Lower Extremity Devices Market size was valued at USD 1.20 Bn. in 2022 and the total Lower Extremity Devices revenue is expected to grow by 7.5 % from 2023 to 2029, reaching nearly USD 1.99 Bn.Lower Extremity Devices Market Overview:

Lower extremity devices are external devices attached or applied to a lower limb to improve function by providing support, controlling motion, reducing pain, correcting deformities, and preventing progression. They are used to support a limb, improve alignment and function, control motion, reduce falls, provide pain relief, correct deformities, and slow the progression. These devices can be either cast or non-casted.Casted lower limb orthotics: These are custom-made after an impression of the patient’s feet is taken. The orthoses will be tailored to the patient’s specific problems and needs. Non-casted lower limb orthotics: these are not tailored to an individual but may be a good way to start wearing orthotics. These devices are made of a variety of materials, including plastic, metal, and carbon fiber. The growing number of sports injuries is driving the lower extremity devices market. As surgical treatments become more common, there is a greater demand for lower extremity devices. In 2019, 24.3 million surgical procedures were performed worldwide. Lower extremity devices are critical in providing pain relief, improving quality of life, and increasing mobility for patients who have had surgery or have abnormalities. In response to changing customer demands, these lower-extremity devices and methods are constantly evolving. Technological advancements and the incorporation of digital technology are now the primary drivers of revenue growth in the lower extremity devices market. However, low awareness of the benefits of extremity devices, as well as an unfavorable reimbursement scenario for these products, are expected to hamper the growth of the lower extremity devices market. Conversely, the Asia-Pacific developing economies offer a lucrative lower extremity devices market opportunity.To know about the Research Methodology :- Request Free Sample Report

Lower Extremity Devices Market Dynamics:

Lower Extremity Devices Market Drivers Increased number of accidents to boost the market Lower extremity devices (or orthoses) is a shoe inserts that a Podiatrist may recommend after a biomechanical assessment/gait analysis. These can be pre-fabricated devices (not tailored to an individual but a less expensive option) or custom-made devices made from a plaster cast of the feet and a bespoke prescription. 1. Increase shock absorption 2. Increase stability (proprioception) 3. Change problematic foot mechanics 4. Moments around joints must be changed (e.g. decrease pronation at the sub-talar joint) 5. Reduce the amount of force within the injured tissue. The increase in the number of patients with bone degenerative diseases is driving lower extremity devices market growth. Osteoporosis, stress fractures, bone fractures, bone cancer, scoliosis, and osteoarthritis are the most common bone-degrading disorders. One of the primary causes of an increase in bone-related disorders is traffic accidents. Pelvic bone fractures are quite common. Adopting a modern lifestyle also causes illnesses that increase the risk of trauma and fracture, as well as obesity and diabetes, which greatly increases the risk of degenerative joint disease. The rapid increase in the elderly population is one of the key factors driving the lower extremity devices market. The elderly are more vulnerable to orthopedic disorders. This is due to the fact that arthritis and osteoarthritis are just two of the orthopedic disorders to which older people are predisposed. Broken bones are most commonly seen after car accidents.Growing preference for Foot Orthoses and Therapeutic Footwear Foot orthoses (FOs) – 1. FOs can be used alone or as a foundation for other lower limb orthoses. FO aligns and supports the foot, as well as prevents, corrects, or accommodates foot deformity and improves overall foot function. FOs are frequently used in conjunction with therapeutic shoes, which should be properly fitted and allow enough room for the foot to grow during weight bearing. 2. Supramalleolar orthoses (SMO) are most commonly used in pediatric patients with hypotonia and flexible foot pronation. 3. Leg length differences of less than 2cm without symptoms are usually not necessary to correct. Never is the total leg length discrepancy corrected; at most, 75% of the discrepancy should be corrected. A shoe can only accommodate a 1cm lift. For shoe lifts greater than 1cm, the patient would need a custom-built shoe with a shoe lift or an external shoe lift. MMR analyzed that the growing use of foot orthoses (FOs) by overweight or obese people of all ages has increased the lower extremity devices market by 25%. Therapeutic Footwear 1. Internal and external shoe modifications to the sole or body of the shoe are both possible. Excavation of the heel and internal sole can help relieve pain or ulcers caused by bony prominences. Pad placement supports or relieves pressure on the arch; heel and lateral wedges promote proper foot positioning or alignment. Shoes with bars on the soles can help with weakness, relieve pressure, transfer load, or promote dorsi or plantar flexion. 2. Heel flares broaden the base and provide cushioning, stability, positioning, and arch support with different heel materials. 3. High-top shoes or boots, particularly in young patients, can provide ankle stability in patients with mild ankle instability or mild foot drop. The growing use of Foot Orthoses and Therapeutic Footwear by accident victims, athletes, and the elderly is driving the lower extremity devices market.

