Global Methanol Market size was valued at USD 30.8 Billion in 2023 and the total Global Methanol revenue is expected to grow at 4.9 % from 2024 to 2030, reaching nearly USD 43.05 Billion. Methanol (CH3OH) is a transparent liquid chemical, volatile, and flammable. Synthesis of carbon monoxide and hydrogen Methanol is produced. Methanol mainly used is in organic synthesis, as a solvent, and as fuel, approx. more than 20 million tons are produced annually. In the chemical industry, methanol is used as a denaturant for ethanol. Biodiesel is produced via a trans-esterification reaction of methanol. Wood alcohol is primarily a by-product of the destructive distillation of wood, with methanol.To know about the Research Methodology :- Request Free Sample Report Global chemical industries of the methanol market is expected to grow during the forecast period. The growing demand for methanol in the production of acetic acid, formaldehyde, and various chemicals. Methanol as an alternative fuel, particularly in the transportation division is given acceptance and has fueled methanol market growth. For cleaner energy sources and the importance of reducing carbon emissions, also the increased use of methanol in energy-related applications, and the growing trends toward renewable methanol is a worthy option in the global energy transition drives the methanol market growth during the forecast period. Major Key players in the methanol market, include Methanol Holdings Limited, Mitsubishi Gas Chemical Company, Methanex Corporation, SABIC, and PetroChina Company Limited. These key players have strategic initiatives such as collaborations, purchases, and partnerships to drive the methanol marketplace and enhance production capacities. The dominance in market share and growth is supported by China, India, South Korea, and Japan, Asia Pacific dominates the methanol market share, by contributing to 40% of the total revenue share of the global methanol market.

Methanol Market Dynamics:

High Demand for Methanol in Automotive and Construction Industries. Methanol serves as an initial element in petrochemical production, which increases the demand for the methanol market. Areas like automotive and construction are driving the growth of the methanol market. Prominent Growth Avenue within this realm is the Methanol-to-Olefins (MTO) or Methanol-to-Propylene segment, ranking the methanol market third-largest and exhibiting rapid growth. In regions like China, the utilization of coal as a primary feedstock in Methanol-to-Olefins facilities highlights the segments dynamism. This is improved by growing demands for key plastics, namely polyethylene and polypropylene. The demand for Methanol to olefin facilities and the significant olefin yield from methanol epitomize the key growth drivers for the methanol market. Methanol is used as Alternative to Eco-Friendly Fuel Which Drives the Methanol Market Growth The rising importance of eco-friendly fuels with evolving regulatory landscapes, is catalyzing the adoption of methanol as a cleaner alternative. Standard for its widespread availability, cost-effectiveness, environmental advantages, and proven safety, methanol is gaining demand as a marine fuel. Its application leads to reductions in emissions of sulfur oxides, nitrogen oxides, and other materials. In regions like Beijing and Shandong in China, air quality regulations are encouraging the phasing out of coal-based industrial boilers and kilns. Growth of Production Capabilities and Inclination towards Low-Emission Fuels Growing production capacities present lucrative opportunities for key manufacturers, aligning with rising methanol market demands during the forecast period. Also, the rising demand for low-emission fuels offers potential paths for robust growth in the global methanol market. Key industries like Construction, Automotive, and Electronics are driving the methanol market growth during the forecast period, especially as these industries pivot towards sustainable fuel solutions. The rising utilization of methanol in producing Dimethyl Ether (DME) and Methyl tert-butyl ether (MTBE) is highlighted as a viable alternative to gasoline. The main advantage of methanol is its ability to blend with gasoline, justifying the need for hazardous octane boosters. This blending capability not only fosters environmental sustainability but also augments automotive performance by diminishing flammability risks.Methanol Market Segment Analysis:

