The North America Data Center Colocation Market size was valued at USD 14.58 Billion in 2023 and the total North America Data Center Colocation revenue is expected to grow at a CAGR of 10.02 % from 2024 to 2030, reaching nearly USD 28.45 Billion by 2030.North America Data Center Colocation Market Overview:

Data Center Colocation refers to a service where businesses rent space, computing resources, and infrastructure within a third-party data center facility. In this arrangement, organizations place their servers, storage, and networking equipment in the colocation provider's data center, benefiting from shared resources, security, and operational efficiency. Colocation services allow businesses to outsource the physical hosting of their IT infrastructure while maintaining control over their equipment and applications. The North America Data Center Colocation Market is a dynamic and thriving sector within the broader information technology and data services industry. North America Data Center Colocation Market encompasses a wide range of services offered by colocation providers to businesses across various sectors.To know about the Research Methodology :- Request Free Sample Report The North America Data Center Colocation Market has witnessed significant growth, driven by the increasing demand for scalable and secure data solutions. The United States, Canada, and Mexico are key contributors to this growth, each experiencing unique market dynamics. The market is characterized by the presence of major players providing colocation services. Key industry players include Equinix, Digital Realty, CoreSite Realty Corporation, Cyxtera Technologies, and others. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the North America Data Center Colocation Market.

North America Data Center Colocation Market Dynamics

Increasing Data Traffic and Storage Needs with Rising Cloud Adoption Driving the North America Data Center Colocation Market Growth The North America Data Center Colocation Market witnesses a substantial surge in demand, fuelled by the proliferation of digital content, widespread cloud service adoption, and the growing reliance on data-intensive applications. As businesses amass extensive data volumes, the imperative for efficient storage and processing capabilities intensifies. Data center colocation services play a pivotal role in meeting this escalating demand, providing scalable solutions for businesses grappling with the challenges of data growth. The pervasive adoption of cloud computing services by North American businesses significantly augments the demand for data center colocation. Companies strategically leverage colocation facilities to establish proximity to cloud service providers, ensuring low-latency connectivity and seamless integration with cloud-based applications in North America Data Center Colocation Market. The synergy between colocation and cloud adoption enhances overall operational efficiency, positioning colocation as a strategic choice for businesses embracing cloud technologies. Data center colocation emerges as a strategic solution for businesses placing a premium on robust business continuity and disaster recovery capabilities. With heightened awareness of the critical importance of uninterrupted operations, North American organizations turn to colocation facilities to ensure data resilience and minimize downtime risks. The geographic diversity of colocation centers enhances redundancy and provides a reliable framework for continuity planning in the North America Data Center Colocation Market. Ongoing digital transformation initiatives across industries propel the demand for scalable and efficient IT infrastructure. Data center colocation becomes a facilitator for businesses undergoing digital transformations, enabling them to adapt to changing technological landscapes. Colocation services support the implementation of new technologies, ensuring optimal performance in the digital era and positioning businesses to thrive in dynamic and evolving markets. North American enterprises strategically opt for data center colocation to achieve significant cost savings and operational efficiencies. By outsourcing data center operations, businesses reduce capital expenditures on infrastructure and maintenance. This allows them to concentrate resources on core competencies while benefiting from the economies of scale offered by colocation providers in North America Data Center Colocation Market. Ultimately, this contributes to a more streamlined and cost-effective operational model. High Initial Investment for Colocation Services and Security and Compliance Concerns Restraining North America Data Center Colocation Market Growth While data center colocation promises long-term cost savings, the initial investment for migrating and setting up operations in a colocation facility substantial. This financial barrier act as a restraint, particularly for smaller businesses in North America, potentially hindering their ability to fully embrace colocation services in the North America Data Center Colocation Market. Security and compliance issues remain significant concerns for businesses contemplating data center colocation. Meeting regulatory requirements and ensuring the security of sensitive data are critical factors that act as restraints, especially for industries with stringent compliance standards. Navigating these concerns carefully is imperative to ensure a secure and compliant colocation environment. Despite offering shared resources and infrastructure, colocation facilities have limitations in terms of customization. Businesses with highly specific or unique infrastructure requirements find it challenging to achieve the desired level of customization in a colocation environment. This limitation pose a restraint, especially for industries with specialized IT infrastructure needs. Businesses relying on data center colocation services become inherently dependent on the operational reliability of third-party providers. Downtime or service interruptions from the colocation facility impact the continuity of operations for businesses, posing a potential restraint in the North America Data Center Colocation Market. Ensuring the reliability and stability of colocation providers becomes crucial for businesses to mitigate this dependency-related risk. Despite being strategically located, challenges in network connectivity arise, impacting the effectiveness of data center colocation. Issues related to network latency, bandwidth limitations, or connectivity disruptions influence the performance of applications hosted in colocation facilities in the North America Data Center Colocation Market. Addressing and mitigating these connectivity challenges are essential to maintaining the overall efficacy of colocation services. The high demand for data center colocation services in prime locations lead to intense competition for available space. Limited availability in these sought-after locations pose a restraint, necessitating businesses to explore alternative locations or consider investments in building their own data centers. The competition for prime locations underscores the importance of strategic planning in the selection of colocation facilities in the North America Data Center Colocation Market.North America Data Center Colocation Market Segment Analysis

