The Marine Coatings Market size was valued at USD 6.67 Billion in 2025, and the total revenue is expected to grow at CAGR of 6.24 % from 2026 to 2032, reaching nearly USD 10.19 Billion. The MMR report on the Marine Coatings Market covers pricing, maintenance, demand, technology, trade, supply chain, and regulatory aspects. It analyzes price variations by product type and region, including raw material impacts and comparisons between conventional and eco-friendly coatings, alongside lifecycle cost, TCO, docking frequency, fuel efficiency, and ROI considerations. Regional demand is examined across vessel categories and usage patterns, while technology trends cover anti-fouling, self-polishing, nanotechnology, hybrid, biocide-free, and low-VOC coatings. Import-export flows, trade dependencies, and tariff impacts are detailed, and supply chain insights highlight production hubs, logistics, inventory strategies, and raw material dependencies. regulatory compliance across IMO, REACH, EPA, port-specific safety norms, and environmental certifications is addressed, offering a complete market intelligence view for stakeholders. Marine coating is used in marine vehicles. This coating increase the aesthetics, weather resilience, resistance to chemical solvents like water and oils, and impact resistance of the ships they are painted on, among other advantages. Marine coatings shield the surfaces against corrosion and fouling below the waterline as well as harm brought on by UV radiation above the waterline. Globally, the majority of marine coating companies have seen challenging market conditions in the marine sector, where the sluggish demand for new shipbuilding and rising competition have resulted in negative organic growth over the past few years. Significantly detrimental effects were seen in the marine new build markets in South Korea and China. According to Research, the marine coatings industry was still difficult in 2024 and has shrunk even more as a result of the weak market for new ships.To Know About The Research Methodology :- Request Free Sample Report

Marine Coatings Market Dynamics:

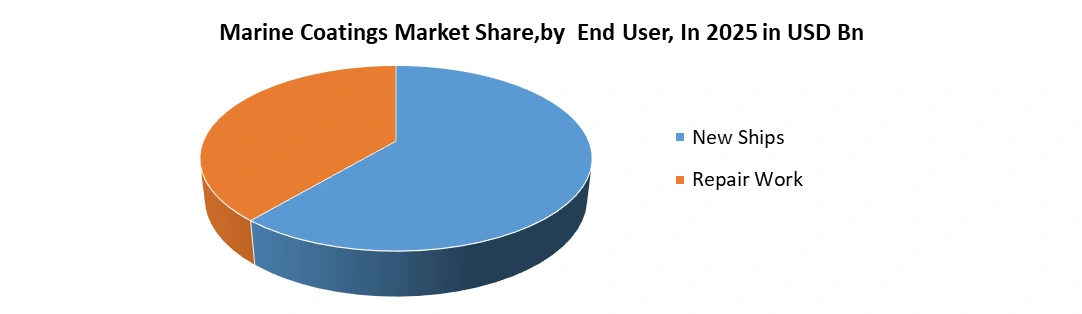

The MMR report covers all the trends and technologies playing a major role in the growth of the Marine Coatings market over the forecast period. It highlights the drivers, restraints, and opportunities expected to impact the market growth during 2025-2032. Development In the Shipbuilding Sector: The growth of the shipbuilding industry is one of the key factors driving the growth of the global marine coatings market. A significant consumer of the worldwide marine coatings market is the shipbuilding sector. Up until 2010, the shipbuilding sector's growth was incredibly slow. It has experienced tremendous growth since 2010, mostly as a result of rising seaborne trade, FDI flows, and the expansion of the operations of multinational corporations. The two key growth factors for the global marine coatings industry are an increase in the production of new ships and the repair and maintenance of old ships. Increased Use of Anti-Corrosion Coatings: Anti-corrosion marine coatings are becoming increasingly well-known in the industry since they aid in protecting the metal components of the vessel from oxidation, salt spray, and moisture. According to reports, the anti-corrosion market segment accounts for about 40% of total marine coatings sales. In order to efficiently fulfil the growing need and draw in a broader consumer base, industry participants are being encouraged by the expanding product demand to create more novel offers. For instance, Nippon Paint Marine unveiled a new antifouling technology in 2024 to raise the consistency and level of antifouling performance. The business claims that it also reduces the amount of time needed for application and increases film thickness. Demand For Offshore Vessels to drive Marine Coatings Market Over the past few years, there has been a significant increase in offshore oil and gas production, which has fuelled the demand for offshore vessels. These ships are crucial in the delivery of supplies, machinery, and tools, as well as in the logistical support of offshore constructions like oil rigs. The offshore vessels industry is anticipated to post a high CAGR through 2032 as a result of rising product demand. Marine Coatings Market Opportunities: Over the forecast period, growing shipbuilding operations are anticipated to