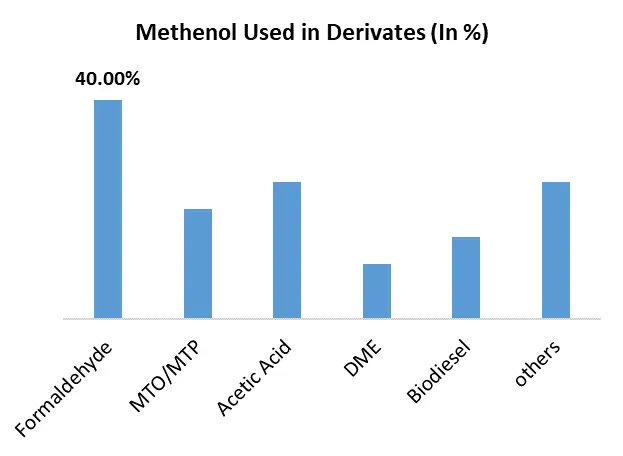

By Feedstock, The coal segment holds a significant share of the global methanol market. The coal segment is expected to compound annual growth rate (CAGR) of 6 % during the forecast period. The increasing usage of coal to produce methanol in countries with abundant coal production is boosting the methanol market growth for this segment. The cost-competitive features of coal has the largest share in the feedstock segment. The Natural gas segment is expected to grow during the forecast period. The cost of production is cheap and at moderate temperatures and pressure, the natural gas production process is simple and economically practical. The natural gas segment was valued at USD 15,200 million in 2023. These factors are boosting the Methanol Market growth for this segment. The increasing demand for natural gas as a feedstock from end-use industries such as automotive, construction, electronics, solvents, pharmaceuticals, appliances, packaging, and insulation leads to the growth of the methanol market.By Derivatives, in 2023, the formaldehyde derivative segment commanded the methanol market, constituting approximately 4.9% of the total revenue. This dominance underscores formaldehyde leading position among methanol derivatives. Acetic acid accounted for 4.4% of the market's revenue share. The expected growth of the Methanol-to-Olefins and methanol-to-propylene sectors in China is a significant driver for the methanol market, propelled by the petrochemical manufacturers' demand for olefins. Consequently, this segment is poised for substantial growth throughout the forecast period.

Methanol Market Regional Insights:

The Asia Pacific methanol market is significantly growing, with revenues expected to rise from USD 17.16 Billion in 2023 to around USD 24.47 Billion by the forecast period reflecting a CAGR of 5.2%. China's robust standing as the leading global methanol producer. Region’s dominance, especially as it contributes to 55% of the worldwide methanol market. Among the regional players, are SABIC, Proman, Ningxia Baofeng Energy Group Co., Ltd., Methanex Corporation, and others. China is expected to maintain its lead, capturing an impressive 72.50% market share and growth revenues nearing USD 17.7 Million by 2030. The North American methanol market is expected a significant growth during the forecast period. In 2023, the North American market size is almost 9.3 million tons with a CAGR of 4.2% and expected to grow by 12.40 million tons in the forecast period.Competitive Landscapes: In April 2023, Methanax Corporation signed an agreement with Suez Methanol derivatives for new pipeline construction and supply of methanol from the Egypt plant. In March 2023, Zagros Petrochemical Company and Dalian Petrochemical Company signed an agreement on the conversion of the methanol plant. The recent agreements between Methanex Corporation and Suez Methanol derivatives, and also Zagros Petrochemical Company and Dalian Petrochemical Company, show significant developments in the methanol market. These associations aim to enhance infrastructure and develop production capabilities. Such strategic moves not only ensure streamlined supply chains but also foster innovation and competitiveness within the methanol sector. These developments are driving market growth, boosting economic activities, and providing diverse industrial applications of methanol.

