Mobile Chargers Market size was valued at USD 19.86 Billion in 2024 and the total revenue is expected to grow at CAGR 9.11 % through 2025 to 2032, reaching nearly USD 39.89 Billion. The MMR report on the Mobile Chargers Market provides an in-depth assessment of key technologies and innovations, including AI-powered smart chargers, solar-powered solutions, wireless charging advancements, IoT-enabled chargers, graphene-based technologies, and safety and protection features. It comprehensively analyzes the regulatory landscape by region, covering international safety standards, e-waste regulations, government incentives for sustainable charging solutions, and energy efficiency requirements. The report further evaluates import–export dynamics in 2024, identifying the top importing and exporting countries and examining the impact of trade policies on global supply chains. In addition, it presents a detailed consumer purchasing behavior analysis, highlighting demand for fast and efficient charging, brand loyalty, compatibility preferences, and the influence of marketing and online reviews. The study also includes a regional price trend analysis, assessing historical pricing trends by charger type (2019–2024), brand-driven price variations, and regional price differences to support strategic pricing and market positioning decisions.Mobile Chargers Market Overview

The mobile chargers market is experiencing significant growth, driven by the increasing penetration of smartphones and the expansion of the consumer electronics sector. As global smartphone ownership reached approximately 4.88 billion in 2024, fueled by affordability and improved internet access, the demand for reliable mobile charging solutions has surged. Emerging markets, particularly in India, Brazil, and parts of Africa, have witnessed significant increases in mobile users, thereby propelling the need for efficient chargers. Additionally, the increasing adoption of complementary devices such as wireless earbuds, smartwatches, and fitness trackers has further stimulated market demand, with consumers increasingly opting for multi-port chargers and portable power banks to accommodate multiple devices. Regionally, the Asia Pacific is the fastest-growing mobile chargers market, driven by rapid smartphone adoption and supportive government initiatives. China's position as the largest smartphone producer and India's impressive production highlight the region's significance in the global mobile chargers market. The competitive landscape is characterized by established companies such as Anker, Belkin, and Samsung, which dominate through innovation and diverse product offerings, besides emerging players such as UGREEN and RAVPower focusing on cost-effective solutions and unique features.To know about the Research Methodology :- Request Free Sample Report

