Global Nuclear Decommissioning Services Market size is forecasted to grow at a CAGR of 5.3% during 2024-2030 from USD 7.56 Bn in 2023 to USD 15.89 Bn by 2030.Nuclear Decommissioning Services Market Overview

A detailed description of the factors and market trends pertaining to different regions is given in detail in the report. The Nuclear Decommissioning Services Market refers to the process of safely shutting down and dismantling nuclear power plants or facilities that are no longer operational or are reaching the end of their operational life. This process involves the removal of radioactive materials, decontamination of the site, and the management of radioactive waste.To know about the Research Methodology :- Request Free Sample Report The Nuclear Decommissioning Services Market has gained prominence in recent years due to the increasing number of aging nuclear power plants and the growing focus on clean and sustainable energy sources. The market for nuclear decommissioning encompasses a range of services, including planning, project management, engineering, decontamination, waste management, and site restoration. Specialized companies with expertise in nuclear engineering, radiation protection, and waste management play a key role in providing these services. Government regulations and guidelines govern the decommissioning process, ensuring compliance with safety standards and the proper management of radioactive waste. This report offers a comprehensive analysis of the global market for Nuclear Decommissioning, featuring both qualitative and quantitative insights. The report is designed to provide valuable insights to help the companies already in the business develop effective growth strategies, analyze the competitive landscape, evaluate their position in the market, and make informed business decisions, as well as also help new entrants take strategic decisions regarding Nuclear Decommissioning Services Market. The report will further be valuable to other key stakeholders like suppliers, distributors, and industry participants, offering them insights into the market's revenue, production, and pricing trends and market share analysis across different segments and regions. Nuclear Decommissioning Services Market Research Methodology: The research conducted for the Nuclear Decommissioning Services Market utilized both primary and secondary data sources to ensure that all possible factors affecting the market were thoroughly examined and validated. The market size for top-level markets and sub-segments is normalized and the impact of inflation, economic downturns, regulatory & policy changes, and other variables is factored into the market forecast. The bottom-up approach and multiple data triangulation methodologies are used to estimate the market size and forecasts. The percentage splits, market shares, and breakdowns of the segments are derived based on weights assigned to each of the segments on their utilization rate and average sale price. The country-wise analysis of the overall market and its sub-segments are based on the percentage adoption or utilization of the given market Size in the respective region or country. Major players in the market are identified through secondary research based on indicators that include market revenue, price, services offered, advancements, mergers and acquisitions, and joint. Extensive primary research was conducted to acquire information and verify and confirm the crucial numbers arrived at after comprehensive market engineering and calculations for market statistics, market size estimations, market forecasts, market breakdown, and data triangulation.

Nuclear Decommissioning Services Market Dynamics

Nuclear Decommissioning Services Market Drivers: The Nuclear Decommissioning Services Market is driven by several factors that shape its growth and development. One of the key drivers is the increasing number of aging nuclear power plants worldwide. Many of these plants are reaching the end of their operational life and need to be safely shut down and dismantled. For instance, in the United States, there are over 90 nuclear reactors, with the average age being more than 35 years, highlighting the urgency for decommissioning activities. This aging infrastructure presents a significant market opportunity for decommissioning services and technologies. Furthermore, the tightening of safety regulations plays a crucial role in driving the Nuclear Decommissioning Services Market. Governments and regulatory bodies are enforcing stricter guidelines to ensure the safe handling of radioactive materials, protection of the environment, and public safety. For example, in Europe, the European Union's Basic Safety Standards Directive sets stringent requirements for decommissioning, waste management, and radiation protection. Compliance with these regulations requires specialized expertise and services, creating market opportunities for companies operating in the nuclear decommissioning