Lower Extremity Devices Market Restraints High Cost of lower-extremity devices hampers the market growth The high cost of lower extremity devices, as well as government restrictions on their use, are impeding the growth of the lower extremity devices market. Restricted healthcare facilities in developing countries, combined with an increase in product recalls, are expected to exert a controlling influence on the lower extremity devices market. The inability of advanced instruments to migrate to a standardized reimbursement landscape hampers their acceptance in the forecast years. Lower Extremity Devices Market Opportunity Recent advances boosting the market As an alternative to traditional orthoses, functional electric stimulation (FES) devices are now used. These devices produce an electrical current that stimulates a muscle, causing it to contract in a predictable movement pattern, resulting in physiological bracing. The FES-AFO, which stimulates the tibialis anterior muscle to produce ankle dorsiflexion and eversion, is the most common FES device for the lower limb. When compared to traditional AFO, these devices have shown moderate gait improvements. A similar concept was used to improve wrist extension in the upper limb. Recent advancements in traditional lower limb orthoses include stance-control orthotic knee joints that provide stance-phase stability while allowing swing-phase flexion. These should allow for a more normal gait pattern by removing some of the movement restrictions of other orthoses. Material advancements, 3-D printing, and robotic exoskeletons are dramatically altering the durability, fabrication time, overall function, and level of assistance provided by orthotic devices. All these recent advances are boosting the lower extremity devices market and are expected to do the same in the forecast period.

Lower Extremity Devices Market Segment Analysis:

Based on Product, The lower extremity devices market is divided into three categories: knee orthotics, foot and ankle orthotics, and hip orthotics. The knee orthotics segment accounted for 45% of market revenue in 2022 and is expected to grow at the fastest CAGR during the forecast period, owing to numerous benefits provided by these goods, such as medial and lateral support, reduced knee rotation, limited damage during activity, and protection against the possibility of injury following surgery. Knee braces can also relieve pain by relieving pressure on the part of the patient's joint most affected by osteoarthritis. A knee brace can also help patients stand and move around with more confidence if their knee feels like it might buckle when they put weight on it.Based on the Application, Lower extremity devices are classified as trauma & fracture and others. The trauma and fracture segment is expected to dominate the market in 2022, owing to an increase in road accidents, which leads to more fractures and traumas. The others segment is expected to grow at the fastest CAGR during the forecast period, owing to an increase in osteoporosis cases.

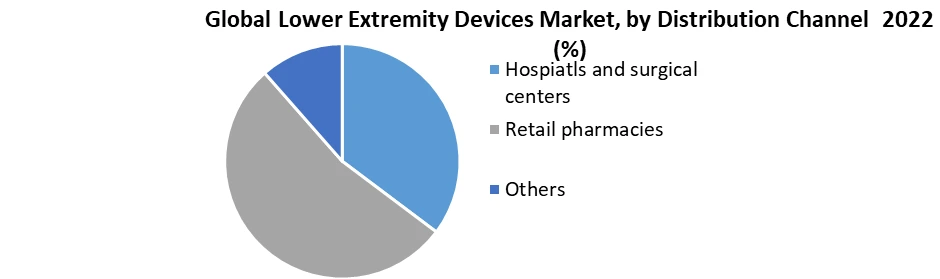

Based on the Distribution Channel, the market is divided into Hospitals and surgical centers, retail pharmacies, and others. Because more patients consult hospitals and surgical centers during trauma and fractures, the hospital & surgical centers segment dominated the lower extremity devices market share in 2022. The other segment is expected to grow at the fastest rate during the forecast period, owing to an increase in the trend of online purchasing due to discounts.

Lower Extremity Devices Market Regional Insights:

North America dominated the lower extremity devices market in 2022 with the highest revenue share during the forecast period due to the increasing penetration of innovative lower extremity devices, specialized healthcare facilities, and the involvement of business leaders. The involvement of business leaders such as DePuy Synthes, Stryker Corporation, Zimmer Biomet, DJO Global, and CONMED in business development is driving the market growth. North America was the leading sales contributor in the global lower extremity devices market in 2022, and this pattern is expected to continue during the forecast period, owing to strong demand for specialized healthcare facilities due to the availability of well-developed healthcare facilities, and broad reimbursement coverage of orthopedic procedures, which have fueled the acceptance of orthopedic surgeries. As the population ages and the number of car accidents increases, so will the demand for orthopedic surgeries in the area. There are several high-incidence orthopedic diseases that are expected to drive the industry's growth in the United States. Asia-Pacific is likely to witness to fastest growth since there is a vast elderly population, solid infrastructure, and a rapidly increasing medical tourism market. High disposable incomes, a growing population, and improved patient awareness of the significance of orthopaedic products are additional factors driving demand in APAC. China and India are predicted to have the largest geriatric populations in the near future due to demographic growth. In the near future, it is anticipated that these nations will be the source of this increase in demand. Last but not least, a sizable consumer base is anticipated to be attracted by the expanding medical tourism sector, which revolves around the provision of specialized healthcare services at a low cost. Japan frequently hosts implant manufacturing due to its advanced healthcare system. Additionally, the regional lower extremity devices market would benefit from increased exposure to cutting-edge technologies.Lower Extremity Devices Market Scope: Inquiry Before Buying