Mobile Chargers Market Dynamics

Expanding Smartphone Accessibility and Consumer Electronics to Drive Mobile Chargers Market Growth The increase in global smartphone penetration and the expansion of the consumer electronics market are major drivers propelling the growth of the mobile charger market. As smartphones become more accessible and affordable, especially in emerging markets such as India, Brazil, and parts of Africa, the number of mobile users has exploded. The proliferation of Internet access, the need for constant connectivity, and the growing dependence on smartphones for daily activities such as communication, entertainment, work, and education have made smartphones indispensable. For instance, in India, smartphone penetration crossed 71% in 2023, driven by affordable models from brands such as Xiaomi and Realme, and the expansion of Internet infrastructure. These new users and existing consumers upgrading to more advanced models require reliable chargers, driving growth in the mobile chargers market. In particular, the shift toward fast-changing technologies further increases demand for specialized chargers that can deliver faster charging speeds, like the 80W chargers used by OnePlus or the 100W fast chargers provided with some Xiaomi phones. • As of 2024, about 4.88 billion people worldwide own a smartphone. This represents an increase of 635 million new users compared to the previous year, 2023. In addition, the growth of complementary consumer electronic products such as wireless earbuds, smart watches, fitness trackers, and tablets significantly boosts the mobile charger market. Devices such as Apple AirPods, and Samsung Galaxy Buds, or the growing adoption of wearables such as Apple Watch or Fitbit require charging solutions, often pushing consumers to invest in devices with more chargers or portable energy solutions. The introduction of multi-port chargers, such as Anker's Multi-Device Fast Chargers, is a direct response to this growing need for multiple charging capabilities. Additionally, consumers' increasing mobility and reliance on electronic devices for work and entertainment has led to an increase in portable chargers and power banks. How Wireless Technology is Revolutionizing the Mobile Chargers Market? Wireless charging technology is transforming the mobile chargers market by providing a reliable, convenient, and secure method for powering devices across various industries, including healthcare, automotive, aerospace, and consumer goods production. Key trends such as rapid advancements in fast charging capabilities are setting the stage for wireless solutions that can compete with or even surpass wired charging speeds. Moreover, the integration of wireless charging into everyday environments is enhancing accessibility and convenience, with furniture, countertops, and automotive interiors being designed with built-in charging capabilities. The rise of eco-friendly solutions aligns with growing sustainability concerns, positioning wireless charging as a more environmentally friendly alternative. Furthermore, the demand for multi-device charging is increasing, with solutions that allow simultaneous charging of multiple gadgets becoming more prevalent. As public charging infrastructure expands and wireless charging stations become standard amenities in coffee shops, airports, and hotels, the technology is set to gain even greater acceptance. The establishment of industry standards and regulations will further ensure interoperability and safety, solidifying wireless charging technology's role as a pivotal growth opportunity in the mobile chargers market. Mobile Chargers Market: Import-Export Analysis In 2023, India emerged as the leading importer of mobile phone chargers, with a total of 195,791 shipments. This substantial volume highlights the high demand for mobile charging solutions in the country. Vietnam followed as the second-largest importer, receiving 111,429 shipments, reflecting the growth of its consumer electronics market. South Korea secured the third spot with 48,926 shipments, indicating a growing need for mobile phone chargers to support the increasing use of smartphones and other electronic devices in the region.China dominated the export market for Mobile Phone Chargers in 2023, with 257,491 shipments. This leading position highlights China's strong manufacturing capabilities and its crucial role in the global supply chain for mobile accessories. Vietnam also made a significant impact as an exporter, with 184,348 shipments, reflecting its advanced manufacturing sector and importance in the mobile accessories industry. South Korea ranked third among exporters, with 6,637 shipments, showcasing its growing presence and contributions to the global mobile chargers market.

Mobile Chargers Market Segment Analysis

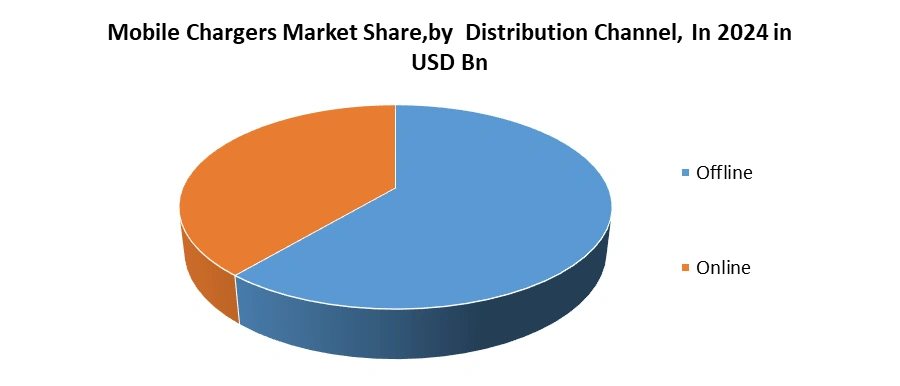

Based on Type, in 2024, the Wired Charger segment dominated the Mobile Chargers Market, driven by its widespread compatibility, faster charging speeds, lower cost, and strong adoption across mass-market smartphones and feature phones. Wired chargers remain the preferred choice in both emerging and developed markets due to reliability and universal USB standards. The Wireless Charger segment is witnessing steady growth, supported by rising penetration of premium smartphones, convenience-driven consumers, and advancements in Qi-enabled fast wireless charging. However, higher prices and slower charging efficiency compared to wired solutions limit mass adoption. Overall, the market reflects a volume-driven dominance of wired chargers, while wireless chargers contribute value-driven growth, particularly in premium and urban consumer segments. Based on Distribution Channel, in 2024, the Offline segment dominated the Mobile Chargers Market, driven by strong presence of electronics retailers, mobile stores, supermarkets, and immediate product availability with physical inspection and after-sales support. The Online segment is experiencing rapid growth, supported by expanding e-commerce platforms, competitive pricing, wider product selection, and increasing consumer preference for doorstep delivery. While offline channels continue to generate higher sales volumes, online channels contribute significantly to value-driven growth, especially among tech-savvy and urban consumers, reflecting a gradual shift toward digital purchasing behavior.