Methanol Market Scope: Inquire before buying

Global Methanol Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2019 to 2023 Market Size in 2023: US$ 30.8 Bn. Forecast Period 2024 to 2030 CAGR: 4.9% Market Size in 2030: US$ 43.05 Bn. Segments Covered: by Feedstock Coal Natural Gas Others by Derivatives Gasoline MTO/MTP Formaldehyde Methyl Tertiary Butyl Ether (MTBE) Acetic Acid Dimethyl Ether (DME) Methyl Methacrylate (MMA) Biodiesel Others by Sub-Derivatives Gasoline additives Olefins UF/PF resins VAM Polyacetals MDI PTA Acetate Esters Acetic anhydride Fuels by End-User Construction Automotive Electronics Appliances Paints & Coatings Insulation Pharmaceuticals Packaging (PET bottles) Solvents Methanol Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Methanol Market Key Players:

1.Atlantic Methanol Production Company(Texas) 2. Celanese Corporation (Texas) 3. Eastman Chemical Company (United States) 4. Methanex Corporation (Canada) 5. Mitsubishi Gas Chemical Co., Inc. (United States) 6. Southern Chemical Corporation (Texas) 7. Natgasoline LLC (Texas) 8. BASF SE (Germany) 9. Methanol Holdings Limited (Trinidad & Tobago) 10. Petroliam Nasional Berhad (Trinidad & Tobago) 11. HELM AG (Hamburg) 12. PETRONAS (Malaysia) 13. Simalin Chemical Industries Pvt Ltd. (Vadodara ) 14. Metafrax Chemicals (Russia) 15. Zagros Petrochemical Company (Iran) 16. SABIC (Saudi Arabia) 17. Mitsui & Co., Ltd (China) 18. Yanzhou Coal Mining Company Ltd. (China) 19. Shanghai Huayi (Group) Company (China) 20. Ningxia Baofeng Energy Group Co. Ltd (China) FAQs: 1. What is the current market of the market? Ans. Global Methanol Market size was valued at USD 30.8 Billion in 2023. 2. What are the key players in the Methanol market? Ans. Atlantic Methanol Production Company (Texas), Celanese Corporation (Texas), Eastman Chemical Company (United States), Methanex Corporation (Canada), Mitsubishi Gas Chemical Co., Inc. (United States), BASF SE (Germany), Natgasoline LLC (Texas), Methanol Holdings Limited (Trinidad & Tobago), Mitsui & Co., Ltd (China), Petroliam Nasional Berhad (Trinidad & Tobago), SABIC (Saudi Arabia), and others 3. Which region is expected to lead the global Methanol Market during the forecast period? Ans. Asia Pacific is expected to lead the global Methanol Market during the forecast period. 4. What is the expected market size and growth rate of the Methanol Market? Ans. The total Global Methanol revenue is expected to grow at 4.9 % during the forecast period, market size is expected USD 43.05 Billion in the forecast period 2024 to 2030. 5. What segments are covered in the Methanol Market report? Ans. The segments covered in the Methanol Market report are Feedstock, Derivatives, Sub-Derivatives, End-use, and Region.