Lower Extremity Devices Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 1.20 Bn. Forecast Period 2023 to 2029 CAGR: 7.5% Market Size in 2029: US$ 1.99 Bn. Segments Covered: by Product 1. Knee orthotics 2. Foot and ankle orthotics 3. Hip orthotics by Application 1. Trauma and Fractures 2. Others by Distribution Channel 1. Hospiatls and surgical centers 2. Retail pharmacies 3. Others Lower Extremity Devices Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Lower Extremity Devices Market, Key Players are

1. DePuy Synthes 2. Stryker Corporation 3. Zimmer Biomet 4. DJO Global 5. CONMED 6. Bone Therapeutics 7. Active Implants 8. OsteoMed 9. Medtronic PLC 10. 3M 11. Bauerfeind 12. DeRoyal Industries Inc 13. Colfax Corporation 14. Orthofix 15. Ossue 16. Essity 17. Thuasne Group 18. Ottobock 19. Trulife Frequently Asked Questions: 1] What segments are covered in the Global Lower Extremity Devices Market report? Ans. The segments covered in the Lower Extremity Devices Market report are based on Product, Application, Distribution Channel, and Region. 2] Which region is expected to hold the highest share in the Global Lower Extremity Devices Market? Ans. The North America region is expected to hold the highest share in the Lower Extremity Devices Market. 3] What is the market size of the Global Lower Extremity Devices Market by 2029? Ans. The market size of the Lower Extremity Devices Market by 2029 is expected to reach US$ 1.99 Bn. 4] What is the forecast period for the Global Lower Extremity Devices Market? Ans. The forecast period for the Lower Extremity Devices Market is 2023-2029. 5] What was the market size of the Global Lower Extremity Devices Market in 2022? Ans. The market size of the Lower Extremity Devices Market in 2022 was valued at US$ 1.20 Bn.

1. Global Lower Extremity Devices Market Size: Research Methodology 2. Global Lower Extremity Devices Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Lower Extremity Devices Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Lower Extremity Devices Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Lower Extremity Devices Market Size Segmentation 4.1. Global Lower Extremity Devices Market Size, by Product (2022-2029) • Knee orthotics • Foot and ankle orthotics • Hip orthotics 4.2. Global Lower Extremity Devices Market Size, by Application (2022-2029) • Trauma and Fractures • Others 4.3. Global Lower Extremity Devices Market Size, by Distribution Channel (2022-2029) • Hospiatls and surgical centers • Retail pharmacies • Others 5. North America Lower Extremity Devices Market (2022-2029) 5.1. North America Lower Extremity Devices Market Size, by Product (2022-2029) • Knee orthotics • Foot and ankle orthotics • Hip orthotics 5.2. North America Lower Extremity Devices Market Size, by Application (2022-2029) • Trauma and Fractures • Others 5.3. North America Lower Extremity Devices Market Size, by Distribution Channel (2022-2029) • Hospiatls and surgical centers • Retail pharmacies • Others 5.4. North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Lower Extremity Devices Market (2022-2029) 6.1. European Lower Extremity Devices Market, by Product (2022-2029) 6.2. European Lower Extremity Devices Market, by Application (2022-2029) 6.3. European Lower Extremity Devices Market, by Distribution Channel (2022-2029) 6.4. European Lower Extremity Devices Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Lower Extremity Devices Market (2022-2029) 7.1. Asia Pacific Lower Extremity Devices Market, by Product (2022-2029) 7.2. Asia Pacific Lower Extremity Devices Market, by Application (2022-2029) 7.3. Asia Pacific Lower Extremity Devices Market, by Distribution Channel (2022-2029) 7.4. Asia Pacific Lower Extremity Devices Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Lower Extremity Devices Market (2022-2029) 8.1. Middle East and Africa Lower Extremity Devices Market, by Product (2022-2029) 8.2. Middle East and Africa Lower Extremity Devices Market, by Application (2022-2029) 8.3. Middle East and Africa Lower Extremity Devices Market, by Distribution Channel (2022-2029) 8.4. Middle East and Africa Lower Extremity Devices Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Lower Extremity Devices Market (2022-2029) 9.1. South America Lower Extremity Devices Market, by Product (2022-2029) 9.2. South America Lower Extremity Devices Market, by Application (2022-2029) 9.3. South America Lower Extremity Devices Market, by Distribution Channel (2022-2029) 9.4. South America Lower Extremity Devices Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. DePuy Synthes 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Stryker Corporation 10.3. Zimmer Biomet 10.4. DJO Global 10.5. CONMED 10.6. Bone Therapeutics 10.7. Active Implants 10.8. OsteoMed 10.9. Medtronic PLC 10.10. 3M 10.11. Bauerfeind 10.12. DeRoyal Industries Inc 10.13. Colfax Corporation 10.14. Orthofix 10.15. Ossue 10.16. Essity 10.17. Thuasne Group 10.18. Ottobock 10.19. Trulife