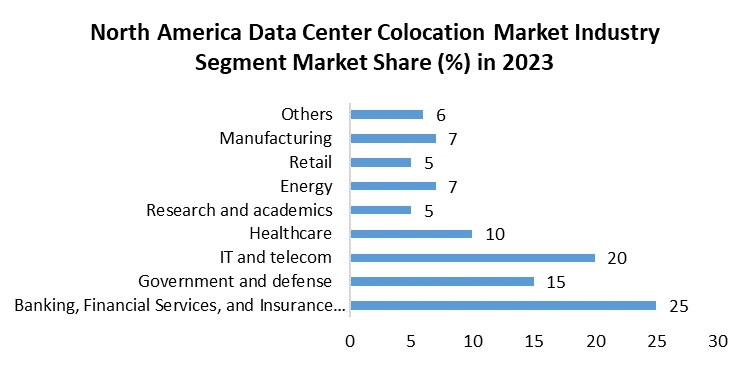

Type: Retail colocation services assert a significant foothold in the North America Data Center Colocation Market. Tailored to diverse business needs, these services provide scalable solutions for organizations seeking partial data center resources. The market dominance of retail colocation is attributed to its flexibility and customized offerings, meeting the evolving demands of businesses in North America. An emerging trend in retail colocation involves the integration of advanced technologies, such as edge computing. This aligns with evolving business requirements for low-latency and high-performance computing, driving innovation within the retail colocation segment and ensuring its continued relevance in the North America Data Center Colocation Market. Wholesale colocation services play a pivotal role in addressing the data storage needs of large enterprises and organizations with substantial requirements. This segment involves leasing entire data center facilities, offering a comprehensive solution for businesses seeking significant data infrastructure resources in North America. With the escalating demand for extensive data storage and processing capabilities, wholesale colocation services present growth opportunities in the North America Data Center Colocation Market. Large enterprises, requiring dedicated and scalable solutions, often turn to wholesale colocation providers to address their evolving data center needs efficiently in North America. End-user: Large enterprises emerge as primary adopters of data center colocation services in North America. These organizations leverage colocation to overcome challenges associated with managing vast data volumes and ensuring optimal performance. The scalability and cost-effectiveness of colocation solutions make them particularly appealing to large enterprises across diverse industries in North America. Large enterprises often have specific customization requirements, and data center colocation providers address these demands with tailored solutions in the North America Data Center Colocation Market. The capability to customize enhances the attractiveness of colocation services, meeting the unique needs of large enterprises operating in various sectors in North America. Small and medium-sized industries are witnessing an increasing adoption of data center colocation services to benefit from scalable infrastructure without hefty upfront investments. The cost savings, operational efficiency, and flexibility offered by colocation make it a viable and attractive choice for businesses in this segment in North America Data Center Colocation Market. As awareness grows and the benefits become more apparent, data center colocation services are penetrating deeper into small and medium industries. This penetration is fuelled by the need for reliable data management and processing capabilities to support the digital transformation initiatives of smaller businesses in North America. Industry: The BFSI sector stands out as a major consumer of data center colocation services in Market due to its critical need for secure and efficient data management. The sector's reliance on real-time data processing and stringent security measures aligns perfectly with the capabilities offered by colocation providers in North America. Colocation services in the BFSI industry must adhere to strict regulatory compliance standards. Providers catering to this sector focus on meeting these requirements, offering solutions that ensure data security, integrity, and compliance with financial regulations in North America. Government and defence organizations strategically utilize data center colocation to manage vast amounts of sensitive data securely. The need for resilient and secure infrastructure makes colocation a preferred choice, enabling these entities to focus on their core responsibilities without compromising data security in North America. Data sovereignty is a critical consideration in colocation services for government and defences in the Market. Colocation providers addressing data sovereignty concerns, such as local data storage options, gain increased acceptance in this sector in North America. The IT and telecom industry places a strong emphasis on network connectivity and low-latency solutions. Data center colocation services, especially those situated in strategic locations, cater to the industry's requirements for seamless connectivity and high-performance infrastructure in North America. With the emergence of edge computing, colocation providers in the IT and telecom sector are increasingly integrating edge facilities into their offerings in the Market. This integration enables businesses to deploy applications closer to end-users, enhancing overall performance in North America. The healthcare industry's adoption of data center colocation is propelled by the need for robust data security and compliance with healthcare regulations. Colocation providers in this sector focus on offering solutions that ensure the confidentiality and integrity of patient data in Market. As the healthcare industry undergoes digital transformation, colocation services play a crucial role in supporting digital health initiatives. The scalability and reliability of colocation infrastructure contribute to the seamless integration of digital technologies in healthcare operations in North America.

