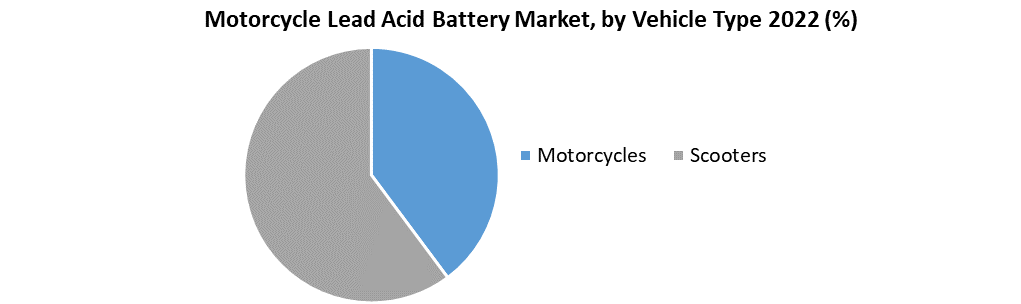

Motorcycle Lead Acid Battery Market is anticipated to reach US$ 3.45 Bn by 2029 from US$ 2.42 Bn in 2022 at a CAGR of 5.2% during a forecast period. Currently, the usage of motorcycle lead-acid batteries all over the globe accounts for over half of the total sales of motorcycles. However, their adoption in scooters is expected to exceed that in motorcycles during the forecast period (2023-2029). In 2022, motorcycle lead-acid batteries worth US$ 2.3 Bn was sold for motorcycle applications.To know about the Research Methodology :- Request Free Sample Report In report, 2022 is considered a base year however 2022’s numbers are on the real output of the companies in the market. Special attention is given to 2022 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

Motorcycle Lead Acid Battery Market Dynamics

Batteries are used while starting, ignition, and vehicle lighting. Thus, with the growing demand for battery-powered vehicles and electric vehicles, the market for lead-acid batteries in motorcycles is expected to grow during the forecast period (2023-2029). In addition, the factors like low cost, easily available, suitable for any type of vehicle, and highly reliable & durable, are driving the market for the motorcycle lead-acid battery. However, several new battery technologies have occupied the market share, yet lead-acid batteries hold the dominant position in the automotive battery market. Manufacturers of motorcycle lead-acid batteries are working on the recycling process for used batteries. According to the US Environmental Protection Agency, around 80% of lead used in new batteries is recyclable. For example, America Battery Recyclers has recycled over 15 billion pounds of battery deposits till 2019. This recycling technology used in lead-acid batteries are expected to create more opportunities for the market’s growth during the forecast period (2023-2029).Increase in demand of motorcycle:

An increase in demand for motorcycles is expected to drive the growth of motorcycle lead-acid batteries. In August 2022, 21.9 million two-wheelers were sold across the world, but that number is still 29.7 percent down from sales in 2019. In Europe, sales of e-motorcycles were up by 51.8% over 2019, and sales of e-mopeds rose by 12.5%. Over in the US, sales of electric models are expected to grow, particularly as the 10% tax credit on e-motorcycle sales has been extended into 2022. This leads to the growth of the motorcycle lead-acid battery market during the forecast period (2023-2029).Motorcycle Lead Acid Battery Market Segmentation Analysis

By Battery Type, Absorbed Glass Mat battery dominated the motorcycle lead-acid battery market with xx% of revenue share in 2022. The growth of the segment is attributed to the benefits like shorter recharge time, low maintenance, best performance in low temperature, highest power density, and 80-90% round trip efficiency. By Vehicle Type, the motorcycle segment held the xx% of market share in 2022. The growth of the segment can be attributed to factors like increasing purchasing power, increasing demand for stylish and attractive bikes. Thus, manufacturers are focusing on manufacturing conventional motorcycles with a stylish look introducing larger displacement engines and good fuel efficiency among others are another major factor expected to propel the demand during the forecast period. The growth of E-scooters is also one of the main reasons for the high demand for lead-acid batteries.