1. Methanol Market: Research Methodology 2. Methanol Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Methanol Market: Dynamics 3.1 Methanol Market Trends by Region 3.1.1 Global Methanol Market Trends 3.1.2 North America Methanol Market Trends 3.1.3 Europe Methanol Market Trends 3.1.4 Asia Pacific Methanol Market Trends 3.1.5 Middle East and Africa Methanol Market Trends 3.1.6 South America Methanol Market Trends 3.2 Methanol Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Methanol Market Drivers 3.2.1.2 North America Methanol Market Restraints 3.2.1.3 North America Methanol Market Opportunities 3.2.1.4 North America Methanol Market Challenges 3.2.2 Europe 3.2.2.1 Europe Methanol Market Drivers 3.2.2.2 Europe Methanol Market Restraints 3.2.2.3 Europe Methanol Market Opportunities 3.2.2.4 Europe Methanol Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Methanol Market Drivers 3.2.3.2 Asia Pacific Methanol Market Restraints 3.2.3.3 Asia Pacific Methanol Market Opportunities 3.2.3.4 Asia Pacific Methanol Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Methanol Market Drivers 3.2.4.2 Middle East and Africa Methanol Market Restraints 3.2.4.3 Middle East and Africa Methanol Market Opportunities 3.2.4.4 Middle East and Africa Methanol Market Challenges 3.2.5 South America 3.2.5.1 South America Methanol Market Drivers 3.2.5.2 South America Methanol Market Restraints 3.2.5.3 South America Methanol Market Opportunities 3.2.5.4 South America Methanol Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Methanol Industry 3.8 The Global Pandemic and Redefining of The Methanol Industry Landscape 3.9 Technological Road Map 3.10 Global Methanol Trade Analysis (2018-2023) 3.10.1 Global Import of Methanol 3.10.2 Global Export of Methanol 4. Global Methanol Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 4.1 Global Methanol Market Size and Forecast, By Feedstock (2024-2030) 4.1.1 Coal 4.1.2 Natural Gas 4.1.3 Others 4.2 Global Methanol Market Size and Forecast, By Derivatives (2024-2030) 4.2.1 Gasoline 4.2.2 MTO/MTP 4.2.3 Formaldehyde 4.2.4 Methyl Tertiary Butyl Ether (MTBE) 4.2.5 Acetic Acid 4.2.6 Dimethyl Ether (DME) 4.2.7 Methyl Methacrylate (MMA) 4.2.8 Biodiesel 4.2.9 Others 4.3 Global Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 4.3.1 Gasoline additives 4.3.2 Olefins 4.3.3 UF/PF resins 4.3.4 VAM 4.3.5 Polyacetals 4.3.6 MDI 4.3.7 PTA 4.3.8 Acetate Esters 4.3.9 Acetic anhydride 4.3.10 Fuels 4.4 Global Methanol Market Size and Forecast, By End-User (2024-2030) 4.4.1 Construction 4.4.2 Automotive 4.4.3 Electronics 4.4.4 Appliances 4.4.5 Paints & Coatings 4.4.6 Insulation 4.4.7 Pharmaceuticals 4.4.8 Packaging (PET bottles) 4.4.9 Solvents 4.5 Global Methanol Market Size and Forecast, by Region (2024-2030) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Methanol Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 5.1 North America Methanol Market Size and Forecast, By Feedstock (2024-2030) 5.1.1 Coal 5.1.2 Natural Gas 5.1.3 Others 5.2 North America Methanol Market Size and Forecast, By Derivatives (2024-2030) 5.2.1 Gasoline 5.2.2 MTO/MTP 5.2.3 Formaldehyde 5.2.4 Methyl Tertiary Butyl Ether (MTBE) 5.2.5 Acetic Acid 5.2.6 Dimethyl Ether (DME) 5.2.7 Methyl Methacrylate (MMA) 5.2.8 Biodiesel 5.2.9 Others 5.3 North America Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 5.3.1 Gasoline additives 5.3.2 Olefins 5.3.3 UF/PF resins 5.3.4 VAM 5.3.5 Polyacetals 5.3.6 MDI 5.3.7 PTA 5.3.8 Acetate Esters 5.3.9 Acetic anhydride 5.3.10 Fuels 5.4 North America Methanol Market Size and Forecast, By End-User (2024-2030) 5.4.1 Construction 5.4.2 Automotive 5.4.3 Electronics 5.4.4 Appliances 