North America Data Center Colocation Market Regional Analysis

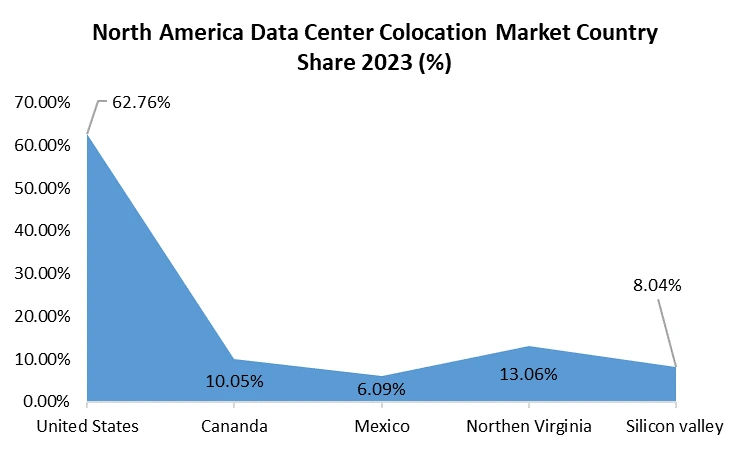

The United States plays a pivotal role in the North America Data Center Colocation Market, witnessing substantial regional growth. This growth is fuelled by the country's advanced technological infrastructure, high demand for data storage, and the presence of key industry players. The regional growth in the US positions it as a driving force in the North American colocation landscape. The U.S. holds a significant market share, reflecting its dominance in the colocation sector. Canada and Mexico also contribute to the market share, with varying degrees of adoption and preferences within each country. Understanding the market share distribution across the U.S., Canada, and Mexico provides insights into the regional dynamics and preferences. North America, as a whole, exhibits immense market potential for data center colocation services in the North America Data Center Colocation Market. The region's technologically advanced ecosystem and the continuous digital transformation across industries contribute to the market's growth potential. Recognizing the market potential in North America is essential for businesses aiming to capitalize on the diverse opportunities within the region. Major colocation service providers in North America, such as Equinix, Digital Realty, and CyrusOne, emerge as regional key players, driving innovation and setting industry standards. Identifying these key players is crucial for businesses seeking strategic partnerships and competitive positioning within the North America Data Center Colocation Market. Factors contributing to regional growth include the increasing demand for scalable data solutions, the adoption of edge computing, and the emphasis on data security and compliance, propelling the Market forward. Recognizing these growth factors enables businesses to align their strategies with the evolving needs of the North American market. The market share in Canada and the U.S. reflects the distribution of colocation services, with providers catering to the specific needs and preferences of each country's business landscape. Understanding the nuanced market share dynamics helps businesses tailor their offerings to meet the distinct requirements of the Canadian and U.S. markets. While the U.S. experiences significant growth, Canada and Mexico also witness regional growth, albeit at different paces. Canada, with its thriving technology sector, contributes to the market's expansion, while Mexico shows potential for increased adoption in the Market. Recognizing the varying growth rates in Canada and Mexico allows businesses to tailor their strategies based on the specific market conditions in each country.