open up new market opportunities. Due to the extreme weather conditions that ships and vessels must endure, there is a strong demand for repair and maintenance activities to keep the ships in operational shape. Additionally, the availability of inexpensive labour in China, India, and Vietnam is boosting the market growth for marine coatings during the projected period of time. In the near future, it is expected that developing economic conditions and advantageous trade policies would present possible business prospects. Additionally, it is anticipated that rising crude oil output brought on by expansion in the oil and gas sector will help the marine coatings market growth. Additionally, the rising need for fuel efficiency and the industrialization of developing regions are expected to facilitate the new markets of marine coatings.Based on the Resin, in 2025, epoxy resins dominated Marine Coatings Market due to their superior corrosion resistance, strong adhesion, and durability, making them the preferred choice for ship hulls, ballast tanks, and offshore structures. Polyurethane coatings follow, supported by their excellent weatherability, abrasion resistance, and aesthetic finish, particularly for topcoats and high-performance applications. Alkyd resins hold a moderate share, primarily used in cost-sensitive and maintenance coatings where ease of application and affordability are prioritized. The others segment, including acrylics and Polyester, and Fluoropolymer, contributes a smaller but growing share, driven by increasing demand for environmentally compliant, low-VOC, and application-specific marine coating solutions. Based on End User, in 2025, new ships accounted for a significant share in Marine Coatings Market, driven by ongoing shipbuilding activities, fleet expansion, and replacement of aging vessels, particularly in Asia Pacific shipyards. repair work dominated recurring demand, as regular maintenance, dry-docking cycles, and corrosion protection requirements necessitate frequent recoating throughout a vessel’s operational life. The repair segment benefits from shorter repainting intervals, mandatory regulatory inspections, and cost-effective life-extension strategies adopted by ship owners, making it a stable and consistently revenue-generating end-user segment for marine coating suppliers.

Marine Coatings Market Segment Analysis:

Marine Coatings Market Regional Insights

North America to Retain Lead through 2032: North America expected to witness significant growth during the forecast period. Thanks to the limited scale of the marine industry in the region, the marine coatings market in North America is growing slowly. In terms of market growth, but at a slower rate, the market for marine coatings in the Europe region is just above the North American market. APAC: With a high growth rate anticipated over the coming years, the APAC marine coatings industry will continue to dominate the worldwide marine market. The consumption of marine coatings has increased dramatically in the APAC region, with China leading the APEJ region and the world in terms of consumption. This is largely due to the growth of shipbuilding, maintenance, and dry-docking operations in the area. The marine coatings market in South Korea is far behind that in China. In terms of market share, the Japan marine coatings market is in third place. The market for marine coatings in the APEJ region is anticipated to grow as a result of an increase in ship owners in Singapore. During the projected period, the Indian market is also anticipated to become a formidable competitor in the marine coatings industry. The marine coatings industry is expected to grow at a solid single digit CAGR overall. Europe: The main factor enhancing the outlook of the European marine coatings market is the existence of renowned boat manufacturers as well as sizable freight and passenger ship fleets that provide logistics solutions for several organisations in the region. The region's import tonnage has climbed by 5% over the last five years, which has helped the local economy grow. For the books, the market had a sizable share of more than 10% in 2024.Key Market Competitors Have Taken Strategic Initiatives:

The strategic moves taken by the major market players have significantly accelerated the growth of the marine coatings market share. Large transport companies that require big freight and passenger ships for logistics are working with these commercial conglomerates. Such as, AkzoNobel N.V. completed the full acquisition of New Nautical Coatings in December 2022 as a tactical move to maintain a strong presence in the yacht coating industry in New York. Versaflex, a paint and coatings producer with a focus on flooring coatings and polyurethane coatings, was bought by PPG Pittsburgh PA in January 2022. This acquisition is anticipated to increase PPG's market penetration and market segment.Research Methodology:

The research methodology used to estimate and forecast the Marine Coatings market began with capturing data on key vendor revenues. The market size of individual segments was determined through various secondary sources including industry associations, white papers, and journals. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up approach was employed to arrive at the overall size of the market, by considering the Marine Coatings adoption rate and Marine Coatings pricing by key players, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as Vice Presidents (VPs), directors, and related executives in the market. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub segments.Marine Coatings Market Scope: Inquire before buying

Global Marine Coatings Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 6.67 Bn. Forecast Period 2026 to 2032 CAGR: 6.24% Market Size in 2032: USD 10.19 Bn. Segments Covered: by Product Type Anti-fouling Anti-corrosion Foul release Anti-slip Others by Resin Epoxy Alkyd Polyurethane Others (Acrylic, Polyester, and Fluoropolymer) by Technology Waterborne Solventborne UV-cured Others by Surfaces Concrete Fiberglass Metal Wood by Marine Type Dry Docking New Shipbuilding by Application Cargo Ships Containers Leisure boats Offshore vessels Others by End User New Ships Repair Work by Distribution Channel Original Equipment Manufacturers (OEM) Aftermarkets Marine Coatings Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Marine Coatings Market, Key Players are:

Major market players in the marine coatings industry include leading manufacturing companies that specialize in advanced coating technologies such as anti-fouling and corrosion-resistant solutions. These market leaders in the marine coatings industry are heavily investing in research and development to enhance their product offerings and maintain a strong market position. Emerging players are also entering the market, driving innovation and competition. To strengthen their position, established companies are implementing various strategic initiatives including new product launches, mergers and acquisitions, and collaborations with other organizations, while also focusing on cost-effective solutions to ensure sustained leadership in the marine coatings industry. 1. Akzo Nobel N.V 2. The Sherwin-Williams Company 3. Jotun 4. Hempel A/S 5. Wacker Chemie AG (Germany) 6. Nippon Paint Holdings Co., Ltd. 7. Kansai Paint Co.,Ltd 8. Axalta Coating Systems, LLC 9. RPM International Inc 10. KCC Corporation (South Korea) 11. Boero Bartolomeo S.p.A. 12. Baril Coatings B.V. (Netherlands) 13. Berger Paints (India) 14. ppg asianpaints 15. Shalimar Paints 16. Carboline Company (US) 17. US Coatings 18. PPG Industries, Inc. (US) 19. Pettit Marine Paints (US) 20. Endura Manufacturing Co. Ltd. 21. MCU Coatings International 22. Protexion (India) 23. Mascoat (US) 24. Excel India Protective Paints Pvt. Ltd. 25. Mathur Corr-Tech Pvt. Ltd. 26. International marine coatings 27. Tiger Coatings 28. Cloverdale Paint Inc. 29. Brunel Marine Coating Systems (UK) 30. VICTRA COLOURS 31. OthersFrequently Asked Questions:

1] What segments are covered in the Market report? Ans. The segments covered in the Market report are based on Product Type, Resin, Technology, Surfaces, Marine Type, Application, End User, Distribution Channel and region 2] Which region is expected to hold the highest share of the Market? Ans. The Asia Pacific region is expected to hold the highest share of the Marine Coatings Market. 3] What is the market size of the Marine Coatings Market by 2032? Ans. The market size of the Marine Coatings Market by 2032 is USD 10.19 Bn. 4] What is the growth rate of the Marine Coatings Market? Ans. The Global Marine Coatings Market is growing at a CAGR of 6.24 % during the forecasting period 2026-2032. 5] What was the market size of the Marine Coatings Market in 2025? Ans. The market size of the Marine Coatings Market in 2025 was USD 6.67 Bn.