Motorcycle Lead Acid Battery Market Regional Insights

The Asia Pacific dominated the market and accounted for 23% of the market share in 2022. The growth of the market in the region is attributed to the growing demand for motorcycles in various countries such as India and China. In addition, significant growth in the automobile sector in Asia countries contributes prominently towards the motorcycle lead-acid battery demand. Almost 87 percent of the electric bicycles sold in China run on lead-acid batteries as of 2019. Some major electric bike manufacturers in the market include Aimea and Yadae. In 2022, manufacturers in Japan sold approximately 29.57 million lead-acid batteries, down from 31.39 million batteries in 2019. In addition, the introduction of electric-powered vehicles and their rapid adoption across China, India, South Korea, and many other Asian countries have fueled the market for motorcycle lead-acid batteries. Moreover, China's plan to replace all petrol and diesel-powered vehicles with electric-powered vehicles by 2027 has boosted the sale of electric scooters and bikes significantly, which is likely to impact the market growth. The objective of the report is to present a comprehensive analysis of the Motorcycle Lead Acid Battery Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Motorcycle Lead Acid Battery Market dynamics, structure by analyzing the market segments and project the Motorcycle Lead Acid Battery Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Motorcycle Lead Acid Battery Market make the report investor’s guide.Motorcycle Lead Acid Battery Market Scope: Inquire before buying

Motorcycle Lead Acid Battery Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 2.42 Bn. Forecast Period 2023 to 2029 CAGR: 5.2% Market Size in 2029: US $ 3.45 Bn. Segments Covered: by Battery Type • Flooded Lead-Acid (FLA) • Absorbed Glass Mat (AGM) by Vehicle Type • Motorcycles • Scooters by Sales Channel •OEMs • Aftermarket Motorcycle Lead Acid Battery Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Motorcycle Lead Acid Battery Market: Key Players

• Bosch Ltd. • Camel Group Co. Ltd. • Southern Batteries Pvt. Ltd. • Dynavolt Renewable Energy Technology Co. Ltd. • Banner Battery • Deltran Battery Tender • Chaowei Power • Leoch International Technology Ltd Inc. • GS Yuasa International • Exide Technologies • ENERSYS • BS-Battery • Batterie Unibat • Bosch • DELTRAN BATTERY TENDER • DYNAVOLTFrequently Asked Questions