sector. Additionally, the growing demand for clean energy sources is driving the Nuclear Decommissioning Services Market. Countries are increasingly focusing on renewable energy and phasing out nuclear power. For instance, Germany had decided to shut down all its nuclear power plants after the Fukushima nuclear disaster, the process is still ongoing and will complete before 2023. This transition to cleaner energy sources necessitates the decommissioning of nuclear facilities, providing opportunities for companies specializing in decommissioning and waste management. Nuclear Decommissioning Services Market Restraints and Challenges: The major challenge in the Nuclear Decommissioning Services Market is the handling and disposal of radioactive waste. The safe management of highly radioactive materials remains a significant concern, requiring innovative waste treatment technologies and secure storage solutions. Companies operating in this market must invest in research and development to develop effective waste management techniques. Moreover, managing potential environmental risks is another challenge in nuclear decommissioning. The decommissioning process involves decontamination of sites and addressing potential environmental contamination resulting from decades of nuclear operation. Remediation and restoration activities are essential to minimize environmental impact and restore affected areas to their original condition. Worker safety is another critical challenge in the decommissioning market. The decommissioning process involves working in hazardous environments with potential exposure to radiation and other safety hazards. Ensuring the safety and well-being of workers throughout the decommissioning process is of paramount importance and requires stringent safety protocols, training, and protective measures. Nuclear Decommissioning Opportunities: In terms of opportunities, the Nuclear Decommissioning Services Market presents prospects for companies involved in engineering, consulting, waste management, and environmental remediation. These companies can offer specialized services such as radiation protection, decontamination, waste transportation, and storage. For example, companies like Westinghouse Electric Company and Orano have established themselves as key players in the nuclear decommissioning sector, offering comprehensive solutions and expertise in decommissioning projects globally. Furthermore, technological advancements play a crucial role in shaping the opportunities in the Nuclear Decommissioning Services Market. Robotics and automation technologies are being developed to enhance the efficiency and safety of decommissioning processes. For instance, remotely operated robotic systems can perform tasks such as dismantling and handling radioactive materials in hazardous environments. Such advancements improve project timelines, reduce costs, and minimize human exposure to radiation. Government initiatives also contribute to market opportunities. Governments around the world are actively supporting and funding decommissioning projects. For instance, the U.S. Department of Energy established the Office of Environmental Management (EM), which focuses on the safe clean-upNuclear Decommissioning Services Market Segment Analysis

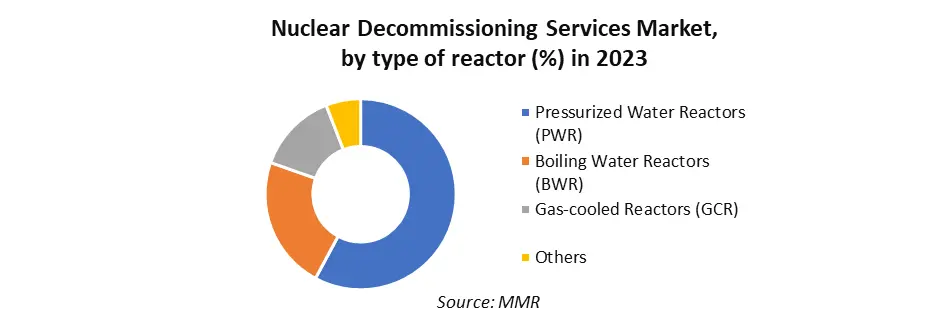

The Nuclear Decommissioning Services Market is segmented based on various factors, including strategy, type of reactors, capacity, and geographical regions. Based on the Strategy, the Nuclear Decommissioning Services Market is categorized into Immediate Dismantling, Deferred Dismantling, and Entombment. These refer to the different approaches and methodologies employed to carry out decommissioning projects. The immediate Dismantling approach is the widely used strategy that involves the prompt dismantling and removal of nuclear facilities following their shutdown. However, Deferred Dismantling is the Strategy where a nuclear facility is placed in a safe, monitored storage condition for an extended period before actual dismantling takes place. As the industry continues to evolve, the deferred dismantling strategy is expected to gain traction, enabling stakeholders to make informed decisions and maximize the overall effectiveness and efficiency of nuclear decommissioning projects. Based on the Type of Reactor, the Nuclear Decommissioning Services Market is categorized into Pressurized water reactors (PWR), boiling water reactors (BWR), and gas-cooled reactors (GCR). The Nuclear Decommissioning Services Market, when segmented by the type of reactor, highlights the specific requirements and challenges associated with decommissioning different reactor types. Pressurized water reactors (PWR) and boiling water reactors (BWR) are the widely used types of reactors in the nuclear industry. With a significant number of PWR and BWR reactors reaching the end of their operational life, the decommissioning demand for these reactor types is expected to grow in the future.