1. Marine Coatings Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2025) & Forecast (2026-2032) 1.1.2. Market Size (Value in USD Billion, Volume in Metric Tons) - By Segments, Regions, and Country 2. Marine Coatings Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Portfolio 2.3.4. End-User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Profit Margin 2.3.7. Market Share (%) 2024 by Region 2.3.8. Growth Rate (%) 2.3.9. R&D Investment (%) 2.3.10. New Product Innovation Rate 2.3.11. Pricing Competitiveness 2.3.12. Regulatory Compliance & Certifications 2.3.13. Distribution Networks 2.3.14. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Marine Coatings Market: Dynamics 3.1. Marine Coatings Market Trends 3.2. Marine Coatings Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Marine Coatings Market 4. Pricing Analysis By Region 4.1. Price Variation by Product Type and Region (2024) 4.2. Impact of Raw Material Costs (e.g., Zinc, Copper Oxide, Sizes) on Pricing 4.3. Price Comparison: Conventional vs. Eco-Friendly Coatings 4.4. Cost Analysis of Coating Systems 5. Maintenance and Lifecycle Economics 5.1. Lifecycle Cost Analysis (LCCA) for Marine Coatings 5.2. Docking Frequency vs. Coating Durability 5.3. Total Cost of Ownership (TCO) Reduction through High-Performance Coatings 5.4. Impact of Coating Selection on Fuel Efficiency and Operational Cost 5.5. Service Life Extension and ROI from Advanced Coating Systems 6. Demand Analysis by Region 6.1. Region-wise Marine Coating Demand by Vessel Category (2024) 6.2. Demand Shifts Due to Fleet Modernization and Decarbonization Mandates 6.3. Usage Patterns: New Shipbuilding vs. Maintenance, Repair & Overhaul (MRO) 6.4. Regional Procurement Trends Among OEM Shipyards and Ports 7. Technology Landscape and Innovation 7.1. Evolution of Anti-Fouling and Self-Polishing Coatings 7.2. Nanotechnology and Smart Coatings for Corrosion Detection 7.3. Biofouling Control without Heavy Metals (e.g., Biocide-Free Tech) 7.4. Hybrid Coatings for Extended Dry Dock Intervals 7.5. Development of Low-VOC and Waterborne Coatings 7.6. Manufacturing Innovation: Spray vs. Roller Applications in Large-Scale Shipyards 8. Import-Export and Trade Analysis 8.1. Top Exporters and Importers of Marine Coatings by Volume and Value 8.2. Tariff Structures for Marine Coating Components (Pigments, Sizes, Solvent) 8.3. Impact of IMO and REACH Compliance on Trade Routes 8.4. Trade Dependencies on Coating Raw Materials (e.g., Titanium Dioxide from China) 8.5. Influence of Environmental and Safety Standards on Cross-Border Trade 9. Supply Chain and Manufacturing Insights 9.1. Global Marine Coating Production Hubs and Facility Mapping 9.2. Dependency on Raw Material Suppliers and Backward Integration 9.3. Bottlenecks in Logistics and Container Freight Impacting Supply Chain 9.4. Inventory Buffering Trends and Lead Times (2020–2025) 9.5. Localization Strategies of Global Coating Manufacturers 10. Regulatory Environment and Compliance Standards 10.1. IMO Guidelines on Biofouling Management and Coating Use 10.2. EU Biocidal Products Regulation (BPR) and REACH Compliance 10.3. U.S. EPA and OSHA Regulations on VOC Emissions and Coating Composition 10.4. Port Authority-Specific Safety Norms (e.g., Singapore, Rotterdam) 10.5. Environmental Certifications (e.g., ISO 14001, GreenLabel, EcoPorts) 11. Marine Coatings Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 