5.4.5 Paints & Coatings 5.4.6 Insulation 5.4.7 Pharmaceuticals 5.4.8 Packaging (PET bottles) 5.4.9 Solvents 5.5 North America Methanol Market Size and Forecast, by Country (2024-2030) 5.5.1 United States 5.5.1.1 United States Methanol Market Size and Forecast, By Feedstock (2024-2030) 5.5.1.1.1 Coal 5.5.1.1.2 Natural Gas 5.5.1.1.3 Others 5.5.1.2 United States Methanol Market Size and Forecast, By Derivatives (2024-2030) 5.5.1.2.1 Gasoline 5.5.1.2.2 MTO/MTP 5.5.1.2.3 Formaldehyde 5.5.1.2.4 Methyl Tertiary Butyl Ether (MTBE) 5.5.1.2.5 Acetic Acid 5.5.1.2.6 Dimethyl Ether (DME) 5.5.1.2.7 Methyl Methacrylate (MMA) 5.5.1.2.8 Biodiesel 5.5.1.2.9 Others 5.5.1.3 United States Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 5.5.1.3.1 Gasoline additives 5.5.1.3.2 Olefins 5.5.1.3.3 UF/PF resins 5.5.1.3.4 VAM 5.5.1.3.5 Polyacetals 5.5.1.3.6 MDI 5.5.1.3.7 PTA 5.5.1.3.8 Acetate Esters 5.5.1.3.9 Acetic anhydride 5.5.1.3.10 Fuels 5.5.1.4 United States Methanol Market Size and Forecast, By End-User (2024-2030) 5.5.1.4.1 Construction 5.5.1.4.2 Automotive 5.5.1.4.3 Electronics 5.5.1.4.4 Appliances 5.5.1.4.5 Paints & Coatings 5.5.1.4.6 Insulation 5.5.1.4.7 Pharmaceuticals 5.5.1.4.8 Packaging (PET bottles) 5.5.1.4.9 Solvents 5.5.2 Canada 5.5.2.1 Canada Methanol Market Size and Forecast, By Feedstock (2024-2030) 5.5.2.1.1 Coal 5.5.2.1.2 Natural Gas 5.5.2.1.3 Others 5.5.2.2 Canada Methanol Market Size and Forecast, By Derivatives (2024-2030) 5.5.2.2.1 Gasoline 5.5.2.2.2 MTO/MTP 5.5.2.2.3 Formaldehyde 5.5.2.2.4 Methyl Tertiary Butyl Ether (MTBE) 5.5.2.2.5 Acetic Acid 5.5.2.2.6 Dimethyl Ether (DME) 5.5.2.2.7 Methyl Methacrylate (MMA) 5.5.2.2.8 Biodiesel 5.5.2.2.9 Others 5.5.2.3 Canada Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 5.5.2.3.1 Gasoline additives 5.5.2.3.2 Olefins 5.5.2.3.3 UF/PF resins 5.5.2.3.4 VAM 5.5.2.3.5 Polyacetals 5.5.2.3.6 MDI 5.5.2.3.7 PTA 5.5.2.3.8 Acetate Esters 5.5.2.3.9 Acetic anhydride 5.5.2.3.10 Fuels 5.5.2.4 Canada Methanol Market Size and Forecast, By End-User (2024-2030) 5.5.2.4.1 Construction 5.5.2.4.2 Automotive 5.5.2.4.3 Electronics 5.5.2.4.4 Appliances 5.5.2.4.5 Paints & Coatings 5.5.2.4.6 Insulation 5.5.2.4.7 Pharmaceuticals 5.5.2.4.8 Packaging (PET bottles) 5.5.2.4.9 Solvents 5.5.3 Mexico 5.5.3.1 Mexico Methanol Market Size and Forecast, By Feedstock (2024-2030) 5.5.3.1.1 Coal 5.5.3.1.2 Natural Gas 5.5.3.1.3 Others 5.5.3.2 Mexico Methanol Market Size and Forecast, By Derivatives (2024-2030) 5.5.3.2.1 Gasoline 5.5.3.2.2 MTO/MTP 5.5.3.2.3 Formaldehyde 5.5.3.2.4 Methyl Tertiary Butyl Ether (MTBE) 5.5.3.2.5 Acetic Acid 5.5.3.2.6 Dimethyl Ether (DME) 5.5.3.2.7 Methyl Methacrylate (MMA) 5.5.3.2.8 Biodiesel 5.5.3.2.9 Others 5.5.3.3 Mexico Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 5.5.3.3.1 Gasoline additives 5.5.3.3.2 Olefins 5.5.3.3.3 UF/PF resins 5.5.3.3.4 VAM 5.5.3.3.5 Polyacetals 5.5.3.3.6 MDI 5.5.3.3.7 PTA 5.5.3.3.8 Acetate Esters 5.5.3.3.9 Acetic anhydride 5.5.3.3.10 Fuels 5.5.3.4 Mexico Methanol Market Size and Forecast, By End-User (2024-2030) 5.5.3.4.1 Construction 5.5.3.4.2 Automotive 5.5.3.4.3 Electronics 5.5.3.4.4 Appliances 5.5.3.4.5 Paints & Coatings 5.5.3.4.6 Insulation 5.5.3.4.7 Pharmaceuticals 5.5.3.4.8 Packaging (PET bottles) 5.5.3.4.9 Solvents 6. Europe Methanol Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 6.1 Europe Methanol Market Size and Forecast, By Feedstock (2024-2030) 6.2 Europe Methanol Market Size and Forecast, By Derivatives (2024-2030) 6.3 Europe Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 6.4 Europe Methanol Market Size and Forecast, By End-User (2024-2030) 6.5 Europe Methanol Market Size and Forecast, by Country (2024-2030) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Methanol Market Size and Forecast, By Feedstock (2024-2030) 6.5.1.2 United Kingdom Methanol Market Size and Forecast, By Derivatives (2024-2030) 6.5.1.3 United Kingdom Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 6.5.1.4 United Kingdom Methanol Market Size and Forecast, By End-User (2024-2030) 6.5.2 France 6.5.2.1 France Methanol Market Size and Forecast, By Feedstock (2024-2030) 6.5.2.2 France Methanol Market Size and Forecast, By Derivatives (2024-2030) 6.5.2.3 France Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 6.5.2.4 France Methanol Market Size and Forecast, By End-User (2024-2030) 6.5.3 Germany 6.5.3.1 Germany Methanol Market Size and Forecast, By Feedstock (2024-2030) 6.5.3.2 Germany Methanol Market Size and Forecast, By Derivatives (2024-2030) 6.5.3.3 Germany Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 6.5.3.4 Germany Methanol Market Size and Forecast, By End-User (2024-2030) 6.5.4 Italy 6.5.4.1 Italy Methanol Market Size and Forecast, By Feedstock (2024-2030) 6.5.4.2 Italy Methanol Market Size and Forecast, By Derivatives (2024-2030) 6.5.4.3 Italy Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 6.5.4.4 Italy Methanol Market Size and Forecast, By End-User (2024-2030) 6.5.5 Spain 6.5.5.1 Spain Methanol Market Size and Forecast, By Feedstock (2024-2030) 6.5.5.2 Spain Methanol Market Size and Forecast, By Derivatives (2024-2030) 6.5.5.3 Spain Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 6.5.5.4 Spain Methanol Market Size and Forecast, By End-User (2024-2030) 6.5.6 Sweden 6.5.6.1 Sweden Methanol Market Size and Forecast, By Feedstock (2024-2030) 6.5.6.2 Sweden Methanol Market Size and Forecast, By Derivatives (2024-2030) 6.5.6.3 Sweden Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 6.5.6.4 Sweden Methanol Market Size and Forecast, By End-User (2024-2030) 6.5.7 Austria 6.5.7.1 Austria Methanol Market Size and Forecast, By Feedstock (2024-2030) 6.5.7.2 Austria Methanol Market Size and Forecast, By Derivatives (2024-2030) 6.5.7.3 Austria Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 6.5.7.4 Austria Methanol Market Size and Forecast, By End-User (2024-2030) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Methanol Market Size and Forecast, By Feedstock (2024-2030) 6.5.8.2 Rest of Europe Methanol Market Size and Forecast, By Derivatives (2024-2030). 6.5.8.3 Rest of Europe Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 6.5.8.4 Rest of Europe Methanol Market Size and Forecast, By End-User (2024-2030) 7. Asia Pacific Methanol Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 7.1 Asia Pacific Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.2 Asia Pacific Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.3 Asia Pacific Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.4 Asia Pacific Methanol Market Size and Forecast, By End-User (2024-2030) 7.5 Asia Pacific Methanol Market Size and Forecast, by Country (2024-2030) 7.5.1 China 7.5.1.1 China Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.5.1.2 China Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.1.3 China Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.1.4 China Methanol Market Size and Forecast, By End-User (2024-2030) 7.5.2 South Korea 7.5.2.1 S Korea Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.5.2.2 S Korea Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.2.3 S Korea Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.2.4 S Korea Methanol Market Size and Forecast, By End-User (2024-2030) 7.5.3 Japan 7.5.3.1 Japan Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.5.3.2 