North America Data Center Colocation Market Scope: Inquire before buying

North America Data Center Colocation Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 14.58 Bn. Forecast Period 2024 to 2030 CAGR: 10.02% Market Size in 2030: US $ 28.45 Bn. Segments Covered: by Type Retail Colocation Wholesale Colocation by End User Large Enterprises Small & Medium Industries by Industry Banking, Financial Services, and Insurance (BFSI) Government and defences IT and telecom Healthcare Research and academics Energy Retail Manufacturing Others North America Data Center Colocation Market by Countries:

North America (United States, Canada, and Mexico)North America Data Center Colocation Market Key Players:

Major Key Players in United States: 1. Equinix Inc. (Redwood City, California) 2. Digital Realty Trust, Inc. (San Francisco, California) 3. CyrusOne Inc. (Dallas, Texas) 4. CoreSite Realty Corporation (Denver, Colorado) 5. Cyxtera Technologies (Miami, Florida) 6. CenturyLink (Monroe, Louisiana) Leading Key Players in Canada: 1. Cologix Inc. (Toronto, Ontario) 2. eStruxture Data Centers (Montreal, Quebec) 3. Q9 Networks Inc. (Toronto, Ontario) 4. Bell Canada (Montreal, Quebec) 5. TELUS (Vancouver, British Columbia) 6. Rogers Communications (Toronto, Ontario) Market Follower key Players in Mexico: 1. Totalplay (Mexico City) 2. Alestra (San Pedro Garza García, Nuevo León) 3. AXTEL (Mexico City) 4. KIO Networks (Mexico City) 5. NEC de México S.A. de C.V. (Mexico City) 6. Telmex (Mexico City) FAQ’s: 1. What Drives the Growth of the Data Center Colocation Market in North America? Ans: The growth is propelled by increasing demand for scalable data solutions, adoption of edge computing, and emphasis on data security and compliance across industries in North America. 2. Who are the Key Players in the Market? Ans: Major players include Equinix, Digital Realty, and CyrusOne, contributing to innovation and setting industry standards in the North American colocation landscape. 3. What Factors Contribute to Regional Growth in the Market? Ans: Regional growth factors include the demand for scalable data solutions, adoption of edge computing, and a strong emphasis on data security and compliance in the United States, Canada, and Mexico. 4. Which Industries Drive Demand for Colocation Services in North America? Ans: Industries such as BFSI, government, IT and telecom, healthcare, research and academics, energy, retail, manufacturing, and others fuel the demand for colocation services. 5. What Regions Show Significant Market Share in North America? Ans: The United States commands a significant market share, and Canada and Mexico contribute to the overall market share, each showcasing varying degrees of adoption and preferences.