Mobile Chargers Market Regional Insights

Asia Pacific is the fastest-growing region in the global mobile chargers market, holding the largest share of XX% in 2023, due to rapid growth in smartphone adoption, supportive government policies, and increasing manufacturing capacities. China, being the world's largest smartphone producer and consumer, plays a crucial role in this market, with its strong manufacturing base for electronics and mobile accessories. Additionally, the affordability of smartphones and mobile accessories in the region has made it easier for consumers to adopt new devices and charging solutions, further boosting the demand for mobile chargers. India, a key player in this region, has emerged as a significant contributor to the global mobile chargers market. India’s production of smartphone chargers is projected to reach 6.5 billion units, with exports valued at USD 4.7 billion. With India currently producing 50% of the global smartphone chargers, the country is well on its way to becoming a leading global exporter. The region's strong mobile adoption and rapid deployment of 5G technology provide a solid foundation for the growth of mobile-based services and components, including chargers. Countries such as Australia, Japan, South Korea, and Singapore are pioneers in 5G adoption, and the rapid adoption of 5G in India further strengthens the region's mobile ecosystem. The mobile sector contributed nearly 5% to the region's GDP in 2022, amounting to USD 810 billion, indicating its economic significance. By 2030, the region is expected to have around 1.4 billion 5G connections, accounting for 41% of total mobile connections, which further drives demand for mobile chargers as smartphone usage expands. • The top three smartphone markets in the Asia Pacific region are India with 1.3 billion smartphone connections, followed by Indonesia with 381 million connections, and Japan with 168 million connections.Mobile Chargers Market Competitive Landscape The competitive landscape of the mobile chargers market is characterized by a mix of established players and emerging players, each vying for market share through innovation, branding, and product diversification. Leading companies such as Anker, Belkin, and Samsung dominate the market with their advanced technology and extensive product portfolios, offering a range of fast-charging solutions, wireless chargers, and power banks that cater to various consumer needs. Apple is known for its exclusive Lightning connectors and MagSafe technology, and Samsung offers a range of fast-charging solutions compatible with its extensive Galaxy product line. Emerging players such as UGREEN and RAVPower are gaining traction by providing cost-effective alternatives and unique features, such as multi-port charging and compact designs. The market is further fueled by increasing smartphone penetration and the demand for fast-charging solutions, encouraging companies to invest in research and development to introduce eco-friendly materials and smarter charging technologies. Competitive strategies include aggressive pricing, effective marketing campaigns, and expansion of distribution channels to improve customer accessibility and brand loyalty, thereby shaping the dynamic landscape of the mobile chargers market. Recent Developments In September 2024, Belkin introduced 11 new products at IFA 2024, focusing on mobile charging solutions and flexible work options for travelers. These new items emphasize the company’s commitment to sustainability by using post-consumer recycled (PCR) plastics. Among the highlights are the Boost Charge Magnetic Foldable Charger and the Boost Charge 3-in-1 Magnetic Foldable Charger, both designed for convenience and fast charging. Additionally, the Boost Charge Pro Magnetic Wireless Travel Pad offers versatile charging options, while the Boost Charge Power Bank 10K comes with an integrated cable for easy use. Finally, the Boost Charge Pro 3-Port Laptop Power Bank 20K is designed to quickly charge laptops and other devices, and the Boost Charge 2-in-1 USB-C and Lightning Cable is durable and versatile. In August 2023, Belkin revealed eight new products at IFA 2023, showcasing innovative Qi2 chargers, powerful USB-C solutions, and immersive audio devices. With a legacy of 40 years in the consumer electronics industry, Belkin emphasized its commitment to innovation and quality, as well as its dedication to producing products more responsibly.