Nuclear Decommissioning Services Market Regional Insights

Regional analysis of the Nuclear Decommissioning Services Market reveals the influence of various factors and government initiatives in driving the market's growth and development across different regions. Currently, Europe holds the highest market share in the Nuclear Decommissioning Services Market. The region's significant market share can be attributed to several factors. Firstly, Europe has a substantial number of aging nuclear power plants that have either reached the end of their operational life or are nearing it. This drives the demand for decommissioning activities. Additionally, stringent safety regulations and environmental standards in Europe necessitate the proper decommissioning and decontamination of nuclear facilities. Government initiatives and support play a crucial role in driving the market in Europe. For instance, the European Commission's Euratom program provides funding for research, development, and innovation in the nuclear sector, including decommissioning projects. Moreover, European countries have established dedicated funds to support decommissioning efforts, such as the Nuclear Liabilities Fund in the United Kingdom and the Energiewende Fund in Germany. Looking ahead, North America is poised to lead the Nuclear Decommissioning Services Market in the near future. The region has a significant number of aging nuclear power plants that will require decommissioning in the coming years. The United States, in particular, has a substantial number of nuclear reactors that are reaching the end of their operational life. The U.S. government, through the Nuclear Regulatory Commission (NRC), oversees the decommissioning process and ensures compliance with safety and environmental regulations. These government initiatives, coupled with a strong emphasis on clean energy and the need to manage aging nuclear infrastructure, position North America as a key region for nuclear decommissioning. Nuclear Decommissioning Services Market, Competitive Landscape The competitive landscape of the Nuclear Decommissioning Services Market is characterized by the presence of established players as well as new entrants. Several companies have established themselves as key players in the industry, offering comprehensive decommissioning solutions and services. One of the prominent established players in the Nuclear Decommissioning Services Market is Westinghouse Electric Company. Westinghouse has a strong presence globally and provides a range of services for the safe decommissioning of nuclear facilities. The company has extensive experience in managing decommissioning projects and offers solutions in waste management, decontamination, and radiation protection. Recent years have also seen new entrants in the Nuclear Decommissioning Services Market, bringing innovation and competition. For example, AECOM is a global infrastructure consulting firm that has expanded its presence in the decommissioning sector. The company offers integrated services in decommissioning planning, environmental remediation, waste management, and radiological engineering. Mergers and acquisitions have played a significant role in shaping the competitive landscape of the market. For instance, in 2020, Jacobs Engineering Group, a leading provider of technical, professional, and construction services, completed the acquisition of Wood Nuclear, a division of Wood Group. This strategic move strengthened Jacobs' position in the Nuclear Decommissioning Services Market by combining their respective capabilities and expertise. Technological advancements have also been key differentiators for companies in the Market. Robotics and automation technologies have been developed to enhance efficiency and safety during decommissioning processes. For example, Japan's Mitsubishi Heavy Industries (MHI) has developed a robotic system called the "MHI Decommissioning Robot System" for the dismantling of nuclear power plants. The system utilizes remotely operated robots equipped with various tools to perform tasks such as cutting and handling radioactive materials. In addition to robotics, innovative approaches to waste management have emerged. For instance, Studsvik, a Swedish company specializing in nuclear waste management, has developed advanced waste treatment technologies. Their technology, known as the "Studsvik RadWaste Treatment System," enables efficient treatment and conditioning of radioactive waste, reducing its volume and facilitating safe disposal. These are just a few examples of the organic and inorganic strategies adopted by the key players in the Nuclear Decommissioning Services Market. In detail analysis of the competitive landscape, the strategies adopted by the companies, and the new trends in different regions of the world are given in the report.Nuclear Decommissioning Services Market Scope: Inquire before buying