1. What is the projected market size & growth rate of Motorcycle Lead Acid Battery Market? Ans- Motorcycle Lead Acid Battery Market is anticipated to reach US$ 3.45 Bn by 2029 from US$ 2.42 Bn in 2022 at a CAGR of 5.2% during a forecast period. 2. What is the key driving factor for the growth of Motorcycle Lead Acid Battery Market? Ans- with the growing demand for battery-powered vehicles and electric vehicles, the market for lead-acid batteries in motorcycles is expected to grow during the forecast period (2022-2029). 3. Which Region accounted for the largest Motorcycle Lead Acid Battery Market share? Ans- The Asia Pacific dominated the market and accounted for 23% of the market share in 2022. 4. What makes China a Lucrative Market for Motorcycle Lead Acid Battery Market? Ans- China's plan to replace all petrol and diesel-powered vehicles with electric-powered vehicles by 2027 has boosted the sale of electric scooters and bikes significantly, which is likely to impact the market growth. 5. What are the top players operating in Motorcycle Lead Acid Battery Market? Ans- Bosch Ltd., Camel Group Co. Ltd., Southern Batteries Pvt. Ltd., Dynavolt Renewable Energy Technology Co. Ltd., Banner Battery, Deltran Battery Tender, Chaowei Power, and Leoch International Technology Ltd Inc.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Motorcycle Lead Acid Battery Market Size, by Market Value (US$ Bn) 3.1. Market Segmentation 3.2. Market Segmentation Share Analysis, 2022 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Motorcycle Lead Acid Battery Market 3.4. Geographical Snapshot of the Motorcycle Lead Acid Battery Market, By Manufacturer share 4. Motorcycle Lead Acid Battery Market Overview, 2022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Motorcycle Lead Acid Battery Market 5. Supply Side and Demand Side Indicators 6. Motorcycle Lead Acid Battery Market Analysis and Forecast, 2022-2029 6.1. Motorcycle Lead Acid Battery Market Size & Y-o-Y Growth Analysis. 7. Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 7.1. Market Size (Value) Estimates & Forecast By Battery Type, 2022-2029 7.1.1. Flooded Lead-Acid (FLA) 7.1.2. Absorbed Glass Mat (AGM) 7.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 7.2.1. Motorcycles 7.2.2. Scooters 7.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 7.3.1. OEMs 7.3.2. Aftermarket 8. Motorcycle Lead Acid Battery Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2022-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 9.1. Market Size (Value) Estimates & Forecast By Battery Type, 2022-2029 9.1.1. Flooded Lead-Acid (FLA) 9.1.2. Absorbed Glass Mat (AGM) 9.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 9.2.1. Motorcycles 9.2.2. Scooters 9.3. Market Size (Value) Estimates & Forecast By Sales Channel,2022-2029 9.3.1. OEMs 9.3.2. Aftermarket 10. North America Motorcycle Lead Acid Battery Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 11.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 11.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 11.3. Market Size (Value) Estimates & Forecast By Sales Channel,2022-2029 12. Canada Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 12.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 12.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 12.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 13. Mexico Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 13.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 13.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 13.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 14. Europe Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 14.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 14.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 14.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 15. Europe Motorcycle Lead Acid Battery Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 16.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 16.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 16.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 17. France Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 17.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 17.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 17.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 18. Germany Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 18.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 18.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 18.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 19. Italy Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 19.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 19.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 19.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 20. Spain Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 20.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 20.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 20.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 21. Sweden Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 21.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 21.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 21.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 22. CIS Countries Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 22.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 22.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 22.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 23. Rest of Europe Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 23.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 23.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 23.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 24. Asia Pacific Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 24.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 24.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 24.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 25. Asia Pacific Motorcycle Lead Acid Battery Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 26.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 26.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 26.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 27. India Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 27.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 27.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 27.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 28. Japan Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 28.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 28.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 28.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 29. South Korea Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 29.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 29.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 29.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 30. Australia Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 30.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 30.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 30.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 31. ASEAN Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 31.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 31.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 31.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 32. Rest of Asia Pacific Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 32.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 32.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 32.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 33. Middle East Africa Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 33.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 33.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 33.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 34. Middle East Africa Motorcycle Lead Acid Battery Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 35.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 35.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 35.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 36. GCC Countries Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 36.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 36.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 36.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 37. Egypt Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 37.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 37.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 37.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 38. Nigeria Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 38.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 38.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 38.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 39. Rest of ME&A Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 39.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 39.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 39.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 40. South America Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 40.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 40.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 40.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 41. South America Motorcycle Lead Acid Battery Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 42.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 42.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 42.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 43. Argentina Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 43.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 43.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 43.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 44. Rest of South America Motorcycle Lead Acid Battery Market Analysis and Forecasts, 2022-2029 44.1. Market Size (Value) Estimates & Forecast By Battery Type,2022-2029 44.2. Market Size (Value) Estimates & Forecast By Vehicle Type,2022-2029 44.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2022-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Motorcycle Lead Acid Battery Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile: Key Players 45.3.1. Bosch Ltd. 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.4. Bosch Ltd. 45.5. Camel Group Co. Ltd. 45.6. Southern Batteries Pvt. Ltd. 45.7. Dynavolt Renewable Energy Technology Co. Ltd. 45.8. Banner Battery 45.9. Deltran Battery Tender 45.10. Chaowei Power 45.11. Leoch International Technology Ltd Inc. 45.12. GS Yuasa International 45.13. Exide Technologies 45.14. ENERSYS 45.15. BS-Battery 45.16. Batterie Unibat 45.17. Bosch 45.18. DELTRAN BATTERY TENDER 45.19. DYNAVOLT 46. Primary Key Insights