Japan Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.3.3 Japan Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.3.4 Japan Methanol Market Size and Forecast, By End-User (2024-2030) 7.5.4 India 7.5.4.1 India Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.5.4.2 India Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.4.3 India Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.4.4 India Methanol Market Size and Forecast, By End-User (2024-2030) 7.5.5 Australia 7.5.5.1 Australia Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.5.5.2 Australia Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.5.3 Australia Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.5.4 Australia Methanol Market Size and Forecast, By End-User (2024-2030) 7.5.6 Indonesia 7.5.6.1 Indonesia Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.5.6.2 Indonesia Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.6.3 Indonesia Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.6.4 Indonesia Methanol Market Size and Forecast, By End-User (2024-2030) 7.5.7 Malaysia 7.5.7.1 Malaysia MethanolMarket Size and Forecast, By Feedstock (2024-2030) 7.5.7.2 Malaysia Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.7.3 Malaysia Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.7.4 Malaysia Methanol Market Size and Forecast, By End-User (2024-2030) 7.5.8 Vietnam 7.5.8.1 Vietnam Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.5.8.2 Vietnam Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.8.3 Vietnam Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.8.4 Vietnam Methanol Market Size and Forecast, By End-User (2024-2030) 7.5.9 Taiwan 7.5.9.1 Taiwan Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.5.9.2 Taiwan Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.9.3 Taiwan Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.9.4 Taiwan Methanol Market Size and Forecast, By End-User (2024-2030) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.5.10.2 Bangladesh Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.10.3 Bangladesh Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.10.4 Bangladesh Methanol Market Size and Forecast, By End-User (2024-2030) 7.5.11 Pakistan 7.5.11.1 Pakistan Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.5.11.2 Pakistan Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.11.3 Pakistan Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.11.4 Pakistan Methanol Market Size and Forecast, By End-User (2024-2030) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Methanol Market Size and Forecast, By Feedstock (2024-2030) 7.5.12.2 Rest of Asia Pacific Methanol Market Size and Forecast, By Derivatives (2024-2030) 7.5.12.3 Rest of Asia Pacific Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 7.5.12.4 Rest of Asia Pacific Methanol Market Size and Forecast, By End-User (2024-2030) 8. Middle East and Africa MethanolMarket Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 8.1 Middle East and Africa Methanol Market Size and Forecast, By Feedstock (2024-2030) 8.2 Middle East and Africa Methanol Market Size and Forecast, By Derivatives (2024-2030) 8.3 Middle East and Africa Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 8.4 Middle East and Africa Methanol Market Size and Forecast, By End-User (2024-2030) 8.5 Middle East and Africa Methanol Market Size and Forecast, by Country (2024-2030) 8.5.1 South Africa 8.5.1.1 South Africa Methanol Market Size and Forecast, By Feedstock (2024-2030) 8.5.1.2 South Africa Methanol Market Size and Forecast, By Derivatives (2024-2030) 8.5.1.3 South Africa Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 8.5.1.4 South