Nuclear Decommissioning Services Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 7.56 Bn. Forecast Period 2024 to 2030 CAGR: 5.3 % Market Size in 2030: USD 15.89 Bn. Segments Covered: by Strategy Immediate Dismantling Deferred Dismantling Entombment by Type of Reactor Pressurized Water Reactors (PWR) Boiling Water Reactors (BWR) Gas-cooled Reactors (GCR) Others by Capacity Up to 800 MW 801 MW-1,000 MW Above 1,000 MW Nuclear Decommissioning Services Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Nuclear Decommissioning Services Key Players

1. Westinghouse Electric Company 2. Bechtel Corporation 3. AECOM 4. Studsvik AB 5. EDF Group 6. GE Hitachi Nuclear Energy 7. Orano Group 8. SNC-Lavalin Group Inc. 9. Magnox Ltd 10. Fluor Corporation 11. Nuvia Group 12. EnergySolutions 13. Jacobs Engineering Group Inc. 14. Holtec International 15. NorthStar Group Services, Inc. 16. Japan Atomic Energy Agency (JAEA) 17. Waste Control Specialists LLC 18. Rolls-Royce Holdings plc 19. Decommissioning Services LLC 20. AREVA GmbH 21. Dominion Energy 22. General Dynamics Corporation 23. Babcock International Group PLC 24. KDC Contractors 25. NAC International Inc. FAQs 1. How big is the Nuclear Decommissioning Services Market? Ans: Nuclear Decommissioning Services Market was valued at USD 7.56 billion in 2023. 2. What is the growth rate of the Nuclear Decommissioning Services Market? Ans: The CAGR of the Nuclear Decommissioning Services Market is 11.2%. 3. What are the segments of the Nuclear Decommissioning Services Market? Ans: There are primarily 4 segments - Strategy, Geography, Type of reactor and Capacity for the Nuclear Decommissioning 4. Which region will experience major growth in the Nuclear Decommissioning Services Market sector? Ans: North America will experience major growth in the Nuclear Decommissioning Services Market sector. 5. Is it profitable to invest in the Nuclear Decommissioning Services Market? Ans: There is a fair growth rate in this market and there are various factors to be analyzed like the driving forces and opportunities of the market which have been discussed extensively in Maximize’s full report. That would help in understanding the profitability of the market

1. Nuclear Decommissioning Services Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Nuclear Decommissioning Services Market: Dynamics 2.1. Nuclear Decommissioning Services Market Trends by Region 2.1.1. North America Nuclear Decommissioning Services Market Trends 2.1.2. Europe Nuclear Decommissioning Services Market Trends 2.1.3. Asia Pacific Nuclear Decommissioning Services Market Trends 2.1.4. Middle East and Africa Nuclear Decommissioning Services Market Trends 2.1.5. South America Nuclear Decommissioning Services Market Trends 2.2. Nuclear Decommissioning Services Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Nuclear Decommissioning Services Market Drivers 2.2.1.2. North America Nuclear Decommissioning Services Market Restraints 2.2.1.3. North America Nuclear Decommissioning Services Market Opportunities 2.2.1.4. North America Nuclear Decommissioning Services Market Challenges 2.2.2. Europe 2.2.2.1. Europe Nuclear Decommissioning Services Market Drivers 2.2.2.2. Europe Nuclear Decommissioning Services Market Restraints 2.2.2.3. Europe Nuclear Decommissioning Services Market Opportunities 2.2.2.4. Europe Nuclear Decommissioning Services Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Nuclear Decommissioning Services Market Drivers 2.2.3.2. Asia Pacific Nuclear Decommissioning Services Market Restraints 2.2.3.3. Asia Pacific Nuclear Decommissioning Services Market Opportunities 2.2.3.4. Asia Pacific Nuclear Decommissioning Services Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Nuclear Decommissioning Services Market Drivers 2.2.4.2. Middle East and Africa Nuclear Decommissioning Services Market Restraints 2.2.4.3. Middle East and Africa Nuclear Decommissioning Services Market Opportunities 2.2.4.4. Middle East and Africa Nuclear Decommissioning Services Market Challenges 2.2.5. South America 2.2.5.1. South America Nuclear Decommissioning Services Market Drivers 2.2.5.2. South America Nuclear Decommissioning Services Market Restraints 2.2.5.3. South America Nuclear Decommissioning Services Market Opportunities 2.2.5.4. South America Nuclear Decommissioning Services Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Nuclear Decommissioning Services Industry 2.8. Analysis of Government Schemes and Initiatives For Nuclear Decommissioning Services Industry 2.9. Nuclear Decommissioning Services Market Trade Analysis 2.10. The Global Pandemic Impact on Nuclear Decommissioning Services Market 3. Nuclear Decommissioning Services Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 3.1.1. Immediate Dismantling 3.1.2. Deferred Dismantling 3.1.3. Entombment 3.2. Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 3.2.1. Pressurized Water Reactors (PWR) 3.2.2. Boiling Water Reactors (BWR) 3.2.3. Gas-cooled Reactors (GCR) 3.2.4. Others 3.3. Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 3.3.1. Up to 800 MW 3.3.2. 801 MW-1,000 MW 3.3.3. Above 1,000 MW 3.4. Nuclear Decommissioning Services Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Nuclear Decommissioning Services Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 4.1.1. Immediate Dismantling 4.1.2. Deferred Dismantling 4.1.3. Entombment 4.2. North America Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 4.2.1. Pressurized Water Reactors (PWR) 4.2.2. Boiling Water Reactors (BWR) 4.2.3. Gas-cooled Reactors (GCR) 4.2.4. Others 4.3. North America Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 4.3.1. Up to 800 MW 4.3.2. 801 MW-1,000 MW 4.3.3. Above 1,000 MW 4.4. North America Nuclear Decommissioning Services Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 4.4.1.1.1. Immediate Dismantling 4.4.1.1.2. Deferred Dismantling 4.4.1.1.3. Entombment 4.4.1.2. United States Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 4.4.1.2.1. Pressurized Water Reactors (PWR) 4.4.1.2.2. Boiling Water Reactors (BWR) 4.4.1.2.3. Gas-cooled Reactors (GCR) 4.4.1.2.4. Others 4.4.1.3. United States Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 4.4.1.3.1. Up to 800 MW 4.4.1.3.2. 801 MW-1,000 MW 4.4.1.3.3. Above 1,000 MW 4.4.2. Canada 4.4.2.1. Canada Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 4.4.2.1.1. Immediate Dismantling 4.4.2.1.2. Deferred Dismantling 4.4.2.1.3. Entombment 4.4.2.2. Canada Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 4.4.2.2.1. Pressurized Water Reactors (PWR) 4.4.2.2.2. Boiling Water Reactors (BWR) 4.4.2.2.3. Gas-cooled Reactors (GCR) 4.4.2.2.4. Others 4.4.2.3. Canada Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 4.4.2.3.1. Up to 800 MW 4.4.2.3.2. 801 MW-1,000 MW 4.4.2.3.3. Above 1,000 MW 4.4.3. Mexico 4.4.3.1. Mexico Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 4.4.3.1.1. Immediate Dismantling 4.4.3.1.2. Deferred Dismantling 4.4.3.1.3. Entombment 4.4.3.2. Mexico Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 4.4.3.2.1. Pressurized Water Reactors (PWR) 4.4.3.2.2. Boiling Water Reactors (BWR) 4.4.3.2.3. Gas-cooled Reactors (GCR) 4.4.3.2.4. Others 4.4.3.3. Mexico Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 4.4.3.3.1. Up to 800 MW 4.4.3.3.2. 801 MW-1,000 MW 4.4.3.3.3. Above 1,000 MW 5. Europe Nuclear Decommissioning Services Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 5.2. Europe Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 5.3. Europe Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 5.4. Europe Nuclear Decommissioning Services Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 5.4.1.2. United Kingdom Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 5.4.1.3. United Kingdom Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 5.4.2. France 5.4.2.1. France Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 5.4.2.2. France Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 5.4.2.3. France Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 5.4.3.2. Germany Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 5.4.3.3. Germany Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 5.4.4.2. Italy Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 5.4.4.3. Italy Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 5.4.5.2. Spain Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 5.4.5.3. Spain Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 5.4.6.2. Sweden Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 5.4.6.3. Sweden Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 5.4.7.2. Austria Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 5.4.7.3. Austria Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 5.4.8.2. Rest of Europe Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 5.4.8.3. Rest of Europe Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 6. Asia Pacific Nuclear Decommissioning Services Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 6.2. Asia Pacific Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 