Mobile Chargers Industry Ecosystem

Mobile Chargers Market Scope:Inquire Before Buying

Global Mobile Chargers Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 19.86 Bn. Forecast Period 2025 to 2032 CAGR: 9.11% Market Size in 2032: USD 39.89 Bn. Segments Covered: by Type Wired Charger Wireless Charger by Port Type Lightning port Micro USB TYPE-C port Others by Power Up to 30W 30W - 60W 60W - 80W Above 80W by Distribution Channel Online Offline Mobile Chargers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Mobile Chargers Market Key Players

1. Belkin International 2. Samsung Electronics Co Ltd 3. iOttie 4. Aukey 5. Koninklijke Philips N.V. 6. Apple Inc. 7. ZAGG Inc. 8. Scosche Industries 9. RAVPower 10. Hama GmbH & Co KG 11. Celly 12. Legrand Group 13. Xiaomi Corporation 14. Huawei Technologies 15. Oppo Electronics 16. Vivo Mobile Communication Co., Ltd. 17. OnePlus 18. Anker Innovations 19. Sony Corporation 20. Ambrane India Pvt. Ltd. 21. Syska 22. Volkano 23. Intelbras 24. Google 25. LG 26. Nokia 27. Satechi 28. Ugreen 29. Zens 30. Logitech 31. Others Frequently Asked Questions: 1] What segments are covered in the Mobile Chargers Market report? Ans. The segments covered in the Mobile Chargers Market report are based on Type, Port Type, Power, Distribution Channel, and region 2] Which region is expected to hold the highest share of the Mobile Chargers Market? Ans. Asia Pacific region is expected to hold the highest share of the Mobile Chargers Market. 3] What is the market size of Mobile Chargers Market by 2032? Ans. The market size of Mobile Chargers Market by 2032 is USD 39.89 Bn. 4] What is the growth rate of Mobile Chargers Market? Ans. The Global Mobile Chargers Market is growing at a CAGR of 9.11% during forecasting period 2025-2032. 5] What was the market size of Mobile Chargers Market in 2024? Ans. The market size of Mobile Chargers Market in 2024 was USD 19.86 Bn.