1. North America Data Center Colocation Market: Research Methodology 2. North America Data Center Colocation Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. North America Data Center Colocation Market: Dynamics 3.1. North America Data Center Colocation Market Trends 3.2. North America Data Center Colocation Market Dynamics 3.2.1.1. North America North America Data Center Colocation Market Drivers 3.2.1.2. North America North America Data Center Colocation Market Restraints 3.2.1.3. North America North America Data Center Colocation Market Opportunities 3.2.1.4. North America North America Data Center Colocation Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by North America 3.7. Key Opinion Leader Analysis For North America Data Center Colocation Industry 3.8. Analysis of Government Schemes and Initiatives For North America Data Center Colocation Industry 3.9. The COVID-19 Pandemic Impact on North America Data Center Colocation Market 4. North America Data Center Colocation Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. North America North America Data Center Colocation Market Size and Forecast, By Type (2022-2029) 4.1.1. Retail Colocation 4.1.2. Wholesale Colocation 4.2. North America North America Data Center Colocation Market Size and Forecast, By End-user (2022-2029) 4.2.1. Large Enterprises 4.2.2. Small & Medium Industries 4.3. North America North America Data Center Colocation Market Size and Forecast, By Industry (2022-2029) 4.3.1. Banking, Financial Services, and Insurance (BFSI) 4.3.2. Government and defense 4.3.3. IT and telecom 4.3.4. Healthcare 4.3.5. Research and academics 4.3.6. Energy 4.3.7. Retail 4.3.8. Manufacturing 4.3.9. Others 4.4. North America Data Center Colocation Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States North America Data Center Colocation Market Size and Forecast, By Type (2022-2029) 4.4.1.1.1. Retail Colocation 4.4.1.1.2. Wholesale Colocation 4.4.1.2. United States North America Data Center Colocation Market Size and Forecast, By End-user (2022-2029) 4.4.1.2.1. Large Enterprises 4.4.1.2.2. Small & Medium Industries 4.4.1.3. United States North America Data Center Colocation Market Size and Forecast, By Industry (2022-2029) 4.4.1.3.1. Banking, Financial Services, and Insurance (BFSI) 4.4.1.3.2. Government and defense 4.4.1.3.3. IT and telecom 4.4.1.3.4. Healthcare 4.4.1.3.5. Research and academics 4.4.1.3.6. Energy 4.4.1.3.7. Retail 4.4.1.3.8. Manufacturing 4.4.1.3.9. Others 4.4.2. Canada 4.4.2.1. Canada North America Data Center Colocation Market Size and Forecast, By Type (2022-2029) 4.4.2.1.1. Retail Colocation 4.4.2.1.2. Wholesale Colocation 4.4.2.2. Canada North America Data Center Colocation Market Size and Forecast, By End-user (2022-2029) 4.4.2.2.1. Large Enterprises 4.4.2.2.2. Small & Medium Industries 4.4.2.3. Canada North America Data Center Colocation Market Size and Forecast, By Industry (2022-2029) 4.4.2.3.1. Banking, Financial Services, and Insurance (BFSI) 4.4.2.3.2. Government and defense 4.4.2.3.3. IT and telecom 4.4.2.3.4. Healthcare 4.4.2.3.5. Research and academics 4.4.2.3.6. Energy 4.4.2.3.7. Retail 4.4.2.3.8. Manufacturing 4.4.2.3.9. Others 4.4.3. Mexico 4.4.3.1. Mexico North America Data Center Colocation Market Size and Forecast, By Type (2022-2029) 4.4.3.1.1. Retail Colocation 4.4.3.1.2. Wholesale Colocation 4.4.3.2. Mexico North America Data Center Colocation Market Size and Forecast, By End-user (2022-2029) 4.4.3.2.1. Large Enterprises 4.4.3.2.2. Small & Medium Industries 4.4.3.3. Mexico North America Data Center Colocation Market Size and Forecast, By Industry (2022-2029) 4.4.3.3.1. Banking, Financial Services, and Insurance (BFSI) 4.4.3.3.2. Government and defense 4.4.3.3.3. IT and telecom 4.4.3.3.4. Healthcare 4.4.3.3.5. Research and academics 4.4.3.3.6. Energy 4.4.3.3.7. Retail 4.4.3.3.8. Manufacturing 4.4.3.3.9. Others 5. North America Data Center Colocation Market: Competitive Landscape 5.1. MMR Competition Matrix 5.2. Competitive Landscape 5.3. Key Players Benchmarking 5.3.1. Company Name 5.3.2. Service Segment 5.3.3. End-user Segment 5.3.4. Revenue (2023) 5.3.5. Company Locations 5.4. Leading North America Data Center Colocation Market Companies, by Market Capitalization 5.5. Market Structure 5.5.1. Market Leaders 5.5.2. Market Followers 5.5.3. Emerging Players 5.6. Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1. Equinix Inc. (Redwood City, California) 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Strategic Analysis 6.1.6. Scale of Operation (Small, Medium, and Large) 6.1.7. Details on Partnership 6.1.8. Regulatory Accreditations and Certifications Received by Them 6.1.9. Awards Received by the Firm 6.1.10. Recent Developments 6.2. Digital Realty Trust, Inc. (San Francisco, California) 6.3. CyrusOne Inc. (Dallas, Texas) 6.4. CoreSite Realty Corporation (Denver, Colorado) 6.5. Cyxtera Technologies (Miami, Florida) 6.6. CenturyLink (Monroe, Louisiana) 6.7. Cologix Inc. (Toronto, Ontario) 6.8. eStruxture Data Centers (Montreal, Quebec) 6.9. Q9 Networks Inc. (Toronto, Ontario) 6.10. Bell Canada (Montreal, Quebec) 6.11. TELUS (Vancouver, British Columbia) 6.12. Rogers Communications (Toronto, Ontario) 6.13. Totalplay (Mexico City) 6.14. Alestra (San Pedro Garza García, Nuevo León) 6.15. AXTEL (Mexico City) 6.16. KIO Networks (Mexico City) 6.17. NEC de México S.A. de C.V. (Mexico City) 6.18. Telmex (Mexico City) 7. Key Findings 8. Industry Recommendations