.2. Aerospace 5.4.2.6.3. Consumer electronics 5.4.2.6.4. Medical 5.4.2.6.5. Others 6. Europe Optical Sensors Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Optical Sensors Market Size and Forecast, By Type (2024-2032) 6.2. Europe Optical Sensors Market Size and Forecast, By Application (2024-2032) 6.3. Europe Optical Sensors Market Size and Forecast, By End-user (2024-2032) 6.4. Europe Optical Sensors Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Optical Sensors Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Optical Sensors Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Optical Sensors Market Size and Forecast, By End-user (2024-2032) 6.4.2. France 6.4.2.1. France Optical Sensors Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Optical Sensors Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Optical Sensors Market Size and Forecast, By End-user (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Optical Sensors Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Optical Sensors Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Optical Sensors Market Size and Forecast, By End-user (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Optical Sensors Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Optical Sensors Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Optical Sensors Market Size and Forecast, By End-user (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Optical Sensors Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Optical Sensors Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Optical Sensors Market Size and Forecast, By End-user (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Optical Sensors Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Optical Sensors Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Optical Sensors Market Size and Forecast, By End-user (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Optical Sensors Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Austria Optical Sensors Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Optical Sensors Market Size and Forecast, By End-user (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Optical Sensors Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Optical Sensors Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7. Asia Pacific Optical Sensors Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7.4. Asia Pacific Optical Sensors Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7.4.4. India 7.4.4.1. India Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Philippines Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Malaysia Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Vietnam Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Thailand Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Optical Sensors Market Size and Forecast, By End-user (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Optical Sensors Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Optical Sensors Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Optical Sensors Market Size and Forecast, By End-user (2024-2032) 8. Middle East and Africa Optical Sensors Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Optical Sensors Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Optical Sensors Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Optical Sensors Market Size and Forecast, By End-user (2024-2032) 8.4. Middle East and Africa Optical Sensors Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Optical Sensors Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Optical Sensors Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Optical Sensors Market Size and Forecast, By End-user (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Optical Sensors Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Optical Sensors Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Optical Sensors Market Size and Forecast, By End-user (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Optical Sensors Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Nigeria Optical Sensors Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Optical Sensors Market Size and Forecast, By End-user (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Optical Sensors Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Rest of ME&A Optical Sensors Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Optical Sensors Market Size and Forecast, By End-user (2024-2032) 9. South America Optical Sensors Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Optical Sensors Market Size and Forecast, By Type (2024-2032) 9.2. South America Optical Sensors Market Size and Forecast, By Application (2024-2032) 9.3. South America Optical Sensors Market Size and Forecast, By End-user (2024-2032) 9.4. South America Optical Sensors Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Optical Sensors Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Optical Sensors Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Optical Sensors Market Size and Forecast, By End-user (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Optical Sensors Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Optical Sensors Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Optical Sensors Market Size and Forecast, By End-user (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Optical Sensors Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Rest of South America Optical Sensors Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Optical Sensors Market Size and Forecast, By End-user (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1 TE Connectivity 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2 Texas Instruments Inc. 10.3 ON Semiconductor 10.4 Analog Devices, Inc. 10.5 Rockley Photonics 10.6 Luna Innovations Inc. 10.7 Broadcom Inc. 10.8 NeoPhotonics Corporation 10.9 ams-OSRAM AG 10.10 STMicroelectronics 10.11 First Sensor AG 10.12 Thorlabs, Inc. 10.13 Jenoptik AG 10.14 Zeiss Group 10.15 Alphasense Ltd. 10.16 Hamamatsu Photonics K.K. 10.17 Rohm Semiconductor 10.18 Sharp Corporation 10.19 Sony Corporation 10.20 Panasonic Holdings Corporation 10.21 Samsung Electronics Co., Ltd. 10.22 LG Innotek Co., Ltd. 10.23 Omron Corporation 10 Key Findings 11 Analyst Recommendations 12 Optical Sensors Market: Research Methodology