1. Mobile Chargers Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion and Volume in Units’000) - By Segments, Regions, and Country 2. Mobile Chargers Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Positioning Of Key Players 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Headquarter 2.4.3. Product Segment 2.4.4. Revenue (2024) 2.4.5. Market Share (%) 2.4.6. Sales Volume (Units'000) 2.4.7. Y-O-Y (%) 2.4.8. Profit Margin (%) 2.4.9. No. of Manufacturing Plant 2.4.10. Sales channels 2.4.11. Customer Engagement Metrics 2.4.12. Reviews and Ratings 2.4.13. Regional Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. Research and Development 3. Mobile Chargers Market: Dynamics 3.1. Mobile Chargers Market Trends 3.2. Mobile Chargers Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Mobile Chargers Market 4. Technologies and Innovations 4.1. AI-Powered Smart Chargers 4.2. Solar-Powered Chargers with Improved Efficiency 4.3. Wireless Charging Advancements 4.4. Smart Chargers with IoT Integration 4.5. Graphene-Based Charging Technology 4.6. Safety and Protection Technologies 5. Regulatory Landscape by Region 5.1. International Standards for Charger Safety 5.2. Environmental Regulations on E-Waste 5.3. Government Incentives for Sustainable Solutions 5.4. Energy Efficiency Standards 6. Import–Export Analysis by Country (2024) 6.1. Top 10 Importers of Mobile Chargers 6.2. Top 10 Exporters of Mobile Chargers 6.3. Impact of Trade Policies 7. Consumer Purchasing Pattern / Behavior Analysis 7.1. Demand for Fast and Efficient Charging 7.2. Brand Loyalty and Awareness 7.3. Increased Focus on Compatibility 7.4. Influence of Marketing and Reviews 8. Price Trend Analysis by Region 8.1. Historical Pricing Trends by Type (2019–2024) 8.2. Influence of Brand on Pricing 8.3. Regional Price Differences 9. Mobile Chargers Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 9.1. Mobile Chargers Market Size and Forecast, By Type (2024-2032) 9.1.1. Wired Charger 9.1.2. Wireless Charger 9.2. Mobile Chargers Market Size and Forecast, By Port Type (2024-2032) 9.2.1. Lightning port 9.2.2. Micro USB 9.2.3. TYPE-C port 9.2.4. Others 9.3. Mobile Chargers Market Size and Forecast, By Power (2024-2032) 9.3.1. Up to 30W 9.3.2. 30W - 60W 9.3.3. 60W - 80W 9.3.4. Above 80W 9.4. Mobile Chargers Market Size and Forecast, By Distribution Channel (2024-2032) 9.4.1. Online 9.4.2. Offline 9.5. Mobile Chargers Market Size and Forecast, By Region (2024-2032) 9.5.1. North America 9.5.2. Europe 9.5.3. Asia Pacific 9.5.4. Middle East and Africa 9.5.5. South America 10. North America Mobile Chargers Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 10.1. North America Mobile Chargers Market Size and Forecast, By Type (2024-2032) 10.1.1. Wired Charger 10.1.2. Wireless Charger 10.2. North America Mobile Chargers Market Size and Forecast, By Port Type (2024-2032) 10.2.1. Lightning port 10.2.2. Micro USB 10.2.3. TYPE-C port 10.2.4. Others 10.3. North America Mobile Chargers Market Size and Forecast, By Power (2024-2032) 10.3.1. Up to 30W 10.3.2. 30W - 60W 10.3.3. 60W - 80W 10.3.4. Above 80W 10.4. North America Mobile Chargers Market Size and Forecast, By Distribution Channel (2024-2032) 10.4.1. Online 10.4.2. Offline 10.5. North America Mobile Chargers Market Size and Forecast, by Country (2024-2032) 10.5.1. United States 10.5.1.1. United States Mobile Chargers Market Size and Forecast, By Type (2024-2032) 10.5.1.2. United States Mobile Chargers Market Size and Forecast, By Port Type (2024-2032) 10.5.1.3. United States Mobile Chargers Market Size and Forecast, By Power (2024-2032) 10.5.1.4. United States Mobile Chargers Market Size and Forecast, By Distribution Channel (2024-2032) 10.5.2. Canada 10.5.2.1. Canada Mobile Chargers Market Size and Forecast, By Type (2024-2032) 10.5.2.2. Canada Mobile Chargers Market Size and Forecast, By Port Type (2024-2032) 10.5.2.3. Canada Mobile Chargers Market Size and Forecast, By