11.1. Marine Coatings Market Size and Forecast, By Product Type (2025-2032) 11.1.1. Anti-fouling 11.1.2. Anti-corrosion 11.1.3. Foul release 11.1.4. Anti-slip 11.1.5. Others 11.2. Marine Coatings Market Size and Forecast, By Resin (2025-2032) 11.2.1. Epoxy 11.2.2. Alkyd 11.2.3. Polyurethane 11.2.4. Others (Acrylic, Polyester, and Fluoropolymer) 11.3. Marine Coatings Market Size and Forecast, By Technology (2025-2032) 11.3.1. Waterborne 11.3.2. Solventborne 11.3.3. UV-cured 11.3.4. Others 11.4. Marine Coatings Market Size and Forecast, By Surfaces (2025-2032) 11.4.1. Concrete 11.4.2. Fiberglass 11.4.3. Metal 11.4.4. Wood 11.5. Marine Coatings Market Size and Forecast, By Marine Type (2025-2032) 11.5.1. Dry Docking 11.5.2. New Shipbuilding 11.6. Marine Coatings Market Size and Forecast, By Application (2025-2032) 11.6.1. Cargo Ships 11.6.2. Containers 11.6.3. Leisure boats 11.6.4. Offshore vessels 11.6.5. Others 11.7. Marine Coatings Market Size and Forecast, By End User (2025-2032) 11.7.1. New Ships 11.7.2. Repair Work 11.8. Marine Coatings Market Size and Forecast, By Distribution Channel (2025-2032) 11.8.1. Original Equipment Manufacturers (OEM) 11.8.2. Aftermarkets 11.9. Marine Coatings Market Size and Forecast, By Region (2025-2032) 11.9.1. North America 11.9.2. Europe 11.9.3. Asia Pacific 11.9.4. Middle East and Africa 11.9.5. South America 12. North America Marine Coatings Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 12.1. North America Marine Coatings Market Size and Forecast, By Product Type (2025-2032) 12.1.1. Anti-fouling 12.1.2. Anti-corrosion 12.1.3. Foul release 12.1.4. Anti-slip 12.1.5. Others 12.2. North America Marine Coatings Market Size and Forecast, By Resin (2025-2032) 12.2.1. Epoxy 12.2.2. Alkyd 12.2.3. Polyurethane 12.2.4. Others (Acrylic, Polyester, and Fluoropolymer) 12.3. North America Marine Coatings Market Size and Forecast, By Technology (2025-2032) 12.3.1. Waterborne 12.3.2. Solventborne 12.3.3. UV-cured 12.3.4. Others 12.4. North America Marine Coatings Market Size and Forecast, By Surfaces (2025-2032) 12.4.1. Concrete 12.4.2. Fiberglass 12.4.3. Metal 12.4.4. Wood 12.5. North America Marine Coatings Market Size and Forecast, By Marine Type (2025-2032) 12.5.1. Dry Docking 12.5.2. New Shipbuilding 12.6. North America Marine Coatings Market Size and Forecast, By Application (2025-2032) 12.6.1. Cargo Ships 12.6.2. Containers 12.6.3. Leisure boats 12.6.4. Offshore vessels 12.6.5. Others 12.7. North America Marine Coatings Market Size and Forecast, By End-User (2025-2032) 12.7.1. New Ships 12.7.2. Repair Work 12.8. North America Marine Coatings Market Size and Forecast, By Distribution Channel (2025-2032) 12.8.1. Original Equipment Manufacturers (OEM) 12.8.2. Aftermarkets 12.9. North America Marine Coatings Market Size and Forecast, by Country (2025-2032) 12.9.1. United States 12.9.1.1. United States Marine Coatings Market Size and Forecast, By Product Type (2025-2032) 12.9.1.2. United States Marine Coatings Market Size and Forecast, By Resin (2025-2032) 12.9.1.3. United States Marine Coatings Market Size and Forecast, By Technology (2025-2032) 12.9.1.4. United States Marine Coatings Market Size and Forecast, By Surfaces (2025-2032) 12.9.1.5. United States Marine Coatings Market Size and Forecast, By Marine Type (2025-2032) 12.9.1.6. United States Marine Coatings Market Size and Forecast, By Application (2025-2032) 12.9.1.7. United States Marine Coatings Market Size and Forecast, By End-User (2025-2032) 12.9.1.8. United States Marine Coatings Market Size and Forecast, By Distribution Channel (2025-2032) 12.9.2. Canada 12.9.2.1. Canada Marine Coatings Market Size and Forecast, By Product Type (2025-2032) 12.9.2.2. Canada Marine Coatings Market Size and Forecast, By Resin (2025-2032) 12.9.2.3. Canada Marine Coatings Market Size and Forecast, By Technology (2025-2032) 12.9.2.4. Canada Marine Coatings Market Size and Forecast, By Surfaces (2025-2032) 12.9.2.5. Canada Marine Coatings Market Size and Forecast, By Marine Type (2025-2032) 12.9.2.6. Canada Marine Coatings Market Size and Forecast, By Application (2025-2032) 12.9.2.7. Canada Marine Coatings Market Size and Forecast, By End-User (2025-2032) 12.9.2.8. Canada Marine Coatings Market Size and Forecast, By Distribution Channel (2025-2032) 12.9.3. Mexico 12.9.3.1. Mexico Marine Coatings Market Size and Forecast, By Product Type (2025-2032) 12.9.3.2. Mexico Marine Coatings Market Size and Forecast, By Resin (2025-2032) 12.9.3.3. Mexico Marine Coatings Market Size and Forecast, By Technology (2025-2032) 12.9.3.4. Mexico Marine Coatings Market Size and Forecast, By Surfaces (2025-2032) 12.9.3.5. Mexico Marine Coatings Market Size and Forecast, By Marine Type (2025-2032) 12.9.3.6. Mexico Marine Coatings Market Size and Forecast, By Application (2025-2032) 12.9.3.7. Mexico Marine Coatings Market Size and Forecast, By End-User (2025-2032) 12.9.3.8. Mexico Marine Coatings Market Size and Forecast, By Distribution Channel (2025-2032) 13. Europe Marine Coatings Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 13.1. Europe Marine Coatings Market Size and Forecast, By Product Type (2025-2032) 13.2. Europe Marine Coatings Market Size and Forecast, By Resin (2025-2032) 13.3. Europe Marine Coatings Market Size and Forecast, By Technology (2025-2032) 13.4. Europe Marine Coatings Market Size and Forecast, By Surfaces (2025-2032) 13.5. Europe Marine Coatings Market Size and Forecast, By Marine Type (2025-2032) 13.6. Europe Marine Coatings Market Size and Forecast, By Application (2025-2032) 13.7. Europe Marine Coatings Market Size and Forecast, By End-User (2025-2032) 13.8. Europe Marine Coatings Market Size and Forecast, By Distribution Channel (2025-2032) 13.9. Europe Marine Coatings Market Size and Forecast, By Country (2025-2032) 13.9.1. United Kingdom 13.9.2. France 13.9.3. Germany 13.9.4. Italy 13.9.5. Spain 13.9.6. Sweden 13.9.7. Russia 13.9.8. Rest of Europe 14. Asia Pacific Marine Coatings Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 14.1. Asia Pacific Marine Coatings Market Size and Forecast, By Product Type (2025-2032) 14.2. Asia Pacific Marine Coatings Market Size and Forecast, By Resin (2025-2032) 14.3. Asia Pacific Marine Coatings Market Size and Forecast, By Technology (2025-2032) 14.4. Asia Pacific Marine Coatings Market Size and Forecast, By Surfaces (2025-2032) 14.5. Asia Pacific Marine Coatings Market Size and Forecast, By Marine Type (2025-2032) 14.6. Asia Pacific Marine Coatings Market Size and Forecast, By Application (2025-2032) 14.7. Asia Pacific Marine Coatings Market Size and Forecast, By End-User (2025-2032) 14.8. Asia Pacific Marine Coatings Market Size and Forecast, By Distribution Channel (2025-2032) 14.9. Asia Pacific Marine Coatings Market Size and Forecast, by Country (2025-2032) 14.9.1. China 14.9.2. S Korea 14.9.3. Japan 14.9.4. India 14.9.5. Australia 14.9.6. Indonesia 14.9.7. Malaysia 14.9.8. Philippines 14.9.9. Thailand 14.9.10. Vietnam 14.9.11. Rest of Asia Pacific 15. Middle East and Africa Marine Coatings Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 15.1. Middle East and Africa Marine Coatings Market Size and Forecast, By Product Type (2025-2032) 15.2. Middle East and Africa Marine Coatings Market Size and Forecast, By Resin (2025-2032) 15.3. Middle East and Africa Marine Coatings Market Size and Forecast, By Technology (2025-2032) 15.4. Middle East and Africa Marine Coatings Market Size and Forecast, By Surfaces (2025-2032) 15.5. Middle East and Africa Marine Coatings Market Size and Forecast, By Marine Type (2025-2032) 15.6. Middle East and Africa Marine Coatings Market Size and Forecast, By Application (2025-2032) 15.7. Middle East and Africa Marine Coatings Market Size and Forecast, By End-User (2025-2032) 15.8. Middle East and Africa Marine Coatings Market Size and Forecast, By Distribution Channel (2025-2032) 15.9. Middle East and Africa Marine Coatings Market Size and Forecast, By Country (2025-2032) 15.9.1. South Africa 15.9.2. GCC 15.9.3. Nigeria 15.9.4. Rest of ME&A 16. South America Marine Coatings Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 16.1. South America Marine Coatings Market Size and Forecast, By Product Type (2025-2032) 16.2. South America Marine Coatings Market Size and Forecast, By Resin (2025-2032) 16.3. South America Marine Coatings Market Size and Forecast, By Technology (2025-2032) 16.4. South America Marine Coatings Market Size and Forecast, By Surfaces (2025-2032) 16.5. South America Marine Coatings Market Size and Forecast, By Marine Type (2025-2032) 16.6. South America Marine Coatings Market Size and Forecast, By Application (2025-2032) 16.7. South America Marine Coatings Market Size and Forecast, By End-User (2025-2032) 16.8. South America Marine Coatings Market Size and Forecast, By Distribution Channel (2025-2032) 16.9. South America Marine Coatings Market Size and Forecast, By Country (2025-2032) 16.9.1. Brazil 16.9.2. Argentina 16.9.3. Colombia 16.9.4. Chile 16.9.5. Rest of South America 17. Company Profile: Key Players 17.1. Akzo Nobel N.V 17.1.1. Company Overview 17.1.2. Business Portfolio 17.1.3. Financial Overview 17.1.4. SWOT Analysis 17.1.5. Strategic Analysis 17.1.6. Recent Developments 17.2. The Sherwin-Williams Company 17.3. Jotun 17.4. Hempel A/S 17.5. Wacker Chemie AG (Germany) 17.6. Nippon Paint Holdings Co., Ltd. 17.7. Kansai Paint Co.,Ltd 17.8. Axalta Coating Systems, LLC 17.9. RPM International Inc 17.10. KCC Corporation (South Korea) 17.11. Boero Bartolomeo S.p.A. 17.12. Baril Coatings B.V. (Netherlands) 17.13. Berger Paints (India) 17.14. ppg asianpaints 17.15. Shalimar Paints 17.16. Carboline Company (US) 17.17. US Coatings 17.18. PPG Industries, Inc. (US) 17.19. Pettit Marine Paints (US) 17.20. Endura Manufacturing Co. Ltd. 17.21. MCU Coatings International 17.22. Protexion (India) 17.23. Mascoat (US) 17.24. Excel India Protective Paints Pvt. Ltd. 17.25. Mathur Corr-Tech Pvt. Ltd. 17.26. International marine coatings 17.27. Tiger Coatings 17.28. Cloverdale Paint Inc. 17.29. Brunel Marine Coating Systems (UK) 17.30. VICTRA COLOURS 17.31. Others 18. Key Findings 19. Analyst Recommendations 20. Marine Coatings Market – Research Methodology