6.3. Asia Pacific Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 6.4. Asia Pacific Nuclear Decommissioning Services Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 6.4.1.2. China Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 6.4.1.3. China Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 6.4.2.2. S Korea Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 6.4.2.3. S Korea Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 6.4.3.2. Japan Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 6.4.3.3. Japan Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 6.4.4. India 6.4.4.1. India Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 6.4.4.2. India Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 6.4.4.3. India Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 6.4.5.2. Australia Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 6.4.5.3. Australia Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 6.4.6.2. Indonesia Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 6.4.6.3. Indonesia Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 6.4.7.2. Malaysia Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 6.4.7.3. Malaysia Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 6.4.8.2. Vietnam Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 6.4.8.3. Vietnam Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 6.4.9.2. Taiwan Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 6.4.9.3. Taiwan Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 6.4.10.2. Rest of Asia Pacific Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 6.4.10.3. Rest of Asia Pacific Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 7. Middle East and Africa Nuclear Decommissioning Services Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 7.2. Middle East and Africa Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 7.3. Middle East and Africa Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 7.4. Middle East and Africa Nuclear Decommissioning Services Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 7.4.1.2. South Africa Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 7.4.1.3. South Africa Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 7.4.2.2. GCC Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 7.4.2.3. GCC Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 7.4.3.2. Nigeria Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 7.4.3.3. Nigeria Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 7.4.4.2. Rest of ME&A Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 7.4.4.3. Rest of ME&A Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 8. South America Nuclear Decommissioning Services Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 8.2. South America Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 8.3. South America Nuclear Decommissioning Services Market Size and Forecast, by Capacity(2023-2030) 8.4. South America Nuclear Decommissioning Services Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 8.4.1.2. Brazil Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 8.4.1.3. Brazil Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 8.4.2.2. Argentina Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 8.4.2.3. Argentina Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Nuclear Decommissioning Services Market Size and Forecast, by Strategy (2023-2030) 8.4.3.2. Rest Of South America Nuclear Decommissioning Services Market Size and Forecast, by Type of Reactor (2023-2030) 8.4.3.3. Rest Of South America Nuclear Decommissioning Services Market Size and Forecast, by Capacity (2023-2030) 9. Global Nuclear Decommissioning Services Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Nuclear Decommissioning Services Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Westinghouse Electric Company 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bechtel Corporation 10.3. AECOM 10.4. Studsvik AB 10.5. EDF Group 10.6. GE Hitachi Nuclear Energy 10.7. Orano Group 10.8. SNC-Lavalin Group Inc. 10.9. Magnox Ltd 10.10. Fluor Corporation 10.11. Nuvia Group 10.12. EnergySolutions 10.13. Jacobs Engineering Group Inc. 10.14. Holtec International 10.15. NorthStar Group Services, Inc. 10.16. Japan Atomic Energy Agency (JAEA) 10.17. Waste Control Specialists LLC 10.18. Rolls-Royce Holdings plc 10.19. Decommissioning Services LLC 10.20. AREVA GmbH 10.21. Dominion Energy 10.22. General Dynamics Corporation 10.23. Babcock International Group PLC 10.24. KDC Contractors 10.25. NAC International Inc. 11. Key Findings 12. Industry Recommendations 13. Nuclear Decommissioning Services Market: Research Methodology 14. Terms and Glossary