Power (2024-2032) 10.5.2.4. Canada Mobile Chargers Market Size and Forecast, By Distribution Channel (2024-2032) 10.5.3. Mexico 10.5.3.1. Mexico Mobile Chargers Market Size and Forecast, By Type (2024-2032) 10.5.3.2. Mexico Mobile Chargers Market Size and Forecast, By Port Type (2024-2032) 10.5.3.3. Mexico Mobile Chargers Market Size and Forecast, By Power (2024-2032) 10.5.3.4. Mexico Mobile Chargers Market Size and Forecast, By Distribution Channel (2024-2032) 11. Europe Mobile Chargers Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 11.1. Europe Mobile Chargers Market Size and Forecast, By Type (2024-2032) 11.2. Europe Mobile Chargers Market Size and Forecast, By Port Type (2024-2032) 11.3. Europe Mobile Chargers Market Size and Forecast, By Power (2024-2032) 11.4. Europe Mobile Chargers Market Size and Forecast, By Distribution Channel (2024-2032) 11.5. Europe Mobile Chargers Market Size and Forecast, By Country (2024-2032) 11.5.1. United Kingdom 11.5.2. France 11.5.3. Germany 11.5.4. Italy 11.5.5. Spain 11.5.6. Sweden 11.5.7. Russia 11.5.8. Rest of Europe 12. Asia Pacific Mobile Chargers Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 12.1. Asia Pacific Mobile Chargers Market Size and Forecast, By Type (2024-2032) 12.2. Asia Pacific Mobile Chargers Market Size and Forecast, By Port Type (2024-2032) 12.3. Asia Pacific Mobile Chargers Market Size and Forecast, By Power (2024-2032) 12.4. Asia Pacific Mobile Chargers Market Size and Forecast, By Distribution Channel (2024-2032) 12.5. Asia Pacific Mobile Chargers Market Size and Forecast, by Country (2024-2032) 12.5.1. China 12.5.2. S Korea 12.5.3. Japan 12.5.4. India 12.5.5. Australia 12.5.6. Indonesia 12.5.7. Malaysia 12.5.8. Philippines 12.5.9. Thailand 12.5.10. Vietnam 12.5.11. Rest of Asia Pacific 13. Middle East and Africa Mobile Chargers Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 13.1. Middle East and Africa Mobile Chargers Market Size and Forecast, By Type (2024-2032) 13.2. Middle East and Africa Mobile Chargers Market Size and Forecast, By Port Type (2024-2032) 13.3. Middle East and Africa Mobile Chargers Market Size and Forecast, By Power (2024-2032) 13.4. Middle East and Africa Mobile Chargers Market Size and Forecast, By Distribution Channel (2024-2032) 13.5. Middle East and Africa Mobile Chargers Market Size and Forecast, by Country (2024-2032) 13.5.1. South Africa 13.5.2. GCC 13.5.3. Nigeria 13.5.4. Rest of ME&A 14. South America Mobile Chargers Market Size and Forecast by Segmentation (by Value in USD Billion Volume in Units’000) (2024-2032) 14.1. South America Mobile Chargers Market Size and Forecast, By Type (2024-2032) 14.2. South America Mobile Chargers Market Size and Forecast, By Port Type (2024-2032) 14.3. South America Mobile Chargers Market Size and Forecast, By Power (2024-2032) 14.4. South America Mobile Chargers Market Size and Forecast, By Distribution Channel (2024-2032) 14.5. South America Mobile Chargers Market Size and Forecast, by Country (2024-2032) 14.5.1. Brazil 14.5.2. Argentina 14.5.3. Colombia 14.5.4. Chile 14.5.5. Rest of South America 15. Company Profile: Key Players 15.1. Belkin International 15.1.1. Company Overview 15.1.2. Business Portfolio 15.1.3. Financial Overview 15.1.4. SWOT Analysis 15.1.5. Strategic Analysis 15.2. Samsung Electronics Co Ltd 15.3. iOttie 15.4. Aukey 15.5. Koninklijke Philips N.V. 15.6. Apple Inc. 15.7. ZAGG Inc. 15.8. Scosche Industries 15.9. RAVPower 15.10. Hama GmbH & Co KG 15.11. Celly 15.12. Legrand Group 15.13. Xiaomi Corporation 15.14. Huawei Technologies 15.15. Oppo Electronics 15.16. Vivo Mobile Communication Co., Ltd. 15.17. OnePlus 15.18. Anker Innovations 15.19. Sony Corporation 15.20. Ambrane India Pvt. Ltd. 15.21. Syska 15.22. Volkano 15.23. Intelbras 15.24. Google 15.25. LG 15.26. Nokia 15.27. Satechi 15.28. Ugreen 15.29. Zens 15.30. Logitech 15.31. Others 16. Key Findings 17. Analyst Recommendations 18. Research Methodology