Africa Methanol Market Size and Forecast, By End-User (2024-2030) 8.5.2 GCC 8.5.2.1 GCC Methanol Market Size and Forecast, By Feedstock (2024-2030) 8.5.2.2 GCC Methanol Market Size and Forecast, By Derivatives (2024-2030) 8.5.2.3 GCC Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 8.5.2.4 GCC Methanol Market Size and Forecast, By End-User (2024-2030) 8.5.3 Egypt 8.5.3.1 Egypt Methanol Market Size and Forecast, By Feedstock (2024-2030) 8.5.3.2 Egypt Methanol Market Size and Forecast, By Derivatives (2024-2030) 8.5.3.3 Egypt Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 8.5.3.4 Egypt Methanol Market Size and Forecast, By End-User (2024-2030) 8.5.4 Nigeria 8.5.4.1 Nigeria Methanol Market Size and Forecast, By Feedstock (2024-2030) 8.5.4.2 Nigeria Methanol Market Size and Forecast, By Derivatives (2024-2030) 8.5.4.3 Nigeria Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 8.5.4.4 Nigeria Methanol Market Size and Forecast, By End-User (2024-2030) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Methanol Market Size and Forecast, By Feedstock (2024-2030) 8.5.5.2 Rest of ME&A Methanol Market Size and Forecast, By Derivatives (2024-2030) 8.5.5.3 Rest of ME&A Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 8.5.5.4 Rest of ME&A Methanol Market Size and Forecast, By End-User (2024-2030) 9. South America MethanolMarket Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 9.1 South America Methanol Market Size and Forecast, By Feedstock (2024-2030) 9.2 South America Methanol Market Size and Forecast, By Derivatives (2024-2030) 9.3 South America Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 9.4 South America Methanol Market Size and Forecast, By End-User (2024-2030) 9.5 South America Methanol Market Size and Forecast, by Country (2024-2030) 9.5.1 Brazil 9.5.1.1 Brazil Methanol Market Size and Forecast, By Feedstock (2024-2030) 9.5.1.2 Brazil Methanol Market Size and Forecast, By Derivatives (2024-2030) 9.5.1.3 Brazil Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 9.5.1.4 Brazil Methanol Market Size and Forecast, By End-User (2024-2030) 9.5.2 Argentina 9.5.2.1 Argentina Methanol Market Size and Forecast, By Feedstock (2024-2030) 9.5.2.2 Argentina Methanol Market Size and Forecast, By Derivatives (2024-2030) 9.5.2.3 Argentina Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 9.5.2.4 Argentina Methanol Market Size and Forecast, By End-User (2024-2030) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Methanol Market Size and Forecast, By Feedstock (2024-2030) 9.5.3.2 Rest Of South America Methanol Market Size and Forecast, By Derivatives (2024-2030) 9.5.3.3 Rest Of South America Methanol Market Size and Forecast, By Sub-Derivatives (2024-2030) 9.5.3.4 Rest Of South America Methanol Market Size and Forecast, By End-User (2024-2030) 10. Global Methanol Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2023 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Methanol Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Atlantic MethanolProduction Company 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 BASF SE 11.3 Celanese Corporation 11.4 Eastman Chemical Company 11.5 Methanex Corporation 11.6 MethanolHoldings Limited 11.7 Mitsubishi Gas Chemical Co., Inc. 11.8 Mitsui & Co., Ltd 11.9 Petroliam Nasional Berhad 11.10 SABIC 11.11 Zagros Petrochemical Company 11.12 HELM AG 11.13 Southern Chemical Corporation 11.14 PETRONAS 11.15 Simalin Chemical Industries Pvt Ltd. 11.16 Metafrax Chemicals 11.17 Yanzhou Coal Mining Company Ltd. 11.18 Shanghai Huayi (Group) Company 11.19 Ningxia Baofeng Energy Group Co. Ltd 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary